- Home

- »

- Display Technologies

- »

-

Commercial Display Market Size, Share, Industry Report 2030GVR Report cover

![Commercial Display Market Size, Share & Trends Report]()

Commercial Display Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Technology, By Component, By Display Size, By Display Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-622-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Display Market Summary

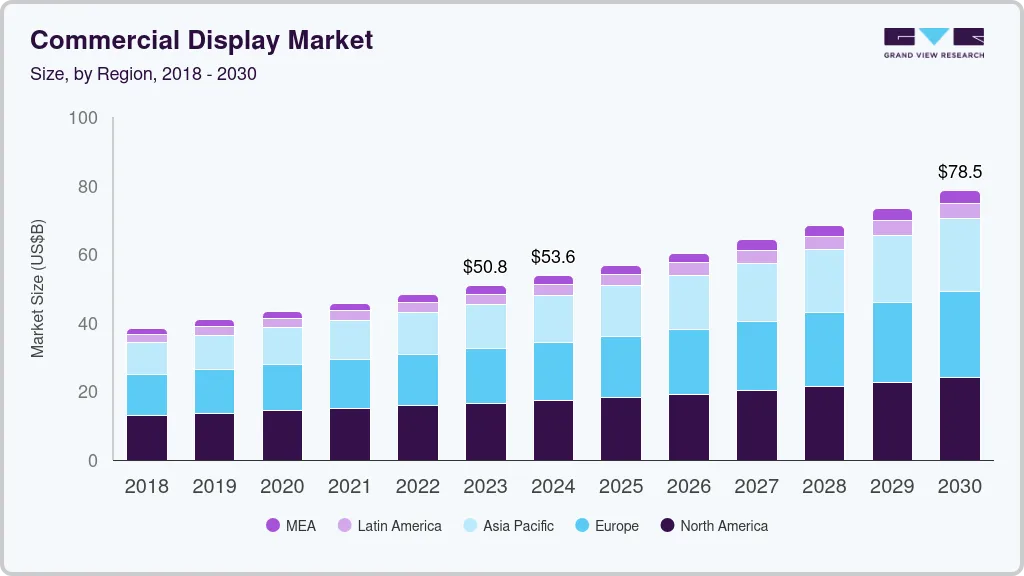

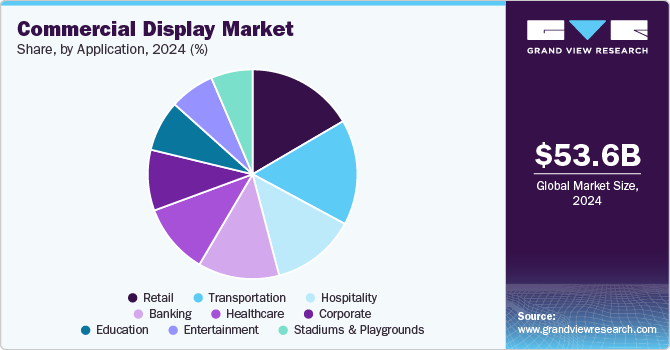

The global commercial display market size was estimated at USD 53.65 billion in 2024 and is projected to reach USD 78.48 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The key drivers attributing to the market expansion include the escalating demand for digital signage, decreasing display panel cost, growing investments for promoting brand awareness, and increased use in transportation, healthcare, and corporate industry due to expanding the transport sector and infrastructural developments being carried out in the emerging countries.

Key Market Trends & Insights

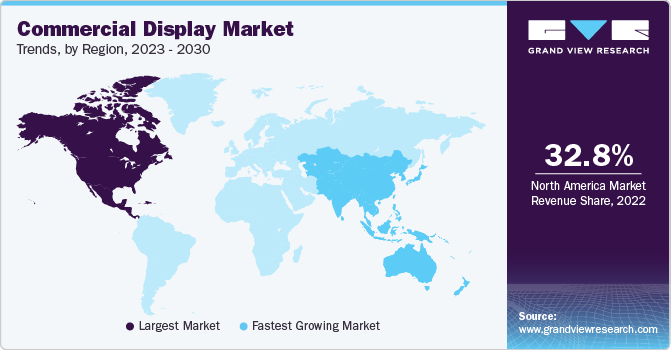

- North America dominated the commercial display industry with a share of 32.28% in 2024.

