- Home

- »

- Advanced Interior Materials

- »

-

Chromatography Instruments Market Size Report, 2030GVR Report cover

![Chromatography Instruments Market Size, Share & Trends Report]()

Chromatography Instruments Market Size, Share & Trends Analysis Report By Chromatography Systems (Liquid Chromatography, Gas Chromatography), By Consumables, By Accessories, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-338-2

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

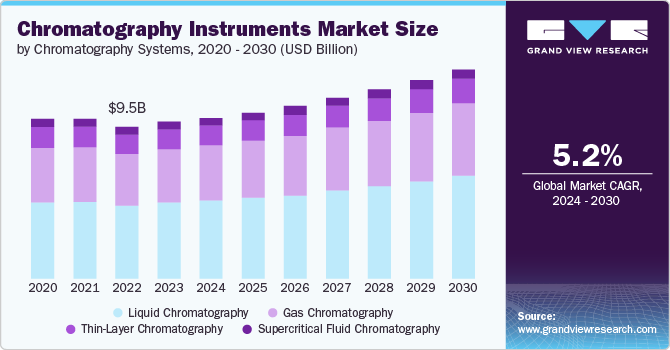

The global chromatography instruments market size was estimated at USD 9,822.6 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The growing pharmaceutical industry is expected to drive the market growth, as these instruments are extensively used in drug discovery, development, and quality control processes. Increasing investments in pharmaceutical R&D, particularly in emerging markets like Asia Pacific, are fueling the demand for chromatography instruments.

The rise of fields like proteomics and metabolomics, which study proteins and metabolites in biological systems, requires sophisticated chromatography instruments for analysis. Advancements in scientific research and the need for accurate and reliable instrumentation are driving the demand for chromatography instruments in the life sciences application.

Chromatography techniques, such as liquid chromatography-mass spectrometry (LC-MS) and gas chromatography-mass spectrometry (GC-MS), are widely accepted analytical methods in the drug approval process. Regulatory bodies like the FDA mandate the use of chromatography instruments for testing the strength, purity, quality, and potency of drug products.

Liquid Chromatography is widely used in the pharmaceutical industry for drug purification, identification of active ingredients, and quality control. Moreover, High-Performance Liquid Chromatography (HPLC) is commonly used in protein separation, enzyme purification, plasma fractionation, and insulin purification.

Drivers, Opportunities & Restraints

The growing demand for chromatography instruments in drug development is a major driver of the global market. Pharmaceutical companies are increasingly using chromatography instruments for purification, identification, and analysis of drug substances and formulations. For example, High-Performance Liquid Chromatography (HPLC) is widely used in the pharmaceutical industry for drug purification and quality control. Furthermore, technological advancements have enabled the development of efficient and advanced chromatography instruments. The introduction of Liquid Chromatography-Mass Spectrometry (LC-MS) and Gas Chromatography-Mass Spectrometry (GC-MS) has revolutionized the drug approval process by providing accurate and reliable analytical techniques for testing the strength, purity, quality, and potency of drug products.

The high cost of chromatography instruments and consumables is a significant restraint in the market. The operating cost of chromatography instruments, which involves the use of multiple consumables, solvents, and maintenance, restricts their use by small companies and research institutions with financial constraints. Moreover, strict regulatory guidelines and safety concerns also hinder the market growth.

The increasing demand for advanced analytical instruments and the growing pipeline of complex drug molecules present significant opportunities in the global market. This has led to the development of novel resins and convenient formats to fulfill specific purification needs for complex drug molecules. Further, the rising research activities in the pharmaceutical and biotech industry have also contributed to the market growth. As the usage of chromatography increases across various research and industry processes, the demand for different types of chromatography consumables is expected to rise.

Chromatography Systems Insights

Based on chromatography systems, the liquid chromatography segment led the market with the largest revenue share of 48.83% in 2023. In the pharmaceutical industry, LC is crucial for drug development, quality control, and ensuring the purity and potency of drug substances. High-Performance Liquid Chromatography (HPLC) is extensively used to separate and quantify different ingredients in drugs, enabling consistent and safe manufacturing processes. LC also aids in determining the concentration of specific substances in a patient's body, guiding medical professionals in prescribing appropriate dosages.

Gas Chromatography Instruments finds applications in the analysis of volatile and semi-volatile organic compounds, making it popular in the pharmaceutical and clinical research organizations. It GC is also used for forensic investigations to identify drugs, poisons, explosives, and accelerants. Moreover, Supercritical Fluid Chromatography (SFC) is an emerging technique used for faster analysis times and reduced solvent consumption compared to traditional liquid chromatography.

