- Home

- »

- Sensors & Controls

- »

-

Micro LED Market Size, Share And Growth Report, 2030GVR Report cover

![Micro LED Market Size, Share, & Trends Report]()

Micro LED Market (2024 - 2030) Size, Share, & Trends Analysis Report By Application (Display, Lighting), By Display Pixel Density (Less Than 3000ppi, Greater Than 5000ppi), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro LED Market Summary

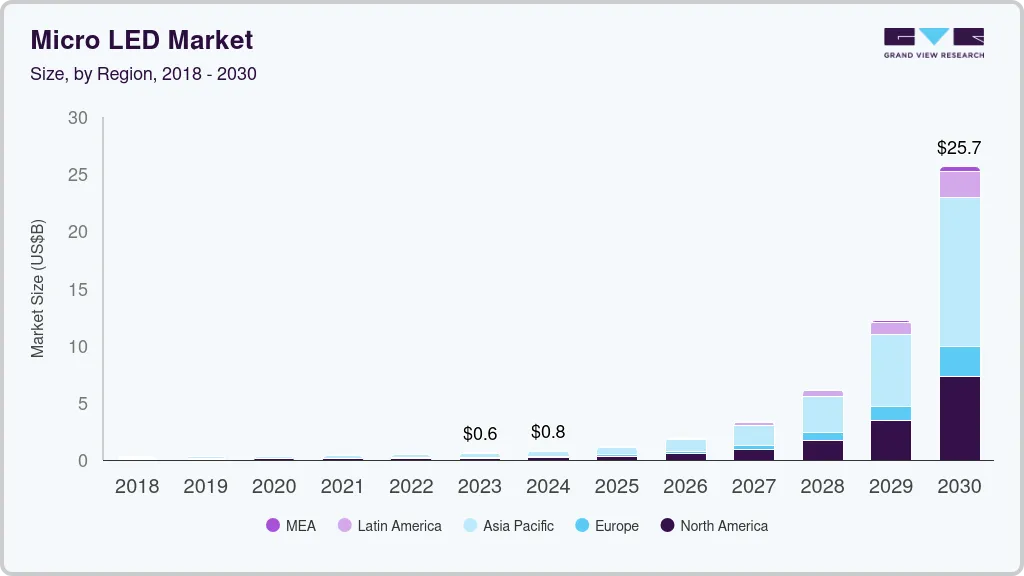

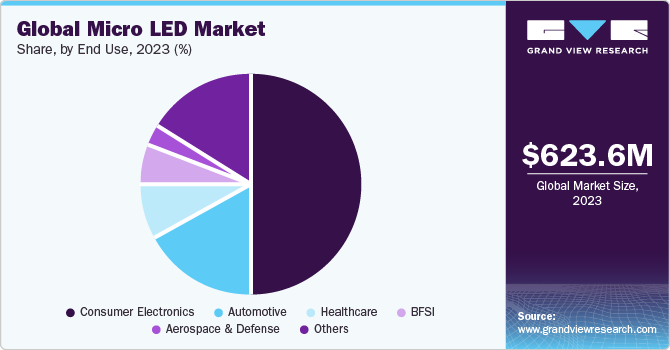

The global micro LED market size was valued at USD 623.6 million in 2023 and is projected to reach USD 25.65 billion by 2030, growing at a CAGR of 77.4% from 2024 to 2030. The increased consumption of on-demand content, ranging from streaming services to high-definition video content, needs screens that can display complex and detailed graphics, which is propelling the growth of the micro LED industry.

Key Market Trends & Insights

- The micro LED market in North America is growing at a significant CAGR of around 78%from 2024 to 2030

- The micro LED market in the U.S. is anticipated to grow at a significant CAGR of 76.7% from 2024 to 2030.

- By application, The display segment held the largest market share of over 82% in 2023.

- By display, the television segment held the largest market share of around 85% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 623.6 Million

- 2030 Projected Market Size: USD 25.65 Billion

- CAGR (2024-2030): 77.4%

- North America: Largest market in 2023

The potential of micro LEDs to deliver high-quality images meets the changing preferences of customers involved in a variety of content consumption activities. The micro LED technology allows the production of ultra-thin and flexible displays, which is one of its distinctive positive effects.

