- Home

- »

- Pharmaceuticals

- »

-

Cancer Immunotherapy Market Size, Industry Report, 2033GVR Report cover

![Cancer Immunotherapy Market Size, Share & Trends Report]()

Cancer Immunotherapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Monoclonal Antibodies, Immunomodulators), By Application, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-693-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cancer Immunotherapy Market Summary

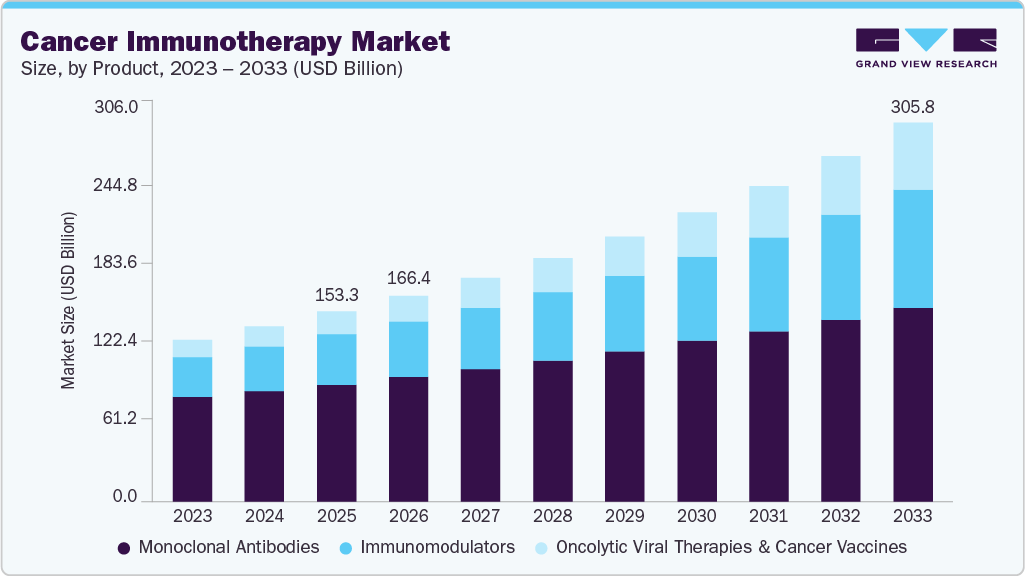

The global cancer immunotherapy market size was estimated at USD 153.27 billion in 2025 and is projected to reach USD 305.80 billion by 2033, growing at a CAGR of 9.02% from 2026 to 2033. The increasing prevalence of cancer is a significant factor driving market growth.

