Market Size & Trends

The China dietary supplement testing services market size was estimated at USD 5.00 billion in 2024 and is expected to grow at a CAGR of 9.0% from 2025 to 2030. This growth is attributed to the increasing health awareness among consumers has led to a higher demand for quality assurance and safety in dietary supplements, influenced by stringent regulations from bodies such as the CFDA. In addition, the growth in disposable income allows consumers to invest more in health products, while a growing interest in sports nutrition and functional foods further propels market expansion. Furthermore, ongoing research and development efforts by manufacturers to enhance product efficacy and shelf life are critical in fostering this growth.

Dietary supplement testing services involve evaluating and analyzing dietary supplements to ensure their safety, efficacy, and compliance with regulatory standards. The increasing consumption of dietary supplements in China, alongside the growing financial capacity of consumers, is significantly boosting the demand for these testing services.

In addition, as busy lifestyles lead to irregular eating habits, more individuals are turning to nutraceuticals and dietary supplements for nutritional support, further driving market growth. Furthermore, there is a notable surge in research and development activities within the industry. Private food manufacturing companies are enhancing their stability testing services, contributing to the expansion of the dietary supplement testing services market.

Moreover, manufacturers are also heavily investing in R&D to improve product longevity and effectiveness. This focus on innovation not only meets consumer demands for high-quality supplements but also aligns with regulatory requirements aimed at ensuring product safety.

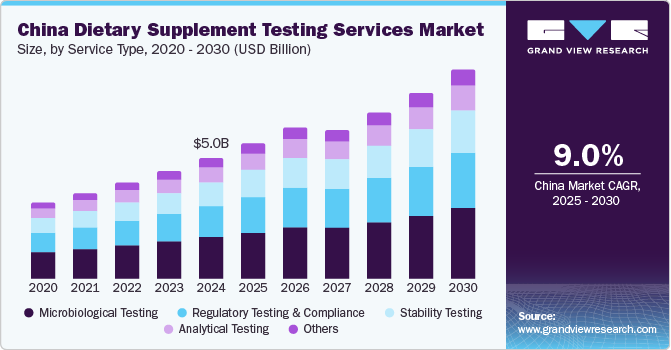

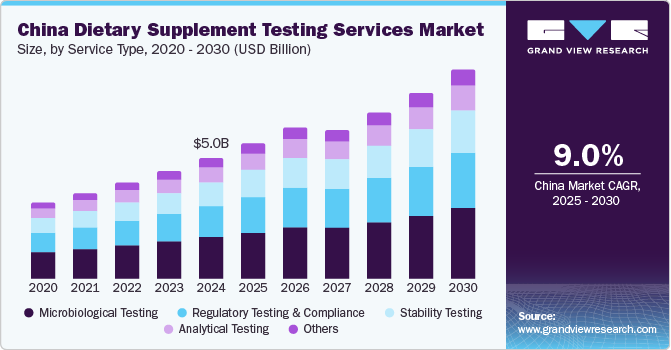

Service Type Insights

The microbiological testing services dominated the market and accounted for the largest revenue share of 34.5% in 2024. This growth is attributed to the increasing demand for safety and quality assurance. In addition, as health consciousness rises among consumers, manufacturers are compelled to ensure that their products are free from harmful microorganisms. Furthermore, rapid microbiological methods (RMM) significantly enhance testing efficiency, reducing the time required for results from 8-10 days to just 1-2 days. This quick turnaround is crucial for maintaining product reliability and consumer trust, thus propelling market growth.

Stability testing services are expected to grow at a CAGR of 9.7% from 2025 to 2030, driven by the need for manufacturers to guarantee that dietary supplements maintain their quality over time. In addition, stability testing becomes essential as companies invest in extending product shelf life and ensuring compliance with stringent regulations. This service evaluates how supplements react under various conditions, ensuring they remain effective and safe throughout their lifespan. Furthermore, the increasing focus on quality assurance and regulatory compliance drives the demand for stability testing, further contributing to expanding China's dietary supplement testing services market.

