- Home

- »

- Medical Devices

- »

-

Clinical Trials Support Services Market, Industry Report 2033GVR Report cover

![Clinical Trials Support Services Market Size, Share & Trends Report]()

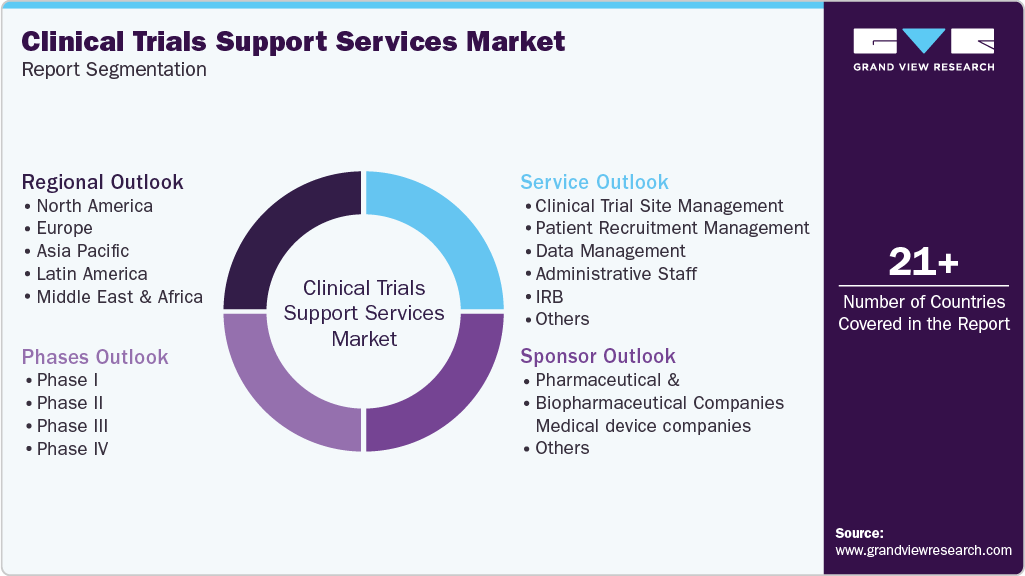

Clinical Trials Support Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Phases (Phase I, Phase II, Phase III, Phase IV), By Service, By Sponsor, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-475-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trials Support Services Market Summary

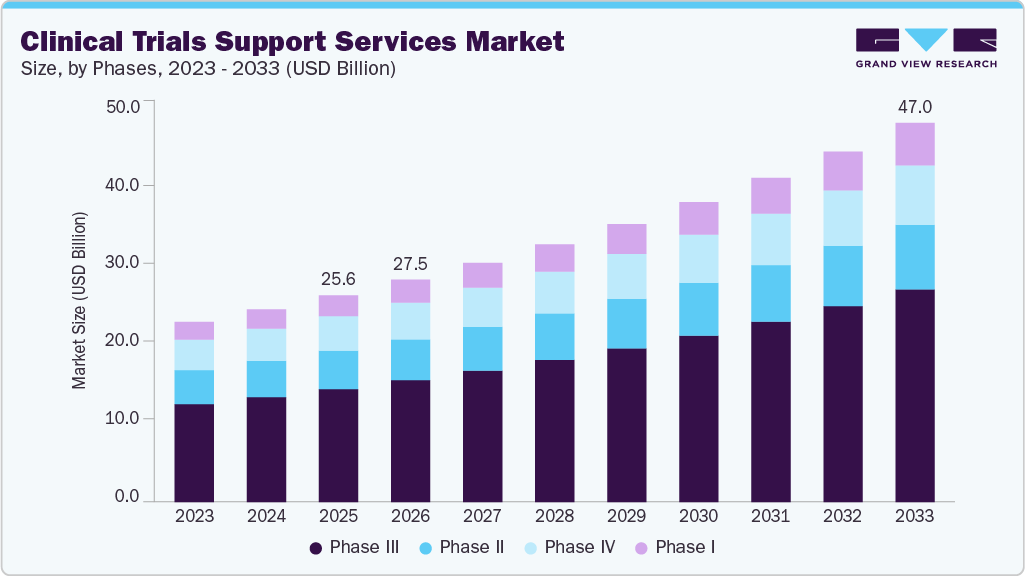

The global clinical trials support services market size was estimated at USD 25.62 billion in 2025 and is projected to reach USD 47.00 billion by 2033, growing at a CAGR of 7.93% from 2026 to 2033. The global market is projected to expand rapidly due to rising demand for trials in emerging economies, increasing R&D investment, and a growing number of contract research organizations (CROs).

