- Home

- »

- Medical Devices

- »

-

Cataract Surgery Devices Market Size, Industry Report, 2033GVR Report cover

![Cataract Surgery Devices Market Size, Share & Trends Report]()

Cataract Surgery Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Phacoemulsification Systems, Intraocular Lenses), By Surgical Technique (Phacoemulsification, FLACS), By Age, By Comorbidity, By End-use (Hospitals, Ophthalmic Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-760-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cataract Surgery Devices Market Summary

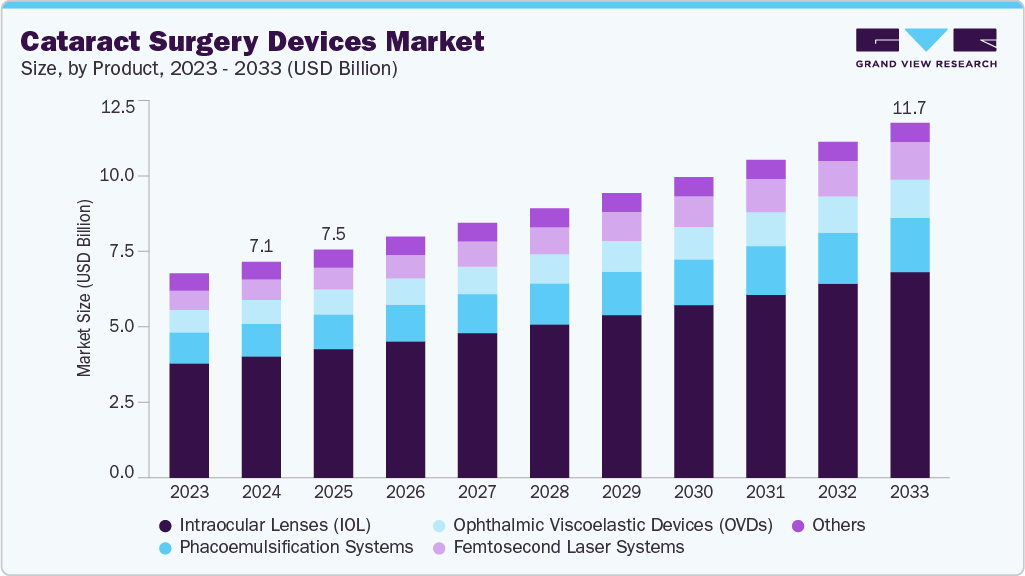

The global cataract surgery devices market size was estimated at USD 7.13 billion in 2024 and is projected to reach USD 11.71 billion by 2033, growing at a CAGR of 5.68% from 2025 to 2033. This growth is attributed to improved access to healthcare services, technological innovation, and the rising healthcare expenditure.

Key Market Trends & Insights

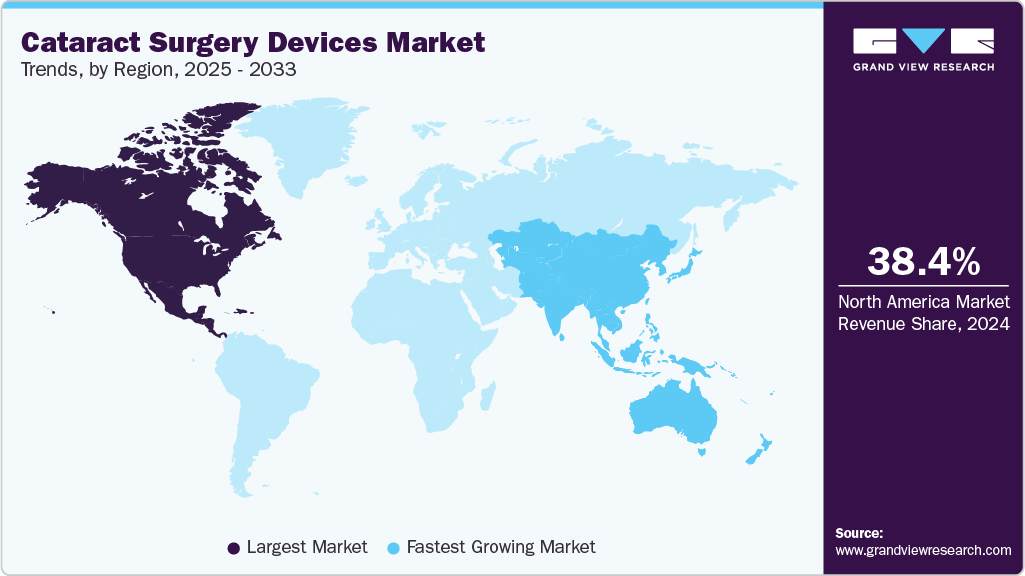

- The North America cataract surgery devices market held the largest global revenue share of 38.41% in 2024.

