- Home

- »

- Medical Devices

- »

-

Carbon Dioxide Incubators Market Size & Share Report 2030GVR Report cover

![Carbon Dioxide Incubators Market Size, Share & Trends Report]()

Carbon Dioxide Incubators Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Water Jacket Carbon Dioxide Incubators, Direct Heat Carbon Dioxide Incubators), By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-128-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Dioxide Incubators Market Trends

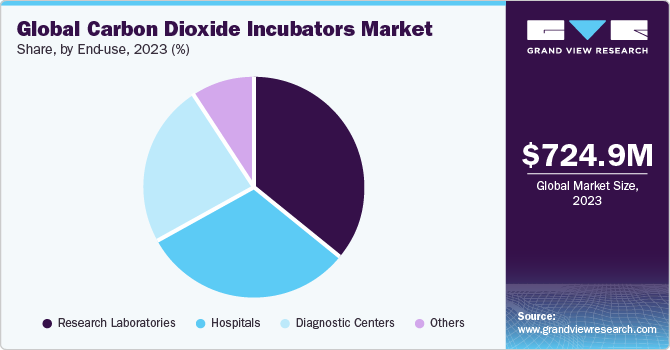

The global carbon dioxide incubators market size was estimated at USD 724.9 million in 2023 and is expected to grow at a CAGR of 6.3% from 2024 to 2030. Growth can be attributed to the increasing R&D in the biotechnology and life sciences sector, technological advancements, rising demand for cell-based therapies, and increasing adoption of plastic surgery, antiaging therapies, tissue repair, & dermatological treatments. Moreover, technological advancements and innovations in the CO2 incubator devices, such as autodecontamination cycles, door opening alarms, preset alarms, self-calibration, password-protected settings, and over-temperature alarms & thermostats are expected to drive the demand for these devices over the forecast period.

The market is predicted to witness significant growth due to an increase in the number of R&D activities in the biotechnology and life science sectors. The growing emphasis on innovative therapies, drug development, and personalized medicine is another factor anticipated to drive the demand for controlled & precise cell culture and experimentation environments. Moreover, biotechnology companies are actively engaged in R&D to create groundbreaking therapies and treatments.

Carbon Dioxide (CO2) incubators play a pivotal role in such therapies by providing optimal conditions for cell growth and ensuring consistent results. In addition, research institutions are investigating new treatments for various diseases and disorders in the life science sector. These incubators enable the cultivation of primary cells & cell lines, crucial for understanding disease mechanisms and testing potential therapies. Research on cancer, neurodegenerative diseases, and infectious diseases significantly benefits from the controlled environment that CO2 incubators offer.

Hence, the rising demand for cell-based therapies in regenerative medicine and healthcare is expected to propel market growth over the forecast period. Cell-based therapies, which include using living cells to treat a wide range of diseases and conditions, require optimal conditions for cell culture & growth-a role CO2 incubators fulfill effectively. Moreover, regenerative medicine, including stem cell therapies, tissue engineering, and cell-based transplantation, has gained substantial attention for its potential to revolutionize medical treatments for Alzheimer's disease and spinal cord injuries. CO2 incubators provide controlled environments where cells can be cultured, expanded, and differentiated to generate functional tissues or replace damaged cells.

Furthermore, the development of personalized cell therapies is on the rise. These incubators are vital in growing patient-specific cells that can be genetically modified and readministered to treat conditions like cancer and genetic disorders. These therapies require precise control over the incubation environment to ensure the efficacy & safety of the manipulated cells. Plastic surgery and dermatological treatments often involve grafting and transplanting tissues for reconstruction or rejuvenation. CO2 incubators facilitate the culture and expansion of cells in these procedures, ensuring graft viability and enhancing patient outcomes.

According to a Plastic Surgery Statistics report, in the U.S., around 50,930 procedures for scar revision were performed in 2022, positioning it among the 10 most frequently performed reconstructive procedures. In addition, antiaging therapies like Platelet-rich Plasma (PRP) treatments rely on concentrated growth factors from a patient's blood to rejuvenate the skin. CO2 incubators play a critical role in preparing PRP by maintaining optimal conditions for cell separation and enrichment, ensuring the therapeutic efficacy of the treatment.

