- Home

- »

- Renewable Energy

- »

-

Chiral Chemicals Market Size, Share, Industry Report, 2030GVR Report cover

![Chiral Chemicals Market Size, Share & Trends Report]()

Chiral Chemicals Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Traditional Separation, Asymmetric Preparation), By Application (Pharmaceuticals, Agrochemicals, Flavors/Fragrances), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-176-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chiral Chemicals Market Summary

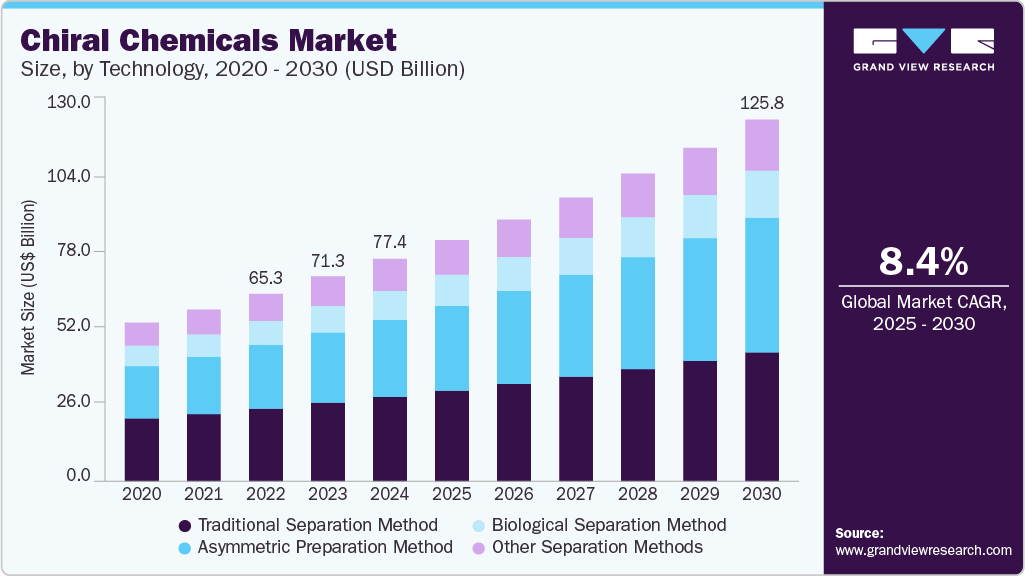

The global chiral chemicals market size was estimated at USD 77,412.4 million in 2024 and is projected to reach USD 125,807.7 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. A key driver propelling the market growth is the increasing demand for enantiomerically pure compounds in the pharmaceutical industry, driven by stringent regulatory requirements and the need for enhanced therapeutic efficacy.

Key Market Trends & Insights

- North America dominated the global chiral chemicals market with a revenue share of 41.4% in 2024.

- The U.S. chiral chemicals market accounted for the largest revenue share in North America in 2024.

- By technology, the traditional separation segment led the market with the revenue share of 43.64% in 2024.

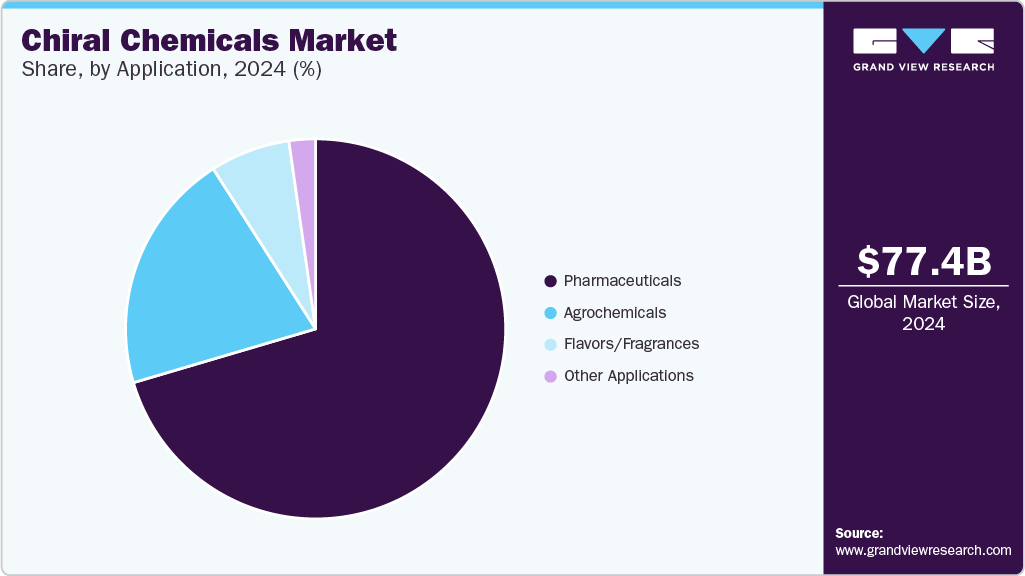

- Based on application, the pharmaceuticals segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 77,412.4 Million

