- Home

- »

- Semiconductors

- »

-

Chiplet Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Chiplet Market Size, Share & Trends Report]()

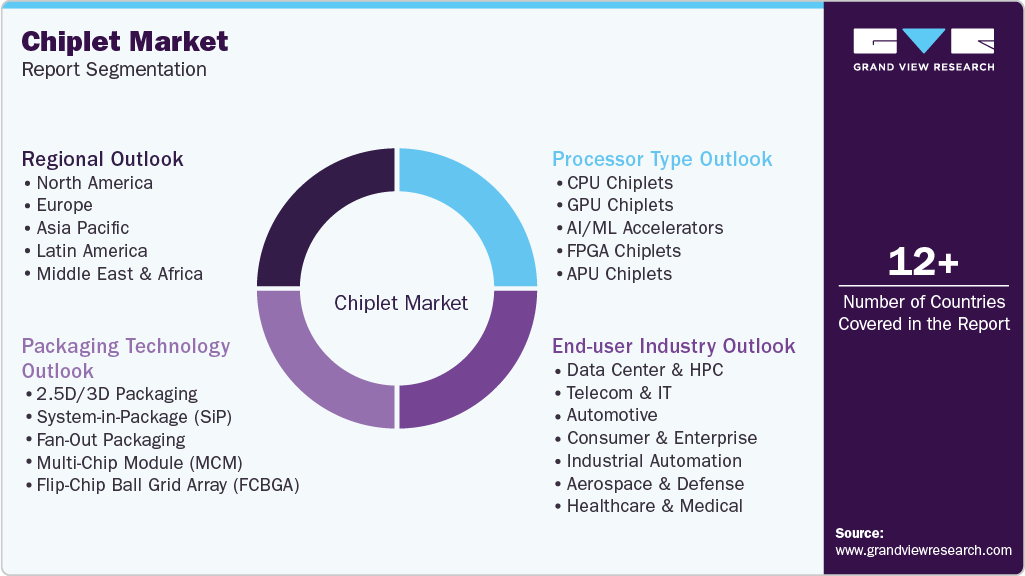

Chiplet Market (2025 - 2033) Size, Share & Trends Analysis Report By Processor Type (CPU Chiplets, GPU Chiplets, AI/ML Accelerators), By Packaging Technology (2.5D/3D Packaging, Multi-Chip Module), By End-user Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-663-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chiplet Market Summary

The global chiplet market size was estimated at USD 9.06 billion in 2024 and is projected to reach USD 223.56 billion by 2033, growing at a CAGR of 43.7% from 2025 to 2033. The market is gaining momentum, driven by surging demand for AI and high-performance computing (HPC) workloads, which require scalable, modular processing architectures.

Key Market Trends & Insights

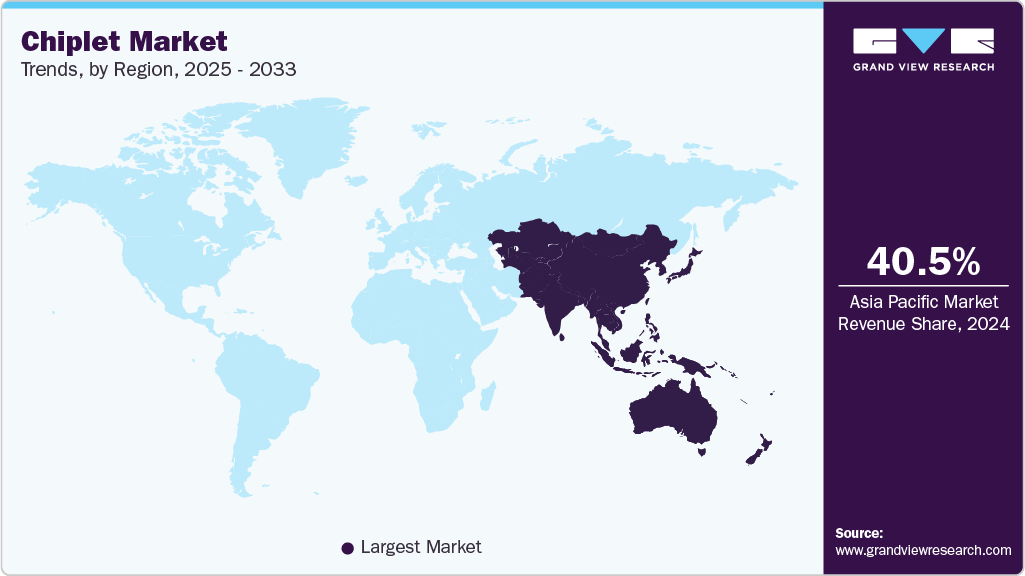

- Asia Pacific chiplet market accounted for a 40.5% share of the overall market in 2024.