Market Concentration & Characteristics

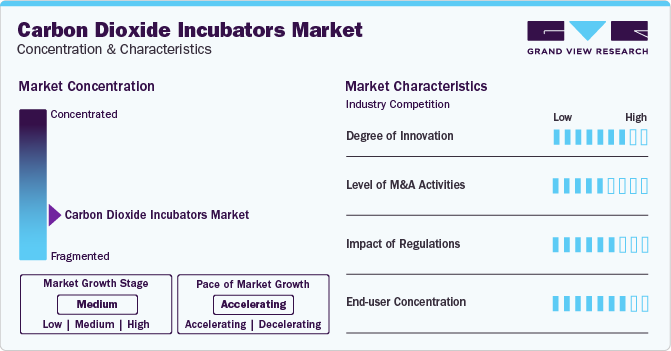

The industry growth stage is medium, and pace of market growth is accelerating.

The degree of innovation in the CO2 incubators industry is high. Innovations in CO2 incubators have been transformative, elevating their functionality and efficiency in various industries, such as biotechnology, healthcare, and research. Modern CO2 incubators integrate advanced technologies like precise temperature & humidity control, optimal gas regulation, and real-time monitoring systems. For instance, Thermo Fisher Scientific Inc. offers CO2 incubators with contamination control, sterilization cycles, and High-efficiency Particulate Air (HEPA) filters to deliver healthy cultures that imitate in vivo responses.

The M&A activities support CO2 incubator companies by expanding their market reach, acquisition of new technologies for innovation, consolidating resources for cost-efficiency, and enhancing their competitive positioning through strategic partnerships. For instance, in June 2023, PHC Holdings Corporation announced the acquisition of SciMed (Asia) Pte. Ltd. This acquisition is expected to expand its life sciences business in the Asia Pacific region.

The impact of regulations is moderate to high in the industry. CO2 incubators must meet specific quality standards to ensure reliability, accuracy, and safety. These standards may include ISO 13485 for medical devices, ISO 17025 for testing & calibration laboratories, and ISO 9001 for quality management systems. CO2 incubators must comply with electrical safety standards and regulations, such as IEC 61010, to ensure protection against electrical hazards. They should also adhere to safety guidelines for potentially hazardous materials and gases.

Companies in the CO2 incubators market undertake geographic expansion strategies to maintain their positions in emerging markets and customer base in these regions. This expansion enables companies to diversify their customer base, mitigate risks associated with market saturation in specific regions, and capitalize on emerging opportunities in different geographical areas. Moreover, expanding into new regions allows companies to leverage local expertise, partnerships, and distribution networks, thereby enhancing market penetration & brand visibility.

Product Type Insights

The water-jacketed CO2 incubators segment held the largest market share of 36.9 % in 2023. This growth can be attributed to improved performance & reliability, making them a preferred choice in research and biotechnology sectors for maintaining precise & consistent incubation environments. Water-jacketed CO2 incubators utilize a heated water system within the chamber walls for consistent temperature control.

This makes them a reliable choice even during disruptions like frequent door openings or power fluctuations. In addition, recent technological developments collectively contribute to enhanced performance, reliability, and user convenience in Carbon Dioxide (CO2) incubators, ultimately improving the quality & reproducibility of cell culture & research outcomes. In addition, enhanced features like dual sterilization systems, precise humidity control, and remote monitoring further contribute to their appeal.

The air-jacket CO2 incubators segment is anticipated to witness the fastest CAGR over the forecast period. Air-jacketed incubators emerged as a viable substitute for water-jacketed, offering distinct advantages. As these are lighter and quicker to install, they maintain comparable temperature uniformity while demanding reduced upkeep. Furthermore, air-jacketed incubators accommodate high-temperature sterilization, reaching levels exceeding 180°C. These attributes position air-jacketed variants as efficient and versatile solutions for various incubation needs.

Furthermore, prominent players in the market are strategically prioritizing the introduction of technologically sophisticated products to maintain their competitive advantage. For instance, in May 2021, Thermo Fisher Scientific introduced a pioneering CO2 incubator that uniquely combines advanced cell growth capabilities with certified cleanroom compatibility. Leveraging the patented THRIVE active airflow technology, this system ensures uniform cell growth and rapid parameter recovery in under 10 minutes. Emphasizing cell culture protection, it offers on-demand 180°C sterilization, dependable contamination control via in-chamber HEPA filtration, and an optional 100% pure copper interior chamber.