- 2030 Projected Market Size: USD 125,807.7 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

Chiral chemicals are compounds that exist in two non-superimposable mirror image forms known as enantiomers. These molecules are identical in composition but differ in spatial arrangement, leading to significant differences in their biological activity.

In many cases, only one enantiomer of a chiral compound exhibits the desired therapeutic or functional effect, while the other may be inactive or even harmful. The global market encompasses the development, production, and application of these optically active substances across a range of industries, including pharmaceuticals, agrochemicals, and flavors & fragrances.

The importance of chiral chemicals lies in their critical role in enhancing the precision, efficacy, and safety of chemical applications, particularly in the pharmaceutical sector. With regulatory agencies increasingly mandating the use of enantiomerically pure drugs, the demand for advanced chiral technologies is rising sharply. Beyond healthcare, chiral chemicals are gaining traction in agriculture for developing more selective and environmentally friendly pesticides, and in the flavors & fragrances industry for creating compounds with distinct olfactory and taste profiles. As industries shift toward sustainable, high-performance solutions, chiral chemistry is becoming a strategic focus area, offering not only functional superiority but also competitive differentiation in global markets.

Drivers, Opportunities & Restraints

The growth of the chiral chemicals industry is primarily driven by the increasing demand for single-enantiomer active pharmaceutical ingredients (APIs), supported by stringent regulatory frameworks emphasizing drug safety, efficacy, and quality. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate the development of optically pure compounds to reduce adverse effects and improve therapeutic outcomes. Furthermore, the rising adoption of chiral switching-reformulating racemic drugs into their active enantiomeric forms-enables pharmaceutical companies to secure patent extensions and maintain market exclusivity. These dynamics are accelerating investments in advanced chiral synthesis technologies, positioning chirality as a critical component of modern drug development strategies.

One of the primary restraints hindering market growth is the high cost and technical complexity associated with the production and scale-up of enantiomerically pure compounds. Advanced methods such as asymmetric catalysis and biocatalysis, while offering high selectivity, often require expensive reagents, specialized infrastructure, and skilled personnel. In addition, maintaining enantiomeric purity at commercial production scales involves rigorous process optimization and quality control, increasing operational costs. These challenges may limit market penetration among small and medium enterprises and in cost-sensitive sectors such as agrochemicals, where economic feasibility remains a key consideration.

The chiral chemicals industry presents strong growth opportunities through the adoption of biocatalytic and green chemistry-based production technologies. With increasing emphasis on sustainability and regulatory compliance, industries are transitioning toward environmentally benign and cost-efficient manufacturing processes. Enzyme-catalyzed reactions and bio-based chiral synthesis offer advantages such as mild operating conditions, reduced solvent usage, and higher enantiomeric excess. Furthermore, the integration of digital tools-including artificial intelligence and computational modeling is enabling faster discovery of novel chiral catalysts and efficient process design. These advancements are expected to unlock new applications, improve profitability, and facilitate market expansion across emerging economies and specialty chemical domains.

Technology Insights

The traditional separation segment led the market with the largest revenue share of 43.64% in 2024, due to its established industrial presence, broad applicability, and lower initial capital requirements. These methods, including classical resolution, crystallization, and chromatography, have been extensively used for decades, especially in pharmaceutical manufacturing, where many legacy processes still rely on these techniques. In addition, traditional methods offer a proven and reliable means of separating enantiomers without the need for complex catalysts or biocatalytic systems, making them more accessible for small to mid-sized manufacturers.

Moreover, these separation methods are highly versatile and adaptable across a wide range of chiral compounds, especially in cases where the development of enantioselective synthesis routes is not economically viable. In many regulatory-approved drugs and agrochemicals, traditional methods continue to be the standard due to existing validated protocols and the high cost and risk associated with switching to newer technologies. As a result, despite the rising momentum of asymmetric catalysis and biocatalysis, the traditional separation method remains dominant, supported by its commercial maturity, ease of implementation, and regulatory familiarity in large-scale production environments.

