- Home

- »

- Automotive & Transportation

- »

-

Cloud Printing Market Size & Share, Industry Report, 2030GVR Report cover

![Cloud Printing Market Size, Share & Trends Report]()

Cloud Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Cloud (Public, Private, Hybrid), By Connectivity (Wi-Fi, TCP-IP, Bluetooth), By Industry (BFSI, Government, Education, IT & Telecommunications, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-557-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Printing Market Size & Trends

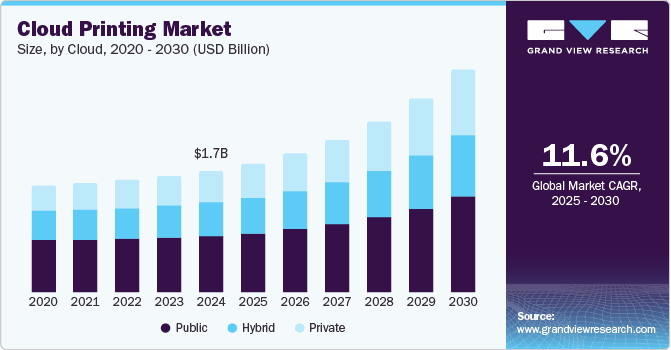

The global cloud printing market size was estimated at USD 1.65 billion in 2024 and is projected to grow at a CAGR of 11.6% from 2025 to 2030. The global movement toward hybrid and remote work has significantly boosted demand for cloud printing solutions. Employees operating outside traditional office environments drive the need for flexible, secure, and accessible print infrastructure. Cloud printing enables users to print from any location, using any device, while maintaining centralized control and security. This shift reduces reliance on office-based hardware and infrastructure, making cloud print services a vital component of modern digital workplaces. The trend is expected to continue fueling adoption, particularly in sectors such as education, finance, and healthcare where document workflows remain essential.

Cloud printing is gaining traction as organizations seek to simplify IT environments and reduce operational costs. Traditional print environments require significant investment in on-premises servers, drivers, and ongoing maintenance. Cloud print services eliminate these components, offering a serverless model that lowers total cost of ownership and improves scalability. This is particularly attractive for large enterprises and multi-site businesses that need a unified print solution. The operational efficiency and cost benefits of serverless printing are strong growth factors pushing companies toward cloud-first print strategies.

Increasing demand for cloud printing services in the retail and e-commerce sector is expected to contribute to the growth of the cloud printing industry. For instance, in April 2025, Star Micronics Co., Ltd. introduced StarIO.Online, a new service for retail stores that simplifies cloud printing through Star Micronics Cloud Services. With StarIO.Online, users can centrally manage and control printers via Star’s hosted servers, significantly reducing the time and costs typically associated with setting up and maintaining dedicated print servers. This solution enables seamless printing and integration with users' applications, all while requiring minimal resources.

Sustainability is becoming a core driver in IT purchasing decisions. Cloud printing contributes to greener practices by reducing paper waste, optimizing print usage, and eliminating the need for energy-consuming print servers. Features such as pull printing, print quotas, and analytics-driven insights help organizations manage and reduce unnecessary printing. In addition, cloud printing supports environmental, social, and governance (ESG) goals, making it an appealing solution for companies aiming to improve their sustainability metrics. The alignment of cloud printing with eco-conscious business strategies is accelerating its adoption globally, thereby driving the cloud printing industry growth.

Factors such as security concerns and dependence on the internet could hamper the growth of the cloud printing industry. Cloud printing offers convenience and flexibility, especially for mobile workforces, but it also presents security concerns and relies on internet connectivity. While cloud printing can be cost-effective for high-volume needs, businesses handling sensitive data might prefer on-premises printing for security reasons. Furthermore, cloud printing depends on an internet connection, meaning that an outage could prevent employees from printing documents, causing delays and potentially hindering the growth of the cloud printing industry.

