- Home

- »

- Disinfectants & Preservatives

- »

-

Caustic Soda Market Size And Share, Industry Report, 2033GVR Report cover

![Caustic Soda Market Size, Share & Trends Report]()

Caustic Soda Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Alumina, Inorganic Chemicals, Organic Chemicals, Textiles, Soaps & Detergents, Water Treatment, Food, Paper & Pulp, Steel/Metallurgy-sintering), By Region, And Segment Forecasts

- Report ID: 978-1-68038-987-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caustic Soda Market Summary

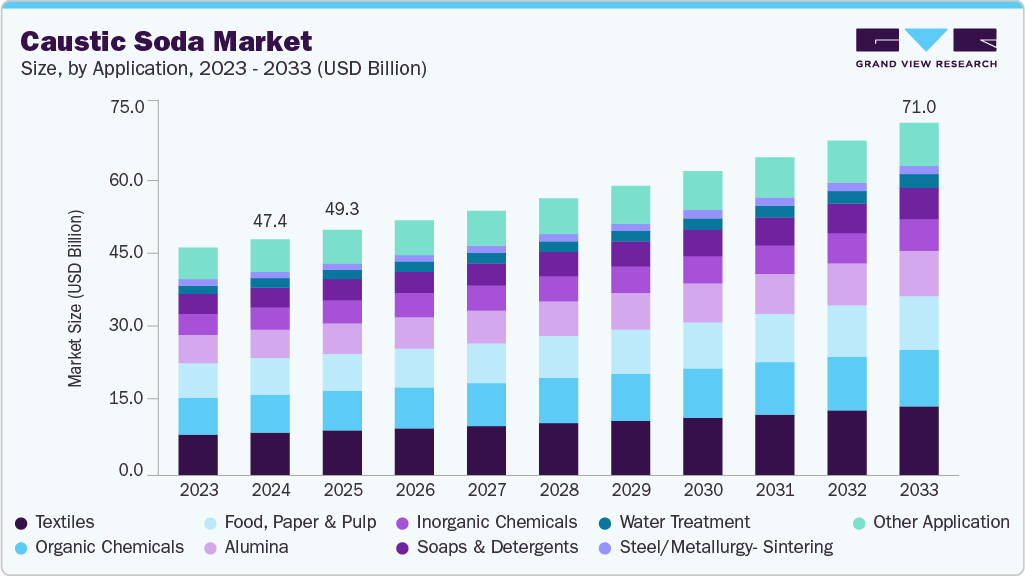

The global caustic soda market size was estimated at USD 47.4 billion in 2024 and is projected to reach USD 71.0 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The increasing demand for aluminum, particularly in the automotive and aerospace industries, has primarily driven the market.

