- Home

- »

- Advanced Interior Materials

- »

-

Ceramics Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Ceramics Market Size, Share & Trends Report]()

Ceramics Market Size, Share & Trends Analysis Report By Product (Traditional, Advanced), By Application (Abrasives, Tiles), By End-use (Industrial, Medical), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-621-9

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Advanced Materials

Report Overview

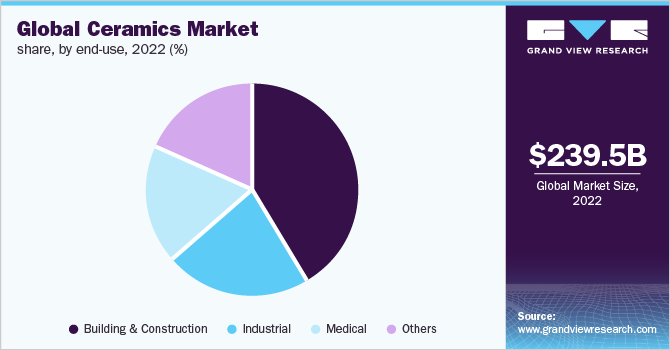

The global ceramics market size was valued at USD 239.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The growth of the building & construction industry where ceramics is extensively used in tiles, sanitary ware, and bricks is expected to drive the market over the coming years. In recent times, indoor home décor techniques and methods have changed worldwide, thereby impacting the application of ceramics in building & construction. The sanitary ware such as toilet bowls, sinks, bathtubs, and shower trays are included in bathroom fixtures and are manufactured from clay and kaolin with quartz and feldspar added to them before being painted. The result is a material, which is extremely hard, resilient, and easy to clean, with good wear and chemical resistance.

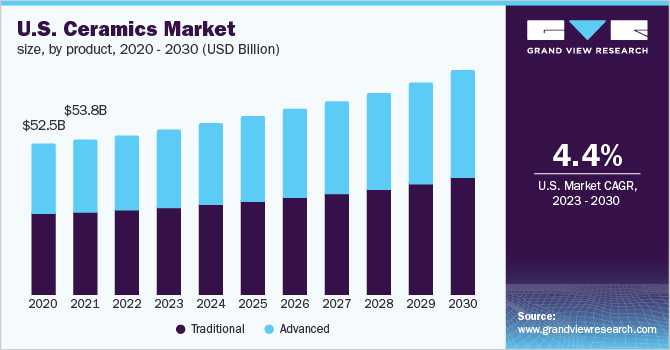

The product demand in the U.S. is expected to be driven by the growing usage of tiles in the country. According to the Tile Council of North America, Inc., the overall consumption of ceramic tiles in the U.S. was approximately 3.11 billion-square feet in 2021. This figure was 9.9% more than in 2020. This growth is attributed to the overall increase in construction activities for the development of new housing units in the U.S., coupled with the economic growth of the country.

Moreover, the easy availability of raw materials such as clay and kaolin, which are commonly produced in the U.S., also benefits the growth of the market in the country. Ball clay is practically used entirely for the production of ceramics, which are used for developing sanitary ware, floor tiles, and tableware. According to The Mineral Commodity Summaries 2022, the production of ball clay in the U.S. was 1.85% more in 2021 than its production in 2020.

Furthermore, the growth of the medical industry is another key driver for the market. Ceramics are being utilized for a very long time for medical applications. The U.S. is one of the prominent countries with a robust healthcare system. According to the Advanced Medical Technology Association (AMTA), since 2011, U.S.’s expenditure on its healthcare facilities has increased significantly. The growth of the healthcare system along with high spending on medical equipment and devices has positively impacted product demand.

The ceramics market, however, faces challenges owing to high energy costs. The recent coal and natural gas crisis caused a surge in their prices, which had a direct impact on the cost of production of ceramics. For instance, in August 2021, the Morbi cluster in India faced a burden of approximately INR 100 crores (~USD 12.25 million) on account of the hike in gas prices.

