- Home

- »

- Advanced Interior Materials

- »

-

Composite Rebar Market Size & Share, Industry Report 2030GVR Report cover

![Composite Rebar Market Size, Share & Trends Report]()

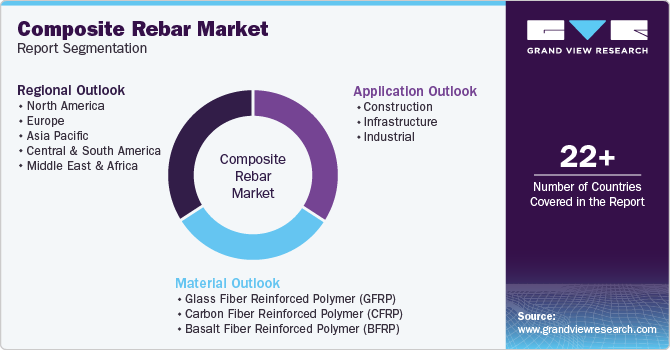

Composite Rebar Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP)), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-529-3

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Composite Rebar Market Summary

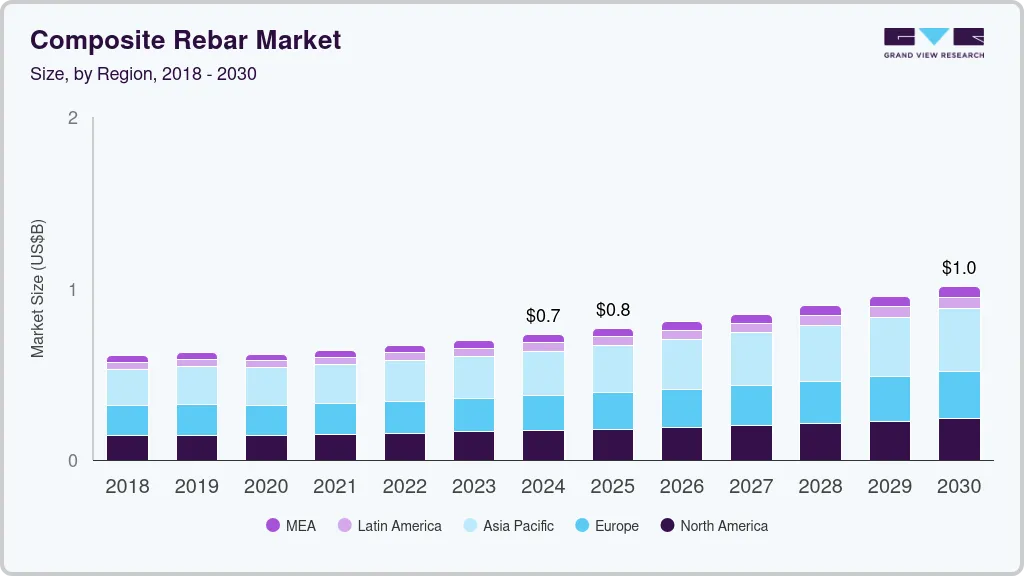

The global composite rebar market size was estimated at USD 729.2 million in 2024 and is projected to reach USD 1.01 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The increasing demand for durable and corrosion-resistant materials in construction projects proliferates the market.

Key Market Trends & Insights

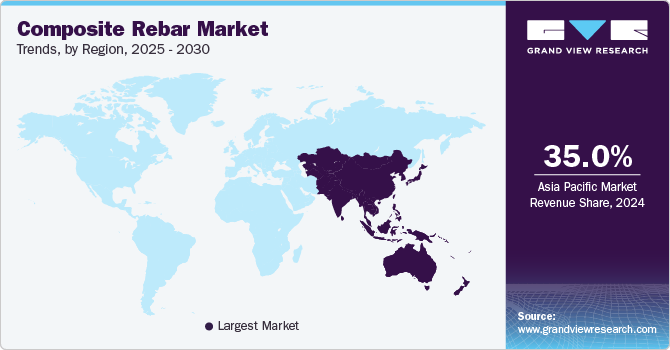

- Asia Pacific is the dominant region for the composite rebar industry with a revenue share of over 35.0% in 2024.