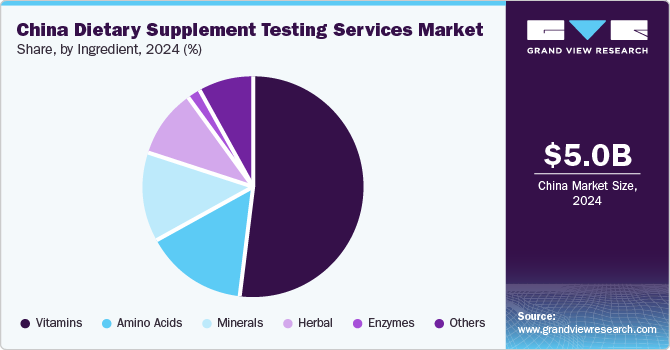

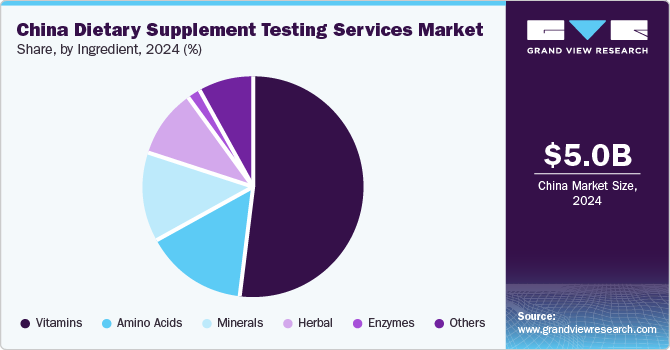

Ingredients Insights

Vitamins led the market and accounted for the largest revenue share of 52.2% in 2024, primarily driven by the ingredient segment of the China dietary supplement testing services market, which is fueled by increasing consumer awareness regarding health and nutrition. In addition, as people become more health conscious, the demand for vitamin supplements has surged due to their recognized benefits in supporting overall well-being, immune function, and disease prevention. Furthermore, the convenience and accessibility of vitamin products have made them popular among consumers, prompting manufacturers to seek reliable testing services to ensure product safety, quality, and efficacy.

The herbal ingredient segment is expected to grow at a CAGR of 9.8% over the forecast period, owing to rising interest in natural remedies and holistic health solutions. In addition, consumers increasingly turn to herbal supplements as alternatives to conventional medicine, motivated by a desire for natural ingredients with fewer side effects. Furthermore, this trend is accompanied by a growing emphasis on the quality and authenticity of herbal products, leading manufacturers to invest in testing services that can validate the safety and potency of their offerings.

Key China Dietary Supplement Testing Services Company Insights

Key companies in the China dietary supplement testing services industry include NSF International, Intertek Group Plc. and others. These companies are employing various strategies to enhance their competitive edge. Strategic collaborations with industry partners enable firms to leverage shared expertise and resources, facilitating market entry and expanding service offerings. In addition, companies are focusing on new product development to introduce innovative testing methodologies that meet evolving regulatory standards and consumer demands. Furthermore, investments in research and development are crucial for improving testing accuracy and efficiency, ensuring high-quality services that align with market needs.

-

Intertek Group Plc ensures product safety, quality, and compliance through comprehensive testing solutions. The company operates in the food and healthcare segment, offering services including microbiological testing, stability testing, and product validation to support dietary supplement manufacturers in meeting regulatory standards and consumer expectations.

-

ALS Limited focuses on delivering high-quality analytical services to ensure product safety and efficacy. Operating within the healthcare and food sectors, the company provides various testing services, such as nutritional analysis, contaminant testing, and stability assessments. Their expertise helps dietary supplement manufacturers comply with regulations while maintaining product integrity and consumer trust.

Key China Dietary Supplement Testing Services Companies:

- NSF International

- Intertek Group Plc

- ALS Limited

- Eurofins Scientific

- SGS SA

- Foodscan Analytics Limited.

China Dietary Supplement Testing Services Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 5.61 billion

|

|

Revenue forecast in 2030

|

USD 8.64 billion

|

|

Growth rate

|

CAGR of 9.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Service type, ingredient

|

|

Country scope

|

China

|

|

Key companies profiled

|

NSF International; Intertek Group Plc; ALS Limited; Eurofins Scientific; SGS SA; Foodscan Analytics Limited.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

China Dietary Supplement Testing Services Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the China dietary supplement testing services market report based on service type and ingredient:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Herbal

-

Vitamins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others