Application Insights

The pharmaceuticals segment accounted for the largest revenue share in 2024 and is expected to maintain its dominance throughout the forecast period, primarily due to the critical role of chirality in drug efficacy, safety, and regulatory compliance. A significant proportion of active pharmaceutical ingredients (APIs) are chiral, and in many cases, only one enantiomer is therapeutically active, while the other may be inactive or produce adverse effects. As a result, pharmaceutical companies are increasingly focusing on the development of enantiomerically pure drugs to enhance patient outcomes and minimize side effects.

Furthermore, global regulatory bodies such as the U.S. FDA and EMA are imposing stringent requirements on chiral purity in drug formulations, driving demand for chiral chemicals in both novel drug development and chiral switching strategies. The ability to reformulate existing racemic drugs into single-enantiomer versions not only improves therapeutic performance but also provides manufacturers with opportunities for patent extensions and market exclusivity, incentivizing further investment in chiral technologies. With the continuous rise in chronic diseases, personalized medicine, and complex small-molecule therapeutics, the need for chiral intermediates and APIs is expected to surge, firmly positioning the pharmaceutical segment as the leading application area during the forecast period.

Regional Insights

North America dominated the chiral chemicals market with the largest revenue share of 41.4% in 2024, owing to its well-established pharmaceutical industry, strong R&D infrastructure, and stringent regulatory framework that emphasizes the use of enantiomerically pure compounds. The presence of leading pharmaceutical and biotechnology companies, coupled with high investments in drug discovery and development, has significantly boosted the demand for chiral chemicals in the region. Moreover, regulatory agencies such as the U.S. FDA actively promote the development of single-enantiomer drugs to enhance therapeutic efficacy and safety, further driving the adoption of advanced chiral technologies.

U.S. Chiral Chemicals Market Trends

The chiral chemicals market in the U.S. accounted for the largest market revenue share in North America in 2024, due to its robust pharmaceutical sector, advanced R&D capabilities, and strong regulatory oversight supporting the development of enantiomerically pure drugs. The country’s leadership in drug innovation, combined with the presence of key market players and significant investment in chiral synthesis technologies, has positioned it as the primary consumer and producer of chiral chemicals in the region.

Asia Pacific Chiral Chemicals Market

The chiral chemicals market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by the rapid expansion of the pharmaceutical and agrochemical manufacturing sectors across key economies such as China, India, South Korea, and Japan. The region benefits from cost-effective production capabilities, a growing pool of skilled chemists, and increasing foreign direct investments in specialty and fine chemicals. Furthermore, rising healthcare expenditure, supportive government initiatives, and the growing emphasis on generic drug manufacturing are accelerating the adoption of advanced chiral technologies. As multinational pharmaceutical companies increasingly outsource API production to Asia Pacific, the demand for chiral intermediates and enantiomerically pure compounds is anticipated to rise significantly, fueling strong market growth across the region.

The Chinachiral chemicals market accounted for the largest market share in Asia Pacific in 2024, primarily due to its expansive and cost-efficient manufacturing infrastructure, which supports large-scale production of enantiomerically pure compounds. The country's strategic investments in advanced chiral synthesis technologies, coupled with abundant raw material availability and a skilled workforce, have enabled it to meet the growing global demand for chiral chemicals, particularly in pharmaceuticals and agrochemicals.

Europe Chiral Chemicals Market Trends

The chiral chemicals market in Europe holds a significant position in the global market, supported by its strong pharmaceutical base, advanced research capabilities, and strict regulatory standards promoting the use of enantiomerically pure compounds. Countries such as Germany, Switzerland, and the UK are home to major pharmaceutical and specialty chemical companies that actively invest in chiral synthesis and separation technologies. In addition, the region's emphasis on green chemistry and sustainable manufacturing practices is further driving innovation and demand for chiral chemicals across pharmaceutical and agrochemical applications.

Latin America Chiral Chemicals Market Trends

The chiral chemicals market in Latin America is emerging as a promising market, driven by the gradual expansion of the pharmaceutical and agrochemical sectors in countries such as Brazil, Mexico, and Argentina. The region benefits from increasing foreign investments, improving regulatory frameworks, and a growing focus on high-value chemical production. In addition, rising demand for crop protection agents and generic pharmaceuticals is expected to boost the consumption of chiral intermediates and compounds over the forecast period.