Consumables Insights

Based on consumable, the columns segment led the market with the largest revenue share of 55.9% in 2023. The design and performance of chromatography columns are crucial factors driving the advancement of chromatography instruments. Innovations in column technology, such as the development of narrow bore and capillary columns, have significantly improved the efficiency and resolution of chromatographic separations.

Chromatography syringes are extensively used in the pharmaceutical and biotechnology industries for drug discovery, development, and quality control. The increasing necessity of research activities, such as the purification of monoclonal antibodies and green chromatography, is fueling the demand for chromatography syringes.

Accessories Insights

Based on accessories, the column accessories segment led the market with the largest revenue share of 48.33% in 2023. Factors like the increasing complexity of samples, the need for higher-resolution separations, and the growing adoption of automated chromatography systems have contributed to the rising demand for column accessories across industries, particularly in pharmaceuticals, biotechnology, and life sciences.

Auto-samplers enable automated injection of samples into chromatography systems, improving efficiency and reproducibility compared to manual injection. Accessories like vials, caps, septa, and syringes are essential components of auto-samplers used across various chromatography techniques such as HPLC, GC, and LC-MS. The growing adoption of auto-sampler systems in pharmaceutical, and environmental testing laboratories is fueling the demand for compatible accessories.

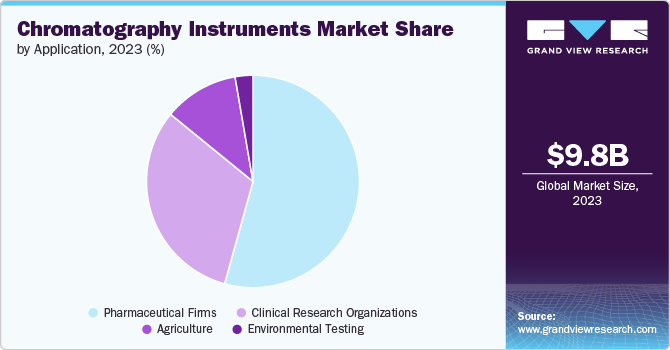

Application Insights

Based on application, the pharmaceutical firms segment led the market with the largest revenue share of 54.33% in 2023. In pharmaceutical companies, chromatography is used to identify and quantify active pharmaceutical ingredients (APIs), detect impurities, evaluate formulations, and monitor stability during drug development and manufacturing. For example, HPLC is used to ensure the correct dosage of APIs and detect impurities that could pose safety risks to patients.

In clinical research, chromatography coupled with mass spectrometry enables accurate identification and quantification of analytes, saving time and money on clinical trials. Chromatography also plays a crucial role in vaccine development by determining the best antibodies for fighting diseases. In addition, gas chromatography is used in pharmaceutical firms to enable detailed and constant analysis of intermediates, final drug products, and packaging materials.

Regional Insights

The chromatography instruments market in North America is anticipated to grow at the fastest CAGR during the forecast period. Regulatory bodies in North America, such as the FDA, mandate the use of chromatography techniques for testing the strength, purity, quality, and potency of drug products. This has led to a significant demand for chromatography instruments in the pharmaceutical and biotechnology industries. Furthermore, the region, has a high budget allocation for research and development compared to other regions. Government policies and funding, such as that of the National Institutes of Health, stimulate market growth by supporting research activities that rely on chromatography instruments.

Asia Pacific Chromatography Instruments Market Trends

Asia Pacific dominates the chromatography instruments market with the revenue share of 68.2% in 2023, due to the rapid industrialization, and increasing investment in pharmaceutical research. The growing number of contract research organizations (CROs) and the expansion of pharmaceutical manufacturing facilities in countries like China and India are driving the demand for chromatography instruments. Furthermore, government initiatives to promote research and development activities are supporting market growth in the region.

The chromatography instruments market in China is estimated to grow at a significant CAGR of 5.8% over the forecast period. China has been steadily increasing its investments in pharmaceutical research and development. The government in China has implemented policies to support the growth of the pharmaceutical industry, leading to a surge in demand for analytical instruments like chromatography systems for drug discovery, development, and quality control.

Europe Chromatography Instruments Market Trends

The chromatography instruments market in Europe is home to several leading pharmaceutical and biotechnology companies that rely on chromatography instruments for drug discovery, development, and quality control. The presence of these companies and their ongoing research activities contribute to the growing demand for chromatography instruments in the region.

Key Chromatography Instruments Company Insights

Some of the key players operating in the market include Agilent Technologies, Thermo Fisher Scientific Inc., PerkinElmer Inc., Waters Corporation, among others.

