- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Bags & Sacks Market Size And Share Report, 2030GVR Report cover

![Plastic Bags & Sacks Market Size, Share & Trends Report]()

Plastic Bags & Sacks Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Non-Biodegradable, Biodegradable), By Product (Trash Bags, Rubble Sacks, Woven Sacks), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-230-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Bags & Sacks Market Summary

The global plastic bags & sacks market size was estimated at USD 23.54 billion in 2023 and is projected to reach USD 34.21 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. Expanding food & beverage, textile, healthcare, pharmaceutical industries along with the rise of e-commerce has played a major role in driving the demand for the plastic bags & sacks as they are used for shipping and delivering a wide range of products ordered online.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of over 43.0% in 2023.

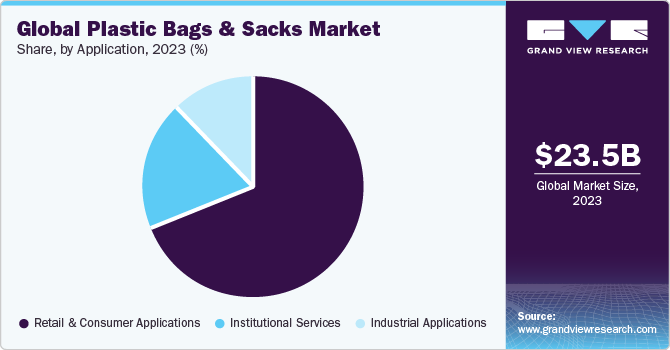

- Based on application, retail & consumer segment accounted for the largest revenue share of over 69.0% in 2023.

- Based on material, non-biodegradable segment dominated the market and accounted for the largest revenue share of over 84.0% in 2023.

- Based on product, T-shirt bags segment held the largest revenue share of over 42.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.54 Billion

- 2030 Projected Market Size: USD 34.21 Billion

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

According to the United States Agricultural Export Yearbook 2022, top fresh fruit export commodities from the U.S. in 2022 included apples, oranges, grapes, cherries, and strawberries. These commodities accounted for a combined total of USD 2.9 billion in export value. Canada, Mexico, Japan, South Korea, and Taiwan were the top markets for these fresh fruit exports. Whereas, in terms of fresh vegetable exports, the top commodities from the U.S. in 2022 were cauliflowers, onions, cabbages, potatoes, and lettuce. These commodities accounted for a combined export total of USD 1.5 billion. Canada, Mexico, and the European Union were the top markets for these fresh vegetable exports. Therefore, substantial U.S. export trade in fresh produce requires extensive usage of plastic packaging to maintain freshness and prevent spoilage during shipping, thus boosting demand for plastic bags and sacks in the U.S.

Cost-effectiveness plays a crucial role in the popularity of plastic bags. Manufacturing plastic bags is relatively inexpensive compared to alternative materials, making them an economical choice for businesses. Lower production costs enable manufacturers to offer affordable packaging solutions, which, in turn, attracts a wide range of businesses seeking cost-efficient packaging options. This cost advantage enhances the market's competitiveness and drives its continued growth.

Additionally, the market for plastic bags and sacks is influenced by advancements in technology and innovation. Manufacturers are constantly developing new formulations and production methods to enhance the performance and environmental sustainability of plastic bags. The introduction of bio-based and biodegradable plastics addresses growing concerns about environmental impact, meeting the increasing demand for more eco-friendly packaging options. Technological innovations contribute to the market's adaptability and its ability to meet evolving consumer preferences and regulatory requirements.

Market Concentration & Characteristics

The market players are increasingly focusing on introducing sustainable and recyclable packaging practices in the plastic bags & sacks market. For instance, in September 2023, Back to the Roots, an organic gardening company, partnered with ProAmpac, a manufacturer of flexible packaging, to launch the garden industry's first soil packaging made entirely from post-consumer recycled (PCR) plastic. For the 2024 gardening season, Back to the Roots will begin transitioning packaging for its top-selling Organic Potting Mix to use 100% PCR plastic certified via the Institute of Sustainability and Carbon Certification's Global ISCC PLUS program. This sustainable packaging innovation will roll out across the Organic Potting Mix product line this year.

