- Home

- »

- Catalysts & Enzymes

- »

-

Cold-active Enzymes Market Size, Industry Report, 2033GVR Report cover

![Cold-active Enzymes Market Size, Share & Trends Report]()

Cold-active Enzymes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Proteases, Carbohydrases, Lipases), By Application (Food & Beverages, Detergents, Biofuels, Textiles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-789-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold-active Enzymes Market Summary

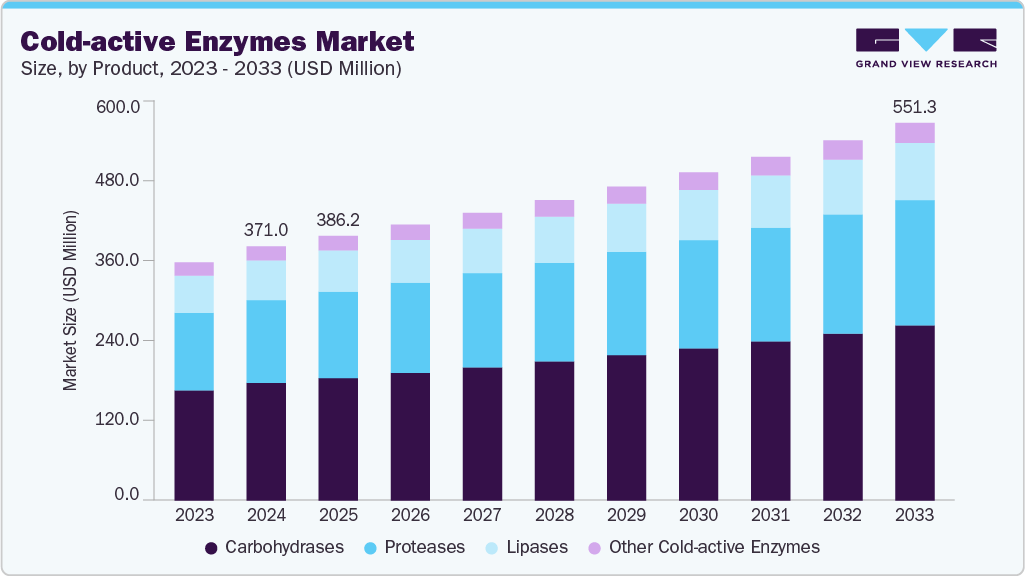

The global cold-active enzymes market size was estimated at USD 371.0 million in 2024 and is projected to reach USD 551.3 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The growth of the global market for cold-active enzymes is primarily driven by the rising demand for energy-efficient and sustainable biotechnological solutions across industries such as food & beverages, detergents, textiles, and biofuels.

Key Market Trends & Insights

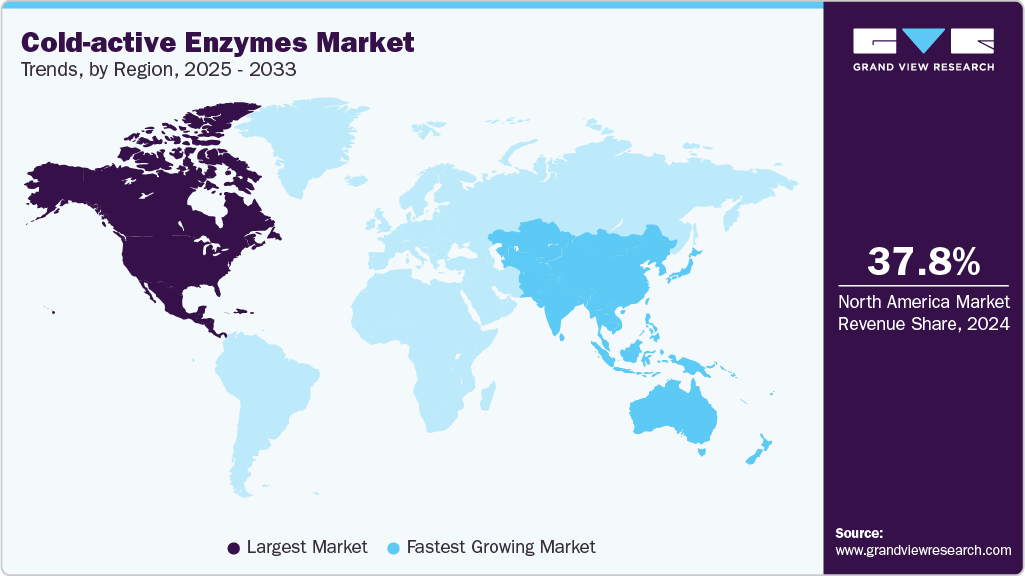

- North America dominated the global cold-active enzymes industry with the largest revenue share of 37.8% in 2024.