-

Agilent Technologies is a leading player in the global market, known for its innovative products and comprehensive portfolio of analytical instruments. The company's chromatography solutions are widely used in various industries, including pharmaceuticals, food and beverage, and environmental testing

-

Thermo Fisher Scientific Inc. is a global leader in serving science, providing a broad range of chromatography instruments and solutions. The company's offerings cater to diverse applications, including clinical diagnostics, research, and industrial testing

SCION Instruments, Bio-Rad Laboratories are some of the emerging market participants in the global market.

-

SCION Instruments is a European manufacturer of chromatography instruments, including Gas Chromatography (GC), Gas Chromatography-Mass Spectrometry (GC-MS), Liquid Chromatography (LC), and Chromatography Data Systems (CDS). The company's production facilities are located in Goes, The Netherlands, while its headquarters are based in Livingston, Scotland. SCION Instruments has established a global network to support sales and provide services to customers worldwide. In addition to supporting its own product lines, the company also offers service and support for legacy Varian chromatography systems

-

Bio-Rad involves in the developing, manufacturing, and marketing a broad range of innovative products for life science research and clinical diagnostics. In the life science research area, Bio-Rad provides instruments, software, consumables, reagents, and content for technologies to separate, purify, identify, analyze, and amplify biological materials

Key Chromatography Instruments Companies:

The following are the leading companies in the chromatography instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific

- Perkinelmer, Inc.

- Merck KGaA

- Sartorius AG

- Bio-Rad Laboratories

- Restek Corporation

- Gilson, Inc.

- Phenomenex

- Cytiva

- SCION Instruments

- Hitachi

- Waters Corporation

- Danaher

Recent Developments

-

In June 2024, Shimadzu Scientific Instruments launched the LCMS RX series, designed to deliver reliable and robust results at lower operating costs. The RX series incorporates advanced technologies such as the CoreSpray ionization source and IonFocus electrode to enhance sensitivity, reliability, and ease of use

-

In February 2024, Thermo Fisher Scientific has introduced the Thermo Scientific Dionex Inuvion Ion Chromatography system, designed to simplify and streamline ion analysis for laboratories of all sizes. The Inuvion system offers easy configurability, allowing users to efficiently determine ionic and small polar compounds with a single, reliable platform. This all-in-one solution provides consistent, high-quality ion analysis results, making it an ideal choice for laboratories that require accurate determination of these types of compounds across various applications

Chromatography Instruments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,241.5 million

Revenue forecast in 2030

USD 13,801.3 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Chromatography systems, consumables, accessories, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Agilent Technologies; Waters Corporation; Shimadzu Corporation; Thermo Fisher Scientific; Perkinelmer, Inc.; Merck KGaA; Sartorius AG; Bio-Rad Laboratories; Restek Corporation; Gilson, Inc.; Phenomenex; Cytiva; SCION Instruments; Hitachi; Waters Corporation; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chromatography Instruments Market Report Segmentation:

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the chromatography instruments market report based on chromatography systems, consumables, accessories, application, and region:

-

Chromatography Systems Outlook (Revenue, USD Million; 2018 - 2030)

-

Liquid Chromatography

-

Gas Chromatography

-

Thin-Layer Chromatography

-

Supercritical Fluid Chromatography

-

-

Consumables Outlook (Revenue, USD Million, 2018 - 2030)

-

Columns

-

Solvents

-

Syringes

-

Others

-

-

Accessories Outlook (Revenue, USD Million, 2018 - 2030)

-

Column Accessories

-

Auto-Sampler Accessories

-

Pumps

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical firms

-

Clinical research organizations

-

Agriculture

-

Environmental Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chromatography instruments market size was estimated at USD 9,822.6 million in 2023 and is expected to reach USD 10,241.5 million in 2024.

b. The global chromatography instruments market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 13,801.3 million by 2030.

b. Asia Pacific dominated the chromatography instruments market, with a revenue share of 68.2% in 2023. The market is witnessing significant growth due to rapid industrialization and increasing investment in pharmaceutical research.

b. Some of the key players operating in the chromatography instruments market include Agilent Technologies, Waters Corporation, Shimadzu Corporation, Thermo Fisher Scientific, Perkinelmer, Inc., Merck KGaA, Sartorius AG, Bio-Rad Laboratories, Restek Corporation, Gilson, Inc., Phenomenex, Cytiva, SCION Instruments, Hitachi, Waters Corporation, Danaher.

b. The growing pharmaceutical industry is expected to drive the demand for chromatography instruments market, as these instruments are extensively used in drug discovery, development, and quality control processes. Increasing investments in pharmaceutical R&D, particularly in emerging markets like Asia Pacific, are fueling the demand for chromatography instruments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."