- Home

- »

- Medical Devices

- »

-

China Endoscopy Devices Market, Industry Report, 2030GVR Report cover

![China Endoscopy Devices Market Size, Share & Trends Report]()

China Endoscopy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Endoscopes, Endoscopy Visualization Systems), By Application (Gastrointestinal (GI) Endoscopy, Laparoscopy), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-207-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2016 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Endoscopy Devices Market Trends

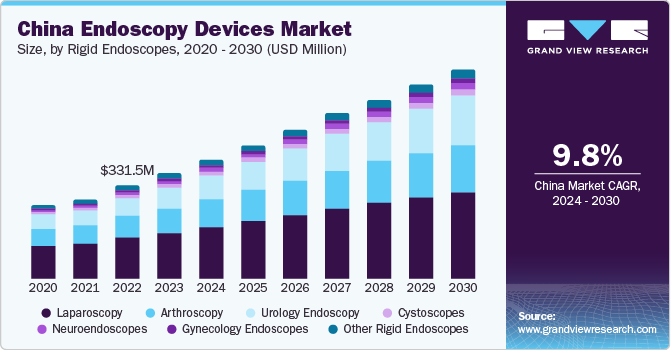

The China endoscopy devices market size was estimated at USD 4.3 billion in 2023 and is projected to register a compound annual growth rate (CAGR) of 10.98% from 2024 to 2030. Rise in adoption of endoscopy devices, mainly endoscopes and visualization systems in healthcare settings is significantly driving market growth. Moreover, geriatric population, highly susceptible to medical conditions requiring endoscopic procedures, such as intestinal perforation, gallstones, pelvic abscesses, endometriosis, and liver abscesses. According to a World Health Organization (WHO) report from 2021, the national population is expected to have approximately 28.0% adults over the age of 60 by 2040.

Advancements in minimally invasive surgeries proved to be beneficial in the treatment of morbid obesity and associated metabolic disorders. Usage of endoscopy devices in clinical diagnosis and therapies of numerous diseases is increasing, as they can facilitate minimally invasive surgeries, thus enabling faster recovery. Due to smaller incisions and lessened muscle disruptions, endoscopic procedures preserve tissue, minimizing complications for the patient and healthcare provider. Moreover, they are economically viable alternatives to open surgeries and result in reduced risk of post-operative complications, shorter hospital stay and recovery time, and decreased blood loss during surgeries.

The advancements in minimally invasive surgical technologies are anticipated to fuel the demand for endoscopic procedures. The development of capsule endoscopes and robot-assisted endoscopy has significantly increased the need for minimally invasive endoscopic surgeries. The introduction of innovative products, particularly in endoscopic visualization systems, is further expected to propel the market. The burgeoning number of healthcare facilities, such as hospitals, oncology specialty clinics, and cancer centers, is leading to a surge in the requirement for endoscopy devices.

During the COVID-19 pandemic, the use of endoscopic devices in China was primarily limited to urgent care, and all elective procedures were postponed. According to a study by the World Journal of Emergency Medicine, endoscopy centers in China had to adapt to the pandemic and the regulations imposed, negatively impacting the market growth. Consequently, the resumption of elective procedures post-pandemic led to significant market growth today.

Market Concentration & Characteristics

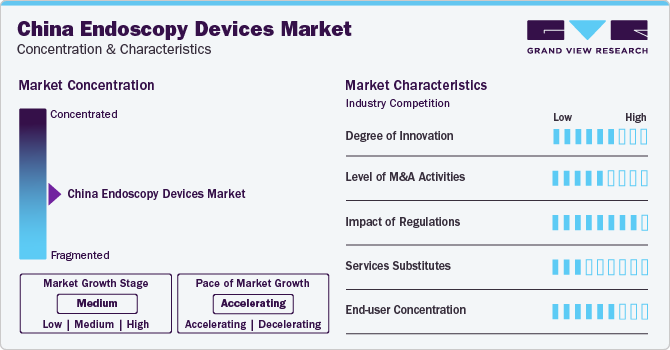

The market growth is moderate, and the pace of market growth is accelerating. The market is moderately competitive, and key players contribute to this competitive landscape with strategic initiatives, product development, research and development, and regional expansion to propel market growth.

The China endoscopy devices market is characterized by a high degree of innovation owing to the increasing research and development by market participants as well as regulatory bodies and academic institutions. Moreover, the Canada Medical Association Journal reports a boom in Canada-China research collaborations leading to the development of novel cystoscopy technologies and revelations.

