- Home

- »

- Power Generation & Storage

- »

-

Combined Heat & Power Installation Market Report, 2030GVR Report cover

![Combined Heat & Power Installation Market Size, Share & Trends Report]()

Combined Heat & Power Installation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Large Scale, Small Scale), By Fuel (Natural Gas, Coal, Biomass), By Technology, By Region, And Segment Forecasts

- Report ID: 978-1-68038-552-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Combined Heat & Power Installation Market Summary

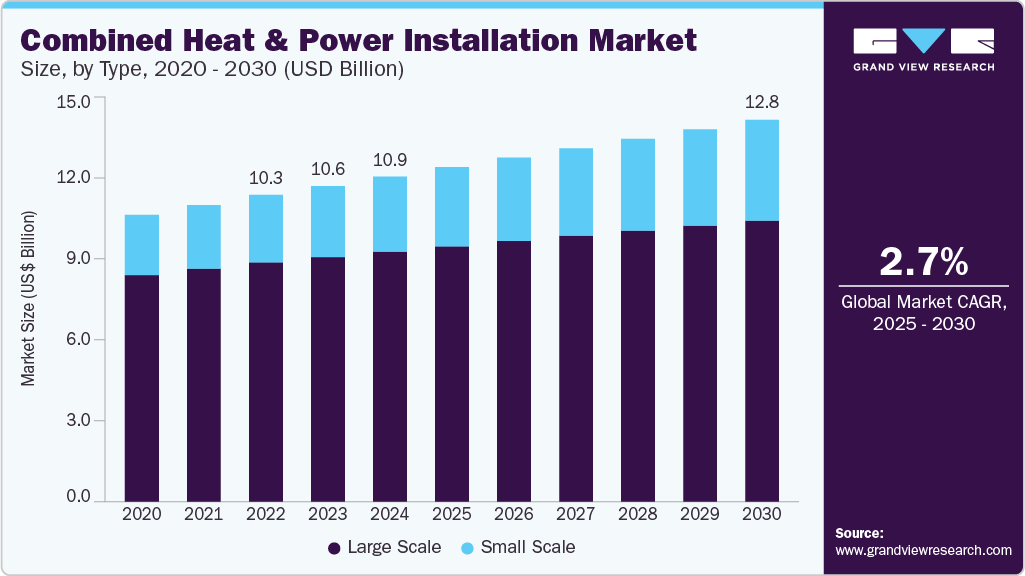

The global combined heat & power installation market size was valued at USD 10.93 billion in 2024 and is projected to reach USD 12.84 billion by 2030, growing at a CAGR of 2.7% from 2025 to 2030. The shift in preference towards replacing conventional energy systems owing to operational cost and uninterrupted utility supply is expected to drive the market for CHP installations.

