- Home

- »

- Medical Devices

- »

-

Cell And Gene Therapy CDMO Market Size Report, 2033GVR Report cover

![Cell And Gene Therapy CDMO Market Size, Share & Trends Report]()

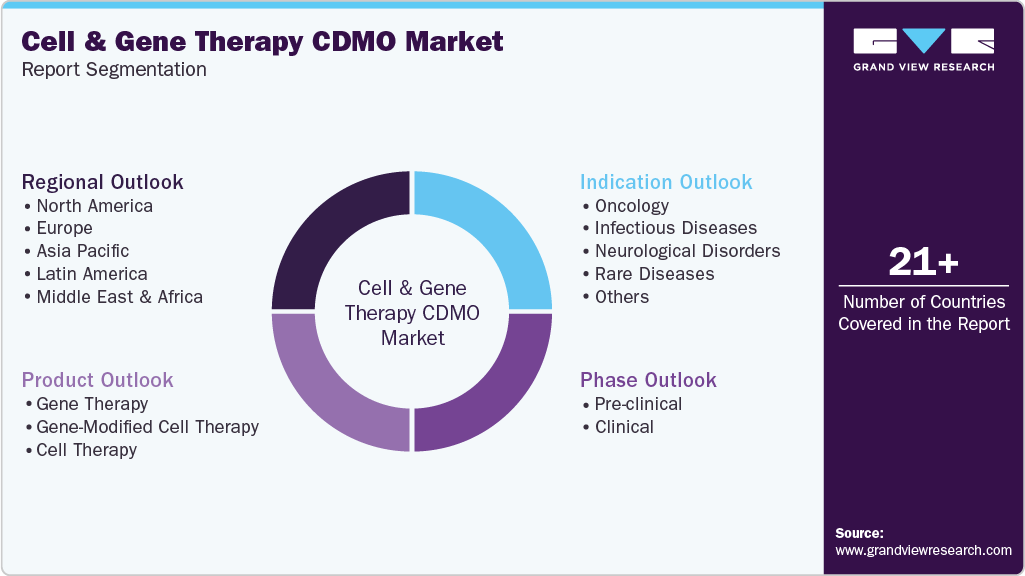

Cell And Gene Therapy CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Phase (Pre-clinical, Clinical), By Product (Gene Therapy, Gene-Modified Cell Therapy, Cell Therapy), By Indication (Oncology, Infectious Diseases), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-167-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell And Gene Therapy CDMO Market Summary