- The Asia Pacific region is experiencing the fastest growth in the commercial display industry, driven by increasing demand across various sectors.

- By product, the digital signage segment dominated the market with a revenue share of over 53.73% in 2024.

- By component, the hardware segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.65 Billion

- 2030 Projected Market Size: USD 78.48 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising use of 3D digital signage for effective branding and promotion of the product is anticipated to provide a lucrative platform for market growth over the forecast period. Innovation in display panel manufacturing methods has resulted in significant cost reduction which is expected to favorably impact market growth. Regulations in pharmaceutical marketing have resulted in the abolishment of traditional practices of distributing branded pens and notepads to doctors, thereby turning to 3D digital signage as a viable marketing tool. Reduction of Ultra-HD display prices over the course of 2020 owing to the growing number of quality display options is expected to catalyze growth over the forecast period. Further availability of energy-efficient displays such as OLED & AMOLED may reduce the operational cost while advertising. The U.S. is anticipated to hold the largest market share in the North American region owing to high growth potential in transportation, healthcare, education, and corporate application sectors which are further expected to drive market growth over the forecast period. Emphasis on increasing brand equity, enhancing brand awareness and perception has resulted in adoption across the corporate sector.

Furthermore, State-of-the-art technologies, such as micro-LED, mini-LED, OLED, and AMOLED, are being incorporated in the latest commercial-grade TVs by manufacturers such as Sony Corporation, LG Display Co., Ltd, and SAMSUNG. Moreover, these players are launching various types of TV panels, such as flexible and rollable panels. In the healthcare sector, these products are widely used in hospitals, clinics, and multi-specialty healthcare centers. Additionally, the hospitality sector is also one of the prominent verticals attributing to the growth of the market owing to the rising number of QSR, restaurants, cafes, bars, hotels, and motels. Such establishments require a large number of display solutions for various applications such as advertisement, menu & food display, and entertainment, thus anticipating to exhibit steady growth over the next six to eight years in the commercial display industry.

Products Insights

The digital signage segment dominated the market with a revenue share of over 53.73% in 2024. Digital signage has witnessed significant adoption in the retail sector, which includes malls, private stores, and showrooms, owing to the growing demand among shop owners for innovative approaches toward advertising. The digital signage segment has further been segmented into video walls, video screens, transparent LED screens, digital posters, kiosks, and others. The others segment includes menu boards and billboards. the increasing demand for interactive and personalized content, particularly through AI integration, which enhances viewer engagement. The rise of cloud-based solutions facilitates remote management and scalability, making digital signage more accessible and cost-effective. Additionally, the adoption of touchless technologies and sustainable practices is expected to further accelerate market expansion in commercial applications.

The display TVs segment accounted to hold significant CAGR growth over the forecast period. This growth is largely driven by rapid urbanization and the increasing adoption of digital signage across various sectors, especially retail and hospitality, where businesses are leveraging advanced display technologies for effective advertising and customer engagement. The demand for high-resolution displays, notably 4K and 8K, is surging as companies seek to enhance visual experience in their marketing strategies. Innovations such as mini-LED and micro-LED technologies are further propelling this market by offering brighter screens with better energy efficiency and contrast ratios. Additionally, the healthcare sector is increasingly utilizing commercial-grade displays for patient communication and information dissemination. As organizations prioritize immersive experiences and dynamic content delivery, the retail segment remains a key revenue driver, accounting for a substantial share of the market.

Technology Insights

The LED segment dominated the market with a revenue share in 2024. The growth is driven as LED displays are more energy-efficient, have a longer lifespan, and provide superior brightness and color accuracy-making them perfect for high-visibility commercial spaces such as retail stores, airports, and corporate environments. The falling production costs of LED displays have made these solutions more accessible, especially for small and medium-sized businesses, which is fueling broader market growth. All in all, the combination of performance improvements, cost reductions, and the increasing demand for interactive, immersive experiences means the LED technology market in commercial displays is set to continue its strong growth.

The LCD segment is projected to experience a significant CAGR from 2025 to 2030. CD technology, for example, is primarily known for its affordability and consistent image quality across different use cases. It’s commonly used for static displays, digital signage, and video walls due to its cost-effectiveness and wide availability. Over the years, LCDs have evolved to improve brightness, color accuracy, and energy efficiency, making them increasingly viable for both indoor and outdoor commercial settings. On the other hand, LED, especially in terms of backlighting (in LCD displays) or direct-view LED panels, tends to offer higher contrast ratios and better energy efficiency but at a higher cost. While LCD is more widely used in traditional displays, LED has become more popular in high-end, large-scale applications like stadiums or giant outdoor screens due to its enhanced brightness and flexibility in design.