Key Market Trends & Insights

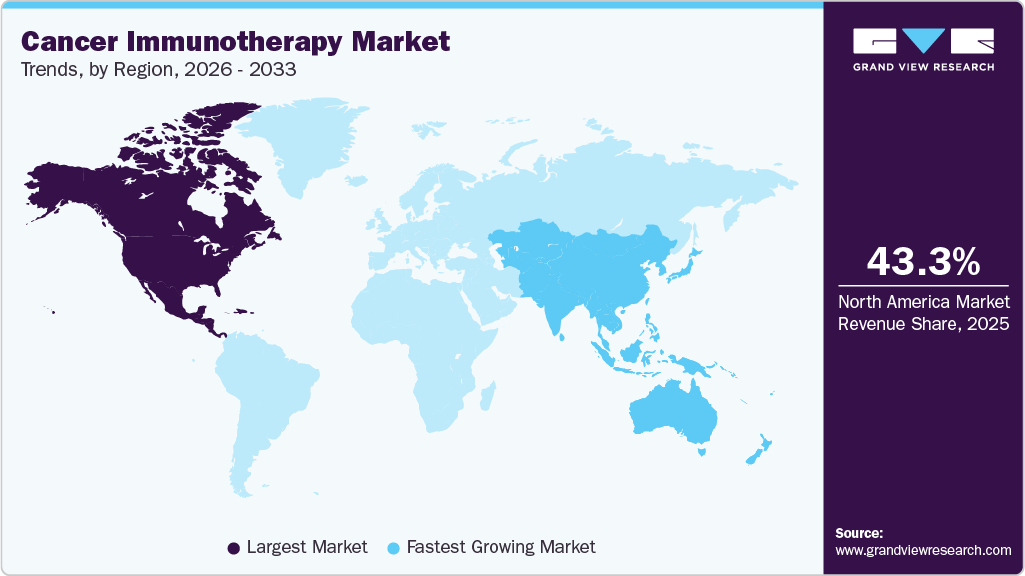

- The North America cancer immunotherapy market dominated with the largest revenue share of 43.26% in 2025.

- The cancer immunotherapy industry in the U.S. is expected to witness a significant CAGR from 2026 to 2033.

- By product, the monoclonal antibodies segment led the market, with the largest revenue share of 61.61% in 2025.

- By application, the lung cancer segment accounted for the largest revenue share in 2025.

- By distribution channel, the hospital pharmacy segment accounted for the largest revenue share in 2025.

- By end use, the hospitals & clinics segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 153.27 Billion

- 2033 Projected Market Size: USD 305.80 Billion

- CAGR (2026-2033): 9.02%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

According to the American Cancer Society Journal, in the U.S., about 2 million new cancer cases and 611,720 cancer deaths are estimated to occur in the year 2024. Growing R&D activities by pharmaceutical companies, technological advancements, and the introduction of novel drugs are expected to drive the growth of the cancer immunotherapy industry in the forecast period. The increasing prevalence of cancer is boosting the demand for the cancer immunotherapy market. According to the International Agency for Research on Cancer (IARC) estimates, in the year 2020, there were about 19.29 million cancer cases, which is estimated to increase to 24.58 million cases by 2030. This significant increase in the disease burden on the population is expected to drive the market growth.

Rising approval of novel immunotherapies is expected to propel the market growth over the forecast period. For instance, in December 2024, AstraZeneca’s immunotherapy drug Imfinzi (durvalumab) became the first and only approved regimen for adult patients with limited-stage small cell lung cancer (LS-SCLC) whose disease has not progressed after platinum-based chemotherapy and radiation therapy. Similarly, the increasing patient preference for subcutaneous drug administration is fueling market growth. In September 2024, the FDA approved Tecentriq Hybreza, the first subcutaneous PD-(L)1 inhibitor, representing a significant breakthrough in cancer immunotherapy. This formulation offers patients a faster treatment option (7 minutes versus 30-60 minutes for intravenous infusion) while maintaining the same safety and efficacy as the intravenous version.

Various strategic initiatives undertaken by major players are also anticipated to facilitate the market demand. For instance, in September 2023, Immatics and Moderna strategically collaborated to develop the Oncology Therapeutics. The collaboration includes an assessment of Immatics' investigational PRAME203 TCRT in combination with the MARTE mRNA cancer vaccine being developed by Moderna. Moreover, in August 2023, FBD Biologics Limited and Shanghai Henlius Biotech, Inc. entered into a strategic collaboration to boost the development of new immunotherapies. These aspects are driving the market growth.

