- Home

- »

- Clinical Diagnostics

- »

-

Cell Viability Assays Market Size, Share & Growth Report, 2030GVR Report cover

![Cell Viability Assays Market Size, Share & Trends Report]()

Cell Viability Assays Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Application (Drug Discovery & Development, Stem Cell Research), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-008-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global cell viability assays market was valued at USD 1.39 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.94% from 2023 to 2030. Cell viability is defined as the existence of living or viable cells and is considered an indicator of good cell health. In many studies, it is the viability levels that are modified due to an event of chemical or physical agents, such as in toxicity assays. Cell viability assays (CVAs) are used to determine the cellular response to any pathogenic agent or drug and thus, have found widespread application in the pharmaceutical and medical industries.

The COVID-19 pandemic led to an increase in the usage of cell viability assays for drug discovery and treatment programs. For instance, in August 2020, Calidi Biotherapeutics Inc. announced that its partner, Personalized Stem Cells, Inc. has received the US FDA approval for the IND (investigational new drug) application submitted. The submitted IND was for the treatment of patients suffering from COVID-19 and pneumonia by using stem-cell therapy. Therefore, the increase in cellular-based therapies for the treatment of COVID-19 infection has significantly sparked the use of cell viability assay for understanding the response of live cells and viability for any line of treatment.

The rising focus on the development of cell-based therapeutics is accelerating market growth. Increasing FDA approvals, clinical trials, and strategic initiatives such as collaborations by major market players are boosting industry growth. For instance, in March 2021, a cell-based gene therapy Abecma (idecabtagene vicleucel) received FDA approval for treating patients with multiple myeloma. In addition, in February 2022, CRISPR Therapeutics and ViaCyte, Inc. announced the dosing of the first patient for the Phase 1 trial for a new gene-edited therapy for Type 1 Diabetes. Such initiatives are projected to propel the industry growth during forecast years.

Moreover, growing funding for cell-based research is expanding growth prospects for the market. For instance, in March 2022, XNK Therapeutics secured USD 12.56 million in funding to develop cell therapies for the maximum number of patients for multiple myeloma and other indications. Similarly, Bit Bio, a Cambridge-based synthetic biology company, secured funding of USD 45 million to accelerate the company’s drive towards industrial-scale manufacturing of human cells and to uncover the operating system of life. Thus, increasing funding is predicted to boost growth during the projection period.

Furthermore, key players in the market are developing sophisticated technologies to meet the rising demand and capture untapped opportunities in the market. For instance, in September 2022, Nanolive launched an automated solution LIVE Cell Death Assay (LCDA) for profiling cell health, death, apoptosis, and necrosis. The LCDA is a user-friendly assay that delivers 13 viability and death-related metrics. Such technological advancements led to an increase in the adoption of cell viability assay in various pharmaceutical and biopharmaceutical, diagnostics labs, and academic and research institutes.

Additionally, growing funding in stem cell research by several governments and operating players are likely to open new growth opportunities for the market. For instance, in June 2021, the 2020 Stem Cell Mission received funding worth USD 18 million from the Federal Minister for Health and Aged Care, the Hon Greg Hunt. The mission focuses on the research that develops and delivers novel, safe, and effective stem cell medicines to enhance health outcomes. In addition, in January 2022, Curi Bio secured funding worth USD 10 million for a stem cell-focused drug discovery platform. Thus, the increasing focus on stem cell research is projected to drive the market during the study period.

Product Insights

The consumables segment dominated the market in 2022 and captured over 60.0% share. The segment is also anticipated to expand at the fastest rate during the forecast period. This can be attributed to the utility of consumables in various pharmaceutical and biopharmaceutical, diagnostic, and stem cell research applications. In addition, several players in the market are offering a wide range of cell viability assay reagents that are non-toxic and ready to use and offer instant high-quality results. For instance, alamarBlue cell viability reagent offered by Thermo Fisher Scientific, Inc. is a non-toxic ready-to-use reagent solution that functions as a cell health indicator by consuming the decreasing power of live cells to quantitatively measure viability.

Luminometric assays held a dominant share in 2022 and are anticipated to witness the fastest growth in the projected timeframe due to their simple protocols, uncomplicated equipment requirement, robustness, and superior sensitivity. Fluorometric assays accounted for the second-largest share in 2022 due to their advantages over colorimetric and dye exclusion assays since they are more sensitive. These qualities altogether enable easy scalability and adaptability from bench research to high throughput applications. Such features of cell viability assay are boosting the consumables segment growth.