- The China chiplet market held a substantial market share in 2024.

- By processor type, the CPU chiplets segment accounted for the largest share of 41.2% in 2024.

- By packaging technology, the 2.5D/3D packaging segment held the largest market share in 2024.

- By End-user industry, the data center & HPC segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.06 Billion

- 2033 Projected Market Size: USD 223.56 Billion

- CAGR (2025-2033): 43.7%

- Asia Pacific: Largest market in 2024

The rising cost and complexity of monolithic system-on-chips (SoCs) are encouraging a shift toward disaggregated chiplet-based designs that improve yield and reduce time-to-market. Additionally, rapid advancements in 2.5D/3D integration and advanced packaging technologies are making heterogeneous integration more feasible and cost-effective. The market also holds significant potential in edge AI and IoT applications, where power efficiency and customization are critical. However, high design and validation costs further act as a restraint, particularly for smaller players with limited R&D budgets.

The surging demand for AI and HPC workloads is driving significant advancements in chiplet technology to meet the need for scalable, efficient computing solutions. Industries across sectors such as healthcare, automotive, and finance increasingly rely on AI for data processing, while HPC applications require enhanced computational power for tasks such as simulations and analytics. Traditional monolithic chips face challenges in addressing these demands efficiently, making modular chiplet architectures more attractive due to their flexibility and cost-effectiveness. For instance, in March 2025, Axelera AI unveiled Titania, a scalable AI inference chiplet based on its Digital In-MemoryComputing (D-IMC) architecture. Supported by up to USD 66.2 million (EUR 61.6 million) in EU funding through the DARE Project, Titania targets edge-to-cloud AI and HPC applications, aligning with Europe’s strategy for processor independence and extreme-scale computing.

As semiconductor nodes advance, the expense to design, manufacture, and validate large monolithic SoCs has escalated dramatically, with costs often ranging from hundreds of millions to over a billion dollars per chip, especially at cutting-edge process nodes like 3nm or 5nm. This increase is driven by the need for greater transistor counts, advanced packaging, and rigorous testing to ensure high yields. Chiplets, by contrast, offer a modular approach that divides functionality across smaller, easier-to-manufacture dies, reducing risk and cost. This modularity also accelerates development cycles and enhances yield by isolating defects to individual chiplets rather than the entire SoC, presenting a more cost-effective and scalable solution for complex semiconductor designs.

Rapid advancements in 2.5D/3D and advanced packaging technologies are driving significant growth in the chiplet market. These packaging innovations enable the integration of multiple heterogeneous dies within a single package, enhancing performance, power efficiency, and form factor compared to traditional monolithic chips. Techniques such as silicon interposers, through-silicon vias (TSVs), and chip-on-wafer-on-substrate (CoWoS) allow for high-density interconnects, reduced signal latency, and improved thermal management.

The expansion into Edge AI and IoT devices is being propelled by the increasing need for scalable, low-latency, and energy-efficient processing solutions that can operate closer to data sources. This trend is driven by the rapid adoption of smart devices, connected sensors, and real-time analytics in automotive and industrial automation applications. To address these demands, chiplet architectures offering modular and customizable integration have become essential, enabling improved performance and faster time-to-market for edge deployments. For instance, in January 2025, DreamBig announced advancements in its MARS Chiplet Platform, integrating 3D HBM-stacked Chiplet Hub and Networking IO Chiplets. Partnering with Samsung Foundry and Silicon Box, DreamBig aims to deliver high-performance AI, data center, and automotive solutions with reduced latency and enhanced energy efficiency. This indicates that chiplet-based platforms are critical enablers of next-generation edge AI and IoT innovations.

High design and validation costs significantly restrain the chiplet market, frequently totaling several million USD per project. The complexity of integrating multiple dies into a cohesive system demands extensive engineering resources, comprehensive testing, and thorough validation to ensure compatibility and reliability across diverse components. These substantial upfront expenses increase financial risk, particularly for smaller companies and startups, limiting broader adoption. Also, the high cost barrier slows innovation and market expansion despite the clear technological advantages of chiplet architectures.