- The U.S. cataract surgery devices industry is expected to grow significantly from 2025 to 2033.

- By product, the intraocular lens segment held the highest market share of 56.19% in 2024.

- By surgical technique, the phacoemulsification segment held a leading market share of 66.28% in 2024.

- By age group, the 50 years & above segment held a leading market share of 90.30% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.13 Billion

- 2033 Projected Market Size: USD 11.71 Billion

- CAGR (2025-2033): 5.68%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the major factors driving the development of this market is the rising prevalence of cataract, specifically due to the aging population. Cataract is one of the most common causes of blindness globally, rising significantly with advancing age. According to an article from the National Library of Medicine, older adults, especially those above 60 years, are most affected by age-related cataracts, often influenced by diseases like diabetes and hypertension. Furthermore, the aging population has added more than 183 million cases of vision loss, making cataracts a growing public health challenge. This demographic trend will accelerate demand for cataract surgeries and advanced surgical devices.Over a very short period, technological improvements have changed surgical techniques and devices dramatically. The use of femtosecond laser-assisted cataract surgery (FLACS), advanced intraocular lenses (multifocal, toric, and EDOF), optical coherence tomography (OCT) imaging, improved phacoemulsification systems, and real-time intraoperative aberrometry has played a big part in accomplishing surgical accuracy, safety, and patient outcomes to a great extent. These new technologies help prevent unwanted side effects, allow for smaller incisions, and give the surgeon a more precise intraocular lens, leading to faster recovery and better vision correction. As a result, the choice of surgeons and patients is gradually turning towards these advanced procedures; thus, the worldwide use of modern cataract surgery devices is increasing.

In recent years, there has been a considerable shift to outpatient and ambulatory surgical centers (ASCs). These centers provide lower procedural costs, quicker patient flow, and improved accessibility, making them highly attractive for cataract surgeries. For example, Unifeye Vision Partners took over Insight Vision Group in 2023, the latter consisting of two multi-specialty ASCs in California, representing the trend of the industry to expand outpatient care facilities. The demand for the development of suitable surgical devices for outpatient settings will increase as more cataract surgeries are performed in ASCs, resulting in further growth of the cataract surgery devices industry.

Cataracts are still the main cause of blindness globally, and they continue to be a major source of vision impairment of moderate-to-severe intensity. So far, 15.2 million cases of global blindness and 78.8 million cases of global moderate-to-severe vision impairment have been reported. The availability of access to cataract surgery is very different, and it is said that the rates of blindness and visual impairment in sub-Saharan Africa and Southeast Asia are eight times higher than those of high-income countries. The least access to healthcare is the most impacted group of people who are the most vulnerable (e.g., aged people, women, residents of rural areas, and members of ethnic minorities). Surgical innovations, intraocular lenses, and diagnostic tools are among the new technologies that have been improving the success and effectiveness of surgeries. Besides that, artificial intelligence has also been gaining ground as a tool for diagnostic accuracy, treatment planning, and surgical approaches. Therefore, patient care in each of these aspects can be improved with the help of AI.

