- Home

- »

- Next Generation Technologies

- »

-

Cloud Professional Services Market, Industry Report, 2033GVR Report cover

![Cloud Professional Services Market Size, Share & Trends Report]()

Cloud Professional Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Consulting, Application & Development, Modernization), By Service Model, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-713-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Professional Services Market Summary

The global cloud professional services market size was estimated at USD 30.64 billion in 2024 and is projected to reach USD 118.79 billion by 2033, growing at a CAGR of 16.5% from 2025 to 2033. The surge in digital transformation across industries is a key driver propelling demand for cloud professional services.

Key Market Trends & Insights

- North America cloud professional services market dominated the global industry with the largest revenue share of 41.7% in 2024.

- The cloud professional services industry in the U.S. is expected to grow significantly over the forecast period.

- By service type, consulting led the market and held the largest revenue share of 31.8% in 2024.

- By service model, the SaaS segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the healthcare segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 30.64 Billion

- 2033 Projected Market Size: USD 118.79 Billion

- CAGR (2025-2033): 16.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Organizations increasingly adopt cloud-first strategies to modernize legacy systems, enhance agility, and improve customer experiences. Cloud professional services, including consulting, migration, implementation, and managed services, ensure a seamless transition to cloud platforms. Businesses seek expert partners to guide them through the complexity of hybrid and multi-cloud environments, regulatory compliance, and data sovereignty challenges. According to the Flexera 2025 State of the Cloud Report, 86% of organizations use a multi-cloud strategy, with 70% adopting hybrid cloud, 14% multiple public clouds, and 2% multiple private clouds. Only 12% rely on a single public cloud, and 2% on a single private cloud, highlighting the growing preference for multi-cloud environments.

Rapid advancements in technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT) are encouraging enterprises to migrate workloads to the cloud. Cloud professional service providers help design and implement scalable cloud infrastructures that support these technologies. Integrating AI and automation into cloud services also increases operational efficiency and reduces manual intervention, creating new opportunities for professional services to optimize and maintain these intelligent systems.

Many organizations are adopting hybrid and multi-cloud environments to avoid vendor lock-in, increase flexibility, and optimize cost-performance ratios. These complex architectures require professional services for cloud orchestration, workload placement, integration, and monitoring. Cloud professionals help companies manage inter-cloud dependencies and ensure smooth interoperability between private and public clouds, making their role increasingly indispensable.

Service Type Insights

The consulting segment dominated the market and accounted for the revenue share of 31.8% in 2024, driven by the increasing complexity of cloud adoption strategies, as organizations seek expert guidance to navigate multi-cloud and hybrid environments, ensure compliance with evolving regulations, and optimize cost structures. Businesses leverage consulting services to align cloud migration with digital transformation objectives, integrate advanced technologies such as AI, IoT, and analytics into cloud ecosystems, and modernize legacy systems without disrupting operations. Moreover, the rapid pace of cloud innovation, coupled with industry-specific customization needs, is fueling demand for consultants who can provide tailored roadmaps, risk mitigation strategies, and change management support to accelerate time-to-value and enhance competitive advantage.

The application and development segment is anticipated to grow at the highest CAGR during the forecast period due to the rising need for cloud-native application creation, modernization, and integration that can scale seamlessly to meet dynamic business demands. Organizations increasingly turn to cloud platforms to build microservices-based architectures, leverage containerization, and implement serverless computing for faster deployment cycles and improved performance. The demand for API-driven ecosystems, low-code/no-code development tools, and DevOps-enabled workflows is also accelerating, enabling faster innovation while reducing operational bottlenecks.

Service Model Insights

The SaaS segment dominated the market and accounted for the largest revenue share in 2024, driven by the increasing preference for subscription-based software delivery that reduces upfront capital expenditure and simplifies IT management. Organizations are adopting SaaS to quickly access industry-specific applications, ensure automatic updates with minimal downtime, and benefit from built-in scalability that supports fluctuating workloads. The growing need for secure, globally accessible collaboration tools to support remote and hybrid workforces is also driving adoption, alongside the integration of advanced features such as embedded analytics, AI-driven insights, and compliance-ready frameworks.

