- Home

- »

- Biotechnology

- »

-

Cell Reprogramming Market Size, Industry Report, 2030GVR Report cover

![Cell Reprogramming Market Size, Share & Trends Report]()

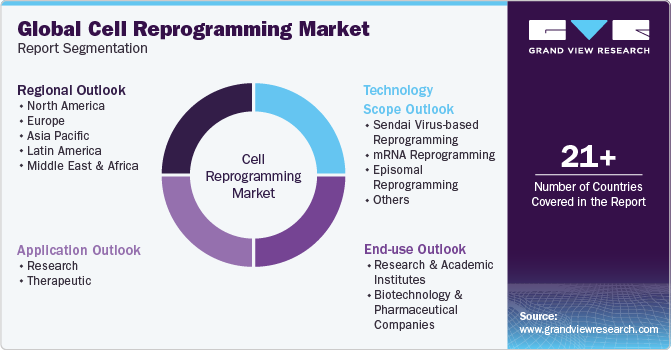

Cell Reprogramming Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Sendai Virus-based Reprogramming, mRNA Reprogramming, Episomal Reprogramming), By Application (Research, Therapeutic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-966-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Reprogramming Market Summary

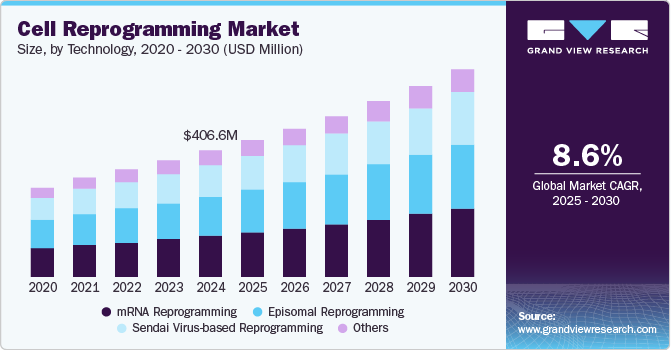

The global cell reprogramming market size was estimated at USD 406.6 million in 2024 and is projected to reach USD 664.2 million by 2030, growing at a CAGR of 8.55% from 2025 to 2030. This growth is supported by the rising interest in reprogramming technologies, particularly their role in transforming specialized cells into different cell types.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UAE is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, mRNA reprogramming accounted for a revenue of USD 132.7 million in 2024.

- mRNA Reprogramming is the most lucrative technology segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 406.6 Million

- 2030 Projected Market Size: USD 664.2 Million

- CAGR (2025-2030): 8.55%

- North America: Largest market in 2024

The increased use of these techniques in cancer research drives market activity, along with a growing number of collaborations and partnerships that aim to accelerate research and development in this area.

In January 2023, a collaboration was announced between Automata, a robotics and automation company in the life sciences sector, and bit.bio. This partnership focuses on developing automated systems to support bit. bio's work in cell reprogramming and precision reprogrammed human cells. Collaborations like this reflect how companies leverage automation and technology to improve the efficiency and scalability of cell reprogramming processes, helping expand their use in research and clinical applications. Such efforts streamline workflows, reduce manual errors, and accelerate the production of consistent, high-quality cell lines. These developments also contribute to reprogrammed cells' broader use in disease modeling, toxicity testing, and regenerative medicine. With the demand for reproducible and cost-effective solutions growing, strategic collaborations play a key role in shaping the market landscape.

An emerging trend significantly impacting the industry is the integration of gene-editing technologies, particularly CRISPR, with reprogramming methods. The ability to precisely edit genes while reprogramming cells enhances reprogrammed cells' accuracy and functionality, offering new possibilities in areas such as disease modeling, regenerative medicine, and personalized treatments. In addition, these technologies enable the creation of disease-specific cell lines for research, which is crucial for understanding complex conditions such as cancer and neurodegenerative diseases. With advancements in gene editing continuing to evolve, they are expected to further drive the adoption of cell reprogramming across various biomedical applications, fostering innovation and expanding market potential.