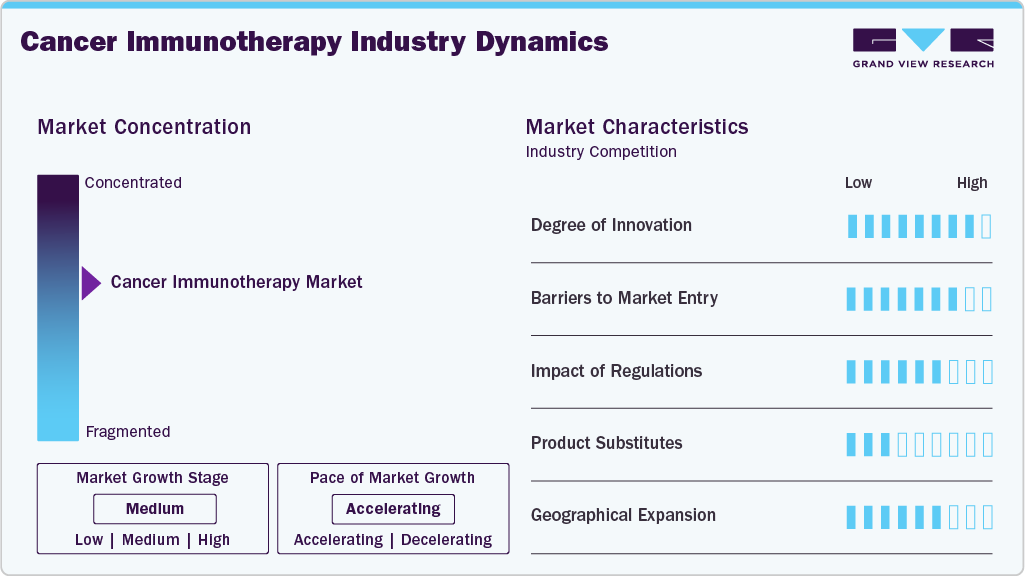

Market Characteristics

The cancer immunotherapy market exhibits a high degree of innovation, driven by the continuous development of immune checkpoint inhibitors, cell therapies, and antibody-based treatments. Companies focus on improving therapeutic precision through novel targets and optimized dosing regimens. Combination therapies are widely explored to enhance efficacy across multiple cancer indications. Advancements in manufacturing processes improve treatment consistency and scalability. Ongoing clinical research sustains a strong pipeline of differentiated immunotherapy products.

Market entry barriers remain high due to the complexity of biologic development and lengthy clinical trial timelines. Significant capital investment is required for research, manufacturing, and specialized infrastructure. Strong intellectual property protection limits competition for approved therapies. Extensive clinical evidence is required to demonstrate the safety and efficacy of this approach across various cancer types. Limited availability of specialized production facilities further restricts new entrants.

Regulatory frameworks significantly influence the development and commercialization pathways of treatments. Strict safety, efficacy, and quality requirements increase development timelines and costs. Post-approval monitoring obligations add to operational complexity for manufacturers. Harmonization of regulatory standards across regions supports global trial execution. Clear regulatory pathways encourage structured development of advanced immunotherapy treatments.

Product substitution pressure remains moderate due to the distinct mechanism of immunotherapies compared to conventional treatments. Chemotherapy, radiation therapy, and targeted therapies serve as alternatives in specific cancer settings. Treatment choice often depends on cancer stage, biomarker status, and patient condition. Immunotherapies offer durable responses that differentiate them from traditional options. Combination use with other treatments reduces the risk of direct substitution.

Geographical expansion focuses on extending treatment availability beyond mature markets. Companies prioritize regions with rising cancer prevalence and improving oncology infrastructure. Local clinical trials support market entry and indication expansion strategies. Partnerships with regional healthcare providers facilitate the delivery of treatment and improve patient access. Expansion efforts emphasize the sustainable commercialization of immunotherapy treatments across diverse regions.

Product Insights

The monoclonal antibodies segment led the cancer immunotherapy industry, accounting for the largest revenue share of 61.61% in 2025. Increasing investment for R&D of monoclonal antibodies-such as bispecific antibodies, conjugated monoclonal antibodies, and naked antigen-binding antibodies, opened new avenues for the growth of companies in the oncology therapeutics space. New-age monoclonal antibodies are designed to impart or possess adaptive immunity, antibody-dependent cellular toxicity, and antigen specificity. Monoclonal antibodies are being largely studied for their therapeutic effects against various types of cancers. For instance, in August 2023, the FDA approved Talvey to treat adult patients with relapsed or refractory multiple myeloma who have received at least four prior lines of treatment, including proteasome inhibitors, immunomodulatory agents, and an anti-CD38 monoclonal antibody.

