- Home

- »

- Processed & Frozen Foods

- »

-

Cheese Powder Market Size, Share & Trends Report, 2030GVR Report cover

![Cheese Powder Market Size, Share & Trends Report]()

Cheese Powder Market Size, Share & Trends Analysis Report By Product (Parmesan, Cheddar, Blue Cheese, Romano, Swiss), By Application (Ready To Eat, Bakery & Confectionery, Snacks), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-045-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global cheese powder market size was worth USD 4.04 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.48% from 2022 to 2030. Cheese powder is a more convenient and affordable option with a longer shelf life for flavoring products. The global industry is expanding as a result of rising snack and convenient food consumption coupled with rising disposable income. The COVID-19 pandemic compelled consumers to stock up on essential food products and snacking options with a longer shelf life such as soups, baking flours, snack bars , and others. The pandemic shifted consumer preference towards convenient eating which presented new private players an opportunity to enter the market to cater to higher demand. These factors positively impacted the global cheese powder market during the pandemic. However, the supply chain disruption caused due to lockdowns in several countries affected the overall production of cheese powder which is predicted to reach pre-covid levels rapidly as restrictions and lockdowns ease.

Cheese powder gives a flavor similar to fresh cheese. This powder is used in a wide range of food products such as sauces, soups, pizzas, seafood, salads, meat, and canned food, as well as seasoned salt and spices. Cheese powder has numerous health benefits, which include blood pressure regulation, improved bone health, muscle and nerve function, and immunity among others. These factors are expected to propel product demand in the coming years.

Another factor expected to boost market growth is consumer awareness of the nutritional value of the product, such as high vitamin and protein content and low calories. Furthermore, manufacturers focus on improving product quality and flavor by offering personalized flavors in the cheddar cheese powder segment, such as sweet, buttery, or savory flours. Additionally, companies also provide durable and attractive packaging, in an attempt to expand the scope and growth of their business.

The presence of a large number of lactose-intolerant people may impede the growth of the global market for cheese powder. Furthermore, the growing vegan population as a result of shifting individual concerns regarding environmental factors and animal welfare is also expected to hamper the market growth. However, the development of organic cheese powder with regional preferences has the potential to substantially boost sales for the local market.

Cheese powders are marketed as low-sodium or low-fat products, with cheese being the main low-salt and low-fat ingredient. However, as consumers are becoming more aware of the adverse effects of consuming cheese such as high cholesterol, heart issues, and obesity, it may restrain the growth of the industry during the forecast period. Finally, the market for cheese foam powder is regarded as a luxurious food ingredient and the factors contributing to increased product demand include urban lifestyles, rising disposable income, and, to some extent, trending street food products.

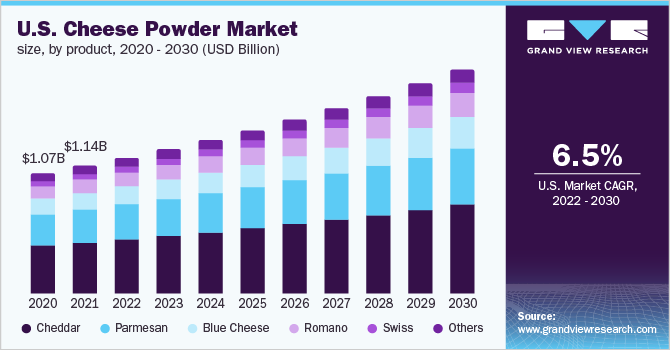

Product Insights

Cheddar cheese held the highest revenue share of 40% in 2021 owing to the rising incorporation of the product in the fast food and convenience food market. Cheddar cheese is a hard, ripened cheese having a long shelf life that has gained popularity due to its distinct aroma, taste, and flavor. It is extremely popular in regions such as North America and Europe. Furthermore, the demand for premium and specialty flavors is expected to drive this segment's growth.

The Swiss cheese segment is expected to have the highest CAGR of 7.6% during the forecast period. Swiss cheese is distinguished by its gleaming, pale yellow color. Its flavor is mild, nut-like, and sweet with a savory but not overpowering taste. This unique flavor of swiss cheese makes it a popular choice among consumers which is expected to propel the demand in the segment. It has a wide range of applications such as it can be added to dips, spreads, and appetizers among other uses. Furthermore, it also boosts richness in mayo dips and cream cheeses.

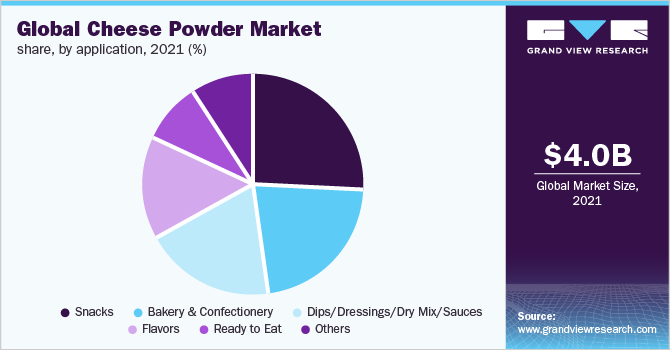

Application Insights

The ready toeat segment is expected to grow at a CAGR of 6.7% over the forecast period. Cheese powders have a longer shelf life and hence can be added to Cheddar and convenience foods which can be preserved for a longer time than fresh cheese. Cheese powders have a consistent quality, can be added in controlled quantities, and do not require refrigeration. Therefore, it has a wide range of applications in packaged ready-to-eat foods

The snacks segment led the market with a revenue share of over 26.4% in 2021 and is expected to grow rapidly during the forecast period. Snacks as meal replacements are becoming more popular in developed regions as the working class population grows. As per data from the 2021 State of Snacking report by Mondelēz International, 85% of people globally consume at least one snack daily. The increased sales of popular snacks such as popcorn, pretzels, pasta, chips, and hummus due to the use of whole food ingredients and clean labels are expected to boost segment growth.

