- Home

- »

- Plastics, Polymers & Resins

- »

-

Clinical Trial Packaging Market Size, Industry Report, 2030GVR Report cover

![Clinical Trial Packaging Market Size, Share & Trends Report]()

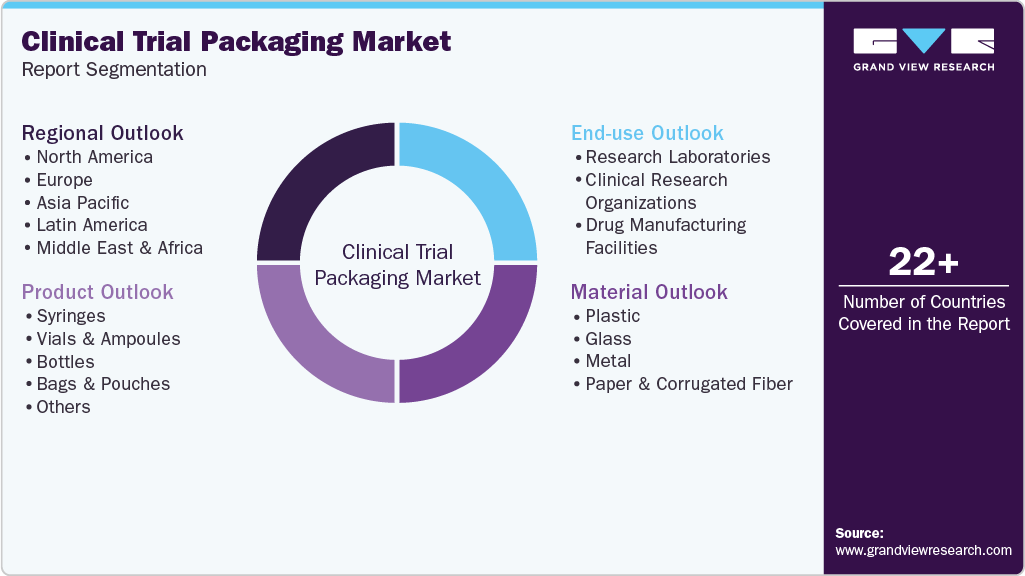

Clinical Trial Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Glass, Metal, Paper & Corrugated Fiber), By Product (Syringes, Vials & Ampoules, Bottles), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-599-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Packaging Market Summary

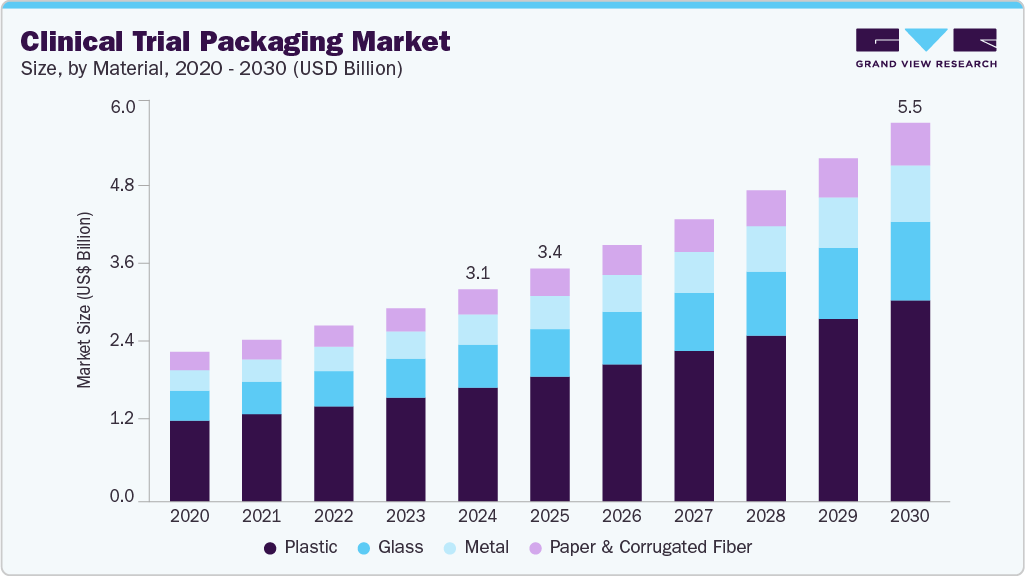

The global clinical trial packaging market size was estimated at USD 3.06 billion in 2024 and is projected to reach USD 5.46 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The market growth is driven by the rising number of clinical trials globally and the growing demand for specialized, temperature-sensitive, and compliant packaging solutions.

