- Home

- »

- Next Generation Technologies

- »

-

Cognitive Cloud Market Size & Share, Industry Report, 2033GVR Report cover

![Cognitive Cloud Market Size, Share & Trends Report]()

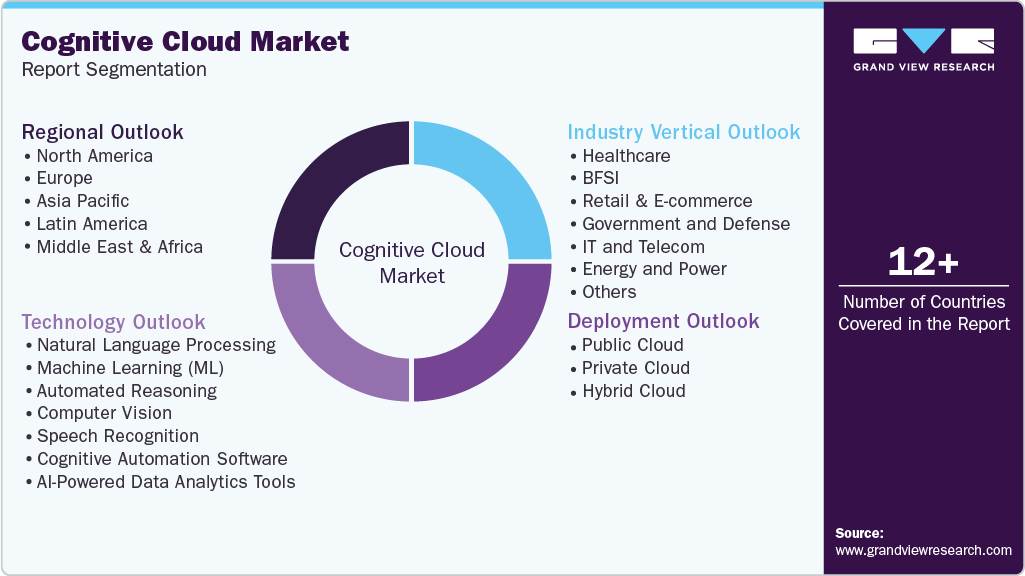

Cognitive Cloud Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (NLP, ML, Automated Reasoning, Computer Vision, Speech Recognition), By Deployment (Public Cloud, Private Cloud), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-713-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cognitive Cloud Market Summary

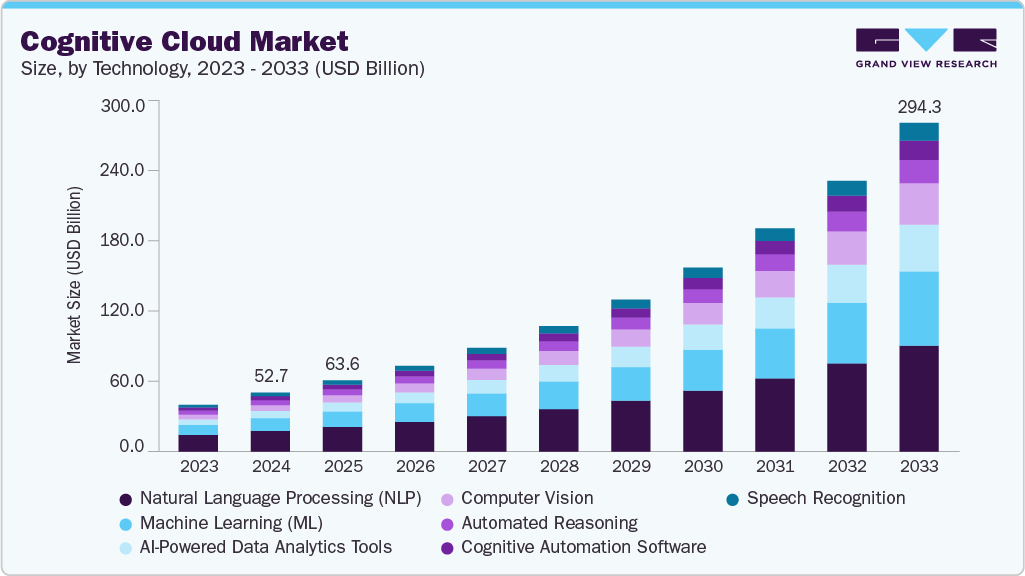

The global cognitive cloud market size was estimated at USD 52.67 billion in 2024 and is projected to reach USD 294.34 billion by 2033, growing at a CAGR of 21.1% from 2025 to 2033. The increasing adoption of AI-powered hybrid cloud solutions drives the market.

