- Home

- »

- Sensors & Controls

- »

-

Burner Management System Market, Industry Report, 2030GVR Report cover

![Burner Management System Market Size, Share & Trends Report]()

Burner Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By Fuel Type (Gas, Oil, Others) By Industry, By Region And Segment Forecasts

- Report ID: GVR-3-68038-755-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Burner Management System Market Trends

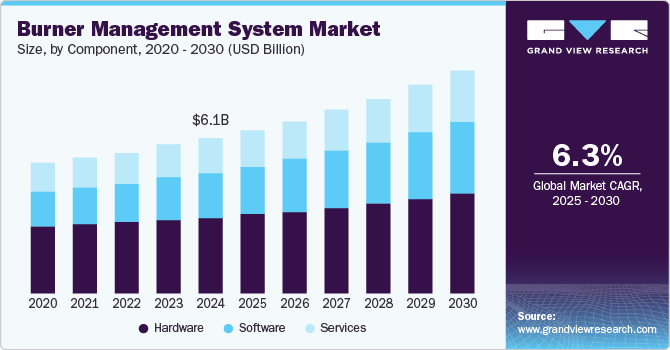

The global burner management system market size was valued at USD 6.09 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. This expansion can be attributed to the need for safety and regulatory compliance. Industries that rely on burner systems, such as oil and gas, power generation, and chemicals, face significant risks associated with burner malfunctions. In response to these concerns, governments have implemented stricter regulations mandating the installation of a Burner Management System (BMS) to ensure safe operations. In addition, the increasing number of workplace accident litigations has prompted companies to adopt BMS solutions to mitigate risks and strengthen safety protocols, further contributing to market growth.

Technological advancements also play a crucial role in the expansion of the burner management system market. The integration of smart technologies and Internet of Things (IoT) capabilities into BMS frameworks has significantly enhanced monitoring, control, and operational efficiency. Innovations such as real-time data analysis, predictive maintenance, and performance optimization are fueling the demand for advanced BMS solutions as industries prioritize process optimization alongside safety standards. Furthermore, the growing emphasis on energy efficiency and sustainability in industrial operations supports the adoption of modern BMS technologies.

Emerging economies are experiencing rapid industrialization and urbanization, which is increasing the demand for reliable BMSs. As the market expands, there is a pressing need for advanced solutions that enhance safety and operational efficiency. Moreover, the shift toward renewable energy sources presents new opportunities for BMS applications in cleaner energy production, further bolstering the burner management system industry. In addition, increasing awareness of the benefits of automated BMSs, such as reduced downtime, improved safety, and enhanced regulatory compliance, is accelerating adoption across various sectors. Continued investments in research and development aimed at advancing system capabilities and incorporating next-generation technologies are expected to support ongoing growth in the burner management system market.

Component Insights

The hardware segment of the BMS industry held the largest revenue share of 49.6% as of 2024. This dominance is attributed to the critical role that hardware components play in ensuring safe and efficient burner operations across various sectors, including oil and gas, power generation, and chemicals. As organizations increasingly prioritize safety and regulatory compliance, the demand for reliable hardware solutions has surged. Furthermore, advancements in technology have enhanced the functionality and efficiency of these hardware systems, making them essential for modern industrial applications. The integration of advanced technologies with BMS has further aided the growth of this segment as companies seek to optimize performance and reduce operational risks. As a result, the hardware segment is expected to continue leading the burner management system industry in the coming years.

The software segment is projected to experience the highest CAGR in the coming years. This growth is driven by the increasing demand for advanced software solutions that enhance monitoring and control of burner operations. Companies are prioritizing safety and efficiency, leading to a rise in real-time data analysis and automation features. Moreover, innovations such as improved Human-Machine Interfaces (HMI) and diagnostic tools are further boosting performance. The integration of sophisticated algorithms into safety interlocks highlights the critical role of software in modern BMS applications. Hence, this segment is expected to expand at a significant pace as organizations work to optimize their burner management processes.

Application Insights

The multiple-burner segment of the burner management system industry held the largest revenue share as of 2024 and is projected to grow at the fastest CAGR over the forecast period. The segment is driven by the increasing complexity of industrial operations requiring multiple burners to enhance performance and efficiency. Industries such as oil and gas, power generation, and chemicals often rely on these systems to boost operational capabilities and improve safety. Simultaneously, managing several burners improves combustion control, reduces emissions, and enhances energy efficiency. Advanced technology enables sophisticated monitoring and control features, further increasing their appeal. As safety and efficiency remain priorities, the demand for multiple burner systems is expected to grow significantly.