Key Market Trends & Insights

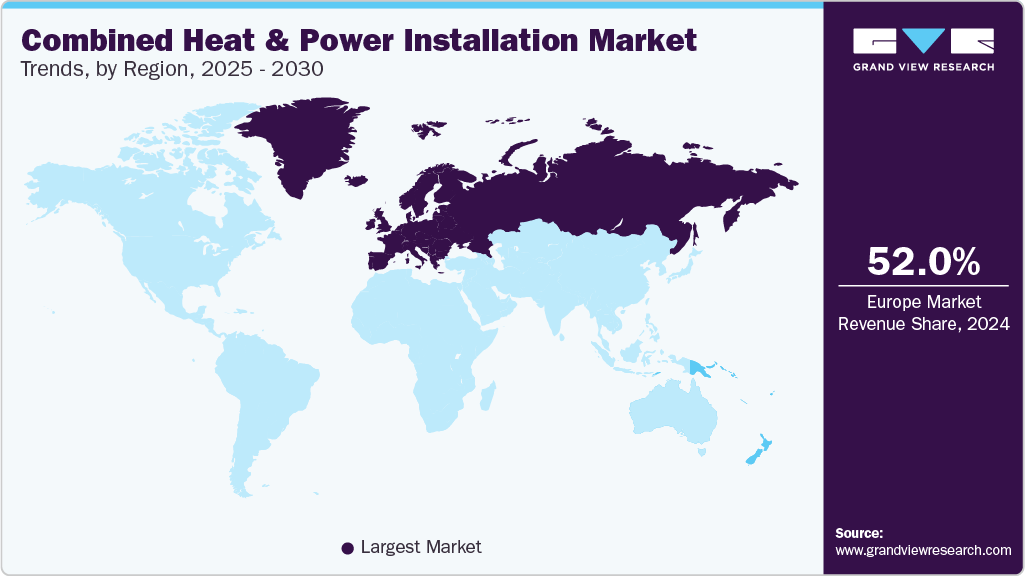

- The European combined heat and power installation market accounted for the largest revenue of 52.0% in 2024.

- Asia Pacific combined heat & power installation market is expected to grow significantly over the forecast period.

- Based on type, the large scale segment dominated the market with the largest revenue share of 76.9% share in 2024.

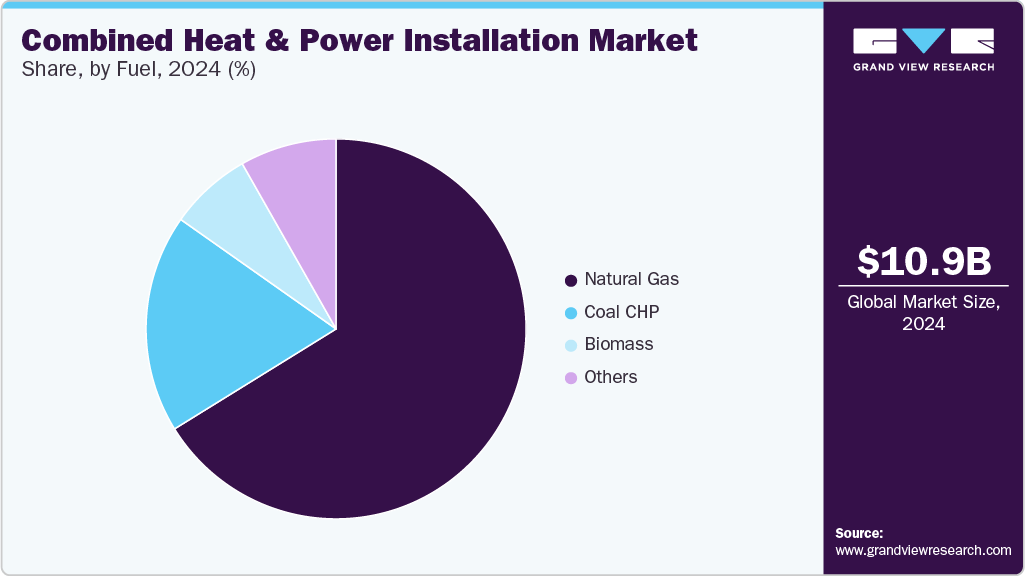

- Based on fuel, the natural gas segment held the largest market share in 2024, fueled by its abundance, cost-effectiveness, and cleaner-burning properties compared to other fossil fuels.

- Based on technology, the combined cycle segment accounted for the largest revenue share in 2024, owing to its exceptional efficiency and versatility.

Market Size & Forecast

- 2024 Market Size: USD 10.93 Billion

- 2030 Projected Market Size: USD 12.84 Billion

- CAGR (2025-2030): 2.7%

- Europe: Largest market in 2024

Continuing demand for captive power generation and consumers’ inclination towards sustainable energy are expected to propel market growth. Growing apprehensions towards Greenhouse Gas (GHG) emissions in line with safety, improved reliability, and efficiency across cogeneration systems will further support the product’s adoption. Besides, rapid investments in renewable energy technologies to limit carbon emissions will drive the market for CHP installations.

Thermal power plants generally use only half of the heat generated to produce electricity, while the remaining heat is exhausted through flue gases, cooling towers, and other means. Through Combined Heat and Power (CHP), or cogeneration, this surplus heat can be captured and reused to generate electricity, potentially increasing the power plant's efficiency to as much as 80%. Strict government regulations aimed at controlling carbon dioxide (CO₂) emissions are expected to drive demand for CHP installations over the forecast period.

