- Home

- »

- Plastics, Polymers & Resins

- »

-

Compostable Plastics Market Size & Share Report, 2030GVR Report cover

![Compostable Plastics Market Size, Share & Trends Report]()

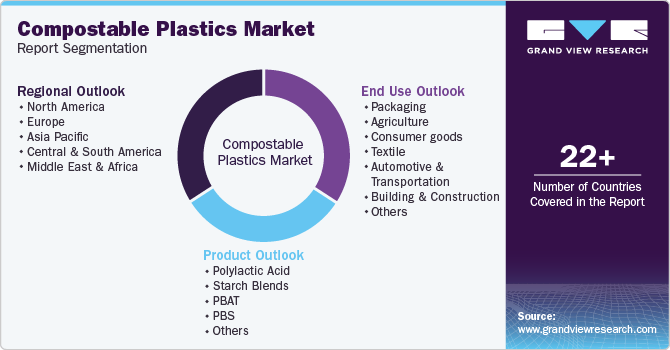

Compostable Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polylactic Acid, Starch Blends, PBAT, PBS), By End-use (Packaging, Agriculture, Consumer Goods, Textile, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-473-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Compostable Plastics Market Size & Trends

The global compostable plastics market size was estimated at USD 2,735.7 million in 2024 and expected to grow at a CAGR of 10.3% from 2025 to 2030. Rising non-degradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for compostable plastics to effectively manage plastic pollution.

The demand for compostable plastics is on the rise as industries shift towards sustainable alternatives to conventional plastics. In recent years, both consumers and corporations have prioritized eco-friendly solutions due to increased environmental awareness and stricter regulations. Packaging industries, particularly in food and beverages, are seeing rapid adoption of compostable plastics as companies aim to meet sustainability goals. Brands across sectors are focusing on reducing plastic waste, and compostable options are becoming a preferred choice in retail and hospitality. In addition, technological advancements are improving the quality and durability of these plastics, making them more viable for broader use.

Drivers, Opportunities & Restraints

Stringent regulations imposed by governments worldwide are a critical driver for the compostable plastics market. Countries around the world are implementing strict bans or limits on single-use plastics, creating a regulatory push towards biodegradable and compostable alternatives. For instance, the European Union’s ban on single-use plastics has significantly boosted demand for compostable materials in Europe. Similarly, policies in the U.S. and Asia promoting environmental sustainability and waste reduction are pushing industries to adopt compostable packaging solutions. The need to comply with these regulations is accelerating the shift towards compostable plastics in key sectors like retail, packaging, and foodservice.

The growing awareness and demand for sustainable products present a significant opportunity for manufacturers of compostable plastics to expand their market reach. As more brands and retailers embrace sustainability goals, there is increasing demand for eco-friendly packaging and materials. This creates room for innovation, especially in developing compostable plastics that are more durable, cost-effective, and compatible with various industrial applications. Furthermore, expanding into emerging markets like Asia and Latin America, where regulatory frameworks are evolving, offers vast growth potential for compostable plastics manufacturers. Companies that invest in research and development can capitalize on these opportunities to cater to a growing customer base seeking greener alternatives.

Despite its potential, the compostable plastics market faces challenges that could hinder its growth. One of the key restraints in the compostable plastics market is the high production cost compared to conventional plastics. The raw materials used in making compostable plastics, such as polylactic acid (PLA) and starch-based compounds, are often more expensive than petroleum-based plastics. In addition, the production processes for compostable materials are less established, making scalability more difficult and costly. This price disparity can limit widespread adoption, especially in cost-sensitive industries where margins are thin. Furthermore, the lack of adequate industrial composting facilities in many regions hinders the end-of-life processing of these plastics, reducing their overall environmental benefit.