Cloud Insights

The public segment accounted for the largest share of 46.6% in 2024 due to its scalability, cost-effectiveness, and ease of deployment. Public cloud solutions allow businesses to leverage third-party infrastructure, eliminating the need for on-site servers and reducing IT overhead. This model is particularly attractive to small and medium-sized enterprises (SMEs) and organizations with distributed or remote workforces, as it enables quick setup, global accessibility, and seamless integration with SaaS platforms such as Microsoft 365 or Google Workspace. The growing demand for flexible, subscription-based print services and the rapid adoption of remote work models continue to fuel the expansion of public cloud printing solutions.

The private segment is expected to grow at the highest CAGR during the forecast period. Private cloud printing is gaining traction among large enterprises and organizations operating in highly regulated industries such as healthcare, finance, and government. Private cloud environments offer greater control, customization, and enhanced security, making them ideal for handling sensitive data and meeting strict compliance requirements. These solutions can be hosted on-premises or by a dedicated third-party provider, offering tailored features and policies suited to specific organizational needs. The increasing emphasis on data privacy, secure document workflows, and regulatory compliance is a key driver for private cloud adoption in the market.

Connectivity Insights

The Wi-Fi segment held the largest market in 2024 due to its speed, range, and ability to support multiple devices simultaneously. It enables users to print from any connected device such as laptops, smartphones, or tablets without needing physical cables or direct proximity to the printer. This makes Wi-Fi ideal for office environments, co-working spaces, and educational institutions where numerous users need access to shared printers. In addition, Wi-Fi-enabled cloud printing solutions often integrate smoothly with enterprise networks, making them scalable and easier to manage across multiple locations.

The Bluetooth segment is expected to register a highest CAGR of 13.3% during the forecast period. Bluetooth connectivity in cloud printing is gaining popularity for its simplicity and convenience, especially in scenarios that require short-range, quick, and device-to-printer communication. It is particularly useful in mobile, retail, and small office setups where users need fast, cable-free printing with minimal infrastructure. While Bluetooth has a limited range compared to Wi-Fi, it offers a straightforward, low-energy connection that doesn't rely on internet access, making it a viable option for field operations, pop-up stores, or point-of-sale systems.

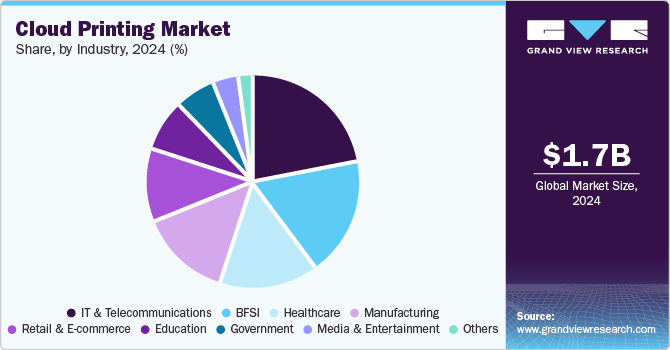

Industry Insights

The IT & telecommunications segment dominated the market in 2024. Factors such as early adoption of cloud technologies by IT and telecom companies and continuous push for digital transformation can be attributed to the segment’s growth. Organizations in this industry require scalable, flexible, and secure print solutions that align with distributed workforces, global operations, and high-volume document workflows. Cloud printing meets these needs by offering centralized management, remote access, and seamless integration with other cloud-based enterprise tools. In addition, IT service providers are increasingly offering cloud print services as part of their managed solutions, further expanding the market. The sector’s emphasis on automation, cost-efficiency, and robust cybersecurity continues to propel the adoption of advanced cloud printing platforms.

The healthcare segment is anticipated to grow rapidly during the forecast period. The healthcare industry is increasingly adopting cloud printing solutions to enhance operational efficiency while maintaining strict compliance with data privacy regulations. Hospitals, clinics, and medical research facilities handle sensitive patient data and require secure, traceable printing processes. Cloud printing allows for secure print release, audit trails, and role-based access, which are essential for maintaining confidentiality and compliance. Furthermore, healthcare organizations benefit from cloud printing’s ability to support multiple locations, streamline administrative workflows, and reduce IT burden. The growing need for secure, reliable, and efficient print infrastructure in a highly regulated environment is a strong growth factor for this segment.

