- Home

- »

- Advanced Interior Materials

- »

-

China Power Tools & Hand Tools Market Report, 2021-2028GVR Report cover

![China Power Tools & Hand Tools Market Size, Share & Trends Report]()

China Power Tools & Hand Tools Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Power Tools, Hand Tools), By Mode Of Operation (Electric, Pneumatic), By Application, By Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68038-380-5

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

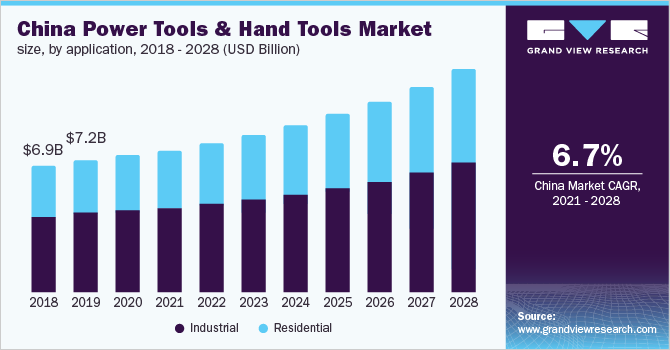

The China power tools and hand tools market size was valued at USD 7.53 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2021 to 2028. In terms of volume, the market is projected to reach 224.7 million units by 2028. The growth can be attributed to growing domestic consumer spending on construction, the rising popularity of Do-It-Yourself (DIY) and Do-It-for-Me (DIFM) for home improvement, and a notable rise in infrastructure development projects under the One Belt One Route (OBOR) initiative. Additionally, rapid industrialization and the surge in the number of construction projects in Guangdong, Jiangsu, and Zhejiang provinces could also bode well for the market growth over the assessment period.

The Chinese power tools and hand tools market faced a decline in sales in Q1/2020 in the wake of the COVID-19 pandemic. However, the market gradually recovered over the rest of the year. The resumption of construction activities, expansion of the rail network, and the announcement of a fiscal package by the Chinese government to develop public infrastructure were some of the factors that offset the impact of the pandemic. Moreover, the increased purchase of power and hand tools through e-commerce platforms has helped the market recover from the impact of the pandemic to a certain extent.

China is a global manufacturing hub and presents an enormous demand for power tools to cater to the market’s mass production requirements. Power tools offer several benefits over hand tools, including the simplification of heavy workloads and increased operational efficiency, ensuring that they are extensively used in both industrial and residential environments. Newer technologies are also being incorporated to improve the efficiency of power tools. For instance, the shift from Nickel-Cadmium (NiCad) to Lithium-Ion (Li-ion) batteries is extensively capitalized by tool manufacturers to produce and commercialize products for domestic and international markets.

The rising popularity of cordless power tools is also expected to favor market growth over the next few years. This can be ascribed to an increase in demand for miniaturized products. Technological advancements in chip-making and battery technology are expected to reduce the need for corded power tools and hand tools. Though foreign brands dominate the country’s power and hand tools market, regional companies are slowly moving from OEMs to self-governed brands in the cordless space.

The ongoing trade tensions between the U.S. and China are likely to impact the prices of power and hand tools in the market. The prices of hand tools prices have declined in the last few years; however, the imposition of tariffs on raw materials such as steel and aluminum led to an increase in prices globally, which was eventually reflected in the China market. In early 2018, U.S. President Trump declared tariffs on billions of dollars worth of Chinese imports citing that unfair trade practices affect U.S.-based manufacturers. Due to these tariffs, prices of products such as power tools increased by about 10 to 25% in 2019, a trend that is expected to continue over the next two to three years.

Product Insights

Based on product, the China Power tools and hand tools market is segmented into power tools and hand tools. The power tools segment accounted for the largest market share of over 69% in 2020 and is expected to expand at a CAGR exceeding 7% over the forecast period. The rising popularity of Li-ion batteries replacing conventional batteries is expected to drive growth over the forecast period. The power tools segment is further categorized into drills, saws, wrenches, grinders, sanders, and others.

The rising popularity of power drills, notably hammer drills, is also expected to bode well for the market growth. The drills segment is expected to register the highest CAGR exceeding 8% over the forecast period. This can be attributed to their lightweight design and long battery life. The hand tools segment is also expected to grow at a promising pace over the forecast period. Ergonomic designs and the introduction of pocket-friendly hand tools such as pliers and wrenches are also expected to boost the demand for hand tools over the forecast period.