Product Insights

Based on product, traditionally held a revenue share of over 57.0% in 2022 of the global market. According to the University of New South Wales (UNSW), traditional ceramics consists of three basic materials or compounds that are silica (quartz), clay, and feldspar. Out of the aforementioned compounds, clay is the most commonly used material. This product type is commonly used in the manufacturing of porcelain tiles, clay bricks, and tableware.

Advanced ceramics are an excellent choice for a wide range of professional applications across several industries. These are distinguished by more than just their remarkable characteristics including inorganics and high-purity compounds in pottery and tableware manufacturing. These are extensively preferred in aviation, vehicles, and armor owing to high corrosion resistance.

Moreover, due to high temperatures and changes in surroundings, faults typically occur due to thermal expansion in a variety of energy and power, aerospace, defense, and automotive components, leading to component failure. Advanced ceramics exhibit substantially lower thermal expansion under the same environmental conditions as other standard alloys and metals. This aspect has affected product consumption across a range of end-use industries.

Application Insights

Based on application, tiles held the largest share of over 47.0% in 2022. There is a huge demand for wall-tiling patterns in living spaces, especially to cater to new application areas outside of bathrooms and kitchens. More and more modern home application settings, including hallways, lobbies, and bedrooms, are using ceramic wall tiles. Moreover, these tiles have replaced traditional stone materials in commercial spaces including corporate offices, hotel lobbies, and museums as a more affordable option.

Sanitary ware is another key application segment of the market, which is anticipated to expand at a CAGR of 5.0% during the forecast period. Ceramic-based sanitary ware is cost-effective, durable, easy to clean, and offers a glossy finish. Sanitary ware is a basic necessity in public, private, and commercial spaces. Growing economic development and rising health concerns have augmented the manufacturing of sanitary ware, which in turn is anticipated to propel segment growth over the coming years.

Bricks & pipes held the third-largest share of the market in 2022. Bricks are inert products made up of nontoxic and natural materials, which do not release volatile organic compounds (VOCs) and promote a healthy interior environment. Ceramic bricks are highly fire resistant and offer insulation from sound, vibrations, electricity, electrostatic discharge, and ionizing radiation, making them ideal for sustainable housing.

End-use Insights

Based on end-use, medical is anticipated to register the fastest growth rate of 5.7% during the forecast period. On account of its inorganic non-metallic composition, ceramics are preferable for producing medical instruments and tools, dental implants, and bioceramics. These are largely preferred for being used inside human bodies owing to exceptional wear resistance and chemical inertness.

The industrial segment held the second-largest share of the market in 2022. The product finds usage in various industries such as energy, mechanical, metallurgy, and chemical. High wear and corrosion resistance, hardness, chemical resistance, thermal and electrical insulation, temperature resistance, and compressive strength make the material useful in the abovementioned industries.

The key application area of ceramics in industrial end-use is refractories. These are defined as substances that can endure operating temperatures of 1,000°C or above. Although the metallurgical industry accounts for a share of over 80% of the overall refractor market for processing both, ferrous and non-ferrous metals, refractories are also used in glass and cement manufacturing and energy generation industries.

Regional Insights

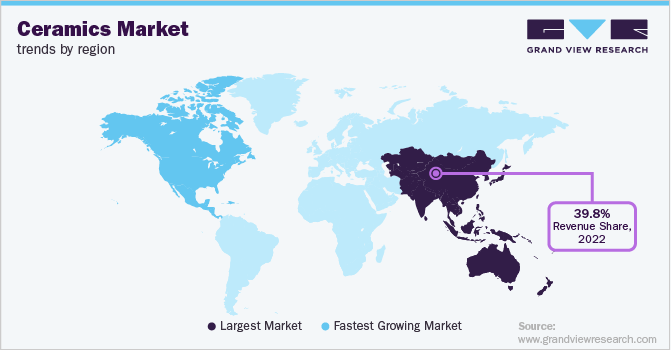

Based on region, Asia Pacific dominated the market with a share of above 39.8% in 2022. The large share is due to the rapidly expanding manufacturing sector in developing economies of the region. The surging demand for advanced ceramics from semiconductor manufacturers is further fueling the market growth. For instance, in February 2022, Taiwan-based UMC announced intentions to invest USD 5 billion in the expansion of its chip production capacity in Singapore.