An ample supply of natural gas, coupled with low pricing, is anticipated to influence the market positively. Natural gas is widely used as a fuel for CHP systems, as it is abundantly available in countries such as Qatar, Russia, Iran, and the U. S. Natural gas-based systems are relatively easy to install and are more cost-effective compared to systems using other fuels. Rising energy prices have prompted power-generating utilities to adopt more efficient methods of electricity generation using fewer resources.

Furthermore, awareness of energy conservation and efficiency measures is increasing in both developed and emerging economies. These factors are likely to support the growth of the CHP market during the forecast period. However, the high initial installation cost of CHP systems is expected to hinder market growth. CHP systems are more expensive than conventional systems, such as boilers and diesel generators. They also have longer payback periods, which depend largely on the frequency of system usage.

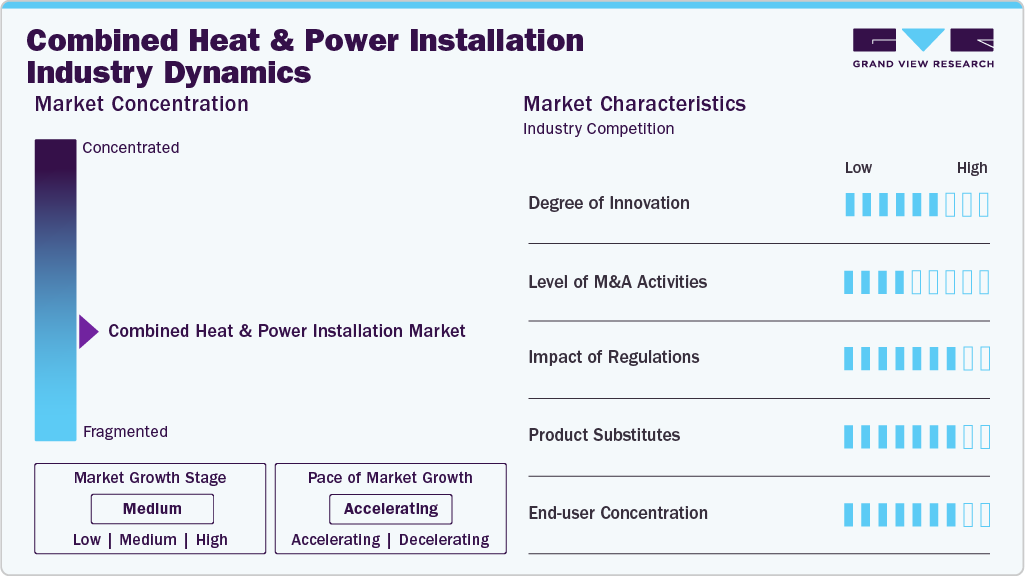

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Ongoing efforts by key industry participants have resulted in fragmented market scenarios by driving technological advancements, enhancing system efficiency, and expanding adoption. Companies such as Catalyst Power and Caterpillar are developing cleaner, more sustainable CHP solutions, integrating renewable energy sources and hydrogen-fueled systems. Strategic partnerships, such as those with OHA Power, enable cost-effective installations for small and mid-sized businesses. In May 2022, Caterpillar Inc. launched a three-year project with District Energy St. Paul in Minnesota to showcase a hydrogen-fueled combined heat and power (CHP) system. The U.S. Department of Energy and the National Renewable Energy Laboratory support the project.

The global combined heat & power installation industry is characterized by the growing integration of smart technologies by enhancing system efficiency, reliability, and control. Smart sensors, IoT devices, and advanced analytics enable real-time monitoring and optimization of energy production and consumption, reducing operational costs and improving performance. These technologies allow for predictive maintenance, minimizing downtime and extending the lifespan of CHP systems.

Type Insights

The large scale segment dominated the market with the largest revenue share of 76.9% share in 2024, attributed to its efficiency in meeting the substantial energy needs of industrial and commercial sectors. Widely used in industries such as chemicals, cement, pulp and paper, textiles, refining, and pharmaceuticals, these systems offer significant cost savings and reduce greenhouse gas emissions. Their ability to generate electricity and heat from a single fuel source, combined with easy integration into existing infrastructure, drives strong demand and widespread adoption across large-scale operations.

