- Home

- »

- Plastics, Polymers & Resins

- »

-

Circular Packaging Market Size, Share, Industry Report 2030GVR Report cover

![Circular Packaging Market Size, Share & Trends Report]()

Circular Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Glass), By End-use (Food & Beverages, Pharmaceuticals), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-528-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Circular Packaging Market Size & Trends

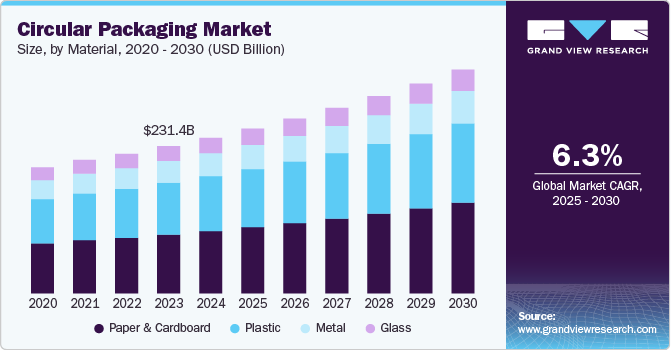

The global circular packaging market size was estimated at USD 244.72 billion in 2024 and is expected to expand at a CAGR of 6.3% from 2025 to 2030. Consumers increasingly demand eco-friendly packaging, pushing brands to adopt recyclable, reusable, and biodegradable materials. This shift drives companies to invest in circular packaging solutions to enhance brand loyalty and meet sustainability expectations.

A key trend shaping the market is the increasing standardization of sustainability practices across global supply chains. Regulatory bodies and industry alliances are introducing harmonized guidelines to ensure recyclability, reusability, and material traceability in packaging design. Organizations such as the Ellen MacArthur Foundation and ISO (International Organization for Standardization) are working with governments to establish measurable criteria for circular packaging compliance. This trend drives companies to adopt uniform material specifications, improve waste collection infrastructure, and integrate digital tracking technologies like blockchain for transparency. As multinational corporations align with these evolving standards, the market is experiencing greater consistency in circular packaging solutions, fostering cross-border trade in sustainable materials and reducing inefficiencies in waste management.

Drivers, Opportunities & Restraints

The enforcement of Extended Producer Responsibility (EPR) regulations is a significant driver propelling the market. Governments worldwide are shifting waste management's financial and operational burden onto packaging producers, requiring them to design products with end-of-life recovery in mind. Countries such as Germany, Canada, and Japan have introduced stringent EPR frameworks mandating manufacturers to ensure recyclability, fund collection programs, and adopt post-consumer recycled (PCR) content. This legislative push is compelling businesses to redesign packaging formats, invest in closed-loop recycling infrastructure, and collaborate with material recovery firms. As EPR compliance becomes a key cost factor, companies that proactively integrate circular packaging strategies are gaining competitive advantages through regulatory alignment, reduced waste disposal expenses, and enhanced brand reputation among environmentally conscious consumers.

The increasing demand for bio-based and compostable packaging presents a major opportunity for innovation and market expansion. As businesses seek alternatives to petroleum-based plastics, advancements in materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and fiber-based composites are gaining momentum. Foodservice, personal care, and e-commerce industries are driving adoption due to their need for sustainable yet functional packaging solutions. Companies investing in bio-based material R&D and scalable production technologies are well-positioned to capitalize on this shift, particularly as regulatory frameworks incentivize compostable packaging in the food and agricultural sectors. However, achieving cost parity with traditional plastics and ensuring widespread composting infrastructure remain crucial factors in accelerating adoption.

Despite the strong momentum behind circular packaging, inadequate recycling and waste collection infrastructure remains a key restraint to market growth. Many developing economies lack efficient material recovery systems, leading to high contamination rates and low recyclability of packaging waste. Even in advanced markets, fragmented collection policies and insufficient investment in advanced sorting technologies create bottlenecks in the recycling process. This limitation undermines the economic viability of circular packaging models, as manufacturers face inconsistent access to high-quality recycled materials. To address this challenge, public-private partnerships and technological interventions, such as AI-driven sorting and chemical recycling, are critical in bridging the infrastructure gap and ensuring the effective implementation of circular packaging principles.

Material Insights

Paper & cardboard dominated the market across the product segmentation in terms of revenue, accounting for a market share of 40.08% in 2024 driven by advancements in fiber recovery and recycling technologies, allowing manufacturers to enhance the durability and reusability of paper-based packaging. Companies are adopting improved pulping and deinking processes to recover high-quality fibers from post-consumer waste, reducing the reliance on virgin materials. Governments and industry stakeholders also invest in closed-loop recycling systems, ensuring that paper packaging maintains its structural integrity over multiple recycling cycles. This innovation is particularly significant as brands across retail and e-commerce increase their demand for sustainable, biodegradable alternatives to plastic-based packaging solutions.

