- Home

- »

- Conventional Energy

- »

-

Bunker Fuel Market Size & Share, Industry Report, 2030GVR Report cover

![Bunker Fuel Market Size, Share & Trends Report]()

Bunker Fuel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Very Low Sulfur Fuel Oil (VLSFO), High Sulfur Fuel Oil (HSFO), Marine Gas Oil (MGO)), By Application (Chemical Bunkers, Bulk Carrier, Oil Tanker, Container), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-611-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bunker Fuel Market Summary

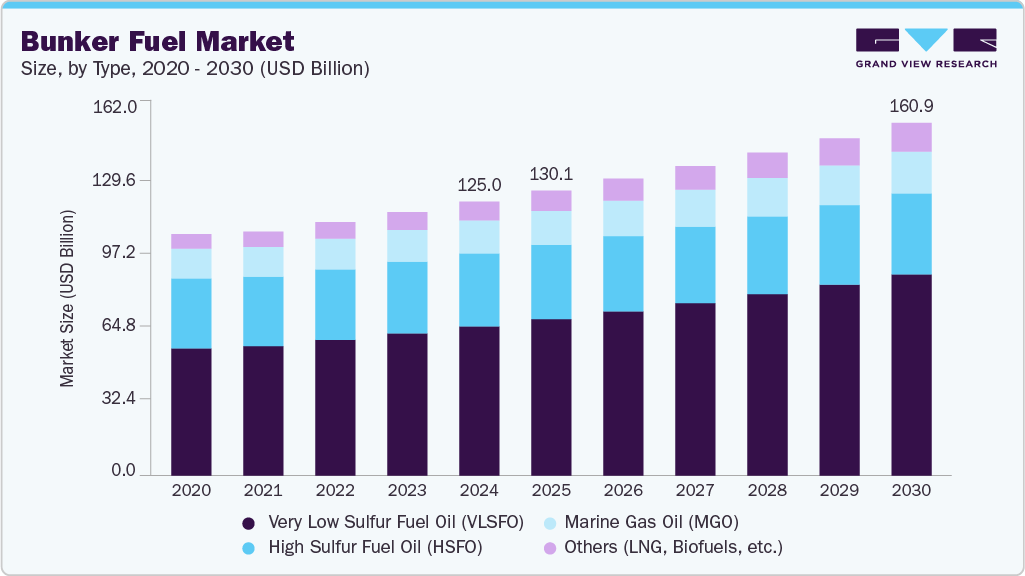

The global bunker fuel market size was estimated at USD 125.05 billion in 2024 and is projected to reach USD 160.94 billion by 2030, growing at a CAGR of 4.35% from 2025 to 2030. The market is witnessing steady growth, driven by the expansion of global maritime trade and increasing demand for reliable marine fuel solutions.