- The market in China is expected to grow at a significant CAGR of 4.9% in terms of revenue from 2025 to 2033.

- By product, the proteases is expected to grow at the fastest CAGR of 4.8% from 2025 to 2033 in terms of revenue.

- By product, the carbohydrases segment held the largest revenue share of 46.3% in 2024 in terms of value.

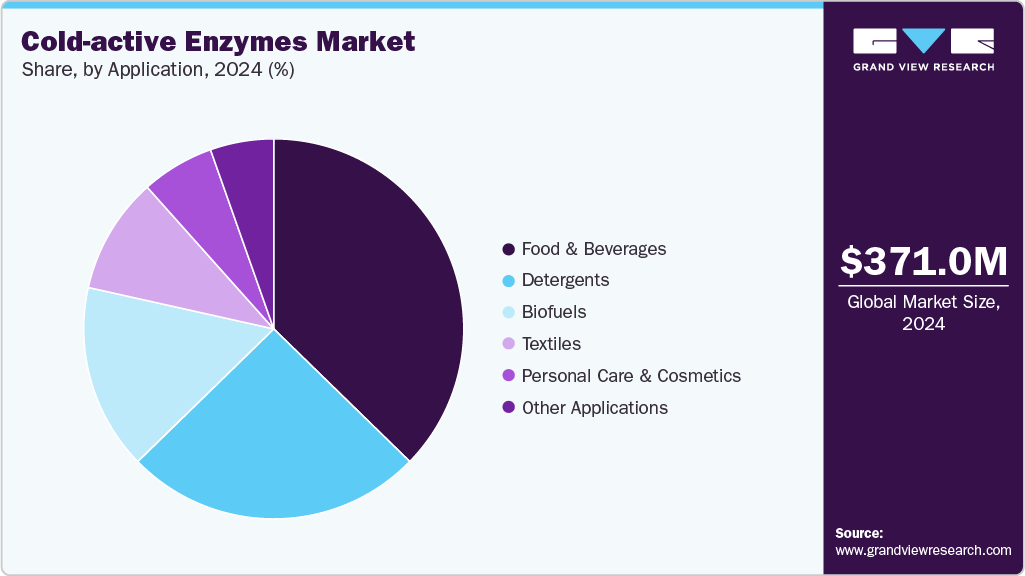

- By application, the food & beverages segment held the largest revenue share of 37.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 371.0 Million

- 2033 Projected Market Size: USD 551.3 Million

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cold-active enzymes operate effectively at low temperatures significantly reducing energy consumption and operational costs compared to conventional enzymes. The increasing adoption of eco-friendly products in detergents and cleaning applications, coupled with the growing use of enzymatic bioprocesses in Arctic and Antarctic biotechnology research, is fueling market expansion. Technological advancements in enzyme engineering and metagenomics for developing highly stable and active enzymes at low temperatures are further propelling market growth.The market presents substantial opportunities driven by expanding industrial applications in low-temperature bioprocessing, particularly within the food processing and detergent sectors. The growing focus on green chemistry and circular bioeconomy initiatives offers new avenues for the use of cold-active enzymes as environmentally sustainable alternatives to chemical catalysts. Emerging economies in Asia Pacific and Latin America are expected to witness increased adoption, supported by industrialization and government incentives promoting sustainable manufacturing. In addition, the integration of artificial intelligence (AI) and computational protein design in cold-active enzyme discovery and optimization is opening pathways for customized enzyme formulations with enhanced activity and stability, creating lucrative opportunities for enzyme manufacturers and biotechnology firms.

Despite their promising potential, the commercialization of cold-active enzymes faces several challenges, including high production costs and stability issues under industrial-scale conditions. The extraction and purification of enzymes from psychrophilic microorganisms require sophisticated bioprocessing techniques, which increase the overall cost of production. Furthermore, limited awareness and technical expertise in developing economies hinder large-scale adoption. The market also encounters difficulties related to maintaining enzyme activity during storage and transport at fluctuating ambient temperatures. The stringent regulatory frameworks governing enzyme applications, particularly in food and pharmaceutical sectors, may delay product approvals and market entry, thereby constraining growth in the short to medium term.