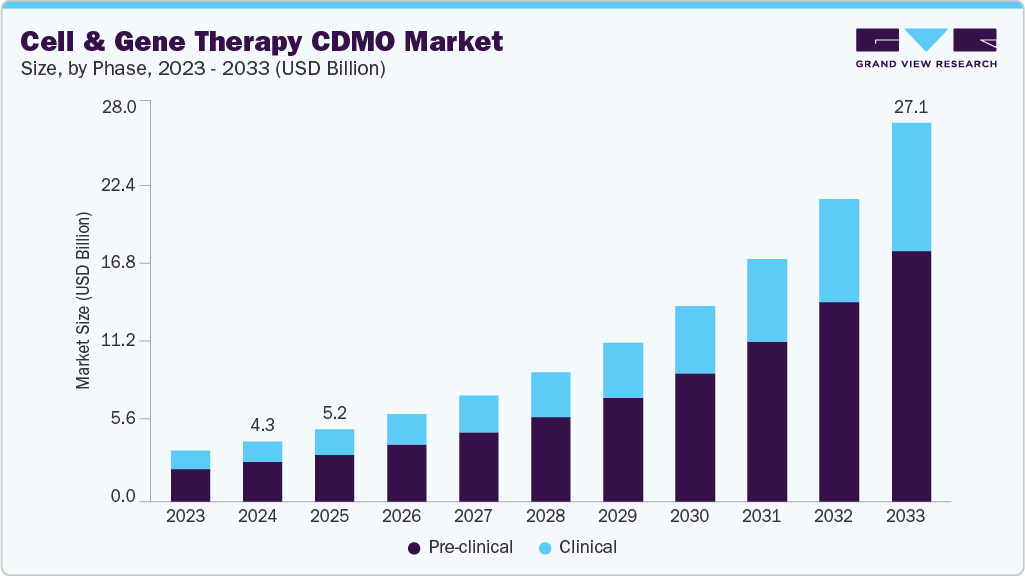

The global cell and gene therapy CDMO market size was valued at USD 4.31 billion in 2024 and is projected to reach USD 27.12 billion by 2033, growing at a CAGR of 23.03% from 2025 to 2033. The industry is driven by the expanding portfolio of cell and gene therapy products, increased researcher attention on rare diseases, and substantial investments from both public and private sectors in research and development.

Key Market Trends & Insights

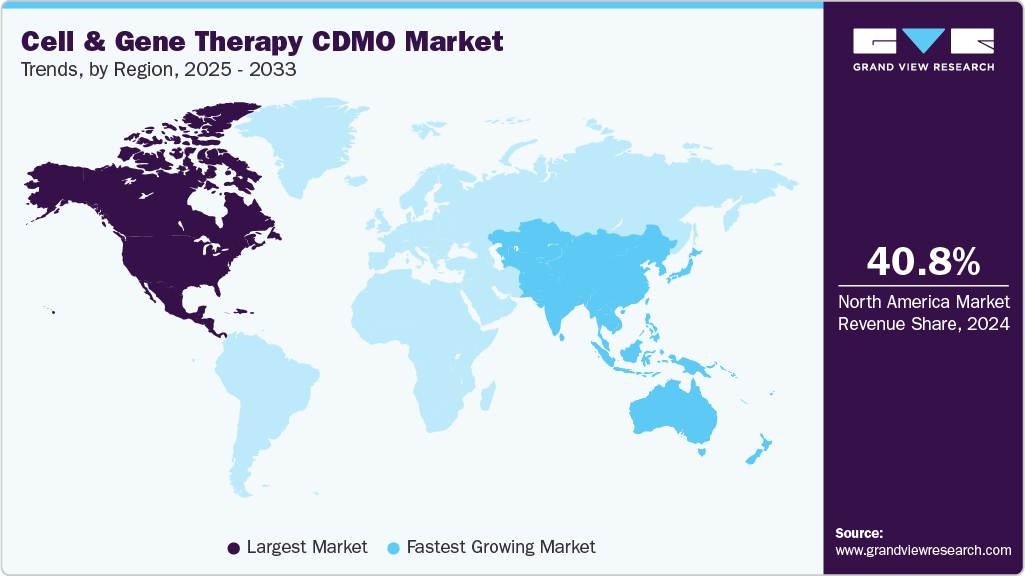

- North America cell and gene therapy CDMO market held the largest share of 40.8% of the global market in 2024.

- The cell and gene therapy CDMO industry in the U.S. is expected to grow significantly over the forecast period.

- By phase, the pre-clinical segment led the market with the largest revenue share of 64.9% in 2024.

- Based on product, the cell therapy segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.31 Billion

- 2033 Projected Market Size: USD 27.12 Billion

- CAGR (2025-2033): 23.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising demand for outsourced services related to cell and gene therapies, the increasing prevalence of chronic ailments such as cancer, a surge in mergers & acquisitions activities, and ongoing technological innovations throughout the cell and gene therapy development process are also fueling the growth. The market is primarily driven by the increased R&D funding and investments in cell and gene therapeutics (CGT) by the biotechnology and pharmaceutical industries. Cell and gene therapies hold significant potential in treating a wide range of diseases, including cancer, genetic disorders, and certain infectious diseases. Hence, owing to the great potential of these therapeutics, there has been a considerable increase in interest from both private and public sectors in the development and discovery of innovative cell and gene therapies. Most big pharmaceutical companies are now investing in CGT to create a strong position in the market. There has been a considerable increase in venture capital investments, especially in the life sciences sector.