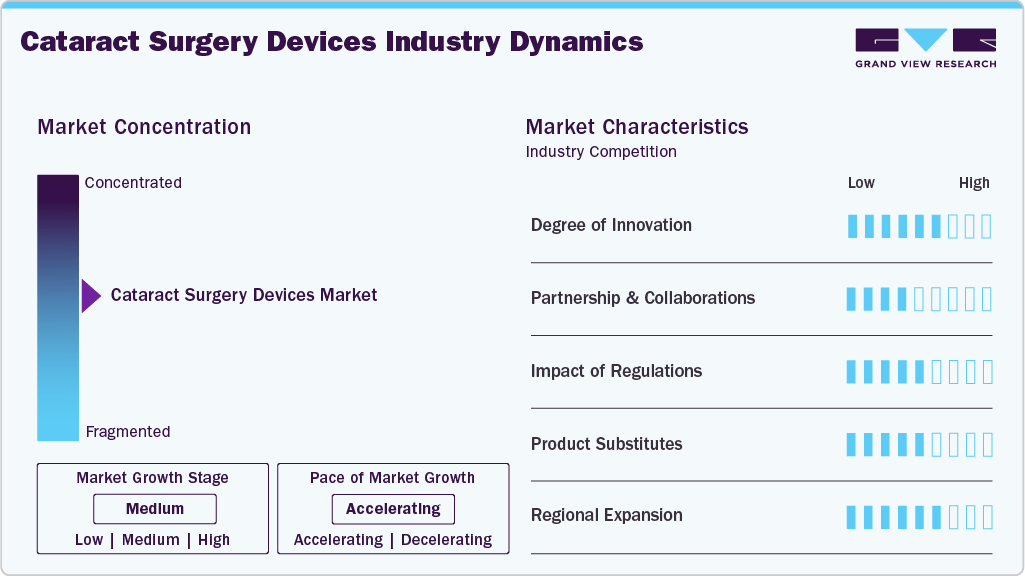

Market Concentration & Characteristics

The cataract surgery devices market is moderately concentrated, with several established competitors, such as Alcon Inc.; Johnson & Johnson; and Carl Zeiss Meditec AG, being some of the key players. These companies have large market shares partly due to their broad product portfolios and global access. The market is growing steadily due to the global aging population, the rising prevalence of cataract-associated visual difficulties, and continual technological advancements in surgical devices, which aim to improve surgeon precision, reduce recovery time, and improve patient outcomes.

The degree of innovation in the cataract surgery devices industry is high, reflecting a steady transition from conventional techniques toward precision-driven, patient-centric solutions. Intraocular lenses (IOLs) have advanced beyond basic monofocal designs to include multifocal, toric, and extended depth-of-focus variants, addressing both refractive errors and astigmatism to improve postoperative quality of life. Phacoemulsification platforms now integrate real-time imaging, fluidics control, and AI-enabled guidance, enhancing surgical safety and consistency. Femtosecond laser systems, although more expensive, represent another leap by automating critical steps such as corneal incisions and capsulotomy with micron-level accuracy. Even supporting tools like ophthalmic viscoelastic devices (OVDs) are evolving to offer better protection of ocular tissues and facilitate lens implantation. Collectively, these innovations demonstrate a strong push not only toward improved visual outcomes but also toward efficiency, minimally invasive techniques, and broader customization to individual patient needs.

Key players in the cataract surgery industry are partnering with ambulatory surgical centers, hospitals, and technology companies to improve patient care. For instance, in April 2024, Carl Zeiss Meditec AG acquired Dutch Ophthalmic Research Center (D.O.R.C.), enhancing its surgical instruments and workflow solutions while strengthening ties with healthcare providers. Similarly, in January 2023, Bausch + Lomb acquired AcuFocus, adding the IC-8 Apthera intraocular lens to its surgical portfolio and expanding options for partnered clinics. These collaborations improve efficiency, patient outcomes, and access to advanced cataract surgical technologies.

Regulatory oversight significantly influences the cataract surgery devices market, especially for intraocular lenses (IOLs). Agencies like the U.S. FDA and the European CE Mark body ensure products meet strict safety, efficacy, and reliability standards. These regulations also aim to foster innovation by adjusting requirements for new IOL technologies. Although regulatory processes can sometimes cause delays, they are vital for safeguarding patients and maintaining clinical quality. Compliance with these standards helps manufacturers build trust, enhance their market standing, and promote safer, more effective cataract procedures.

In the market for cataract surgery devices, genuine substitutes are scarce because intraocular lenses (IOLs) and supporting surgical technologies are the standard treatment for restoring vision after cataract removal. Nonetheless, there are some alternative options at the edges. Non-surgical solutions, such as stronger eyeglasses, contact lenses, or magnifying devices, can temporarily help manage vision problems but cannot replace cataract removal once the opacity worsens. Meanwhile, research into anti-cataract eye drops and drugs that slow lens opacification is ongoing, but no clinically approved non-surgical alternatives exist yet. Within surgical methods, techniques like manual small-incision cataract surgery (MSICS) can be lower-cost options compared to phacoemulsification systems, especially in resource-limited areas. However, because of the high success and widespread use of IOL implantation, these substitutes are limited, reinforcing surgery as the only definitive treatment for cataracts.