This adaptability opens new avenues for creative design in goods such as smartphones, wearables, automobile screens, digital signage, and massive operations digital screens. Due to the small size of the LEDs, integrating micro LED displays with electronic components is a major challenge. To attain seamless integration with touchscreen cameras, sensors, and connection components, complex engineering solutions need to be implemented. This complex nature of the integration procedure adds more complexity to the entire product development issues, slowing micro LED product delivery times. Furthermore, the complex processes essential in the production of micro LED displays, such as reliable mass transportation and the utilization of specialized equipment, substantially contribute to increased production costs, which is hindering the market growth.

Micro LED screens are predicted to play an increasingly important part in wearable technology over the forecasted period. Micro LED integration into smartwatches, laptops, AR/VR glasses, and fitness trackers is expected to grow in popularity. Manufacturers are expected to overcome existing barriers, allowing them to produce micro LED displays suited for larger applications such as high-end televisions and industrial displays. Streamlining these processes can help micro LED technology become more easily accessible and economically feasible in the forecast period. The cost of micro LED displays is anticipated to fall as production processes improve and the economy of scale increases. The decline in manufacturing costs is expected to fuel market growth, rendering micro LED technology less expensive across a wide range of applications and industries.

Market Concentration & Characteristics

One of the main growth opportunities in the micro LED industry is the increasing demand for high-quality displays in various devices such as TVs, smartphones, and wearables. Micro LEDs offer better brightness, contrast, and energy efficiency compared to traditional LEDs and OLEDs. This makes them ideal for creating better visuals in next-generation screens. In addition, as production techniques improve and costs decrease, more companies are adopting micro LED technology, leading to wider use in different industries and driving market growth.

A few key players in the market adopted the mergers & acquisition strategy to expand their product offerings. For instance, in March 2024, Taiwan-based AUO Corporation, a provider of optoelectronic solutions, announced the acquisition of Behr-Hella Thermocontrol GmbH (BHTC), a German company. The goal of this acquisition is to merge BHTC's automotive human-machine interfaces and climate control systems with AUO's automotive display technologies and advanced Micro LED technology. This combination aims to transform smart cockpit designs and enhance human-machine interaction services.

The threat of substitutes in the market is significant due to the presence of well-established and rapidly advancing alternative display technologies such as OLED and LCD. OLED displays, in particular, offer advantages such as deep blacks and flexibility, making them a strong competitor. LCDs are cost-effective and have a dominant market presence. In addition, emerging technologies such as quantum dot displays and mini LEDs also pose a threat by offering high efficiency and improved performance.

Companies are forming alliances to combine expertise, share intellectual property, and streamline the manufacturing process. The global market is poised for growth, driven by technological superiority, diverse application potential, and strategic industry collaborations. However, the market faces challenges such as high initial costs, complex manufacturing processes, and competition from other advanced display technologies.

Application Insights

The display segment held the largest market share of over 82% in 2023. The growing consumer demand for high-resolution displays, particularly in products such as televisions, smartphones, and monitors, has substantially propelled the display segment's rise. The display industry has gained traction among environmentally conscious customers and businesses, owing to the sustainable practices of micro LED technology. Smart cities and the Internet of Things (IoT) have increased demand for micro LED displays in public places, transportation, and construction. The display segment plays a key role in delivering real-time information and improving the entire urban experience, from interactive information kiosks to digital street furniture is anticipated to propel the display segment growth during the forecast period.

The lighting segment is expected to grow at a CAGR of more than 76% during the forecast period. The segment growth can be attributed to the advent of smart homes and smart cities, which has fueled demand for automated lighting solutions, and micro LED technology is at the front of the smart lighting revolution. Micro-optics have been an integral part of regulating and intensifying the light emitted by micro LEDs. Advanced micro-optical technology is being implemented into vehicle lighting, commercial displays, and architectural lighting to improve both visual impact and operational efficiency. The combination of micro LED lighting and augmented reality technology opens up new opportunities for interactive and immersive experiences during the forecast period.