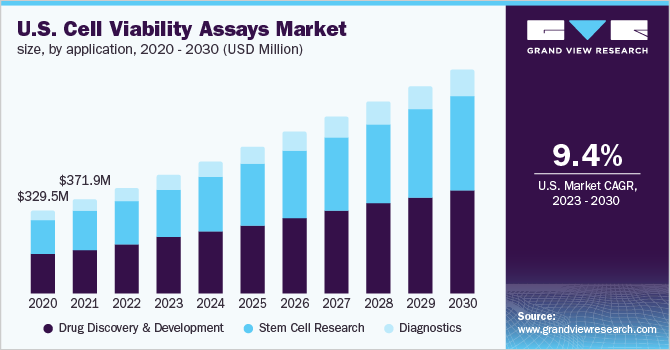

Application Insights

The stem cell research segment held the largest share of over 40.0% in 2022 and is anticipated to register the fastest CAGR during the forecast period. Stem cell therapy has become an advanced and promising scientific research area in recent times. Key players in the market are marching towards the development of novel instruments to support the research. For instance, in May 2022, Beckman Coulter Life Sciences launched a novel solution AQUIOS STEM System for stem cell analysis. The innovation helps in analyzing and enumerating viable cells by decreasing the manual and error-prone steps and significantly reducing the turnaround time. Furthermore, the funding associated to stem cell research has augmented in recent years, which has further hastened the research growth in this field. For instance, in May 2022, Canada’s Stem Cell Network announced funding worth USD 19.5 million for 32 regenerative medicine and stem cell research clinical trials and projects.

The drug discovery and development segment held the second-largest share in 2022. Cell viability assays play a vital role in various stages of drug discovery and development due to their versatility, flexibility, and adaptability. Cell viability assays are fundamentally used for screening the response of the cells against a chemical compound or a drug during the drug discovery and development process. Furthermore, they are used to estimate the cellular variations related to cell death such as modifications in protein expression and loss of membrane integrity in enzymatic activity upon exposure to a test compound. Such applications of cell viability assay in drug discovery and development are driving the segment.

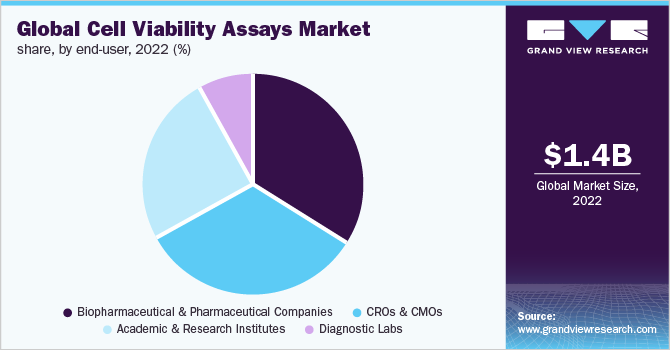

End-user Insights

The biopharmaceutical and pharmaceutical companies segment captured the largest revenue share of over 30.0% in 2022 owing to the widespread use of viability assay in pharmaceuticals to evaluate the influence of developed agents on cells. Researchers use numerous types of assays to monitor the effect of developed therapeutics that often target cancer tumors. In addition, toxicity levels of the compounds or agents can be evaluated using a cell viability assay. Such broad applications of cell viability assay in the biopharmaceutical and pharmaceutical industry drive the segment.

CROs and CMOs are expected to grow at the fastest rate of 11.57% over the forecast period. Pharmaceutical companies are entering into collaborations with CROs and CMOs for numerous reasons. These collaborations have the potential to improve process efficiency, cut costs, and decrease time to market. In November 2021, Hamlet Pharma signed a collaboration with a CRO Galenica AB for the development of BAMLET for pharmaceutical use. BAMLET is a potent therapeutic for colon cancer and cell viability assays have applications in revealing the biological activity of the product and for the development of suitable drug formulation. Such collaborations are projected to increase the usage of cell viability assays in various applications including drug discovery and development, thereby fueling the industry growth during forecast years.