Key Market Trends & Insights

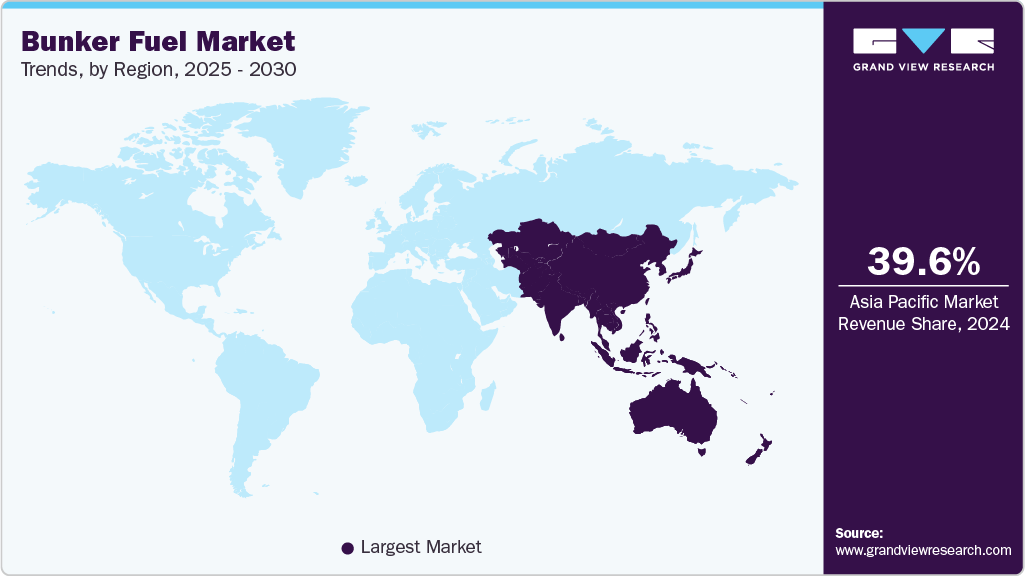

- Asia Pacific held 39.56% revenue share of the global bunker fuel market in 2024.

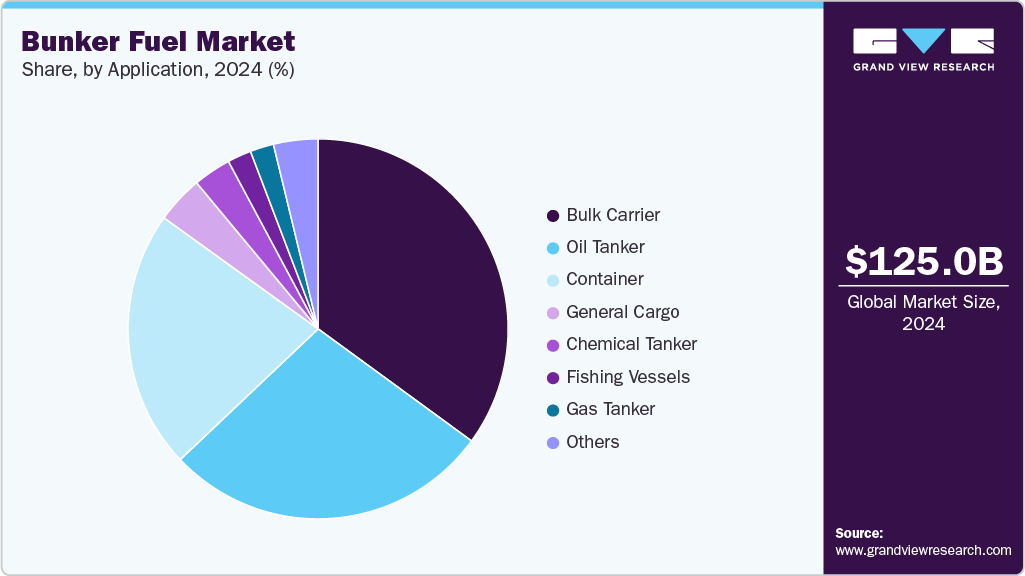

- Based on fuel type, the very low sulfur fuel oil (VLSFO) segment dominated the bunker fuel market with a revenue share of 54.43% in 2024.

- Based on applications, the chemical tankers segment is expected to register the fastest CAGR of 8.77% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 125.05 Billion

- 2030 Projected Market Size: USD 160.94 Billion

- CAGR (2025-2030): 4.35%

- Asia Pacific: Largest market in 2024

Key factors such as rising international shipping activities, ongoing fleet expansions, and the rebound of seaborne commerce are contributing to market momentum. Furthermore, evolving regulations by the International Maritime Organization (IMO) regarding sulfur emissions are prompting a shift toward cleaner fuel alternatives, reshaping the dynamics of bunker fuel consumption across major ports worldwide.Technological innovations, including the adoption of advanced fuel blending techniques and digital monitoring systems, are improving bunker fuel efficiency and environmental compliance. These advancements enable better quality control, real-time fuel consumption tracking, and optimized logistics, contributing to cost savings and reduced emissions. Additionally, the growing emphasis on low-sulfur and alternative fuels aligns with global environmental regulations, making bunker fuel solutions increasingly focused on sustainability and cleaner maritime operations.

The shipping and logistics sectors are rapidly adopting cleaner bunker fuels and emission-reducing technologies to comply with International Maritime Organization (IMO) regulations and meet corporate sustainability goals. Flexible fuel supply agreements, including contracts for low-sulfur and liquefied natural gas (LNG) bunkers, reduce reliance on traditional high-sulfur fuels and lower upfront costs for operators. This trend is especially prominent in Asia and Europe, where stringent emission norms and expanding port infrastructure drive demand for greener fuel options.