Display Insights

The television segment held the largest market share of around 85% in 2023. The segment growth is attributed to the shift toward larger television displays and has gained traction owing to changing customer tastes for home entertainment. Micro LED televisions meet the need for offering a new level of clarity and authenticity as television buyers favor larger screens with ultra-high-definition technology. Micro LED technology's energy efficiency is a compelling component, attributed to its prominence in the television segment in the market. Furthermore, micro LEDs can create brilliant and colorful displays while utilizing less power than conventional technologies.

The smartwatch segment is expected to grow at a CAGR of 144.5% over the forecast period. The increasing trend of health and fitness tracking has become a core feature of smartwatches, driving their demand. The precision and clarity of micro LED displays improve the readability of vital health metrics and notifications in bright outdoor environments. In addition, the toughness and longer lifespan of micro LEDs align with the durability requirements of wearables, which are often exposed to varying conditions and need to withstand daily wear and tear.

Lighting Insights

The general lighting segment held the largest market share of around 72.0% in 2023 and is expected to maintain its dominance by the year 2030. This segment growth can be attributed to micro LED lighting's incorporation into smart lighting systems, which is a key driver of its rise in general lighting. General lighting micro LED technology enables fine control over color temperatures, allowing lighting solutions to be tailored to specific settings and user preferences. General lighting applications in commercial and industrial environments is anticipated to propel the market growth in the forecast period. Human-centric lighting (HCL) applications will evolve further, utilizing micro LED technology to create lighting environments that prioritize occupant well-being. To coordinate general lighting, accurate control over color temperatures and brightness will be utilized in the forecast period.

The automotive segment is expected to witness the fastest CAGR of more than 78% over the forecast period. The growth of the segment can be attributed to the emergence of electric and self-driving vehicles, opening new avenues for lighting innovation, and micro LED technology is at the core of these developments. Micro LED illumination combined with Advanced Driver Assistance Systems (ADAS) and Advanced Forward Lighting (AFLs) aim to improve the overall operation and safety aspects of automobiles. By delivering higher illumination and decreasing glare, micro LED headlights contribute to an improved night driving experience. Future micro LED technology will be significant in integrating the use of augmented reality (AR) into automobile displays and head-up display (HUD) systems.

Display Pixel Density Insights

The 3000ppi-5000ppi segment held a market share of around 34% in 2023 and is expected to maintain its dominance till 2030. This segment growth can be attributed to the increasing popularity of 3000ppi to 5000ppi pixel densities, which is particularly evident in small form-factor devices such as smartwatches, cell phones, and AR/VR glasses. The growing interest in virtual reality and augmented reality technologies has increased the need for displays with high pixel density. Manufacturers are using advanced manufacturing technologies to lower the size of individual micro LEDs, increasing pixel density and enabling more precise and detailed images. This advancement is vital for applications demanding ideal visual precision, such as smartphones with premium features and virtual reality gadgets.

The greater than 5000ppi segment is anticipated to witness the fastest CAGR of around 79% over the forecast period. The growth of the segment can be attributed to the gaming industry, a key consumer of high-performance displays, which has contributed significantly to the rise of 5000ppi panels. In the competitive gaming hardware market, the use of 5000ppi displays in video game displays and devices has become an essential differentiation. The increasing demand for devices with higher resolutions and more immersive displays reflects the possibilities of 5000ppi panels, which contributed to the broad adoption of 5000ppi displays.

End Use Insights

The consumer electronics segment held the largest revenue share of 50.0% in 2023. The widespread use of micro LED screens in smartphones has changed the experience of playing, propelling the consumer electronics market. Customer electronics can determine the reciprocal relationship between technology advancement and customer demand. Manufacturers respond by using micro LED technology as consumers demand gadgets that have improved display quality, extended battery life, and appealing designs. In addition to smartphones and smartwatches, the future consumer electronics market in the micro LED segment is expected to see an array of varied gadgets. Micro LED displays are set to be integrated into products such as e-book readers, digital cameras, and portable video game systems.

