- Home

- »

- Petrochemicals

- »

-

Butane Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Butane Market Size, Share & Trends Report]()

Butane Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (LPG, Petrochemicals, Refineries, Others) By Region (North America, Europe, APAC, MEA), And Segment Forecasts

- Report ID: 978-1-68038-192-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

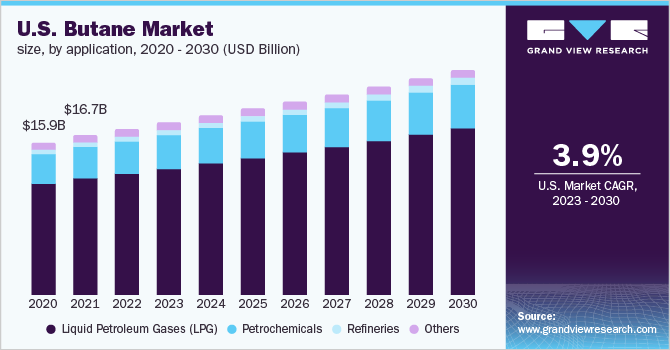

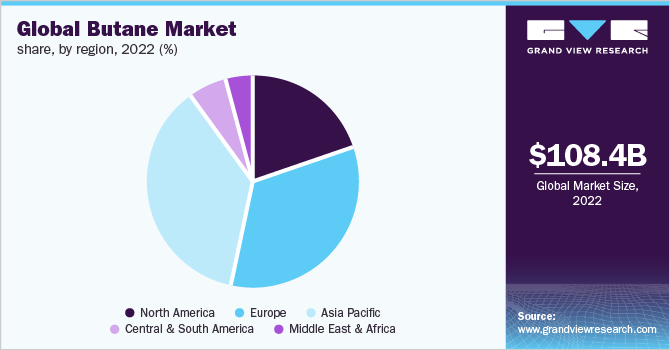

The global butane market size was estimated at USD 108.43 billion in 2022 and is projected to reach USD 149.28 billion by 2030, growing at a CAGR of 4.1% from 2023 to 2030. The growth is attributable to the increasing application of butane in the making of liquid petroleum gases (LPG). Growing demand for LPG in numerous application such as residential cooking, fuel in automobile, industrial agriculture, and others, due to its properties like easy liquefiable and high flammability is likely to propel the market growth over the future years.

Increasing adoption of LPG as a domestic fuel in emerging economies of Asia Pacific by the means of government subsidies is expected to remain a key driving factor for the growing demand for butane. It is also used for manufacturing various primary petrochemicals and the massive petrochemical capacity expansion in the Middle East. Auto gas is one of the fastest emerging alternative transportation fuels on account of its low carbon footprint compared to gasoline and diesel.

Butane is used as a feedstock in petrochemical complexes for producing various petrochemicals such as ethylene, butadiene, which is a key raw material for the production of synthetic rubber, and maleic anhydride. The petrochemical industry represents the second biggest user after LPG. Ethylene which is considered one of the major petrochemical building blocks for manufacturing numerous vital petrochemicals is mainly produced via naphtha, however, some petrochemical complexes around the world, which are flexible on their feedstock slates, use butane to manufacture ethylene.

Automotive liquefied petroleum gas, also known as auto gas, is used as a fuel in automobiles in many regions worldwide. Auto gas has high energy content and burns easily compared to other energy sources or fuels. Consumption of auto gas has been rapidly increasing over the last few years, majorly due to its environmental benefits. National governments of various countries have been promoting the use of auto gas through various initiatives. The growing use of butane in the production of automotive gas is likely to propel the market over the projected years.

The strike of COVID-19 further propelled the demand for butane owing to the rising consumption of LPG for cooking across the world. Global lockdown due to the growing risk of infection from COVID-19 compelled people to cook their food at home. This factor triggered the growth of the market across the globe.

Application Insights

LPG application segment dominated the market with the highest revenue share of 69.7% in 2022. Its high share is driven by its growing use of LPG in various applications such as residential & commercial, chemical & petrochemical, industrial, refinery, auto fuel, and others. The consumption of LPG for cooking has exponentially increased since the outbreak of COVID-19 owing to the rising dependability on home cooking on the account of the shutdown of restaurants.