The oncolytic viral therapies and cancer vaccines segment is anticipated to witness significant growth over the forecast period. The development of cancer vaccines, which are hindered by significant obstacles such as a lack of immunogenicity and immunosuppressive effects within the tumor microenvironment, must succeed. According to the American Association for Cancer Research in June 2023, the US Food and Drug Administration has only approved a limited number of therapeutic vaccines. Some of the choices available include sipuleucel-T (Provenge), which is a vaccine made from cells and is authorized as a treatment for unconventional prostate cancer; laherparepvec talimogene (Imlygic or T-VEC), which is a vaccine derived from a virus and is approved for Bacillus Calmette Guérin and treating metastatic melanoma; and a weakened strain of bacteria used to prevent the recurrence of early-stage bladder cancer following surgery. These aspects are driving the market growth.

Application Insights

The lung cancer segment accounted for a revenue share of 18.11% in 2025. The increasing prevalence of lung malignancies, growing awareness programs, increasing adoption of immunotherapy, and presence of a robust pipeline of investigational candidates are some of the key factors expected to drive the segment's growth. Furthermore, rising product approval and product launches are fueling the demand forward. For instance, in November 2023, the US Food and Drug Administration (FDA) granted marketing authorizations to Augtyro (Bristol, Inc.) for the treatment of locally refractory or metastatic Non-Small Cell Lung Cancer (NSCLC) with Repotrectinib.

The prostate cancer segment is estimated to register a significant CAGR over the forecast period. Increasing prevalence and rising awareness about immunotherapy drugs is estimated to drive the market growth over the coming years. For instance, according to the American Cancer Society journal, an estimated 299.010 cancer cases will be diagnosed in the U.S., and 35,250 men will die in 2024. Additionally, a strong presence of pipeline drugs expected to be commercialized in the coming years is anticipated to boost the overall market growth.

Distribution Channel Insights

The hospital pharmacy segment dominated the cancer immunotherapy industry, with the largest revenue share of 55.00% in 2025. The rising demand for immunotherapies in hospitals, combined with the increasing number of hospitalizations resulting from a surge in cancer diseases, drives hospital pharmacy growth. The difficulty of the treatment and patients getting affected aged over 65 years increased the hospitalization rate of cancer patients. This has resulted in a high share of the segment. As a result, the segment's share in this market is large.

The online pharmacy segment is estimated to register a significant CAGR over the forecast period. The growing demand for the internet pharmacy segment is a key factor, including a surge in internet penetration, an increasing adoption of telemedicine, greater use of technology, and convenience & time efficiency. Moreover, in the forecast period, the presence of prominent e-pharmacy players and their discounts will also help drive the demand in this segment, contributing to the market growth.