Processor Type Insights

The CPU chiplets segment accounted for the largest share of 41.2% in 2024. Chiplet-based CPU designs enable modular development, offering flexibility, reduced time-to-market, and cost advantages over traditional monolithic SoCs. These benefits are especially crucial in the era of AI and cloud computing, where rapid iteration and customization are key. Factors such as the increasing demand for high-performance computing, rising adoption of heterogeneous integration, improved scalability in data center architectures, and growing investments in advanced packaging technologies is supporting the segment growth.

The AI/ML accelerators segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by surging demand for generative AI workloads, increasing deployment of energy-efficient inference hardware, advancements in chiplet-based heterogeneous integration, and rising investments in data center AI infrastructure. This growth is fueled by the industry shift toward specialized processors that can deliver high throughput with lower latency and power consumption, especially for transformer-based and large language models.

For instance, in March 2025, Ayar Labs launched the world’s first UCIe-compliant optical interconnect chiplet for AI systems. Delivering 8 Tbps bandwidth via its TeraPHY chiplet and SuperNova light source, the solution enhances AI scale-up efficiency, lowers power consumption, and enables cross-vendor interoperability using optical links. This highlights the critical role of chiplet-based AI/ML accelerators in meeting escalating performance and efficiency demands, particularly as enterprises and hyperscalers look to scale compute resources without compromising power budgets or interoperability.

Packaging Technology Insights

The 2.5D/3D packaging segment accounted for the largest share in 2024, driven by increasing demand for high-bandwidth interconnects, rising adoption of heterogeneous integration, growing AI and HPC workloads, and rapid advancements in advanced packaging technologies. These packaging approaches allow dense chiplet integration with improved signal integrity, thermal management, and modular scalability, making them essential for next-generation systems. For instance, in March 2025, Global Unichip Corp. (GUC) announced the successful launch of the industry’s first 32G UCIe 2.0 PHY silicon on TSMC’s 3nm process using CoWoS packaging. Targeting AI and HPC, the solution delivers 10 Tbps/mm bandwidth density and includes advanced reliability features for high-speed, chiplet-based architectures. Such developments demonstrate how 2.5D and 3D packaging are becoming critical enablers of performance and efficiency gains in modern chiplet-based systems, especially across compute-intensive domains.

The system-in-package (SiP) segment is expected to grow at a significant CAGR during the forecast period, driven by increasing miniaturization of electronics, rising demand for heterogeneous integration, growing adoption of wearables and edge devices, and the need for improved power efficiency. SiP technology allows multiple integrated circuits and passive components to be packaged into a single module, reducing board space and enabling compact system designs ideal for consumer, medical, and IoT applications.

End-user Industry Insights

The data center & HPC segment accounted for the largest share in 2024, driven by the rising complexity of AI workloads, growing need for modular compute scaling, increasing adoption of chiplet-based processors for thermal and yield efficiency, and surging demand for low-latency, high-bandwidth interconnects. As compute-intensive applications proliferate, traditional monolithic SoCs are becoming less viable, making chiplet architectures increasingly attractive in high-density data center environments. According to the Federal Register, the U.S. hosted approximately 5,000 data centers in 2023, and is projected to grow by about 9% annually through 2030. This sustained expansion reflects the growing demand for scalable, energy-efficient infrastructure to support AI training, HPC simulations, and real-time analytics. These applications increasingly benefit from chiplet-based designs.

The telecom & IT segment is expected to register a notable CAGR from 2025 to 2033. As telecom networks evolve, latency-sensitive applications such as cloud-native RAN, real-time video processing, and AI-driven traffic management require agile compute and memory resources distributed across the network. The segment growth is mainly attributed to the growing need for high-throughput, low-latency interconnects, increasing adoption of disaggregated architectures, rising deployment of edge computing infrastructure, and ongoing migration to 5G and 6G networks. These trends are accelerating demand for chiplet-based solutions that can optimize bandwidth, power efficiency, and modular scalability.

Regional Insights

The Asia Pacific chiplet marketaccounted for 40.5% of the global share in 2024 driven by robust regional semiconductor investment programs, increasing demand for AI and HPC systems, growing participation in chiplet standardization efforts, and the rise of advanced packaging infrastructure. Governments across the region are aggressively supporting local manufacturing ecosystems to meet the computational needs of emerging sectors such as AI, electric vehicles, and cloud computing. These trends are accelerating the shift toward chiplet-based architectures that offer better scalability, yield, and energy efficiency compared to traditional monolithic SoCs.