PaaS is expected to grow significantly during the forecast period as businesses increasingly seek agile platforms that streamline the entire application lifecycle, from coding to deployment, without the burden of managing underlying infrastructure. Rising demand for real-time data processing, advanced analytics, and AI/ML model deployment pushes organizations toward PaaS solutions offering integrated development environments, managed databases, and seamless scalability. The segment is further propelled by the growing need to support multi-cloud interoperability, facilitate continuous integration and continuous delivery (CI/CD) pipelines, and enable faster prototyping of innovative products.

Deployment Insights

The public segment dominated the market and accounted for the largest revenue share in 2024 due to its cost-efficiency, flexibility, and ease of provisioning, which make it particularly attractive for startups, SMEs, and enterprises seeking rapid scalability without large infrastructure investments. The ability to instantly access a vast range of computing resources on demand and global availability through distributed data centers supports faster market expansion and disaster recovery readiness. Public cloud environments also drive adoption through their robust partner ecosystems, offering pre-integrated services and third-party applications that accelerate innovation.

Hybrid is expected to grow at a significant CAGR during the forecast period as organizations seek to balance the control and customization of private infrastructure with the scalability and innovation of public cloud environments. This model is increasingly favored for enabling seamless data and workload portability, allowing businesses to optimize performance by running mission-critical applications on-premises while leveraging cloud resources for burst capacity or specialized workloads. The growth is further fueled by the need to support edge computing initiatives, enable unified management across diverse environments, and accommodate complex governance or sovereignty requirements without compromising agility.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the largest revenue share in 2024 as multinational corporations increasingly require sophisticated, enterprise-grade cloud solutions to manage vast and complex IT ecosystems. These organizations leverage cloud professional services to orchestrate global operations, integrate disparate business units, and implement advanced governance frameworks that ensure consistent performance across multiple regions. Rising demand for high-availability architectures, advanced cybersecurity frameworks, and compliance with diverse international regulations is also driving adoption.

The SMEs segment is expected to grow at a significant CAGR during the forecast period as smaller businesses increasingly turn to cloud solutions to compete with larger players by leveraging enterprise-grade capabilities without the associated infrastructure burden. Many SMEs adopt cloud professional services to streamline IT operations, improve speed-to-market, and access advanced digital tools that would otherwise be cost-prohibitive. The availability of tailored service packages, pay-as-you-go pricing models, and industry-specific cloud solutions lowers entry barriers and encourages adoption.

