- Home

- »

- Medical Devices

- »

-

Colorectal Surgery Market Size, Share, Industry Report 2033GVR Report cover

![Colorectal Surgery Market Size, Share & Trends Report]()

Colorectal Surgery Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Endoscopes, Electrosurgical Devices), By Surgery Type (Right Hemicolectomy, Left Hemicolectomy), By Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-443-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Colorectal Surgery Market Summary

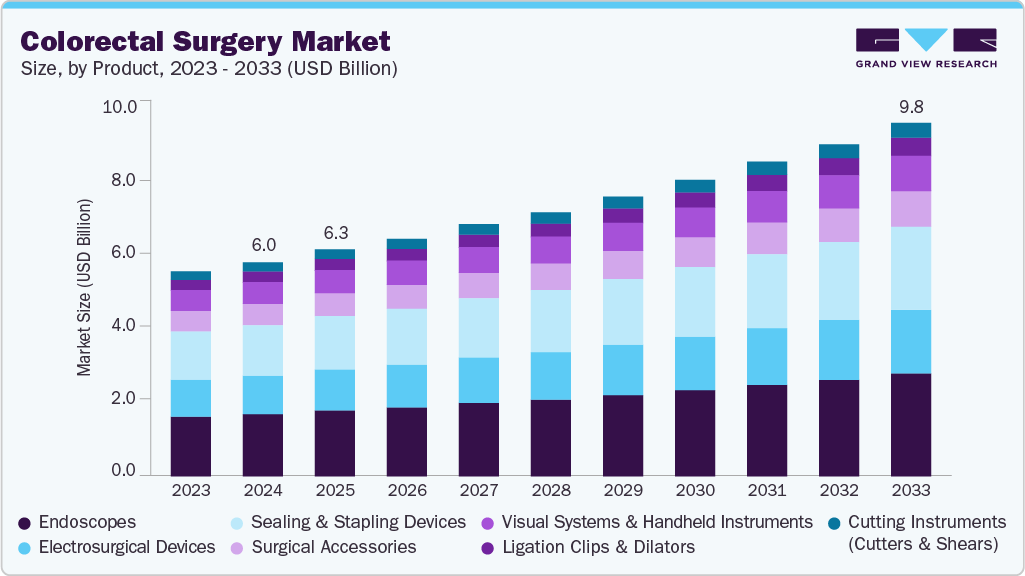

The global colorectal surgery market size was estimated at USD 6.0 billion in 2024 and is projected to reach USD 9.8 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The market growth is primarily fueled by the rising incidence of colorectal diseases, advancements in surgical technologies, supportive regulatory environments, and proactive government initiatives.

Key Market Trends & Insights

- North America was the largest revenue generating market in 2024.

- By product, endoscopes segment dominated the market with a substantial share of 28.5% in 2024.

- By surgery type, the right hemicolectomy segment held the largest revenue share of 22.8% in 2024.

- By indication, the colorectal cancer segment dominated the market in 2024.

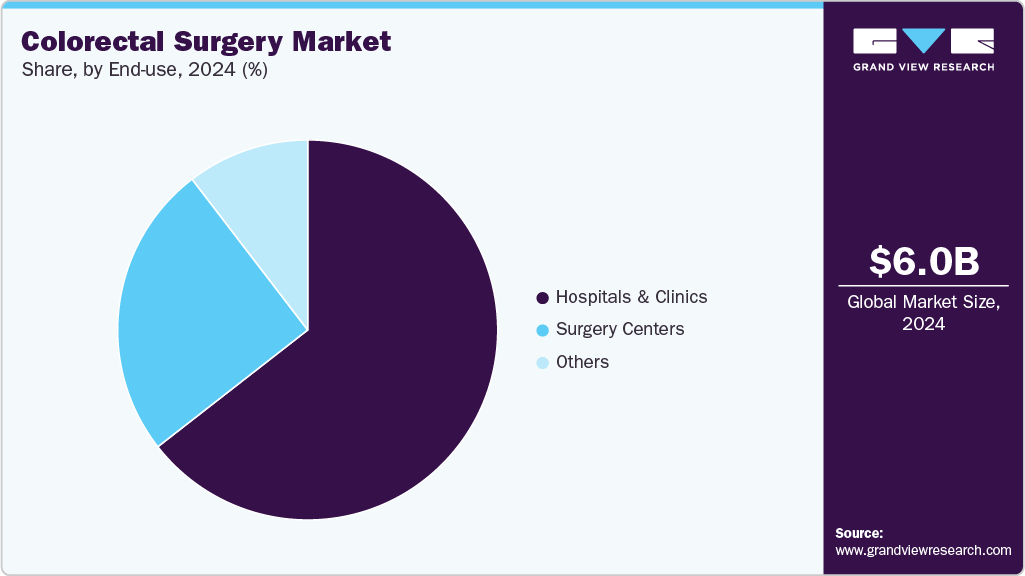

- By end-use, hospitals & clinics dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.0 Billion

