- Home

- »

- Consumer F&B

- »

-

Coffee Creamer Market Size, Trends, Industry Report, 2033GVR Report cover

![Coffee Creamer Market Size, Share & Trends Report]()

Coffee Creamer Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dairy-based, Non-dairy), By Type (High-fat, Low-fat, Fat-free), By Form (Liquid, Powder), By Nature, By Packaging Type, By Flavor, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-154-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Creamer Market Summary

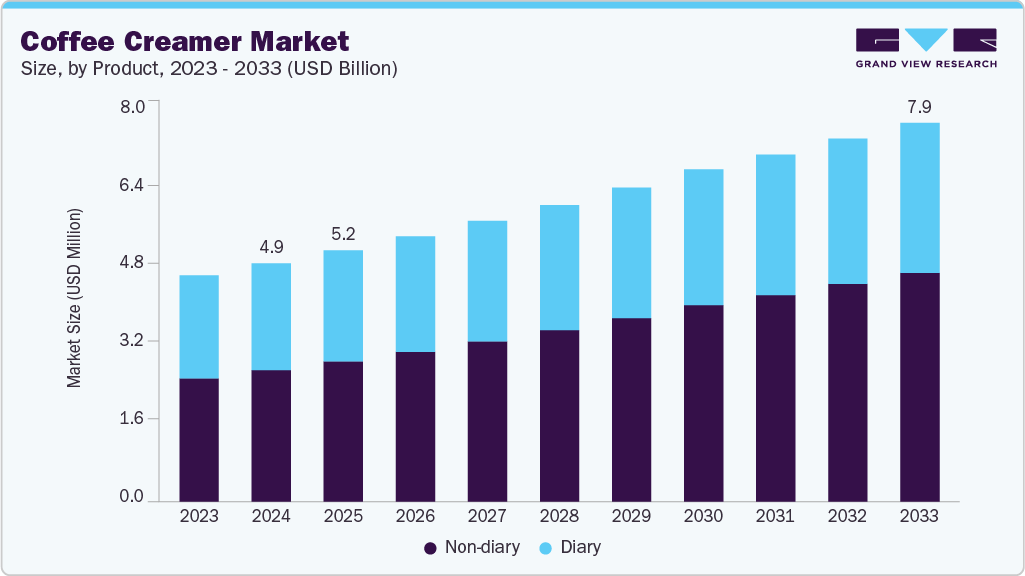

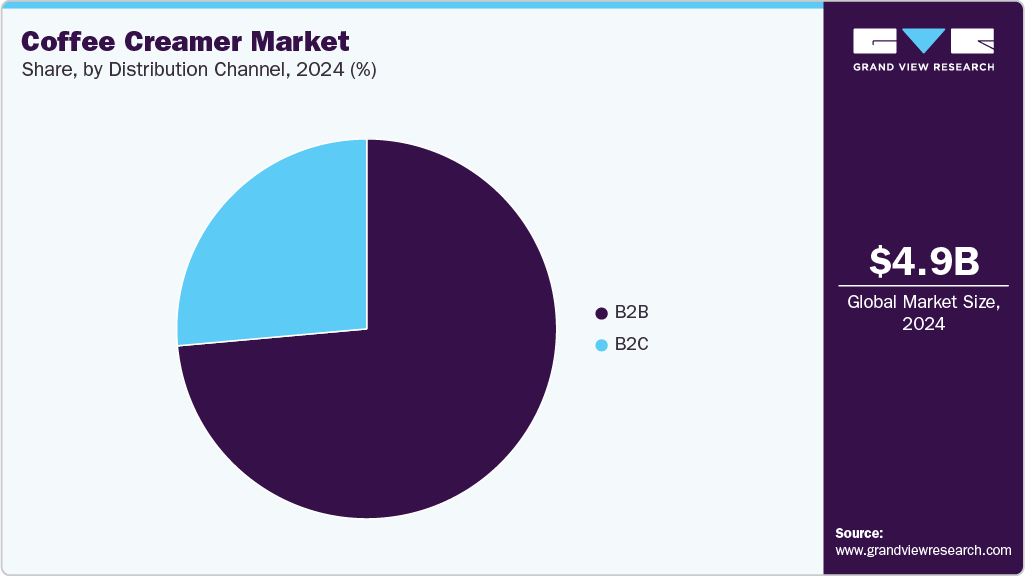

The global coffee creamer market size was estimated at USD 4.95 billion in 2024 and is projected to reach USD 7.88 billion in 2033, growing at a CAGR of 5.3% from 2025 to 2033. The availability of innovative flavors and functional ingredients, convenience and on-the-go consumption, expansion of e-commerce and omnichannel retailers, and overall growth in the food service industry are some of the key drivers of the market.