The increasing demand for clean energy from the residential sector is expected to drive the market for CHP installations. Growing awareness of the benefits of cogeneration systems is crucial for the CHP industry, as these systems are increasingly favored over conventional methods. Major markets include countries such as the U.S., Germany, and Japan. In residential applications, CHP systems are primarily used for purposes such as wastewater treatment. They are also deployed in commercial settings, including office buildings, hospitals, casinos, airports, and military bases. These systems are most effective in buildings with “heat sinks,” such as swimming pools.

The small-scale segment is expected to be the fastest-growing segment with a CAGR of 4.9% during the forecast period. This surge is propelled by its versatility and suitability for various residential, commercial, and small industrial applications. These systems are more cost-effective and easier to install than their large-scale counterparts, making them ideal for decentralized energy solutions. Increased demand for energy efficiency and sustainability in smaller operations drives their adoption. Technological advancements and favorable policies further propel their growth, positioning the small-scale segment for significant expansion.

Fuel Insights

The natural gas segment held the largest market share in 2024, fueled by its abundance, cost-effectiveness, and cleaner-burning properties compared to other fossil fuels. Natural gas offers high efficiency and lower emissions, making it an attractive choice for CHP systems. Its stable supply and extensive infrastructure further enhance its appeal for industrial and commercial applications. Moreover, supportive government policies and incentives for cleaner energy have propelled the adoption of natural gas-powered CHP systems, solidifying their leading position in the combined heat & power installation industry.

The biomass segment is anticipated to grow at the fastest CAGR from 2025 to 2030. Biomass is mainly used as fuels for small scale CHP systems and projected to witness high growth rates as they help to decrease harmful environmental gases and attain government targets of using renewable sources of energy. Other fuel types include wood, processed waste, and oil. Wood waste is used in applications to run small scale CHP systems, and therefore, is used in residential and commercial applications. The processed waste heat generated from industrial plants is used in CHP systems for generating electricity and thermal energy. Oil powered CHP systems are easy to install and are energy efficient.

Technology Insights

The combined cycle segment accounted for the largest revenue share in 2024,owing to its exceptional efficiency and versatility. By combining gas and steam turbines, these systems achieve superior energy conversion, reducing both fuel costs and emissions. The dual-turbine setup ensures optimal performance and swift adaptation to varying energy demands, making them highly appealing for industrial and utility applications.

The reciprocating engine segment is set to experience the fastest CAGR over the forecast period, driven by its flexibility, efficiency, and scalability. These engines are ideal for various applications, from small-scale residential to large industrial settings. Their ability to run on various fuels, including natural gas and biogas, enhances their appeal.

Application Insights

The industrial segment held the largest share in 2024, propelled by its high energy demands and need for efficient, cost-effective power solutions. Industrial facilities benefit greatly from CHP systems, which provide reliable electricity and utilize waste heat for various processes, enhancing overall energy efficiency. Furthermore, industrial sectors often have larger budgets and infrastructure to support the integration of CHP systems. These factors make CHP systems an attractive and practical choice for industrial applications, leading to market dominance.

The commercial segment is projected to be the fastest-growing segment from 2025 to 2030, fueled by the rising need for dependable and efficient energy solutions in offices, hospitals, hotels, and retail centers. CHP systems offer notable cost savings and energy efficiency, making them appealing to commercial entities. As energy prices increase and sustainability becomes a priority, more businesses are adopting CHP systems to reduce their carbon footprint and operating costs. This trend towards energy-efficient solutions is set to drive rapid expansion in the commercial segment.

Regional Insights

The North American combined heat and power installation market is anticipated to witness significant growth over the forecast period, attributed to the region's focus on energy efficiency and sustainability. Growing awareness of environmental concerns and stringent regulations drives the adoption of CHP systems. In addition, advancements in technology and significant investments in renewable energy sources support this trend. With rising energy costs and an increasing demand for reliable power, businesses and municipalities are turning to CHP solutions to meet their needs, positioning North America for substantial market growth.

U.S. Combined Heat & Power Installation Market Trends

The U.S. combined heat & power installation market held the largest share in the regional market in 2024 due to its advanced infrastructure, high energy demand, and supportive regulatory framework. Emphasizing energy efficiency and sustainability, combined with substantial investments in research and development, has propelled the widespread implementation of CHP systems.