Key Market Trends & Insights

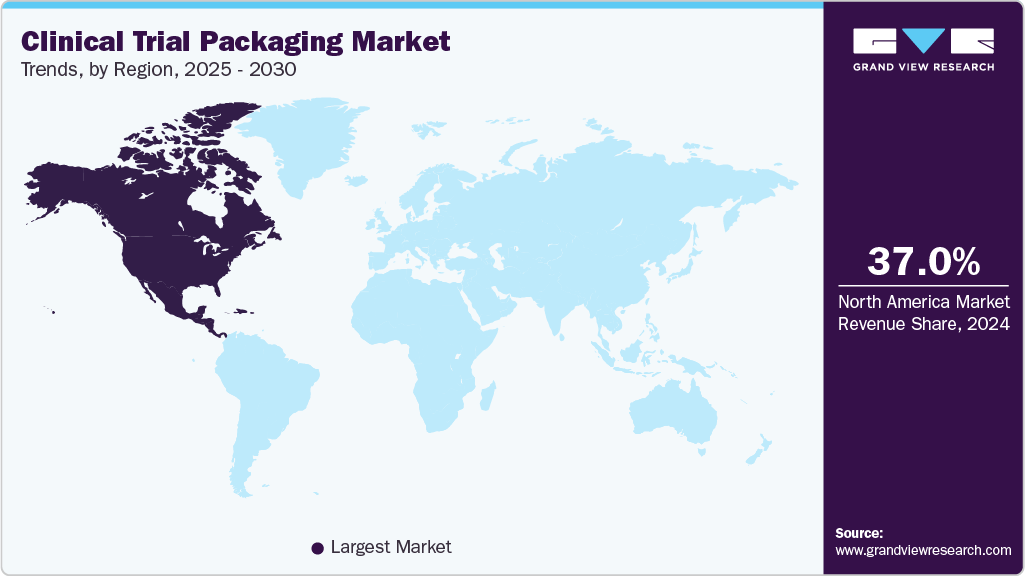

- North America dominated the clinical trial packaging market and accounted for the largest revenue share of over 37.0% in 2024.

- The U.S. leads in clinical trial packaging industry due to its high R&D expenditure, complex trial designs, and regulatory requirements.

- In terms of material segment, the plastic material segment recorded the largest revenue share of over 53.0% in 2024.

- In terms of product segment, the vials & ampoules segment recorded the largest market revenue share of over 31.0% in 2024.

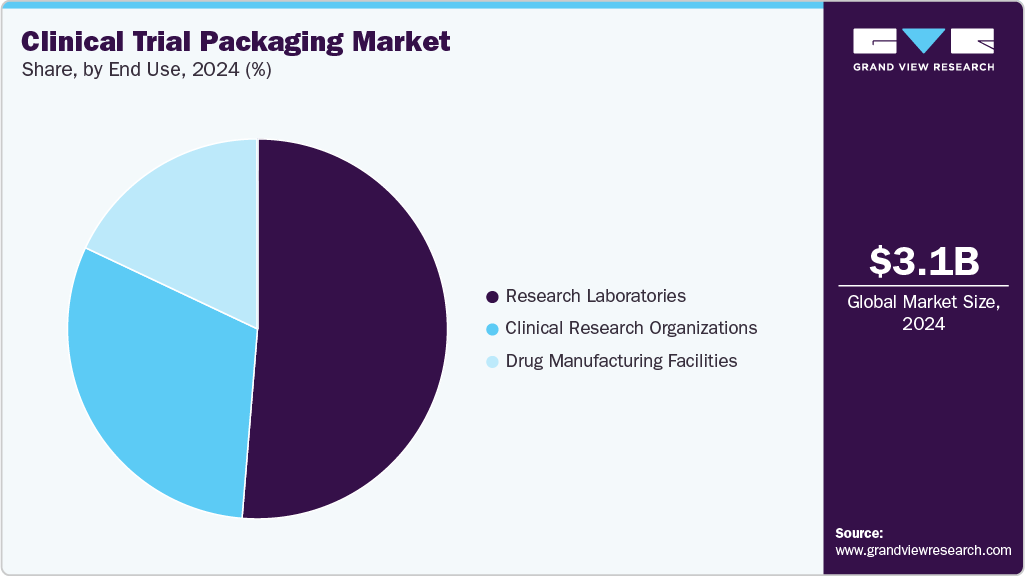

- In terms of end use segment, the research laboratories segment recorded the largest market share of over 51.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.06 Billion

- 2030 Projected Market Size: USD 5.46 Billion

- CAGR (2025-2030): 10.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region market

Increasing regulatory scrutiny and the complexity of trial protocols also necessitate secure and adaptive packaging formats. The clinical trial packaging industry’s growth is primarily driven by the rising number of clinical trials globally, spurred by growing investments in pharmaceutical R&D and the surge in novel drug development. With regulatory agencies such as the FDA and EMA pushing for stringent safety and efficacy evaluations, the demand for well-structured and compliant clinical trials has intensified. For example, the increasing development of personalized medicines, biologics, and vaccines, especially during events such as the COVID-19 pandemic, has led to a sharp increase in the volume and complexity of clinical trials, which in turn necessitates specialized packaging solutions that can handle cold chain requirements, small-batch formats, and adaptive trial designs.