Middle East & Africa Chiral Chemicals Market Trends

The chiral chemicals market in the Middle East & Africa is at a nascent stage but is witnessing gradual growth, driven by increasing investments in pharmaceutical manufacturing and healthcare infrastructure, particularly in countries like Saudi Arabia, the UAE, and South Africa. As governments in the region diversify their economies beyond oil, there is a growing focus on developing local pharmaceutical and specialty chemical capabilities. In addition, the rising demand for high-quality medicines and agrochemicals is expected to create new opportunities for the adoption of chiral technologies in the coming years.

Key Chiral Chemicals Company Insights

Some of the key players operating in the market include Johnson Matthey and BASF.

-

Johnson Matthey is a prominent player in the global chiral chemicals industry, renowned for its extensive portfolio of chiral catalysts, ligands, and biocatalytic technologies. The company excels in asymmetric hydrogenation, holding a 40% market share in chiral hydrogenation catalysts, and its High-Throughput Experimentation platform accelerates catalyst optimization, benefiting pharmaceutical and agrochemical manufacturers.

-

In December 2023, Johnson Matthey partnered with Basecamp Research to expand its biocatalysis offerings, aiming to reduce energy consumption and waste in the pharmaceuticals and agrochemicals sectors. With a global manufacturing footprint spanning the US, UK, India, and China, Johnson Matthey ensures consistent catalyst supply and supports customers through development, scale-up, and commercial implementation stages. The company's commitment to sustainability and innovation solidifies its leadership in the chiral chemicals industry.

-

BASF is a leading global supplier in the chiral chemicals industry, offering an extensive portfolio of optically active intermediates under its ChiPros brand. These chiral amines and auxiliaries are integral to the synthesis of active pharmaceutical ingredients (APIs), providing high enantiomeric purity and scalability for industrial applications. Leveraging advanced biocatalytic processes, BASF has developed efficient production methods for chiral intermediates, enhancing both yield and sustainability. The company's commitment to innovation is further demonstrated by the inauguration of its Catalyst Development and Solids Processing Center in Ludwigshafen, Germany, in December 2024, aimed at accelerating the development of novel chiral catalysts and processing technologies. With a robust global manufacturing network and a focus on sustainable chemistry, BASF continues to play a pivotal role in advancing chiral technologies across the pharmaceutical and agrochemical industries.

Key Chiral Chemicals Companies:

The following are the leading companies in the chiral chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Solvias

- Ascensus

- Chiral Technologies

- Johnson Matthey

- BASF

- W. R. Grace & Co.-Conn.

- PerkinElmer Inc.

- Codexis, Inc.

- The Dow Chemical Company

- Chiracon GmbH

Recent Developments:

-

In July 2024, Chiracon GmbH shared research on a groundbreaking approach, offering an efficient and eco-friendly strategy for developing high-value chemical compounds.

-

In March 2024, W. R. Grace & Co.-Conn announced the expansion of its fine chemical CDM facility in South Haven, enhancing its capacity to serve customers.

Chiral Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83,977.0 million

Revenue forecast in 2030

USD 125,807.7 million

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil; Argentina

Key companies profiled

Solvias.; Ascensus.; Daicel Chiral Technologies; Johnson Matthey; BASF SE; W. R. Grace & Co.-Conn.; PerkinElmer Inc.; Codexis, Inc.; Dow; LUMITOS AG

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chiral Chemical Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chiral chemicals market report based on the product, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Separation Method

-

Asymmetric Preparation Method

-

Biological Separation Method

-

Other Separation Methods

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Agrochemicals

-

Flavors/Fragrances

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chiral chemicals market size was estimated at USD 77,412.4 million in 2024 and is expected to reach USD 83,977.0 million in 2025.

b. The global chiral chemicals market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 125,807.7 million in 2030.

b. North America held the largest market share in the global chiral chemicals market due to its robust pharmaceutical and agrochemical industries, which drive significant demand for enantiomerically pure compounds. The region's advanced research and development infrastructure, coupled with stringent regulatory standards emphasizing drug safety and efficacy, further bolster the adoption of chiral technologies.

b. Some key players operating in the market include Solvias, Ascensus, Chiral Technologies, Johnson Matthey, BASF, W. R. Grace & Co.-Conn., PerkinElmer Inc., Codexis, Inc., The Dow Chemical Company and Chiracon GmbH.

b. The growth of the chiral chemicals market is primarily driven by the increasing demand for enantiomerically pure active pharmaceutical ingredients (APIs), as pharmaceutical companies seek to improve drug efficacy, safety, and regulatory compliance. Additionally, rising applications of chiral compounds in agrochemicals, coupled with technological advancements in asymmetric synthesis and biocatalysis, are fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.