Key Market Trends & Insights

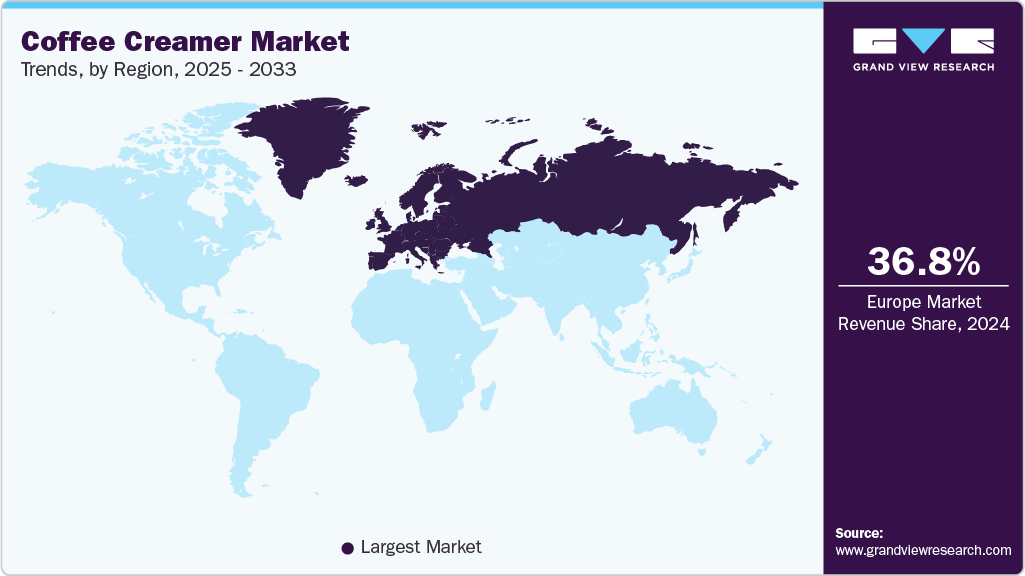

- Europe dominated the global coffee creamer market in 2024 with a revenue share of 36.84%.

- The coffee creamer market in China is growing at the significant CAGR over the forecast period.

- Based on product, non-dairy segment accounted for a share of 55.16% in 2024.

- By type, high-fat segment dominated the market with a share of 64.72% in 2024.

- By form, liquid segment accounted for a revenue share of 60.43% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 4.95 Billion

- 2033 Projected Market Size: USD 7.88 Billion

- CAGR (2025-2033): 5.3%

- Europe: Largest market in 2024

Coffee creamer offers a convenient way to add flavor and richness to coffee without the need for additional ingredients or preparation expediting the market growth. Many consumers are looking for healthier and more natural alternatives to traditional dairy creamers. Non-dairy creamers made from ingredients such as almond, soy, or coconut milk are becoming increasingly popular. The availability of a wide variety of flavored creamers, including seasonal flavors, is driving the market growth.

Consumers are attracted to the novelty and variety of different flavors and can choose from the extensive options available to elevate their coffee experience. The growth of e-commerce and online grocery shopping is allowing consumers to access and purchase coffee creamer products. The global coffee consumption is rising, and this trend is expected to continue. As a result, product demand is expected to increase during the forecast period. On account of this, many companies are launching products to grab the maximum possible market share. For instance, in January 2024, Darigold launched Belle Coffee Creamer in the U.S. market, introducing a premium, dairy-based product line made with simple ingredients, aiming to meet growing consumer demand for natural, flavorful, and high-quality coffee enhancers. Furthermore, increasing spending on coffee across the globe is another major factor propelling market growth.

