- Home

- »

- Biotechnology

- »

-

Cell Lysis And Disruption Market Size & Share Report, 2030GVR Report cover

![Cell Lysis And Disruption Market Size, Share & Trends Report]()

Cell Lysis And Disruption Market (2023 - 2030) Size, Share & Trends Analysis Report By Technique, By Product, By Cell Type (Mammalian Cells, Bacterial Cells, Yeast/Algae/Fungi, Plant Cells), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-320-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Lysis And Disruption Market Size & Trends

The global cell lysis and disruption market size was valued at USD 4.89 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. A rise in the adoption of gene expression protocols in the biotechnology industry has majorly driven the growth of this market. The expansion in the biopharmaceutical industry would provide new growth avenues to the market, as retrieval and purification of biopharmaceuticals involve cell lysis & disruption. Moreover, adopting biotech processes in pharmaceutical, agricultural, and bio-services industries is expected to drive the market, as cell lysis holds substantial importance in bioprocess.

Cell lysis has many applications in biotechnology processes used in pharmaceutical industries, agriculture, and bio-services. The process of rupturing the cell membrane and cell walls to collect intracellular fluids is employed in western and southern blotting for the degradation of DNA and sensitive proteins while studying lipids, proteins, and other biomolecules. The prevalence of chronic illnesses is rising, research and development expenditure is growing, and the biopharmaceutical and pharmaceutical sectors are advancing quickly, all of which are major drivers of the cell lysis & disruption market.

Growing investments by several organizations, including government and private, towards the research and development related to biotechnological processes and academics are expected to drive the market significantly further. Research and development efforts for biotechnological processes and academia are highly funded by several organizations, including governments and commercial businesses. Additionally, rising demand for innovative therapies and an increase in the prevalence of chronic diseases are supporting market expansion.

The application of cell lysis in the pharmaceutical and biopharmaceutical sectors is expected to expand, and personalized treatment is expected to be the most adopted method. Personalized medicine is one of the most recent advances in gene-related research, which offers patient-specific, custom-tailored therapies. This field has enormous implications for illness prevention, diagnosis, and therapy. The growth of the biopharmaceutical industry presents numerous opportunities for market expansion. Therefore, implementing biotech processes in the pharmaceutical, agricultural, and bio-services sectors will help the market flourish, as cell lysis is a crucial part of the bioprocess.

The COVID-19 pandemic had a positive impact on market growth. An increase in research and development activities for developing a vaccine for COVID-19 augmented the demand for technologies used for bioprocessing, including cell lysis & disruption. The severe respiratory effects of the virus created an urgent demand for innovative treatments, leading to further medication discoveries and favorable effects on the cell lysis industry. The impact of cell lysis on coronavirus was the subject of several research investigations.

For instance, the Department of Biotechnology (DBT) in India launched a research study to sequence 1,000 SARS-CoV-2 genomes from samples during the height of the COVID-19 pandemic to comprehend the developing behavior of the virus. The samples were gathered from around India to research how the virus evolves and affects the disease's symptoms. The need for cell lysis equipment and reagents expanded as more research projects began using various procedures. Owing to this, key companies shifted their focus on offering bioprocessing-related solutions, driving substantial revenue growth.

Technique Insights

The cell lysis & disruption market is divided into segments based on the technique used to carry out the disruption. The reagent-based method is the most widely accepted segment by technique. As these methods do not destroy the biological activity of the final products, they are mild and ideally suited for laboratory samples. These facts make them a suitable choice for laboratory usage, consequently leading to their dominance in terms of market share throughout the forecast period.

Major players operating in this space have traditionally adopted physical disruption methods to extract intracellular contents. However, adopting these methods has decreased due to expensive and cumbersome equipment requirements. Owing to the presence of variability in the apparatus, physical disruption methods are difficult to repeat, thus reducing their market penetration.

Product Insights

Based on the product type, the cell lysis and disruption market is classified into instruments, reagents & consumables, and kits & reagents. The reagents & consumables segment is the most widely used segment, and it is estimated to advance at a significant CAGR during the forecast period. Factors attributing to the segment’s high estimated share include their application for selective product release and controlled lysis, as they provide biological specificity to the process.

Different kits and enzymes are available for bacterial, plant, yeast, and mammalian samples due to the enzyme specificity. These enzymes are commercially available in a variety of forms. Major brands include, but are not limited to, Alfa Aesar, MilliporeSigma, MP Biomedicals LLC, Pierce Biotechnology Inc., and Promega Corp.