- In terms of material, Carbon fiber reinforced polymer (CFRP) is anticipated to register the fastest CAGR over the forecast period.

- In terms of application, Infrastructure is anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 729.2 Million

- 2030 Projected Market Size: USD 1.01 Billion

- CAGR (2025 - 2030): 5.7%

- Asia Pacific: Largest market in 2024

Traditional steel rebars are prone to rust and degradation, especially in harsh environments such as coastal areas or regions with high humidity. Composite rebars, made from materials such as fiberglass, basalt, or carbon fiber, offer superior resistance to corrosion, making them an attractive alternative for infrastructure projects like bridges, highways, and marine structures. This durability translates to longer lifespans and reduced maintenance costs, a major selling point for developers and governments.Composite rebars are lighter than steel, which reduces transportation costs and carbon emissions during logistics. Additionally, their production process often has a lower environmental impact than steel rebar manufacturing, which is energy-intensive and contributes significantly to greenhouse gas emissions. As governments and organizations worldwide push for greener building standards and carbon neutrality, composite rebars are increasingly being adopted to meet these sustainability goals. This trend is further supported by incentives and regulations promoting using environmentally friendly materials in construction.

Polymer chemistry and fibre technology innovations have led to composite rebars with enhanced mechanical properties, such as higher tensile strength and improved flexibility. These advancements have expanded the range of applications for composite rebars, making them suitable for use in more demanding structural environments. Furthermore, automated manufacturing techniques have reduced production costs, making composite rebars more economically competitive with traditional steel rebars. As research and development continue, the performance and affordability of composite rebars are expected to improve further, driving growth of the composite rebar industry.

Rapid urbanization and population growth in countries like India, China, and Brazil have led to a surge in construction activities, including developing roads, bridges, and residential buildings. These regions' governments prioritize infrastructure projects to support economic growth and improve living standards. Composite rebars are being increasingly adopted in these projects due to their durability, lightweight nature, and resistance to environmental factors. This trend is expected to continue as emerging markets modernize their infrastructure and seek long-lasting, cost-effective solutions.

Drivers, Opportunities & Restraints

The increasing demand for durable and corrosion-resistant construction materials is fueling the adoption of the market, particularly in harsh environments like marine or industrial structures. Traditional steel rebar is prone to corrosion, leading to costly maintenance and structural degradation. Additionally, the rising focus on sustainable and eco-friendly construction practices is pushing for the use of composite materials, as they are lightweight and can help reduce the overall carbon footprint of construction projects.

As developing nations invest in large-scale infrastructure projects like bridges, roads, and buildings, the demand for advanced construction materials is expected to rise. Furthermore, the market is poised to benefit from the increasing awareness of the long-term economic benefits of composite rebar. These rebars enhances structures' durability and safety and offers manufacturers opportunities to innovate with new composite materials. With growing investments in research and development, there is an opportunity to expand applications beyond traditional construction and into industries like marine, aerospace, and renewable energy.

The manufacturing process and materials used in producing composite rebar can make it more expensive, which may deter budget-conscious project developers and contractors from adopting this technology. Additionally, the lack of widespread standards and regulations in construction may limit its acceptance in certain regions or sectors.

Material Insights

GFRP rebars are highly durable, making them ideal for use in environments that are prone to corrosion, such as marine structures, coastal construction, and infrastructures exposed to de-icing salts. This property helps extend the lifespan of concrete structures, which is a significant advantage over traditional steel reinforcement. As a result, the demand for GFRP composite rebars is increasing, particularly in areas with challenging weather conditions or where long-term infrastructure durability is essential.