Market players in the China endoscopy devices market are adhering to merger and acquisition activities to increase their product portfolio and aid product capabilities. For instance, in December 2023, Medtronic plc announced a partnership with Cosmo Intelligent Medical Devices to leverage their AI-integrated healthcare solutions in endoscopic care.

The medical devices regulatory framework has changed drastically since the COVID-19 pandemic. Moreover, reduced costs associated with shorter hospital stays and shorter postoperative care and recovery during this pandemic further boost the adoption of endoscopy procedures. Accordingly, the National Medical Products Administration (NMPA), has been amending and regulating manufacturers of pharmaceuticals and medical devices in China. In January 2024, the NMPA approved the innovative single-port endoscopic surgical robot developed by Shenzhen Edge Medical Co., Ltd.

Market participants strive for new features to drive product expansions, investing in heavy research and development. For instance, the “see-and-treat" TRUCLEAR hysteroscope by Smith & Nephew exemplifies a vital technological advancement in this market.

Key market players consider regional expansion an important strategy for market sustenance and growth. For instance, in July 2023, PENTAX Medical, a division of the HOYA Group, announced that they would be establishing a new endoscope manufacturing, R&D, and service center in Shanghai, specifically catering to the Chinese market.

End-use Insights

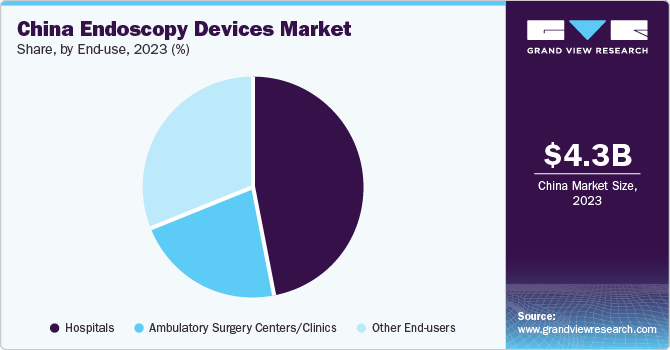

Hospital-based endoscopy market led with a share of 46.73%, owing to the rapidly growing number of surgeries performed in hospitals and the presence of several hospitals and primary care centers in China. Moreover, certain technologically advanced procedures supported by endoscopic devices can be expensive, often limiting their availability to hospitals. Moreover, to ensure patient care quality, endoscopic devices need timely maintenance, and hospitals ensure that this is achieved due to their strict regulatory functioning.

Ambulatory surgery centers (ASCs)/clinics are anticipated to grow at the fastest rate from 2024 to 2030. Less time required for endoscopy, minimal discomfort owing to the introduction of keyhole surgeries, and rapid recovery time are key factors likely to drive the demand for endoscopic surgeries in ASCs & clinics, positively impacting the market. The increased risk of infections related to reusable sigmoidoscopies is driving the demand for disposable products. This, in turn, is promoting the ASCs & clinics segment further.

Product Insights

Endoscopy visualization components market dominated this pace in 2023 with a revenue share of 34.3%, owing to technological advancements in visualization components, such as camera heads, light sources, and HD monitors. Novel product developments and an increase in investment by market players in R&D to develop next-generation visualization systems are some of the major factors propelling market growth. For instance, Johnson & Johnson MedTech announced that their MONARCH Platform and MONARCH Bronchoscope, the first robot-assisted technology used in peripheral lung procedures, received regulatory approval in China.

The endoscopes segment is anticipated to grow at a lucrative CAGR over the forecast period. Disposable endoscopes are expected to grow at the fastest CAGR in the endoscopes market as they can help prevent the risk of cross-contamination, thereby reducing the incidence of hospital-acquired infections. A number of initiatives are being undertaken to promote disposable endoscopes. Several key players are investing in the development of disposable endoscopes. Thus, new product developments and subsequent product launches are expected to drive the market in the coming years.

Application Insights

The gastrointestinal (GI) endoscopy market dominated with a staggering 55.52% market share. Increase in the number of gastroscopies; rise in adoption of endoscopes for diagnosis and treatment of GI diseases; and availability of advanced products for gastroscopy are some of the factors driving the gastroscopy market. In addition, GI endoscopy is poised for growth owing to developments in the area of disposable duodenoscopes in the market. For instance, in May 2023, Wuhan Endoangel Medical Technology Co. Ltd.’s lower GI endoscopy auxiliary diagnosis system, assisted by artificial intelligence in real time with quality control, was approved by the NMPA.