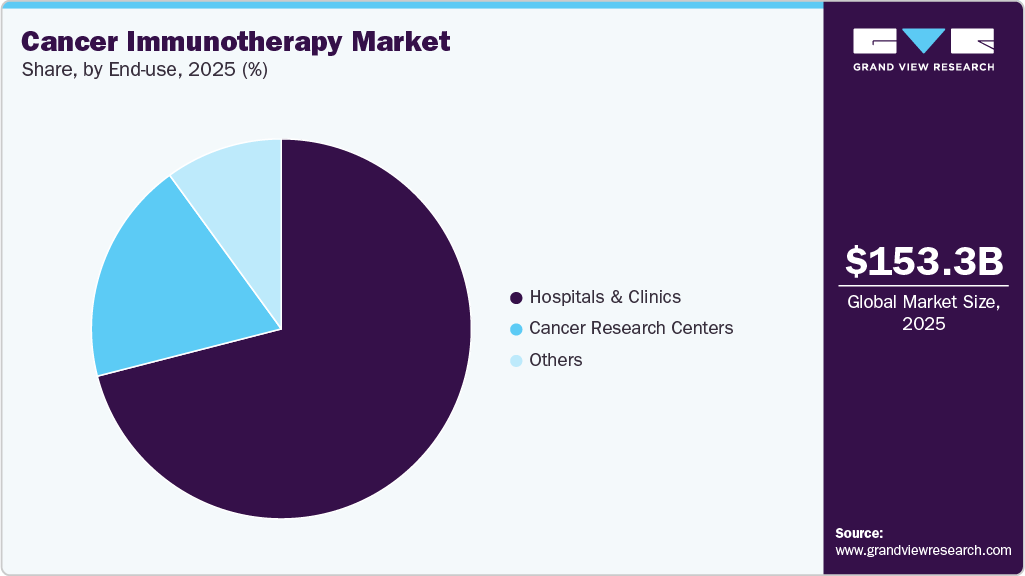

End Use Insights

The hospitals & clinics segment led the cancer immunotherapy market, with the largest revenue share of 71.42% in 2025. In addition to the rising incidence of diseases, the increased treatment rate, higher awareness, and diagnosis of malignancies, as well as the large number of hospitals offering immunotherapies, are contributing to an increase in the number of patients treated. To treat cancer, hospitals are adopting immunotherapies. According to the National Cancer Institute article published in April 2023, in the U.S., 25% of patients died in a hospital, with 62% hospitalized at least once in the last month of life for the cancer treatments.

The cancer research centers segment is estimated to register the significant CAGR over the forecast period. Increased research on cancer and ongoing supportive activities carried out by the government or national organizations in the form of grant funding have contributed to segment growth with a view to stimulating demand. According to the Becker's Healthcare article published in November 2023, to expand research into cancer, Texas Oncology has recently revealed its Amarillo Comprehensive Cancer Center, a state-of-the-art facility representing a significant investment of USD 150 million. This cutting-edge center is poised to enhance cancer care, providing advanced and comprehensive services in the Amarillo region. These aspects are expected to boost the market growth.

Regional Insights

North America held the largest share of the cancer immunotherapy market in 2025, accounting for 43.26% of global revenue, due to advanced research infrastructure and high adoption of novel therapies. The strong presence of major biopharmaceutical companies and active clinical trial pipelines drive rapid product introductions. Robust reimbursement frameworks and mature payer systems enable broader patient access to high-cost therapies. High incidence of cancer types treated with immunotherapies sustains steady demand for new modalities. Well-established diagnostic capabilities support the selection of personalized immunotherapy and lead to improved outcomes. Large venture capital and private investment flows accelerate biotech innovation and commercialization.

U.S. Cancer Immunotherapy Market Trends

The United States represents the core of North American dominance with the highest concentration of industry players and trial sites. Extensive clinical research activity results in frequent regulatory filings and a steady stream of new therapeutic candidates. Strong commercialization expertise enables the rapid scaling of approved therapies and the wide availability of treatments. High per capita healthcare spending supports uptake of premium cancer treatments. Comprehensive diagnostic and biomarker services allow targeted patient selection for immunotherapy regimens. A competitive venture ecosystem fuels mergers, acquisitions, and pipeline expansion.

Europe Cancer Immunotherapy Market Trends

The Europe cancer immunotherapy industry exhibits rapid adoption, driven by established oncology networks and centers of excellence. The presence of multinational pharmaceutical firms supports multi-country clinical programs and coordinated launches. The growing incidence of certain cancers prompts increased demand for immune-based treatments and supportive diagnostics. Advanced hospital and laboratory infrastructure facilitate the administration and monitoring of complex therapies. Regional payer collaboration methods enable market access pathways in multiple countries. Cross-border academic collaborations accelerate translational research and biomarker discovery.

The UK cancer immunotherapy market growth is supported by strong academic-industry partnerships and world-class cancer research institutions. High clinical trial activity in major cancer centers ensures early patient access to emerging immunotherapies. Robust diagnostic laboratory networks facilitate precision medicine approaches and the adoption of companion diagnostics. Active private and public funding of translational projects stimulates early-stage biotech growth. The concentration of specialist oncology centers improves treatment outcomes and clinician expertise. Established biopharma presence promotes local manufacturing and commercial operations.

The cancer immunotherapy market in Germany demonstrates solid expansion supported by advanced hospital infrastructure and oncology referral systems. Strong domestic pharmaceutical research contributes to a steady pipeline of immuno-oncology candidates. High physician awareness and specialist training promote the appropriate use of immunotherapy across various tumor types. Wide availability of diagnostic testing supports biomarker-driven treatment decision-making. Hospital-based centers deliver complex therapies, including cell and gene modalities. Collaborations between industry and academic centers accelerate clinical development.