Key Market Trends & Insights

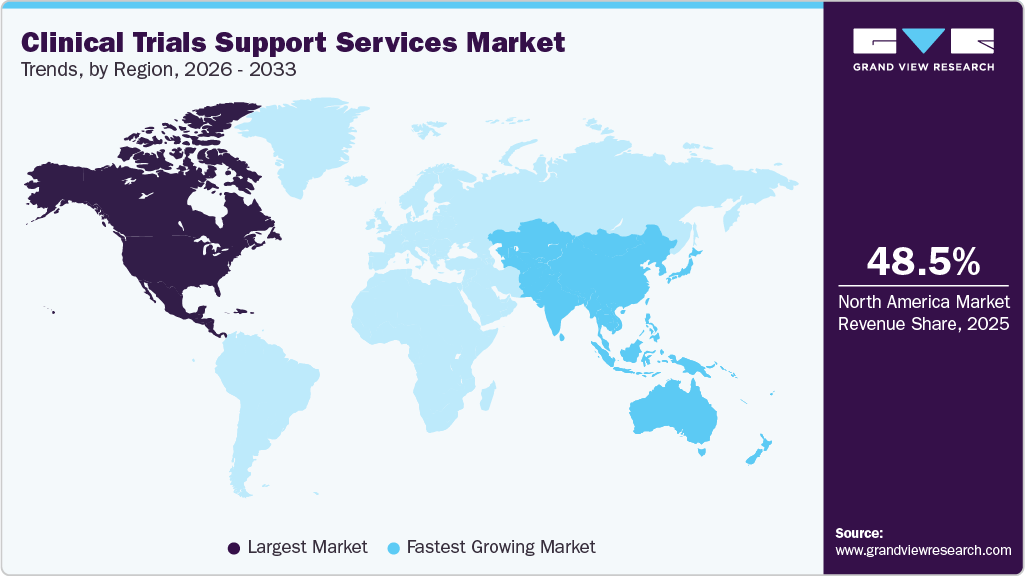

- North America dominated the global clinical trials support services market with the largest revenue share of 48.50% in 2025.

- The clinical trials support services industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on phases, the phase III segment accounted for the largest market revenue share in 2025.

- Based on service, the clinical trial site management segment accounted for the largest market revenue share in 2025.

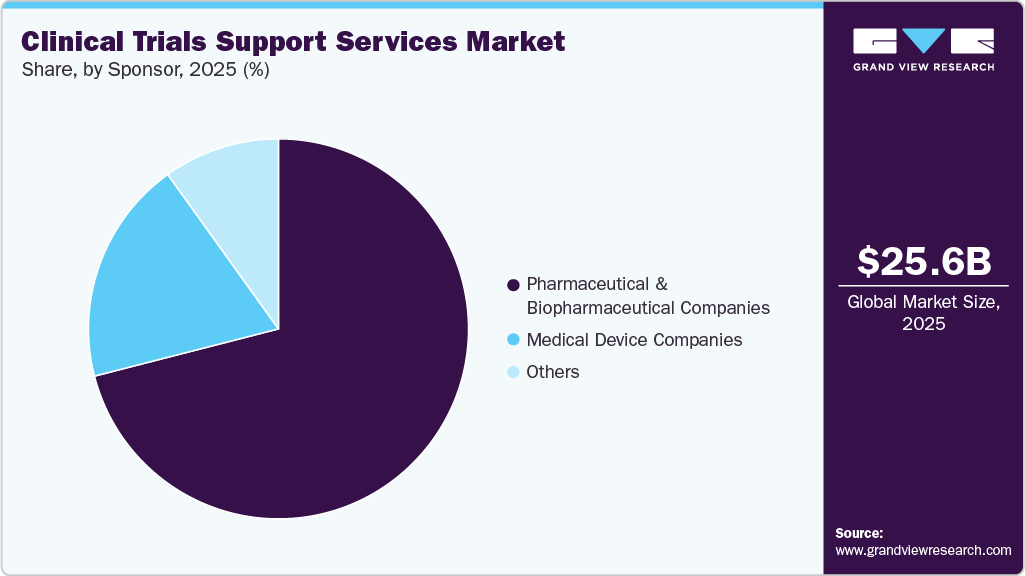

- Based on sponsor, the pharmaceutical & biopharmaceutical companies segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 25.62 Billion