Market Concentration & Characteristics

The competitive landscape of the cold-active enzymes industry is characterized by a two-tier structure in which large, diversified enzyme and chemical players compete alongside specialized biotechnology firms. Global incumbents such as Novozymes and BASF leverage deep R&D pipelines, extensive IP portfolios, and broad commercial footprints to defend share across high-volume applications (detergents, food processing and industrial biocatalysis). Formulation and application specialists, IFF and Amano Enzyme, compete by bundling enzymes with formulation science and customer-facing product development, enabling faster adoption by detergent and food manufacturers. Regional and cost-focused players such as Advanced Enzyme Technologies and KDN Biotech provide manufacturing scale and price competitiveness for commodity and semi-specialty enzyme products in Asia, while innovators like Takara Bio and Enzymatica carve niche positions with cold-active molecular biology and therapeutic/medical enzyme offerings. This mix creates a market where breadth of portfolio, proven low-temperature performance, regulatory credentials, and distribution partnerships are as important as raw enzyme activity metrics.

Competition is increasingly shifting from simple product substitution to value-added services and customized solutions. Winning strategies include proprietary enzyme engineering (to improve activity/stability at low temperatures), co-development partnerships with formulators and OEMs, and regional manufacturing to reduce logistics and cold-chain complexity. Pressure on margins from commoditization is balanced by opportunities in premium segments (clean-label food processing, bio-based detergents, and specialized bioprocessing), prompting consolidation, licensing, and targeted M&A. For new entrants and incumbents alike, success will depend on demonstrating scalable production economics, clear regulatory pathways for target applications, and go-to-market models that pair technical support with application validation, especially in high-growth APAC markets where local players and customers favor agile, cost-effective partners.

Product Insights

Carbohydrases dominated the market with the largest revenue share of 46.3% in 2024, primarily due to their extensive utilization across food & beverage, detergent, and biofuel industries. These enzymes play a critical role in breaking down complex carbohydrates such as starch, cellulose, and hemicellulose into simpler sugars under low-temperature conditions, ensuring high catalytic efficiency without requiring elevated heat input. Their ability to retain activity at sub-optimal industrial temperatures significantly reduces energy consumption and enhances process sustainability, key priorities for manufacturers striving to lower carbon footprints. In the food & beverage sector, cold-active carbohydrases are extensively used for brewing, baking, and dairy applications, improving texture and flavor profiles while maintaining product quality. Additionally, their role in bioethanol production from cold-region biomass further contributes to their market leadership, supported by growing demand for renewable energy sources.

Proteases and lipases collectively represent the second major product categories, driven by their growing adoption in cold-water detergents, textile processing, and biocatalytic synthesis. Cold-active proteases enable effective protein degradation and stain removal at lower washing temperatures, supporting energy-efficient formulations aligned with sustainability trends in the home care sector. Lipases are gaining prominence in biodiesel production and food flavor enhancement, owing to their versatility and high substrate specificity at low temperatures. The “Other Cold-active Enzymes” segment, which includes polymerases, nucleases, and oxidoreductases, is emerging as a niche yet high-potential category fueled by applications in molecular biology, pharmaceuticals, and bioremediation. Continuous research in enzyme engineering and metagenomic exploration of polar microorganisms is expected to enhance the catalytic stability and yield of these enzyme classes, supporting broader industrial integration and fueling long-term market growth.

Application Insights

The food & beverages segment captured the largest revenue share of 37.3% in 2024 in the global cold-active enzymes industry, driven by the rising adoption of low-temperature bioprocessing technologies to preserve product quality, nutritional value, and sensory attributes. Cold-active enzymes, particularly carbohydrases and proteases, are widely used in brewing, dairy, baking, and juice clarification processes where mild operating conditions are essential to prevent protein denaturation and flavor loss. Their ability to catalyze reactions efficiently at lower temperatures reduces energy input and enhances process sustainability, a key competitive advantage for food manufacturers aiming to minimize production costs and carbon emissions. The increasing consumer preference for clean-label and naturally processed products has prompted manufacturers to substitute synthetic additives with enzymatic alternatives, further boosting demand. Continuous innovations in enzyme formulation and immobilization have also improved enzyme stability in diverse food matrices, reinforcing their dominance within the industry.

The detergents segment held the second-largest share, supported by growing demand for cold-water washing solutions that reduce energy consumption without compromising cleaning efficiency. Cold-active proteases and lipases enable superior stain removal and fabric care in low-temperature wash cycles, aligning with sustainability-driven consumer trends. The biofuels and textiles segments are expanding steadily as industries transition toward eco-friendly, enzyme-based production pathways that minimize chemical use and wastewater generation. Meanwhile, the personal care & cosmetics segment is gaining traction with the introduction of cold-active enzymes for skin exfoliation and biocatalytic formulation of cosmetic ingredients, offering mild yet effective bioactive performance. The other applications segment, encompassing pharmaceuticals, bioremediation, and environmental biotechnology, is emerging as a niche but high-growth area, supported by expanding research into psychrophilic enzymes for novel biochemical and industrial applications.