The growing complexity of clinical trials, particularly due to the rise in global, multi-site studies and adaptive trial methodologies, is also contributing to the market growth. These studies require sophisticated packaging solutions that ensure drug stability, accurate dosing, and traceability across multiple geographic locations and time zones. As trials increasingly include decentralized and remote components, such as direct-to-patient drug distribution, packaging must evolve to ensure tamper-evidence, patient compliance, and secure labeling. For example, packaging that includes smart labels or integrated RFID tags is gaining traction, allowing sponsors to monitor conditions such as temperature and humidity in real time throughout the distribution chain.

Regulatory compliance and serialization mandates are also key factors driving the clinical trial packaging market. Clinical trial materials must meet rigorous standards for labeling, documentation, and tracking, especially in Phase III trials and those involving controlled substances. This has encouraged the adoption of standardized, GMP-compliant packaging formats that support both blinding and randomization while also facilitating traceability and audit-readiness. For instance, Europe’s Falsified Medicines Directive (FMD) and the U.S. Drug Supply Chain Security Act (DSCSA) require serialized packaging and aggregation, which adds to the complexity and importance of compliant packaging in trials.

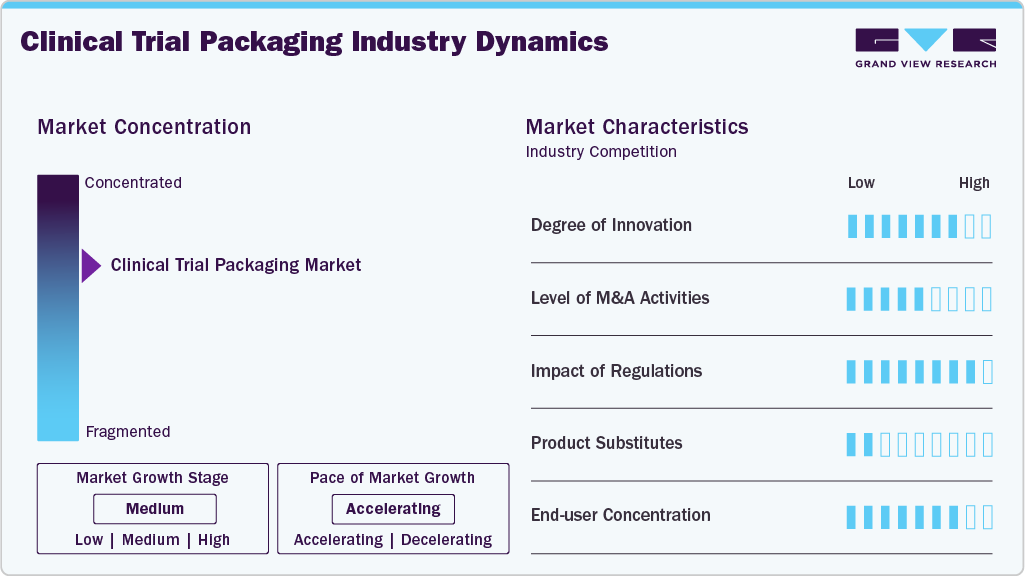

Market Concentration & Characteristics

Clinical trial packaging is a specialized segment of the pharmaceutical packaging industry, designed to meet the stringent requirements of clinical research. Unlike commercial packaging, it must accommodate complex study designs, including blinding, randomization, and varying dosage regimens. Each trial may involve unique packaging configurations, such as placebo-controlled or multi-arm studies, requiring flexibility in design and execution. Additionally, clinical trial packaging must comply with Good Manufacturing Practices (GMP) and international regulatory standards to ensure patient safety and data integrity.

A key characteristic of clinical trial packaging is its high level of customization. Packaging must be tailored to the specific needs of each trial, including language-specific labeling for global studies, temperature-sensitive materials for biologics, and child-resistant features for certain patient populations. Serialization and track-and-trace technologies are often incorporated to maintain supply chain integrity. Furthermore, packaging designs must facilitate easy use by patients and healthcare providers while ensuring blinding is maintained to prevent bias in trial results.