In March 2023, ClearBags launched a new line of child-resistant bags for the pharmacy market that are home compostable. These bags are made from a proprietary blend of food-safe materials and are designed to decompose in composting environments. They have achieved certification from the American Society for Testing and Materials (ASTM) and feature a high barrier coating to retain freshness by protecting contents against moisture, oxygen, and odors. For safety, bags include child-resistant zippers that can only be opened by adults with two-hand dexterity. Composting instructions are printed on the inner flap of these innovative bags that combine sustainability, performance, and child safety.

Application Insights

Based on application, the market is segmented into retail & consumer applications, institutional services, and industrial applications. The retail & consumer application segment is further sub-segmented into grocery, food & beverage, clothing & apparel, and other applications. Retail & consumer dominated the application segment and accounted for the largest revenue share of over 69.0% in 2023. This positive outlook is due to growing economies and middle classes in developing countries, which has led to the expansion of the retail sector.

Moreover, plastic bags and sacks are witnessing rising demand in industrial applications due to their versatility, lightweight, and low cost. Industries such as agriculture, food processing, chemicals, pharmaceuticals, and construction are extensively using plastic bags and sacks for packaging, transporting, and storing goods. Key factors driving this growth include plastic's resistance to moisture and chemicals and its ability to customize properties such as toughness and permeability.

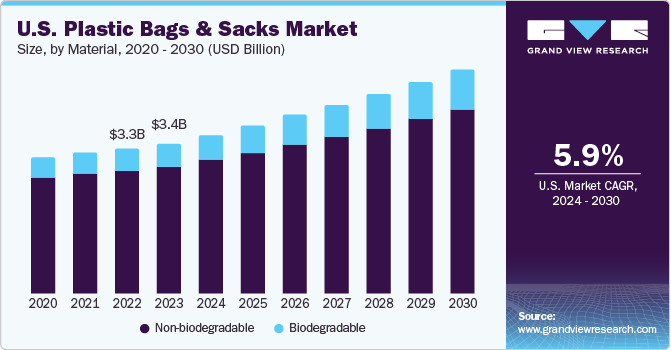

Material Insights

Based on material, plastic bags & sacks market is segmented into non-biodegradable and biodegradable material. The non-biodegradable segment is further sub-segmented into high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), polypropylene (PP), polystyrene (PS), and other non-biodegradable materials. This segment dominated the market and accounted for the largest revenue share of over 84.0% in 2023. This positive outlook is due to the widespread use of conventional plastics in packaging applications across various sectors, including the food industry. Plastic packages offer several advantages such as being economical, functional, lightweight, and versatile.

The biodegradable material segment is further sub-segmented into polylactic acid (PLA), polyhydroxyalkanoates (PHA), polybutylene succinate (PBS), starch blends, and other biodegradable materials. This segment is anticipated to grow at the fastest CAGR of 7.6% during the forecast period. This optimistic landscape can be attributed to the growing environmental concerns and the need to reduce the impact of packaging waste on climate and ecosystems.

Product Insights

Based on product, the market for plastic bags & sacks is segmented into t-shirt bags, trash bags, rubble sacks, woven sacks, and others. T-shirt bags held the largest revenue share of over 42.0% in 2023. T-shirt bags are suitable for packaging small-medium sized goods and are convenient to carry for consumers. Additionally, these bags are preferred for their excellent aesthetic appeal and improved stiffness in frozen food packaging.

Trash bags is another key product segment of the industry. These bags are widely used in households, commercial establishments, and industries for waste management purposes. They provide convenience and hygiene by containing and isolating waste, preventing odors and leakage. Moreover, trash bags are often used as liners for small trash cans, giving them a second life and further contributing to their popularity. Demand for trash bags is expected to continue growing, driven by the increasing need for effective waste management solutions across the globe.

Regional Insights

The growth of the North America plastic bags and sacks market is driven by the emergence of e-commerce, rising food delivery services, and expansion of the construction and agriculture industry across the region. Rapid growth in e-commerce has led to a surging use of plastic mailing bags, packaging sleeves, air pillows, and inflatable packaging for shipping products, thus driving regional market growth.

U.S. Plastic Bags & Sacks Market Trends

The increasing demand for plastic bags and sacks market in the U.S. is fueled by increased usage of bags and sacks in retail and institutional packaging applications. Furthermore, the expanding fast-food service industry in the country is expected to positively influence the market growth. Berry Global Inc.; Inteplast Group; Novolex; ProAmpac; and Poly-America, L.P. are some major plastic bags & sacks manufacturers present in the U.S.