End-use Insights

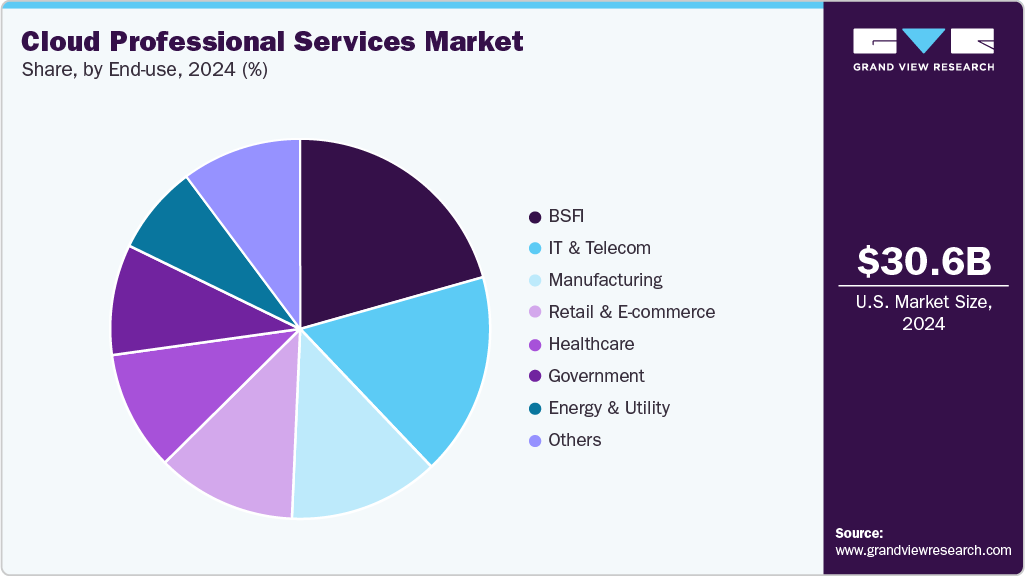

The BSFI segment dominated the market and accounted for the largest revenue share in 2024 as financial institutions increasingly adopt cloud solutions to power real-time transaction processing, enhance digital banking experiences, and enable advanced fraud detection through AI-driven analytics. The sector is leveraging cloud platforms to support open banking initiatives, integrate fintech partnerships, and deliver personalized financial services at scale. Moreover, the need for high-speed data processing to comply with evolving risk management and reporting standards drives adoption and the ability to rapidly launch new digital products while maintaining stringent security and encryption protocols to safeguard sensitive customer data.

The healthcare segment is expected to grow significantly over the forecast period as healthcare providers and life sciences organizations increasingly adopt cloud solutions to support telemedicine platforms, enable remote patient monitoring, and streamline collaboration across care teams. The growing use of cloud-based systems to integrate electronic health records (EHR) from multiple sources improves interoperability and clinical decision-making. In addition, the sector is leveraging cloud infrastructure to accelerate medical research through high-performance computing, support AI-driven diagnostics, and facilitate large-scale genomic data analysis. The ability to securely share data across stakeholders while meeting stringent healthcare compliance requirements further propels adoption.

Regional Insights

North America dominated the global cloud professional services market with the largest revenue share of 41.7% in 2024, driven by cloud adoption maturity, advanced enterprise IT infrastructures, and a strong ecosystem of hyperscale cloud providers such as AWS, Microsoft Azure, and Google Cloud. There's an increasing demand for migration and integration services as large enterprises modernize their operations and unify on-premises systems with SaaS platforms.

U.S. Cloud Professional Services Market Trends

The cloud professional services market in the U.S. is expected to grow significantly at a CAGR of 16.2% from 2025 to 2033, due to the surge in federal government cloud modernization projects and growing investments in digital public infrastructure. The financial services, life sciences, and healthcare industries heavily invest in cloud-based solutions that require strict compliance and high availability, driving a surge in demand for domain-specific consulting, cloud governance, and managed services.

Europe Cloud Professional Services Market Trends

The cloud professional services market in Europe is anticipated to register considerable growth from 2025 to 2033 due to increasing focus on sovereign cloud strategies and GDPR-aligned cloud compliance. As companies navigate fragmented data regulations across EU countries, cloud professional services are being used to implement governance frameworks, regional data centers, and audit trails.

The UK cloud professional services marketis expected to grow rapidly in the coming years. Financial institutions and public sector agencies are investing in cloud professional services to align with FCA, NHS, and ICO guidelines. Moreover, the growing fintech and healthtech ecosystem demands customized multi-cloud strategies to support rapid innovation and user-centric design.

The cloud professional services market in Germany held a substantial market share in 2024 due to the rise of Industry 4.0 initiatives, which emphasize cloud-based automation, smart manufacturing, and predictive analytics. German enterprises, especially in automotive and industrial sectors, leverage cloud professional services to enable secure connectivity between machines, systems, and sensors across global production lines. In addition, stringent local data protection laws are creating demand for cloud consultants with regional legal expertise.

Asia Pacific Cloud Professional Services Industry Trends

Asia Pacific held a significant share in the global market in 2024, due to rapid digitalization among emerging economies, government-led smart city projects, and rising demand from cloud-first startups. Diverse regulatory landscapes across countries push businesses to invest in cloud services that offer scalable compliance solutions.