- 2033 Projected Market Size: USD 9.8 Billion

- CAGR (2025-2033): 5.6%

- North America: Largest market in 2024

Colorectal cancer, as reported by the World Cancer Research Fund International, is the third most prevalent cancer globally, constituting around 10% of all cancer cases and ranking as the second leading cause of cancer-related mortality worldwide. As per American Cancer Society, in 2025, 2,041,910 new cancer cases and 618,120 cancer deaths are projected to occur in the U.S.The rising incidence of colorectal cancer, alongside disorders such as inflammatory bowel disease (IBD) and diverticulitis, is driving up the demand for colorectal surgeries and treatments. According to the World Cancer Research Fund, in 2022, the global incidence of colorectal cancer was recorded at 1,926,425 cases, with an Age-standardized Rate (ASR) of 18.4 per 100,000 individuals. Among men, there were 1,069,446 new cases, with an ASR of 22.0, while women accounted for 856,979 cases, with an ASR of 15.2. In terms of mortality, colorectal cancer led to 904,019 deaths worldwide, with an overall ASR of 8.1 per 100,000. The mortality figures for men stood at 499,755 deaths, with an ASR of 9.9, whereas for women, the number of deaths was 404,244, with an ASR of 6.5. The growing prevalence of lifestyle-related risk factors such as obesity and sedentary habits is contributing to this trend. In addition, increased public awareness and educational efforts regarding healthy lifestyles and regular screenings are anticipated to further drive market growth by promoting early detection and effective treatment interventions.

Advancements in surgical technologies are a significant catalyst for growth in the colorectal surgery market. The introduction and widespread use of minimally invasive techniques, such as laparoscopic and robotic-assisted surgeries, have transformed the field by offering benefits like shorter recovery periods, reduced surgical trauma, and enhanced precision. Robotic systems such as the da Vinci Surgical System have significantly improved surgical outcomes and patient safety. In August 2023, a study published by the National Library of Medicine, highlighted that robotic surgery for colorectal cancer offers superior outcomes to traditional laparoscopy, particularly in achieving optimal surgical results. As these technologies evolve and become more widely available, their increased adoption is anticipated to propel market growth further.

Government initiatives to enhance colorectal cancer screening and treatment significantly fuel market growth. Numerous countries have established national screening programs designed to diagnose colorectal cancer at its earliest and most treatable stages. For instance, in 2024, the US Preventive Services Task Force (USPSTF) and other expert medical groups recommend that adults between the ages of 45 and 75 get screened for colorectal cancer. The decision to screen for those between 76 and 85 should be made on a case-by-case basis, which has led to increased demand for diagnostic procedures. This early detection boosts the need for follow-up surgeries and drives market demand for advanced surgical interventions. Government-funded research and grants are also crucial in advancing new surgical techniques and treatment modalities. These initiatives support innovation in the field, further expanding market opportunities and improving patient outcomes.