Regional expansion is a major growth driver for the cataract surgery devices market. While North America and Europe dominate with high adoption of advanced technologies, emerging regions such as Asia Pacific, Latin America, and the Middle East & Africa present strong opportunities due to large patient pools, rising healthcare spending, and government programs to improve eye care access. Success in these markets depends on balancing affordability with innovation and aligning with local regulatory and clinical needs, enabling companies to capture growth beyond saturated developed markets.

Product Insights

The intraocular lenses (IOL) devices segment accounted for the largest market share of 56.19% in 2024 and is expected to grow at a CAGR of 6.05% over the forecast period. The growth is fueled by the rising incidence of cataracts, an increasing demand for premium lenses, and technological advancements that have led to better visual outcomes and patient satisfaction. Intraocular lenses (IOLs) are frequently implanted in different patient cohorts since they address cataract removal and refractive needs. Therefore, they have the highest adoption rate of all intraocular products used in cataract surgery. For instance, in April 2025, Rayner announced the expansion of its IOL manufacturing capacity to meet the growing global demand for IOLs. This expansion highlights the rapid adoption of IOLs as the preferred product category, indicating their significant role in improving cataract surgical outcomes and contributing to the growth of this expanding market.

The adoption of femtosecond laser systems is witnessing significant growth at a CAGR of 7.0%, fueled by the growing interest in precision, safety, and minimally invasive practices. These systems employ ultrafast laser pulses to carry out several necessary maneuvers in cataract surgery, like corneal incisions, capsulotomy, and lens fragmentation, with better precision than traditional manual methods. The shift from conventional phacoemulsification to femtosecond-assisted surgery has resulted in better results, lower surgical complications, and rapid patient recovery. For instance, a study conducted in October 2023 showed enhanced adoption of femtosecond laser ablation in ophthalmic surgery. It reported improved precision and outcomes in surgery, accounting for the increased global uptake of femtosecond laser systems.

Surgical Technique Insights

The phacoemulsification surgical technique accounted for the largest market share of 66.28% in 2024, at a CAGR of 5.70%, driven by its established position as the standard technique for cataract extraction. This method has several advantages, such as small incisions, quick recovery, and fewer complications. The rise in the incidence of cataract, especially among older people, has increased the need for an efficient and effective surgical remedy. According to an article by ProBiologists, in 2025, phacoemulsification's effectiveness and quick visual recovery have solidified its status as the preferred method for cataract surgery.

The femtosecond laser-assisted cataract surgery (FLACS) segment is witnessing significant growth at a CAGR of 5.83% during the forecast period. This growth is driven by its accuracy, safety, and advantages in providing better visual outcomes than conventional surgical techniques. Compared to manual techniques, FLACS automates some of the more time-consuming, delicate, and potentially difficult steps, such as corneal incisions, capsulotomy, and lens fragmentation. With FLACS, these intricacies are completed efficaciously, while reducing surgical complication rates and improving the reproducibility of the steps. This approach shortens patient recovery times and is satisfactory to patients, with cases in both developed and emerging markets increasing, and inquiring further into the segment in cataract surgery.

Age Group Insights

The 50 years & above age group segment dominated the cataract surgery devices industry in 2024, with a share of 90.30% and a CAGR of 5.68%. Adults in this age group are the primary recipients of cataract surgery, as the prevalence of age-related cataracts rises significantly after 50. Cataract surgery restores vision, improves quality of life, and prevents blindness in older adults. According to a population-based survey across 55 countries, adults aged 50 and older accounted for most cataract surgical procedures. Early access to surgery in this age group helps maintain independence and reduces the risk of falls and other age-related complications.

The 19-50 Years age group is expected to grow significantly, at a CAGR of 5.67% during the forecast period. This rise is driven by younger individuals with early-onset cataracts due to lifestyle factors, such as excessive screen time, unhealthy diet, smoking, and UV light exposure. In addition, the rise in diabetes and hypertension among systemic health problems in younger adults is contributing to early cataracts. Increased awareness of eye health and the availability of affordable eye care are also allowing this age group to access care more timely.