Carbon fiber reinforced polymer (CFRP) is anticipated to register the fastest CAGR over the forecast period. CFRP rebars offer superior performance to traditional steel reinforcement, particularly in strength-to-weight ratio and long-term durability. Their ability to withstand harsh environmental conditions, including high temperatures, aggressive chemicals, and corrosion, makes them ideal for critical infrastructure applications like bridges, tunnels, and marine structures. This has led to a growing demand for CFRP rebars in construction projects requiring long-lasting, high-performance materials.

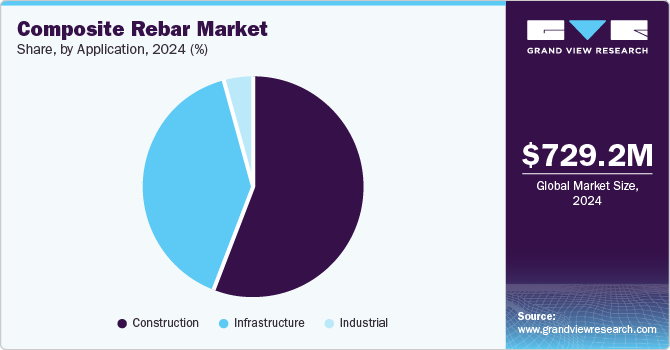

Application Insights

With rapid urbanization and the rising need for sustainable buildings, governments worldwide are investing heavily in high-rise residential building projects. This increased focus on construction projects requires materials that offer enhanced strength, durability, and resistance to environmental factors. Many green building certifications, such as LEED (Leadership in Energy and Environmental Design), promote sustainable materials. As construction projects strive for eco-friendly solutions and energy-efficient buildings, the adoption of composite rebar is becoming more widespread.

Infrastructure is anticipated to register the fastest CAGR over the forecast period. Many countries are increasing their investments in infrastructure projects, such as roads, highways, bridges, and urban transit systems. Composite rebar offers a long-term solution that reduces maintenance costs and improves the longevity of structures, making it an attractive option for public-private partnerships. Additionally, government regulations promoting durable materials and reducing maintenance costs encourage the wider adoption of composite rebar in large-scale infrastructure initiatives.

Regional Insights

Governments and private entities invest heavily in rebuilding and strengthening infrastructure, such as bridges, roads, and tunnels, requiring durable, long-lasting materials such as composite rebar. For instance, in October 2024, the U.S. Department of Transportation’s Federal Highway Administration (FHWA) allocated substantial funding for the repair and construction of bridges in coastal states like Florida and Louisiana, where composite rebar was extensively used to ensure longevity and reduce maintenance costs.

U.S. Composite Rebar Market Trends

The increasing demand for composite rebars in specialized industries, such as marine and offshore construction, proliferates the U.S. composite rebar industry. Traditional steel rebar tends to deteriorate rapidly when exposed to seawater, causing significant issues in marine structures like piers, seawalls, and docks. Composite rebars, with their high resistance to corrosion from saltwater, have become a preferred choice in these applications, offering extended lifespans and reducing maintenance costs.

Asia Pacific Composite Rebar Market Trends

Asia Pacific is the dominant region for the composite rebar industry with a revenue share of over 35.0% in 2024. The rapid urbanization and infrastructure development across emerging economies such as China, India, and Southeast Asian countries proliferate the composite rebar industry. Governments in these regions are investing heavily in construction projects, including bridges, highways, and residential complexes, to support economic growth and accommodate expanding populations.

Europe Composite Rebar Market Trends

Europe market held a significant share of the composite rebar industry in 2024. The European Union's focus is increasing sustainable construction practices and reducing the carbon footprint of the building and construction industry. With stringent environmental regulations aimed at achieving net-zero emissions by 2050, sustainable and durable materials have become a key priority.

