- Home

- »

- Petrochemicals

- »

-

Canadian Oilfield Chemicals Market Size Report, 2030GVR Report cover

![Canadian Oilfield Chemicals Market Size, Share & Trends Report]()

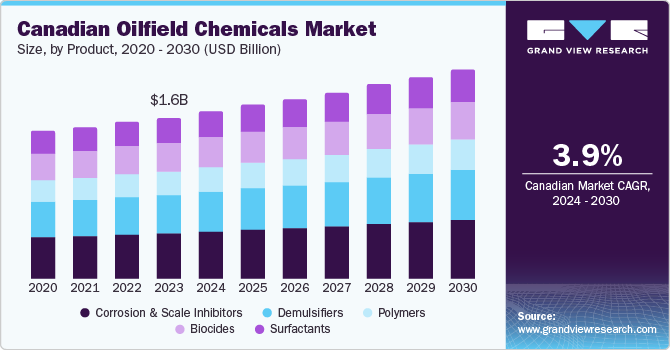

Canadian Oilfield Chemicals Market Size, Share & Trends Analysis Report By Product (Corrosion & Scale Inhibitors, Demulsifiers, Biocides, Surfactants, Polymers), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-994-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

The Canadian oilfield chemicals market size was valued at USD 1.64 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. Growing domestic demand, increasing exploration, regulations leading to increasing market opportunities for bio-based oilfield chemicals, and a shift towards hydrocarbon resources are some of the key growth driving factors for this industry. The development of unconventional resources such as shale gas and tight oil in Canada raises the need for various oilfield chemicals to address challenges associated with extraction. In addition, the ongoing advancements in drilling and production technologies, such as hydraulic fracturing and horizontal drilling, and increasing focus on enhanced oil recovery techniques are expected to influence the growth of this market during the forecast period.

The Canadian oilfield chemicals market is experiencing significant growth driven by the increasing exploration and production activities in the oil and gas sector. Canada is one of the significant oil producers worldwide, with an average production of about 5.8 million barrels per day (b/d) of petroleum and other liquid fuels recorded in 2023, largely driven by its vast reserves of unconventional resources such as oil sands, shale gas, and tight oil. As of January 2024, Canada's oil reserves reached 163 billion barrels, ranking fourth globally after Venezuela, Saudi Arabia, and Iran.

Technological advancements in drilling and completion processes are another significant growth driver for the oilfield chemicals market in Canada. Rising innovations such as rotary steerable systems, horizontal drilling, and hydraulic fracturing, which have become standard in oil and gas production, require specialized chemicals to manage wellbore stability, reduce fluid loss, and prevent corrosion. Moreover, the growth of enhanced oil recovery (EOR) projects is also driving the demand for oilfield chemicals in the region. As conventional oil fields mature, the focus shifts to EOR techniques, such as chemical flooding, to maximize recovery rates. Several oilfield companies are employing chemical EOR methods to extend the life of mature fields, leading to a great demand for specialized and advanced chemicals, including demulsifiers, biocides, and surfactants, to improve oil mobility and boost recovery.

In addition, the stringent environmental regulations and sustainability are also expanding the growth of oilfield chemicals in the region. Regulatory bodies such as the Canadian Environmental Protection Act have implemented strict guidelines to reduce the environmental impact of oil and gas operations. This has increased demand for environment-friendly and biodegradable chemicals that minimize ecological damage and improve safety. Companies increasingly invest in research and development to create greener chemical alternatives, further driving market growth. For example, in August 2024, BASF introduced a new chemical, "Fourtiva," specifically designed for gasoil and mild resid feedstock to assist refiners in creating higher-value products, boosting profitability, and reducing carbon emissions.

Product Insights

Based on products, the corrosion & scale inhibitors segment dominated the global industry and accounted for a revenue share of 28.4% in 2023. Rising exploration of oil and gas drive the segment growth. According to the Canadian Associated of Petroleum Producers (CAPP), Canada is the fifth-largest natural gas producer and fourth-largest crude oil producer globally, which leads to increased demand for these scale inhibitors that are crucial for preventing damage and ensuring the longevity of pipelines, storage tanks, wellbores, and other vital equipment.

Moreover, approximately 95% of Canada’s oil production, including the oil sands and all existing natural gas production, takes place in the Western Canadian Sedimentary Basin (WCSB), where conditions often include high temperatures, high pressures, and corrosive fluids, making corrosion & scale inhibitors more crucial to protect metal surfaces from rust and degradation.

The surfactants segment is expected to experience the fastest CAGR during the forecast period. Growth of this segment in primarily driven by the factors such as growing use of Enhanced Oil Recovery (EOR) technology, and emergence of new formulations of surfactants with increasing applications. Surfactants are extensively used in Enhanced Oil Recovery (EOR), drilling fluids, production processes, hydraulic fracturing, and water treatments. In addition, growing inclination towards use of sustainable solutions has resulted in increasing demand for the bio-base surfactants.