End-use Insights

The research laboratories segment held the largest market share of 36.2% in 2023. The demand for precise and reliable incubation systems is increasing, with growing research activities in cell biology, microbiology, and drug development. Research laboratories require precise conditions to ensure accurate and reproducible results, making CO2 incubators indispensable. Their versatility in accommodating different cell types & experiments positions them as essential equipment for various scientific investigations. As research drives advancements in medicine, biotechnology, and various disciplines, the demand for CO2 incubators in laboratories remains consistently high. CO2 incubators offer advanced features such as temperature control, humidity regulation, and sterile conditions, catering to the diverse needs of researchers.

The hospitals segment is expected to grow at the fastest rate over the forecast period. Hospitals hold a significant market share due to their crucial role in clinical applications and patient care. CO2 incubators are essential for maintaining cell cultures and specimens in controlled environments vital for diagnostic tests, research, and medical treatments. In hospitals, CO2 incubators are used for activities such as cell therapies, tissue culturing, microbial testing, and IVF. These controlled conditions ensure accurate and reliable results, directly impacting patient diagnosis & treatment outcomes.

Application Insights

The in vitro fertilization segment held the largest market share of 40.3% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This growth can be attributed to the rising number of infertility cases and advancements in assisted reproductive technologies. Using CO2 incubators in IVF ensures embryos' viability and allows researchers & clinicians to closely monitor their growth & development. The controlled conditions the incubator provides minimize fluctuations that could adversely affect embryo health. As a result, CO2 incubators have become a cornerstone of IVF clinics and laboratories, enabling them to consistently achieve higher success rates in fertility treatments.

Moreover, companies operating in the market are launching technologically advanced incubators for IVF treatments to maintain a competitive edge, thereby driving segment growth. For instance, in May 2022, Cook Medical introduced the MINC+ Benchtop Incubator exclusively for IVF clinics in the U.S. and Canada. It is an advanced generation of the MINC, a mini-incubator that has been a basic component in IVF facilities for over 20 years.

The research and clinical applications segment held a substantial market share in 2023. Carbon Dioxide (CO2) incubators play a vital role in research laboratories and clinical applications by providing a controlled and contamination-free environment for working with cell and tissue cultures. These incubators regulate crucial conditions such as temperature, humidity, and CO2 levels, ensuring safe & reliable experimentation. They are essential for various applications, including bacterial cultures, cell & tissue growth, biochemical studies, pharmaceutical work, and food analysis. Their usage extends to preserving stable atmospheres for cell growth, microbiological cultures, and fluorescence microscopy processes.

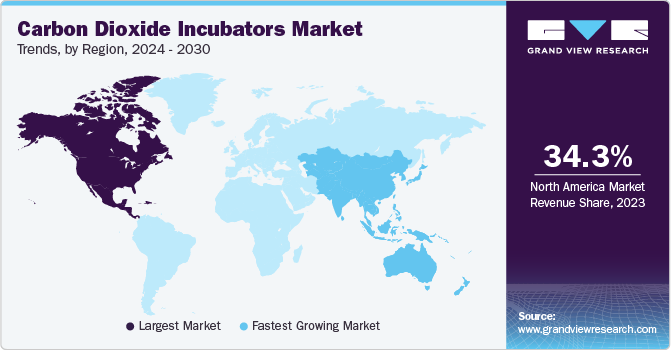

Regional Insights

The North America CO2 incubators market dominated the overall industry in 2023, with a revenue share of 34.3%. Increasing spending on healthcare research and well-established research institutes, pharmaceutical companies, & healthcare facilities in the region have created a strong demand for CO2 incubators. Moreover, technological advancements in the region have led to the introduction of innovative CO2 incubators equipped with features such as improved temperature stability, advanced contamination control, and user-friendly interfaces. North America’s emphasis on advanced research and the adoption of state-of-the-art laboratory equipment has significantly contributed to its dominance in the market.