Furthermore, an increased clinical pipeline and persistent reliance on outsourcing due to the specialized expertise and infrastructure required for production are also factors which is driving market growth. According to the data published by clinicaltrials.org there are currently over 2,000 ongoing clinical trials in cell and gene therapies that are progressing through development stages, and each transition from early to late phase amplifies the demand for viral vectors, plasmids, and clinical-grade cell processing. FDA approvals of novel treatments such as Casgevy for sickle cell disease and Elevidys for Duchenne muscular dystrophy in 2023-24, alongside EMA’s approval of Roctavian for hemophilia A, highlight the growing momentum of advanced therapies entering the commercial stage. Most small and mid-sized biotech firms pioneering these innovations lack large-scale GMP facilities, making partnerships with CDMOs essential to reach patients. To meet this surge, leading players like Lonza, Catalent, WuXi Advanced Therapies, and Thermo Fisher have invested heavily in expanding viral vector and cell therapy capacity, indicating strong confidence in sustained outsourcing demand. Together, these drivers position the market for sustained high growth as approvals accelerate, pipelines deepen, and manufacturing needs outpace in-house capabilities.

Opportunity Analysis

The cell and gene therapy CDMO market offers strong opportunities as demand for specialized manufacturing continues to outpace the in-house capabilities of most biotech firms. A growing wave of FDA and EMA approvals, supported by more than two thousand active clinical trials worldwide, ensures consistent outsourcing needs for viral vectors, plasmids, and advanced cell processing. CDMOs that invest in flexible, automated, and multi-platform facilities stand to capture long-term contracts from both emerging biotech developers and established pharmaceutical companies. Expanding infrastructure in regions like Asia-Pacific, alongside North America and Europe, further creates opportunities to serve a global pipeline of therapies moving rapidly toward commercialization.