Comorbidity Insights

The without comorbidities segment led the cataract surgery devices market with the largest revenue share of 64.56% in 2024. The segment is expected to grow at a CAGR of 5.66% over the forecast period. These individuals are generally healthier adults whose cataracts result from normal aging or the impact of lifestyle choices. Growing awareness about eye health, regular eye examinations, and thoughtful access to cost-effective surgical treatment are all drivers of demand for cataract surgery in this population. By considering early intervention in patients with no comorbidities, patients can retain clear vision, improve their quality of life, and minimize the consequences of untreated cataracts in terms of potential surgery and reduced regular activities.

The with comorbidities segment is expected to grow significantly at a CAGR of 5.70% during the forecast period. Individuals with certain health conditions, like diabetes, hypertension, or cardiovascular diseases, are at the greatest risk of developing cataracts, and they often require surgery earlier than healthy adults. Routine medical monitoring, increased awareness of eye health, and proactive management of associated health conditions drive this population's demand for cataract surgery. Addressing cataracts in patients with comorbidities is crucial to prevent vision impairment and maintain overall quality of life.

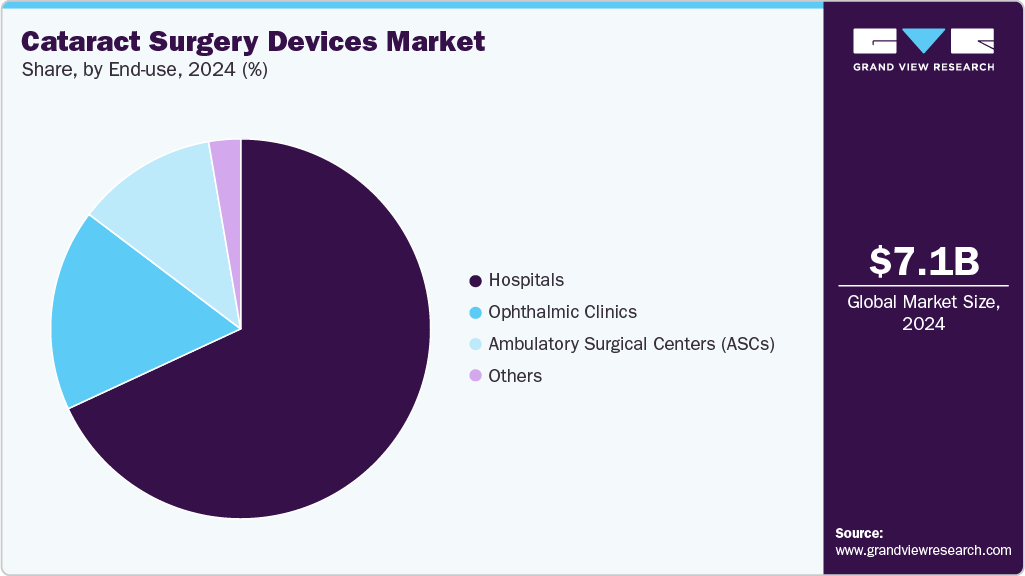

End-use Insights

The hospitals segment dominated the cataract surgery devices market with the largest revenue share of 68.08% in 2024. Hospitals provide comprehensive care and have the infrastructure to handle even a complex procedure. They offer pre-surgery evaluations, advanced surgical equipment, and post-surgery follow-up all in one place. Patients prefer hospitals for safety, convenience, and the ability to manage complications quickly. Additionally, hospitals are expanding their ophthalmology departments and adopting new technologies, which attracts more patients and drives growth in this segment.

The ambulatory surgical centers (ASCs) segment is expected to grow significantly at a CAGR of 6.05% during the forecast period. ASCs are vastly preferred because of their cost-effectiveness, efficiency, and patient convenience. Cataract procedures in ASCs are generally less expensive than hospital outpatient departments, providing savings for patients and healthcare systems. Adopting advanced surgical technologies and streamlined processes in ASCs further drives their growth, making them a key setting for cataract surgeries.