Key Market Trends & Insights

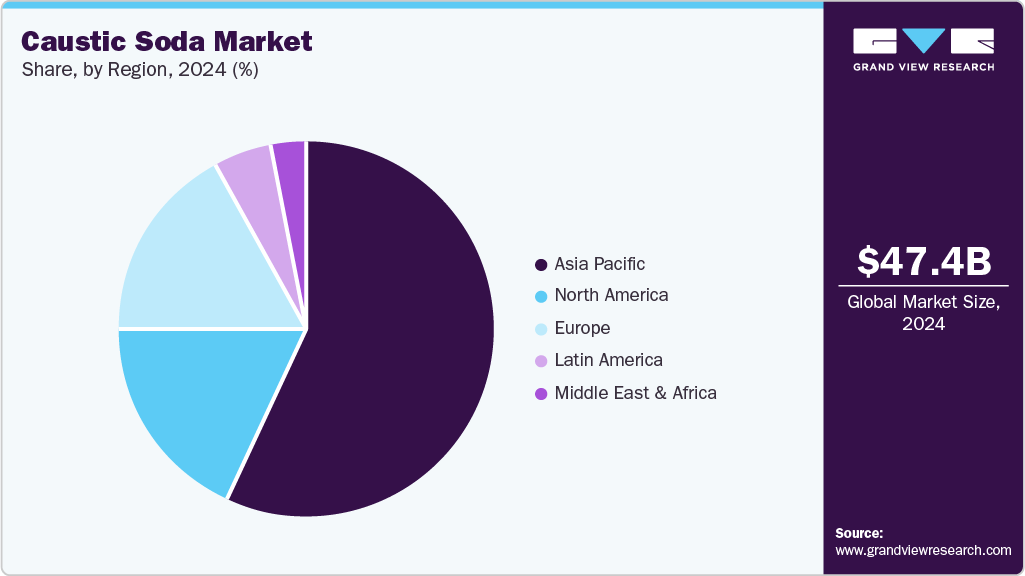

- The Asia Pacific caustic soda market dominated the global industry with a 57.3% share in 2024.

- China Caustic Soda Market held 70.9% revenue share of the Asia Pacific region.

- By application, textiles dominated the market with a revenue share of 18.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 47.4 Billion

- 2033 Projected Market Size: USD 71.0 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Aluminum production requires significant amounts of caustic soda to extract alumina from bauxite ore. As industries strive to produce lighter and more fuel-efficient vehicles and aircraft, the demand for aluminum and, consequently, caustic soda has surged.The aluminum industry’s reliance on caustic soda by application, particularly in the Bayer process, is a major driver of market demand for sodium hydroxide. The product is critical in efficiently extracting alumina from bauxite, reinforcing consistent consumption across global aluminum operations. With increasing emphasis on safety, recycling, and sustainability, demand remains strong, further supported by innovations in waste management and residue repurposing. This makes the aluminum sector a stable, growing end-use market for caustic soda.

The growing electric vehicle-based application of caustic soda drove steady demand for its multiple roles in battery manufacturing. Although its primary use is often for pH control rather than as a direct raw material, caustic soda is essential in preparing uniform electrode coatings, cleaning production equipment, and neutralizing acidic or alkaline waste streams. The choice between lithium carbonate and lithium hydroxide as battery precursors also impacts caustic soda demand. Lithium hydroxide, which requires the product in its production, is increasingly preferred for high-performance lithium-ion batteries despite its higher cost and reactivity. As industry shifts toward advanced battery chemistries, the demand for caustic soda is expected to grow in parallel.

Another significant factor is the expansion of the pulp and paper industry. The product is essential in the pulping process, where it helps break down wood chips into pulp. With the rising demand for paper products, including packaging materials and hygiene products, the pulp and paper industry has continued to be a major consumer of caustic soda. Additionally, the growing emphasis on recycling and sustainable practices has further boosted the demand for caustic soda in paper recycling processes.

The water treatment sector also plays a crucial role in driving the caustic soda market. With the global concerns over water scarcity and pollution intensifying, there is an increasing need for effective water treatment solutions. The product is widely used in water treatment plants to adjust pH levels, remove heavy metals, and neutralize acidic wastewater. The push for clean and safe drinking water, especially in developing regions, has significantly contributed to the market’s growth.

However, the market faces challenges like fluctuating energy prices and supply chain complexities. The energy-intensive nature of caustic soda production makes it vulnerable to changes in energy costs, which can impact profitability. In addition, the transportation and storage of the product require stringent safety measures due to its highly corrosive nature, adding to the logistical challenges.

Despite these challenges, the growing utilization of caustic soda in emerging applications has presented significant opportunities. For instance, due to the rising demand for high-quality fabrics, the textile industry has increasingly used the product in dyeing and finishing processes. Similarly, the food and beverage industry employs the product for cleaning and sanitation, further expanding its market scope.