Healthcare segment is expected to grow at a significant CAGR of around 79.2% over the forecast period. There is a growing demand for high-quality displays in healthcare settings for medical imaging, diagnostic purposes, patient monitoring, and surgical procedures. Micro LED displays offer high resolution, brightness, color accuracy, and contrast ratio, making them suitable for medical applications where visual clarity and accuracy are critical. Similarly, micro LED displays are being integrated into surgical navigation systems and Augmented Reality (AR) platforms to provide surgeons with real-time guidance, anatomical visualization, and procedural information during surgeries.

Regional Insights

The micro LED market in North America is growing at a significant CAGR of around 78%from 2024 to 2030. The market has expanded significantly owing to the growing integration of micro LED displays in consumer devices, including smartwatches, smartphones, and televisions. The development and marketing of innovative micro LED technologies have been made easier by the region's strong ecosystem of research institutions, tech businesses, and highly qualified workforce. North America's prominence in the micro LED market is partly attributable to its involvement in the global supply chain. Companies in the micro LED sector are playing a key role in the manufacturing and distribution of essential components, such as LED chips and completed micro LED displays, which supports the expansion of the North America market growth in the forecast period.

U.S. Micro LED Market Trends

The micro LED market in the U.S. is anticipated to grow at a significant CAGR of 76.7% from 2024 to 2030. The growth of the market can be attributed to the rising demand for bright, power-efficient display panels for wearable devices, such as Head-Mounted Displays (HMDs) and smartwatches. The policies being pursued by the U.S. government to encourage the adoption of energy-efficient lighting solutions, such as micro LED lighting, also bode well for the growth of the market. These policies establishing minimum energy efficiency standards for lighting products are designed to encourage consumers to prefer energy-efficient lighting over relatively inefficient lighting technologies.

Asia Pacific Micro LED Market Trends

The micro LED market in Asia Pacific is anticipated to grow at a significant CAGR of 75.4%from 2024 to 2030. The region is home to a huge and increasingly educated population with a growing need for high-quality electronic products. The growing middle-class population, combined with rising disposable money, has resulted in an upsurge in demand for premium consumer electronic devices. The APAC region, particularly China, Japan, and South Korea, has been at the epicenter of technical innovation. These countries are home to leading electronics brands, semiconductor manufacturers, and research organizations that are pushing advancements in micro LED technology. Furthermore, the diversification of micro LED applications creates new market prospects, contributing to the region's rapid growth rate.

The China micro LED market is growing significantly at a CAGR of 81.0% from 2024 to 2030. China is one of the leading countries dominating automotive production. The demand for micro LED displays in China is increasing as Chinese automakers are developing technologically advanced cars with advanced infotainment systems, digital cockpits, and Advanced Driver Assistance Systems (ADAS) featuring high-quality displays.

The micro LED market in India is growing significantly at a CAGR of 77.6% from 2024 to 2030. The initiatives being pursued by the government to encourage domestic manufacturing and adoption of energy-efficient products have been a major factor driving the growth of the market in the country. For instance, in April 2021, the government of India approved the Production-Linked Incentive (PLI) scheme to boost domestic manufacturing of LED lights, among other products. Such initiatives are expected to help reduce the prices of micro LED solutions and drive their adoption in the country.

The Japan micro LED market is growing significantly at a CAGR of 74.6% from 2024 to 2030. The technological developments have helped improve manufacturing techniques, enhance chip designs, and increase production volumes of micro LED chips. Manufacturers have achieved economies of scale and are producing micro LED displays cost-effectively. LED lighting companies are expanding their product portfolios by introducing micro LED displays with enhanced capabilities.

Europe Micro LED Market Trends

The micro LED market in Europe is anticipated to grow significantly at a CAGR of 78.9% from 2024 to 2030. This growth is driven by the growing adoption of micro LED displays by the incumbents of the aerospace & defense, automotive, and consumer electronics industries. The growth of the regional market can also be attributed to the growing demand for Organic Light Emitting Diodes (OLED) displays, the increasing use of Near-Eye Displays (NED), and the advances in display technologies aimed at eliminating the need for a backlight while improving color clarity and simulation to produce a brighter display.