- 2033 Projected Market Size: USD 47.00 Billion

- CAGR (2026-2033): 7.93%

- North America: Largest market in 2024

- Asia Pacific: Second Fastest growing market

The pharmaceutical firms’ (R&D) venture has been steadily growing every year, mainly due to patent expirations. An ordinary patent terminates after 20 years; in the pharmaceutical area, there is an arrangement that provides for the entry of a generic version of the medication into the market following a period of 10 years. Thus, companies are increasing their R&D investments to accelerate the development of drugs, thereby expanding the entire market.Clinical trials support services are quite useful in the event of a drug, such as assay design and clinical testing. It also covers tasks such as strengthening clinical test locations, securing and storing research medications, calculating drug dosages, and handling kits. Preclinical groundwork and research are supported by clinical test services, which include clinical test site assistance, obtaining & storing study drugs, blinding of drugs for studies, patient recruitment, coordination, and reconciliation of returned medications.

In addition, growing adoption of new technologies has fueled market growth. Many software tools for data management are referred to as “Clinical Data Management” (CDM) systems. Multicentric trials require CDM systems to handle massive volumes of data. The majority of CDM systems used by pharmaceutical companies are commercial, but a few open-source tools are also available. Oracle Clinical, Clintrial, Oracle Clinical, Macro, RAVE, and eClinical Suite are common CDM tools. Maintaining an audit record of data management actions is important in regulatory submissions. These CDM tools help ensure the audit trail and manage discrepancies. The CDM activities include data collection, CRF annotation, CRF tracking, database design, data entry, medical coding, data validation, discrepancy management, and database lock.

Opportunity Analysis

Clinical trial support services are experiencing significant growth driven by several factors, including increasing investment in R&D activities, a growing range of biologics in the pipeline, and the complexity of protocols, which are creating a need for specialized expertise. As a result, pharmaceutical and biotech companies are outsourcing a broader range of activities, including site management, patient recruitment, data analytics, and regulatory documentation. This outsourcing helps accelerate timelines and lessen operational burdens. Furthermore, the increasing number of decentralized and hybrid trial models is further driving the demand for digital platforms, remote monitoring tools, and solutions that facilitate virtual engagement with patients. Moreover, emerging markets are becoming increasingly attractive for cost-effective trials, which are expected to drive the global expansion of investigators' networks and diverse patient populations, further contributing to market growth. Furthermore, regulatory harmonization and a growing focus on real-world evidence are opening new opportunities for service providers to offer integrated, comprehensive support for clinical development.

Impact of U.S. Tariffs on the Global Clinical Trials Support Services Market

U.S. tariffs have shown a notable impact on the global clinical trials support services industry, attributed to rising operational costs, disruptions to supply chains, and hindrances to cross-border collaborations. Besides, among clinical research organizations (CROs) and sponsors, increased import duties on medical devices, laboratory consumables, and digital equipment have resulted in increased expenses during trial execution. In addition, growing fluctuations in the costs of raw materials and technology, driven by these tariffs, have led to a significant impact on outsourced testing, data management, and logistics services. Thus, to mitigate tariff exposure, global companies are increasingly considering relocating trial sites or supplier bases, which can alter the geographic distribution of trials.

Moreover, tariffs have introduced the regulatory uncertainties that extend both contracting and procurement timelines. While some U.S. domestic service providers might find opportunities through reshoring, multinational CROs face pressure on their profit margins. Thus, growing competitive scenarios in clinical trials support services, along with the rising need to refine their sourcing strategies, diversify their supply partners, and renegotiate contracts, are contributing to market growth. Such factors are expected to drive the market growth over the estimated time period.