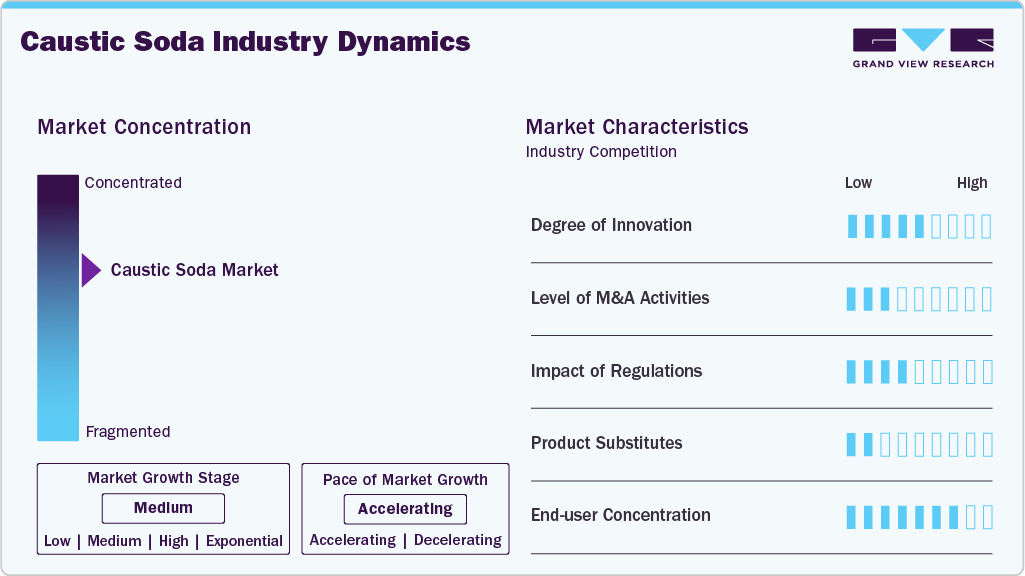

Market Concentration & Characteristics

The caustic soda market is moderately concentrated, dominated by a few large, vertically integrated players. The companies leverage economies of scale, captive chlorine production via chlor-alkali, and extensive global distribution networks to maintain strong market positions. Their integration across the chemical value chain, from salt brine extraction to chlorine and caustic soda, allows for cost efficiencies, consistent product quality, and supply reliability across multiple industries, including aluminum, paper, textiles, and chemicals.

At the same time, emerging manufacturers in Asia-Pacific and the Middle East are expanding their presence by capitalizing on low-cost raw materials, favorable energy pricing, and growing domestic demand. Backed by investments in chlor-alkali facilities within industrial clusters or economic zones, these regional players focus on price-sensitive markets and bulk applications, including alumina refining and water treatment. This dual dynamic of global consolidation and regional expansion shapes the competitive landscape of the caustic soda market.

However, threats to the caustic soda market in aluminum production include increasing environmental regulations, the challenge of managing red mud waste, and potential shifts toward alternative, greener production methods that reduce or replace caustic soda use. By investing in advanced recycling technologies, companies are developing a sustainable red mud utilization strategy and adopting digital innovations to enhance process efficiency and compliance.

Application Insights

Textiles based caustic soda dominated the market with a revenue share of 18.2% in 2024, due to its crucial role in various stages of textile processing, including scouring, bleaching, and dyeing. The demand for high-quality textiles, driven by consumer preferences for better fabric quality and vibrant colors, has led to an increased consumption of caustic soda in the industry. For instance, in scouring, the product removes natural impurities such as waxes, oils, and pectins from raw fibers.

The product is used in the mercerization process, which enhances cotton fibers' strength, luster, and dye affinity, making them more suitable for high-end textile products. Moreover, the growing trend towards sustainable and eco-friendly textiles has increased the demand for caustic soda. Textile manufacturers have increasingly adopted processes that minimize environmental impact, and caustic soda is a key component in several of these processes. For instance, it produces viscose rayon, a biodegradable fiber gaining popularity as a sustainable alternative to synthetic fibers.

Soaps and detergents based caustic soda are steadily growing with a CAGR of 5.3% from 2025 to 2033, due to its crucial ingredient in saponification, where fats and oils are converted into soap. This chemical reaction is fundamental to producing solid and liquid soaps and thus makes the product indispensable for the industry. Additionally, the expanding middle-class population in emerging economies has contributed to the rising demand for personal care and household cleaning products.

The market was influenced by the ongoing trend towards premium and specialized cleaning products, such as antibacterial and hypoallergenic soaps, necessitating caustic soda in their formulation. Moreover, the industrial and institutional cleaning sectors are significant consumers of caustic soda-based detergents. These sectors require large quantities of cleaning agents to maintain hygiene standards in various facilities, including hospitals, schools, and commercial establishments.