Furthermore, the industry is experiencing significant advancements driven by innovative technologies and substantial investments. For instance, in September 2024, GC Therapeutics launched with USD 75 million in financing to advance its TFome platform, the world’s first “plug-and-play” induced pluripotent stem cell (iPSC) programming system. This platform integrates synthetic biology, gene editing, cell engineering, and machine learning to streamline the development of cell therapies across various therapeutic areas. Such breakthroughs are accelerating the transition of cell reprogramming technologies from research to clinical applications, expanding their potential in regenerative medicine and personalized treatments.

Emerging Trends and Innovations Shaping the Cell Reprogramming Market

Integration of AI and Machine Learning in Cell Reprogramming

The industry is evolving rapidly, with several technological advancements playing a key role in driving progress. A significant development is the integration of artificial intelligence (AI) and machine learning into reprogramming processes. AI technologies are being increasingly applied to optimize reprogramming protocols, predict genetic outcomes, and enhance gene editing techniques. For example, in October 2024, Shift Bioscience, a UK-based biotech company, completed a USD 16 million seed funding round to advance its AI-powered platform for cellular reprogramming. This platform utilizes generative AI models to predict gene-based interventions capable of safely rejuvenating human cells, offering promising implications for regenerative medicine and age-related disease therapies. These innovations reduce the time and costs associated with reprogramming cells, making the process more scalable and applicable to various therapeutic areas.

Advancements in Genome Editing Tools Enhancing Cell Reprogramming

Advances in genome editing tools such as CRISPR, prime editing, and base editing are significantly transforming the landscape of cell reprogramming. These technologies enable more precise and controlled genetic modifications, which are crucial for applications in gene therapy, personalized medicine, and regenerative medicine. In 2023, Prime Medicine demonstrated breakthroughs in prime editing, showcasing its ability to correct genetic mutations with enhanced precision and safety in reprogrammed cells. The development of their PASSIGE platform, which allows the insertion of large genetic sequences into cells, further improves gene-editing techniques. These innovations are opening new possibilities for treating a wide range of complex diseases, from genetic disorders to cancer, solidifying genome editing as a key driver in the evolution of cell reprogramming.

Growth of Organoid Development in Cell Reprogramming Applications

Organoid development is also gaining significant traction within the field of cell reprogramming. These 3D miniature, simplified versions of organs provide more accurate disease models and are increasingly used in disease modeling, drug discovery, and personalized treatments. In September 2023, Stanford University's Kuo Lab received an Arc Institute Ignite Award to collaborate on developing novel organoid technologies, reflecting the growing interest and investment in this area. Organoids enable researchers to test new therapies on human-like tissues rather than relying on animal testing, making them a critical tool in accelerating research and treatment development. With continuous advancements, organoid technologies are expected to revolutionize disease research and treatment, offering highly personalized solutions and improving clinical trial effectiveness. The integration of organoid development with reprogrammed cells is expanding the potential of cell reprogramming across various therapeutic applications.

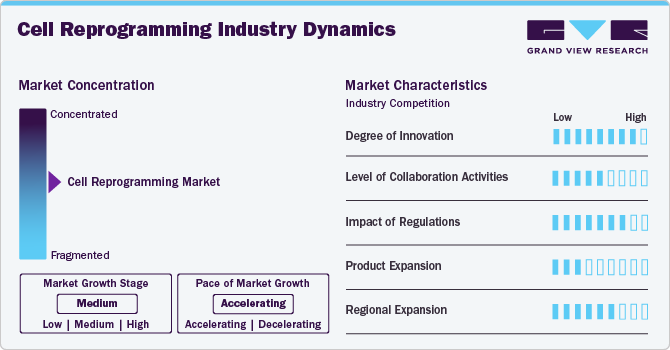

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation, largely driven by its transformative applications in regenerative medicine, disease modeling, and drug discovery. Scientific progress in induced pluripotent stem cells (iPSCs), direct lineage reprogramming, and genome editing technologies is driving research momentum. Academic institutions and biotech firms are exploring novel reprogramming techniques, such as non-integrating vectors and small-molecule approaches, to enhance safety and efficiency. While commercial translation is still in early stages, innovations in cell fate manipulation and personalized cell-based therapies continue to push the technological frontier.

The industry is characterized by strong collaboration across academia, research hospitals, and emerging biotechnology firms. Partnerships are focused on translational research, clinical validation, and platform development. Public-private consortia and joint ventures are also prominent, supporting GMP-grade reprogramming and quality-controlled production for clinical applications. Additionally, collaborations with CDMOs and CROs are growing to streamline process development and regulatory compliance, particularly for scalable cell manufacturing and international clinical trial support.