Product Insights

Based on product, the starch blends segment led the market with a revenue share of 40.37% in 2023 owing to their cost-effectiveness and availability compared to other biodegradable materials. Starch, derived from renewable resources such as corn, potato, and tapioca, is abundant and relatively inexpensive, making it an attractive option for manufacturers looking to reduce costs while offering sustainable products. Starch blends are versatile and can be combined with other biodegradable polymers to enhance flexibility and durability, allowing them to be used in a wide range of applications, from packaging to agricultural films.

The polylactic acid (PLA) segment is expected to grow at a significant rate over the forecast period. The segment is driven by the compostable plastics market is its growing demand in the food packaging and disposable products sector. PLA is widely recognized for its biocompatibility and safety, making it an ideal material for food containers, cutlery, and packaging. The rising consumer preference for biodegradable alternatives to single-use plastics is accelerating the use of PLA in these applications.PLA is sourced from renewable resources such as corn and sugarcane, aligning with the global push for sustainability. Technological advancements in PLA production have also reduced costs and improved performance, making it a more viable alternative to traditional plastics.

End-use Insights

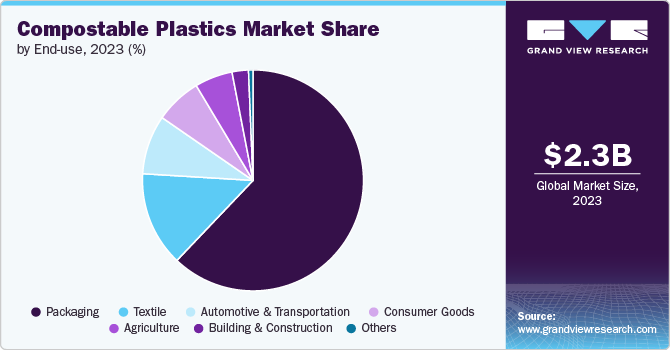

Based on end use, the packaging segment dominated the market with the largest revenue share of 62.10% in 2023, driven bythe increasing demand for sustainable and eco-friendly packaging solutions from both consumers and businesses. As awareness around environmental issues such as plastic pollution grows, companies across various sectors-especially in food, beverage, and retail-are adopting compostable packaging to meet sustainability goals and respond to consumer preferences for greener products. Governments worldwide are also imposing regulations and bans on traditional plastic packaging, further pushing businesses to switch to compostable alternatives. Compostable plastics offer a solution to reduce the environmental impact of packaging waste, particularly single-use items, while enhancing brand image by showcasing a commitment to sustainability.

The flame retardants segment is poised to grow at the fastest rate from 2024 to 2030. This can be attributed to the industry's growing focus on sustainability and reducing vehicle weight to enhance fuel efficiency. Automakers are increasingly looking for eco-friendly materials to replace conventional plastics in interior components like trims, panels, and seating. Compostable plastics, derived from renewable resources, offer a lower carbon footprint and contribute to the overall sustainability goals of the automotive industry.

Regional Insights

In North America, the compostable plastics market is primarily driven by the growing consumer demand for eco-friendly products and stringent environmental regulations aimed at reducing plastic pollution. Major corporations in industries such as retail, packaging, and food services are adopting compostable materials to align with sustainability goals and respond to consumer expectations. In addition, the region's strong research and development capabilities are fostering innovations in compostable plastic materials, improving their performance and broadening their use in various applications.

U.S. Compostable Plastics Market Trends

In the U.S., the compostable plastics market is being propelled by state-level regulations banning single-use plastics, such as California’s single-use plastic bans, which are prompting businesses to seek biodegradable alternatives. Retailers, restaurants, and food delivery services are increasingly turning to compostable packaging to comply with these regulations and cater to environmentally conscious consumers.

Europe Compostable Plastics Market Trends

Europe dominated the global compostable plastics market and accounted for largest revenue share of 43.57% in 2023, owing to the region's strict environmental policies, such as the European Union’s Single-Use Plastics Directive, which has led to a ban on certain plastic products and is encouraging the adoption of compostable alternatives. European consumers are highly eco-conscious, and there is increasing demand for sustainable packaging in sectors like food, beverage, and personal care. In addition, the circular economy initiatives across the EU are promoting the use of biodegradable and compostable materials, as these can be integrated into waste management systems to reduce landfill pressure. European companies are also increasingly investing in research to enhance the functionality and affordability of compostable plastics.

