- Home

- »

- Green Building Materials

- »

-

Commercial Green Construction Market Size Report, 2030GVR Report cover

![Commercial Green Construction Market Size, Share & Trends Report]()

Commercial Green Construction Market (2025 - 2030) Size, Share & Trends Analysis Report By Project Type (Public, Private), By Technology (High Tech/Smart Buildings, Traditional Green Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-513-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Green Construction Market Summary

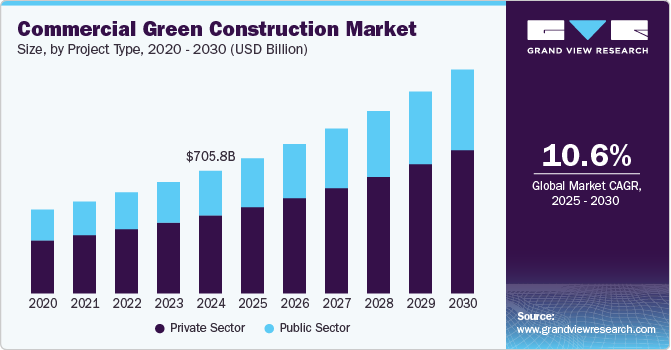

The global commercial green construction market size was estimated at USD 705.8 billion in 2024 and is projected to reach USD 1289.0 billion by 2030, growing at a CAGR of 10.6% from 2025 to 2030. The demand for commercial green construction is expected to increase significantly in the coming years due to growing awareness about environmental sustainability and the economic benefits associated with green building practices.

Key Market Trends & Insights

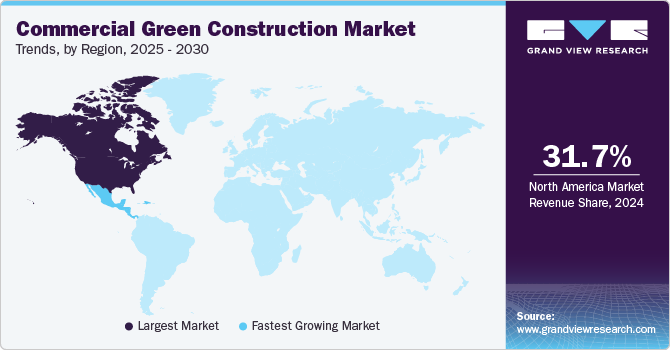

- North America dominated the commercial green construction market with the largest revenue share of 31.74% in 2024.

- The commercial green construction market in Latin America is anticipated to grow at the fastest CAGR during the forecast period.

- Based on project type, the private sector segment led the market with the largest revenue share of 63.33% in 2024.

- Based on technology, the traditional green construction segment led the market with the largest revenue share of 62.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 705.8 Billion

- 2030 Projected Market Size: USD 1289.0 Billion

- CAGR (2025-2030): 10.6%

- North America: Largest market in 2024

- Latin America: Fastest growing market

As climate change concerns intensify, governments and corporations are pushing for more sustainable building solutions that reduce energy consumption, water usage, and carbon emissions. This shift is driven by the implementation of strict building codes and regulations globally, which encourage the use of energy-efficient materials, renewable energy sources, and green technologies such as smart building systems, solar panels, and eco-friendly insulation.

Furthermore, businesses and property developers are increasingly prioritizing green certifications (e.g., LEED, BREEAM) as a way to attract environmentally conscious tenants and investors. The economic benefits, such as long-term energy cost savings, improved operational efficiency, and the potential for higher rental rates, are also accelerating the adoption of green construction practices. In addition, the rise of corporate social responsibility (CSR) and ESG initiatives among private sector players is contributing to the widespread adoption of green building standards.

Despite the rising demand for commercial green construction, there are several factors that may hamper growth globally. High upfront costs associated with green building technologies and materials remain a significant barrier, particularly in regions where economic conditions are less favorable or where developers are more cost-sensitive. The initial investment required for energy-efficient systems, sustainable building materials, and green certifications can be prohibitive for smaller companies or those with limited access to financing.