Regulatory frameworks play a crucial role in shaping the pace and direction of the cell reprogramming industry. Guidelines concerning genomic stability, vector safety, and long-term efficacy present high entry barriers. However, initiatives such as the FDA’s RMAT designation and Japan’s fast-track approvals for regenerative medicine offer more defined regulatory pathways. Compliance with global GMP and GTP standards remains critical for clinical translation and commercialization. Regulatory alignment across regions is also emerging, facilitating smoother international development.

Product expansion remains at a nascent but active stage, with most cell reprogramming-based therapies in early clinical or preclinical development. Efforts are focused on applications for neurodegenerative diseases, cardiovascular repair, and rare genetic disorders. Advances in autologous and allogeneic iPSC-derived therapies, alongside exploration of in vivo reprogramming strategies, support a pipeline of diversified therapeutic candidates. However, the lack of standardized protocols and scalability challenges continues to limit rapid product diversification in commercial pipelines.

Regional expansion is dynamic, with North America, Europe, and East Asia leading in R&D and clinical activities. Countries like the U.S., Japan, China, and the UK are investing heavily in research infrastructure and translational programs. Emerging regions in Southeast Asia and the Middle East are gaining traction through government-backed biotech initiatives and cross-border academic collaborations. Multinational firms are forming alliances with local research institutions and regulatory bodies to enable regional market entry and expand global trial networks.

Technology Insights

The mRNA reprogramming segment dominated the market in 2024, accounting for the largest share of 32.63%. This dominance can be attributed to the growing preference for non-integrating methods that minimize the risk of insertional mutagenesis. mRNA-based reprogramming offers a safer and more efficient approach for generating induced pluripotent stem cells (iPSCs) without altering the host genome. Researchers and developers increasingly favor this method for its high reprogramming efficiency, rapid expression, and suitability for clinical-grade applications. Its scalability and compatibility with Good Manufacturing Practice (GMP) standards have further supported its widespread adoption in regenerative medicine and therapeutic development.

The Sendai virus-based reprogramming segment is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to the method's efficiency and ability to generate induced pluripotent stem cells (iPSCs) without integrating into the host genome. The Sendai virus-based reprogramming approach is recognized for maintaining high reprogramming efficiency while minimizing the risk of genomic alterations, making it particularly attractive for therapeutic applications. In addition, advancements in virus-free reprogramming protocols and improvements in the delivery of reprogramming factors are expected to further drive the adoption of this technology in clinical and research settings. Researchers are increasingly utilizing this method to develop disease models, explore regenerative therapies, and accelerate drug discovery, reinforcing its growth potential in the market.

Application Insights

The research segment dominated the market, with the largest share of 67.30% in 2024. This dominance is driven by the extensive use of cell reprogramming techniques, such as induced pluripotent stem cells (iPSCs), in studying cell biology, disease modeling, and drug discovery. These techniques provide researchers with a versatile platform for investigating cellular mechanisms and developing novel therapies. Several academic and research institutions, such as Gladstone Institutes and the Salk Institute for Biological Studies, actively employ reprogramming technologies to explore regenerative treatments and improve disease modeling capabilities. This widespread use reinforces the importance of cell reprogramming in both fundamental and translational research.

The therapeutic segment is projected to grow at the fastest CAGR during the forecast period. This rapid growth is driven by the increasing application of cell reprogramming techniques in developing treatments for various diseases, including neurodegenerative disorders, heart diseases, and genetic conditions. The ability to reprogram cells into specific cell types offers promising potential for regenerating damaged tissues and repairing organs. Researchers are particularly focused on how these techniques can be used to create personalized therapies and improve the effectiveness of treatments for conditions that currently have limited therapeutic options. Along with the rise in scientific research surrounding cell reprogramming therapeutics, businesses are making significant strides to commercialize these technologies. For instance, Asgard Therapeutics AB received approval from the U.S. Patent & Trademark Office for a patent related to reprogramming cells into dendritic cells, which is expected to protect and promote innovation in the field until 2038. This development is anticipated to drive demand for reprogramming technology and further contribute to market growth.