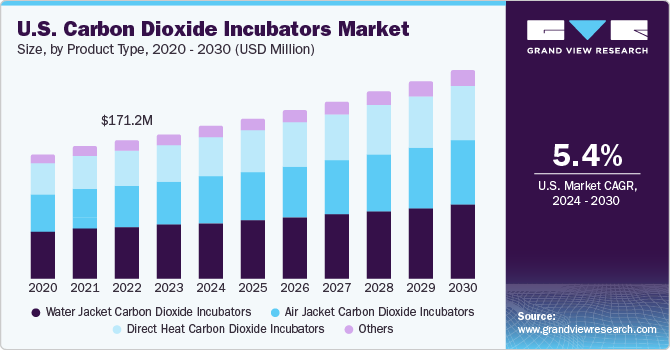

U.S. Carbon Dioxide Incubators Market Trends

The CO2 incubators market in the U.S. held a substantial share of the North American market in 2023. This growth can be attributed to the country’s robust and sophisticated research ecosystem, featuring esteemed universities, research establishments, and biotech entities. In addition, the U.S. healthcare sector stands out globally with its advanced diagnostic hubs, medical facilities, and pharmaceutical enterprises. The convergence of these factors, including advanced research capabilities, a thriving healthcare landscape, and a culture of innovation & technology, fosters a conducive environment for extensively utilizing CO2 incubators.

Europe Carbon Dioxide Incubators Market Trends

The CO2 incubators market in Europe is expected to grow significantly during the forecast period. The European Union has a strong and competitive healthcare & pharmaceutical sector, serving public health and driving job creation, trade, & scientific advancements. In 2019, medicine producers led research investment with a significant EUR 37 billion (USD 40.05 billion) contribution. The industry offered 800,000 direct job opportunities and achieved a noteworthy trade surplus of EUR 109.4 billion (USD 118.7 billion). Moreover, the growing presence of emerging biopharmaceutical companies, constituting over 70% of the research pipeline globally, contributed to the sector's vibrancy. Such a thriving pharmaceutical landscape in Europe can potentially drive the demand for advanced laboratory equipment, such as CO2 incubators, as they are integral to the R&D activities that are a crucial part of this dynamic industry.

The carbon dioxide incubators market in Germany held a substantial market share in 2023. Medical technologies play a crucial role in the healthcare sector. Major U.S. suppliers, such as GE Healthcare, Johnson & Johnson, Becton Dickinson, Abbott, Abbvie, Thermo Fisher Scientific, Stryker, Zimmer, 3M, McKesson, Cardinal Health, and Henry Schein, have established subsidiaries in Germany. A strong combination of technological advancements, strategic government initiatives, and new product launches by key players propel growth of the CO2 incubators market in Germany. Technological innovations, such as precise temperature & gas control, advanced sterilization methods, and improved user interfaces, have heightened the efficiency and reliability of CO2 incubators.

The UK carbon dioxide incubators market is expected to grow at a significant pace during the forecast period. The growing adoption of assisted reproductive technologies and the increasing number of IVF cycles in the UK highlight the relevance of advanced equipment, such as CO2 incubators, in maintaining optimal conditions for successful embryo development, which can contribute to the growth of CO2 incubators market. For instance, in 2021, UK-licensed fertility centers witnessed a substantial rise in IVF and Donor Insemination (DI) treatments, with approximately 55,000 patients undergoing these procedures, an increase from around 53,000 in 2019.

Asia Pacific Carbon Dioxide Incubators Market Trends

The CO2 incubators market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period, owing to the expanding biotechnology and healthcare sectors. Asia Pacific is home to emerging economies, such as China and India, where governments increasingly allocate funds to strengthen R&D in various fields. For instance, in October 2022, Recharge Capital, a prominent thematic-first private investment firm, announced a ~USD 3 million incubation investment in Generation Prime, a digital healthcare platform. This platform emerged as the pioneer in offering comprehensive IVF and related health services across Southeast Asia, catering to a population of over 600 million. Such strategic investments, focusing on expanding healthcare services, can potentially boost the adoption of advanced medical equipment, including CO2 incubators, contributing to market growth.

The carbon dioxide incubators market in Japan held a significant share in 2023. Infertility and the persistently low birth rate pose significant concerns for Japan. With a declining birth rate and a rapidly aging population, the country faces potential demographic challenges that could impact its social and economic fabric. Despite various government efforts to encourage larger families, the nation's birth rate remains persistently low. In response, the Prime Minister of Japan aimed to integrate IVF and fertility treatments into the national health insurance system in 2022 while enhancing subsidies in the interim, thereby contributing to the CO2 incubator market growth.

The India carbon dioxide incubators market is expected to witness robust growth driven by healthcare advancements and scientific research. The country's growing pharmaceutical and biotechnology sectors, coupled with increasing government emphasis on research & innovation, have propelled the demand for advanced laboratory equipment. Moreover, the launch of technologically advanced products by key companies is driving market growth.

