- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Canada Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Canada Nutraceuticals Market Size, Share & Trends Report]()

Canada Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-213-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Nutraceuticals Market Summary

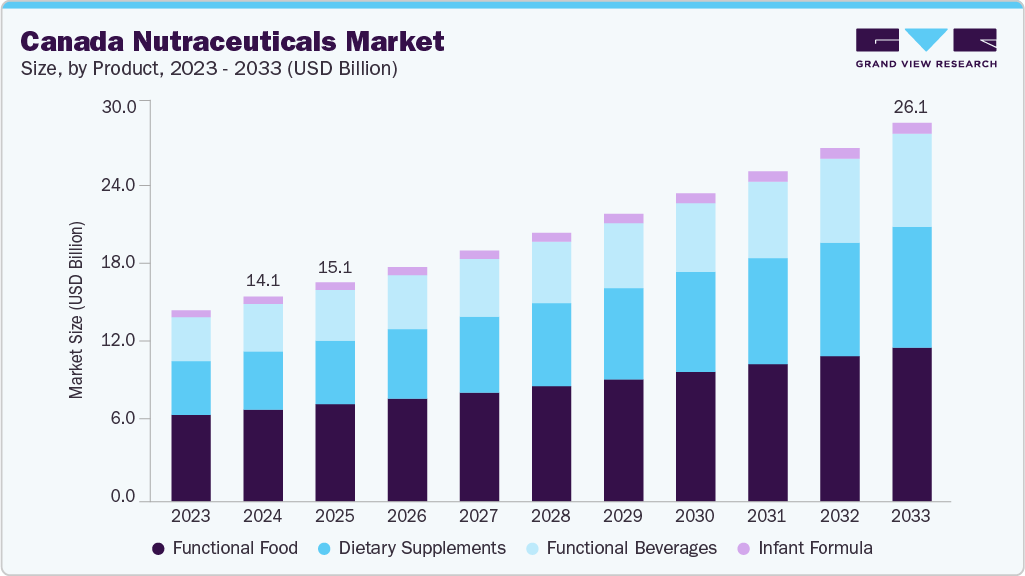

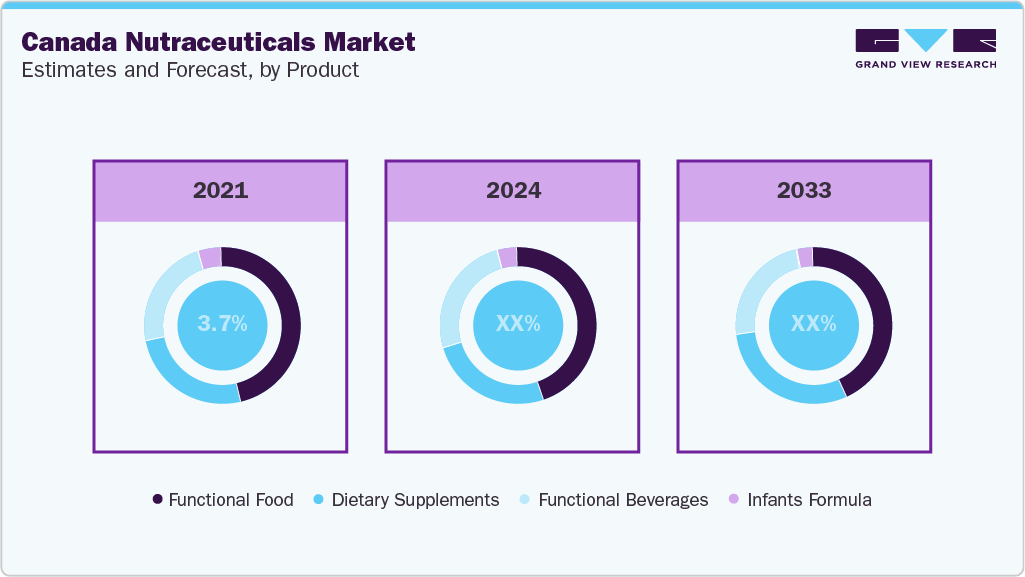

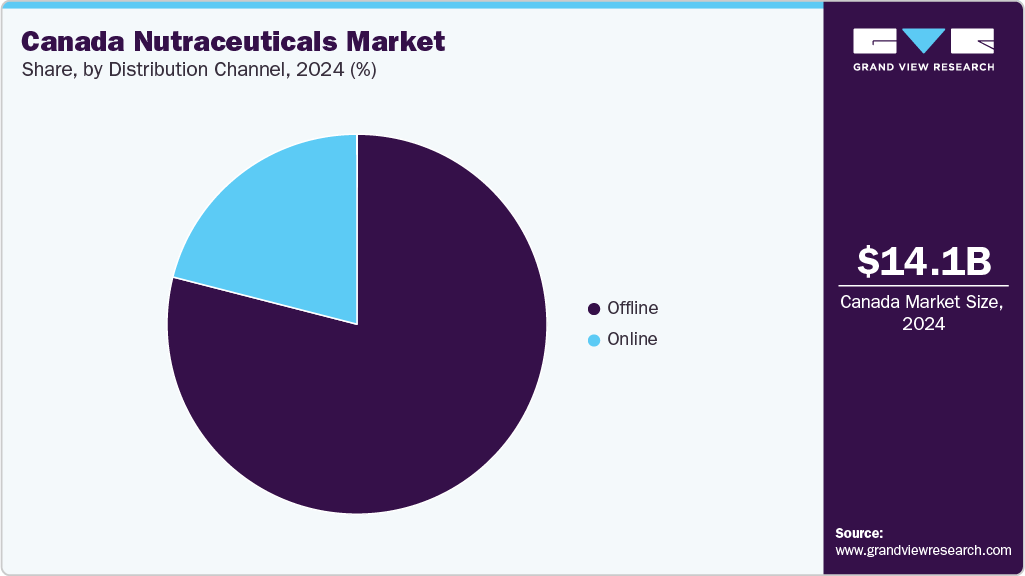

The Canada nutraceuticals market size was estimated at USD 14.09 billion in 2024 and is