Mode of Operation Insights

Based on the mode of operation, the market has been segmented into electric, pneumatic, and others. The electric segment accounted for nearly two-thirds of the market in 2020 and is expected to expand at a more than 7% CAGR over the forecast period. The rising popularity of cordless power tools and lightweight and ergonomic designs of electric power and hand tools are anticipated to drive the growth of the segment over the forecast period. Advancements in battery technology are also expected to boost the demand for electric power and hand tools over the forecast period.

Companies such as Makita, Stanley Black and Decker Inc., and Techtronic Industries Ltd have emphasized improving their technical capabilities to strengthen their cordless product portfolios. For instance, advancements in FlexVolt technology developed by DeWalt, a Stanley Black, and Decker Inc. brand, allowed the company to adopt small brushless motors, which allow power tools to offer improved efficiency. Similarly, advancements such as the red lithium battery developed by Milwaukee, a brand of Techtronic Industries Ltd, also enabled the company to manufacture power tools with a longer lifespan. Such advancements are likely to bode well for the market over the assessment period.

Application Insights

Based on application, the market has been bifurcated into industrial and residential. The residential segment accounted for nearly two-fifths of the market in 2020 and is projected to reach USD 5.10 billion by 2028. The market growth can be attributed to the rising popularity of DIFM and DIY home improvement and landscaping projects. Additionally, the rising demand for ergonomic and pocket-friendly hand tools is expected to work favorably for the market over the forecast period.

The industrial segment accounted for the larger market share of around 60% in 2020 and is estimated to reach USD 7 billion by 2028. The growth prospects of the segment can be ascribed to rapid industrialization and rising applications in commercial sectors, notably in construction and automotive. The industrial segment is further categorized into oil and gas, automotive, aerospace and defense, construction, rail, and others. The automotive and construction segments collectively accounted for nearly 50% of the market in 2020, thanks to the surge in construction spending in Guangdong, Jiangsu, and Zhejiang provinces.

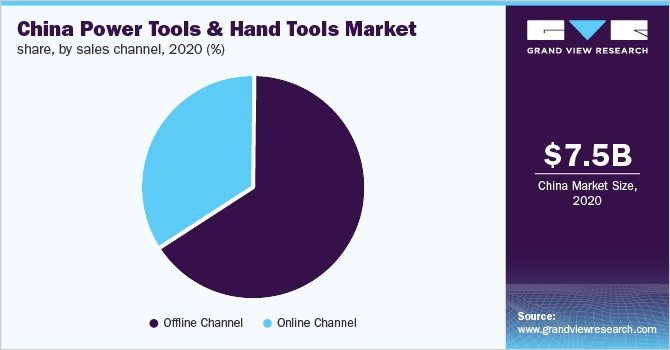

Sales Channel Insights

Based on the sales channel, the market is bifurcated into the offline channel and online channel. Owing to the presence of several small-scale manufacturers, the offline sales channel is likely to continue to dominate over the forecast period. OEMs earn the majority of the sales through distribution channels that include retailers, dealers, distributors, and importers. The offline channel accounted for more than 65% market share in 2020 and is projected to reach USD 7.8 billion by 2028.

The online channel covers OEM sales across e-commerce platforms and third-party e-commerce marketplaces such as Alibaba.com, Made in China.com, and Global Sources. E-commerce channels allow OEMs to automate manual and labor-intensive processes and provide customer self-service options, eventually reducing operational costs. The COVID-19 pandemic boosted the online sales of OEMs, a trend expected to continue over the next few years as well. The online channel is expected to grow at a CAGR exceeding 7% over the forecast period.

Key Companies & Market Share Insights

The China power and hand tools market is highly fragmented and features international players such as Stanley Black and Decker, Inc.; Makita Corporation; Techtronic Industries Co. Ltd; and several privately-held domestic vendors such as Zhejiang HangboPowertools Co., Ltd; Positecgroup.com; and Hangzhou Great Star Industrial Co., Ltd. These players are concentrating on strengthening their hold on the market by implementing strategies such as mergers & acquisitions, partnerships, and geographical expansion. These strategies help companies expand their business geographically and further enhance their service offerings across national and international markets. For instance, in July 2018, Zhejiang SALI Abrasive Technology Co., Ltd. opened several new retail stores in Uzbekistan to expand its presence. The company offers several types of power tools and hand tools through these shops in Uzbekistan.