Regional Insights

The North America cataract surgery devices market held the largest global revenue share of 38.41% in 2024. The North American cataract surgery devices marketdemonstrates significant growth due to the high incidence of cataract cases, the quickly aging population, and increases in demand for premium surgical devices such as vanced intraocular lenses (IOLs). Technological innovations in surgical devices and the greater adoption of outpatient surgery centers contribute to the growth of this market. For instance, the increasing demand for premium IOLs in the U.S. and Canada indicates a growing trend toward individualized treatment and improved visual outcomes, emphasizing how the evolving patient needs and advanced surgical solutions influence the regional market growth.

U.S. Cataract Surgery Devices Market Trends

The U.S. cataract surgery devices industry is seeing robust growth driven by the rising prevalence of cataracts and awareness of treatment options. The University Of Florida Department Of Ophthalmology reports that by age 80, over 50% of all Americans will have cataracts and approximately 4 million cataract surgeries are performed annually in the U.S. Because of improved surgical techniques and devices, the outcome of surgery is remarkable, with over 90% of patients achieving 20/20 vision with glasses and surgical infection rates of less than 0.1%. All these facts suggest a large and growing population, a reasonable success with surgery, and increased demand for sophisticated devices for cataract surgery.

Europe Cataract Surgery Devices Market Trends

The Europe cataract surgery devices industry is experiencing substantial growth over the forecast period, due to new technologies and changes in surgical techniques. For example, Immediate Sequential Bilateral Cataract Surgery (ISBCS) involves cataract procedures on both eyes during a single operation. Research shows patients can often return to their daily activities soon after ISBCS, leading to shorter recovery times and reduced costs. At the same time, data-driven tools are helping surgeons perform more accurate procedures. For instance, the ESCRS IOL calculator lets surgeons input patient data once and compare results across multiple modern formulas, making decision-making faster and more efficient.

The UK's cataract surgery devices market is expanding due to hospitals and clinics preferring more advanced intraocular lenses (IOLs) to improve surgical outcomes. For instance, a study conducted by the Royal College of Ophthalmologists in 2023 explains how some hospitals will take on the costs of the more expensive hydrophobic IOLs to enable better long-term results, whilst others will use cheaper hydrophilic IOLs, highlighting the demand for better-quality cataract surgery devices in the UK.

The cataract surgery devices market inGermany is witnessing significant growth, driven by an aging population, rising cataract prevalence, and technological advancements. The country’s leadership is exemplified by ZEISS, showcasing milestones at ESCRS 2025 such as over 10 million surgeries with VisionBlue, the AI-powered CIRRUS PathFinder, and integrated cataract-glaucoma workflows. Platforms like DORC EVA NEXUS highlight Germany’s focus on improving surgical outcomes and strengthening its global Cataract Surgery device presence.

The cataract surgery devices market in France is witnessing significant growth, led by its aging population, increasing cataract prevalence, and continued adoption of newer technologies in surgical techniques. For instance, in December 2022, Elios Vision, Inc. announced that its ELIOS procedure had been registered to treat glaucoma with cataract surgery through an implant-free laser-assisted methodology. The clinical utilization of ELIOS demonstrates the ongoing importance of France in enhancing clinical outcomes and streamlining the integration of novel challenges in remaining innovative in advancing surgical workflows within cataract surgery, thereby enhancing its influence in the regional cataract surgery device sector.

Asia Pacific Cataract Surgery Devices Market Trends

The Asia Pacific cataract surgery devices industry is growing rapidly due to an aging population, rising prevalence of cataracts, and technological advancements in surgery. Asia-Pacific represents a substantial proportion of cataract incidence in countries such as India and China, which have extensive patient demographics and government initiatives to reduce avoidable blindness. Moreover, the growing middle class is adding to the demand for advanced cataract treatment, which includes premium intraocular lenses (IOLs) and contemporary surgical devices. Eye health is a major public health concern, impacting people’s quality of life and daily activities. At the 36th APACRS Annual Meeting and the 24th CSCRS in Chengdu, leading cataract and refractive surgery experts across the Asia-Pacific region shared knowledge and insights. Alcon, a global leader in eye care, showcased its latest ophthalmic surgical products, equipment, and refractive cataract solutions. The company also unveiled upgraded innovations based on its Clareon intraocular lens platform, aiming to make advanced eye care more accessible and support the growing needs of the Chinese market.