Regional Insights

The North America caustic soda market secured 18.0% of the revenue share in 2024, owing to the robust expansion of the automotive and aerospace industries, where aluminum is widely applied for lightweight and fuel-efficient designs. Caustic soda is crucial in the extraction of alumina from bauxite ore, a necessary step in aluminum production. In addition, North America, particularly the U.S. and Canada, has a well-established pulp and paper sector that relies heavily on caustic soda for the pulping process.

U.S. Caustic Soda Market Trends

The U.S. caustic soda market is growing due to its demand in the paper and pulp industry as it essential in the chemical pulping process, especially in the production of market pulp. Market pulp, which is widely used across various paper grades, requires a significant amount of caustic soda, approximately 35 kg per ton, to break down lignin and separate cellulose fibers, making it the largest consumer of caustic soda within the industry. Although packaging materials like containerboard use mostly recycled pulp, which requires minimal caustic soda, the high production volume of packaging materials in response to the growing e-commerce and logistics sectors helps maintain demand.

In other segments, such as printing, writing, and tissue paper, caustic soda usage depends on whether mills are integrated or rely on externally sourced market pulp. Mills using market pulp shift the caustic soda consumption upstream to pulp producers. As a result, the U.S. market maintains a steady demand for caustic soda, driven by the high chemical requirements of market pulp production, the scale of packaging manufacturing, and the structure of the paper and pulp supply chain.

Asia Pacific Caustic Soda Market Trends

The caustic soda market in Asia Pacific dominated with a 57.3% share in 2024, owing to its widespread application in various end use industries such as textiles, paper & pulp, and chemical manufacturing. In addition, the rapid industrialization and urbanization in developing economies such as China and India have necessitated the adoption of advanced water treatment technologies, thereby boosting the demand for the product in the region.

China held over 70.9% revenue share of the Asia Pacific Caustic Soda Market in 2024, owing to its massive industrial base and rapid economic growth. The country’s enormous population and presence of various manufacturing industries, including textiles, paper & pulp, and the cement industry have significantly driven the market growth.

Europe Caustic Soda Market Trends

The caustic soda market in Europe held 16.6% of the global revenue share in 2024. This can be credited to the growing use of caustic soda in the soap and detergent industry. The heightened awareness of hygiene and cleanliness, particularly post-pandemic, has led to increased consumption of soaps and detergents, thereby driving the demand for the product. Furthermore, the market was further driven by sustainable practices initiated by stringent environmental regulations.

Middle East & Africa Caustic Soda Market Trends

The Middle East & Africa caustic soda market is experiencing strong growth, primarily driven by rising alumina production. Caustic soda is critical in the Bayer process for refining bauxite into alumina, a key input in aluminum manufacturing. As regional investments in aluminum smelting and downstream processing expand, particularly in the UAE and Saudi Arabia, the demand for the product continues to rise. This trend aligns with national industrialization goals and infrastructure development, reinforcing caustic soda's strategic importance as a core industrial chemical supporting high-volume, energy-intensive sectors.

Latin America Caustic Soda Market Trends

The Latin American caustic soda market is witnessing steady growth, largely driven by its extensive use in the soaps and detergents sector. As hygiene awareness and consumer demand for personal and home care products increase across the region, caustic soda remains a vital raw material for saponification and cleaning formulations. Local manufacturers are ramping up production to meet the rising needs of rural and urban populations. Additionally, the trend toward eco-friendly and biodegradable cleaning products supports the continued use of caustic soda in producing plant-based and sustainable detergent formulations, solidifying its role in the region’s evolving consumer goods industry.

Key Caustic Soda Company Insights

Some key players operating in the caustic soda market include Les dsm-firmenich and Kraton Corporation

-

Dow, a global chemical leader headquartered in the U.S., is a major player in the caustic soda market, leveraging its extensive chlor-alkali production capacity. As part of its vertically integrated operations, Dow uses caustic soda as a raw material and an intermediate across multiple downstream applications, including manufacturing organic and inorganic chemicals, water treatment solutions, and specialty polymers. The company’s caustic soda production supports high-volume demand in textiles, pulp & paper, and alumina refining. Dow’s commitment to sustainability is reflected in its investment in energy-efficient electrolysis technologies and circular economy initiatives, ensuring a reliable, lower-emission supply of the product to global markets.