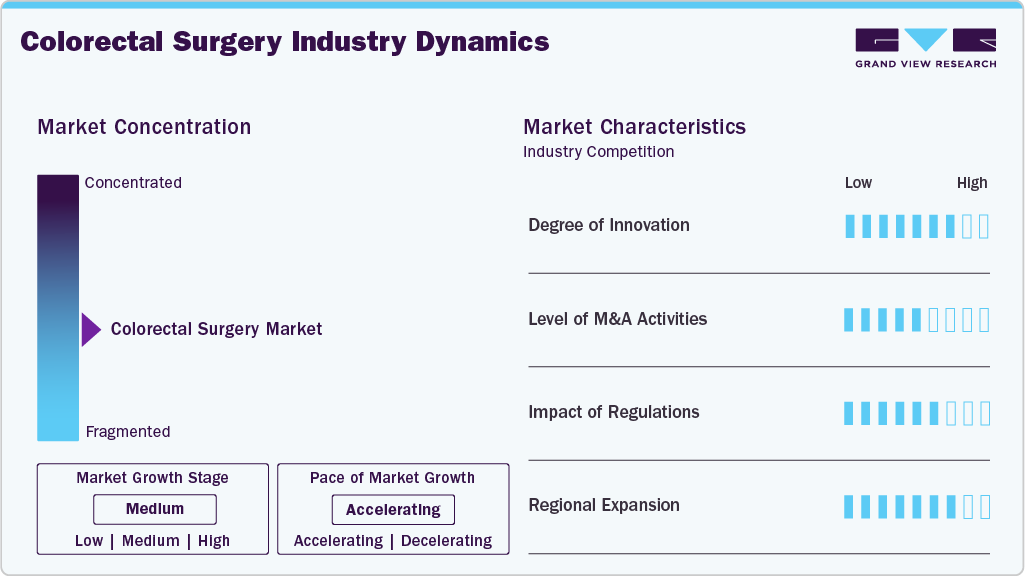

Market Characteristics & Concentration

The market is rapidly advancing due to technological innovations and research breakthroughs. Robotic systems, like the da Vinci Surgical System, enhance precision and reduce recovery times for complex procedures. Improved imaging technologies, such as 3D endoscopy and real-time intraoperative imaging, have heightened diagnostic and surgical accuracy. The introduction of smart surgical instruments with integrated sensors also boosts surgical outcomes. Studies show that robotic-assisted surgeries lead to shorter hospital stays and fewer complications compared to traditional methods.

In September 2024, Odin Medical Ltd., an Olympus Corporation company, has received U.S. Food and Drug Administration (FDA) 510(k) clearance for the CADDIE computer-aided detection device, marking the first cloud-based Artificial Intelligence (AI) technology designed to assist gastroenterologists in detecting suspected colorectal polyps during colonoscopy procedures, this innovation reflects the market's dynamic evolution and continuous growth driven by technological advancements and new product introductions.

Mergers and acquisitions (M&A) significantly influence the colorectal surgery market as major medical device companies pursue strategic acquisitions to broaden their product portfolios and market presence. For instance, in June 2024, Asensus Surgical, Inc. merged with KARL STORZ Endoscopy-America, Inc., a subsidiary of the prominent medical technology firm KARL STORZ SE & Co. KG. Such strategic consolidations allow companies to integrate complementary technologies, enhance innovation capabilities, and strengthen their competitive edge. These M&A activities expand the scope of available surgical technologies and diagnostics and accelerate market growth by combining expertise and resources from diverse industry players.

Regulations play a crucial role in shaping the market. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) ensure the safety and efficacy of surgical devices and technologies. Streamlined approval processes for advanced devices, such as robotic surgery systems and new diagnostic tools, facilitate quicker market entry and innovation. For instance, the FDA's 510(k) clearance process allows for faster approval of devices with demonstrated safety and effectiveness. Additionally, regulatory support for clinical trials and research grants accelerates the development of novel treatments. However, stringent regulatory requirements also pose challenges, potentially delaying market entry and increasing costs for new technologies.

The regional expansion of colorectal surgery reflects growing demand and varying healthcare dynamics. North America and Europe remain dominant markets due to advanced healthcare infrastructure and the high prevalence of colorectal diseases. However, emerging markets in Asia-Pacific and Latin America are experiencing rapid growth. For instance, the increasing incidence of colorectal cancer in countries like China, India, and Australia, where lifestyle changes and aging populations are contributing to rising disease rates, is driving demand for advanced surgical solutions. Favorable government initiatives in these regions, such as increased funding for cancer screening programs and healthcare infrastructure improvements, further fuel market expansion.

Product Insights

The endoscopes segment dominated the market with a substantial share of 28.5% in 2024, driven by the increasing adoption of minimally invasive procedures, where endoscopes play a crucial role. Endoscopes are essential for providing detailed internal views with minimal incisions, which reduces recovery times and improves patient outcomes. Innovations like high-definition (HD) and 4K endoscopy systems have improved image clarity and diagnostic precision. For instance, in August 2022, Medtronic India introduced GI Genius, an advanced AI-powered endoscopy module designed to enhance colorectal cancer treatment in India. This technology offers real-time data and superior visualization during colonoscopies, using AI to identify and highlight suspicious polyps, thus improving detection accuracy and treatment effectiveness. These advancements make endoscopes increasingly effective and versatile in diagnosing and treating colorectal conditions.