The bakery and confectionery is expected to progress at a CAGR of 6.3% during the forecast period of 2022-2030. Global consumer preferences are shifting in favor of baked goods, which is expected to boost the industry’s growth. Consequently, product demand in the bakery & confectionery segment, both on the domestic and industrial levels, is likely to further present opportunities for manufacturers during the projected timeframe.

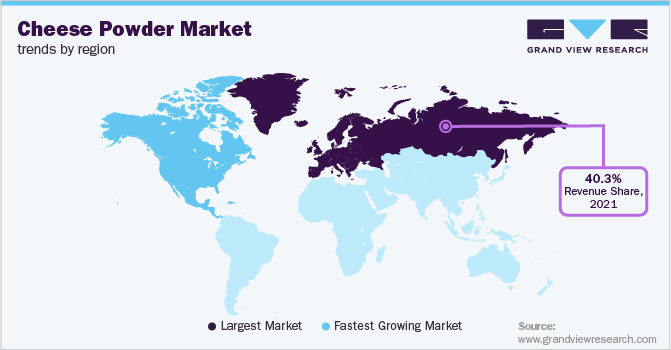

Regional Insights

Europe dominated the global market with a share of over 40.3% of total revenue in 2021. The usage of processed cheese in restaurants and cafes is propelling regional market growth. According to a report published by European Food Safety Authority (EFSA) in 2022, almost 50% of people in Europe prefer reduced-fat food products. Therefore, diets that restrict sugar or fat are most popular in the region. Additionally, manufacturers are expected to be compelled to develop novel cheese powder products to cater to the growing lactose-intolerant population and people prefer reduced-sugar foods in the region.

North America is expected to expand at a CAGR of 6.6% during the forecast period. Large-scale consumption of dairy products, changing demographics, and quick access to dairy technologies have all contributed to the market growth for cheese powder in the region. Furthermore, the rising consumer preference for the consumption of ready-to-eat food products owing to hectic schedules is expected to fuel the regional market in the coming years.

Key Companies & Market Share Insights

The global cheese products market is highly competitive owing to a large number of industry players. The market provides various opportunities for new entrants due to changing consumer preferences and the easy availability of raw materials. Companies are involved in product retailing through e-commerce, supermarkets, and hypermarkets. Furthermore, major players engage in competitive strategies such as new product launches, joint ventures, strengthening of online presence, and capacity expansions among others.

For instance, in August 2022, Kraft Heinz made an agreement to sell its cheese powder manufacturing business to Kerry Group for USD 107.5 million. The deal also includes Kraft Heinz's powdered cheese production facility in Albany, Minnesota. Kraft Heinz was planning to work to tailor its portfolio and focus on core businesses, whereas Kerry Group has been looking to expand its ingredient offerings. Some prominent players in the global cheese powder market include:

-

Land O'Lakes, Inc.

-

Kerry Group PLC

-

Kraft Heinz Company

-

Lactosan A/S

-

Archer Daniels Midland

-

Commercial Creamery Company

-

Kanegrade Limited

-

Aarkay Food Products Ltd.

-

All American Foods

-

Dairiconcepts, L.P

Cheese Powder Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.29 billion

Revenue forecast in 2030

USD 7.11 billion

Growth Rate (Revenue)

CAGR of 6.48% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

Land O'Lakes, Inc.; Kerry Group PLC; Kraft Heinz Company; Lactosan A/S; Archer Daniels Midland; Commercial Creamery Company; Kanegrade Limited; Dairiconcepts; L.P.; All American Foods; Aarkay Food Products Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cheese Powder Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cheese powder market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Cheddar

-

Parmesan

-

Blue Cheese

-

Romano

-

Swiss

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Snacks

-

Bakery & Confectionery

-

Dips/Dressings/Dry Mix/Sauces

-

Flavors

-

Ready to Eat

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cheese powder market size was estimated at USD 4.04 billion in 2021 and is expected to reach USD 4.29 billion in 2022.

b. The global cheese powder market is expected to grow at a compound annual growth rate of 6.48% from 2022 to 2030 to reach USD 7.11 billion by 2030.

b. Europe dominated the cheese powder market with a share of 40.3% in 2021. This is attributable to cheese powders becoming an essential ingredient in both domestic and industrial sector owing to its smell and high nutritional content.

b. Some key players operating in the cheese powder market include Land O'Lakes, Inc., Kerry Group PLC, Kraft Heinz Company, Lactosan A/S, Archer Daniels Midland, Commercial Creamery Company, Kanegrade Limited and Aarkay Food Products Ltd.

b. Key factors that are driving the market growth include surge in requirement of cheese powder in a wide range of snacks, especially in the developed markets

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."