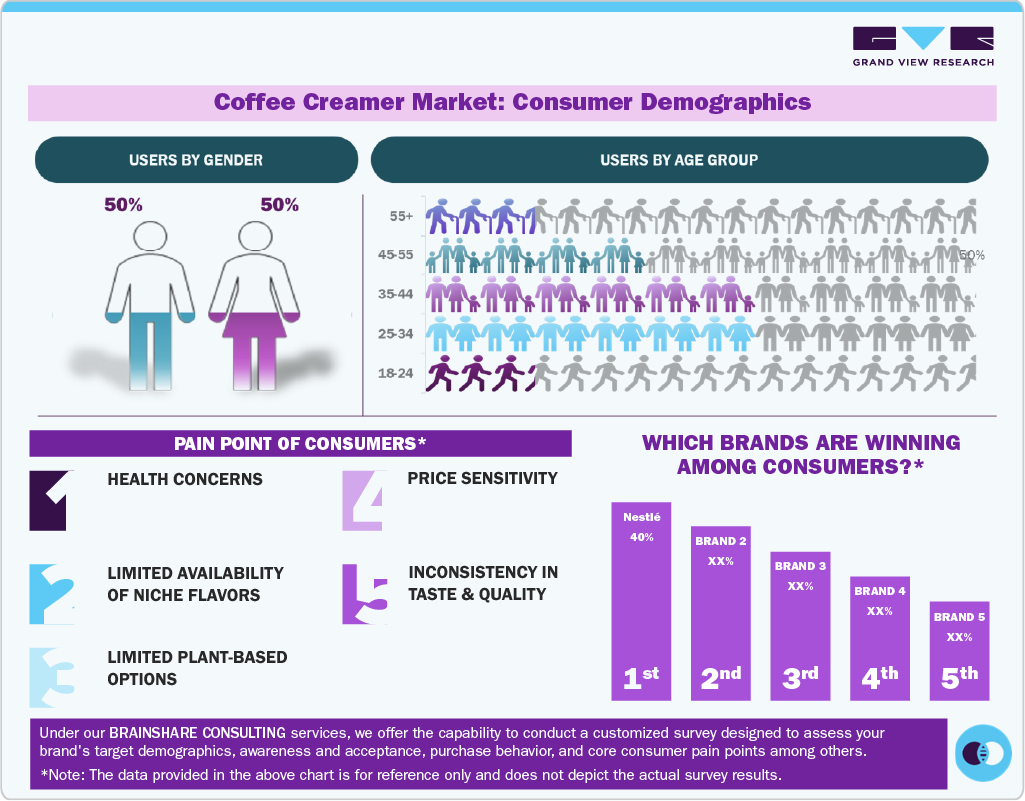

Consumer Insights for Coffee Creamer

Consumers are becoming more health-conscious and ingredient-aware, driving demand for clean-label, low-sugar, and plant-based options. Younger demographics, especially Millennials and Gen Z, are leading the shift toward oat and almond milk creamers, prioritizing digestive health, sustainability, and ethical sourcing. There's also a growing preference for creamers that cater to specific dietary needs, indicating a move toward personalization in everyday consumption. This has opened up opportunities for brands offering innovative formats and functional ingredients such as adaptogens.

Moreover, convenience and indulgence remain key motivators. Many consumers view coffee moments as small daily rituals, and flavored creamers improve this experience with café-style taste at home. Seasonal and limited-edition variants drive trial and emotional connection. In addition, the rise of iced and cold-brew coffee has led to increased interest in creamers that blend well in cold beverages, signaling the need for better functionality and versatility. The market is evolving from generic dairy whiteners to lifestyle-driven, premium products that align with consumer values and daily routines.

Product Insights

Non-dairy coffee creamer accounted for a market share of 55.16% in 2024. The segment is expected to maintain dominance over the forecast period owing to increasing demand for plant-based products, a growing vegan population, rising lactose intolerance, and among others. As more consumers become health-conscious and environmentally aware, there is a growing demand for plant-based products. Due to such demand, in November 2023, Coffee Mate introduced its first whitened non-dairy ready‑to‑drink iced coffee line. The refrigerated 50‑oz bottles featured Caramel and French Vanilla flavors, offered 25% less sugar, and marked the brand’s expansion beyond creamers.

Non-dairy creamers are made from plant-based ingredients such as soy, almonds, and coconut, making them popular choice among consumers who prefer plant-based options. Thus, non-dairy coffee creamers are experiencing significant growth propelling the market growth. Non-dairy coffee creamers are expected to accelerate at a CAGR of 6.9% throughout the forecast period. Due to such demands, key companies are taking many initiatives to strengthen their presence in the market. For instance, in January 2024, MPearlRock, a strategic partnership between New York’s PearlRock Partners and MidOcean Partners, completed the acquisition of Nutpods, a Bellevue, Washington–based plant‑based creamer brand, aiming to accelerate its nationwide expansion in the non‑dairy coffee creamer market.