The France cancer immunotherapy market exhibits consistent uptake of immunotherapies driven by specialized oncology networks and research institutes. Active clinical research programs provide access to novel agents and combination strategies. Robust diagnostic capabilities support patient stratification and treatment personalization. The growing prevalence of cancer increases demand for advanced therapies and supportive care services. A strong presence of multinational and domestic biotechs facilitates technology transfer and commercialization. Integrated hospital systems facilitate the delivery of complex immunotherapy regimens.

Asia Pacific Cancer Immunotherapy Market Trends

The Asia Pacific cancer immunotherapy industry is expected to register the significant CAGR of 10.51% over the forecast period. A growing patient population and higher cancer incidence create a large addressable market for immunotherapies. Expanding healthcare infrastructure in major economies enables the administration of advanced therapies and monitoring. Increasing local R&D investment and partnerships with global firms enrich the regional pipeline. The greater availability of diagnostics and biomarker testing improves the uptake of targeted therapy. Cost-optimization strategies and biosimilar development enhance market affordability and access.

The Japan cancer immunotherapy market showcases strong adoption driven by advanced biotech research and a high level of clinical expertise in oncology. Significant domestic innovation supports the development of novel immune modalities and cell therapies. Well-established hospital systems and cancer centers facilitate the safe delivery and monitoring of complex treatments. High standard of diagnostic services supports biomarker-driven patient selection and therapy optimization. Active collaborations between local firms and global partners accelerate the market entry of new products. Robust payer reimbursement practices facilitate patient access to innovative therapies.

The cancer immunotherapy market in China exhibits rapid expansion, fueled by large patient volumes and increasing enrollment in clinical trials. Growing domestic biotech capabilities support the accelerated development of locally originated immunotherapies. Expanding hospital capacity and oncology center networks improve treatment reach across urban areas. Increased availability of companion diagnostics enables precision treatment approaches. Strategic partnerships between Chinese firms and multinational companies accelerate technology transfer and commercialization. Cost-competitive manufacturing capabilities promote regional production and supply scalability.

Latin America Cancer Immunotherapy Market Trends

The Latin America cancer immunotherapy industry’s growth is driven by rising cancer awareness and the gradual enhancement of oncology care infrastructure. Increasing clinical trial participation in key countries provides early access to investigational immunotherapies. The expansion of specialized cancer centers enhances their capacity to administer advanced treatments and manage side effects. Growing diagnostic services facilitate biomarker testing and patient selection in urban markets. Partnerships with multinational developers enable product launches and knowledge transfer. Market access strategies emphasize affordability and phased rollouts across countries.

The Brazil cancer immunotherapy market exhibits notable uptake supported by concentrated oncology centers and an expanding private healthcare sector. Active participation in international clinical trials offers patients access to new immunotherapy agents. Strengthening diagnostic and pathology services improves the identification of eligible patients for targeted immunotherapies. The presence of regional distributors and local clinical expertise facilitates the rollout of therapy in major cities. Market dynamics favor combination therapies and personalized treatment plans. Increasing domestic investment supports local research collaborations.

Middle East & Africa Cancer Immunotherapy Market Trends

Improved oncology capabilities and selective adoption in tertiary care centers lead the growth of the MEA market. Growing awareness of advanced cancer treatments among clinicians supports referrals to specialized facilities. Investment in diagnostic laboratories enhances capacity for biomarker-driven therapy selection. Partnerships with international pharma firms facilitate product availability in key urban markets. Focus on training and knowledge transfer improves clinical management of immunotherapy patients. Market access strategies often prioritize high-burden cancer types and center-based delivery.