For instance, in August 2024, OPENEDGES Technology launched its UCIe-compliant OPENEDGES UCIe Controller (OUC) IP, enabling reliable die-to-die connectivity for chiplet systems and supporting heterogeneous integration across vendors. Earlier, in July 2023, Silicon Box inaugurated a USD 1.48 billion semiconductor packaging facility in Singapore, focused on high-density chiplet integration for AI, EVs, data centers, and wearables. The facility leverages proprietary interconnect technologies to minimize power consumption and shorten product development cycles. Such developments reflect Asia Pacific’s rapid advances in chiplet packaging capabilities and UCIe-compliant IP innovation, reinforcing its position as a global hub for next-generation semiconductor design and integration.

The China chiplet market held a substantial market share in 2024. The market is experiencing rapid growth, driven by strong government-led semiconductor self-sufficiency goals, rising investment in chiplet R&D, the push to localize advanced packaging capabilities, and increasing demand for AI and data center processors. As the country faces continued export restrictions and supply chain disruptions, the chiplet approach is gaining traction for enabling scalable and cost-efficient domestic semiconductor innovation.

Chinese authorities are proactively funding foundational research and chiplet integration capabilities across academia and industry to accelerate domestic innovation in this space. For instance, in August 2023, the National Natural Science Foundation of China launched a USD 6.4 million research program to fund up to 30 projects dedicated to chiplet integration. The initiative aims to improve local design capabilities, cut development costs, and deliver competitive performance for next-generation processor technologies.

The chiplet market in Japan held a significant share in 2024. The market is influenced by the steady advancement of domestic semiconductor initiatives, strong public-private R&D partnerships, growing emphasis on advanced packaging, and the strategic push to develop next-generation 2nm-class technologies. Japan’s government and industry leaders are intensifying efforts to reclaim global competitiveness in chip manufacturing by investing in future-ready chiplet-based platforms.

As part of this national strategy, Japan is actively collaborating with global technology leaders to accelerate innovation in chiplet packaging. For instance, in June 2024, Rapidus and IBM expanded their collaboration to jointly develop chiplet packaging technology for 2nm-generation semiconductors. Supported by Japan’s NEDO, the initiative will leverage IBM’s advanced packaging capabilities to scale mass production and strengthen Japan’s footprint in the global chiplet and semiconductor packaging ecosystem.

Europe Chiplet Market Trends

The Europe chiplet industry was identified as a lucrative region in 2024. The European chiplet market is witnessing significant transformation, driven by rising AI infrastructure investments, strategic public funding initiatives, a growing focus on chiplet-based interconnect innovations, and a strong emphasis on open, standards-based semiconductor ecosystems. As European nations seek to reduce dependency on foreign chip supply chains, regional support for advanced packaging and modular architectures is accelerating.

To support these goals, governments are directly investing in next-generation chiplet technologies. For instance, in October 2024, Alphawave Semi received a research grant from the UK's Advanced Research + Invention Agency (ARIA) as part of a USD 63 million (GBP 50 million) initiative to eliminate networking bottlenecks in AI systems. The funding is focused on advancing chiplet-based connectivity to enhance interconnect efficiency across AI accelerator clusters.This underscores Europe’s strategic direction to lead in AI-era semiconductor design by fostering scalable, power-efficient chiplet infrastructure through coordinated public-private R&D efforts.

The Germany chiplet market is being shaped by increasing investment in domestic semiconductor capabilities, strong government backing for advanced packaging R&D, rising demand for localized AI compute infrastructure, and participation in Pan-European processor initiatives. Germany's industrial leadership in automotive, automation, and edge AI also creates demand for chiplet-based solutions that offer modularity, efficiency, and faster time-to-market.

The chiplet market in UK is advancing steadily, supported by a growing focus on AI infrastructure development, increasing R&D investments in chiplet interconnect technologies, and strong collaboration with global foundries for next-generation semiconductor packaging. As chiplet adoption accelerates across AI and HPC applications, domestic firms are leading innovations that improve data transfer speeds, reduce power consumption, and enable modular system scaling. For instance, in July 2024, Alphawave Semi introduced the industry’s first 3nm UCIe Die-to-Die IP using TSMC’s CoWoS packaging. Designed for AI, HPC, and hyperscaler applications, the IP delivers 8 Tbps/mm bandwidth density, and 24 Gbps D2D speeds, supports multiple protocols, and offers enhanced reliability via live per-lane health monitoring.