Europe Combined Heat & Power Installation Market Trends

The European combined heat and power installation market accounted for the largest revenue of 52.0% in 2024, fueled by its stringent environmental regulations and strong commitment to energy efficiency and sustainability. The region has invested heavily in modernizing energy infrastructure and integrating renewable sources. Government policies and incentives for clean energy technologies have boosted the adoption of CHP systems.

Russia Combined Heat & Power Installation Market Trends

Russia's combined heat and power installation market held the largest share in the regional market in 2024, propelled by its vast energy resources and commitment to improving energy efficiency. With an ample supply of natural gas, Russia has the potential to widely implement CHP systems. Government support for energy-efficient technologies and the modernization of infrastructure further drive this growth.

Asia Pacific Combined Heat & Power Installation Market Trends

Asia Pacific combined heat & power installation market is expected to grow significantly over the forecast period, owing to the rapid industrial development, urban expansion, and increasing energy needs in countries including China, India, and Japan. Significant investments in efficient energy solutions are being made to support growing economies and to curb greenhouse gas emissions.

Key Combined Heat & Power Installation Company Insights

Some of the key companies in the combined heat and power installation industry include Mitsubishi Heavy Industries, Ltd., Siemens, Clarke Energy, Cummins Inc., and Capstone Green Energy Holdings, Inc.

-

Mitsubishi Heavy Industries Ltd. offers advanced gas turbines, steam turbines, and power generation solutions, including combined cycle power plants and renewable energy systems.

-

Siemens provides a wide range of energy products and services, from low-emission power generation to energy management and automation solutions, supporting the transition to a sustainable energy future.

Key Combined Heat & Power Installation Companies:

The following are the leading companies in the combined heat & power installation market. These companies collectively hold the largest market share and dictate industry trends.

- E.ON SE

- Mitsubishi Heavy Industries, Ltd.

- Siemens

- Centrica plc

- General Electric Company

- BDR Thermea Group

- Dalkia Aegis

- Clarke Energy

- Cummins Inc.

- Capstone Green Energy Holdings

- Caterpillar

- Elite Energy & Engineering LTD

- Doosan Fuel Cell Co., Ltd

- Tecogen Inc.

- Wärtsilä

Recent Developments

-

In October 2024, Innio Group started operating a new hydrogen-fueled Combined Heat and Power (CHP) plant in Austria. The project offers industrial plant green electricity & heat.

-

In August 2023, Bloom Energy unveiled an advanced Combined Heat and Power (CHP) solution with its Bloom Energy Server. This innovative system uses high-temperature exhaust (over 350°C) to generate industrial steam and absorption chilling, aiming for net-zero heating and cooling.

Combined Heat & Power Installation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.25 billion

Revenue forecast in 2030

USD 12.84 billion

Growth Rate

CAGR of 2.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in GW, USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, fuel, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Russia, Germany, France, U.K., Italy, Spain, Netherlands, Poland, China, Japan, India, South Korea, Taiwan

Key companies profiled

E.ON SE; Mitsubishi Heavy Industries, Ltd.; Siemens; Centrica plc; General Electric Company; BDR Thermea Group; Dalkia Aegis; Clarke Energy; Cummins Inc.; Capstone Green Energy Holdings, Inc.; Caterpillar; Elite Energy & Engineering LTD.; Doosan Fuel Cell Co., Ltd.; Tecogen Inc.; and Wärtsilä.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Combined Heat & Power Installation Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global combined heat & power installation market report on the basis of material, end-use industry, product, size, and region:

-

Type Outlook (Volume, GW; Revenue, USD Million, 2018 - 2030)

-

Large scale

-

Small scale

-

-

Fuel Outlook (Volume, GW; Revenue, USD Million, 2018 - 2030)

-

Natural Gas

-

Coal CHP

-

Biomass

-

Others

-

-

Technology Outlook(Volume, GW; Revenue, USD Million, 2018 - 2030)

-

Combined Cycle

-

Steam Turbine

-

Combustion/Gas Turbine

-

Reciprocating Engine

-

Other

-

-

Application Outlook (Volume, GW; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, GW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Taiwan

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.