The UK micro LED market is growing significantly at a CAGR of 77.6% from 2024 to 2030. Micro LED lighting can play a vital role in catering to the growing demand for premium, luxury decorative lighting solutions commonly popular among high-income UK consumers looking forward to enhancing the aesthetic appeal of their homes. Micro LED lighting can help in designing the shape of decorative lighting, including chandeliers and downlights.

The micro LED market in Germany is projected to grow significantly at a CAGR of 78.3% from 2024 to 2030 driven by the strategic initiatives being pursued by the incumbents of the automotive industry to develop innovative, micro LED-based automotive lighting designed to enhance driving comfort and road safety.

The France micro LED market is anticipated to grow significantly at a CAGR of 79.1% from 2024 to 2030. Advances in micro LED display technology are playing a potent role in driving the demand for wearable devices in France. Micro LED displays hold the potential to enhance visual experience by optimizing energy consumption, brightness, and contrast. Having realized that smartphones featuring micro LED displays can guarantee superior image quality, micro LED manufacturers in the country are developing more efficient and versatile micro LED displays.

Middle East & Africa Micro LED Trends

The micro LED market in the Middle East & Africa region is growing significantly at a CAGR of 80.0% from 2024 to 2030. The growth of the regional market can be attributed to the increasing usage of micro LED displays in military and automotive applications and the growing popularity of the Internet of Things (IoT), which is projected to increase the demand for laptops, projectors, smartwatches, and smartphones.

The Saudi Arabia micro LED market is growing significantly at a CAGR of 79.0% from 2024 to 2030. Micro LED displays utilize self-illuminating pixels to enhance contrast and color performance compared to conventional LED-backlit LCDs. The continuous improvements in efficiency, brightness, and color management, and the ongoing miniaturization of LEDs have increased the popularity of micro LEDs across diverse industries in Saudi Arabia.

Key Micro LED Company Insights

Some of the key players operating in the market include LG Electronics, Samsung Electronics Co., Ltd, and Sony Corporation.

-

LG Electronics manufactures and distributes consumer electronics and home appliances and offers a diverse range of products. The company's portfolio includes monitors, televisions, personal computers, refrigerators, washing machines, audio devices, and air purifiers, among others. The company operates across the globe, offering innovative solutions in sectors such as entertainment, automotive components, and solar panels across Europe, the Americas, the Middle East, Africa, and Asia Pacific.

-

Samsung Electronics Co., Ltd., a subsidiary of Samsung Group, is a manufacturer of consumer electronics, mobile communications, information technology, and device solutions. The company's diverse product portfolio includes televisions, washing machines, refrigerators, air conditioners, medical devices, monitors, printers, computers, network systems, and digital cameras. The company manufactures LCD and LED panels, smartphones, tablets, and related accessories.

PlayNitride Inc., AUO Corporation, and VueReaL are some of the emerging market participants in the micro LED industry.

-

PlayNitride Inc. is dedicated to semiconductor research and development for external entities, technical exploration in semiconductor fields, and consultancy for semiconductor design and development. It also specializes in the designing and development of transferring microscale devices onto non-native substrates. The company has a significant presence in Taiwan, Japan, and other countries.

-

VueReal develops and manufactures micro LED display technologies. The company utilizes microscopic LEDs to create high-resolution, high-brightness, and energy-efficient displays. With a variety of sizes and configurations, these displays integrate millions of efficient micro-devices into the system substrate, enhancing electronic systems. VueReal's micro-LED technology ensures the highest display resolution, achieved through self-aligned transfer and dependable integration processes. Clients can utilize nano-device processing, sophisticated integration technologies, and advanced system design for diverse applications.

Key Micro LED Companies:

The following are the leading companies in the micro LED market. These companies collectively hold the largest market share and dictate industry trends.

- AUO Corporation

- Cincoze Co., Ltd.

- Cooledge Lighting Inc.

- Cree LED

- eLux, Inc.