Key Market Trends & Insights

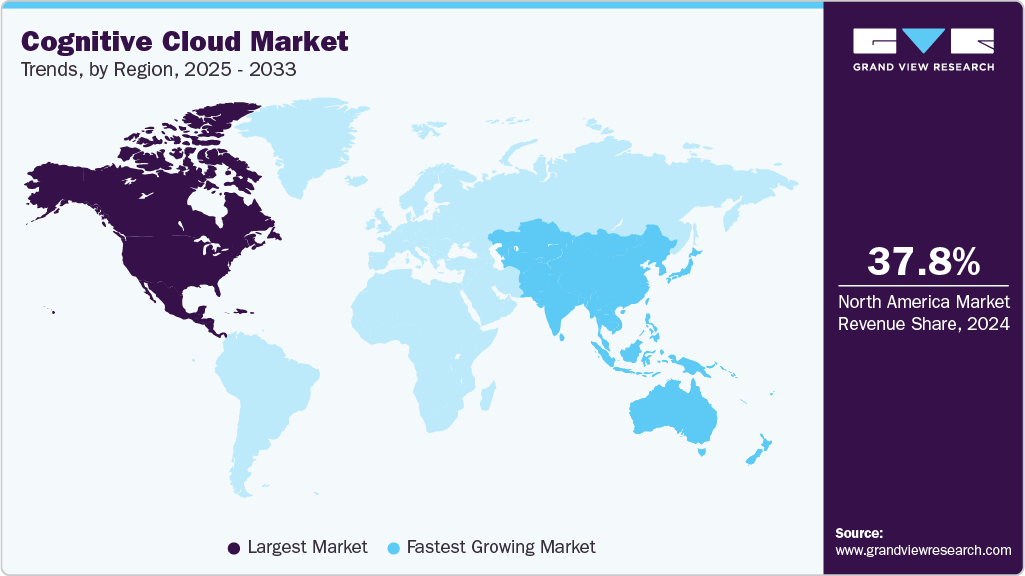

- North America Cognitive Cloud dominated the global market with the largest revenue share of 37.8% in 2024.

- The cognitive cloud market in the U.S. led the North America market and held the largest revenue share in 2024.

- By technology, natural language processing (NLP) led the market and held the largest revenue share of 35.2% in 2024.

- By deployment, the public cloud segment held the dominant position in the market and accounted for the largest revenue share of 48.3% in 2024.

- By industry vertical, the retail and e-commerce segment is expected to grow at the fastest CAGR of 24.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 52.67 Billion

- 2033 Projected Market Size: USD 294.34 Billion

- CAGR (2025-2033): 21.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Businesses are integrating artificial intelligence (AI) and machine learning (ML) with hybrid cloud systems to enable real-time data processing and scalability. This movement enhances automation, predictive analytics, and customized customer experiences in industries such as healthcare and finance. Demand for secure, adaptable, cost-effective cloud infrastructures propels this market's expansion. Enterprises are increasingly adopting AI-powered automation to improve operational efficiency. These solutions integrate seamlessly into existing systems, reducing reliance on manual processes. Automation enables faster and more accurate decision-making across business functions.

Personalization features enhance customer engagement and satisfaction. The approach supports scalability and adaptability in diverse market environments. For instance, in November 2024, Intalio, a UK-based service management company, launched a suite of advanced AI capabilities and cognitive services with multilingual support, offering tools for intelligent document categorization, automated indexing, real-time summarization, GPT-based chatbots, and data analytics. These solutions streamline workflows, enhance decision-making, and enable personalized, multilingual engagement.

Agentic AI is driving a shift in the cognitive cloud toward autonomous, context-aware agents that operate within enterprise environments to execute tasks without continuous human oversight. These systems manage complex, multi-step processes from predicting potential issues to initiating resolutions and optimizing workflows directly within existing digital ecosystems. Agentic AI enables streamlined operations and reduces manual intervention, supporting faster, data-driven decision-making at scale. Its growing use across industries is expanding the scope of cognitive cloud applications, moving enterprise support from reactive responses to proactive, self-directed operations. For instance, in October 2024, SupportLogic, a U.S.-based software company, launched its Cognitive AI Cloud, an AI platform featuring autonomous, context-aware agents that integrate into enterprise workflows to prevent escalations, improve efficiency, and deliver hyper-personalized customer support. Advanced AI engines power the platform and integrate with major business systems to enable proactive, predictive operations.