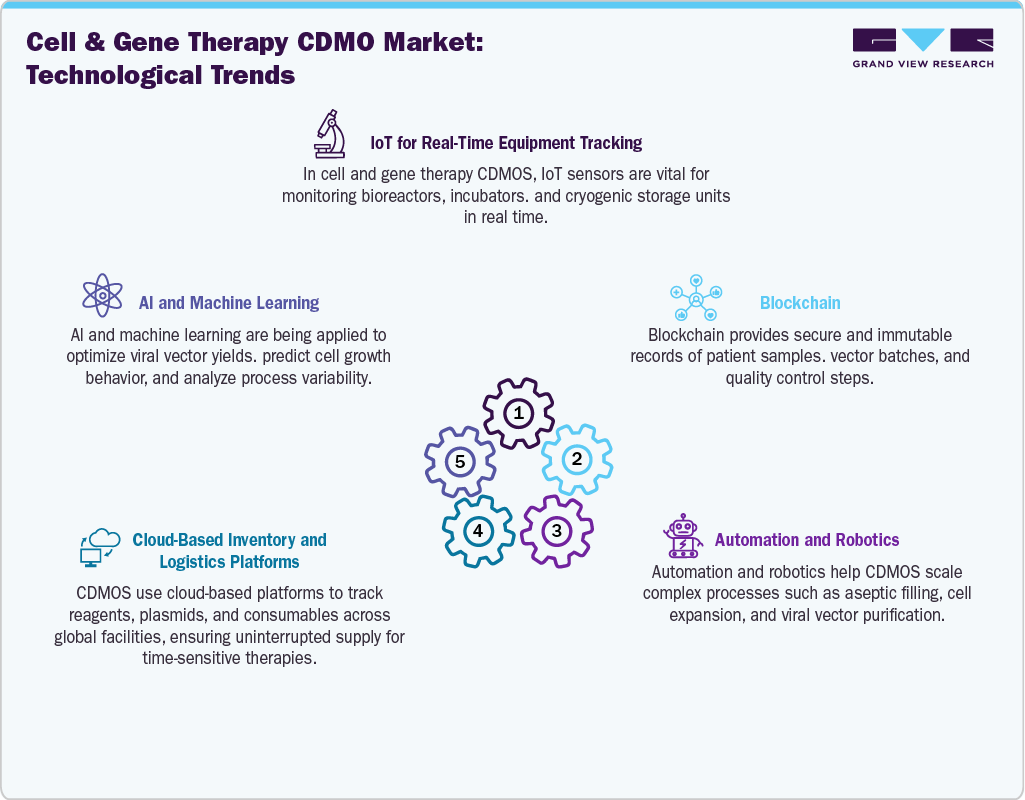

Technological Advancements

The technology landscape for cell and gene therapy CDMOs is defined by the rapid adoption of advanced platforms that enable efficiency, scalability, and compliance in manufacturing. Viral vector production technologies, including AAV and lentiviral systems, remain at the core of gene therapy manufacturing, while closed-system bioreactors and automated cell processing units are increasingly used for cell therapies such as CAR-T and TILs. Single-use technologies and modular cleanrooms provide flexibility to handle diverse therapy pipelines while reducing contamination risks and turnaround times. Digital tools, including electronic batch records and real-time monitoring systems, are also being integrated to ensure quality control and regulatory compliance. Together, these innovations create a foundation for CDMOs to meet rising demand and deliver complex therapies at both clinical and commercial scale.