The single-burner segment is expected to experience substantial growth, particularly in smaller-scale applications where simplicity and cost-efficiency are critical. These systems are easy to install and integrate, making them attractive to businesses aiming to enhance processes without extensive changes. Furthermore, the increasing focus on energy efficiency has led many companies to adopt single-burner solutions that optimize fuel usage while maintaining safety standards. This segment caters to diverse industrial needs, offering practical and efficient solutions that drive increasing demand and sustain its importance in the market.

Fuel Type Insights

The gas segment held the largest revenue share as of 2024 in the burner management system industry. This dominance is primarily due to the widespread use of natural gas in various industrial applications, including power generation and manufacturing. Gas burners are favored for their efficiency, lower emissions, and cost-effectiveness compared to other fuel types. In addition, the growing emphasis on reducing carbon footprints has led many industries to transition from coal and oil to cleaner-burning natural gas. The reliability and performance of gas burners further enhance their appeal in modern industrial settings. As a result, the gas segment is expected to maintain its leading position in the burner management system market.

The oil segment is expected to have a significant CAGR in the coming years. This growth is due to the versatility of oil as a vital energy source for various industries. Innovations in oil burner technology are improving efficiency and reducing emissions, which helps sustain the demand for oil-based systems. In addition, as companies seek reliable energy solutions, the oil segment remains well-positioned for continued significance. The oil segment is adapting to meet changing market demands and technological advancements.

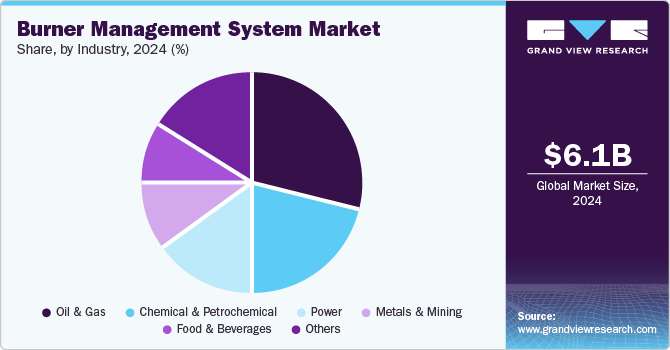

Industry Insights

The oil and gas segment held the largest revenue share in the Burner Management System (BMS) industry in 2024. This dominance can be attributed to the extensive use of oil and gas across various sectors, including power generation and manufacturing. The demand for efficient and reliable burner management solutions is significant among consumers. Moreover, the ongoing transition toward cleaner energy sources has led many companies to invest in advanced burner systems that optimize fuel usage and reduce emissions. Furthermore, the established infrastructure and technological advancements within the oil and gas sector contribute to its strong market position. Therefore, this segment is expected to maintain its leading position in the BMS market.

The chemical and petrochemical sector is anticipated to experience the highest CAGR during the forecast period. This growth is fueled by increasing demand for chemical products in applications such as pharmaceuticals and agriculture. As industries strive to enhance operational efficiency and safety, there is a rising need for advanced burner management systems tailored to chemical processes. In addition, stringent environmental regulations are encouraging companies to adopt cleaner technologies that minimize emissions. Innovations in burner technology enable more precise control over combustion processes, which is essential for chemical manufacturing. Thus, the chemical and petrochemical segment represents a significant growth area within the market.

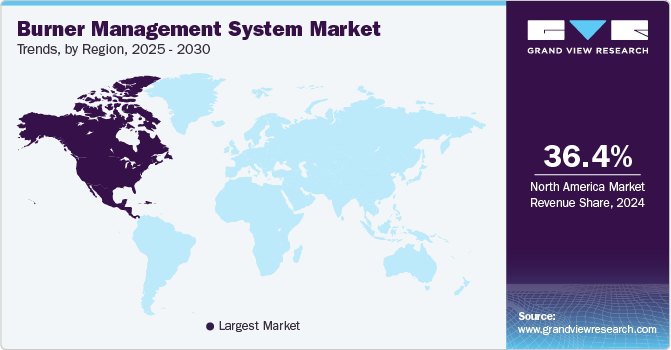

Regional Insights

North America dominated the global burner management system market with a revenue share of 36.4% in 2024. This strong position can be attributed to the high demand for BMS solutions across various industries, particularly oil and gas, where safety and efficiency are critical. The region's established infrastructure and technological advancements further enhance its market leadership. In addition, the growing investments in energy efficiency and regulatory compliance are boosting the adoption of advanced BMSs. The presence of key market players in North America also contributes to the region's growth. As a result, North America is expected to maintain its dominance in the BMS market.