North America is anticipated to register a CAGR of 4.2% during the forecast period. Soaring investments from domestic and international investors in residential/commercial construction activities in North America are anticipated to fuel the requirements for artware and tableware in the region. Further, growing infrastructural developments are anticipated to prove fruitful for segment growth.

Europe is another prominent market for ceramics, where the product demand is expected to be highest in tiles. Around 28% of the overall employee strength of the European ceramics industry is engaged in tile manufacturing. In addition, the region consumes approximately 1.8 million units of ceramic roof tiles every year. The region holds a strong position in the global tiles industry with Italy, Germany, France, and Spain being the leading exporters of ceramic tiles.

Key Companies & Market Share Insights

The market is competitive in nature. The players operating in this market continuously carry out product developments to stay ahead of their competitors. For instance, in May 2022, CeramTec GmbH launched a new product named AIN HP, which is a relatively new high-performance substrate. This ceramic substrate is ideal for use in power converters in rail vehicle production. Some of the prominent players in the global ceramics market include:

-

3M

-

AGC Ceramics Co., Ltd.

-

CeramTec GmbH,

-

CoorsTek Inc.

-

Du-Co Ceramics Company

-

Kajaria Ceramics

-

MOHAWK INDUSTRIES, INC.

-

Morgan Advanced Materials

-

RAK CERAMICS

-

Saint Gobain

Ceramics Market Report Scope

Report Attribute

Details

Market size in 2023

USD 248.89 billion

Revenue forecast in 2030

USD 359.35 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Turkey; China; India; Japan; Brazil; GCC

Key companies profiled

AGC Ceramics Co., Ltd., 3M; CoorsTek Inc.; CeramTec GmbH; Du-Co Ceramics Company; RAK CERAMICS; Kajaria Ceramics; MOHAWK INDUSTRIES, INC.; Morgan Advanced Materials; Saint Gobain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramics Market Segmentation

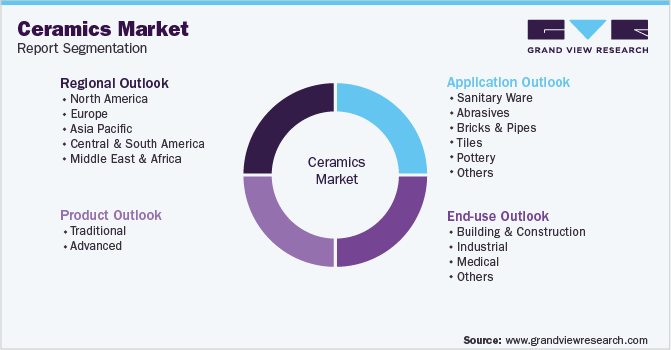

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the ceramics market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Traditional

-

Advanced

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Sanitary Ware

-

Abrasives

-

Bricks & Pipes

-

Tiles

-

Pottery

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Building & Construction

-

Industrial

-

Medical

-

Others

-

-

Regional Outlook ( Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global ceramics market size was estimated at USD 239.53 billion in 2022 and is expected to reach USD 248.89 billion in 2023.

b. The global ceramics market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 359.35 billion by 2030.

b. Based on product, traditional dominated the ceramics market with a revenue share of over 57.0% in 2022, owing to tiles consumption for various household applications and sanitary ware fitting.

b. Some key players operating in the ceramics market include AGC Ceramics Co., Ltd., 3M; CoorsTek Inc. CeramTec GmbH, Du-Co Ceramics Company. RAK CERAMICS, Kajaria Ceramics MOHAWK INDUSTRIES, INC. Morgan Advanced Materials, and Saint Gobain, among others.

b. Growth in the global construction industry is expected to propel the demand for tiles and sanitary ware, which is anticipated to augment the ceramics market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."