Regional Insights

North America cold-active enzymes industry dominated the global market with a 37.8% revenue share in 2024, driven by strong demand from mature industries such as food & beverages, detergents, and biofuels. The region’s focus on sustainable manufacturing practices and energy-efficient bioprocessing technologies has accelerated the adoption of cold-active enzyme formulations that minimize thermal input and operational costs. Extensive R&D activities in enzyme engineering, particularly in the U.S. and Canada, coupled with the presence of leading players such as Novozymes, BASF SE, and International Flavors & Fragrances (IFF), have reinforced regional market leadership. The region also benefits from advanced regulatory frameworks that support biotechnological innovation, alongside growing investment in green chemistry and bioeconomy programs promoting enzyme-based industrial applications.

U.S. Cold-active Enzymes Market Trends

The United States cold-active enzymes industry accounted for 77.7% of the North American market in 2024, underscoring its position as a global hub for biotechnology innovation and enzyme manufacturing. The country’s robust industrial base in detergents, food processing, and renewable biofuels has fostered large-scale deployment of cold-active enzyme technologies. Key market drivers include the rapid shift toward low-temperature laundry detergents and energy-efficient bioprocesses, supported by corporate sustainability initiatives. The presence of advanced biomanufacturing infrastructure and leading enzyme producers, along with a highly developed research ecosystem in molecular biology and protein engineering, positions the U.S. as a frontrunner in both production and export of cold-active enzyme products.

Europe Cold-active Enzymes Market Trends

Europe cold-active enzymes industry captured a 28.4% share of the global market in 2024, driven by stringent environmental regulations, advanced biotechnology capabilities, and growing industrial adoption of bio-based solutions. The European Union’s emphasis on decarbonization and circular bioeconomy initiatives has accelerated enzyme applications in food, textiles, and detergents. Countries such as Germany, Denmark, and the Netherlands host leading enzyme manufacturers and research institutions focusing on psychrophilic enzyme discovery and optimization. European consumers’ preference for eco-friendly products and cold-wash detergents has further strengthened demand, while regional R&D programs under Horizon Europe continue to promote innovation in enzyme stabilization and large-scale production efficiency.

Germanycold-active enzymes industry represents one of the most dynamic enzyme markets in Europe, driven by a strong industrial biotechnology sector and a robust manufacturing ecosystem. The country’s focus on sustainable production and high-value bioprocessing applications has increased the integration of cold-active enzymes, particularly in the food, textile, and detergent industries. Leading research institutes such as Fraunhofer and Max Planck are actively engaged in developing cold-adapted enzyme strains derived from Arctic and Alpine microorganisms. Furthermore, Germany’s well-established chemical and life sciences industry, supported by a skilled workforce and R&D-intensive ecosystem, positions it as a key innovation hub and exporter of enzyme technologies within the European market.

Asia Pacific Cold-active Enzymes Market Trends

The Asia Pacificcold-active enzymes industry accounted for 19.4% of the global market in 2024, emerging as the fastest-growing regional segment due to rapid industrialization, expanding bioprocessing capacity, and favorable government policies promoting biotechnology innovation. The region’s food & beverage, detergent, and biofuel sectors are increasingly adopting cold-active enzymes to enhance process efficiency and sustainability. Countries such as China, Japan, India, and South Korea are leading contributors, supported by investments in enzyme production infrastructure and partnerships between academic institutions and industrial players. The growing preference for energy-efficient consumer products and eco-friendly detergents further accelerates regional market growth.

China cold-active enzymes industry held a 46.9% share of the Asia Pacific market in 2024, positioning it as a key manufacturing and consumption center in the region. The country’s dominance stems from large-scale enzyme production facilities, cost-efficient bioprocessing capabilities, and government-backed initiatives promoting sustainable industrial biotechnology. Domestic companies such as KDN Biotech and Jiangsu Boli Bioproducts Co., Ltd. are expanding their portfolios of cold-adapted enzymes for food, detergent, and biofuel applications. Furthermore, China’s focus on reducing industrial energy consumption and carbon emissions aligns with the adoption of low-temperature enzyme technologies, while increasing exports of enzyme-based formulations reinforces its growing influence in the global value chain.