ORGKHIM Biochemical Holding and Pinova, Inc. are emerging market participants in the caustic soda market.

-

Tata Chemicals Ltd. is an influential and emerging leader in the caustic soda market, particularly across Asia and Africa, leveraging its integrated operations and strategic regional presence. Headquartered in India, the company operates large-scale chlor-alkali plants in Mithapur and other locations, supplying the product to key sectors such as textiles, alumina, soaps & detergents, and water treatment. Tata Chemicals has significantly expanded its footprint in Africa through its operations in Kenya and its focus on value-added downstream chemicals. The company emphasizes energy efficiency, sustainable brine management, and green chemistry practices, aligning with the growing demand for eco-friendly industrial inputs. Its robust supply chain, regional adaptability, and investment in process innovation position Tata Chemicals as a competitive and fast-growing player in the caustic soda value chain across emerging markets.

Key Caustic Soda Companies:

The following are the leading companies in the caustic soda market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Olin Corporation

- Westlake Corporation

- Occidental Petroleum Corporation

- Formosa Plastics Corporation

- Tata Chemicals Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay

- Grasim Industries Limited

- SABIC

- Covestro AG

- Hanwha Group

Recent Developments

-

In December 2023, Dow introduced Caustic DEC and TRACELIGHT DEC, two new low-carbon caustic soda products under its Decarbia portfolio, featuring up to 90% reduced CO₂ emissions. Produced via renewable energy-powered electrolysis and certified by ISCC PLUS, these products support industrial and food-grade applications while helping customers lower Scope 3 emissions. This launch underscores Dow’s commitment to decarbonizing the caustic soda value chain and advancing sustainable, transparent chemical production in Europe.

-

In December 2024, SABIC's launch of LNP ELCRES CXL PC copolymers highlights growing demand for materials with high chemical resistance, including resistance to caustic soda. The inclusion of a 5% caustic soda solution in SABIC’s chemical testing underscores the relevance of caustic soda exposure in sectors like mobility, electronics, and infrastructure. This development signals a need for advanced materials capable of withstanding caustic soda, indirectly supporting ongoing demand for sodium hydroxide in industrial applications while driving innovation in compatible polymer technologies.

Caustic Soda Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.2 billion

Revenue forecast in 2033

USD 71.0 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France, Spain, China; India; Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Dow; Olin Corporation; Westlake Corporation, Occidental Petroleum Corporation; Formosa Plastics Corporation; Tata Chemicals Ltd.; Shin-Etsu Chemical Co., Ltd.; Solvay; Grasim Industries Limited; SABIC; Covestro AG; Hanwha Group

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caustic Soda Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global caustic soda market report based on application, and region:

-

Application Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2033)

-

Alumina

-

Inorganic Chemicals

-

Organic Chemicals

-

Food, Paper & Pulp

-

Soaps & Detergents

-

Textiles

-

Water Treatment

-

Steel/Metallurgy- Sintering

-

Other

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global caustic soda Market size was estimated at USD 47.4 billion in 2024 and is expected to reach USD 49.2 billion in 2025.

b. The global caustic soda market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 71.0 billion by 2033.

b. The textiles-based segment led the market and accounted for the largest revenue share of 18.2% in 2024, due to its crucial role in various stages of textile processing, including scouring, bleaching, and dyeing.

b. Some of the key players operating in the caustic soda market include Dow, Olin Corporation, Westlake Corporation, Occidental Petroleum Corporation, Formosa Plastics Corporation, Tata Chemicals Ltd., Shin-Etsu Chemical Co., Ltd., Solvay, Grasim Industries Limited, SABIC, Covestro AG, Hanwha Group

b. The growth is attributed to caustic soda’s expanding application in aluminum production, which requires significant amounts of caustic soda to extract alumina from bauxite ore.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.