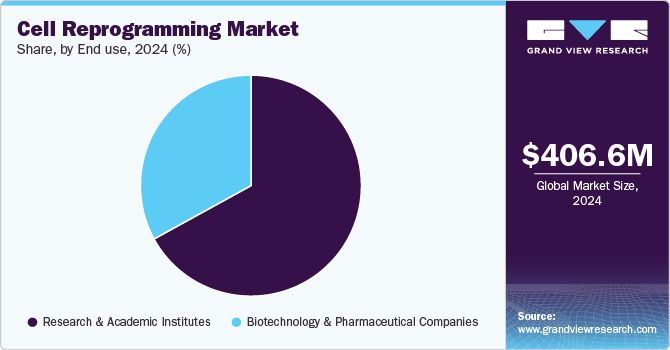

End-use Insights

The research & academic institutes segment captured the largest market share of 67.30% in 2024. This significant share is due to the increasing adoption of cell reprogramming techniques, such as induced pluripotent stem cells (iPSCs), in academic and research settings for various applications, including disease modeling, drug discovery, and stem cell research. Research and academic institutions are leveraging these technologies to deepen their understanding of cellular mechanisms, explore potential treatments, and develop personalized therapies. The ability to generate patient-specific cell lines has further enhanced the value of cell reprogramming in drug testing and disease modeling, enabling more accurate and predictive outcomes. Prominent research institutions such as the Harvard Stem Cell Institute, the Salk Institute for Biological Studies, and the Gladstone Institutes are at the forefront of exploring the therapeutic potential of reprogrammed cells, driving innovation in areas like regenerative medicine and targeted cancer therapies. With the demand for more personalized and precise research continuing to grow, the research & academic institutes segment is expected to maintain its leadership in the market.

The biotechnology & pharmaceutical companies segment is projected to register the fastest CAGR during the forecast period. This growth is driven by the increasing application of cell reprogramming techniques in drug discovery, personalized medicine, and therapeutic development. These techniques enable companies to develop patient-specific models, improving drug testing accuracy and efficiency. For instance, in December 2024, Sumitomo Chemical and Sumitomo Pharma established a joint venture named RACTHERA Co., Ltd., focused on regenerative medicine and cell therapy. The collaboration aims to accelerate the development and commercialization of iPSC-based treatments by combining pharmaceutical expertise with industrial engineering capabilities. Such initiatives highlight the expanding role of biotechnology and pharmaceutical companies in shaping the future of the cell regeneration market.

Regional Insights

North America cell reprogramming market dominated the global industry with a share of 39.69% in 2024. The high revenue share is supported by the presence of major companies in the region. In addition, many firms are taking strategic steps to grow their business and strengthen their role in the market. For instance, in July 2023, Stem Genomics SAS and Pluristyx, Inc. entered into a partnership along with an equity investment in Stem Genomics. This collaboration is designed to offer a smoother process for checking the genetic quality of Pluristyx's pluripotent stem cell (PSC) lines, using the iCS-digital PSC assay developed by Stem Genomics. Such efforts continue to support the growth of the cell reprogramming market in North America.

U.S. Cell Reprogramming Market Trends

The U.S. cell reprogramming market is experiencing significant growth, driven by strong research activities and substantial investments in regenerative medicine. The increasing focus on personalized medicine and the application of cell reprogramming techniques, such as CRISPR and iPSC, in drug discovery and therapy development, is fueling market expansion. The presence of leading biotechnology companies, research institutions, and a favorable regulatory environment further supports innovation in the sector. In addition, the growing demand for more effective treatments for chronic diseases and collaborations between biotech firms and research organizations continue to strengthen the U.S.'s role in advancing cell reprogramming technologies.

Asia Pacific Cell Reprogramming Market Trends

Asia Pacific cell reprogramming market is projected to grow at the highest CAGR of 9.17% during the forecast period. This growth is driven by factors such as the rising prevalence of chronic conditions, widespread adoption of products for analysis and visualization, advancements in technology, and increased investments in R&D. In addition, numerous companies are expanding their studies based on multiomics, further supporting market expansion. For example, in February 2023, Novo Nordisk A/S and Heartseed, Inc. made a significant advancement by administering the first dose in their Phase 1/2 clinical study (LAPiS Study) for HS-001, a cell therapy aimed at treating heart failure. HS-001, derived from iPSCs, uses purified heart muscle cell clusters to potentially restore heart function in patients with advanced heart failure. Such developments highlight the growing focus on regenerative medicine in the Asia Pacific region, driving the market's growth during the forecast period.