The growth of the cataract surgery devices market in Japan is driven by several factors. A rapidly aging population has led to a growing prevalence of cataracts, increasing the need for timely surgical interventions. Advances in surgical technology, including femtosecond laser-assisted cataract surgery, premium intraocular lenses (IOLs), and data-driven surgical planning tools, enable safer, more precise procedures and further encourage adoption. Additionally, rising patient awareness of vision quality and the desire for improved postoperative outcomes push public and private healthcare providers to invest in cutting-edge cataract surgery solutions. For instance, Alcon’s UNITY VCS and CS systems, featuring UNITY 4D Phaco, HYPERVIT 30K, and Intelligent Fluidics, aim to improve efficiency and outcomes in cataract and vitreoretinal surgery, with shipments to Japan expected in May 2025, highlighting the country’s adoption of advanced surgical technologies.

The India cataract surgery devices market is growing steadily due to advancements in technology, increased access to healthcare, and a growing patient population. The rising rate of cataracts, increased awareness, and affordability of surgical treatments are driving demand for higher-quality surgical devices. In August 2025, the Army Hospital Research and Referral (AHRR) in Delhi became the first government facility in India and the second facility in South Asia to conduct robotic custom laser cataract surgery, demonstrating the increased use of innovative technologies in the public health sector.

Latin America Cataract Surgery Devices Market Trends

Latin America is an emerging space in the cataract surgery devices industry, as demand grows due to an aging population, an increase in cataract prevalence, and technological advances in surgery. There is an increasing adoption of advanced ophthalmic surgical procedures in the region, a key driver of demand for cataract surgery devices, particularly ophthalmic viscoelastic devices (OVDs) and intraocular lenses. Emerging markets in countries such as Brazil and Argentina drive the demand for cataract surgical devices, reflecting the continued modernization. The technology-based care trend is changing care for patients diagnosed with cataracts. These trends illustrate Latin America's growing position in the global cataract surgery device market, combining rising patient demand and the adoption of advanced surgical solutions.

Brazil’s cataract surgery devices market is expanding rapidly, propelled by technological innovation, increasing cataract cases, greater healthcare awareness, and better access to advanced procedures. Using premium IOLs and laser-assisted surgical systems improves precision and patient outcomes, while government programs, private sector growth, and startups continue to drive demand. Rayner’s introduction of the RayOne Galaxy and RayOne Galaxy Toric AI-designed spiral IOLs highlights this trend, offering continuous vision with less glare and halo effects, and showcasing Brazil’s adoption of cutting-edge ophthalmic technologies.

Middle East and Africa Cataract Surgery Devices Market Trends

The cataract surgery devices industry in the Middle East and Africa is steadily expanding, fueled by an aging population and the rising occurrence of cataracts. Cataract-related surgical devices constitute a significant part of the broader ophthalmology market, indicating growing demand for advanced solutions. Increased healthcare investments and modern eye care facilities improve access to surgeries, while innovations such as phacoemulsification systems and premium intraocular lenses improve patient outcomes. These factors collectively strengthen the role of cataract surgery devices throughout the region.

The Saudi Arabia cataract surgery devices market is growing steadily, driven by technological advancements, an aging population, and increased awareness of eye health. The rising number of cataract cases has created a strong demand for improved surgical devices that enhance precision, safety, and patient outcomes. Minimally invasive techniques like phacoemulsification and the development of advanced intraocular lenses (IOLs) are resulting in better visual results and shorter recovery times. These trends show the country's wider adoption of modern ophthalmic technologies and greater investment in eye care infrastructure.

The cataract surgery devices market in the UAE is expanding due to technological advances, a higher prevalence of cataracts, and an increasing demand for precision in surgical procedures. Incorporating modern devices such as femtosecond laser-assisted cataract surgery (FLACS), microincision phacoemulsification systems, and premium intraocular lenses (IOLs) is enhancing surgical outcomes and patient recovery. Industry leaders like Dr. Rami Hamed Center (DRHC) in Dubai are leading this trend by introducing advanced technologies that include multifocal, toric, and extended depth-of-focus IOLs, supporting the country’s goal to modernize eye care and boost the market growth.

Key Cataract Surgery Devices Company Insights

The cataract surgery devices market is highly competitive, with key players such as Alcon Inc.; Johnson & Johnson Vision; and Bausch+Lomb holding significant positions. The major companies undertake various organic and inorganic strategies such as product introduction, collaborations, and regional expansion to serve the unmet needs of their customers.