The Saudi Arabia cancer immunotherapy market is experiencing accelerating uptake, supported by the growth of tertiary hospital capacity and specialized oncology programs. The increasing incidence of cancer and higher demand for advanced treatments drive interest in immunotherapies. The expansion of diagnostic services enables the targeted selection and monitoring of therapy. Collaborations with international pharmaceutical companies provide access to late-stage clinical data and approved agents. The development of local clinical expertise supports the safe administration of complex regimens. Concentration of treatment in major medical cities enables focused investment and patient referral networks.

Key Cancer Immunotherapy Company Insights

Pfizer Inc., AstraZeneca, and Merck & Co., Inc. hold strong positions in the Cancer Immunotherapy Market through broad oncology portfolios and continued clinical development success. F. Hoffmann-La Roche Ltd. and Bristol-Myers Squibb Company maintain leadership supported by established immuno-oncology brands and strong global commercialization capabilities. Novartis AG and Lilly focus on advancing next-generation immunotherapies with emphasis on precision oncology and combination regimens. Johnson & Johnson Services, Inc. leverages diversified oncology platforms and strategic partnerships to strengthen its immunotherapy footprint. Immunocore, Ltd. is emerging with differentiated T-cell receptor-based technologies targeting hard-to-treat cancers. Competitive intensity continues to increase as companies expand indications, refine patient targeting, and enhance clinical outcomes. The market exhibits sustained growth potential, driven by innovation, expanding pipelines, and increasing clinical adoption.

Key Cancer Immunotherapy Companies:

The following are the leading companies in the cancer immunotherapy market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- Novartis AG

- Lilly

- Johnson & Johnson Services, Inc.

- Immunocore, Ltd.

Recent Developments

-

In November 2025, Innova Therapeutics completed the acquisition of Enci Therapeutics to advance its lead cancer therapy program, IVT-8086, a first-in-class humanized monoclonal antibody targeting SFRP2.

-

In June 2025, Glenmark Pharmaceuticals launched Tevimbra (tislelizumab) in India following regulatory approval, marking its entry into immune-oncology by offering a novel therapy for non-small-cell lung cancer and esophageal cancer.

-

In January 2025, Kazia Therapeutics in Australia launched the ABC-Pax trial, evaluating paxalisib combined with immunotherapy in women with advanced triple-negative breast cancer, aiming to enhance treatment efficacy and monitor responses via liquid biopsy.

Cancer Immunotherapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 166.36 billion

Revenue forecast in 2033

USD 305.80 billion

Growth rate

CAGR of 9.02% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Pfizer Inc.; AstraZeneca; Merck & Co., Inc.; F. Hoffmann-La Roche Ltd.; Bristol-Myers Squibb Company; Novartis AG; Lilly; Johnson & Johnson Services, Inc.; Immunocore, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cancer Immunotherapy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cancer immunotherapy market report based on product, application, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies

-

Immunomodulators

-

Oncolytic Viral Therapies and Cancer Vaccines

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Melanoma

-

Prostate Cancer

-

Head and Neck Cancer

-

Ovarian Cancer

-

Pancreatic Cancer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Cancer Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players in cancer immunotherapy market are Pfizer Inc.; AstraZeneca; Merck & Co., Inc; F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; F. Hoffmann La-Roche Ltd.; Novartis AG; Lilly; Johnson & Johnson Services, Inc; and Immunocore, Ltd, among others.

b. The increasing prevalence of cancer, surge in R&D activities for the development of targeted diseases, and increasing approval of novel immunotherapies for cancer treatment are the major factors driving the cancer immunotherapy market growth over the forecast period.

b. The global cancer immunotherapy market is expected to witness a compound annual growth rate of 9.02% from 2026 to 2033 to reach USD 305.80 billion by 2033.

b. The global cancer immunotherapy market size was valued at USD 153.27 billion in 2025 and is anticipated to reach USD 166.36 billion in 2026.

b. Based on product, the monoclonal antibodies segment accounted for a share of 6.61% in 2025 due to the higher number of approved products and high prescription rate of monoclonal antibodies.

b. North America held the largest share of 38.86% in 2025 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the presence of major market players in the region, increasing introduction of novel immunotherapies, and presence of government and non-government bodies to promote research activities for cancer immunotherapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.