Component Insights

The hardware segment dominated the market with the largest revenue share in 2024. The segment growth can be attributed to the higher demand for hardware compared to software. Hardware components include displays, extenders & cables, accessories, and installation equipment. These components withstand changing climatic conditions and contain a heat management system to ensure proper heat dissipation and prevent overheating. The commercial display industry has seen significant growth in recent years, with hardware components playing a crucial role in this expansion. Advancements in display technology, such as LED, OLED, and microLED, have improved the quality, brightness, and energy efficiency of commercial screens, driving demand across various sectors. As businesses increasingly adopt digital signage for marketing, communication, and interactive applications, the need for high-performance hardware components, including processors, graphics cards, and connectivity modules, is intensifying.

The commercial display industry is experiencing significant growth, and software components play a critical role in driving this evolution. As digital signage and interactive displays become increasingly popular, there’s a rising demand for software solutions that can enhance user engagement, streamline content management, and improve overall system efficiency. Cloud-based platforms are gaining traction, offering scalability and remote management capabilities, allowing businesses to update and control displays across multiple locations with ease. Additionally, the integration of AI and machine learning into software components is revolutionizing content delivery by enabling personalized and dynamic experiences based on audience behavior or environmental factors.

Display Size Insights

The below 32-inch segment dominated the market with the largest revenue share in 2024, driven by the demand for below 32-inch displays is experiencing steady growth, driven by several factors. Smaller displays are increasingly favored in settings where space is limited or for applications requiring close-up viewing, such as point-of-sale (POS) systems, digital signage in retail environments, and information kiosks. These compact displays are also ideal for use in corporate offices, healthcare facilities, and educational institutions, where they are utilized for wayfinding, meeting room schedules, or interactive displays. As businesses continue to prioritize digital transformation, the need for smaller, cost-effective screens that are easy to install and manage has increased.

The commercial display industry has seen significant growth in the demand for displays above 75 inches, driven by the increasing need for larger, more impactful visual solutions in a variety of sectors. These larger screens are especially popular in corporate environments, retail spaces, and public venues, where they help create immersive, attention-grabbing experiences. In corporate settings, they are being used for dynamic signage, collaboration, and presentations, as businesses focus on enhancing communication and productivity. Retailers are increasingly adopting larger displays for digital signage, enabling them to deliver high-definition advertising, promotions, and interactive content that capture customer attention. Public spaces such as airports, stadiums, and transportation hubs have also turned to oversized displays to provide clear, visible information for large crowds.

Display Type Insights

Flat panel dominated the display type segment market with a significant market share in 2024, as the flat panel displays are primarily used for large screens with LCD technology. Based on LCD technology, the flat panel market has been segmented into indoor flat panel LCD and outdoor flat panel LCD. Indoor flat panel LCDs are expected to gain higher traction as they offer high resolution and low pitch capabilities. key factor contributing to this growth is the rising adoption of digital signage solutions. Businesses are increasingly utilizing flat panel displays for advertising, information dissemination, and interactive customer engagement. Additionally, the shift toward larger, higher-resolution screens with enhanced capabilities, such as OLED and 4K/8K displays, is propelling the market forward. These advancements offer superior image quality, durability, and energy efficiency, making them an attractive option for commercial use.

Curved panel is accounted to hold significant CAGR growth over forecast period. the key growth drivers include the increasing demand for enhanced customer experiences, as curved displays provide a more dynamic and aesthetically pleasing viewing angle. The rise of experiential marketing in retail and advertising sectors is pushing the demand for displays that can catch attention and create memorable interactions. Additionally, technological advancements have made curved panels more affordable and versatile, allowing businesses of all sizes to adopt them. The evolution of OLED and LED technologies has also contributed to the growth, offering better image quality, brightness, and contrast, which makes these panels ideal for high-traffic environments.