The electrosurgical devices segment is expected to experience the significant CAGR of over the forecast period. Modern electrosurgical devices feature advanced energy delivery systems that precisely control tissue cutting and coagulation. These devices facilitate minimally invasive procedures, resulting in shorter recovery periods and fewer postoperative complications. Recent innovations, such as hybrid electrosurgical systems integrating multiple functions-cutting, coagulation, and vaporization-enhance their versatility and effectiveness. During colorectal surgeries, tools like diathermy units and radiofrequency ablation systems are vital for efficiently cutting, coagulating, and sealing tissues. These sophisticated devices' continuous development drives their increased adoption and contributes significantly to the market's growth.

Surgery Type Insights

The right hemicolectomy segment held the largest revenue share of 22.8% in 2024 as it is one of the most frequently performed procedures, driven by the high prevalence of right-sided colon cancers, adenomas, and inflammatory bowel disease affecting the cecum and ascending colon. The trend is further supported by the growing adoption of minimally invasive approaches (laparoscopic and robotic), which require advanced stapling systems, energy devices, and trocars—boosting per-procedure device costs. Rising colorectal cancer screening programs are also leading to earlier detection of right-sided lesions, thereby increasing surgical volumes. Together, high clinical incidence, standardized surgical practice, and technology-intensive procedures make right hemicolectomy the leading revenue contributor.

The low anterior resection (LAR) segment is anticipated to grow at the significant CAGR during the forecast period. This growth is attributed to the advancements in surgical techniques and improvements in patient outcomes. LAR is a preferred procedure for treating cancers located in the lower part of the rectum, allowing for the removal of the affected area while preserving the anal function. The growth of the LAR segment is attributed to the increasing incidence of rectal cancer, which often requires this specific surgical approach. According to the American Cancer Society, approximately 46,220 new cases of rectal cancer are expected in the U.S. in 2024, highlighting a substantial demand for effective surgical interventions. LAR is a preferred procedure for treating cancers located in the lower part of the rectum, allowing for the removal of the affected area while preserving anal function. This capability aligns with the growing emphasis on maintaining quality of life and functionality for cancer patients.

Indication Insights

The colorectal cancer segment dominated the market in 2024. This is primarily attributed to the high prevalence of colorectal cancer, advancements in early detection and treatment, and significant investments in research and development. According to the WHO, Colorectal cancer remains one of the most common cancers globally, with the World Health Organization reporting over 1.9 million new cases in 2020. The American Cancer Society projects nearly 153,000 new cases in the U.S. alone for 2024. This substantial patient population drives demand for surgical interventions, contributing to the dominance of the colorectal cancer segment in the overall market. The introduction of advanced screening technologies, such as high-sensitivity fecal tests and colonoscopy with improved imaging capabilities, has facilitated earlier diagnosis of colorectal cancer. Early-stage detection allows for more effective surgical treatment options, including minimally invasive techniques, contributing to better patient outcomes and increased surgical volumes. Recent preoperative planning and staging developments, including MRI and PET scans, further support precise surgical interventions and enhance overall treatment efficacy.

The Crohn's disease segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is attributed to the rising incidence of the disease, a type of inflammatory bowel disease (IBD) characterized by chronic inflammation of the gastrointestinal tract. The Global Burden of Disease Study reports that the prevalence of IBD, including Crohn's disease, is increasing worldwide, with higher rates observed in developed countries. For instance, the prevalence of Crohn's disease in the United States is estimated to be about 201 per 100,000 people, and similar trends are observed in Europe and other regions. This rising prevalence necessitates more frequent and advanced surgical interventions, contributing to the segment's rapid growth. Developing new biological therapies and targeted treatments has improved disease management and patient outcomes. Medications such as anti-TNF agents and newer biologics like IL-12/23 inhibitors have shown efficacy in reducing inflammation and inducing remission in Crohn's disease patients. These advancements reduce the need for surgical intervention for many patients and lead to more complex cases requiring surgical management, thus driving the segment's growth.