North America Chiplet Market Trends

The North America chiplet industry was identified as a lucrative region in 2024. The chiplet market in North America is being driven by increasing defense-sector investments in secure semiconductors, strong participation in open chiplet ecosystems, rising demand for customizable compute solutions, and early access to advanced packaging nodes. The region benefits from the presence of major semiconductor design houses and foundry alliances that are accelerating adoption of modular architectures through collaborative development models. For instance, in June 2025, QuickLogic joined the Intel Foundry Chiplet Alliance to accelerate the development of secure, eFPGA-based chiplets for defense and commercial markets. The collaboration offers early access to Intel’s 18A process and advanced packaging roadmap, and supports standards-based, multi-chip solutions using UCIe interconnect to enable flexibility and security.

Canada chiplet market is gaining traction, supported by growing investments in semiconductor R&D, government-backed innovation programs, and increased interest in AI and quantum computing infrastructure.

The chiplet market in Mexico is still nascent but poised for gradual expansion due to the country’s rising role as a nearshoring hub for electronics manufacturing.As North American OEMs seek to diversify manufacturing bases, Mexico's proximity to the U.S. and evolving capabilities in advanced packaging could unlock new opportunities for chiplet deployment.

U.S. Chiplet Market Trends

The U.S. chiplet industry held a dominant position in 2024. The chiplet market in the U.S. is witnessing significant transformation, driven by sustained federal investments in semiconductor innovation, increasing AI and HPC workloads, strategic ecosystem partnerships, and the rising shift toward modular system design. The U.S. continues to lead in high-performance computing infrastructure and silicon R&D, making it a fertile ground for chiplet adoption across defense, hyperscale, and commercial sectors. For instance, in October 2024, Lawrence Berkeley National Laboratory and the Open Compute Project partnered to explore chiplet-based architectures for high-performance computing (HPC). The initiative targets performance stagnation in supercomputing by advancing modular chiplet integration to enhance energy efficiency and processing capabilities in future systems. Such developments highlight the U.S.'s strategic focus on chiplet-driven innovation to maintain its global leadership in HPC, AI infrastructure, and semiconductor technology.

Key Chiplet Company Insights

Some of the key players operating in the market include Advanced Micro Devices, Inc. (AMD), Intel Corporation, NVIDIA Corporation, Marvell Technology, Inc., and Broadcom Inc.

-

Founded in 1969 and headquartered in Santa Clara, California, Advanced Micro Devices, Inc. (AMD) is a global semiconductor company specializing in chiplet-based processors and high-performance computing solutions. The company is widely recognized for pioneering multi-die architecture in commercial CPUs and GPUs, including its EPYC server processors and Ryzen desktop chips. AMD’s chiplet design approach enables improved scalability, performance-per-watt, and manufacturing flexibility across data center, gaming, and AI applications.

-

Founded in 1968 and headquartered in Mountain View, California, Intel Corporation is a multinational technology company specializing in semiconductor manufacturing and modular chiplet integration. The company offers a broad portfolio of processors, accelerators, and interconnect technologies optimized for data centers, edge computing, AI, and client devices. Intel has been at the forefront of developing open standards including UCIe and advancing its IDM 2.0 strategy to support next-generation chiplet-based systems. With initiatives such as the Intel Foundry Services and Chiplet Alliance, Intel is driving innovation in packaging, design enablement, and cross-vendor interoperability.

Key Chiplet Companies:

The following are the leading companies in the chiplet market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc. (AMD)

- Intel Corporation

- NVIDIA Corporation

- Marvell Technology, Inc.

- Broadcom Inc.

- Samsung Electronics Co., Ltd.

- Tenstorrent Inc.

- Amazon Web Services, Inc. (AWS)

- Alibaba Group Holding Ltd. (T-Head)

- Microsoft Corporation

Recent Developments

-

In January 2025, YorChip and ChipCraft introduced a low-cost, low-power 8-bit 200Ms/s ADC chiplet. This solution addresses a gap in the chiplet market, offering designers a high-speed ADC without the high costs or power requirements of standard ASSPs or complex IP licensing for custom SoCs.

-

In October 2024, Berkeley Lab and the Open Compute Project announced a collaboration to advance chiplet-based technologies for high-performance computing (HPC). The initiative, including the Open Chiplet Economy Experience Center, aims to restore historical growth rates in HPC performance and energy efficiency through modular chiplet innovations.

