- Home

- »

- Next Generation Technologies

- »

-

Cloud Information Technology Service Management Market Report 2030GVR Report cover

![Cloud Information Technology Service Management Market Size, Share & Trends Report]()

Cloud Information Technology Service Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution), By Technology (Network Management, Database Management System), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Information Technology Service Management Market Summary

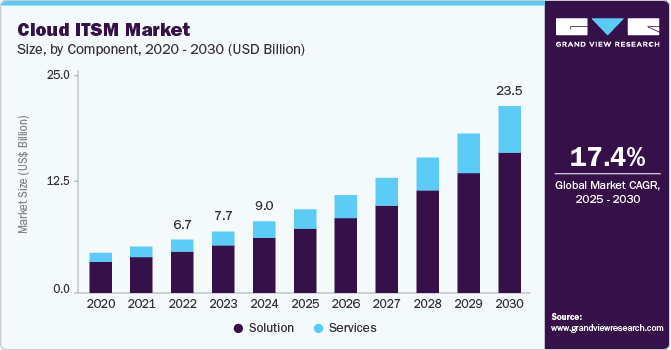

The global cloud information technology service management market size was estimated at USD 9.01 billion in 2024 and is projected to reach USD 23.53 billion by 2030, growing at a CAGR of 17.4% from 2025 to 2030. This growth is driven by the increasing demand for flexible, scalable, and cost-effective IT solutions.

Key Market Trends & Insights

- North America ITSM market dominated with a revenue share of over 40% in 2024.

- The Europe cloud ITSM market is expected to witness significant growth over the forecast period.

- The Asia Pacific cloud ITSM market is anticipated to register the highest CAGR over the forecast period.

- Based on component, the solution segment led the market in 2024, accounting for over 76% share of the global revenue.

- In terms of enterprise size, the large enterprises segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.01 Billion

- 2030 Projected Market Size: USD 23.53 Billion

- CAGR (2025-2030): 17.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As organizations increasingly adopt digital transformation strategies, cloud-based information technology service management (ITSM) tools are becoming essential to manage complex IT infrastructures efficiently. These solutions offer benefits such as rapid deployment, improved operational efficiency, and enhanced service delivery, which are key drivers for market growth. The rise in remote work and hybrid environments has further accelerated the adoption of cloud ITSM platforms that support decentralized IT operations. Moreover, the growing emphasis on customer experience, automation, and compliance with IT governance frameworks fuels the demand for integrated and intelligent ITSM solutions.

The growth of the cloud ITSM market is primarily driven by the rising adoption of cloud computing across businesses of all sizes. Enterprises are increasingly prioritizing agility, scalability, and reduced infrastructure costs, which cloud-based ITSM platforms enable. Traditional ITSM systems often require heavy upfront investment and ongoing maintenance, whereas cloud ITSM offers a subscription-based model with lower capital expenditure and faster deployment. This shift aligns with the broader trend of digital transformation, where businesses aim to modernize legacy systems and adopt IT solutions that support faster innovation cycles. Moreover, the shift from a product-centric to a service-centric IT model demands tools that support dynamic service delivery, which cloud ITSM platforms facilitate effectively.

The growing complexity of IT environments, especially with the proliferation of hybrid and multi-cloud ecosystems, necessitates more advanced service management capabilities. Cloud ITSM platforms help organizations manage a wide array of IT services, incidents, assets, and changes across distributed infrastructure. As digital services become mission-critical, downtime or service disruptions can have significant operational and financial repercussions. Cloud-based ITSM enables real-time monitoring, incident response automation, and intelligent service workflows, all of which enhance reliability and performance. In sectors such as banking, healthcare, and manufacturing, where regulatory compliance and uninterrupted services are vital, cloud ITSM ensures consistent governance and service continuity.

Component Insights

The solution segment led the market in 2024, accounting for over 76% share of the global revenue. This dominance can be attributed to the widespread adoption of core ITSM functionalities such as incident management, change management, asset management, and service desk solutions. Organizations increasingly prioritize these tools to ensure operational efficiency, service availability, and regulatory compliance in dynamic IT environments. The demand for integrated platforms that offer centralized control and real-time visibility into IT services has also contributed to the segment’s growth. As digital transformation accelerates, companies are investing in comprehensive ITSM solutions to enhance end-user experience, reduce downtime, and support scalable IT operations.