Integrating cognitive cloud solutions with IoT and edge computing is accelerating across industries. Organizations increasingly leverage this combination to process data closer to its source, significantly reducing latency in analytics and decision-making. It also enables real-time monitoring of critical assets and operations, with industries such as manufacturing, healthcare, and transportation being key adopters. Edge devices equipped with AI models can perform advanced analysis without relying solely on central cloud systems, while cognitive cloud platforms enhance these capabilities through scalable processing power and adaptive learning. This synergy supports predictive maintenance and operational optimization, and as adoption grows, it is expected to redefine how businesses manage and utilize real-time data streams.

Technology Insights

The natural language processing (NLP) segment dominated the market in 2024, accounting for a 35.2% share, due to its broad applicability across multiple industries. It enables machines to understand, interpret, and respond highly accurately to human language, making it essential for various business applications. Enterprises utilize NLP for chatbots, virtual assistants, and automated customer support, streamlining communication processes and improving response times. It is also widely used for sentiment analysis, language translation, and content summarization, enhancing both customer engagement and operational efficiency. Cloud-based NLP solutions provide scalability and accessibility, catering to organizations of all sizes.

The ML segment is growing as organizations increasingly adopt data-driven strategies to improve efficiency and innovation. It enables systems to learn from vast datasets, identify patterns, and make accurate predictions without explicit programming. Businesses use ML for applications such as predictive analytics, fraud detection, recommendation engines, and process optimization. Its integration with cognitive cloud platforms enhances scalability, accelerates model training, and supports real-time insights. Increasing demand for automation, personalized services, and intelligent decision-making fuels ML adoption across sectors. This strong growth trajectory positions ML as a core driver of advancements in the market.

Deployment Insights

Public cloud holds the largest share in the market in 2024. The public cloud segment dominated the market due to its cost efficiency, scalability, and ease of deployment, making it a preferred choice for enterprises of all sizes. It enables rapid deployment of AI and cognitive applications without the need for significant infrastructure investments. On-demand access to computing resources supports flexible and dynamic workload management. Continuous advancements in cloud security and compliance frameworks have increased trust among enterprises. Its adoption spans industries such as healthcare, BFSI, retail, and IT services. These factors have collectively reinforced its leading position in the global market.

The hybrid cloud segment is growing as organizations aim to combine the strengths of public and private environments. It allows critical and sensitive data to remain in secure, on-premises systems while utilizing the public cloud for scalable processing and advanced analytics. This structure enables cost optimization while maintaining high levels of security and compliance. Hybrid deployments provide flexibility for dynamic workload distribution across multiple environments. Industries handling regulated or confidential information are increasingly adopting this model. These benefits drive strong growth for the hybrid cloud segment within the market.

Industry Vertical Insights

The BFSI segment dominated the market in 2024, owing to its strong focus on security, compliance, and advanced data analytics capabilities. Financial institutions use cognitive solutions for fraud detection, risk management, and personalized customer services. AI-powered analytics enhance decision-making by delivering real-time insights from large volumes of transactional data. Automation of routine processes reduces operational costs and improves efficiency. The sector’s rapid adoption of chatbots, virtual assistants, and predictive analytics has further strengthened its position. These applications have made BFSI the most prominent user of cognitive cloud solutions globally.

The retail and e-commerce segment is growing due to increasing demand for personalized shopping experiences and efficient inventory management. Businesses in this sector utilize cognitive cloud solutions to analyze customer behavior and recommend tailored products. AI-driven chatbots and virtual assistants are improving customer engagement and service speed. Real-time analytics help retailers optimize pricing strategies and manage supply chains effectively. Integration with IoT devices enables better tracking of goods and predictive restocking. These advancements are driving significant growth for retail and e-commerce adoption of cognitive cloud technologies.

Regional Insights

North America holds the largest share in the cognitive cloud market at 37.8% due to its advanced technological infrastructure and high adoption of AI-driven solutions across industries. Strong presence of major cloud providers and continuous investment in innovation further strengthen the region’s market position. This environment fosters rapid deployment of cognitive cloud applications, supporting enterprise efficiency and customer experience improvements. Favorable regulatory frameworks encourage cloud-based AI adoption while ensuring data security and compliance.

U.S. Cognitive Cloud Market Trends

The cognitive cloud market in the U.S. is driven by strong enterprise adoption across BFSI, healthcare, retail, and government sectors. High investments in AI, machine learning, and advanced analytics boost platform capabilities and scalability. Widespread cloud infrastructure and the presence of major technology providers accelerate innovation. Regulatory frameworks around data privacy and security are maturing, enabling greater trust in cloud-based AI solutions.