Asia Pacific Plastic Bags & Sacks Market Trends

Asia Pacific accounted for the largest revenue share of over 43.0% in 2023. Asia Pacific has a large consumer base with China, India, and Indonesia being some of the most populous countries in the world. The rapid pace of urbanization across the region has led to increased use of plastic bags and sacks for shopping, transportation, and storage.

Plastic bags & sacks market in India is driven by the rising urbanization, growth of organized retail, and expanding food delivery services. Key drivers include convenience, low cost, durability, and light weight of plastic bags compared to alternatives. However, concerns over plastic waste and environmental impact have led some states to impose partial or total bans on certain types of plastic bags. For instance, in November 2022, the Punjab government ordered a complete ban on the use of plastic carry bags across the state. This ban applies to manufacturing, stocking, distribution, sale, and use of plastic carry bags.

Europe Plastic Bags & Sacks Market Trends

The growth of theplastic bags & sacks market in Europe is experiencing a shift toward the adoption of environmentally friendly bags. The European Union has been persistent about minimizing the consumption of single-use plastic bags and sacks. Furthermore, the market is anticipated to be growing by the increasing usage of bioplastics in several end-use industries such as packaging, consumer goods, automotive & transport, and medical devices.

Germany plastic bags and sacks market’s growth is driven by the retail and packaging industries. However, there is a growing shift towards more sustainable options such as reusable shopping bags and biodegradable plastics due to increased environmental activism and EU regulations. For example, since January 2022, lightweight plastic bags have been banned in Germany. This ban applies to all plastic bags between 15 and 50 micrometers thick, and they can no longer be given to customers. This is part of Germany's efforts to reduce single-use plastics and promote the use of more sustainable alternatives.

Plastic bags & sacks market in the UK has experienced significant demand for recyclable and biodegradable plastics owing to stringent government actions and successful campaigns like Greenpeace to tackle plastic pollution. In May 2021, the charge for single-use plastics was raised to 10 pence which drastically minimized the use of non-biodegradable plastic bags.

Central & South America Plastic Bags & Sacks Market Trends

Theplastic bags & sacks market in Central & South Americais expected to grow at a significant pace during the forecast period owing to the booming e-commerce and retail sectors, demand for flexible packaging, and government initiatives to promote sustainable plastics. For instance, in cities like Sao Paulo, white plastics are banned and are replaced by bags sourced from sugarcane ethanol.

Brazil plastic bags & sacks market’s growth is driven by rising retail, food, and manufacturing industries that utilize plastic packaging for consumer goods and products. Major drivers include increasing urbanization and disposable incomes leading to greater consumption, e-commerce growth requiring shipping packages and bags, expanding organized retail with plastic carry bags, and the convenience and low cost of plastic packaging solutions.

Middle East & Africa Plastic Bags & Sacks Market Trends

The plastic bags & sacks market in Middle East & Africais anticipated to witness significant growth from 2024 to 2030. Plastic manufacturers in the region have a strong presence in the pharmaceutical packaging sector. Initiatives such as Vision 2030, which is aimed at developing the non-oil sectors in the Middle East, reflect the changing market dynamics and are projected to be pivotal for the MEA market growth.

Saudi Arabia plastic bags & sacks market stands out as one of the largest in the region. The country has a growing meat consumption and meat packaging sector, which is characterized by a strong preference for poultry. The country has the highest per capita consumption of chicken in the world, at 50 kg annually. Poultry meat is considered a primary source of protein for consumers in Saudi Arabia. This outlook is expected to create a demand for reliable and effective packaging solutions, thus driving demand for plastic bags and sacks across the country.

Key Plastic Bags & Sacks Company Insights

The market is highly fragmented with the presence of a significant number of companies offering various types of plastic bags and sacks. The major players are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansions to increase market share and presence.

-

In August 2023, Hefty reintroduced its limited-edition Hefty Cinnamon Pumpkin Spice Ultra Strong trash bags. These trash bags come in a festive Cinnamon Pumpkin Spice scent and offer features such as flex strength, secure-fit closure, odor control, and resistance to leaks, punctures, and rips. The product was available at select retailers, including Amazon and Walmart, in various pack sizes.