The service segment is predicted to foresee significant growth in the forecast years, driven by the increasing need for implementation, integration, and support services that help organizations maximize the value of their cloud ITSM investments. As businesses adopt more complex cloud-based systems, they often require expert guidance to configure solutions, align them with internal processes, and ensure seamless migration from legacy systems. Managed services and consulting offerings are also in high demand, especially among Small and Medium Enterprises (SMEs) lacking in-house ITSM expertise. Additionally, the growing emphasis on continuous service improvement and proactive monitoring has boosted demand for ongoing support and optimization services.Vendors are responding by expanding their service portfolios to include training, customization, and analytics support, enabling businesses to derive actionable insights from their ITSM operations.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share in 2024, driven by their extensive and complex IT infrastructures. These organizations manage large volumes of data, multiple business applications, and globally distributed teams, which necessitate robust and scalable ITSM solutions. Cloud ITSM platforms provide the flexibility and automation needed to streamline operations, ensure compliance, and improve service delivery across diverse departments. Large enterprises also invest in advanced features such as AI-driven analytics, self-service portals, and predictive maintenance to enhance IT efficiency and reduce operational risks. Furthermore, their significant IT budgets and strategic focus on digital transformation initiatives support the adoption of comprehensive cloud-based ITSM systems.

The SME segment is anticipated to exhibit the highest CAGR over the forecast period, driven by the growing awareness of the operational and cost efficiencies enabled by cloud ITSM solutions. Small and medium-sized enterprises are increasingly embracing digital tools to streamline IT operations, reduce manual workloads, and enhance service responsiveness. Cloud ITSM offers a scalable, pay-as-you-go model that is highly suitable for SMEs with limited budgets and IT staff. As these businesses expand, they seek agile solutions that can grow with their needs without significant infrastructure investment. Additionally, the rise of remote work and reliance on SaaS applications has made it crucial for SMEs to adopt ITSM platforms that support remote monitoring, issue resolution, and user support. Vendors are also tailoring solutions to meet the specific needs of SMEs by offering simplified, user-friendly platforms with quick deployment capabilities.

Vertical Insights

The IT & telecom segment accounted for the largest revenue share in 2024 due to the high demand for streamlined service management and continuous IT infrastructure optimization. This sector operates in a fast-paced, technology-driven environment where uninterrupted service delivery and rapid issue resolution are necessary. Cloud ITSM solutions help telecom and IT companies manage large-scale, distributed networks, handle vast volumes of service requests, and ensure compliance with strict Service Level Agreements (SLAs). Additionally, the need for automation, real-time monitoring, and efficient incident and change management further drives adoption within this segment. With the increasing deployment of 5G, IoT, and cloud-native technologies, IT and telecom firms are prioritizing advanced ITSM tools to support scalability and service innovation.

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. This growth is driven by the increasing need for reliable, secure, and efficient IT service management to support healthcare operations and patient care delivery. As healthcare providers digitize their operations through Electronic Health Records (EHRs), telemedicine, and cloud-based systems, the complexity of their IT environments grows, necessitating advanced ITSM solutions. Cloud ITSM platforms enable healthcare organizations to manage incidents, maintain system uptime, and ensure data security while complying with stringent regulations such as HIPAA and GDPR. Moreover, the rising demand for remote care and digital health services has underscored the need for seamless IT support and infrastructure monitoring.

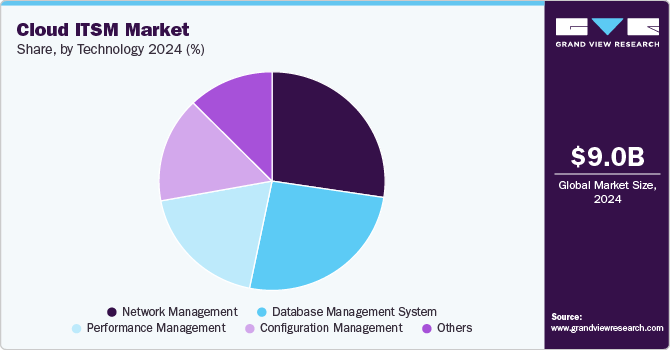

Technology Insights

The Network Management segment held the dominant revenue share in 2024. The dominance is primarily driven by the growing complexity of cloud-based infrastructures and the increasing reliance on seamless connectivity, real-time monitoring, and automated troubleshooting. Enterprises are prioritizing network performance and uptime, prompting widespread adoption of advanced network management solutions to ensure business continuity and operational efficiency. Additionally, the proliferation of IoT devices and remote work environments is intensifying the need for robust network visibility and control.