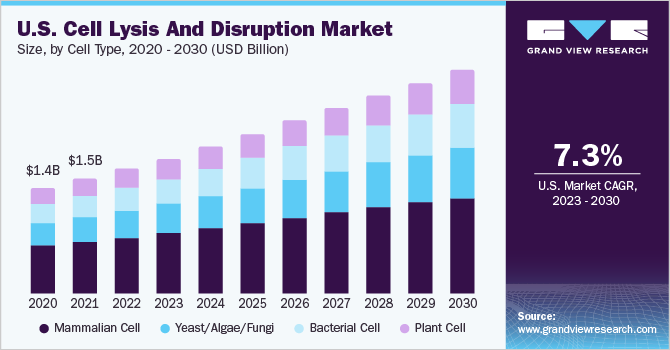

Cell Type Insights

The mammalian cells segment accounted for the highest revenue share of over 45% in 2022 and is expected to remain dominant throughout the forecast period. This is because mammalian culture systems are extensively used to bio-manufacture viral vaccines, therapeutic proteins, and other recombinant products. In addition, the adoption of 3D mammalian culture systems in the areas of stem cell and cancer research is anticipated to further boost segment growth.

As the efficiency of reagents varies with the type of cell used, key players have developed reagents that work specifically on mammalian cells. For instance, Merck Millipore provides a range of mammalian lysis reagents that are utilized to prepare mammalian phosphorylated, cytosolic, and nuclear proteins. Some of these products include CytoBuster protein extraction reagent, NucBuster protein extraction kit, PhosphoSafe extraction reagent, and ProteoExtract kits.

The global market for cell lysis & disruption is segmented, based on cell type, into mammalian, bacterial, yeast/algae/fungi, and plant cells. The yeast/algae/fungi segment is estimated to be the fastest-growing segment over the forecast period, owing to the prevalence of infections in animals and plants, which has a significant impact on the food and food products processing industries.

Application Insights

Based on the application, the cell lysis & disruption market is divided into protein isolation, downstream processing, cell organelle isolation, and nucleic acid isolation. The protein isolation segment accounted for the highest revenue share in 2022. The major application areas of protein isolation include proteomics, western blotting, and immunoprecipitation. Demand for efficient and rapid lysis techniques that can extract the proteins with minimal protein breakdown or oxidation is expected to fuel segment growth.

Besides this, viscosity, which results from cell debris and genomic contamination, is another challenge that needs to be addressed, pronouncing research activities in this segment. The development of advanced bioprocessing reagents and equipment that can readily complement the established disruption procedures is anticipated to propel segment growth in the market.

On the other hand, the demand for industrial biotechnology products, such as hormones, antibodies, enzymes, antibiotics, and vaccines, has driven the market demand for downstream processing. Extensive efforts for the COVID-19 vaccine development have also supplemented market growth. Pfizer-BioNTech, Moderna, and Johnson & Johnson’s Janssen are some of the approved vaccines for COVID-19 that make use of these techniques.

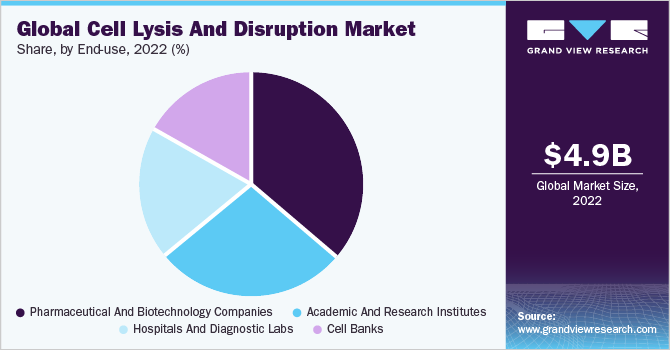

End-use insights

The pharmaceutical & biotechnology companies segment accounted for the largest market revenue share of 36.5% in 2022. This growth is aided by the presence of several biotechnology companies that are exploring molecular biology and bioprocess techniques, thus extensively employing cell lysis protocols. The rise in demand for biopharmaceuticals is expected to drive segment growth.

The safety and efficacy offered by biopharmaceutical products, along with their ability to tackle clinical conditions that were untreatable previously, have driven their demand. Therefore, pharmaceutical organizations are increasingly shifting toward manufacturing biopharmaceutical products, which, in turn, would drive the market. The presence of several protocols for tumorigenicity testing and research has led to a substantial usage of cell disruption methods in biospecimen banking facilities. Clinical research for drug development is further expected to drive potential growth in the coming years.

Based on end-use, the market is segmented into academic and research institutes, hospitals and diagnostic labs, cell banks, and pharmaceutical and biotechnology companies. The academic and research institutes segment is estimated to be the fastest-advancing segment, with a CAGR of 11.7% during the projection period. The growth of this segment can be attributed to the increase in expenditure on related research and development activities globally.