Central & South America Composite Rebar Market Trends

Central & South America composite rebar industry is anticipated to grow significantly over the forecast period. The region's vulnerability to natural disasters, such as earthquakes, floods, and hurricanes, is another important factor driving the adoption of composite rebar. Several countries in Central and South America, particularly in the Pacific Ring of Fire and along coastal areas, are prone to seismic activity and extreme weather events. Traditional steel rebar can be susceptible to corrosion over time, especially in humid or saline environments, leading to structural weaknesses in buildings and infrastructure. Composite rebar, with its superior resistance to corrosion and excellent durability in challenging environments, offers a more reliable and long-lasting solution for reinforcing structures in disaster-prone areas.

Middle East & Africa Composite Rebar Market Trends

The Middle East’s harsh environmental conditions, especially the extreme temperatures and high humidity in coastal areas, create a high demand for materials that are durable and resistant to environmental degradation. Steel rebars used in reinforced concrete tend to corrode quickly in these conditions, leading to costly repairs and maintenance. Composite rebars, however, offer excellent resistance to corrosion, making them well-suited for infrastructure in coastal or humid regions.

Key Composite Rebar Company Insights

Some of the key players operating in the composite rebar market include Aslan FRP, Armastek, and others.

-

Aslan FRP’s offerings are designed to enhance the durability and performance of concrete structures while providing significant resistance to corrosion and other environmental factors. Their innovative composite rebar solutions improve the longevity of construction projects and contribute to more sustainable building practices by reducing maintenance costs associated with traditional steel reinforcement.

-

Armastek is a pioneering company specializing in developing and manufacturing glass fiber-reinforced polymer composite rebars, which are revolutionizing the construction industry. Their GFRP rebar offers numerous advantages over traditional steel reinforcement, including enhanced durability, corrosion resistance, and significantly lighter weight, up to 80% lighter than steel.

Key Composite Rebar Companies:

The following are the leading companies in the composite rebar market. These companies collectively hold the largest market share and dictate industry trends.

- Aslan FRP

- Armastek

- Nanjing Fenghui Composite

- Tribeni Fiber

- Hubei Yulong

- Fusite

- Fiberline

- Technobasalt

- Marshall Composite Technologies

- Sireg Geotech

Recent Developments

-

In November 2024, GFRP Tech, a glass fiber-reinforced polymer (GFRP) product manufacturer, launched a new manufacturing facility in Linbro Park, Gauteng, South Africa. This multi-million rand facility is the first in the region and will produce GFRP rebar, mesh, and bends, including the company's flagship EnviraBar and EnviraMesh products. The facility has undergone international testing and auditing by the FRP Institute in the U.S. and has already fulfilled its first order for a construction project in Bedfordview in September 2024.

Composite Rebar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 765.9 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Aslan FRP; Armastek; Nanjing Fenghui Composite; Tribeni Fiber; Hubei Yulong; Fusite; Fiberline; Technobasalt; Marshall Composite Technologies; Sireg Geotech; othersBottom of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composite Rebar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global composite rebar market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Glass Fiber Reinforced Polymer (GFRP)

-

Carbon Fiber Reinforced Polymer (CFRP)

-

Basalt Fiber Reinforced Polymer (BFRP)

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global composite rebar market size was estimated at USD 729.2 million in 2024 and is expected to reach USD 765.9 million in 2025.

b. The global composite rebar market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 1.01 billion by 2030.

b. The glass fiber reinforced polymer segment dominated the market with a revenue share of over 79.9% in 2024.

b. Some of the key vendors of the global composite rebar market are Aslan FRP; Armastek; Nanjing Fenghui Composite; Tribeni Fiber; Hubei Yulong; Fusite; Fiberline; Technobasalt; Marshall Composite Technologies; Sireg Geotech; among others.

b. The key factor that is driving the growth of the global composite rebar market is the growing demand for durable, corrosion-resistant materials in construction projects. Additionally, the increasing awareness of the benefits of composite rebar, such as its lightweight and cost-effective properties, further contributes to its market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.