In the plastic segment, the rise of chemical recycling is playing a pivotal role in driving circular packaging adoption. Unlike traditional mechanical recycling, which degrades polymer quality over time, chemical recycling breaks down plastic waste into virgin-equivalent raw materials, making it possible to achieve higher purity and performance in recycled plastics. This technology is gaining traction as companies seek to meet ambitious recycled content targets set by regulatory bodies and sustainability commitments. With major investments from global packaging firms and petrochemical companies, the scalability of chemical recycling is improving, allowing for greater integration of high-quality recycled plastics in industries such as food packaging, healthcare, and consumer goods.

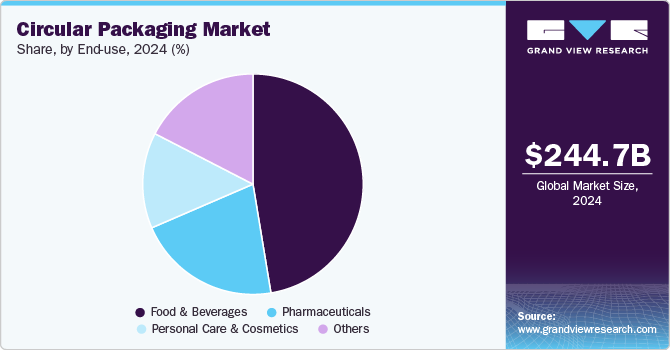

End-use Insights

Food and beverages dominated the market across the end-use segmentation in terms of revenue, accounting for a market share of 47.40% in 2024. The food and beverages sector is experiencing a strong regulatory push toward recyclable and compostable packaging, driving the adoption of circular packaging solutions. Governments worldwide enforce stricter laws on single-use plastics, mandating that food brands and packaging manufacturers incorporate biodegradable, fiber-based, or recycled-content materials. New labeling standards are also being introduced to ensure consumers can correctly dispose of packaging waste, reducing landfill accumulation. With major food chains, beverage brands, and retailers aligning with these regulations, the market for sustainable packaging solutions is expanding, accelerating investments in material innovation and closed-loop recycling systems.

In the personal care and cosmetics industry, leading brands are shifting towards circular packaging through in-house sustainability initiatives and innovative refillable packaging models. Companies are redesigning product packaging to incorporate refill stations, reusable containers, and mono-material designs that simplify recycling. Luxury and mass-market beauty brands are setting ambitious sustainability targets, phasing out complex multi-layer plastic packaging in favor of recyclable glass, bio-based materials, and post-consumer recycled plastics. These efforts meet consumer demand for sustainable beauty products and align with broader corporate ESG (Environmental, Social, and Governance) commitments, strengthening brand reputation in a highly competitive market.

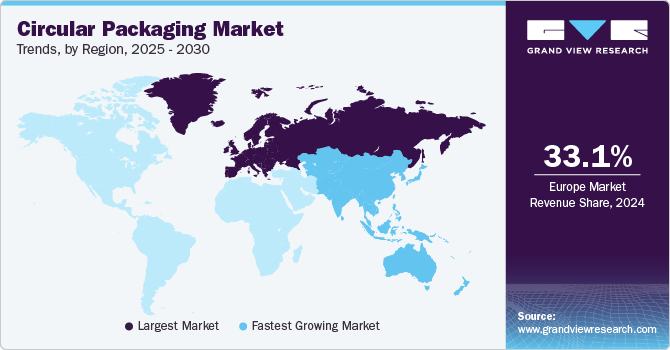

Regional Insights

Europe dominated the global circular packaging market and accounted for the largest revenue share of 33.10% in 2024. Europe is at the forefront of circular packaging adoption, driven by stringent EU regulations under the Circular Economy Action Plan (CEAP) and the European Green Deal. The EU’s Packaging and Packaging Waste Regulation (PPWR) imposes strict recyclability criteria, sets minimum recycled content requirements, and mandates reusable packaging targets across various industries. These policies are compelling businesses to redesign packaging formats, increase investments in post-consumer recycled (PCR) materials, and collaborate on cross-border recycling initiatives.