Type Insights

The high-fat coffee creamer market accounted for a market share of 64.72%in 2024, owing to increasing consumer preference for richer, creamier textures and indulgent flavors that closely mimic traditional dairy cream. In addition, the popularity of keto and low-carb diets fueled demand for high-fat creamers as functional additions to coffee, especially among health-conscious and fitness-focused consumers seeking energy-boosting options.

Fat-free coffee creamers are growing at the fastest CAGR of 6.0% from 2025 to 2033. Coffee creamers with low or no-fat content are generally more prominent in the market as they cater to health-conscious consumers who are looking for ways to reduce their calorie and fat intake. However, there is still a significant demand for coffee creamers with a moderate amount of fat. These creamers are preferred by consumers who value the taste and creaminess of their coffee and are not as concerned about their calorie intake.

Form Insights

The liquid coffee creamer segment accounted for the largest market share of 60.43% in 2024. This dominance is attributed to the increasing demand for convenience products among consumers, especially millennials and Gen Z. Liquid coffee creamer offers a quick and hassle-free way of adding flavor and creaminess to coffee, making it a preferred choice over traditional milk or cream. In addition, the rising trend of at-home coffee consumption has further boosted the demand for liquid coffee creamer products. The market is also witnessing an increasing number of new product launches with innovative flavors and health benefits, which are attracting more consumers and driving market growth.

The powdered coffee creamer segment is growing at the fastest CAGR of 5.6% over the forecast period. This growth is attributed to its longer shelf life, affordability, and ease of storage and transportation, especially in regions with limited refrigeration. In addition, powdered creamers are highly popular among consumers in developing countries and institutional settings such as hotels, offices, and airlines. Their versatility, wide availability in local retail, and cost-effectiveness continue to fuel rising demand.

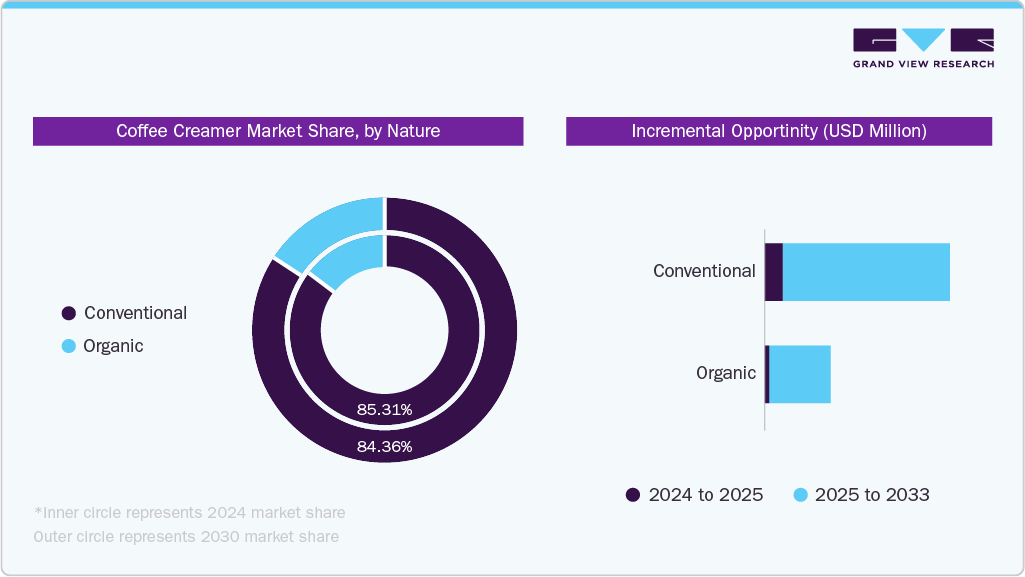

Nature Insights

Conventional coffee creamer segment accounted for the largest market share of 85.31% in 2024. This can be attributed to several factors, such as the availability of a wide variety of flavors and types, ranging from classic vanilla and hazelnut to seasonal flavors like pumpkin spice. Moreover, conventional creamers are often more affordable and have a longer shelf life, making them a convenient choice for both consumers and retailers. In addition, many consumers prefer conventional creamers over alternative options due to their taste and texture. Overall, the combination of affordability, availability, and variety has allowed conventional coffee creamers to maintain their position as the preferred choice among consumers.

