- Home

- »

- Plastics, Polymers & Resins

- »

-

Canada Plastic Decking Market Size & Share Report, 2030GVR Report cover

![Canada Plastic Decking Market Size, Share & Trends Report]()

Canada Plastic Decking Market (2023 - 2030) Size, Share & Trends Analysis Report By Resin (High-density Polyethylene, Low-density Polyethylene, Polypropylene, Polyvinyl Chloride), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-067-0

- Number of Report Pages: 69

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

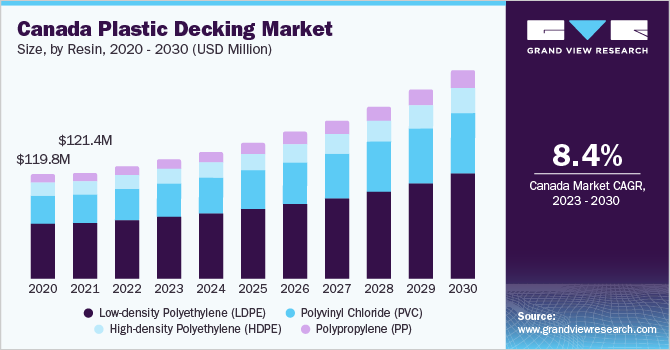

The Canada plastic decking market size was valued at USD 128.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The rising demand for aesthetic work and living spaces has propelled the demand for plastic decking across Canada. It is anticipated to follow similar trends throughout the forecast period. Plastic has infiltrated the decking industry in the past few years. Consumers no longer settle for traditional counterparts such as timber and desire trouble-free decking. Consumers have switched to plastic decking from wood to avoid high maintenance costs. Plastic decking when compared to wood does not require sealing, painting, or sanding. Once a plastic deck board is installed owners only need to clean their deck with water and soap, which is not burdensome.

High heat or solar energy is powerful, which can cause the PVC decks to crack & separate and cause wood decks to turn grey. There have been complaints of the old PVC decks becoming brittle and unattractive due to high heat conditions, as vinyl is not immune to the combination of UV rays and heat.

Increasing demand for the beautification of buildings coupled with increasing demand for innovative and low-maintenance products is boosting the growth of the plastic decking market. Rapid urbanization is also expected to create lucrative opportunities in the industry. Furthermore, the plastic decking market is expected to be positively influenced by the opportunities from residential and non-residential sectors.

Resin Insights

The low-density polyethylene (LDPE) resin segment led the market and accounted for more than 54.9% of the revenue share in 2022. LDPE is a chemically inert and high-clarity polymer, which is widely used owing to its barrier properties, flexibility, stress crack resistance, and good impact strength. In addition, it is one of the economic polymers available across the globe. Composite decking is an amalgamation of reclaimed wood fibers and recycled plastic films. The plastic film that goes into composite decking is known as LDPE and combines with wood flour or wood fiber.

High-density polyethylene (HDPE) decking offers an alternative to common decking options such as wood composite lumber and wood. The cost of HDPE decking is slightly higher compared to traditional wood and low-end composite decking. However, it offers significant cost savings over time. The adoption of HDPE decking is growing due to its low-maintenance decking solution, which is attracting more and more consumers.

PVC is one of the majorly used plastics across building and construction applications such as window profiles, cables, pipes, flooring, and roofing. Furthermore, PVC resin is being widely utilized to manufacture decks as it provides high resistance to mold, moisture control, and resistivity toward decay and humidity compared to traditional materials such as wood and composites.