The U.S. burner management system market dominated the regional market. This growth is driven by stringent regulatory compliance requirements, which are compelling industries, particularly oil and gas, to adopt advanced BMS solutions to enhance safety and mitigate risks. In addition, an increase in industrial safety concerns has heightened awareness of the need for effective burner management, leading to greater investments in these systems. The aging infrastructure across various sectors necessitates modernization efforts, creating opportunities for BMS providers. Furthermore, technological advancements, such as IoT and data analytics, improve the functionality and efficiency of BMS. Moreover, the growing demand for energy-efficient solutions aligns with corporate sustainability goals, further propelling the market. Hence, the U.S. is expected to continue leading the regional market over the forecast period.

Europe Burner Management System Market Trends

Europe is a significant player in the burner management system market, driven by stringent safety regulations and a strong focus on energy efficiency. The region's commitment to reducing carbon emissions has led to increased investments in advanced burner technologies across various industries. Countries such as Germany and the U.K. are at the forefront of adopting innovative BMS solutions to enhance operational safety and compliance. Furthermore, the growing chemical and petrochemical sectors in Europe are expected to boost demand for effective burner management systems. The emphasis on sustainability and renewable energy sources also supports market growth in the region. As a result, the European market is expected to grow at a steady pace over the forecast period.

Asia Pacific Burner Management System Market Trends

The Asia Pacific burner management system market is anticipated to experience the highest CAGR. This growth can be attributed to rapid industrialization and increasing investments in safety systems across various sectors. In 2023, the Indian government implemented stricter safety standards for industrial operations, prompting companies to invest in burner management systems to ensure compliance and enhance operational safety. Governments in China, India, and Japan are committed to reducing emissions, which further supports the adoption of burner management systems.

China dominated the Asia Pacific BMS market due to its extensive industrial sector. The country’s focus on modernizing its manufacturing processes has led to an increase in investments in advanced burner technologies. In 2024, the Chinese government plans to implement stricter emission standards, which will drive the demand for effective BMS solutions across various industries. Moreover, initiatives aimed at improving energy efficiency are prompting industries to adopt sophisticated burner management systems. This commitment to safety and environmental standards enhances the appeal of BMSs across multiple applications. As a result, the Chinese market is expected to grow rapidly in alignment with its industrial advancements.

Key Burner Management System Company Insights

Some key companies in the BMS market are ABB; Babcock & Wilcox Enterprises, Inc; The Cleaver-Brooks Company, Inc; and GE Vernova. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

- ABB, a global leader in industrial automation, offers advanced burner management systems that optimize efficiency, safety, and energy use. Its innovative technologies support precise combustion control, reducing emissions and enhancing power generation and oil and gas industry performance.

- Babcock & Wilcox Enterprises, Inc. excels in energy and environmental technologies, providing advanced burner management solutions for large-scale organizations. Its systems enhance combustion safety, fuel efficiency, and regulatory compliance, making it a trusted choice in the power and energy sectors.

Key Burner Management System Companies:

The following are the leading companies in the burner management system market. These companies collectively hold the largest market share and dictate industry trends- ABB

- Babcock & Wilcox Enterprises, Inc

- The Cleaver-Brooks Company, Inc

- Emerson Electric Co.

- GE Vernova

- Honeywell International Inc

- Rockwell Automation

- Schneider Electric

- Siemens

- Yokogawa Deutschland GmbH

Recent Developments

-

In April 2024, Emerson Electric Co introduced the ASCO Series 148/149, a cutting-edge motorized actuator and shutoff valve designed to improve the safety and reliability of combustion systems. This system ensures shutoff in less than a second, providing critical safety enhancements for industrial fuel burners, even in extreme conditions. By increasing operational efficiency and meeting stringent safety standards, this innovation aligns with the rising demand for advanced burner management solutions in various industries.

-

In February 2022, Fossil Power Systems (FPS) was acquired by Babcock & Wilcox Enterprises, Inc., enhancing its expertise in combustion and emissions control technologies. This acquisition supports Babcock & Wilcox's strategic objective of strengthening its presence in the BMS market.

Burner Management System Market Report Scope

Report Attribute

Details

Marketsizevalue in 2025

USD 6.41 billion

Revenue forecast in 2030

USD 8.68 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB; Babcock & Wilcox Enterprises, Inc; The Cleaver-Brooks Company, Inc; Emerson Electric Co.; GE Vernova; Honeywell International Inc; Rockwell Automation; Schneider Electric; Siemens; Yokogawa Deutschland GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burner Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global burner management system market report based on component, application, fuel type, industry, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Multiple-Burner

-

Single-Burner

-

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas

-

Oil

-

Others

-

-

Industry Outlook (Revenue, USD Million; 2018 - 2030)

-

Oil & Gas

-

Chemical & Petrochemical

-

Power

-

Metals & Mining

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.