-

In March 2023, Berry Global relaunched its Green Sack range of refuse sacks, which are made from over 90% recycled agricultural and post-consumer plastic waste. The range is packed in a more convenient-to-use dispenser box for cleaning, hospitality, and facilities management sectors. Green Sack range is used in a variety of applications from facilities management, and healthcare to local authorities. Sacks are manufactured using the CHSA Refuse Sack Standard and are available in a large variety of sizes. Besides, it is thinner, stronger, and more sustainable, and is manufactured from UK waste at Berry Global's UK facilities, helping to conserve resources and reduce landfill.

Key Plastic Bags & Sacks Companies:

The following are the leading companies in the plastic bags & sacks market. These companies collectively hold the largest market share and dictate industry trends.

- Berry Global Inc.

- Mondi

- Amcor plc

- Inteplast Group

- Smurfit Kappa

- Novolex

- Bischof+Klein SE & Co. KG

- Alfa Poly Plast

- Goglio SpA

- ARIHANT PACKAGING

- ProAmpac

- Schur

- Starlinger & Co Gesellschaft m.b.H.

- Packman Packaging Private Limited

- Knack Packaging Pvt. Ltd.

- The Buckeye Bag Company

- Kanpur Plastipack Limited

- Fujian Yangqiang Plastic Products Co., Ltd.

- VAVA PACK CO., LTD.

- Leadpacks (Xiamen) Environmental Protection Packing Co., Ltd.

Plastic Bags & Sacks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.83 billion

Revenue forecast in 2030

USD 34.21 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Berry Global Inc.; Mondi; Amcor plc; Inteplast Group; Smurfit Kappa; Novolex; Bischof+Klein SE & Co. KG; Alfa Poly Plast; Goglio SpA; ARIHANT PACKAGING; ProAmpac; Schur; Starlinger & Co Gesellschaft m.b.H.; Packman Packaging Private Limited; Knack Packaging Pvt. Ltd.; The Buckeye Bag Company; Kanpur Plastipack Limited; Fujian Yangqiang Plastic Products Co., Ltd.; VAVA PACK CO., LTD.; Leadpacks (Xiamen) Environmental Protection Packing Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Bags & Sacks Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plastic bags & sacks market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Non-biodegradable

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Linear Low-density Polyethylene (LLDPE)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Others

-

-

Biodegradable

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Polybutylene Succinate (PBS)

-

Starch Blends

-

Others

-

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

T-shirt Bags

-

Trash Bags

-

Rubble Sacks

-

Woven Sacks

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Retail & Consumer Applications

-

Grocery

-

Food & Beverage

-

Clothing & Apparel

-

Others

-

-

Institutional Services

-

Hospitality

-

Healthcare

-

Others

-

-

Industrial Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic bags & sacks market was estimated at around USD 23.54 billion in the year 2023 and is expected to reach around USD 24.83 billion in 2024.

b. The global plastic bags & sacks market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach around USD 34.21 billion by 2030.

b. Retail & consumer application emerged as a dominating application segment with a value share of around 69.0% in the year 2023 owing to the growing economies and middle classes in developing countries, which has led to the expansion of the retail sector, thus fueling the demand for plastic bags & sacks.

b. The key market player in the plastic bags & sacks market includes Berry Global Inc., Mondi, Amcor plc, Inteplast Group, Smurfit Kappa, Novolex, Bischof+Klein SE & Co. KG, Alfa Poly Plast, Goglio SpA, ARIHANT PACKAGING, ProAmpac, Schur, Starlinger & Co Gesellschaft m.b.H., Packman Packaging Private Limited, Knack Packaging Pvt. Ltd., The Buckeye Bag Company, Kanpur Plastipack Limited, Fujian Yangqiang Plastic Products Co., Ltd., VAVA PACK CO., LTD., Leadpacks (Xiamen) Environmental Protection Packing Co., Ltd.

b. Expanding food & beverage, textile, healthcare, and pharmaceutical industries across the globe are driving the demand for plastic bags & sacks. Moreover, the rising e-commerce industry is expected to boost the demand for plastic bags & sacks as they are used for shipping and delivering a wide range of products ordered online.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.