To gain a competitive edge in the commercial green construction industry, players are focusing on several strategies, such as innovation, sustainability, and technological advancements. Many companies are investing in R&D to develop more cost-effective and sustainable building materials, such as recyclable composites and energy-efficient insulation. This helps them reduce construction costs while meeting environmental standards and customer demands.

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating. The commercial green construction industry is fragmented. Companies are pursuing strategic partnerships with governments, organizations, and suppliers to access green building incentives, certifications, and funding. Players are also increasingly enhancing their sustainability credentials by obtaining green certifications such as LEED, BREEAM, and WELL, which help differentiate them in a market where corporate social responsibility (CSR) is highly valued. Companies are focusing on end-to-end solutions, offering comprehensive green building services that span from design and construction to energy management and retrofitting, thus increasing their value proposition.

The commercial green construction industry faces substitution threats from conventional construction methods that do not focus on sustainability, and the use of traditional building materials like concrete and steel. While these options often come at a lower upfront cost, they tend to have higher energy consumption and environmental impact in the long run. This makes them less attractive in the face of growing demand for eco-friendly buildings, thereby driving increased adoption of green construction. However, cost-sensitive developers may still lean towards these substitutes, affecting overall market demand.

Project Type Insights

Based on project type, the private sector segment led the market with the largest revenue share of 63.33% in 2024. The private sector's demand for commercial green construction is fueled by the growing focus on corporate social responsibility (CSR), environmental, social, and governance (ESG) goals, and the need for operational efficiency. Businesses, especially large corporations, are increasingly seeking green building certifications like LEED to enhance their brand image, attract environmentally conscious tenants, and meet investor expectations for sustainability. Moreover, energy-efficient buildings offer long-term savings in operating costs, maintenance, and utilities, making them financially appealing. With the rise of eco-conscious consumers and investors, private companies are also motivated to contribute to global sustainability efforts.

The public sector segment is also expected to witness at a notable CAGR of 10.4% over the forecast period, on account of increasing as governments worldwide implement stringent environmental regulations and sustainable development goals. Public sector projects, including government buildings, schools, and hospitals, are increasingly being built with green standards to reduce carbon footprints, improve energy efficiency, and promote environmental responsibility. Many governments are setting ambitious net-zero emissions targets and offering incentives for green certifications, further driving the demand for sustainable construction.

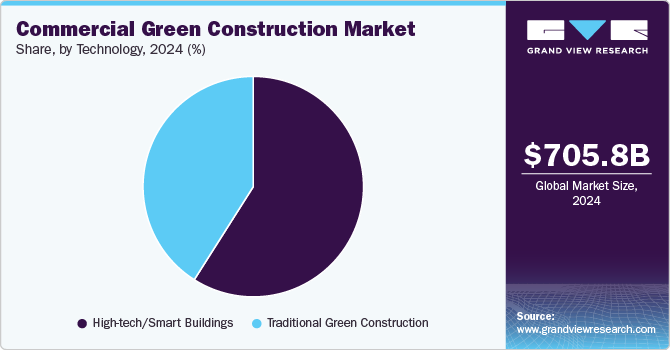

Technology Insights

Based on technology, the traditional green construction segment led the market with the largest revenue share of 62.44% in 2024. The market for commercial green construction is rapidly increasing in high-tech/smart buildings due to the integration of cutting-edge technologies that enhance sustainability and operational efficiency. These buildings are equipped with IoT sensors, AI-driven energy management systems, and smart grids to monitor and optimize energy use, reduce waste, and improve occupant comfort.

As businesses and property owners seek to lower energy consumption and carbon emissions, smart buildings offer a solution that not only meets green building standards but also provides real-time data on energy usage, air quality, and other environmental factors. The demand is further boosted by the growing emphasis on occupant well-being and the ability to integrate renewable energy sources, such as solar panels and wind turbines, into smart building systems.

The high tech/smart buildings segment is also expected to witness at a notable CAGR of 10.8% over the forecast period, on account of increasing demand for energy-efficient buildings continues to rise across a variety of industries. These buildings incorporate proven sustainable practices such as high-performance insulation, natural ventilation, and the use of eco-friendly materials to improve energy efficiency and reduce resource consumption.