Application Insights

Retail dominated the commercial display market with a significant revenue share in 2024, the retail sector's growth is driven by a rising demand for interactive and immersive customer experiences. As consumers become more tech-savvy, retailers are increasingly adopting digital signage, interactive displays, and video walls to engage customers and enhance the shopping experience. These technologies allow for dynamic content delivery, real-time promotions, and personalized advertising, which can significantly boost customer engagement and sales. Moreover, the integration of AI and data analytics in commercial displays is providing retailers with actionable insights to better understand consumer behaviour and preferences. This enables more targeted marketing strategies and improved inventory management.

Curved panel is accounted to hold significant CAGR over the forecast period. The transportation application in the commercial display industry is poised for significant growth as demand for dynamic, real-time information and interactive displays continues to rise. Smart transportation systems are integrating commercial displays to improve passenger experience, enhance safety, and deliver timely information, such as real-time arrivals, weather updates, and service disruptions. With the increasing adoption of digital signage in transportation hubs like airports, train stations, and bus terminals, the need for high-quality, durable, and energy-efficient displays is driving innovation. Furthermore, the integration of AI and IoT with commercial displays is enabling personalized, context-aware content tailored to passengers' needs, while enhancing operational efficiency for transportation operators. The rise of electric vehicles and autonomous transport is also creating new opportunities for in-vehicle commercial displays to engage passengers with infotainment, navigation, and advertising.

Regional Insights

North America dominated the commercial display industry with a share of 32.28% in 2024, particularly the U.S., is a hub for technological innovation and research and development. Companies in the region are at the forefront of developing cutting-edge display technologies, such as 4K and 8K displays, OLED, and LED technologies. The strong emphasis on R&D drives the adoption of advanced commercial displays. Additionally, North America has a strong and stable economy, which supports significant investments in commercial display technologies. Businesses in sectors such as retail, corporate, healthcare, and hospitality have the financial resources to invest in high-quality display solutions.

U.S. Commercial Display Market Trends

The U.S. commercial display industry is expanding due to growing need for businesses to engage customers and enhance brand visibility is propelling the adoption of digital displays in retail, hospitality, and corporate environments. With the rise of interactive displays, touchscreens, and high-resolution screens, organizations are opting for more dynamic and personalized advertising solutions. Additionally, the integration of AI and machine learning in display systems is improving the efficiency of content management and targeting, which is attracting more companies to invest in these solutions.

Europe Commercial Display Market Trends

Europe's commercial display industry is experiencing steady growth, driven as businesses increasingly rely on digital signage for marketing and communication, demand for high-quality, versatile displays continues to rise. The shift toward remote work and hybrid models has also accelerated the need for digital solutions in corporate environments, including video conferencing systems and interactive displays. Additionally, industries like retail, hospitality, and transportation are investing in advanced display technologies such as OLED, LED, and 4K screens to enhance customer experience and engagement. Integration of AI and IoT capabilities into commercial displays is another growth driver, enabling more personalized content and improved efficiency.

Asia Pacific Commercial Display Market Trends

The Asia Pacific region is experiencing the fastest growth in the commercial display industry, driven by increasing demand across various sectors such as retail, hospitality, corporate environments, and transportation. This growth is fueled by the rapid digital transformation and technological advancements, with an increasing shift towards interactive and dynamic digital signage solutions. Key drivers include the adoption of OLED and LED technologies, as well as AI-driven content management systems that enhance customer experience.

Key Commercial Display Company Insights

-

BOE Technology Group Co., Ltd. is a prominent Chinese company operating in display manufacturing. The company has established itself as a major player in display technology, manufacturing intelligent interface products across a diverse range of devices, including smartphones, laptops, televisions, and virtual reality headsets. The company's business strategy, dubbed "1+4+N+Eco-chain," encompasses a multi-faceted approach. At its core is the display business, supplemented by endeavors in IoT solutions, sensor development, Micro LED (MLED) technology, and smart medical engineering. This diversified strategy, combined with the company's substantial global presence and substantial investment in innovation, as evidenced by over 80,000 patents filed, solidified BOE's position as a significant manufacturer in the display industry.