The industry is also marked by tight timelines and variable demand. Clinical trials often face delays or protocol changes, requiring packaging suppliers to adapt quickly. Small batch production is common, as trials may involve limited patient cohorts or phased rollouts. Just-in-time manufacturing and inventory management are critical to avoid waste and ensure timely delivery to global trial sites. This dynamic environment demands close collaboration between sponsors, contract research organizations (CROs), and packaging providers.

Material Insights

The plastic material segment recorded the largest revenue share of over 53.0% in 2024. Plastic is a widely used material in clinical trial packaging due to its versatility, lightweight nature, and cost-effectiveness. It is commonly used for bottles, pouches, and vials. The increasing need for sterile, single-use packaging solutions in trials and rising clinical research activities in emerging economies further bolster plastic’s dominance. Additionally, innovations in biodegradable and recyclable plastics are addressing sustainability concerns, widening their acceptance in regulatory-compliant packaging.

The metal segment is expected to grow at the fastest CAGR of 11.1% during the forecast period. Metal, particularly aluminum, is utilized in clinical trial packaging for its exceptional barrier properties, mechanical strength, and light-proof characteristics. It is commonly found in foil pouches and canisters. Metal ensures that drugs remain protected from light, moisture, and gases throughout the clinical trial process. The need for high barrier protection and extended drug shelf life primarily drives the use of metal in clinical trial packaging.

Product Insights

The vials & ampoules segment recorded the largest market revenue share of over 31.0% in 2024 and is expected to grow at the fastest CAGR of 10.8% during the forecast period. Vials and ampoules are the most used primary packaging formats in clinical trials due to their versatility in holding liquid, lyophilized, and powder-based drugs. Vials offer reusability and resealing features, while ampoules provide a tamper-proof single-use solution. They are widely used in early-phase trials and for drugs requiring long-term stability. Growth in parenteral drug development and temperature-sensitive biologics also fuels the need for durable, inert packaging such as vials and ampoules.

Bottles, made from glass or high-grade plastic, are used for packaging oral liquids, capsules, and tablets in clinical trials. Their design allows for easy labeling and dosage administration, making them a preferred choice for outpatient clinical trial settings and long-term medication regimes. Rising demand for oral drug formulations in clinical trials, coupled with the need for cost-effective, tamper-evident packaging solutions, supports the use of bottles.

End Use Insights

The research laboratories segment recorded the largest market share of over 51.0% in 2024. Research laboratories are key stakeholders in early-stage drug development, responsible for preclinical and clinical testing. These laboratories require specialized clinical trial packaging solutions to ensure sample integrity, compliance with regulatory standards, and efficient identification during complex trials. They primarily handle small-batch packaging for trial samples, reagents, and investigational drugs under controlled environments.

The clinical research organizations segment is projected to grow at the fastest CAGR of 10.8% during the forecast period. CROs are third-party service providers that manage clinical trials for pharmaceutical, biotechnology, and medical device companies. Their involvement ranges from trial design to data management, including packaging and labeling of investigational products. Due to their scale and specialization, CROs often outsource or partner with clinical trial packaging firms to efficiently handle multi-site trials and international regulatory demands. The rising trend of outsourcing clinical trials by pharma and biotech firms to reduce costs and accelerate timelines is a major growth driver.

Regional Insights

North America dominated the clinical trial packaging market and accounted for the largest revenue share of over 37.0% in 2024. This positive outlook is due to its robust pharmaceutical R&D ecosystem, stringent regulatory standards, and high adoption of innovative packaging technologies. The U.S. accounts for nearly 50% of global clinical trials, necessitating reliable and compliant packaging solutions. For instance, the FDA’s emphasis on patient-centric trials has increased demand for smart packaging with tracking capabilities. Additionally, the growth of personalized medicine and orphan drug trials requires specialized packaging, such as small-batch, high-precision labeling. Companies such as Catalent and PCI Pharma Services provide advanced serialization and anti-counterfeiting solutions to meet these demands.

U.S. Clinical Trial Packaging Market Trends

The U.S. leads in clinical trial packaging industry due to its high R&D expenditure, complex trial designs, and regulatory requirements. The growth of decentralized clinical trials (DCTs) has increased demand for direct-to-patient packaging with tamper-evident features. Companies such as Thermo Fisher Scientific offer integrated packaging and logistics solutions for DCTs.