End-use Insights

Hospitals & clinics dominated the market in 2024, capturing a substantial revenue share. Hospitals have advanced surgical infrastructure, including state-of-the-art operating rooms, sophisticated imaging systems, and specialized surgical teams. This makes them the preferred setting for complex colorectal surgeries, which often require intensive care and multidisciplinary approaches. The dominant role of hospitals and clinics is mainly due to their capacity to handle high patient volumes and offer a wide range of surgical services. Moreover, hospitals provide integrated services from preoperative assessments to postoperative care and rehabilitation, essential for optimal outcomes in colorectal surgeries. For instance, multidisciplinary teams, including surgeons, oncologists, radiologists, and pathologists, work collaboratively in these settings to ensure thorough treatment planning and execution, which enhances the overall effectiveness of colorectal interventions.

Surgery centers are anticipated to achieve the fastest CAGR during the forecast period. These facilities generally offer lower operational costs than hospitals, allowing them to provide procedures at reduced prices. Surgery centers are well-suited to perform minimally invasive and elective surgeries, allowing for shorter recovery times and quicker patient turnover. The American Society of Anesthesiologists notes that advances in minimally invasive techniques and anesthetic practices have made it increasingly feasible for patients to undergo procedures and return home on the same day. This trend leads more patients to opt for surgery centers for their procedures, driving the segment's growth. Additionally, the increasing emphasis on patient convenience and personalized care drives demand for surgery centers. Patients increasingly seek out facilities that offer flexible scheduling, reduced waiting times, and a more comfortable, less intimidating environment than traditional hospitals.

Regional Insights

North America colorectal surgery market is experiencing robust growth, driven by a combination of a high prevalence of colorectal diseases, advancements in medical technology, and supportive healthcare infrastructure. Colorectal cancer remains a leading cause of cancer-related deaths in the region, with the American Cancer Society projecting nearly 153,000 new cases in the U.S. alone in 2024. This high incidence drives demand for colorectal surgeries. The U.S. healthcare system is characterized by advanced surgical facilities, a high adoption rate of innovative technologies like robotic-assisted surgery, and a comprehensive range of treatment options, further propelling market growth.

U.S. Colorectal Surgery Market Trends

The colorectal surgery market in U.S. is significant for its advanced surgical technologies, high incidence of colorectal cancer, and well-developed healthcare infrastructure. The country boasts cutting-edge surgical centers and the widespread use of minimally invasive techniques, such as laparoscopic and robotic-assisted surgeries, which improve precision and recovery times. Over the past two decades, fatality rates from colorectal cancer have decreased due to advancements in screening and treatment. However, the Centers for Disease Control and Prevention have observed a slight increase in colorectal cancer rates among individuals aged 45 to 54. In July 2022, U.S. Digestive Health (USDH) launched AI-assisted colonoscopy screenings, utilizing the G.I. Genius Intelligent Endoscopy module-the largest installation in the country. This technology assists physicians in detecting hard-to-spot, potentially cancerous polyps, offering improved diagnostic capabilities and broader access to this innovation across southeastern, southwestern, and central Pennsylvania.

Europe Colorectal Surgery Market Trends

The colorectal surgery market in Europe is witnessing substantial growth driven by several key factors: a high incidence of colorectal cancer, advancements in surgical technologies, and supportive healthcare policies. The European Union has enacted comprehensive cancer control initiatives, including nationwide screening programs that promote early detection and effective treatment of colorectal cancer. With over 500,000 new cases reported annually across Europe, the prevalence of this disease underscores the critical need for effective interventions. Technological innovations, such as cutting-edge imaging techniques and minimally invasive surgical approaches, are increasingly adopted across European nations. These advancements enhance patient outcomes by improving diagnostic accuracy and reducing recovery times, further fueling the demand for colorectal surgeries throughout the region. In 2024, the Safe-anastomosis Programme in Colorectal Surgery (EAGLE) is an international initiative led by the European Society of Coloproctology (ESCP) aimed at reducing anastomotic leak rates following right colectomy and ileocaecal resection. Building upon the success of the initial EAGLE study, which demonstrated that implementing specific interventions could reduce anastomotic leaks by up to 20%, the EAGLE2 program has been developed to validate these findings further.