Organic coffee creamer is expected to grow at a CAGR of 6.0% over the forecast period due to rising consumer awareness about clean-label products, health and wellness trends, and the perceived benefits of chemical-free, non-GMO ingredients. Increasing demand for sustainable and ethically sourced products further supports the growth of organic creamers across both developed and emerging markets. In August 2022, Nestlé expanded Coffee Mate’s portfolio by launching plant-based creamers made from a blended base of oat and almond milk. Initially offered in French Vanilla and Caramel flavors, the products debuted at select Walmart stores before rolling out nationwide.

Flavor Insights

The flavored coffee creamer segment held the revenue share of 63.39% in 2024. Flavored coffee have become increasingly popular among consumers, leading to significant demand in recent years. This can be attributed to several factors, such as the growing demand for customization and personalization in the food and beverage industry. Flavored creamers offer a variety of options, ranging from classic flavors like vanilla and caramel to more unique and seasonal options such as cinnamon rolls and peppermint.

The Regular/Unflavored segment is expected to grow at the fastest CAGR of 5.6% over the forecast period due to increasing consumer preference for simple, versatile options that blend seamlessly with different coffee types. This segment appeals to health-conscious individuals who avoid artificial flavors and additives and also caters to traditional consumers who prefer the classic taste and consistency of plain creamers without added sweetness or complexity.

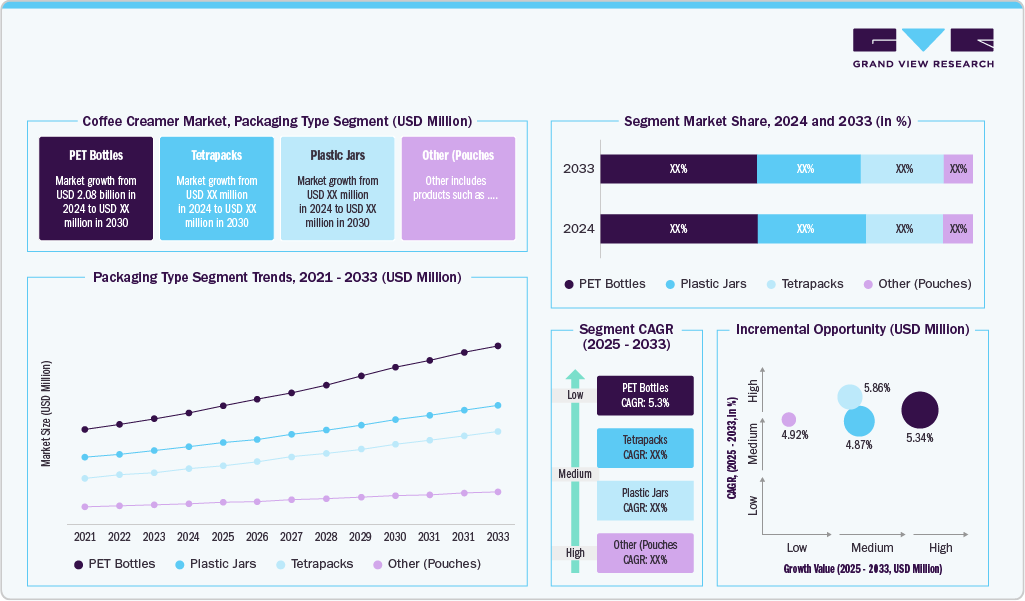

Packaging Type Insights

The PET bottled coffee creamer accounted for a revenue share of 42.12% in 2024. PET bottles are lightweight and shatterproof, making them a more convenient and safer option for consumers to use and transport. PET bottles offer better protection against oxygen and light, which helps preserve the freshness and flavor of the creamer for longer periods. In addition, PET bottles are recyclable, and this makes them a more sustainable packaging option that aligns with the growing demand for eco-friendly products among consumers. The popularity of PET bottles in the market is set to continue as manufacturers continue to invest in product innovation and packaging design to meet changing consumer preferences.

Coffee creamer tetra packs market is growing at the fastest CAGR of 5.9% over the forecast period due to rising demand for lightweight, eco-friendly, and recyclable packaging. These packs offer extended shelf life, convenience in storage and transportation, and are increasingly preferred for liquid coffee creamers. The growing focus on sustainability and reduced plastic usage further accelerates the adoption of Tetrapack formats globally.