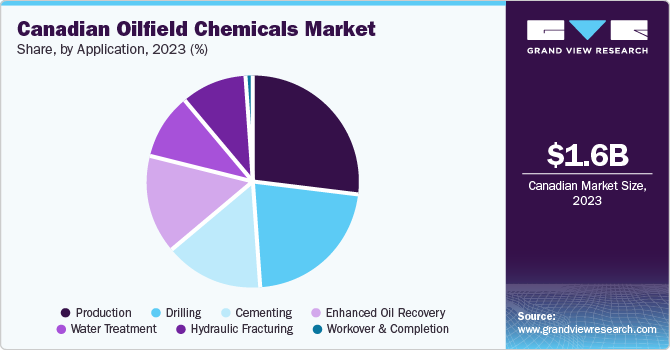

Application Insights

The production segment dominated the Canadian oilfield chemicals market in 2023. The key growth factors are the increasing complexity of managing oilfields and unconventional resources, rising demand for energy, and technological advancements. Chemicals help in optimizing the flow and separation of oil, gas, and water, reducing viscosity, and preventing scale and corrosion, which are vital for maintaining uninterrupted production and reducing operational downtime. Furthermore, the ongoing advancements in drilling and extraction technologies have fueled the demand for production applications in Canadian oilfield chemicals. For example, several companies utilize a range of production chemicals, including drilling fluids and demulsifiers, to maintain well integrity, prevent formation fluid influx, and maximize penetration levels during drilling. In addition, the growing environmental concerns and push for eco-friendly solutions have prompted manufacturers to focus on cleaner, sustainable oilfield chemicals.

The enhanced oil recovery segment is expected to register the fastest CAGR over the forecast period. As conventional oil reserves decline, the focus has increasingly shifted to employing EOR techniques to extend the life of existing fields and improve recovery rates. In Canada, a substantial portion of oil production comes from mature fields such as the Pembina oil field, necessitating using EOR methods to enhance oil mobilization and recovery. Furthermore, the growing emphasis on maximizing recovery from unconventional resources further supports the demand for EOR chemicals. The depleting oil reserves and increasing energy demand owing to growing population and industrial development are likely to create further demand for EOR chemicals to improve oil recovery from the depleting reservoir. In addition, continuous advances in EOR methods, including polymer flooding and surfactant-polymer flooding, have further demanded the application of chemical EOR to improve reservoir efficiency.

Key Companies & Market Share Insights

Some of the key companies involved in the Canadian oilfield chemicals market include BASF, Dow, Akzo Nobel N.V., The Lubrizol Corporation, DuPont, and others. To address the growing competition in the market, key companies are adopting strategies such as innovation, technological advancements, collaborations, and more.

-

BASF is a multinational chemical company operating in more than 80 countries. BASF operates in various industries, including automotive, construction, and energy. The company's portfolio includes well-known brands such as BASF Care Creations, Infinergy, and others. The company provides various chemical solutions in oil and gas operations, including drilling fluids, production chemicals, and enhanced oil recovery chemicals such as surfactants and polymers.

-

Dow is a material science company that offers a wide range of products and solutions catering to different markets and applications. Dow has categorized its operations into three business segments: packaging and specialty plastics, industrial intermediaries and infrastructure, and performance materials and coatings. Dow offers various solutions in oilfield chemicals to help oil and gas companies improve their performance and reduce environmental impact.

Key Canadian Oilfield Chemicals Companies:

The following are the leading companies in the Canadian oilfield chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Dow

- DuPont

- Croda International Plc

- The Lubrizol Corporation

- Stepan Company

- Akzo Nobel N.V.

Recent Developments

-

In May 2024, Dow collaborated with the State of Wyoming and the University of Wyoming to enhance oil recovery methods, including foam-assisted gas injection with recovered hydrocarbon, carbon dioxide, or other gases to rejuvenate oil fields.

-

In May 2024, BASF announced an investment for expansion of their Basoflux chemicals a range of paraffin inhibitors at the BASF site in Tarragona, Spain. These chemicals are used to manage the deposition of paraffin wax in oil pipelines and production facilities. This investment by BASF in increasing the production capacity for Basoflux aims to meet the growing demand for these inhibitors.

Canadian Oilfield Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.70 billion

Revenue Forecast in 2030

USD 2.13 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application

Key companies profiled

BASF; Dow: DuPont; Croda International Plc; The Lubrizol Corporation; Stepan Company; Akzo Nobel N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canadian Oilfield Chemicals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canadian oilfield chemicals market report based on product and application

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrosion & Scale Inhibitors

-

Demulsifiers

-

Biocides

-

Surfactants

-

Polymers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling

-

Production

-

Cementing

-

Enhanced Oil Recovery

-

Water Treatment

-

Hydraulic Fracturing

-

Workover and Completion

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."