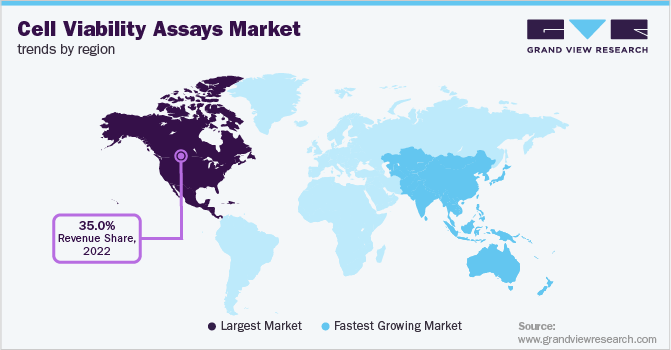

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2022. This major share can be attributed to the rise in investment initiatives by the government, the increasing incidence of chronic diseases such as cancer, and the presence of high-quality infrastructure for clinical and laboratory research in North America. For instance, according to Globocanreport, approximately 2,281,658 new cancer cases were recorded in the U.S. in 2020, with nearly 612,390 deaths. Thus, the rising prevalence of chronic and infectious diseases and the increasing focus on cell-based therapeutics are expanding the growth prospects of the market.

Asia Pacific is estimated to witness the fastest growth over the forecast period due to rising demand for novel therapeutics in the region. Furthermore, increasing R&D investment by governments and rapid infrastructural development are the other factors boosting regional growth. In addition, several regional players are receiving funding for developing a treatment for various chronic diseases such as cancer. For instance, in June 2022, Immuneel Therapeutics received funding worth USD 15 million for the development of affordable cell and gene therapy for cancer patients in India. Such initiatives in this region are likely to propel industry growth during the forecast period.

Key Companies & Market Share Insights

Major players in the market are executing numerous strategies including novel product launches, partnerships, collaborations, mergers and acquisitions, and geographical expansion to expand their market presence. For instance, in April 2020, BioTek Instruments launched a novel cell count and viability starter kit. The kit can help researchers quickly obtain high-quality cell results by automating the error-prone and tedious process of cell counting. Some prominent players in the global cell viability assays market include:

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories, Inc.

-

Merck KGaA

-

BD

-

PerkinElmer Inc.

-

Promega Corporation

-

Biotium

-

Creative Bioarray

-

Abcam plc

-

Charles River Laboratories

Cell Viability Assays Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.55 billion

Revenue forecast in 2030

USD 3.01 billion

Growth rate

CAGR of 9.94% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; BD; PerkinElmer Inc.; Promega Corporation; Biotium; Creative Bioarray; Abcam plc; Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

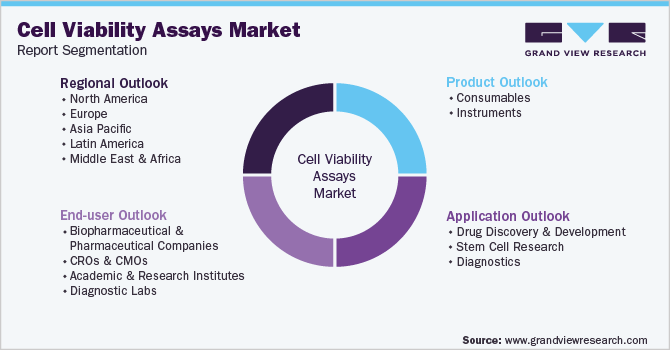

Global Cell Viability Assays Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cell viability assays market report based on product, application, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents And Assay Kits, By Type

-

Dye Exclusion Assays

-

Colorimetric Assays

-

Fluorometric Assays

-

Luminometric Assays

-

-

Microplates

-

-

Instruments

-

Spectrophotometer

-

Microscopy

-

Cell Imaging And Analysis System

-

Flow Cytometry

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery And Development

-

Stem Cell Research

-

Diagnostics

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Diagnostic Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell viability assays market size was estimated at USD 1.39 billion in 2022 and is expected to reach USD 1.55 billion in 2023.

b. The global cell viability market is expected to grow at a compound annual growth rate of 9.94% from 2023 to 2030 to reach USD 3.01 billion by 2030.

b. The consumables segment dominated the global market in 2022 and captured the maximum share of the overall revenue. The large share can be attributed to their utility in various pharmaceutical & biopharmaceutical, diagnostic, and stem cell research applications.

b. Some key players operating in the cell viability market include Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, BD, PerkinElmer Inc, Promega Corporation, Biotium, Creative Bioarray, and Abcam plc

b. The rising prevalence of chronic and infectious diseases, coupled with the increasing focus on cell-based therapeutics are expanding the growth prospects of the market. In addition, growing funding for cell-based research and increasing use of automated instruments are the key factors driving the cell viability assay (CVAs) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.