Traditional green construction remains an attractive option for developers and businesses that prioritize lower upfront costs while still adhering to environmental standards. With regulatory pressures pushing for green building certifications and tax incentives in many regions, traditional green construction methods are becoming more widely adopted.

Regional Insights

North America dominated the commercial green construction market with the largest revenue share of 31.74% in 2024, due to heightened environmental awareness, energy efficiency goals, and the push for sustainable infrastructure. Governments and businesses are prioritizing green building certifications and reducing carbon footprints. The availability of incentives, coupled with a growing focus on ESG goals in both the public and private sectors, is further driving the adoption of commercial green construction.

U.S. Commercial Green Construction Market Trends

The commercial green construction market in the U. S is fueled by stringent regulations, such as LEED certification requirements for public projects, and a shift towards sustainability in real estate development. Rising energy costs and government incentives for eco-friendly building practices are also contributing to the growth of green commercial projects. In addition, corporate sustainability commitments are increasing private sector investment in green buildings.

Asia Pacific Commercial Green Construction Market Trends

The commercial green construction market in Asia Pacific is driven by rapid urbanization, and the growing middle class is fueling the demand for commercial green construction. Governments in countries like Japan and Singapore are implementing strict green building codes and promoting eco-friendly infrastructure. In addition, the region's focus on energy efficiency and environmental sustainability is pushing both public and private sectors toward green construction projects.

The China commercial green construction market is anticipated to grow at the fastest CAGR during the forecast period. China's commitment to sustainable development and green building certifications is driving demand for commercial green construction. As the government prioritizes energy efficiency and environmentally friendly infrastructure, demand for green buildings and smart cities continues to grow. China's ambitious carbon neutrality goals and the rapid expansion of green energy technologies are further accelerating the shift towards sustainable construction.

Europe Commercial Green Construction Market Trends

The commercial green construction market in Europe is experiencing growing demand for commercial green construction driven by ambitious climate goals and the EU’s Green Deal. Stringent building codes and environmental regulations are pushing developers to adopt sustainable building practices, while green financing options and eco-friendly certifications like BREEAM are fostering further growth. The emphasis on sustainable urbanization and the construction of zero-energy buildings is accelerating market demand.

The Germany commercial green construction market is anticipated to grow at a significant CAGR during the forecast period. Germany's strong commitment to renewable energy, carbon neutrality, and green construction practices is propelling demand for commercial green buildings. The country's energy-efficient building standards, backed by government incentives and regulations, make it a leading market in sustainable construction. Furthermore, corporate sustainability and the need for energy-efficient solutions in both commercial and industrial sectors continue to drive demand.

Latin America Commercial Green Construction Market Trends

The commercial green construction market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. In Latin America, demand for commercial green construction is increasing due to a combination of growing urbanization, environmental awareness, and government incentives. Many countries in the region are focusing on sustainable development, with projects in sectors like renewable energy and green buildings becoming more prevalent. Increased investment in eco-friendly infrastructure is helping to meet both local and international sustainability targets.

Middle East & Africa Commercial Green Construction Market Trends

The commercial green construction market in the Middle East & Africa is increasing due ambitious infrastructure projects and a focus on energy efficiency. The region's growing interest in smart cities, green buildings, and renewable energy is accelerating demand for sustainable construction. In addition, economic diversification in countries like the UAE and Saudi Arabia is driving significant investments in green building technologies and sustainable development projects.

Key Commercial Green Construction Company Insights

Some of the key players operating in market include AECOM and Jacobs Engineering Group, Inc.

-

AECOM, along with its subsidiaries, designs, finances, and operates infrastructural assets across the world. Its design and consulting services segment offers consulting, planning, engineering designs, and construction management services for industrial & commercial applications and government projects of transportation and energy.

-

Jacobs Engineering Group, Inc. offers technical and construction services. It is engaged in engineering, interiors, designing, architecture, planning, scheduling, estimating, accounting, safety, and other related services. The company also offers operational & maintenance services, field construction, consulting, and environmental remedial construction services.