Key Carbon Dioxide Incubators Company Insights

The CO2 incubator market is expected to exhibit moderate-to-high competitiveness due to a diverse range of competitive players, from midsize & small enterprises to large multinational corporations. Market penetration and product launches are among the key strategies players are adopting to fulfill customer demands while upholding their brand reputation. For instance, in July 2021, Thermo Fisher Scientific Inc. announced the launch of the Heracell Vios CR CO2 Incubator. The incubator is ideal for applications in GMP environments.

Key Carbon Dioxide Incubators Companies:

The following are the leading companies in the carbon dioxide incubators market. These companies collectively hold the largest market share and dictate industry trends.

- PHC Holdings Corporation

- Thermo Fisher Scientific Inc.

- Eppendorf SE

- Memmert GmbH + Co.KG

- BINDER GmbH

- Bellco Glass

- NuAire, Inc.

- Sheldon Manufacturing, Inc.

- LEEC Limited

Recent Developments

-

In May 2021, Vaisala integrated the CO2 probe GMP251 with the wireless RFL100 data logger. This new configuration harnesses the exceptional measurement stability and accuracy of the GMP251 probe, offering dependable CO2 percentage measurements for incubators utilized in applications such as gene therapy, cell culturing, and vaccine research.

-

In August 2021, The Baker Company, Inc. introduced ReCO2ver, an innovative “rapid recovery” cell culture incubator designed to enhance customer value in microbiology, cell culture, and biological safety fields.

-

In April 2021, Thermo Fisher Scientific Inc. introduced the cleanroom compatible third-party certified CO2 incubators, Thermo Scientific Forma Steri-Cycle CR CO2 Incubators and Thermo Scientific Heracell Vios CR CO2 Incubators, ideal for Good Manufacturing Practices (GMP) grade A/B environments and ISO Class 5. These incubators showcase a functional particle control system and verify compatibility with standard cleanroom cleaning methods, rendering them well-suited for integration into the GMP production setup or cleanroom suite.

Carbon Dioxide Incubators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 768.3 million

Revenue forecast in 2030

USD 1.11 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PHC Holdings Corporation; Thermo Fisher Scientific Inc.; Eppendorf SE; Memmert GmbH + Co.KG; BINDER GmbH; Bellco Glass; NuAire, Inc.; Sheldon Manufacturing, Inc.; LEEC Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

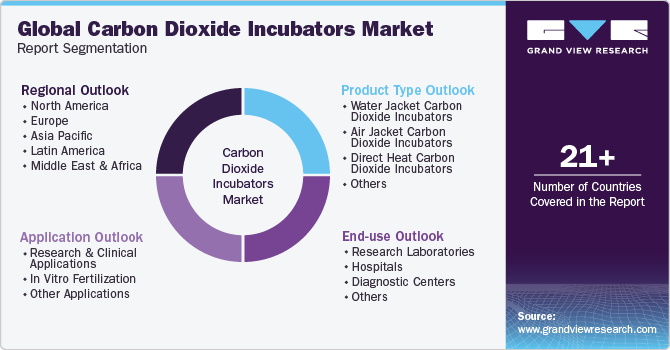

Global Carbon Dioxide Incubators Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon dioxide incubators market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Jacket Carbon Dioxide Incubators

-

Air Jacket Carbon Dioxide Incubators

-

Direct Heat Carbon Dioxide Incubators

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research and Clinical Applications

-

In Vitro Fertilization

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Laboratories

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global carbon dioxide incubators market size was estimated at USD 724.9 million in 2023 and is expected to reach USD 768.3 million in 2024.

b. The global carbon dioxide incubators market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 1.11 billion by 2030.

b. North America dominated the market with a share of 34.60% in 2023. Advanced healthcare infrastructure, significant R&D investments, and the strong presence of pharmaceutical & biotechnology companies drive demand for precise cell culture environments. Moreover, rising focus on drug discovery, personalized medicine, and regenerative therapies accelerates market expansion.

b. Some key players operating in the carbon dioxide incubators market include PHC Holdings Corporation; Thermo Fisher Scientific Inc.; Eppendorf SE; Memmert GmbH + Co.KG; BINDER GmbH; Bellco Glass; NuAire, Inc.; Sheldon Manufacturing, Inc.; LEEC Limited.

b. Key factors that are driving the market growth include increasing R&D in the biotechnology and life science sectors, growing demand for cell-based therapies, increasing adoption of plastic surgery, antiaging therapies, tissue repair, and dermatological treatments, and technological advancements in CO2 incubators.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.