Technological Advancements

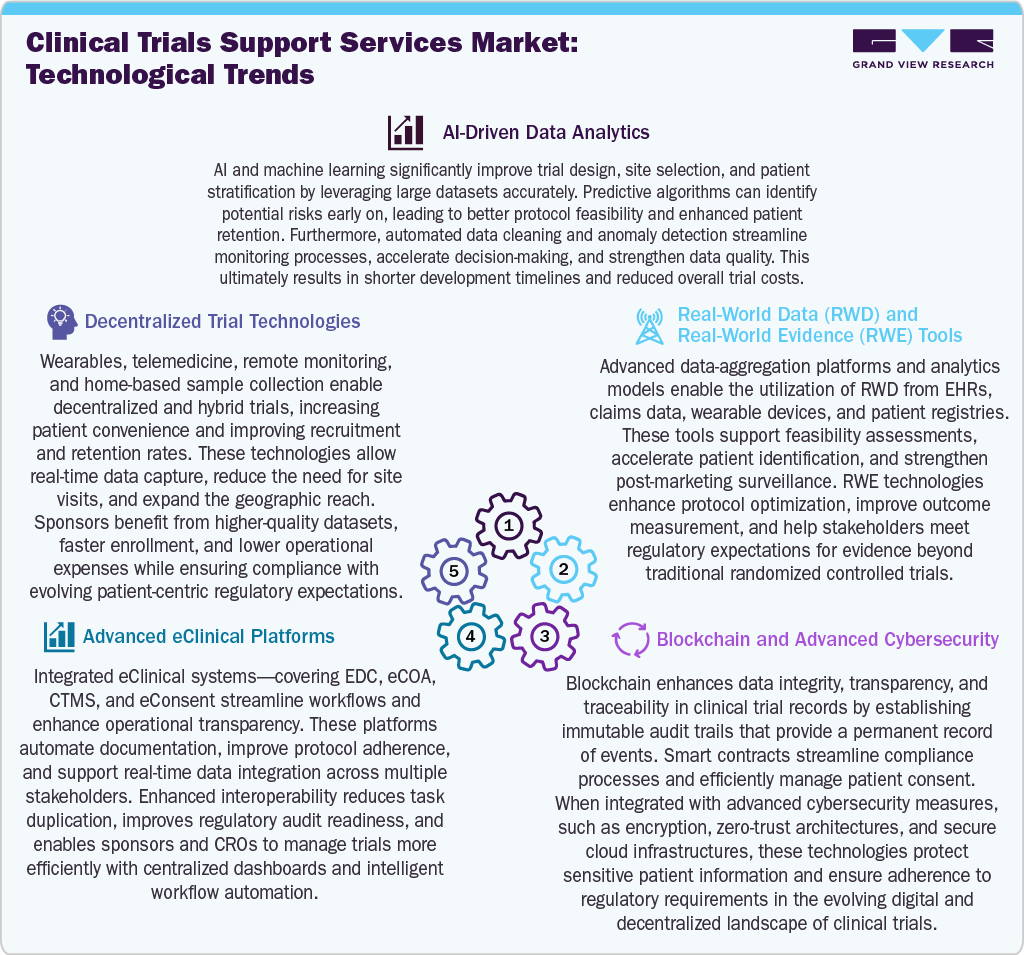

Technological advancements are transforming clinical trials support services by enhancing efficiency, accuracy, and patient engagement. AI-driven analytics optimize protocol design, site selection, and risk prediction, while decentralized trial technologies, including wearable devices, telemedicine, and remote monitoring, enhance recruitment and facilitate real-time data capture. In addition, the increased adoption of integrated eClinical platforms streamlines operations through automated documentation, interoperability, and centralized dashboards, contributing to market growth. Besides, the real-world data and evidence tools improve feasibility assessments, patient identification, and outcome measurement by leveraging EHRs, claims data, and registries.

Moreover, blockchain and advanced cybersecurity technologies enhance data integrity, consent management, and regulatory compliance by utilizing immutable audit trails and secure architectures. Thus, these innovations reduce trial timelines, improve data quality, expand patient access, and support the shift toward digital, patient-centric clinical development models.