The UK colorectal surgery market is experiencing significant growth. The high prevalence of colorectal cancer boosted the colorectal surgery market in the UK, advancements in surgical technologies, and national healthcare initiatives. According to Cancer Research UK, colorectal cancer is one of the most common cancers in the UK, with approximately 42,000 new cases diagnosed annually. The National Health Service (NHS) provides comprehensive cancer care, including early screening programs and advanced surgical facilities. Moreover, the UK has seen increased adoption of minimally invasive techniques, such as laparoscopic and robotic-assisted surgeries, supported by ongoing research and development efforts. Government initiatives aimed at improving cancer detection and treatment further drive market growth.

The colorectal surgery market in Germany is growing due to a combination of high disease prevalence, advanced medical technologies, and a strong healthcare system. Germany has one of the highest rates of colorectal cancer in Europe, with over 70,000 new cases annually, driving significant demand for surgical interventions. The country is known for its high-quality healthcare infrastructure and early adoption of innovative surgical techniques, including robotic-assisted and minimally invasive surgeries.

Asia Pacific Colorectal Surgery Market Trends

The colorectal surgery market in Asia Pacific region is expanding rapidly due to increasing colorectal cancer incidence, rising healthcare standards, and growing access to advanced surgical technologies. The prevalence of colorectal cancer is rising in several Asia Pacific countries due to lifestyle changes and an aging population. For instance, the incidence of colorectal cancer in China and India is increasing, prompting greater demand for surgical interventions. The region is experiencing advancements in surgical techniques, including minimally invasive and robotic-assisted surgeries, driven by investments in healthcare infrastructure and technology.

India colorectal surgery market is experiencing rapid growth, fueled by the increasing incidence of colorectal cancer, improving healthcare infrastructure, and advancements in surgical technologies. According to the World Cancer Research Fund International, colorectal cancer rates are rising in India due to changing dietary habits and an aging population, with over 70,038 new cases projected in 2022. The Indian healthcare system is seeing significant investments in advanced surgical technologies and facilities, such as robotic-assisted and minimally invasive surgical techniques.

The colorectal surgery market in Australia is noticed by its high-quality healthcare system, increasing colorectal cancer rates, and adoption of advanced surgical technologies. Colorectal cancer is one of the most prevalent cancers in Australia, with approximately 17,000 new cases reported annually. The Australian healthcare system provides comprehensive cancer care, including state-of-the-art surgical facilities and early screening programs. The adoption of minimally invasive techniques, such as laparoscopic and robotic-assisted surgeries, is growing due to their benefits in reducing recovery times and improving outcomes.

Latin America Colorectal Surgery Market Trends

The colorectal surgery market in Latin America is expanding due to increasing colorectal cancer incidence, improving healthcare infrastructure, and advancements in surgical technologies. The region is seeing a rise in colorectal cancer rates, driven by lifestyle changes and an aging population. For instance, Brazil and Mexico are experiencing higher cancer incidence, which increases the demand for surgical interventions. The growth of healthcare facilities and the adoption of advanced surgical techniques, including minimally invasive and robotic-assisted surgeries, contribute to market expansion.

Brazil colorectal surgery market is driven by a high incidence of colorectal cancer, advancements in surgical technologies, and improvements in healthcare infrastructure. Colorectal cancer is a leading cause of cancer-related deaths in Brazil, with over 40,000 new cases projected annually. The Brazilian healthcare system is witnessing significant improvements in cancer care, including adopting advanced surgical techniques such as laparoscopic and robotic-assisted surgeries. Investments in healthcare infrastructure and technology, coupled with government initiatives aimed at increasing cancer screening and treatment access, are driving Brazil's colorectal surgery market growth.

Middle East & Africa Colorectal Surgery Market Trends

The colorectal surgery market in the Middle East and Africa is expanding significantly due to rising colorectal cancer rates, improving healthcare infrastructure, and increased access to advanced surgical technologies. The prevalence of colorectal cancer is increasing in several countries within the region, driven by lifestyle factors and an aging population. The healthcare systems in the Middle East and Africa are seeing advancements in surgical technologies, including minimally invasive and robotic-assisted surgeries. Investments in healthcare infrastructure and government initiatives to improve cancer screening and treatment access are also contributing to market growth.