Despite these positive developments, challenges such as fluctuating crude oil prices, regulatory uncertainties, and the infrastructure gap for alternative fuels remain. However, continued innovation in fuel technologies and growing industry awareness of environmental imperatives are expected to address these barriers. As maritime trade evolves, the bunker fuel market is set to play a vital role in supporting cleaner, more efficient, and compliant shipping operations worldwide.

Drivers, Opportunities & Restraints

Increasing global maritime trade and stricter environmental regulations boost demand for cleaner and more efficient bunker fuels. The need to comply with the International Maritime Organization’s (IMO) sulfur cap and greenhouse gas reduction targets pushes shipowners and operators to seek low-sulfur fuel alternatives and advanced fuel blends. This shift is especially critical for ports and shipping lanes experiencing high traffic, where reducing emissions and improving fuel efficiency are top priorities.

The bunker fuel market opportunities are growing with technological advancements in fuel formulation, blending, and real-time fuel monitoring systems. The rising adoption of alternative bunker fuels, such as liquefied natural gas (LNG) and biofuels, presents significant growth potential, especially in regions aiming to cut maritime pollution. Furthermore, expanding port infrastructure for cleaner fuel supply and increasing investment in emission-compliant bunkering facilities offer promising avenues for market expansion.

However, the bunker fuel market faces notable restraints. Volatility in crude oil prices impacts fuel costs and supply chain stability, creating uncertainties for operators. Regulatory complexities and inconsistent enforcement across countries can delay the transition to compliant fuels. Additionally, the limited availability of infrastructure for alternative fuels in many key shipping hubs and concerns about the compatibility of new fuel types with existing vessels pose challenges. Overcoming these barriers will be crucial for sustaining growth and supporting the maritime industry’s evolving environmental commitments.

Type Insights

VLSFO plays a critical role in the bunker fuel market by meeting stringent International Maritime Organization (IMO) sulfur emission regulations while maintaining cost efficiency for ship operators. This fuel type effectively balances environmental compliance and operational performance, making it the preferred choice across commercial shipping fleets worldwide. As ports and fuel suppliers expand infrastructure to support VLSFO availability, its prominence in the market continues to grow.

VLSFO fuels undergo precise blending and quality assurance processes to ensure optimal engine performance and reduced emissions. The widespread adoption of VLSFO is driven by its compatibility with existing ship engines and the lower capital expenditure required compared to alternative fuels. Additionally, long-term supply contracts and flexible bunker delivery options provide stability and convenience for marine operators. The sustained demand for VLSFO is especially evident in key maritime regions where environmental regulations and shipping volumes remain high, solidifying its position globally as the leading bunker fuel type.

Application Insights

Bulk carriers represent significant global maritime shipping, transporting large volumes of raw materials such as coal, iron ore, and grains. Their high fuel consumption and extensive shipping routes make them major consumers of bunker fuels, particularly Very Low Sulfur Fuel Oil (VLSFO). The operational demands of bulk carriers require reliable and cost-effective fuel solutions, driving steady demand in this segment. Furthermore, increasing trade volumes and expanding infrastructure in emerging markets continue to support the growth of bulk carrier fleets worldwide.

The oil tanker is another key segment in the bunker fuel market due to the critical need for reliable marine fuels to transport oil, chemicals, and liquefied natural gas (LNG). Tankers often operate in sensitive and heavily regulated environments, requiring compliance with stringent fuel sulfur limits and environmental standards. The bunker fuel supply model caters to these vessels by offering a variety of fuel types, blending options, and flexible delivery services. Additionally, the ongoing shift toward cleaner fuels and emission control technologies further enhances the demand for compliant bunker solutions within the tanker sector, supporting the market’s overall expansion.