The Database Management System (DBMS) segment is poised to witness the highest growth rate from 2025 to 2030. The surge in cloud-native applications, data-intensive workloads, and the demand for real-time analytics is propelling the growth of cloud-based DBMS solutions. Organizations across industries are investing heavily in scalable and intelligent database management to support digital transformation initiatives, making this segment a key growth driver in the ITSM market’s future landscape. Moreover, advancements in AI and machine learning are enabling smarter, self-optimizing database systems that further enhance performance and decision-making capabilities.

Regional Insights

North America ITSM market dominated with a revenue share of over 40% in 2024. The growth is primarily attributed to the region's early adoption of advanced technologies, the strong presence of leading cloud ITSM vendors, and high digital maturity across industries. Organizations in the U.S. and Canada have heavily invested in digital transformation, cloud infrastructure, and automation, driving demand for efficient IT service management solutions. Moreover, the widespread adoption of remote and hybrid work models has further accelerated the need for cloud-based ITSM platforms to manage decentralized IT environments.

U.S. Cloud ITSM Market Trends

The U.S. cloud ITSM market is expected to grow at a significant CAGR from 2025 to 2030, driven by the increasing demand for agile, scalable IT service management solutions across enterprises of all sizes. As businesses continue to modernize their IT infrastructure, there is a growing need for cloud-native platforms that support automation, real-time service monitoring, and seamless integration with other enterprise systems. The proliferation of remote work, coupled with the rise in digital services, has heightened the importance of maintaining uninterrupted IT support and operations. Additionally, U.S. companies are investing in AI-powered ITSM capabilities to enhance service delivery, reduce manual workloads, and proactively manage incidents and outages.

Europe Cloud ITSM Market Trends

The Europe cloud ITSM market is expected to witness significant growth over the forecast period, driven by increasing digital transformation initiatives across both public and private sectors. European organizations are rapidly adopting cloud technologies to enhance IT agility, reduce operational costs, and meet evolving service demands. The region's strong regulatory landscape, including GDPR and national data protection laws, is prompting businesses to seek secure and compliant cloud ITSM solutions. Additionally, the growing emphasis on IT governance, risk management, and service continuity is fueling the demand for centralized and automated IT service management platforms.

Asia Pacific Cloud ITSM Market Trends

The Asia Pacific cloud ITSM market is anticipated to register the highest CAGR over the forecast period, fueled by rapid digitalization, increasing cloud adoption, and expanding IT infrastructure across emerging economies. Countries such as China, India, Japan, and Australia are witnessing significant growth in IT spending as businesses modernize operations and shift toward cloud-based service models. The region’s growing population of tech-savvy users, rising number of SMEs, and strong push for digital government services are further driving demand for scalable and cost-effective ITSM solutions. Additionally, the proliferation of mobile devices, remote workforces, and SaaS applications necessitates robust IT service management capabilities to ensure seamless IT support and system reliability.

Key Cloud ITSM Company Insights

Some key players in the cloud ITSM market, such as Atlassian, BMC Software, Inc., Broadcom, and Cloud Software Group, Inc., are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Broadcom Inc. is a global technology company that develops, designs, and supplies a broad range of infrastructure software and semiconductor solutions. Broadcom is known for its software division, which offers solutions such as Automic, CA Service Management, and DX Operational Intelligence. These tools provide comprehensive ITSM capabilities, including IT service automation, monitoring, and management. Broadcom's ITSM products are designed to enhance service delivery, streamline IT operations, and improve end-user experiences. The company serves various sectors, including telecommunications, financial services, and manufacturing, leveraging its expertise in software and hardware integration to deliver robust IT solutions.