Regional Insights

The North America cloud printing industry was identified as a lucrative region in 2024. Factors such as early cloud adoption, strong IT infrastructure, and a high concentration of large enterprises and tech firms can be attributed to the growth of the cloud printing market. The region's focus on digital transformation, remote work enablement, and cost optimization has driven widespread adoption of cloud-based print services.

U.S. Cloud Printing Market Trends

The U.S. cloud printing market held a dominant position in 2024. U.S. enterprises are quick to embrace SaaS solutions, including cloud print platforms integrated with Microsoft 365 and Google Workspace. The federal government and healthcare sectors also contribute significantly due to their demand for secure, compliant printing infrastructure. Widespread remote work, BYOD policies, and a strong culture of innovation make the U.S. a highly lucrative and mature market for cloud printing providers.

Europe Cloud Printing Market Trends

Europe cloud printing market is expected to register a moderate CAGR from 2025 to 2030. The market growth is driven by strict data privacy regulations such as GDPR and a strong push toward sustainable IT practice. European companies value energy efficiency, reduced paper waste, and green IT initiatives, all of which are supported by cloud printing technologies. Enterprises and public institutions across Europe are increasingly migrating to secure, scalable cloud platforms to streamline operations. In addition, the presence of regional leaders in managed print services and cloud infrastructure supports continued adoption.

The UK cloud printing market is expected to grow at a notable CAGR from 2025 to 2030. The market growth is driven by hybrid work trends and the need for flexible IT infrastructure. The country’s organizations are investing in cloud solutions to modernize their print environments, reduce infrastructure costs, and ensure business continuity. The UK government's digital-first initiatives, along with widespread adoption of cloud productivity tools in sectors such as education, healthcare, and legal services, are key growth drivers in this market.

The Germany cloud printing market held a substantial market share in 2024. The country’s strong manufacturing base and stringent data protection standards can be attributed to the growth of the market. German enterprises are adopting private and hybrid cloud printing models to ensure compliance with national and EU-level regulations. Industrial firms and engineering companies leverage cloud printing for secure document workflows, while also benefiting from centralized print control across distributed production sites. The combination of industry-specific needs and regulatory compliance is a major growth factor behind the cloud printing industry’s growth in the country.

Asia Pacific Cloud Printing Market Trends

The Asia Pacific cloud printing market is anticipated to grow at a CAGR of 13.7% during the forecast period. Factors such as rapid digital transformation, expanding SME sectors, and increasing internet penetration are driving the growth of the market. Countries in this region are heavily investing in IT infrastructure and cloud-based business models to support their growing economies. APAC is also home to a rising number of startups and mobile-first businesses that benefit from cost-effective and scalable print solutions. Government-led smart city and digital workplace initiatives are further propelling adoption across various sectors.

The India cloud printing market is expected to grow at highest growth rate during the forecast period. India is experiencing strong momentum in cloud printing adoption, fueled by its vibrant startup ecosystem, growing SME base, and a nationwide push toward digitalization. The demand for cost-effective, flexible print solutions is high, particularly in education, healthcare, and IT services. Government initiatives such as Digital India are encouraging cloud-first strategies across public and private sectors. More organizations are shifting to cloud-based platforms to support remote work and improve operational efficiency, making India a rapidly growing market for cloud printing.

The China cloud printing market held a substantial market share in 2024 owing to its booming enterprise cloud ecosystem and investments in digital infrastructure. Chinese tech companies are developing localized cloud print solutions to serve domestic demand while adhering to national data protection laws. Cloud printing is also being adopted in manufacturing, retail, and education sectors to streamline workflows and support large-scale operations. The government’s emphasis on digital transformation and smart manufacturing is accelerating growth of the market.