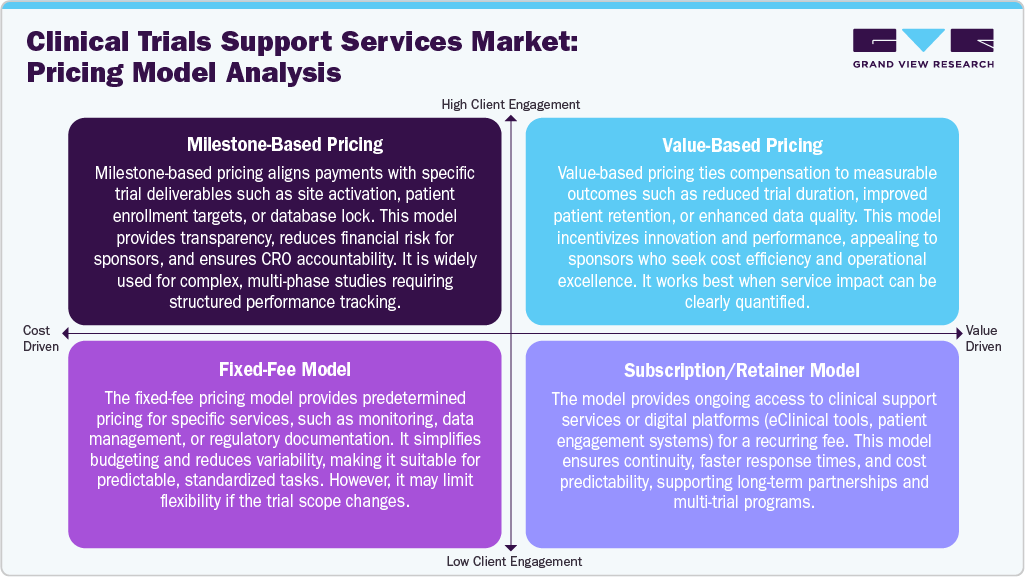

The clinical trials support services industry employs a range of pricing models to cater to diverse sponsor requirements and project complexities. Milestone-based pricing ties payments to specific deliverables, such as patient enrollment, site initiation, or database lock, promoting transparency and accountability in performance. Value-based pricing aligns compensation with tangible outcomes, such as faster timelines, improved data quality, or enhanced patient retention, motivating CROs to optimize operational efficiencies. The fixed-fee model offers costs for well-defined activities, making it ideal for routine tasks such as data management or regulatory documentation; however, it may restrict flexibility if project scopes change.

In addition, the subscription or retainer model provides ongoing access to digital platforms, analytics tools, or dedicated support teams for a recurring fee, thereby fueling the long-term collaboration and financial stability across multiple studies. Thus, these models contribute to customized, efficient, and results-oriented trial execution. Such factors are expected to drive the market over the estimated time period.

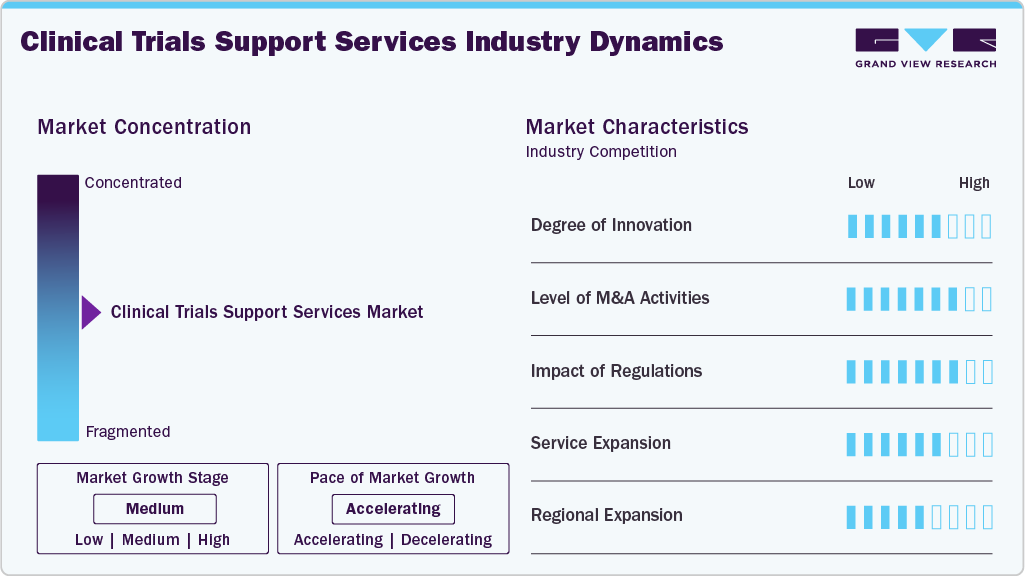

Market Concentration & Characteristics

The market growth stage is medium, and growth is accelerating. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

The clinical trials support services industry is witnessing strong innovation driven by AI-enabled patient recruitment, decentralized trial models, real-time data analytics, and remote monitoring technologies. Companies are integrating wearables, ePRO platforms, and automation to enhance data accuracy, reduce trial timelines, and improve patient engagement, thereby creating a highly dynamic and evolving competitive landscape.

Regulatory bodies such as the FDA, EMA, and local authorities are increasingly emphasizing trial transparency, data integrity, patient safety, and compliance with Good Clinical Practice (GCP). These regulations influence protocol design, documentation, and technology adoption, compelling CROs and service providers to invest in quality management systems and validated digital platforms to remain compliant.