Companies such as Ronix Tools and NINGBO YONGFEITE ELECTRICAL& SCIENCE CO., LTD. are engaged in developing new technologies through strategic partnerships to gain a competitive edge in the market. For instance, in April 2021, Ronix Tools introduced the new power detect technology in its four new brushless tools, including Hammer Drill, Angle Grinder (DCG415), and Circular Saw (DCS574), and Reciprocating Saw (DCS368). The technology recognizes the battery with which the tools are paired and adjusts power output accordingly. The technology is suitable for high-end applications. Some of the prominent players operating in the China power tools &hand tools market are:

-

Atlas Copco AB

-

CHERVON (China) Trading Co., Ltd.

-

Ebic Tools Limited

-

Emerson Electric Co.

-

Guizhou GangZhiyi Commercial Trade Co., Ltd

-

Hangzhou Great Star Industrial Co., Ltd.

-

Hilti Corporation

-

Hongyu Tool Corporation

-

Ingersoll Rand, Inc (Gardner Denver)

-

Jiangsu Guoqiang Tools Co., Ltd

-

Koki Holdings Co., Ltd

-

Makita Corporation

-

NINGBO YONGFEITE ELECTRICAL& SCIENCE CO., LTD

-

Positecgroup.com

-

Robert Bosch Group (Robert Bosch Tool Corporation)

-

Ronix Tools

-

SHANGHAI KEN TOOLS CO., LTD

-

Stanley Black & Decker Inc

-

Techtronic Industries Co. Ltd.

-

Zhejiang HangboPowertools Co., Ltd

-

Zhejiang SALI Abrasive Technology Co., Ltd

-

ZHENGYANG TECHNOLOGY CO., LTD.

China Power Tools & Hand Tools Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 7.80 billion

Revenue forecast in 2028

USD 12.25 billion

Revenue Growth Rate

CAGR of 6.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million and Volume in Million units and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment covered

Product, mode of operation, application, sales channel

Country scope

China

Key companies profiled

Atlas Copco AB; Emerson Electric Co.; Stanley Black & Decker Inc; Makita Corporation; Koki Holdings Co., Ltd; Techtronic Industries Co. Ltd.; NINGBO YONGFEITE ELECTRICAL& SCIENCE CO., LTD; Positecgroup.com; Hangzhou Great Star Industrial Co., Ltd.; Jiangsu Guoqiang Tools Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the China power tools &hand tools market based on product, mode of operation, application, and sales channel.

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2028)

-

Power Tools

-

Drills

-

Hammer Drills

-

Other Drills

-

-

Saws

-

Wrenches

-

Grinders

-

Sanders

-

Others

-

-

Hand Tools

-

Wrenches

-

Screwdrivers

-

Other Hand Tools

-

-

-

China Power Tools Mode of Operation Outlook (Revenue, USD Million, 2017 - 2028)

-

Electric

-

Corded

-

Cordless

-

-

Pneumatic

-

Others

-

-

China Power Tools & Hand Tools Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Industrial

-

Oil & gas

-

Automotive

-

Aerospace & Defense

-

Construction

-

Rail

-

Others

-

-

Residential

-

-

China Power Tools & Hand Tools Sales Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline Channel

-

Online Channel

-

Frequently Asked Questions About This Report

b. The China Power Tools & Hand Tools market size was estimated at USD 7.53 billion in 2020 and is expected to reach USD 7.80 billion in 2021.

b. The China Power Tools & Hand Tools market is expected to grow at a compound annual growth rate of 6.7% from 2021 to 2028 to reach USD 12.25 billion by 2028.

b. Power Tools dominated the China Power Tools & Hand Tools market with a share of 68% in 2021. This is attributable to BRI initiatives and rising infrastructure spending in commercial, residential, and industrial projects.

b. Some key players operating in the China Power Tools & Hand Tools market include Atlas Copco AB, CHERVON (China) Trading Co., Ltd., Ebic Tools Limited, Hangzhou Great Star Industrial Co., Ltd., Hongyu Tool Corporation, Ingersoll Rand, Inc (Gardner Denver), Jiangsu Guoqiang Tools Co., Ltd, Koki Holdings Co., Ltd, Makita Corporation, NINGBO YONGFEITE ELECTRICAL& SCIENCE CO., LTD, Positecgroup.com, Robert Bosch Group (Robert Bosch Tool Corporation), Ronix Tools, Stanley Black & Decker Inc, Techtronic Industries Co. Ltd., Zhejiang Hangbo Powertools Co., Ltd, Zhejiang SALI Abrasive Technology Co., Ltd, and ZHENGYANG TECHNOLOGY CO., LTD.

b. Key factors that are driving the China Power Tools & Hand Tools market growth include the promising expansion of the infrastructure development and manufacturing sector China’s new Dual-Circulation Strategy (DCS), and rising preference for cordless power tools & growth of Lithium-Ion (LI-ION) battery technology across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.