projected to reach USD 26.07 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. Canada’s nutraceutical market is growing steadily, influenced by changes in the population, an increase in chronic illnesses, and a stronger focus on maintaining health proactively.

Key Market Trends & Insights

- By product, the functional food segment held the highest market share of 44.8% in 2024.

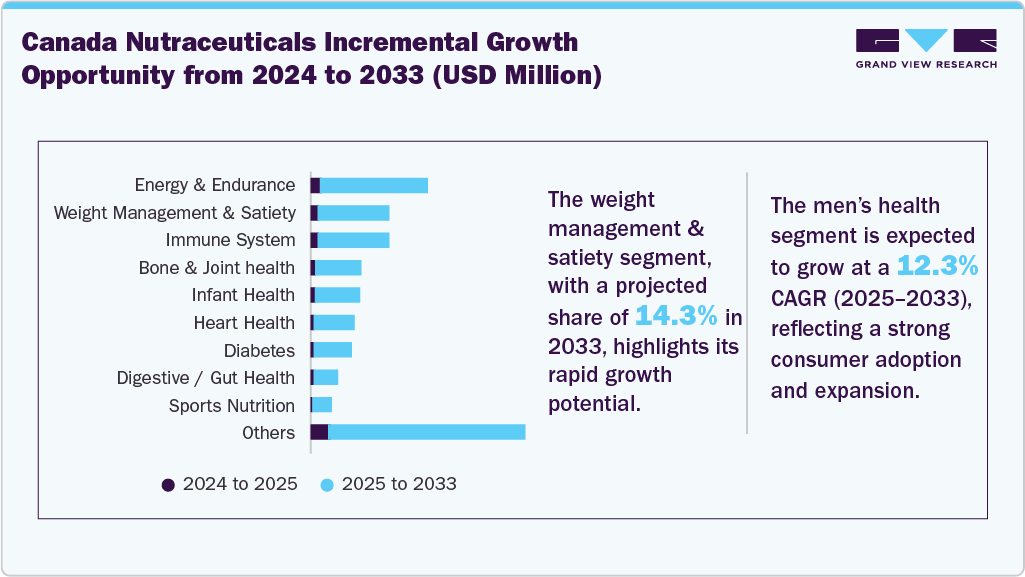

- Based on application, the weight management & satiety segment held the highest market share in 2024.