- Europa Science Ltd

- Innolux Corporation

- KYOCERA Corporation

- LEYARD

- LG Electronics.

- OSRAM GmbH.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Unilumin

- VueReaL

Recent Developments

-

In January 2024, Samsung Electronics unveiled its new collections of QLED, MICRO LED, OLED, and Lifestyle displays. This launch marks the beginning of AI-driven screens, featuring an advanced AI processor designed to transform features of smart displays. These latest offerings enhance audio and visual quality and boast AI-enhanced functionalities protected by Samsung Knox. They aim to motivate and support diverse personal lifestyles.

-

In January 2024, AUO Corporation unveiled its transparent micro LED display series featuring a 60-inch display at a global professional audiovisual integration event, ISE 2024. This versatile technology seamlessly integrates into diverse settings, delivering an advanced visual experience for applications such as digital signage, commercial displays, corporate meeting rooms, and residential interiors.

-

In May 2023, Q-Pixel Inc., a company based in Los Angeles, unveiled an unprecedented development in the display technology sector. They introduced the first-ever full-color, ultra-high resolution microLED screen with Polychromatic microLED technology. This full-color LED screen boasts an unparalleled pixel density of 5000 pixels per inch (PPI).

-

In November 2022, Epistar and PlayNitride Display, subsidiaries of Ennostar Inc. and PlayNitride Inc., respectively, collaborated to establish a production line dedicated to manufacturing 6-inch Micro LED epi-wafers. This collaboration was aimed at addressing technological challenges and paving the way for the adoption of Micro LEDs in various applications, such as see-through displays for wearables, automotive displays, and transparent display products.

-

In August 2021, Jade Bird Display and WaveOptics, a UK-based company manufacturing diffractive waveguides for AR wearables, announced a strategic supplier relationship with Jade Bird Display for Micro LED micro displays, integrating JBD's 0.13-inch AmµLED panel into its latest development kit, the Leopard. The Leopard, showcasing an advanced level of deployable and customizable augmented reality technology, features WaveOptics's patented waveguide technology.

Micro LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 824.2 million

Market Value forecast in 2030

USD 25.65 billion

Growth Rate

CAGR of 77.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Market Value in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Application, display pixel density, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa.

Key companies profiled

AUO Corporation; Cree LED; Cincoze Co., Ltd.; Cooledge Lighting Inc.; eLux, Inc.; Europa Science Ltd; Innolux Corporation; KYOCERA Corporation; LEYARD; LG Electronics.; Samsung Electronics Co., Ltd.; Sony Corporation; Unilumin; VueReaL; OSRAM GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro LED Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global micro LED market report based on application, display pixel density, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Display

-

Television

-

AR & VR

-

Automotive

-

Smartwatch

-

Smartphone, Tablets, and Laptops

-

-

Lighting

-

General Lighting

-

Automotive Lighting

-

-

-

Display Pixel Density Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 3000ppi

-

3000ppi to 5000ppi

-

Greater than 5000ppi

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

BFSI

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micro LED market size was estimated at USD 623.6 million in 2023 and is expected to reach USD 824.2 million in 2024.

b. The global micro LED market is expected to grow at a compound annual growth rate of 77.4% from 2024 to 2030, reaching USD 25.65 billion by 2030.

b. Asia Pacific dominated the global micro-LED market with a share of 54.74% in 2023, which is attributable to factors such as the presence of major players in the micro-LED market in the region, high sales of smartphones and other consumer electronics, and improving digital infrastructure has all together contributed to the growth of the Asia pacific region.

b. Some key players operating in the global micro LED market include AUO Corporation, Cree LED, Cincoze Co., Ltd., Cooledge Lighting Inc., eLux, Inc., Europa Science Ltd, Innolux Corporation, KYOCERA Corporation, LEYARD, LG Electronics., Samsung Electronics Co., Ltd.,Sony Corporation, Unilumin, VueReaL, and OSRAM GmbH.

b. Key factors driving the growth of the global micro-LED market include rising purchasing power, increasing population, high sales of consumer electronics products, low cost of micro LED products, and increasing demand for high-quality video entertainment, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.