Middle East & Africa Cold-active Enzymes Market Trends

The Middle East & Africa (MEA) cold-active enzymes industry represents a nascent yet promising market for cold-active enzymes, driven by the diversification of industrial sectors and the rising adoption of eco-friendly technologies. Demand is primarily concentrated in the food processing, textile, and detergent industries, particularly across the Gulf Cooperation Council (GCC) countries and South Africa. The region’s growing investment in renewable energy and sustainable industrial practices aligns with the broader global shift toward green chemistry. However, limited local enzyme production capabilities and dependence on imports remain key challenges. Strategic collaborations with international enzyme manufacturers and the development of regional biomanufacturing hubs are expected to create long-term growth opportunities in the MEA cold-active enzymes industry.

Latin America Cold-active Enzymes Market Trends

The Latin American cold-active enzymes industry is at an emerging stage, supported by the gradual modernization of food processing, detergent, and bioethanol production industries. Countries such as Brazil, Mexico, and Argentina are leading regional adoption, driven by expanding biofuel programs and agricultural biotechnology initiatives. The region’s growing focus on energy efficiency and sustainable production has encouraged enzyme suppliers to introduce cold-active variants suitable for local climatic and industrial conditions. Although limited domestic production currently constrains supply, partnerships with global biotechnology firms and increased government funding for bio-based R&D are expected to enhance regional competitiveness over the forecast period.

Key Cold-active Enzymes Company Insights

Key players, such as Advanced Enzyme Technologies, Novozymes A/S , BASF SE, Amano Enzyme Inc. , Enzymatica AB , and International Flavors & Fragrances Inc. are dominating the market.

-

Advanced Enzyme Technologies Ltd. (AETL) is a research-driven enzyme and probiotic manufacturer headquartered in Thane, India, with a global operational footprint through subsidiaries and manufacturing facilities in India, the U.S., and Europe. The company offers over 400 proprietary enzyme and probiotic products, derived from more than 65 indigenous enzyme strains, and serves customers in over 45 countries. AETL positions itself as an eco-safe solutions provider, extending enzyme applications across human and animal nutrition, food processing, textiles, detergents, biofuels, and other industrial bioprocessing sectors. With strategic acquisitions (such as the German R&D firm evoxx Technologies GmbH) and substantial R&D investment, AETL emphasizes enzyme engineering and customized enzyme blends to capture growth in both domestic and international markets.

Key Cold-active Enzymes Companies:

The following are the leading companies in the cold-active enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Enzyme Technologies

- Novozymes A/S

- BASF SE

- Amano Enzyme Inc.

- Enzymatica AB

- International Flavors & Fragrances Inc.

- KDN Biotech (Shanghai) Co., Ltd.

- Takara Bio Inc.

Cold-active Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 386.2 million

Revenue forecast in 2033

USD 551.3 million

Growth Rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Advanced Enzyme Technologies; Novozymes A/S; BASF SE; Amano Enzyme Inc.; Enzymatica AB; International Flavors & Fragrances Inc.; KDN Biotech (Shanghai) Co., Ltd.; Takara Bio Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold-active Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global cold-active enzymes market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Proteases

-

Carbohydrases

-

Lipases

-

Other Cold-active Enzymes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food & Beverages

-

Detergents

-

Biofuels

-

Textiles

-

Personal Care & Cosmetics

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global cold-active enzymes market size was estimated at USD 371.0 million in 2024 and is expected to reach USD 386.2 million in 2025.

b. The global cold-active enzymes market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 551.3 million by 2033.

b. The food & beverages segment dominated the cold-active enzymes market with a 37.3% revenue share in 2024 due to their extensive use in low-temperature food processing applications such as brewing, baking, dairy, and juice clarification. Cold-active enzymes enable efficient biocatalysis without compromising product texture, flavor, or nutritional value while reducing energy consumption.

b. Some of the key players operating in the cold-active enzymes market include Advanced Enzyme Technologies, Novozymes A/S, BASF SE, Amano Enzyme Inc., Enzymatica AB, International Flavors & Fragrances Inc., KDN Biotech (Shanghai) Co., Ltd., and Takara Bio Inc.

b. The cold-active enzymes market is primarily driven by the growing demand for energy-efficient and sustainable industrial processes across food & beverages, detergents, textiles, and biofuels. Increasing adoption of low-temperature bioprocessing reduces operational costs and carbon emissions, making these enzymes attractive to manufacturers. Technological advancements in enzyme engineering and metagenomics are enabling highly stable and efficient cold-active enzymes, further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.