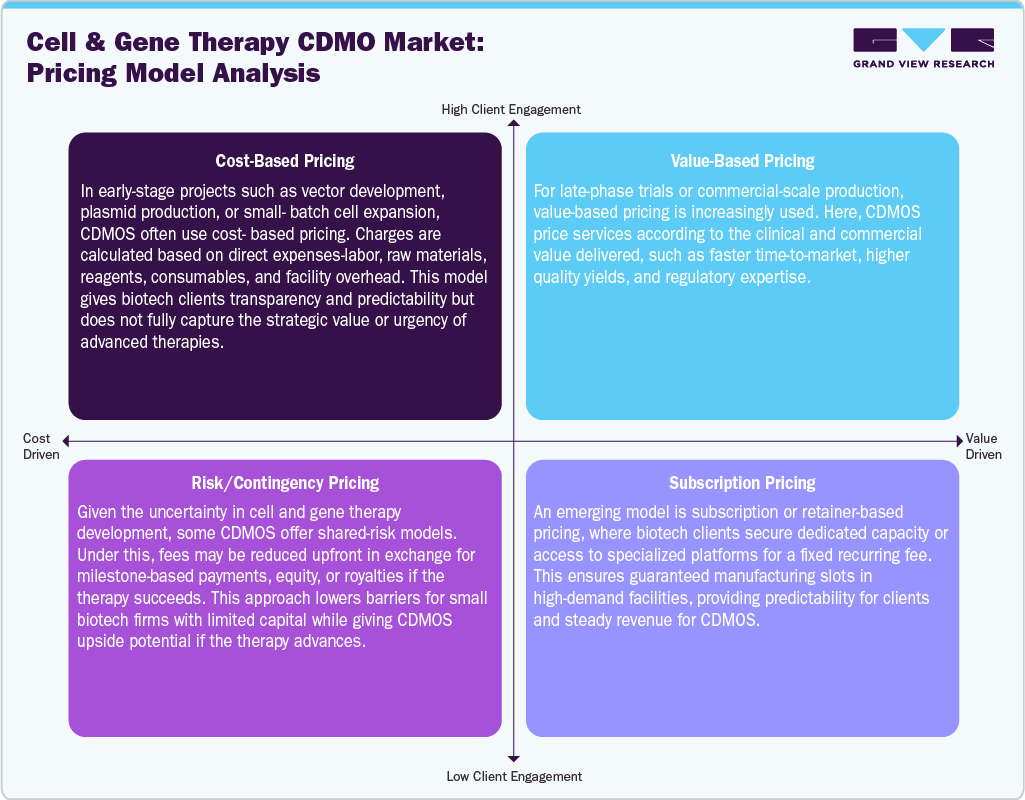

Pricing Analysis

Pricing in the cell and gene therapy CDMO market is shaped by the complexity of processes, scarcity of specialized expertise, and high capital intensity of GMP-compliant facilities. Costs typically vary across phases of development, with early-stage process development and small-batch vector or cell production priced at a premium due to customization and low throughput, while commercial-scale contracts are structured with long-term supply agreements that balance volume with lower per-unit costs. Pricing models often combine fixed fees for facility access and development services with variable charges tied to scale, vector yield, and consumables. Factors such as the type of therapy (AAV vs. lentiviral vectors, CAR-T vs. NK cells), the degree of automation, and regulatory stringency further influence contract values. Given the shortage of global capacity, CDMOs maintain strong pricing power, and sponsors often accept higher costs in exchange for faster timelines and secure supply chains, making pricing both a reflection of technical complexity and market scarcity.

Phase Insights

On the basis of phase, the market is classified into pre-clinical and clinical. The pre-clinical segment accounted for the largest revenue share of 64.9% in 2024. The growth of the segment is due to the majority of activity in the cell and gene therapy space is concentrated in discovery and early development. Thousands of therapies are still in the pipeline, requiring services such as vector design, process development, and small-scale manufacturing. Biotech companies, especially startups, rely heavily on CDMOs during this stage due to limited in-house expertise and infrastructure, driving strong demand for outsourced pre-clinical work.

The clinical segment is anticipated to grow at a lucrative CAGR during the forecast period. The segment growth is driven due to the advancements from early R&D into human trials. An expanding pipeline of cell and gene therapies is steadily transitioning into Phase I-III studies, requiring larger volumes of GMP-grade materials, regulatory-compliant manufacturing, and clinical trial logistics support. The increasing number of FDA and EMA designations for gene therapies, alongside accelerated approval pathways, is also intensifying outsourcing needs in clinical stages.

Product Insights

On the basis of product, the market is segregated into gene therapy, gene-modified cell therapy, and cell therapy. The cell therapy segment dominated the market with a revenue share of 42.8% in 2024. The growth of the segment is due to the wide applicability of these therapies across oncology, autoimmune disorders, and rare diseases, combined with the relatively advanced stage of clinical pipelines compared to other modalities. The strong adoption of CAR-T therapies, proven efficacy in hematological malignancies, and continued expansion into solid tumors have accelerated demand for CDMO support in areas such as cell isolation, expansion, and cryopreservation.

The Gene-Modified Cell Therapy segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is due to the rapid expansion of CAR-T, TCR-T, and NK cell therapies, which are demonstrating strong clinical efficacy in both hematological and solid tumor indications. Growing numbers of clinical trials, coupled with FDA breakthrough and orphan designations, are accelerating the development of these therapies and creating significant demand for CDMO services in genetic engineering, viral vector supply, and large-scale GMP manufacturing.