Japan cloud professional services market is expected to grow rapidly in the coming years, driven by the acceleration of cloud adoption in manufacturing, banking, and public services, especially in response to an aging workforce. Cloud professional services are helping enterprises build low-maintenance, AI-ready infrastructures that support robotic process automation (RPA), smart supply chains, and digital citizen services.

The cloud professional services market in China held a substantial market share in 2024, due to the rise of homegrown cloud providers and government initiatives such as New Infrastructure that promote digital upgrades across transportation, education, and health. Cloud professional services are essential in helping businesses localize applications, navigate strict cybersecurity laws, and integrate with China's unique digital ecosystem.

Key Cloud Professional Services Company Insights

Key players in the cloud professional services industry are Accenture, Amazon Web Services, Inc., Atos SA, Microsoft, and Capgemini. These companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Atos SE announced the completion of a data center migration project for IGM Financial Inc., a Canada-based wealth and asset management firm. The transformation involved migrating IGM’s assets to a modern, cloud-native infrastructure built on Microsoft Azure and Google Cloud Platform (GCP). The new environment enhances operational efficiency, speed, and scalability. Leveraging Atos’ expertise in agile, scalable architecture, the solution strengthens risk mitigation and improves reporting and issue remediation visibility.

-

In November 2024, Accenture acquired Award Solutions, a U.S.-based firm specializing in training and consulting for advanced wireless and network technologies such as 5G, the Internet of Things (IoT), and cloud-based solutions. This acquisition strengthens Accenture’s capabilities in next-generation connectivity and enhances its ability to support clients in adopting and scaling emerging technologies across industries.

Key Cloud Professional Services Companies:

The following are the leading companies in the cloud professional services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services, Inc.

- Atos SE

- Capgemini

- Cognizant

- Fujitsu

- Google Cloud

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Microsoft

- NTT DATA

- Oracle

- SAP SE

- TATA Consultancy Services Limited

Cloud Professional Services Report Scope

Report Attribute

Details

Market size in 2025

USD 35.04 billion

Revenue forecast in 2033

USD 118.79 billion

Growth rate

CAGR of 16.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, service model, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Amazon Web Services, Inc.; Atos SE; Capgemini; Cognizant; Fujitsu; Google Cloud; HCL Technologies Limited; IBM Corporation; Infosys Limited; Microsoft; NTT DATA; Oracle; SAP SE; TATA Consultancy Services Limited

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Professional Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cloud professional services market report based on service type, service model, deployment, enterprise size, end-use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consulting

-

Application and Development

-

Integration and Optimization

-

Implementation and Migration

-

Modernization

-

-

Service Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

SaaS

-

IaaS

-

PaaS

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT and Telecom

-

Government

-

Healthcare

-

Manufacturing

-

Retail and E-commerce

-

Energy and Utility

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud professional services market size was estimated at USD 30.64 billion in 2024 and is expected to reach USD 35.04 billion in 2025.

b. The global cloud professional services market is expected to grow at a compound annual growth rate of 16.5% from 2025 to 2033 to reach USD 118.79 billion by 2033.

b. The consulting segment dominated the market and accounted for the revenue share of 31.8% in 2024, driven by the increasing complexity of cloud adoption strategies, as organizations seek expert guidance to navigate multi-cloud and hybrid environments, ensure compliance with evolving regulations, and optimize cost structures.

b. Some key players operating in the cloud professional services market include Accenture, Amazon Web Services, Inc., Atos SE, Capgemini, Cognizant, Fujitsu, Google Cloud, HCL Technologies Limited, IBM Corporation, Infosys Limited, Microsoft, NTT DATA, Oracle, SAP SE, TATA Consultancy Services Limited

b. The surge in digital transformation across industries is a key driver propelling demand for cloud professional services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.