Growing demand for auto fuel on the account of increasing use of cars and other automobiles for daily commutes is likely to influence the demand for butane over the forthcoming years. According to a report published by the World Economic Forum in 2022, near about 76.0% of residents use their own cars to commute between their homes and workplace in the U.S. In Germany, over 65.0% working-class population use their own cars to travel to their work. This factor is likely to accelerate the demand for butane over many years to come.

Growing consumption of petrochemicals is another factor contributing to the growth of the market globally. Petrochemicals are also found in various modern energy systems, wind turbine blades, solar panels, and thermal insulation for buildings, batteries, and electric vehicle parts. The rising utilization of petrochemicals in applications such as fertilizers, plastics, clothing, packaging, tires, detergent, medical equipment, and more, is anticipated to influence the growth of the market over the forecasted years.

Regional Insights

Asia Pacific dominated the butane market with the highest revenue share of 36.6% in 2022. Asia Pacific is among the high-prospect markets for chemical industry stakeholders. Rapid economic growth coupled with an increase in individual power consumption is encouraging growth in Asia Pacific. In addition to South Korea and Japan, flourishing countries like India, China, Indonesia, and others offer lucrative growth opportunities for the market.

Europe presents lucrative growth opportunities owing to the rising production of liquid petroleum gas (LPG) in countries like Russia, Germany, the UK, and others. The rising consumption of LPG in residential and commercial for cooking and heating application is the key driver for the growing consumption of the product in Europe over the forthcoming years. Low carbon emission of butane in comparison with coal for energy generation is another contributing factor behind the growth of the market in Europe.

North America is anticipated to witness stable growth in demand for butane owing to rising production of crude and natural gas in the U.S. U.S. is among the key producers of petrochemicals, accounting for nearly 40.0% of the total global petrochemical production per year, according to the International Energy Agency (IEA). Growing petrochemical production is anticipated to accelerate the demand for butane over the foreseeable future in the U.S.

Key Companies & Market Share Insights

The global market is fragmented on the account of the presence of various players in the business operating globally. Emerging players and leaders in the country that include small manufacturers, traders, and players operating at country and regional levels capture a significant market share. Some prominent players in the global butane market comprise:

-

British Petroleum

-

Chevron Corporation

-

China National Petroleum Corporation (CNPC)

-

Valero Energy Corporation

-

Conocco Phillips Inc.

-

Devron Energy Corporation

-

Exxon Mobil Corporation

-

Proton Gases India Pvt. Ltd.

-

Perenco

-

Royal Dutch Shell plc

-

Linde AG

-

TotalEnergies

-

Praxair

Butane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 112.90 billion

Revenue forecast in 2030

USD 149.28 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Million Tons, Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; Russia; China; India; Japan; South Korea; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; Iran

Key companies profiled

British Petroleum; Chevron Corporation; China National Petroleum Corporation (CNPC); Valero Energy Corporation; Conocco Phillips Inc.;, Devron Energy Corporation; Exxon Mobil Corporation; Perenco; Royal Dutch Shell plc; Linde AG; TotalEnergies; Praxair

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Butane Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the butane market report based on application, and region:

-

Application Outlook (Volume, Million tons, Revenue, USD Million; 2018 - 2030)

-

Liquid Petroleum Gases (LPG)

-

Residential/Commercial

-

Chemical/Petrochemical

-

Industrial

-

Auto Fuel

-

Refinery

-

Others

-

-

Petrochemicals

-

Refineries

-

Others

-

-

Regional Outlook (Volume, Million tons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global butane market size was estimated at USD 108.43 billion in 2022 and is expected to reach USD 149.28 billion in 2030.

b. The global butane market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 149.28 billion by 2030.

b. Asia Pacific dominated the butane market with a share of 36.7% in 2022. This is attributable to surge in demand for the gas in refineries and chemical processing units in China.

b. Some key players operating in the butane market include British Petroleum (BP), ConocoPhillips Inc., Chevron Corporation and Exxon Mobil Corporation.

b. Key factors that are driving the market growth include increasing penetration of LPG as a domestic fuel in emerging markets, growth of global autogas vehicle industry, and rapid petrochemicals capacity expansion in the Middle East.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.