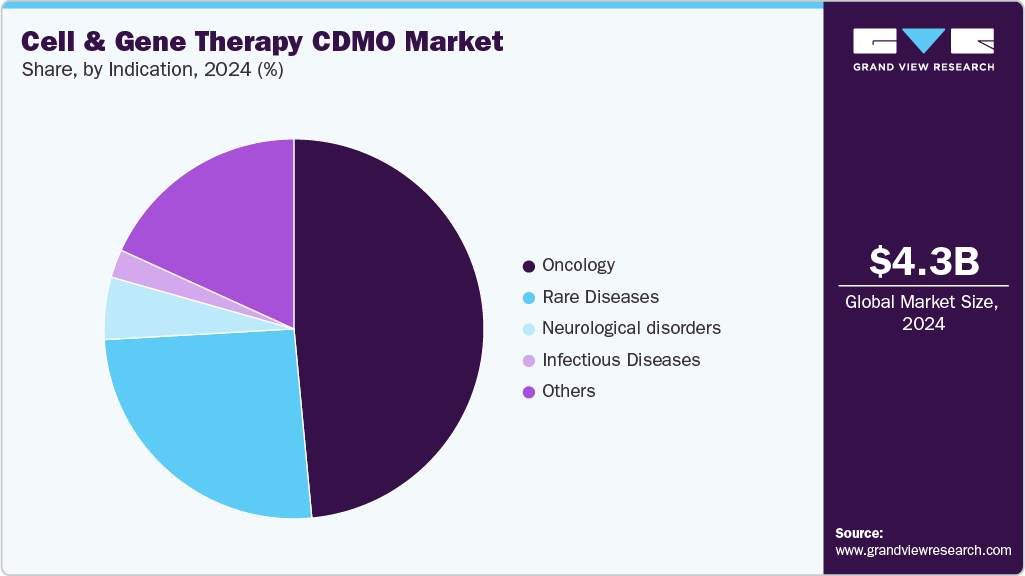

Indication Insights

On the basis of indication, the market is segregated into oncology, infectious diseases, neurological disorders, rare diseases, and others. The oncology segment held the largest market share in 2024, due to the high prevalence of cancer globally and the proven success of cell and gene therapies in treating hematologic malignancies. Therapies such as CAR-T have shown remarkable remission rates in leukemias and lymphomas, prompting accelerated approvals and strong commercial uptake. In addition, oncology dominates the clinical trial pipeline, with a majority of ongoing studies in cell and gene therapy targeting either hematological cancers or exploring applications in solid tumors.

The rare diseases segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to the unique suitability of cell and gene therapies in addressing conditions with limited or no existing treatment options. Many rare diseases are monogenic in nature, making them ideal candidates for gene replacement or modification approaches. Regulatory agencies such as the FDA and EMA continue to grant orphan drug designations, priority reviews, and accelerated approvals for rare disease therapies, incentivizing development and investment in this space.

Regional Insights

North America cell and gene therapy CDMO market accounted for the largest revenue share of 40.8% in 2024. This is attributed to a strong concentration of clinical trials, advanced manufacturing facilities, and early adoption of cell and gene therapies. The presence of leading CDMOs and biopharma companies, combined with supportive regulatory frameworks from the FDA, strengthens its dominance.

U.S. Cell and Gene Therapy CDMO Market Trends

The cell and gene therapy CDMO market in the U.S. held the largest regional share in 2024. The country’s growth is due to high R&D spending, strong venture funding, and rapid commercialization of CAR-T and gene therapies. The country’s robust network of CDMOs, along with early regulatory approvals, fuels consistent outsourcing demand.

Europe Cell and Gene Therapy CDMO Market Trends

The cell and gene therapy CDMO market in Europe is expected to grow significantly due to the region’s favorable policies such as the EMA’s PRIME designation and strong academic-industry collaborations. The region is seeing steady growth in clinical pipelines, with CDMOs investing heavily in capacity expansion.

Germanycell and gene therapy CDMO market held a significant share in 2024, owing to the country’s strong biopharma R&D, clinical trial activity, and government incentives for advanced therapies. Its manufacturing base and skilled workforce make it a preferred hub for CDMO expansion.

The cell and gene therapy CDMO market in the UK held a significant share in 2024. The growth of the market is due to investments in advanced therapy medicinal products (ATMP) infrastructure. Support from the Cell and Gene Therapy Catapult and increased government funding for biotech startups boost outsourcing opportunities.

Asia Pacific Cell and Gene Therapy CDMO Market Trends

The cell and gene therapy CDMO market in Asia Pacific is expected to be the fastest growing market from 2025 to 2033 due to rising biotech investments, expanding patient pools, and lower manufacturing costs. Governments in countries such as China, Japan, and South Korea are actively supporting local ATMP manufacturing hubs.