Europe Cognitive Cloud Market Trends

The cognitive cloud market in Europe is supported by increasing digital transformation initiatives across industries and strict compliance requirements like GDPR. Organizations are integrating AI-driven cloud platforms to enhance operational efficiency and customer personalization while maintaining data sovereignty. The region is seeing steady adoption in healthcare, automotive, and manufacturing, alongside rapid uptake in financial services. Collaborative projects between the public and private sectors accelerate innovation and cross-border cloud integration.

Asia Pacific Cognitive Cloud Market Trends

The cognitive cloud market in Asia Pacific is expanding rapidly due to large-scale digital adoption and the proliferation of mobile-first economies. Governments are promoting AI and cloud initiatives to modernize public services and industry infrastructure. Retail, telecommunications, and manufacturing enterprises are adopting cognitive cloud solutions to improve scalability, customer engagement, and supply chain optimization. High internet penetration and growing startup ecosystems further fuel innovation in AI-powered cloud platforms.

Key Cognitive Cloud Company Insights

Some key companies in the Cognitive Cloud industry include Amazon Web Services, Inc., CognitiveScale Inc., Google LLC, IBM Corporation, and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Google LLC has been advancing its cognitive cloud capabilities through Google Cloud AI, which integrates AI models into scalable cloud services. The company offers tools for natural language processing, computer vision, and predictive analytics to support diverse enterprise needs. Its platform utilizes TensorFlow and Vertex AI to streamline model development and deployment. Strategic partnerships across industries have expanded the adoption of its AI-powered cloud solutions.

-

IBM Corporation continues to enhance its cognitive cloud portfolio through the Watson platform, providing AI-driven analytics, NLP, and automation capabilities. The company focuses on industry-specific solutions, particularly in healthcare, finance, and supply chain. Integrating hybrid cloud with AI allows enterprises to deploy models securely across environments. Collaborations with global partners have helped extend Watson’s reach and capabilities.

Key Cognitive Cloud Companies:

The following are the leading companies in the cognitive cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- CognitiveScale Inc.

- Google LLC

- IBM Corporation

- Microsoft

- Nuance Communications, Inc.

- Oracle

- SAP SE

- Salesforce, Inc.

- SAS Institute Inc.

Recent Developments

-

In August 2025, Microsoft integrated OpenAI's GPT-5 models into its Copilot ecosystem, including Microsoft 365 Copilot, GitHub Copilot, Azure AI Foundry, and Copilot Studio. This integration introduces a "smart mode" feature for optimal performance.

-

In August 2025, Amazon Web Services, Inc. partnered with OpenAI to offer OpenAI’s open-weight models via Amazon Bedrock and SageMaker. This partnership includes models like gpt-oss-120B and gpt-oss-20B, designed for code generation and scientific reasoning tasks.

-

In December 2024, Infosys Limited, an Indian information technology services and consulting company, collaborated with Google LLC to launch a Center of Excellence powered by Infosys Topaz and Google Cloud’s generative AI. This co-innovation hub focuses on enterprise AI solutions across contact-center AI, agentic AI, speech-to-speech, and more, fostering customized solution development with co-created impact.

Cognitive Cloud Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 63.57 billion

Revenue forecast in 2033

USD 294.34 billion

Growth rate

CAGR of 21.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Technology, deployment, industry vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; CognitiveScale Inc.; Google LLC; IBM Corporation; Microsoft; Nuance Communications, Inc.; Oracle Corporation; SAP SE; Salesforce, Inc.; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cognitive Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cognitive cloud market in terms of technology, deployment, industry vertical, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural Language Processing

-

Machine Learning (ML)

-

Automated Reasoning

-

Computer Vision

-

Speech Recognition

-

Cognitive Automation Software

-

AI-Powered Data Analytics Tools

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Government and Defense

-

IT and Telecom

-

Energy and Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cognitive cloud market size was estimated at USD 52.67 billion in 2024 and is expected to reach USD 63.57 billion in 2025.

b. The global cognitive cloud market is expected to grow at a compound annual growth rate of 21.1% from 2025 to 2033 to reach USD 294.34 billion by 2033.

b. North America dominated the cognitive cloud market with a share of 37.8% in 2024. This dominance is attributable to advanced cloud infrastructure, strong enterprise adoption of AI-driven technologies, and the presence of leading technology providers in the region.

b. Some key players operating in the cognitive cloud market include Amazon Web Services, Inc., CognitiveScale Inc., Google LLC, IBM Corporation, Microsoft, Nuance Communications, Inc., Oracle Corporation, SAP SE, Salesforce, and SAS Institute Inc.

b. Key factors driving the market growth include increasing adoption of AI and machine learning, rising demand for scalable cloud infrastructure, growing need for real-time data processing, expansion of digital transformation initiatives, and strong investments from technology providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.