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.09 Billion

- 2033 Projected Market Size: USD 26.07 Billion

- CAGR (2025-2033): 7.1%

As more people age, there is a rising need for supplements that help with joint care, brain function, and heart health.The rise in obesity and diabetes is pushing many Canadians to take preventive steps, including regularly using nutraceutical products. Shoppers are becoming more careful about their choices, showing a clear preference for natural, plant-based products with simple, clean labels. Ingredients such as flaxseed, turmeric, and probiotics are gaining popularity as people look for natural ways to stay healthy. Canadian companies are also exploring new ways to deliver these products.

This growing demand for ethical, sustainable, and local production is also reflected in consumer loyalty to homegrown brands such as CanPrev, Webber Naturals, and Jamieson, emphasizing transparency and clean formulations. Another key trend shaping the market is the surge in personalized nutrition, powered by advances in AI, genetic diagnostics, and wearable health trackers. Canadians are increasingly seeking supplements tailored to their unique lifestyle, dietary preferences, and microbiome profiles, contributing to a sharp rise in demand for probiotics, prebiotics, and gut-health-focused formulations.

In addition to growing health awareness, factors such as the expansion of e-commerce and improvements in product delivery formats are significantly increasing market accessibility and consumer engagement. The rising popularity of convenient formats such as gummies, sachets, and plant-based functional bars has been well received by younger, lifestyle-focused consumers.

Consumer Insights

Consumer behavior in Canada is influenced by local preferences, strong brand loyalty, wide product selections, and wellness trends such as veganism. Canadians have many opportunities to try functional foods and supplements, with gyms and fitness centers serving as important access points for health-conscious consumers. Younger consumers, in particular, are increasingly opting for plant-based protein bars and snacks. Brands such as Wholly Veggie have become available in major grocery chains, including Loblaws and Sobeys, addressing the rising demand for clean-label and vegan products. This trend represents a wider shift toward preventive health and nutrition focused on lifestyle, particularly among urban millennials and Gen Z. Convenience, natural ingredients, and ethical sourcing have become important factors influencing buying decisions in this market segment.

Urban parents are driving demand for prenatal and infant nutrition products, favoring formulations enriched with probiotics and omega-3s readily available in specialized health stores. Concurrently, e-commerce platforms, such as Well.ca and Loblaws, offering transparent ingredient lists, user reviews, and convenient home delivery, have become a preferred channel for busy consumers, reducing barriers to product trials and repeat purchases.