Europe Clinical Trial Packaging Market Trends

Europe is a major hub in the clinical trial packaging industry due to its strong regulatory framework, centralized clinical trial approvals via the EU Clinical Trials Regulation (CTR), and increasing focus on sustainability. Germany and the UK lead in clinical research, with a growing demand for eco-friendly and compliant packaging. Additionally, Europe’s aging population drives trials for chronic diseases, requiring user-friendly packaging for elderly patients, such as easy-open blister packs.

Asia Pacific Clinical Trial Packaging Market Trends

Asia Pacific is projected to grow at the fastest CAGR of 10.8% during the forecast period. This outlook is due to its cost-effective manufacturing, growing pharmaceutical outsourcing, and increasing clinical trial activity. Countries such as India and China offer significant cost savings in packaging and logistics compared to Western markets, attracting global sponsors. Additionally, regulatory reforms, such as China’s National Medical Products Administration (NMPA) streamlining approval processes, have boosted clinical trials. For example, in 2023, China saw a 20% increase in Phase III trials, driving demand for specialized clinical packaging solutions. The rise of biologics and biosimilars in Asia Pacific further fuels the need for advanced packaging, such as temperature-controlled solutions for sensitive drugs.

Key Clinical Trial Packaging Company Insights

The competitive environment of the clinical trials packaging market is characterized by a mix of global packaging giants and specialized niche players, all striving to meet the stringent regulatory, safety, and logistical demands of the pharmaceutical industry. Key players compete on factors such as innovation in temperature-controlled and tamper-evident solutions, compliance with international regulations (such as FDA, EMA, and ICH guidelines), and capabilities in just-in-time and small-batch production for personalized medicine trials.

The competition is further intensified by increasing outsourcing to contract packaging organizations (CPOs) and the rise of decentralized clinical trials, which require more agile and technology-driven packaging solutions. This environment fosters continuous investment in smart packaging, sustainability, and automation to gain a competitive edge.

-

In April 2025, Gerresheimer AG announced the launch of complete silicone-oil- and PFAS-free syringe systems, developed in cooperation with Injecto Group A/S, featuring both glass and cyclic olefin polymer (COP) options. By eliminating silicone oil, these ready-to-fill syringes significantly reduce particle load, thereby minimizing potential medical risks and side effects, making them especially suitable for sensitive biologics and high-demand applications such as ophthalmology.

-

In October 2024, Nipro launched its D2F (Direct-to-Fill) glass vials, powered by Stevanato Group’s advanced EZ-fill technology, to provide the pharmaceutical industry with a high-quality, ready-to-use (RTU) packaging solution designed for aseptic fill-finish processes. This innovative packaging solution aims to improve mechanical durability, lower downtime, and decrease rejection rates during quality inspections.

Key Clinical Trial Packaging Companies:

The following are the leading companies in the clinical trial packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Clinigen Limited

- PCI Pharma Services

- Yourway

- WestRock Company

- Oliver

- CCL Industries Inc.

- Sharp Services, LLC

- SCHOTT Pharma

- Gerresheimer AG

- Borosil Scientific

- Nipro

Clinical Trial Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.36 billion

Revenue forecast in 2030

USD 5.46 billion

Growth Rate

CAGR of 10.2% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Thermo Fisher Scientific Inc.; Clinigen Limited; PCI Pharma Services; Yourway; WestRock Company; Oliver; CCL Industries Inc.; Sharp Services, LLC; SCHOTT Pharma; Gerresheimer AG; Borosil Scientific; Nipro

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Plastic

-

Glass

-

Metal

-

Paper & Corrugated Fiber

-

-

Product Outlook (Revenue, USD Million 2018 - 2030)

-

Syringes

-

Vials & Ampoules

-

Bottles

-

Bags & Pouches

-

Others

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Research Laboratories

-

Clinical Research Organizations

-

Drug Manufacturing Facilities

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global clinical trial packaging market was estimated at around USD 3.06 billion in the year 2024 and is expected to reach around USD 3.36 billion in 2025.

b. The global clinical trial packaging market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach around USD 5.46 billion by 2030.

b. Research laboratories emerged as the dominating end-use segment in the clinical trial packaging market due to their high involvement in early-phase trials and frequent handling of diverse sample types. Their need for specialized, secure, and compliant packaging drives demand in this segment.

b. The key players in the clinical trial packaging market include Thermo Fisher Scientific Inc., Clinigen Limited, PCI Pharma Services, Yourway, WestRock Company, Oliver, CCL Industries Inc., Sharp Services, LLC, SCHOTT Pharma, Gerresheimer AG, Borosil Scientific, and Nipro.

b. The clinical trial packaging market is driven by the increasing number of clinical trials globally and the rising demand for specialized, tamper-evident, and regulatory-compliant packaging. Growth in biologics and personalized medicine further fuels the need for advanced packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.