The urology endoscopy (cystoscopy) market is expected to grow at the fastest rate over the forecast period. Growing number of urology surgeries and increasing prevalence of urologic cancer are expected to drive the demand for urology endoscopies. The rising demand for cystoscopes for urological purposes, increasing R&D activities for the development of technologically advanced cystoscopes and ureteroscopes, and their growing adoption during the pandemic are factors anticipated to fuel the market in the future.

Key China Endoscopy Devices Company Insights

The market is fragmented, with prominent players accounting for a large percentage. Some key companies operating in the China endoscopy devices market include Boston Scientific Corporation; Olympus Corporation; Stryker Corporation; Zhejiang Tiansong Medical Instrument Co. Ltd.; and PENTAX Medical. Moreover, the market is further driven by the increasing demand for minimally invasive procedures, an increase in presence of trained endoscopists for a broad range of applications, the development of surgical devices to increase indications of endoscopic surgeries, and product advancements.

Mergers & acquisitions, large investments in R&D, and development of new products or product modifications are among key strategies market participants adopt to gain competitive edge. Strategic alliances play a crucial role in market expansion for several companies in the country.

Key China Endoscopy Devices Companies:

- Boston Scientific Corporation

- Johnson and Johnson

- Medtronic plc

- Olympus Corporation

- Stryker Corporation

- Zhejiang Tiansong Medical Instrument Co. Ltd.

- PENTAX Medical

- Smith and Nephew PLC

- Fujifilm Holdings Corporation

- Cook Medical

- Karl Storz SE & Co. KG

Recent Developments

-

In July 2020, PENTAX Medical and Hitachi entered into a 5-year contract to develop endoscopic ultrasound systems, further strengthening the technological collaboration between the two companies.

-

In August 2020, Olympus acquired Arc Medical Design Limited, a subsidiary of Norgine B.V., underscoring their commitment to expanding their portfolio with respect to GI therapeutic devices and advancing their development of colonoscopy tools.

-

In April 2021, FUJIFILM Medical Systems, Inc., a part of FUJIFILM Holdings Corporation, launched G-EYE 700 series colonoscope, which was developed using Smart Medical to assist in visualization, stabilization, and control while performing colonoscopies.

China Endoscopy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.84 billion

Revenue forecast in 2030

USD 9.04 billion

Growth rate

CAGR of 10.98% from 2024 to 2030

Actual data

2016 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use

Country scope

China

Key companies profiled

Boston Scientific Corporation; Johnson and Johnson; Medtronic plc; Olympus Corporation; Stryker Corporation; Zhejiang Tiansong Medical Instrument Co. Ltd.; PENTAX Medical; Smith and Nephew PLC; Fujifilm Holdings Corporation; Cook Medical; Karl Storz SE & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the China endoscopy devices market report based on product, application and end-use:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

Robot Assisted Endoscopes

-

-

Endoscopy Visualization Systems

-

Standard Definition (SD) Visualization Systems

-

2D systems

-

3D systems

-

-

High Definition (HD) Visualization Systems

-

2D systems

-

3D systems

-

-

-

Endoscopy Visualization Component

-

Camera Heads

-

Insufflators

-

Light Sources

-

High Definition Monitors

-

Suction Pumps

-

Video Processors

-

-

Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Gastrointestinal (GI) Endoscopy

-

Laparoscopy

-

Obstetrics/Gynecology Endoscopy

-

Arthroscopy

-

Urology Endoscopy (Cystoscopy)

-

Bronchoscopy

-

Mediastinoscopy

-

Otoscopy

-

Laryngoscopy

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers/Clinics

-

Other End-users

-

Frequently Asked Questions About This Report

b. The China endoscopy devices market size was estimated at USD 4.3 billion in 2023 and is expected to reach USD 4.84 billion in 2024.

b. The China endoscopy devices market is expected to grow at a compound annual growth rate of 11% from 2024 to 2030 to reach USD 9.04 billion by 2030.

b. Endoscopy visualization systems dominated the China endoscopy devices market with a share of 34.3% in 2023. This is attributable to the increasing preference for HD visualization systems by medical professionals in the diagnosis & treatment of complex diseases.

b. Some key players operating in the China endoscopy devices market include Boston Scientific Corporation; Johnson and Johnson; Medtronic plc; Olympus Corporation; Stryker Corporation; Zhejiang Tiansong Medical Instrument Co. Ltd.; PENTAX Medical; Smith and Nephew PLC; Fujifilm Holdings Corporation; Cook Medical; Karl Storz SE & Co. KG

b. Key factors that are driving the endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.