Product Insights

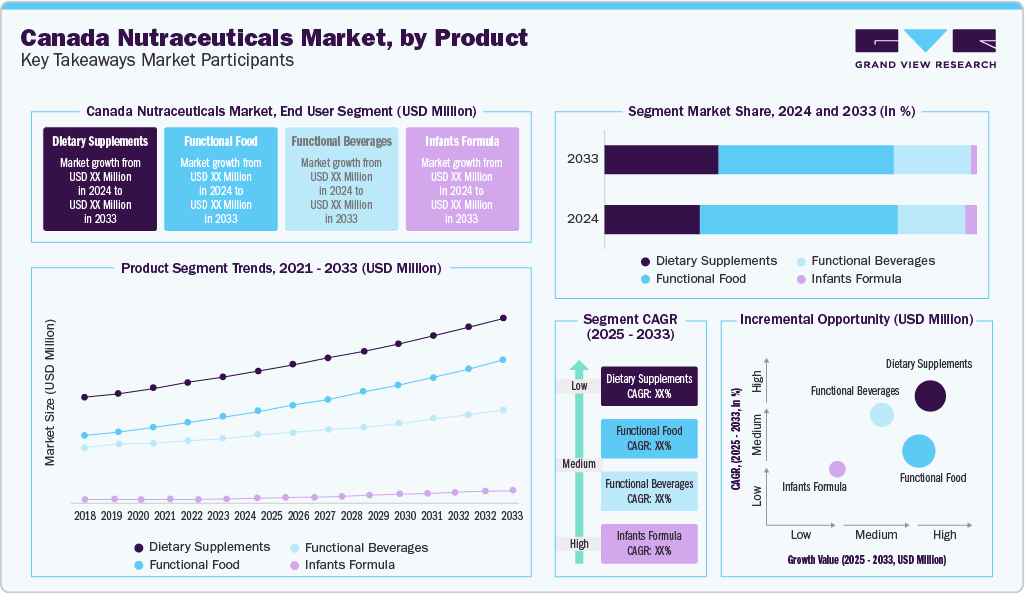

The functional food segment dominated the Canadian nutraceuticals industry with the largest share of 44.8% in 2024, driven by consumers’ desire to combine nutrition and convenience in everyday eating. Canadians are increasingly seeking foods that offer more than basic nutrition as they want added health benefits. This has driven strong growth in functional beverages and snack bars enriched with protein, fiber, or botanicals. Retailers are increasingly merchandising products such as yogurt with added probiotics and snack bars fortified with plant proteins, making it easy for customers to compare health benefits through shelf labels and apps.

Innovation within this segment is further driven by ongoing research into superfoods and native ingredients. Notably, studies from Memorial University have revealed sea buckthorn’s cardiovascular and anti-inflammatory properties, inspiring new product launches across Canada. Rich in omega-3 fatty acids and polyphenols, sea buckthorn extracts are now featured in juices and bars designed to promote heart health and mild weight management, exemplifying the fusion of scientific insight and consumer demand in the functional food market.

The dietary supplements segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2033, driven by increasing consumer focus on preventive healthcare and wellness, with more individuals using supplements to address nutritional gaps and support overall health. The aging population is key, as older adults often need specific nutrients to manage age-related health issues. In addition, the rise of personalized nutrition and the availability of customized supplements for sports performance, weight management, and immune support are attracting a broader range of consumers. Advances in supplement technology, including improved delivery methods such as liposomes and nanotechnology, are enhancing product effectiveness and appeal. Moreover, growing awareness of the connection between gut health and overall wellness has boosted demand for probiotics and prebiotics, further expanding the market.

Application Insights

The weight management & satiety application accounted for the largest market share of the Canadian nutraceuticals industry in 2024. The rising prevalence of obesity and related health issues is driving consumers to seek convenient, natural alternatives beyond traditional dieting. This has increased demand for products that promote satiety, regulate appetite, and support fat burning, with a strong focus on plant-based ingredients, fiber-rich formulations, and scientifically supported benefits. In addition, the wellness movement is shifting attention from simple weight loss to overall health, boosting interest in nutraceuticals that enhance metabolism, gut health, and energy balance. Consumers are increasingly looking for sustainable solutions rather than quick fixes. The convenience of ready-to-drink shakes, bars, and powders also plays a significant role, offering easy options that fit busy lifestyles.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. Men are becoming more proactive in managing specific health issues and maintaining overall wellness. This shift is driven by greater awareness of preventive healthcare and a deeper understanding of nutrition’s role in enhancing performance, vitality, and long-term health. As a result, there is an increasing demand for supplements focused on prostate health, muscle growth and strength, energy support, and hormonal balance. For instance, Webber Naturals’ Super Prostate is a once-daily supplement combining saw palmetto, pumpkin seed oil, lycopene, zinc, and selenium. It is formulated to alleviate mild to moderate BPH symptoms, such as weak urinary flow and frequent nighttime urination. This product illustrates how supplement manufacturers are addressing the increasing male demand for targeted, preventive health solutions.