Key Cloud Printing Company Insights

Some of the key companies in the cloud printing industry include Xerox Corporation, Microsoft Corporation, Ricoh USA, Inc., and PaperCut Software Pty Ltd, among others. Organizations are prioritizing the integration of advanced technologies to enhance their services and maintain a competitive edge. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, business expansions, new service launches, and partnerships, among others.

-

Xerox Corporation offers a range of cloud printing services designed to support modern, flexible work environments. These services help organizations simplify their print infrastructure, reduce IT overhead, and improve document security.

-

Microsoft Corporation supports cloud printing services primarily through its Universal Print solution, a cloud-based print infrastructure built into Microsoft 365. Universal Print is designed to simplify printing in enterprise environments by moving key print functionalities to Microsoft cloud.

Key Cloud Printing Companies:

The following are the leading companies in the cloud printing market. These companies collectively hold the largest market share and dictate industry trends.

- Xerox Corporation

- Microsoft Corporation

- Ricoh USA, Inc.

- PaperCut Software Pty Ltd

- ezeep GmbH

- LRS Output Management

- Konica Minolta Business Solutions Europe GmbH

- Apogee Corporation

- HP Development Company, L.P

- ThinPrint Cloud Services, Inc.

Recent Developments

-

In November 2024, Pharos announced the launch of Pharos Cloud, the trsted PrintOps platform designed to meet the scalability, security, and reliability needs of global enterprises. By eliminating the need for print servers, Pharos Cloud empowers organizations to transition to a user-friendly SaaS solution that boosts IT efficiency, strengthens security, and delivers seamless printing experience.

-

In October 2024, Tungsten Automation, a prominent company in Document Automation and Security, unveiled its Hybrid Cloud Print Solution, which integrates the features of ControlSuite and Printix to unify print and capture workflows across varied IT environments. The Hybrid Cloud Print Solution delivers enhanced flexibility, a streamlined experience for both users and administrators, and strong security seamlessly managing both cloud and on-premises environments within a unified platform.

Cloud Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 3.04 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cloud, connectivity, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Xerox Corporation; Microsoft Corporation; Ricoh USA, Inc.; PaperCut Software Pty Ltd; ezeep GmbH; LRS Output Management; Konica Minolta Business Solutions Europe GmbH; Apogee Corporation; HP Development Company, L.P; ThinPrint Cloud Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud printing market report based on cloud, connectivity, industry, and region.

-

Cloud Outlook (Revenue, USD Million; 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Connectivity Outlook (Revenue, USD Million; 2018 - 2030)

-

Wi-Fi

-

TCP-IP

-

Bluetooth

-

Others

-

-

Industry Outlook (Revenue, USD Million; 2018 - 2030)

-

BFSI

-

Government

-

Education

-

IT & Telecommunications

-

Manufacturing

-

Healthcare

-

Retail & E-commerce

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud printing market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 1.75 billion in 2025.

b. The global cloud printing market is expected to grow at a compound annual growth rate of 11.6% from 2025 to 2030 to reach USD 3.04 billion by 2030.

b. The North America cloud printing industry was identified as a lucrative region in 2024. Factors such as early cloud adoption, strong IT infrastructure, and a high concentration of large enterprises and tech firms can be attributed to the growth of the cloud printing market. The region's focus on digital transformation, remote work enablement, and cost optimization has driven widespread adoption of cloud-based print services.

b. Some key players operating in the cloud printing market include Xerox Corporation, Microsoft Corporation, Ricoh USA, Inc., PaperCut Software Pty Ltd, ezeep GmbH, LRS Output Management, Konica Minolta Business Solutions Europe GmbH, Apogee Corporation, HP Development Company, L.P, and ThinPrint Cloud Services, Inc.

b. Key factors that are driving the market growth include global move toward hybrid and remote work and reduced operational costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.