Japan cell reprogramming market dominated the Asia Pacific region in 2024. The country’s strong focus on regenerative medicine, coupled with significant government support and a well-established biotechnology sector, has driven the growth of cell reprogramming technologies. Japan’s aging population and increasing healthcare demands have further fueled the need for advanced therapeutic solutions, such as iPSCs. Prominent research institutions, such as RIKEN, a renowned research institution in Japan, and Kyoto University, continue to lead innovations in stem cell research. RIKEN has significantly contributed to the development of iPSCs, while Kyoto University has been involved in the clinical applications of iPSC technologies. These efforts further drive the growth of the cell reprogramming market in Japan.

China cell reprogramming market is driven by substantial government support, strategic investments, and a rapidly advancing biotechnology sector. The country has strongly emphasized stem cell research and regenerative medicine, fostering innovations in cell reprogramming technologies. Institutions such as Tsinghua University and companies like Boya Life are at the forefront of developing iPS cell-based therapies for cardiovascular diseases and neurological disorders. These advancements are further supported by government funding and policies that promote collaboration between the academic, research, and private sectors. With a large population and growing healthcare needs, China plays a crucial role in the growth of the cell reprogramming market.

Europe Cell Reprogramming Market Trends

Europe cell reprogramming industry is supported by robust research efforts, academic leadership, and a regulatory environment that encourages innovation in regenerative medicine. Countries such as Germany, the UK, and France are advancing stem cell research, particularly in developing and applying induced pluripotent stem (iPS) cells for disease modeling and potential therapeutic use. Research institutions and universities across the region are actively engaged in exploring cell reprogramming technologies, while the European Medicines Agency (EMA) provides a supportive regulatory framework that facilitates clinical trials and early-stage commercialization of cell-based therapies.

In addition, cross-border collaborations funded under initiatives like Horizon Europe promote targeted cell reprogramming research. Partnerships between academic centers and biotechnology firms further drive innovation in treating degenerative, cardiovascular, and neurological disorders. Together, these factors are strengthening Europe’s contribution to the global expansion of the cell reprogramming market.

The UK cell reprogramming market is driven by its strong academic infrastructure, government-supported research initiatives, and expanding biotechnology sector. Leading universities and research institutions in the UK are at the forefront of advancing cell reprogramming technologies, particularly in developing induced pluripotent stem (iPS) cells for therapeutic applications. The UK government has provided targeted funding and established strategic programs to support regenerative medicine, fostering innovation in disease modeling and cell-based therapies. Regulatory frameworks from the Medicines and Healthcare products Regulatory Agency (MHRA) facilitate clinical research and the early-stage development of reprogrammed cell therapies. In addition, the UK is actively engaged in European collaborations focused on cell reprogramming, with biotechnology companies working alongside academic centers to translate research into clinical solutions for neurological, cardiovascular, and degenerative diseases. These factors collectively enhance the UK's role in driving the cell reprogramming market forward.

Germany cell reprogramming market is driven by its advanced research infrastructure, government-backed funding, and strong academic-industry collaborations. The country's well-established biotechnology ecosystem supports the development of induced pluripotent stem (iPS) cell technologies, with institutions like the Fraunhofer Institute and the Max Planck Institute playing key roles in stem cell research and regenerative medicine. Germany's regulatory environment, overseen by the Federal Institute for Drugs and Medical Devices (BfArM), ensures clear pathways for clinical research and the commercialization of cell-based therapies. The country's focus on regenerative medicine is further supported by public-private partnerships that drive innovation. Germany's aging population and increasing prevalence of chronic conditions like neurological and cardiovascular diseases also contribute to the growing demand for cell reprogramming-based therapies.