Distribution Channel Insights

The offline distribution segment dominated the Canada nutraceuticals industry in 2024. Manufacturers rely on established pharmacy, supermarket, and specialty health store networks to increase brand visibility and encourage product trials. They use shelf placement, in-store demonstrations, and pharmacist recommendations to influence buying decisions. In addition, broader consumer trends such as veganism and the demand for plant-based nutrition are shaping product development and retail strategies.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. With more young consumers purchasing supplements, fortified foods, and wellness snacks through digital platforms, nutraceutical brands are increasingly launching products directly on e-commerce sites and investing in mobile apps and social media storefronts to meet this demand. Meanwhile, major retailers are enhancing their last-mile delivery capabilities. In October 2024, Empire Company Limited, parent of Sobeys, Farm Boy, Longo’s, and FreshCo, partnered with Instacart and Uber Eats to deliver groceries and health products on demand.

Key Canada Nutraceuticals Company Insights

Some of the key players in the Canada nutraceuticals market include Amway, General Mills Inc.,Yakult U.S.A. Inc. and others.

- Danone has a significant presence in Canada through its functional and health-oriented food and beverage brands, including Activia, Oikos, Silk, Two Good, and Danone yogurt. These brands offer products that promote gut health, provide higher-protein nutrition, and meet dairy-alternative requirements. The company meets consumer demand for clean-label and plant-based options, protein-fortified and gut-friendly formats.

Key Canada Nutraceuticals Companies:

- General Mills Inc.

- Amway

- Danone.

- Yakult U.S.A. Inc.

- Nestlé Health Science

- Herbalife International of America, Inc.

Recent Developments

-

In February 2025, Danone launched Oikos PRO, a high-protein Greek-style yogurt range with 18-24 grams of protein per serving and no added sugar, produced locally across its Boucherville plant network. This marks the first Canadian production of a premium probiotic-fortified dairy line.

-

In May 2024, Lactalis Canada launched its Enjoy! line, a high-protein, unsweetened plant-based beverage range of oats, almonds, and hazelnuts, in the nation.

-

In April 2024, Herbalife Canada introduced its Herbalife V vegan product line, featuring organic, non-GMO, and Kosher options. The launch, which won the DSA Marketing & Sales Campaign Award at Engage 2024, targets the growing plant-based segment among Canadian consumers.

Canada Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.09 billion

Revenue forecast in 2033

USD 26.07 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

General Mills Inc.; Amway; Danone.; Yakult U.S.A. Inc.; Nestlé Health Science; Herbalife International of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canada Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Frequently Asked Questions About This Report

b. The Canada nutraceuticals market size was estimated at USD 14.09 billion in 2024 and is expected to reach USD 15.10 billion in 2025.

b. The Canada nutraceuticals market is expected to grow at a compounded growth rate of 7.1% from 2025 to 2033 to reach USD 26.07 billion by 2033.

b. The functional foods held the share of 37.6% in 2024. Several benefits associated with functional foods, such as regulating the immune system & blood lipids, fighting fatigue, and providing nutritional supplements, are anticipated to boost the segment’s growth. The companies in the country are extensively involved in developing and launching new products in the market.

b. Some key players operating in the Canada nutraceuticals market include Cargill Incorporated; ADM; DuPont de Nemours, Inc.; Nestlé; General Mills, Inc.; Innophos, Inc.; W.R. Grace & Co.; Amway Corp.; Alva-Amco; Avrio Health L.P; Abbott Laboratories; Pfizer Inc.

b. Key factors that are driving the market growth include rising awareness of nutritional supplements among working professionals in Canada for maintaining the balanced nutrition in human body is expected to promote the consumption of dietary supplements. In addition, high adoption rates for herbal medicines among individuals in the Canada, on account of rising concerns over hazardous effects associated with conventional pharma drugs, are expected to contribute to the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.