Regional Insights

The North American bunker fuel market is witnessing stable growth, supported by strong maritime trade, evolving environmental standards, and significant port activity in the U.S. and Canada. Regulatory frameworks like the North American Emission Control Area (ECA) are pushing shippers toward the use of cleaner fuels such as Very Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG). Major ports, including Los Angeles, Houston, and Vancouver, are enhancing their bunkering infrastructure to support a diverse fuel mix. Additionally, fuel quality monitoring programs and emission reduction incentives reinforce the adoption of sustainable marine fuel options across the region.

U.S. Bunker Fuel Market Trends

In the U.S. bunker fuel market, stringent emission regulations under the EPA and MARPOL Annex VI are shaping the fuel mix in the marine sector. Demand for compliant fuels like VLSFO and LNG continues to grow, particularly in high-traffic ports such as New York, Long Beach, and Seattle. The country also invests in green port initiatives and alternative fuel research to decarbonize its shipping industry. Moreover, digital fuel tracking and efficiency systems are gaining popularity, helping shipping companies reduce operational costs while meeting compliance standards.

Asia Pacific Bunker Fuel Market Trends

The Asia Pacific bunker fuel market dominates the global market, driven by high-volume shipping activity, rapid port expansion, and proactive adaptation to IMO 2020 sulfur regulations. Singapore remains the world's leading bunkering hub, known for its advanced fueling infrastructure and transparent fuel quality standards. China is expanding its LNG bunkering network and has designated Emission Control Areas (ECAs) to curb marine pollution, while South Korea and Japan are investing in low-emission fuel technologies. The region's strategic location along major shipping routes and supportive policies and innovation continue to bolster market growth.

Europe Bunker Fuel Market Trends

The European bunker fuel market is evolving in response to the EU's maritime decarbonization targets and sustainability mandates. Ports in the Netherlands, Germany, and the UK are adopting green technologies, offering marine gas oil (MGO), VLSFO, and LNG bunkering services. EU-funded initiatives like the Fuel EU Maritime regulation and Green Shipping Corridors are accelerating the transition to low-carbon marine fuels. Blockchain applications in fuel traceability and increased R&D in biofuels and ammonia are emerging trends across European ports, positioning the region as a progressive force in maritime fuel innovation.

Latin America Bunker Fuel Market Trends

Latin America bunker fuel market is expanding due to increased coastal and international shipping activity, especially in Brazil, Panama, and Chile. The Panama Canal remains a vital global transit route, creating consistent demand for bunkering services. The region is slowly adapting to IMO 2020 guidelines, with growing interest in cleaner fuel alternatives. Brazil is enhancing its bunkering infrastructure in key ports like Santos and Rio de Janeiro, while regional energy strategies are beginning to integrate LNG as a long-term marine fuel solution. However, fuel availability and policy consistency remain ongoing challenges.

Middle East & Africa Bunker Fuel Market Trends

The Middle East & Africa bunker fuel market is critical in the global market, supported by its strategic location and robust energy sector. Major bunkering hubs like Fujairah in the UAE and Port Said in Egypt serve global trade routes, offering a wide range of marine fuels, including VLSFO and LNG. Saudi Arabia's Vision 2030 and the UAE's Energy Strategy 2050 encourage investment in sustainable bunkering solutions. In Africa, South Africa and Egypt are enhancing port capabilities to attract more transcontinental bunkering operations, though infrastructure gaps and regulatory fragmentation continue to hinder rapid growth.

Key Bunker Fuel Company Insights

Some key players operating in the market include BP p.l.c., Exxon Mobil Corporation, Royal Dutch Shell PLC, Lukoil, Sinopec Group, Gazprom Neft PJSC, Chevron Corporation, Nestle, and others.

-

In February 2024, TotalEnergies announced the launch of a new bunker barge equipped to supply VLSFO and LNG bunkers at the Port of Rotterdam, strengthening its foothold in Europe's busiest marine fuel hub.

-

In March 2024, Neste expanded its bio-based marine fuel supply chain in Northern Europe by collaborating with major shipping lines to reduce carbon emissions, aligning with the rising demand for sustainable bunker solutions.

Key Bunker Fuel Companies:

The following are the leading companies in the bunker fuel market. These companies collectively hold the largest market share and dictate industry trends.

- BP p.l.c.