M&A activity in the clinical trials support services industry is rising as large CROs acquire niche service providers to expand capabilities in decentralized trials, biometrics, and specialized therapeutic areas. Consolidation strengthens global delivery networks, enhances technological depth, and enables firms to offer integrated, end-to-end solutions, thereby creating competitive advantages in a rapidly evolving landscape.

The clinical trials support services industry is moderately fragmented, with global CROs, mid-sized firms, and specialized technology providers competing across different service segments. Variability in capabilities, regional presence, and therapeutic expertise creates a diverse competitive ecosystem. Emerging digital-first companies further increase fragmentation by introducing innovative patient engagement, data management, and remote monitoring solutions.

Regional expansion is accelerating as CROs broaden operations to leverage faster recruitment, lower trial costs, and growing investigator networks. Companies are establishing strategic partnerships, local site alliances, and technology hubs to strengthen global trial execution and improve access to diverse patient populations.

Phases Insights

The phase III segment led the market with the largest revenue share of 54.6% in 2025. Segment growth is driven by the rising demand for numerous late-stage studies, the increasing prevalence of chronic and rare diseases, and the growing adoption of decentralized clinical trials. In the market, these clinical trial support services facilitate Phase III clinical trials to validate safety and efficacy before regulatory approval. Further, the phase is the most expensive clinical trial, and the failure rate in this phase is the highest due to the sample size, as the study design requires complex dosing at an optimal level. Moreover, the increasing demand for extensive patient recruitment, global site management, and advanced data monitoring is contributing to market growth. Thus, most pharmaceutical companies are heavily relying on CROs to reduce costs, accelerate timelines, and manage complex, multicountry operations. Thus, such factors are expected to drive the market growth.

The phase I segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by an expanding pipeline of innovative drugs, biologics, and cell & gene therapies, as well as growing investment in oncology, immunology, and research activities related to rare diseases. In the market, most sponsors rely on CROs for study startup, healthy volunteer recruitment, rigorous safety monitoring, sample collection management, early-phase patient screening, data management, assay redesign & and other services, which further drive market growth. Furthermore, the increasing demand for outsourcing Phase I clinical trials is expected to drive market growth.

Service Insights

The clinical trial site management segment accounted for the largest market revenue share in 2025. The segment growth is driven by a rising number of clinical trials, high prevalence of chronic diseases, and an increase in the number of CROs offering services. In addition, the increasing complexity of protocols, higher volumes of studies, and the necessity for efficient coordination among global trial sites are contributing to market growth. Further, many sponsors are shifting towards specialized site management services to ensure consistent compliance with Good Clinical Practice (GCP), minimize operational bottlenecks, and enhance site performance. Moreover, digital tools such as remote monitoring, Electronic Investigator Site Files (eISF), and site performance analytics are strengthening both the quality and efficiency of site management. Thus, these factors are expected to drive the market over the estimated time period.

The patient recruitment management segment is expected to experience at the fastest CAGR during the forecast period. The segment growth is driven by the rising complexity of clinical trials, strict enrollment timelines, and the increasing requirement for diverse and representative patient populations. Besides, the growing prevalence of chronic diseases and the rising demand for efficient recruitment pathways are expected to drive market growth. Moreover, most sponsors are focusing on accelerating enrollment, enhancing patient retention, and reducing trial delays with the support of clinical trial services. Such factors are expected to drive the market over the estimated time period.

Sponsor Insights

The pharmaceutical & biopharmaceutical companies segment accounted for the largest market revenue share in 2025. This can largely be attributed to the expanding R&D pipelines in oncology, immunology, rare diseases, and advanced biologics. In addition, the increasing complexity of clinical trials and the growing trend of global multicenter studies prompt sponsors to outsource expertise for faster execution, enhanced regulatory compliance, and improved cost efficiency. In addition, the rising focus on shortening drug development timelines is encouraging the adoption of digital technologies, decentralized trial models, and advanced analytics. Companies also rely on CROs for patient recruitment, site management, data monitoring, and operational scalability. Such factors are expected to drive the market growth over the estimated time period.

The medical device companies’ segment is expected to experience at the fastest CAGR during the forecast period. The segment growth is driven by an increased focus on regulatory requirements, and rising advancements in diagnostics, wearables, minimally invasive devices, and digital health tools are expected to drive the market for efficient feasibility, pivotal, and post-approval studies. In addition, to navigate these complexities, most of the companies are shifting to CROs for services such as patient recruitment, site coordination, data management, and global regulatory navigation. Moreover, most companies are expanding their market presence and reliance on specialized clinical support services, which are expected to drive the market over the estimated time period.