Germany Circular Packaging Market Trends

Germany circular packaging market is growing significantly over the forecast period. Germany’s leadership in circular packaging is driven by its highly efficient deposit return system (DRS) and advanced closed-loop recycling infrastructure. The country’s well-established Pfand system, which incentivizes consumers to return used beverage containers for recycling, has achieved collection rates exceeding 90%. Furthermore, Germany’s Packaging Act (VerpackG) mandates strict recycling and eco-design requirements, forcing businesses to eliminate unnecessary packaging and enhance material recyclability. German companies also invest in digital product passports and track-and-trace solutions to improve material transparency and facilitate circular supply chains. With continuous regulatory pressure and industry collaboration, Germany remains a global benchmark for circular packaging practices

North America Circular Packaging Market Trends

The circular packaging market in North America is being driven by aggressive sustainability commitments from multinational corporations aiming for net-zero waste and reduced plastic dependency. Major consumer goods companies, retailers, and food service chains are setting ambitious targets to increase the use of recycled content, phase out non-recyclable materials, and develop closed-loop packaging systems. This corporate push is supported by collaborative initiatives such as the U.S. Plastics Pact and the Canada Plastics Pact, which are accelerating industry-wide transitions toward circular packaging.

The circular packaging market in the U.S. is expected to grow significantly over the forecast period. In the U.S., government incentives and funding for recycling infrastructure are key drivers for circular packaging adoption. The Bipartisan Infrastructure Law allocated billions of dollars to improve waste collection, expand material recovery facilities (MRFs), and advance composting programs. Additionally, state-level initiatives such as California’s SB 54 and New York’s Extended Producer Responsibility (EPR) laws require packaging producers to finance and manage the lifecycle of their products, pushing companies to prioritize recyclable and reusable packaging solutions. As federal and state agencies continue supporting circular economy initiatives, businesses rapidly develop innovative packaging materials and invest in eco-friendly supply chains to stay compliant and competitive..

Asia Pacific Circular Packaging Market Trends

The circular packaging market in the Asia Pacific is expanding due to increasing consumer awareness and retailer-driven sustainability initiatives. Leading e-commerce and FMCG companies in countries such as China, India, and Japan are adopting sustainable packaging as part of their corporate responsibility strategies to address growing environmental concerns. Regulatory policies, including China’s plastic waste restrictions and India’s ban on single-use plastics, further accelerate this shift.

Key Circular Packaging Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Loop Industries, TerraPak, Amcor plc, Sealed Air, DS Smith, Mondi plc, Smurfit Kappa, Berry Global, and Huhtamaki. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their types' performance, cost-effectiveness, and sustainability.

Key Circular Packaging Companies:

The following are the leading companies in the circular packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Loop Industries

- TerraPak

- Amcor plc

- Sealed Air

- DS Smith

- Mondi plc

- Smurfit Kappa

- Berry Global

- Huhtamaki

- ecoSPIRITS

Recent Developments

-

In January 2025, SIG partnered with the Ellen MacArthur Foundation to promote circular packaging systems. This collaboration allowed SIG to utilize the Foundation's expertise to reduce waste, improve recyclability, and increase the use of renewable materials.

-

In August 2024, Unilever, USAID, and EY launched The CIRCLE Alliance in June to promote packaging circularity and reduce plastic waste. With a commitment of USD 21 million, the initiative supports small businesses and entrepreneurs in the plastics value chain, particularly women in the informal waste sector in the Global South. CIRCLE aims to reduce plastic use, manage waste, and foster circular economies, initially focusing on India, Indonesia, Vietnam, and the Philippines.

Circular Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 259.12 billion

Revenue forecast in 2030

USD 351.69 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Loop Industries; TerraPak; Amcor plc; Sealed Air; DS Smith; Mondi plc; Smurfit Kappa; Berry Global; Huhtamaki; ecoSPIRITS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circular Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global circular packaging market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper & Cardboard

-

Plastic

-

Metal

-

Glass

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global circular packaging market size was estimated at USD 244.72 billion in 2024 and is expected to reach USD 259.12 billion in 2025.

b. The global circular packaging market is expected to grow at a compound annual growth rate of 6.30% from 2025 to 2030 to reach USD 351.69 billion by 2030.

b. Consumers are increasingly demanding eco-friendly packaging, pushing brands to adopt recyclable, reusable, and biodegradable materials. This shift is driving companies to invest in circular packaging solutions to enhance brand loyalty and meet sustainability expectations.

b. Some key players operating in the Electronic Packaging market Loop Industries, TerraPak, Amcor plc, Sealed Air, DS Smith, Mondi plc, Smurfit Kappa, Berry Global, and Huhtamaki.

b. Paper & cardboard dominated the circular packaging market across the product segmentation in terms of revenue, accounting for a market share of 40.08% in 2024 driven by advancements in fiber recovery and recycling technologies, allowing manufacturers to enhance the durability and reusability of paper-based packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.