- Exxon Mobil Corporation

- Royal Dutch Shell PLC

- Lukoil

- Sinopec Group

- Gazprom Neft PJSC

- Chevron Corporation

- PETRONAS

- Total SE

- Neste

Bunker Fuel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 130.10 billion

Revenue forecast in 2030

USD 160.94 billion

Growth rate

CAGR of 4.35% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

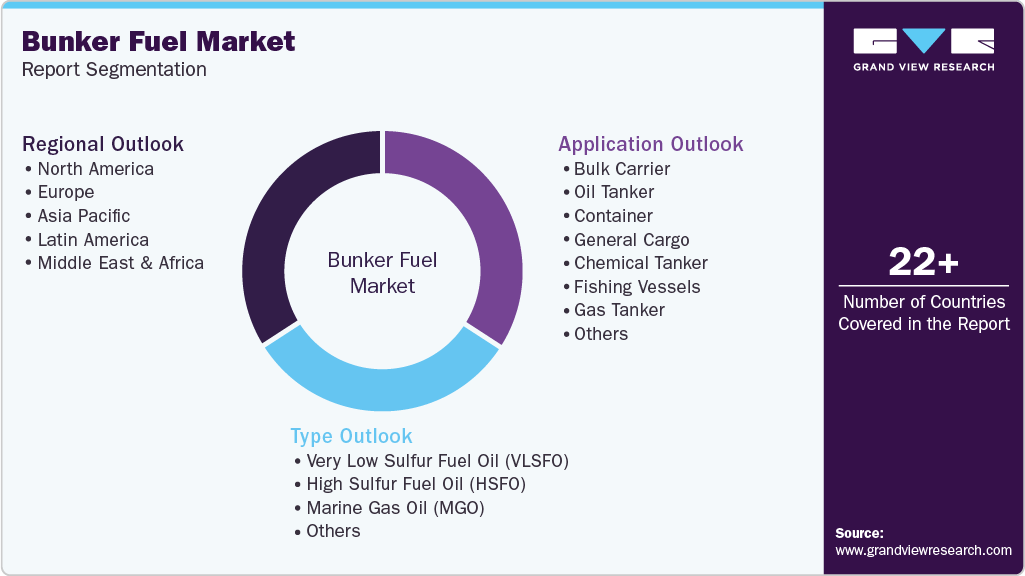

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia;South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BP p.l.c.; Exxon Mobil Corporation; Royal Dutch Shell PLC; Lukoil; Sinopec Group; Gazprom Neft PJSC; Chevron Corporation; PETRONAS; Total SE; Neste

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bunker Fuel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bunker fuel market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Very Low Sulfur Fuel Oil (VLSFO)

-

High Sulfur Fuel Oil (HSFO)

-

Marine Gas Oil (MGO)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bulk Carrier

-

Oil Tanker

-

Container

-

General Cargo

-

Chemical Tanker

-

Fishing Vessels

-

Gas Tanker

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bunker fuel market size was estimated at USD 125.05 billion in 2024 and is expected to reach USD 130.10 billion in 2025.

b. The global bunker fuel market is expected to grow at a compound annual growth rate of 4.35% from 2025 to 2030 to reach USD 160.94 billion by 2030.

b. The very low sulfur fuel oil (VLSFO) segment dominated the global bunker fuel market with a revenue share of over 54.43% in 2024. Following the implementation of the IMO 2020 regulation limiting sulfur content in marine fuels to 0.5%, VLSFO emerged as the primary choice for most commercial vessels due to its compliance and global availability.

b. Some of the key vendors operating in the global bunker fuel market include BP p.l.c.; Exxon Mobil Corporation; Royal Dutch Shell PLC; Lukoil; Sinopec Group; Gazprom Neft PJSC; Chevron Corporation; PETRONAS; Total SE; and Neste.

b. The key factor driving the growth of the global bunker fuel market is the steady expansion of international maritime trade, which continues to increase demand for marine fuel across major shipping routes. As global cargo volumes rise, fueled by e-commerce, globalization, and intercontinental supply chains, the need for efficient and compliant bunker fuels—especially Very Low Sulfur Fuel Oil (VLSFO)—has grown substantially.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.