-

SAMSUNG is a multinational electronics company that provides Information Technology (IT), consumer electronics, and mobile communication products and solutions worldwide. The company operates through four segments, namely Device eXperience (DX), Device Solutions (DS), SDC, and Harman. SAMSUNG offers digital signage solutions for sports events. The company’s global network spans North America & Central/South America; Europe, the Middle East, and Africa; and Southeast & Southwest Asia. The company has manufacturing centers in the U.S., South Korea, and China; and R&D centers in the U.S., Canada, the U.K., Israel, India, Japan, China, Taiwan, and South Korea. The company is listed on the Korea Exchange (KRX) with the ticker symbol: KRX: 005930

Key Commercial Display Companies:

The following are the leading companies in the commercial display market. These companies collectively hold the largest market share and dictate industry trends.

- SAMSUNG

- CDW

- Cisco Systems, Inc.

- Dell Inc.

- Koninklijke Philips N.V.

- LG DISPLAY CO., LTD.

- NEC Corporation

- Panasonic Holdings Corporation

- Daktronics

- Sharp Electronics Corporation

- Sony Corporation

Recent Development

-

In April 2024, Daktronics and the University of Colorado collaborated to install six LED displays spanning 8,800 square feet at Folsom Field in Boulder, Colorado, in the U.S. ahead of the 2024 season kickoff. Daktronics aimed to significantly enhance fan engagement during football games and other stadium events with the new video display boards

-

In February 2024, SHARP Electronics of Canada Ltd., a Sharp Corporation subsidiary, announced the launch of MultiSync PNME Series displays, developed in collaboration with NEC Corporation. The PNME Series prioritizes maintaining commercial reliability while integrating modernized features to address the evolving demands of customers within the digital signage market. The PNME range provides improved flexibility and performance for digital signage applications, offering sizes ranging from 43 to 65 inches and featuring high haze and anti-reflective panels to minimize glare

-

In February 2024, SAMSUNG presented cutting-edge innovations in commercial display technology at the Integrated Systems Europe (ISE) 2024 display exhibition in Barcelona, Spain. SAMSUNG featured the largest exhibition area of 1,728-meter square among participants, attracting over 7,000 visitors on the first day and a total of 23,000 attendees throughout the event. One of the launches was a new interactive display, WAD, showcasing notable upgrades, including 8GB RAM and 64GB of memory, ensuring improved performance

-

In January 2024, Sony Professional Solutions Europe announced a partnership with Signagelive (Remote Media Group Limited), a digital signage software provider based in the U.K., to augment the versatility of its BRAVIA 4K Professional Displays powered by System on Chip (SoC) technology. The user-friendly content management platform of Signagelive (Remote Media Group Limited) is now seamlessly integrated with Sony Group Corporation's displays, delivering comprehensive digital signage solutions for businesses of all scales. The partnership is aimed at providing businesses with top-tier professional displays with enhanced display management capabilities.

Commercial Display Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.82 billion

Revenue forecast in 2030

USD 78.48 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market revenue in USD million/billion CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, component, display type, application, display size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

CDW; Cisco Systems, Inc.; Dell Inc.; Koninklijke Philips N.V.; LG DISPLAY CO., LTD.; NEC Corporation; Panasonic Holdings Corporation; Daktronics; SAMSUNG; Sharp Electronics Corporation; Sony Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Commercial Display Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global commercial display market report based on product, technology, component, display type, application, display size, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Signage

-

Video Walls

-

Video Screens

-

Transparent LED Screens

-

Digital Posters

-

Kiosks

-

Others

-

-

Display Monitor

-

Display TVs

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LCD

-

LED

-

Mini LED

-

Micro LED

-

Other LED

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Display Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 32 inches

-

32 to 52 inches

-

52 to 75 inches

-

Above 75 inches

-

-

Display Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flat Panel

-

Curved Panel

-

Other Panel

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial display market size was estimated at USD 53.65 billion in 2024 and is expected to reach USD 56.82 billion in 2025.

b. The global commercial display market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 78.48 billion by 2030.

b. Digital signage dominated the commercial display market with a share of 53.73% in 2024. This is attributable to the high penetration of digital signage products in shopping complexes and retail stores such as supermarkets and hypermarkets.

b. Some key players operating in the commercial display market include SAMSUNG; LG Display Co., Ltd.; CDW; Koninklijke Philips N.V.; Dell; Cisco Systems, Inc.; Sharp Electronics Corporation; NEC Display Solutions; Panasonic Corporation; and Sony Corporation.

b. Key factors driving market growth rapid technological advancements and the increasing demand for digital signage across various industries, rise in smart city initiatives, proliferation of smart devices, and growing investments in advertising.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.