Distribution Channel Insights

Sales of coffee creamer through B2B channels accounted for a market share of 73.58% in 2024. This segment's larger share is attributed to its extensive product usage in restaurants and cafes. Product sales are rising across the globe due to the growing number of cafes and coffee outlets. Moreover, roasted coffee is highly served by various businesses in the hospitality industry, including hotels, restaurants, and others, which is expected to propel industry growth. The B2C distribution channel has emerged as a significant contributor to market growth.

Sales of coffee creamers through B2C channels are expected to grow at a CAGR of 5.7% from 2025 to 2033. The growth of the e-commerce sector has made it easier for businesses to reach a wider customer base, including those in remote areas, which has helped expand the overall market. The convenience of ordering online and home delivery has made it more appealing for consumers to purchase coffee creamers in bulk quantities, contributing to higher sales volumes. The availability of a wide variety of flavors and types of coffee creamers through online platforms has enabled consumers to easily explore and try new products, further driving the growth of this distribution channel.

Regional Insights

North America coffee creamer market is expected to grow at a CAGR of 5.2% over the forecast period due to the region's well-established coffee culture, high consumption of specialty coffee beverages, and wide availability of innovative creamer products. Rising demand for plant-based and sugar-free alternatives and a strong presence of major brands like Nestlé and Danone continue to drive market growth. Convenience and premiumization trends are also shaping consumer preferences.

U.S. Coffee Creamer Market Trends

The U.S. coffee creamer market growth is driven by high coffee consumption rates and a growing preference for flavored and functional creamers. The surge in keto and low-carb diets has boosted demand for high-fat and MCT-based creamers. Moreover, increased demand for organic, non-GMO, and lactose-free creamers, especially via online platforms, is supporting market expansion.

Europe Coffee Creamer Market Trends

The Europe region dominated the coffee creamer market with a revenue share of 36.84% in 2024. The dominance is primarily attributed to increasing coffee shop penetration and shifting from traditional dairy to plant-based creamers. Germany, France, and the Netherlands are key markets. Consumers’ preference for clean-label products, growing awareness of lactose intolerance, and strong regulatory support for sustainable packaging are shaping market dynamics.

The UK coffee creamer market is fueled by the rising trend of premium and specialty coffee, both in cafes and at home. Demand for dairy-free and oat-based creamers is accelerating, supported by the vegan movement and health awareness. Local brands and private labels are focusing on organic, low-sugar options with recyclable packaging, gaining traction among environmentally conscious consumers.

Asia Pacific Coffee Creamer Market Trends

Asia-Pacific is growing at the CAGR of 6.8% over the forecast period, owing to rapid urbanization, increased Western dietary influence, and the expanding café culture. Rising disposable incomes in countries like India, Japan, and South Korea are fostering demand for convenient, flavored creamers. In addition, regional players are launching affordable and localized products, especially non-dairy and powdered formats, to penetrate rural and semi-urban markets.

Coffee creamer market in China is growing significantly due to the rising popularity of coffee among young consumers and the proliferation of coffee chains such as Luckin Coffee and Starbucks. The demand for liquid and single-serve creamers is growing in tandem. Health-focused consumers are also driving demand for low-fat and lactose-free creamer options.

Latin America Coffee Creamer Market Trends

Latin America coffee creamer market is growing significantly over the forecast period, supported by the expanding urban middle class and increased coffee consumption outside traditional formats. While dairy creamers remain popular, consumer shifts toward flavored and health-conscious options are gaining momentum, especially among millennials. E-commerce growth is also aiding accessibility in remote areas.

The Brazil coffee creamer market is growing as the country offers a significant market for creamers, especially flavored and sweetened varieties. The demand for affordable powdered creamers is strong in rural areas, while urban consumers increasingly opt for premium, lactose-free, and functional alternatives. Domestic companies are investing in regional flavor customization to tap local tastes.

Middle East & Africa Coffee Creamer Market Trends

The coffee creamer industry in the Middle East and Africa region is showing a steady growth over the forecast period, driven by increasing urbanization, Western lifestyle influence, and the growth of coffee chains. The UAE and Saudi Arabia are key markets with strong demand for premium and imported creamers. Powdered creamers remain popular in African countries for their long shelf life and affordability.

The UAE coffee creamer market is growing due to high demand in both the household and HoReCa sectors. Market growth is also fueled by increasing coffee and specialty beverage consumption, rising tourism, thriving café culture, and the convenience factor of non-dairy, flavored creamers.