Regional Insights

North America dominated the global clinical trials support services market with the largest revenue share of 48.50% in 2025. The regional growth is driven by the established presence of pharmaceutical and biotechnology R&D companies, an increased volume of clinical trials, and a focus on comprehensive regulatory frameworks that prioritize data quality and patient safety. Besides, the presence of robust infrastructure, skilled investigators, and a growing trend toward digital and decentralized trial technologies is expected to drive market growth. Moreover, the increasing incidence of chronic diseases and the growing need for effective patient recruitment, data management, and site monitoring are likely to drive market growth. In addition, growing investment in innovative therapies, such as biologics and gene therapies, is expected to drive the trend towards outsourcing to CROs for clinical trial support services. Moreover, strong partnerships among industry stakeholders, academic institutions, and technology providers are contributing to market growth.

U.S. Clinical Trials Support Services Market Trends

The clinical trials support services market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by substantial pharmaceutical and biotech R&D investments, an increased density of clinical trials, and strong demand for advanced study execution capabilities. Furthermore, the growing need for sophisticated study execution capabilities and the development of complex biologics, oncology treatments, and therapies for rare diseases necessitate the requirement for patient recruitment, comprehensive data management, and coordinated site solutions, which are expected to drive market growth. Moreover, in the U.S., the regulatory landscape is prioritizing the quality, transparency, and real-time data oversight, which has led to increased adoption of digital and decentralized trial technologies. Furthermore, the growing demand for real-world evidence and precision medicine is expected to drive market growth over the forecast period.

The Canada clinical trials support services market is driven by the increased adoption of support services, including patient-centric clinical research coordination services & support, which advances clinical studies and improves clinical trials across a diverse range of therapeutic areas. Several other factors contributing to market growth include a robust regulatory environment, diverse patient populations, and increasing investments in pharmaceutical and biotech research and development (R&D). Furthermore, the presence of well-established clinical infrastructure, experienced investigators, and high-quality data standards attracts global sponsors, thereby driving market growth. For instance, in January 2023, the Canadian Institutes of Health Research Clinical Trials Fund announced funding from the Minister of the Federal Economic Development Agency for Southern Ontario. The USD 31 million investment will support training programs, new clinical trial projects, and the establishment of the Accelerating Clinical Trials (ACT) Consortium, Canada's first national clinical trials consortium. Such initiatives are expected to drive market growth over the estimated period.

Europe Clinical Trials Support Services Market Trends

The clinical trials support services market in Europe is driven by a robust regulatory framework, a diverse patient population, advanced research infrastructure, and an increased requirement for studies in oncology, neurology, and rare diseases. In addition, growing adoption of decentralized and hybrid trial models is anticipated to enhance efficiency, while digital tools strengthen patient recruitment and site coordination. Moreover, collaboration among academic centers, hospitals, and industry fuels innovation. Rising R&D investments and the need for real-world evidence further accelerate outsourcing to CROs across the region. Such factors are expected to drive the market.

The Germany clinical trials support services market held a significant share in Europe in 2025, owing to the increased focus on regulatory standards, presence of advanced healthcare infrastructure, and highly skilled investigator base. Besides, increasing presence of academic medical centers and specialized research institutions, supporting complex trials in oncology, cardiology, and rare diseases are anticipated to drive the market growth. In addition, high R&D investment from pharmaceutical and biotechnology companies for efficient patient recruitment, data management, and site monitoring are likely to drive the market growth. Moreover, increased digital health and adoption of decentralized trial technologies further strengthen operational efficiency. Such factors are expected to drive the market growth.

The clinical trials support services market in the UK is driven by robust government support, a sophisticated research infrastructure, and a well-trained clinical workforce. In addition, the presence of streamlined regulatory pathways and growing approval frameworks is expected to encourage the study in the market. Moreover, increased demand for oncology, rare diseases, and precision medicine is anticipated to drive the need for efficient patient recruitment, site management, and data services. Furthermore, strong collaboration among the NHS, academic institutions, and industry sponsors continues to boost outsourcing to CROs. Such factors are expected to drive the market growth.

Asia Pacific Clinical Trials Support Services Market Trends

The clinical trials support services market in Asia Pacific is projected to register at the fastest CAGR during the forecast period. This growth can be attributed to large and diverse patient populations, lower trial costs, and increasing research and development investments from global pharmaceutical and biotechnology companies. The growth of the pharmaceutical industry in the China, Japan and India is a key factor contributing to market growth. In addition, the substantial presence of key market players and continuous clinical trials is anticipated to drive market growth for patient recruitment, site management, and data services.Moreover, increased adoption of decentralized trials, digital tools, and real-world evidence collection improves operational efficiency, leading sponsors to increasingly outsource to regional Contract Research Organizations (CROs) enhance the market. Such factors are expected to drive the market.