-

BMC Software, Inc. is a foremost provider of IT solutions specializing in ITSM software. Its flagship ITSM platform, BMC Helix, offers comprehensive capabilities for IT service automation, incident management, asset management, and workflow optimization. BMC Helix leverages AI, machine learning, and cloud technology to provide intelligent, predictive, and user-centric IT services. The company’s solutions are widely used across various industries, including healthcare, finance, and retail, to improve IT operations, enhance service delivery, and drive digital transformation. With decades of expertise, BMC Software, Inc. is recognized for helping organizations modernize their IT infrastructure and streamline complex IT environments.

Key Cloud ITSM Companies:

The following are the leading companies in the cloud information technology service management (ITSM) market. These companies collectively hold the largest market share and dictate industry trends.

- Atlassian

- BMC Software, Inc.

- Broadcom

- Cloud Software Group, Inc

- Freshworks Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Ivanti.

- Open Text

- ServiceNow

- Thales

Recent Developments

-

In February 2025, Freshworks Inc. partnered with Unisys to expand the reach of its IT Service Management (ITSM) solutions. Unisys will act as a Managed Service Provider (MSP) in Freshworks Inc.'s ecosystem, reselling solutions such as Freshservice and Device42. This collaboration aims to enhance service provision for mid-market and small enterprise clients, a segment that larger legacy ITSM providers have traditionally underserved. The partnership supports Freshworks Inc.'s mission to deliver simple, effective ITSM solutions to businesses in this market.

-

In January 2025, ServiceNow and Google Cloud expanded their partnership to integrate generative AI across enterprise technology stacks. ServiceNow will offer its Now Platform, along with IT Service Management (ITSM), Customer Relationship Management (CRM), and Security Incident Response (SIR) solutions on Google Cloud Marketplace and Google Distributed Cloud (GDC). This collaboration will enable AI-enhanced experiences for millions of users by integrating BigQuery for enterprise data insights and extending these insights to Google Workspace. Users will be able to interact with ServiceNow data in Google Sheets and Chat and build generative AI applications with Vertex AI, enhancing both functionality and accessibility.

-

In May 2024, SolarWinds Worldwide, LLC launched SolarWinds AI, a generative AI engine designed to enhance IT operations and support tech professionals in managing modern digital environments. Initially introduced within SolarWinds Service Desk, the AI-powered feature aims to improve ITSM by speeding up ticket resolution, allowing agents to resolve issues in minutes instead of hours or days. Using LLMs and proprietary algorithms, SolarWinds AI can summarize complex ticket histories, suggest agent responses, and recommend steps for issue resolution. The company plans to expand this AI integration across its observability and IT management solutions, offering new capabilities for DevOps, SecOps, and database teams.

Cloud ITSM Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.54 billion

Revenue forecast in 2030

USD 23.53 billion

Growth rate

CAGR of 17.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Atlassian; BMC Software, Inc.; Broadcom; Cloud Software Group, Inc.; Freshworks Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Ivanti.; Open Text; ServiceNow; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud ITSM Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cloud information technology service management (ITSM) market report based on component, technology, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Configuration Management

-

Performance Management

-

Network Management

-

Database Management System

-

Other Applications

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-Commerce

-

IT & Telecom

-

Energy & Utilities

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global cloud information technology service management market size was estimated at USD 9.01 billion in 2024 and is expected to reach USD 10.54 billion in 2025.

b. The global cloud information technology service management market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2030 to reach USD 23.53 billion by 2030.

b. North America dominated the cloud ITSM market with a share of 40.6% in 2024. This is attributable to the region's early adoption of advanced technologies, the strong presence of leading cloud ITSM vendors, and high digital maturity across industries.

b. Some key players operating in the Cloud IT Service Management (ITSM) market include Atlassian; BMC Software, Inc.; Broadcom; Cloud Software Group, Inc.; Freshworks Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Ivanti.; Open Text; ServiceNow

b. Key factors that are driving the market growth include increasing demand for flexible, scalable, and cost-effective IT solutions, the rise in remote work and hybrid environments, and the growing emphasis on customer experience, automation, and compliance with IT governance frameworks

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.