Key Coffee Creamer Company Insights

Key companies in the coffee creamer industry primarily focus on innovation, flavor diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across retail and food service channels.

Key Coffee Creamer Companies:

The following are the leading companies in the coffee creamer market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Danone

- Chobani, LLC

- DreamPak LLC

- Viceroy Holland BV

- PT. Santos Premium Krimer

- Kerry Group plc.

- FrieslandCampina

- Land O'Lakes, Inc.

- Fujian Jumbo Grand Food Co., Ltd.

- Heartland Food Products Group

- Leaner Creamer LLC

- Califia Farms, LLC

- nutpods Dairy-Free Creamer

- Laird Superfood

Recent Developments

-

In April 2025, Coffee Mate reintroduced its Dirty Soda Creamers in the U.S., collaborating with Dr Pepper and Orange Crush. The limited-edition Coconut Lime and Orange Cream Pop flavors were initially available at Albertsons, later expanding to Target and Kroger for summer retail sales.

-

In March 2025, Violife launched its Supreme Coffee Creamers, introducing a lentil‑based formula that stayed creamy and blended seamlessly. Available in Tempting Vanilla, Seductive Caramel, and Boldly Original, the launch was supported by the nationwide “Creamy Confessions” campaign.

-

In January 2025, Violife launched its Supreme Sweet Cream lentil-based coffee creamers. The dairy‑free line included Boldly Original, Tempting Vanilla, and Seductive Caramel flavors. It features a protein-rich, allergen‑free formula that blends smoothly in hot or cold beverages.

-

In December 2024, Coffee Mate, by Nestlé launched two limited‑edition White Lotus creamers, inspired by the tropical, Thailand‑based third season of the HBO series. The Thai Iced Coffee and Piña Colada flavors were positioned to evoke luxury resort vibes.

-

In October 2024, Coffee Mate launched its first Cold Foam Creamer line, offering French Vanilla, Italian Sweet Crème, and Brown Butter Chocolate Chip Cookie flavors. The refrigerated cans featured 25% less sugar and 25% more servings, elevating at-home cold beverages

Coffee Creamer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue Forecast in 2033

USD 7.88 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, form, nature, flavor, packaging type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Nestlé; Danone; Chobani, LLC; DreamPak LLC; Viceroy Holland BV; PT. Santos Premium Krimer; Kerry Group plc.; FrieslandCampina; Land O'Lakes, Inc.; Fujian Jumbo Grand Food Co., Ltd.; Heartland Food Products Group; Leaner Creamer LLC; Califia Farms, LLC; nutpods Dairy-Free Creamer; Laird Superfood

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Creamer Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global coffee creamer market report based on product, type, form, nature, flavor, packaging type, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dairy-based

-

Non-dairy

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

High-fat

-

Low-fat (<3 grams)

-

Fat-free (<0.5 grams)

-

-

Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Liquid

-

Powder

-

-

Nature Outlook (Revenue, USD Billion, 2021 - 2033)

-

Organic

-

Conventional

-

-

Flavor Outlook (Revenue, USD Billion, 2021 - 2033)

-

Regular/ Unflavored

-

Flavored

-

-

Packaging Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plastic Jars

-

Tetra packs

-

PET Bottles

-

Others (pouches)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2B

-

B2C

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coffee creamer market size was estimated at USD 4.95 billion in 2024 and is expected to reach USD 7.88 billion in 2033.

b. The global coffee creamer market is expected to grow at a compounded growth rate of 5.3% from 2025 to 2033.

b. Non-dairy coffee creamer dominated the market and held the largest revenue share of 55.2% in 2024. The segment is expected to maintain dominance over the forecast period owing to increasing demand for plant-based products, growing vegan population, rising lactose intolerance among others.

b. Some key players operating in market include Nestlé; Danone; Chobani, LLC; DreamPak LLC; Viceroy Holland BV; Santos Premium Krimer; Kerry Group plc.; FrieslandCampina; Land O'Lakes, Inc.; Fujian Jumbo Grand Food Co., Ltd.; Heartland Food Products Group; Leaner Creamer LLC; Califia Farms, LLC; nutpods Dairy-Free Creamer; Laird Superfood

b. The rising demand for coffee creamers can be attributed to the availability of innovative flavors and functional ingredients, convenience and on-the-go consumption, expansion of e-commerce and omnichannel retailers, and overall growth in the food service industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.