The Japan clinical trials support services market is driven by various cost-saving clinical trial support services, technological advancements, and growing expertise across disease studies. Such factors are anticipated to drive the Japan market.

The clinical trials support services market in China is driven by the vast patient pool, an increase in clinical trials, low cost of trials, a developed clinical research infrastructure, growing approval of new drugs, technological advancement, a strong hospital network, and the availability of medical practitioners are further boosting the growth of the Asia Pacific market. Also, R&D expenditures made by market players for the creation of new treatments have led to a rise in clinical trial numbers, further fueling the market growth. These clinical trials support services in the country and contribute to advancing clinical research.

The India clinical trials support services market is driven by the presence of key players offering comprehensive support services; the presence of multinational pharmaceutical & biopharmaceutical companies has led to the rise in the requirement for various clinical trial support services. Moreover, the growing medical research and developing pharmaceuticals are further expected to drive market growth in India. Thus, clinical trial activity in the country are expected to drive the market growth.

Key Clinical Trials Support Services Company Insight

The key market players implement several strategic initiatives, such as expansion, acquisitions, partnerships and agreements, collaborations, etc., to increase market presence and gain a competitive edge, driving market growth.

Key Clinical Trials Support Services Companies:

The following are the leading companies in the clinical trials support services market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories International, Inc.

- Wuxi Apptec, Inc.

- Iqvia Holdings, Inc.

- Syneos Health, Inc.

- Eurofins Scientific

- PPD, Inc. (Pharmaceutical Product Development)

- Icon Plc

- Laboratory Corporation of America Holdings (Labcorp)

- Alcura

- Parexel International Corporation

Recent Developments

-

In July 2024, DocMode Health Technologies launched new clinical research services. The company aims to provide comprehensive solutions encompassing clinical trial management, regulatory compliance, data analysis, and more. The service will support pharmaceutical companies, healthcare providers, and researchers in conducting high-quality clinical studies efficiently and effectively.

-

In January 2024, IQVIA launched technology-based platform One Home for Sites. It acts as a single dashboard for the systems & support clinical research site to perform all clinical trials.

Clinical Trials Support Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 27.54 billion

Revenue forecast in 2033

USD 47.00 billion

Growth rate

CAGR of 7.93% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 – 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phases, service, sponsor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Charles River Laboratories International, Inc.; Wuxi Apptec, Inc; Iqvia Holdings, Inc; Syneos Health, Inc.; Eurofins Scientific; PPD, Inc. (Pharmaceutical Product Development); Icon Plc; Laboratory Corporation of America Holdings (Labcorp); Alcura; and Parexel International Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trials Support Services Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the clinical trials support services market report based on the phases, service,sponsor and region:

-

Phases Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Trial Site Management

-

Patient Recruitment Management

-

Patient recruitment & Registry Services

-

Patient retention

-

Others

-

-

Data Management

-

Administrative Staff

-

IRB

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & biopharmaceutical companies

-

Medical device companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials support services market size was estimated at USD 25.62 billion in 2025 and is expected to reach USD 27.54 billion in 2026.

b. The global clinical trials support services market is expected to grow at a compound annual growth rate of 7.93% from 2026 to 2033 to reach USD 47.00 billion by 2033.

b. North America dominated the clinical trials support services market with a share of 48.50% in 2025 driven by the established presence of pharmaceutical and biotechnology R&D companies, an increased volume of clinical trials, and a focus on comprehensive regulatory frameworks that prioritize data quality and patient safety

b. Some key players operating in the clinical trials support services market include Charles River Laboratories International, Inc., Wuxi Apptec, Inc, Iqvia Holdings, Inc, Syneos Health, Inc., Eurofins Scientific, PPD, Inc. (Pharmaceutical Product Development), Icon Plc, Laboratory Corporation of America Holdings (Labcorp), Alcura, and Parexel International Corporation among others.

b. The global clinical trials support services market is projected to expand rapidly due to expand rapidly due to rising demand for trials in emerging economies, increasing R&D investment, and a growing number of contract research organizations (CROs). The pharmaceutical firms’ (R&D) venture has been steadily growing every year, mainly due to patent expirations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.