-

In July 2024, DreamBig Semiconductor announced a USD 75 million funding round co-led by Samsung Catalyst Fund to accelerate commercialization of its MARS Chiplet Platform and Chiplet Hub. The platform enables scalable AI, datacenter, and automotive solutions, incorporating advanced 3D HBM stacking for bandwidth-intensive applications like generative AI.

-

In June 2024, Achronix and Primemas partnered to integrate Achronix’s Speedcore eFPGA IP into Primemas’ SoC Hublet platform. This chiplet-based solution enables programmable, scalable, and cost-effective performance for AI, data centers, and cloud applications, enhancing flexibility and accelerating time-to-market through advanced embedded FPGA capabilities.

-

In June 2024, SEMIFIVE signed an MoU with OPENEDGES Technology to jointly develop a chiplet platform integrating OPENEDGES’ LPDDR6 memory subsystem. Targeting high-performance computing (HPC), the partnership leverages SEMIFIVE’s SoC design expertise and 4nm process optimization to enhance memory performance, reduce design costs, and accelerate time-to-market.

-

In June 2024, Rapidus and IBM expanded their partnership to jointly develop chiplet packaging technology for 2nm-generation semiconductors. Supported by Japan’s NEDO initiative, the collaboration aims to establish high-performance chiplet packaging processes through joint R&D at IBM’s North American facilities, enhancing Japan’s role in the global semiconductor supply chain.

-

In July 2023, Marvell joined Imec’s automotive chiplet initiative to develop scalable compute SoCs for autonomous vehicles. The collaboration focuses on enabling super-human sensing through multi-chiplet modules that integrate high-performance processing and sensor fusion capabilities, essential for next-generation automotive safety, performance, and reliability.

Chiplet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.29 billion

Revenue forecast in 2033

USD 223.56 billion

Growth rate

CAGR of 43.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Processor type, packaging technology, end-user industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Advanced Micro Devices, Inc. (AMD); Intel Corporation; NVIDIA Corporation; Marvell Technology Inc.; Broadcom Inc.; Samsung Electronics Co., Ltd.; Tenstorrent Inc.; Amazon Web Services, Inc. (AWS); Alibaba Group Holding Ltd. (T-Head); Microsoft Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chiplet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global chiplet market report based on processor type, packaging technology, end-user industry, and region:

-

Processor Type Outlook (Revenue, USD Million, 2021 - 2033)

-

CPU Chiplets

-

GPU Chiplets

-

AI/ML Accelerators

-

FPGA Chiplets

-

APU Chiplets

-

-

Packaging Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

2.5D/3D Packaging

-

System-in-Package (SiP)

-

Fan-Out Packaging

-

Multi-Chip Module (MCM)

-

Flip-Chip Ball Grid Array (FCBGA)

-

-

End-user Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Center & HPC

-

Telecom & IT

-

Automotive

-

Consumer & Enterprise

-

Industrial Automation

-

Aerospace & Defense

-

Healthcare & Medical

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chiplet market size was estimated at USD 9.06 billion in 2024 and is expected to reach USD 12.29 billion in 2033.

b. The global chiplet market is expected to grow at a compound annual growth rate of 43.7% from 2025 to 2033 to reach USD 223.56 billion by 2033.

b. The Asia Pacific chiplet market accounted for 40.5% of the global share in 2024 driven by robust regional semiconductor investment programs, increasing demand for AI and HPC systems, growing participation in chiplet standardization efforts, and the rise of advanced packaging infrastructure. Governments across the region are aggressively supporting local manufacturing ecosystems to meet the computational needs of emerging sectors such as AI, electric vehicles, and cloud computing.

b. Some key players operating in the chiplet market include Advanced Micro Devices, Inc. (AMD), Intel Corporation, NVIDIA Corporation, Marvell Technology, Inc., Broadcom Inc., Samsung Electronics Co., Ltd., Tenstorrent Inc., Amazon Web Services, Inc. (AWS), Alibaba Group Holding Ltd. (T-Head), Microsoft Corporation

b. Key factors that are driving the market growth include surging demand for AI and high-performance computing (HPC) workloads, which require scalable, modular processing architectures. The rising cost and complexity of monolithic system-on-chips (SoCs) are encouraging a shift toward disaggregated chiplet-based designs that improve yield and reduce time-to-market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.