Key Cataract Surgery Devices Companies:

The following are the leading companies in the cataract surgery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon Inc.

- Johnson & Johnson Vision

- Bausch + Lomb

- Carl Zeiss Meditec AG

- HOYA Surgical

- NIDEK Co., Ltd.

- Rayner

- STAAR Surgical

- LENSAR, Inc.

- Ophtec BV

Recent Developments

-

In September 2025, the TECNIS PureSEE intraocular lens (IOL) was introduced for cataract surgery, offering clear vision across all distances without glasses. A multicenter study showed high patient satisfaction, reduced spectacle dependence, and fewer visual side effects, marking a major advancement in cataract surgery devices.

-

In June 2025, the ASCRS (American Society of Cataract and Refractive Surgery) meeting highlighted major advances in cataract care, including innovations in intraocular lens (IOL) technologies, new pre- and postoperative medical drops, and updates on legislative and regulatory challenges. These developments aim to improve surgical outcomes, patient safety, and access to cataract surgery.

-

In April 2025, Alcon launched the UNITY Vitreoretinal Cataract System (VCS) and the UNITY Cataract System (CS), advanced surgical platforms designed to improve the efficiency and accuracy of cataract surgeries. These systems include 4D Phaco Technology, Intelligent Fluidics, and Thermal Sentry for safer and quicker procedures. The devices have received FDA 510(k) clearance and will be introduced in the U.S., Europe, Japan, and Australia, aiming to enhance surgical outcomes and patient safety.

-

In September 2024, Johnson & Johnson launched the TECNIS Odyssey next-generation intraocular lens (IOL) for cataract surgery, promising continuous, precise vision at all distances under any lighting.

Cataract Surgery Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.53 billion

Revenue forecast in 2033

USD 11.71 billion

Growth rate

CAGR of 5.68% from 2025 to 2033

Actual period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgical technique, age group, comorbidity, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Alcon Inc.; Johnson & Johnson Vision; Bausch + Lomb; Carl Zeiss Meditec; HOYA Surgical Optics;

NIDEC Co., Ltd; Rayner; STAAR Surgical; LENSAR, Inc.; Ophtec BV.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cataract Surgery Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the cataract surgery devices market report on the basis of product, surgical technique, age group, comorbidity, end -se, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Phacoemulsification Systems

-

Femtosecond Laser Systems

-

Intraocular Lenses (IOL)

-

Monofocal Intraocular Lens

-

Multifocal Intraocular Lens

-

Toric Intraocular Lens

-

Accommodative Intraocular Lens

-

-

Ophthalmic Viscoelastic Devices (OVDs)

-

Others

-

-

Surgical Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Phacoemulsification

-

Manual small-incision cataract surgery (MSICS)

-

Femtosecond laser-assisted cataract surgery (FLACS)

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

18 Years & Below

-

19-50 Years

-

50 Years & Above

-

-

Comorbidity Outlook (Revenue, USD Million, 2021 - 2033)

-

With Comorbidities

-

Without Comorbidities

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ophthalmic Clinics

-

ASCs

-

Others

-

-

Regional Outlook (Revenue, USD million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cataract surgery devices market size was valued at USD 7.13 billion in 2024 and is expected to reach a value of USD 7.53 billion in 2025.

b. The global cataract surgery devices market is expected to grow at a compound annual growth rate of 5.68% from 2025 to 2033 to reach USD 11.71 billion by 2033.

b. The intraocular lenses (IOL) devices segment accounted for the largest revenue share in 2024, due to the rising incidence of cataracts, an increasing demand for premium lenses, and technological advancements that have led to better visual outcomes and patient satisfaction.

b. Some key players operating in the global cataract surgery devices market include Alcon Inc., Johnson & Johnson Vision, Bausch +Lomb, Carl Zeiss Meditec, HOYA Surgical Optics, NIDEC Co., Ltd, Rayner, STAAR Surgical, LENSAR, Inc., Ophtec BV.

b. Key drivers of the cataract surgery devices market include the rising prevalence of cataracts due to aging populations, advancements in surgical technologies such as femtosecond lasers and premium intraocular lenses, and the growing adoption of outpatient and minimally invasive procedures that improve patient outcomes and reduce recovery time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.