Saudi Arabia colorectal surgery market is experiencing rapid growth due to rising colorectal cancer incidence, medical technology advancements, and healthcare service improvements. Colorectal cancer rates in Saudi Arabia are increasing, driven by changing dietary habits and an aging population. The country is investing heavily in healthcare infrastructure, including developing advanced surgical facilities and adopting innovative surgical technologies such as robotic-assisted surgeries. Government initiatives, including national cancer screening programs and medical research funding, enhance early detection and treatment capabilities, further driving market expansion.

Key Colorectal Surgery Company Insights

The colorectal surgery market is dominated by several major companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative treatment options. They also expanded their product portfolios through strategic collaborations, mergers, and acquisitions.

Key Colorectal Surgery Companies:

The following are the leading companies in the colorectal surgery market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical.

- Medtronic plc

- Johnson & Johnson

- Stryker Corporation

- Olympus Corporation

- Conmed Corporation

- B. Braun SE

- Karl Storz SE & Co. KG

- Boston Scientific Corporation

Recent Developments

-

In January 2025, Panakeia introduced PANProfiler Colon, an AI-driven software tool designed to determine microsatellite instability (MSI) and mismatch repair deficiency (dMMR) status directly from H&E-stained colon cancer tissue samples within minutes. This innovation aims to expedite molecular profiling, thereby facilitating more timely and personalized treatment decisions in colorectal cancer care.

-

In October 2024, the FDA approved the Exact Sciences' Cologuard Plus test, a next-generation, non-invasive screening tool for colorectal cancer. Designed for adults aged 45 and older at average risk, Cologuard Plus enhances early detection by identifying specific DNA markers and blood in stool samples. Clinical trials demonstrated a 95% sensitivity for colorectal cancer and a 43% sensitivity for advanced precancerous lesions, with a specificity of 94%. This approval marks a significant advancement in colorectal cancer screening, offering a convenient and effective alternative to traditional methods.

-

In June 2024, SafeHeal received Breakthrough Device designation from the U.S. FDA for its Colovac Endoluminal Bypass Sheath. The Colovac device is designed to provide a temporary internal bypass for colorectal surgery patients, aiming to reduce the need for diverting stomas. This innovative sheath allows the colon to heal while minimizing complications associated with traditional stoma placement, potentially improving patients' post-surgical recovery and quality of life.

-

In January 2024, Olympus Latin America announced the launch of its next-generation EVIS X1 endoscopy system to healthcare professionals in Mexico. The unveiling took place at a prominent event in Mexico City, showcasing the advanced capabilities of this cutting-edge system. The EVIS X1 represents a significant leap forward in endoscopic technology, offering enhanced visualization and diagnostic precision to support superior patient care.

Colorectal Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.3 billion

Revenue forecast in 2033

USD 9.8 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery type, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Intuitive Surgical.; Medtronic plc; Johnson & Johnson; Stryker Corporation; Olympus Corporation; Conmed Corporation; B. Braun SE; Karl Storz SE & Co. KG; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Colorectal Surgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global colorectal surgery market report based on product, surgery type, indication, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Endoscopes

-

Electrosurgical Devices

-

Visual Systems & Handheld Instruments

-

Sealing & Stapling Devices

-

Ligation Clips & Dilators

-

Cutting Instruments (Cutters & Shears)

-

Surgical Accessories

-

-

Surgery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Right Hemicolectomy

-

Left Hemicolectomy

-

Subtotal Hemicolectomy

-

Low Anterior Resection

-

Abdomino-Perineal Resection

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Colon Polyps

-

Crohn's Disease

-

Colorectal Cancer

-

Colitis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Surgery Centers

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global colorectal surgery market size was valued at USD 22.30 billion in 2024 and is expected to reach USD 24.23 billion in 2025.

b. The global colorectal surgery market is projected to grow at a compound annual growth rate (CAGR) of 8.64% from 2025 to 2030 to reach USD 36.66 billion by 2030.

b. The subtotal hemicolectomy segment held the largest revenue share of 28% in 2024. Subtotal hemicolectomy, which involves the removal of a significant portion of the colon, is often employed to treat complex and advanced cases of colorectal cancer

b. Some of the key players operating in this market include Intuitive Surgical.; Medtronic plc; Johnson & Johnson; Stryker Corporation; Olympus Corporation; Conmed Corporation; B. Braun SE; Karl Storz SE & Co. KG; Boston Scientific Corporation.

b. Key growth drivers include rising incidence of colorectal diseases, advancements in surgical technologies, supportive regulatory environments, and proactive government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.