China cell and gene therapy CDMO market held the largest regional share in 2024. The growth is due to the country’s surge in clinical trials, growing domestic biotech companies, and government-backed funding for cell and gene therapy infrastructure. Strategic alliances with international CDMOs are further boosting the market’s scale-up capacity.

The cell and gene therapy CDMO market in Japan is expected to grow over the forecast period. The country’s growth is due toits accelerated regulatory approval system for regenerative medicines. The country’s focus on stem cell and gene-modified therapies, along with partnerships with global CDMOs, is driving rapid growth.

India cell and gene therapy CDMO market is anticipated to grow at a lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies.

Key Cell and Gene Therapy CDMO Companies Insights

Key players operating in the cell and gene therapy CDMO market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cell and Gene Therapy CDMO Companies:

The following are the leading companies in the cell and gene therapy CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Catalent, Inc

- Cytiva

- Samsung Biologics

- Thermo Fisher Scientific Inc.

- Novartis AG

- WuXi AppTec

- AGC Biologics

- OmniaBio

- Rentschler Biopharma SE

- Charles River Laboratories

Recent Developments

-

In August 2025, Lonza entered into a collaboration agreement with Excellos and Akadeum Life Sciences to launch an initiative aimed at improving upstream cell therapy manufacturing by raising starting material quality and integrating modular workflows. This collaboration targets efficiencies and reproducibility across the cell and gene therapy production process.

-

In January 2025, Catalent entered a strategic collaboration with Galapagos NV to support decentralized manufacturing of GLPG5101, a CAR-T therapy for non-Hodgkin lymphoma. This partnership is designed to enhance patient access and accelerate clinical studies by leveraging local manufacturing sites.

Cell And Gene Therapy CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.17 billion

Revenue forecast in 2033

USD 27.12 billion

Growth rate

CAGR of 23.03% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, product, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

Lonza; Catalent, Inc; Cytiva; Samsung Biologics; Thermo Fisher Scientific Inc.; Novartis AG; WuXi AppTec; AGC Biologics; OmniaBio; Rentschler Biopharma SE; Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell And Gene Therapy CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cell and gene therapy CDMO market report based on phase, product, indication, and region.

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-clinical

-

Clinical

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Gene Therapy

-

Ex-vivo

-

In-vivo

-

-

Gene-Modified Cell Therapy

-

CAR T-cell therapies

-

CAR-NK cell therapy

-

TCR-T cell therapy

-

Others

-

-

Cell Therapy

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Infectious Diseases

-

Neurological disorders

-

Rare Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global cell and gene therapy CDMO market size was valued at USD 4.31 billion in 2024, and the market is expected to reach USD 5.17 billion by 2025.

b. The global cell and gene therapy CDMO market is expected to grow at a compound annual growth rate (CAGR) of 23.03% from 2025 to 2033 . The market is expected to reach USD 27.12 billion by 2033.

b. The Pre-clinical segment accounted for the largest revenue share of 64.9% in 2024. The high shares of this segment are attributed to the increasing pipeline of CGT products in the past few years.

b. Some prominent players in the market are Lonza; Catalent, Inc; Cytiva; Samsung Biologics; Thermo Fisher Scientific Inc.; Novartis AG; WuXi AppTec; AGC Biologics; OmniaBio; Rentschler Biopharma SE; Charles River Laboratories

b. The cell and gene therapy CDMO market is experiencing robust growth during the analysis period, fueled by an expanding portfolio of cell and gene therapy products, increased researcher attention on rare diseases, substantial investments from both public and private sectors in research and development, rising demand for outsourced services related to cell and gene therapies, increasing prevalence of chronic ailments such as cancer, a surge in mergers & acquisitions activities, and ongoing technological innovations throughout the cell and gene therapy development process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.