Middle East & Africa Cell Reprogramming Market Trends

The Middle East and Africa cell reprogramming market is driven by increasing investments in biotechnology and healthcare innovation. Several countries in the region, including the UAE, Saudi Arabia, and South Africa, are making strides in advancing stem cell research and regenerative medicine. Government-backed initiatives and partnerships with international research institutions are fostering the development of cell reprogramming technologies, particularly in areas like disease modeling and regenerative therapies. In addition, the growing demand for advanced medical treatments and a rising healthcare burden due to chronic diseases are propelling interest in cell-based therapies. While the regulatory landscape across MEA is still evolving, there is a clear focus on creating frameworks that support the safe application and commercialization of cell reprogramming technologies. With the region continuing to invest in healthcare innovation and research, its role in the cell reprogramming market is expected to expand, particularly with more collaborations and clinical trials being initiated.

Saudi Arabia cell reprogramming market is driven by its substantial investments in biotechnology and regenerative medicine. The country's Vision 2030 initiative, which emphasizes healthcare innovation and scientific research, is fueling the development of cutting-edge technologies, including cell reprogramming. Saudi Arabia's government has been instrumental in funding stem cell research and fostering partnerships with international research institutions to promote advancements in regenerative therapies. Key research institutions and universities are focused on exploring induced pluripotent stem (iPS) cells for disease modeling and potential therapeutic applications. In addition, the rising demand for advanced medical treatments and the country's growing healthcare needs further drive the adoption of cell-based therapies. With Saudi Arabia continuing to strengthen its biotechnology infrastructure and regulatory frameworks, its role in the cell reprogramming market is expected to grow, particularly with more clinical trials and research collaborations emerging.

The UAE cell reprogramming market is driven by substantial investments in biotechnology, healthcare innovation, and a strong commitment to advancing regenerative medicine. The UAE government has been instrumental in supporting stem cell research and fostering international collaborations. Key institutions like the United Arab Emirates University and the Abu Dhabi Stem Cells Centre are at the forefront of advancing stem cell technologies, while the opening of GMP-certified facilities in Dubai further strengthens the region's biotechnology infrastructure. The growing demand for advanced medical treatments and innovative therapies, combined with the UAE's robust regulatory environment, positions the country as a regional leader in cell reprogramming and regenerative medicine.

Key Cell Reprogramming Company Insights

Key players are undertaking various strategic initiatives to maintain their market presence. In addition, numerous strategic initiatives enable market players to strengthen their business avenues. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Cell Reprogramming Companies:

The following are the leading companies in the cell reprogramming market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Allele Biotechnology and Pharmaceuticals Inc.

- ALSTEM

- STEMCELL Technologies

- Merck KGaA

- Bio-Techne

- REPROCELL Inc.

- Lonza

- FUJIFILM Corporation (Fujifilm Cellular Dynamics)

- Mogrify Limited

Recent Developments

-

In January 2024, FUJIFILM Cellular Dynamics and Opsis Therapeutics granted BlueRock Therapeutics an exclusive global license to develop and commercialize an iPSC-derived cell therapy for retinal diseases. This move highlights the growing clinical integration of reprogrammed cells in regenerative medicine. The agreement reflects increasing commercial activity in the cell reprogramming market, particularly in the development of targeted iPSC-based therapies.

-

In July 2023, Pluristyx, Inc. entered into an agreement with the Advanced Regenerative Manufacturing Institute (ARMI) | BioFabUSA to manufacture and distribute clinical-grade induced pluripotent stem cells (iPSCs) developed by Pluristyx. The collaboration is intended to support scalable, consistent, and cost-effective production of stem cell-derived products for therapeutic use. Under this agreement, ARMI | BioFabUSA, along with its affiliates and members, can access clinical-grade iPSCs for the manufacturing of cell and gene therapies.

Cell Reprogramming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 440.7 million

Revenue forecast in 2030

USD 664.2 million

Growth rate

CAGR of 8.55% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Allele Biotechnology and Pharmaceuticals Inc.; ALSTEM; STEMCELL Technologies; Merck KGaA; Bio-Techne; REPROCELL Inc.; Lonza; FUJIFILM Corporation (Fujifilm Cellular Dynamics); Mogrify Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Reprogramming Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell reprogramming market report on the basis of technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sendai Virus-based Reprogramming

-

mRNA Reprogramming

-

Episomal Reprogramming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Therapeutic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Academic Institutes

-

Biotechnology & Pharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.