Fluor Corporation and Galfar Engineering & Contracting SAOG (Galfar), are some of the emerging market participants in commercial green construction industry.

-

Fluor Corporation is one of the major players in the infrastructure ownership. It deals with fully integrated professional services and project management. The company offers solutions for capital investment, design, engineering, consulting, construction, operations, and maintenance for various industries such as oil & gas, mining, infrastructure, metallurgy, power, and energy.

-

Galfar Engineering & Contracting SAOG (Galfar), along with its subsidiaries, is engaged in manufacturing, construction, equipment hires, and personnel training in the Sultanate of Oman, India, and other GCC countries. The company is involved in the construction of residential, commercial, government, and educational buildings.

Key Commercial Green Construction Companies:

The following are the leading companies in the commercial green construction market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Jacobs Engineering Group, Inc.

- Fluor Corporation

- Galfar Engineering & Contracting SAOG (Galfar)

- KIMLY CONSTRUCTION PTE. LTD

- Soilbuild Construction Group Ltd.

- Lum Chang

- The Turner Corp.

- Clark Group

- DPR Construction

Recent Developments

-

In December 2023, Fluor Corporation was contracted by Dow to construct the world's first Net-Zero Scope 1 and Net-Zero Scope 2 Integrated Ethylene Cracker and Derivatives Complex in Fort Saskatchewan Alberta, Canada. Dow’s current manufacturing facilities are being expanded and refurbished as part of the overall program.

Commercial Green Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 778.6 billion

Revenue forecast in 2030

USD 1289.0 billion

Growth rate

CAGR of 10.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Project type, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Singapore

Key companies profiled

AECOM; Jacobs Engineering Group, Inc.; Fluor Corporation; Galfar Engineering & Contracting SAOG (Galfar); KIMLY CONSTRUCTION PTE. LTD; Soilbuild Construction Group Ltd.; Lum Chang; The Turner Corp.; Clark Group; DPR Construction

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

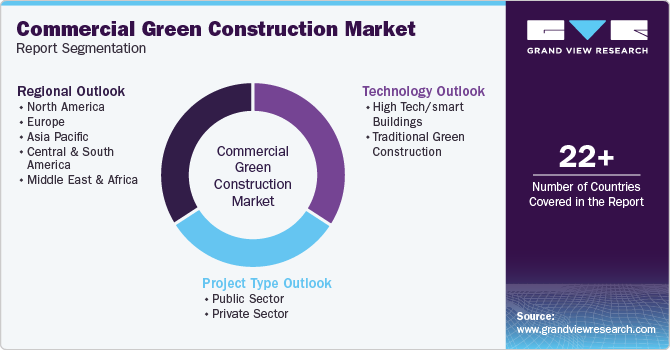

Global Commercial Green Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial green construction market report based on project type, technology, and region:

-

Project Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Sector

-

Private Sector

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Tech/Smart Buildings

-

Traditional Green Construction

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global commercial green construction market size was estimated at USD 705.8 billion in 2024 and is expected to reach USD 778.6 billion in 2025.

b. The global commercial green construction market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2030 to reach USD 1,289.0 billion by 2030.

b. Based on Project Type, the private sector accounted for the largest revenue share of 63.7% in 2024. The private sector's demand for commercial green construction is fueled by the growing focus on corporate social responsibility (CSR), environmental, social, and governance (ESG) goals, and the need for operational efficiency. With the rise of eco-conscious consumers and investors, private companies are also motivated to contribute to global sustainability efforts.

b. Some of the key players operating in the commercial green construction market include AECOM, Jacobs Engineering Group, Inc., Fluor Corporation, Galfar Engineering & Contracting SAOG (Galfar), KIMLY CONSTRUCTION PTE. LTD, Soilbuild Construction Group Ltd., Lum Chang, The Turner Corp., Clark Group, and DPR Construction.

b. The key factors that are driving the commercial green construction market include growing awareness about environmental sustainability and the economic benefits associated with green building practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.