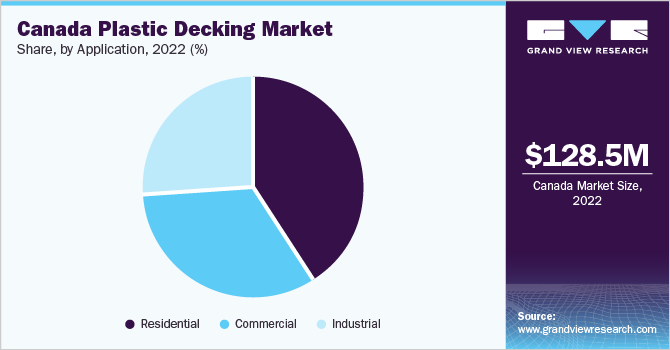

Application Insights

The residential application segment led the market and accounted for more than 41.1% of the revenue share in 2022. Owing to environmental concerns, manufacturers are engaged in developing wood alternatives. For instance, Miura Board is offering deck boards that blend 100% recycled plastics and post-consumer carpet fibers into a durable, weatherproof composite. These boards are environmentally friendly, durable, versatile, and ideal for industrial applications.

Plastic decking is a durable solution for commercial businesses. Plastic decking offers various low-maintenance solutions and designs possibilities for businesses to expand their seating area. Plastic deck boards are made entirely from plastic resins including polypropylene, polyethylene, and polyvinyl chloride. Plastic decking has completely changed the landscape of commercial decking by offering durable, low-maintenance, long-lasting, and aesthetically appealing deck boards.

Key Players & Market Share Insights

The market is moving toward consolidation on account of the presence of a large number of global and regional players. Major players have strong distribution networks and product brands in the global market. The ongoing research & development activities in the market exhibit several growth and expansion opportunities, which in turn is projected to positively influence the overall growth.

Manufacturers engage in expansion activities for plastic decking. For instance, in February 2022, Tiva Building Products announced its expansion into the U.S. with the purchase of a 50,000-square-foot production plant in South Carolina that covers approximately 36 acres of land. The facility is anticipated to offer services to the existing wholesale distributors of the company, including Weston Forest Products and Sherwood Lumber. Some prominent players in the Canada plastic decking market include:

-

Green Bay Decking

-

TAMKO Building Products LLC

-

UPM (UPM ProFi)

-

UFP Industries, Inc.

-

Advanced Environmental Recycling Technologies, Inc.

-

Azek Building Products, Inc.

-

Cardinal Building Products

-

Certainteed Corporation

-

Fiberon

Canada Plastic Decking Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 136.5 million

Revenue forecast in 2030

USD 239.8 million

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million sq. ft., revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, application

Country scope

Canada

Key companies profiled

Green Bay Decking; TAMKO Building Products LLC; UPM (UPM ProFi); UFP Industries, Inc.; Advanced Environmental Recycling Technologies, Inc.; Azek Building Products, Inc.; Cardinal Building Products; Certainteed Corporation; Fiberon

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Plastic Decking Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the Canada plastic decking market report based on resin, and application:

-

Resin Outlook (Volume, Million Sq. Ft.; Revenue, USD Million, 2018 - 2030)

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

-

Application Outlook (Volume, Million Sq. Ft.; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Volume, Million Sq. Ft.; Revenue, USD Million, 2018 - 2030)

-

Canada

-

Frequently Asked Questions About This Report

b. The Canada plastic decking market size was estimated at USD 128.5 million in 2022 and is expected to reach USD 136.5 million in 2023.

b. The Canada plastic market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 239.8 million by 2030.

b. High-density Polyethylene (HDPE) across the resin type segment dominated the Canada Plastic Decking Market with a share of 22.04% in 2022. High-density polyethylene (HDPE) decking offers an alternative to common decking options such as wood composite lumber and wood. The cost of HDPE decking is slightly higher compared to traditional wood and low-end composite decking, however, it offers significant cost savings over time.

b. Key market players present across the Canada Plastic Decking Market are Green Bay Decking; TAMKO Building Products LLC; UPM (UPM ProFi); UFP Industries, Inc.; Advanced Environmental Recycling Technologies, Inc.; Azek Building Products; Certainteed Corporation; and Fiberon LLC.

b. Key factors that are driving the market growth include adpotion of plastic material across decking in contrast to its counterparts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.