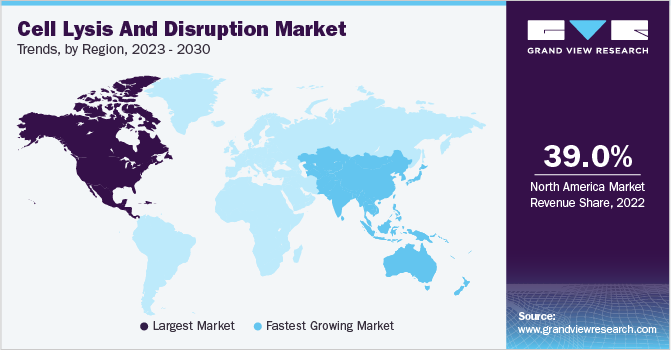

Regional Insights

North America dominated the market with the largest revenue share of 39.0% in 2022. The presence of several government initiatives in the U.S. and Canada that support molecular biology research, precision medicine, and cancer research is attributed to the market dominance of this region. Extensive private and public investments in target therapeutics and novel drug discovery of various complicated and rare diseases are anticipated to drive the demand further.

On the other hand, Asia Pacific is expected to expand at the fastest CAGR of 10.9% over the forecast period. This growth can be credited to the increasing interest of key players in emerging markets of the APAC region to reap higher profits. In Asian countries, such as Japan and China, rapid adoption of technological innovations and regulatory environment that supports innovation further influence market growth. In addition, the fast-emerging field of personalized cancer medicine in Asian countries is anticipated to impact market growth positively.

Key Companies & Market Share Insights

Most key companies focus on business expansion strategies, such as novel product launches, acquisitions, and collaborations, to enhance their market position. For instance, in March 2023, Seagen, through its advisor S&C, announced its imminent acquisition by Pfizer for USD 43 billion. The transaction, estimated to double Pfizer's portfolio of early-stage cancer therapies, is the largest merger and acquisition deal disclosed until March 2023.

In another instance, in January 2021, Thermo Fisher Scientific, Inc. announced the acquisition of Henogen S.A., the viral vector manufacturing business of Novasep. This expanded the company's capabilities for gene and cell therapies & vaccines and enhanced its cell lysis and disruption business as part of the manufacturing workflow. Some of the key players operating in the global cell lysis and disruption market include:

-

Thermo Fisher Scientific, Inc.

-

Merck KGaA

-

Bio-Rad Laboratories, Inc.

-

F. Hoffmann-La Roche Ltd.

-

QIAGEN

-

Danaher

-

Miltenyi Biotec

-

Claremont BioSolutions, LLC

-

IDEX

-

Parr Instrument Company

-

Covaris, LLC

-

Cell Signaling Technology, Inc.

-

Qsonica

-

BD

Cell Lysis And Disruption Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.37 billion

Revenue forecast in 2030

USD 9.63 billion

Growth Rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, product, cell type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; QIAGEN; Danaher; Miltenyi Biotec; Claremont BioSolutions, LLC; IDEX; Parr Instrument Company; Covaris, LLC; Cell Signaling Technology, Inc.; Qsonica; BD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Lysis And Disruption Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell lysis and disruption market report based on technique, product, cell type, application, end-use, and region:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagent-based

-

Detergent

-

Enzymatic

-

-

Physical Disruption

-

Mechanical Homogenization

-

Ultrasonic Homogenization

-

Pressure Homogenization

-

Temperature Treatments

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

High Pressure Homogenizers

-

Sonicator

-

French Press

-

Microfluidizer

-

Bead Mill

-

Other Instruments

-

-

Reagents & Consumables

-

Enzymes

-

Detergent Solutions

-

Ionic Detergent

-

Nonionic Detergent

-

Zwitterionic Detergent

-

-

Kits & Reagents

-

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian Cell

-

Bacterial Cell

-

Yeast/Algae/Fungi

-

Plant Cell

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Isolation

-

Downstream Processing

-

Cell Organelle Isolation

-

Nucleic Acid Isolation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic And Research Institutes

-

Hospitals And Diagnostic Labs

-

Cell Banks

-

Pharmaceutical And Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell lysis and disruption market size was estimated at USD 4.9 billion in 2022 and is expected to reach USD 5.37 billion in 2023.

b. Some key players operating in the cell lysis and disruption market include Thermo Fisher Scientific, Inc.; Merck KGaA; F. Hoffmann-La Roche Ltd; Qiagen NV; Becton Dickinson & Company (BD); Danaher Corporation; Bio-Rad Laboratories, Inc.; Miltenyi Biotec GmbH; Claremont BioSolutions, LLC; Microfluidics International Corporation; Parr Instrument Company; BioVision, Inc.; Covaris, Inc.; and Qsonica LLC.

b. The growing focus on personalized medicine is expected to provide ample opportunities for the growth of cell lysis and disruption market.

b. The global cell lysis and disruption market is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 9.63 billion by 2030.

b. Key factors that are driving the cell lysis and disruption market growth include a rise in government funding for research, a high prevalence of diseases, and expanding biotechnology and biopharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.