Germany, known for its leadership in environmental innovation, is driving the compostable plastics market through its strong regulatory framework and advanced recycling infrastructure. The country’s focus on reducing carbon emissions and minimizing plastic waste is pushing industries, especially in packaging and automotive sectors, to adopt compostable alternatives. Germany’s well-developed industrial composting facilities support the effective disposal of compostable plastics, making them a more viable option for businesses. Moreover, the German government's incentives for green technologies and sustainable materials are fostering the development and commercialization of new compostable plastic products, further stimulating market growth.

Asia Pacific Compostable Plastics Market Trends

In the Asia Pacific region, the rapid industrialization and urbanization, coupled with growing environmental awareness, are driving the demand for compostable plastics. Countries like China, India, and Japan are witnessing a shift towards sustainable practices, spurred by government initiatives aimed at reducing plastic waste and promoting biodegradable alternatives. In addition, the rise of e-commerce and food delivery services has increased the need for sustainable packaging, making compostable plastics a key solution.

Key Compostable Plastics Company Insights

The compostable plastics market is highly competitive, with several key players dominating the landscape. Major companies include Total Corbion, NatureWorks, BASF, Evonik Industries AG, Sulzer Ltd, Vizag chemical, Mitsubishi Chemical Corporation, Entec Polymers, Fujian Greenjoy Biomaterial Co., Ltd., and Orinko Advanced Plastics Co., Ltd. The compostable plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Compostable Plastics Companies:

The following are the leading companies in the compostable plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Total Corbion

- NatureWorks

- BASF

- Evonik Industries AG

- Sulzer Ltd

- Vizag chemical

- Mitsubishi Chemical Corporation

- Entec Polymers

- Fujian Greenjoy Biomaterial Co., Ltd.

- Orinko Advanced Plastics Co., Ltd.

Recent Developments

-

In April 2024, The Indian Ministry of Environment, Forest and Climate Change (MOEFCC) announced the publication of the Plastic Waste Management (Amendment) Rules, 2024, which revise the existing regulations from 2016. This update aims to enhance the management of plastic waste by expanding the Extended Producer Responsibility (EPR) framework to include more stakeholders involved in plastic production and waste processing.

-

In May 2024, SKC announced plans to build the world's largest biodegradable plastic plant in Hai Phong, Vietnam, with construction expected to start in the first half of 2024. This facility will focus on producing Polybutylene Adipate Terephthalate (PBAT) with an annual capacity of 70,000 tons. Hai Phong is strategically chosen due to its strong logistics and renewable energy infrastructure, aligning with environmental sustainability goals.

Compostable Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,131.1 million

Revenue forecast in 2030

USD 5,119.8 million

Growth rate

CAGR of 10.3% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Total Corbion, NatureWorks, BASF, Evonik Industries AG, Sulzer Ltd, Vizag chemical, Mitsubishi Chemical Corporation, Entec Polymers, Fujian Greenjoy Biomaterial Co., Ltd., Orinko Advanced Plastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compostable Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented compostable plastics market report on the basis of product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Consumer goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global compostable plastics market size was estimated at USD 2.34 billion in 2023 and is expected to reach USD 3.13 billion in 2024.

b. The global compostable plastics market is expected to grow at a compound annual growth rate of 11.01% from 2023 to 2030 to reach USD 5.12 billion by 2030.

b. Europe dominated the global compostable plastics market and accounted for largest revenue share of 43.57% in 2023, owing to the region's strict environmental policies, such as the European Union’s Single-Use Plastics Directive, which has led to a ban on certain plastic products and is encouraging the adoption of compostable alternatives.

b. Some key players operating in the compostable plastics market include Total Corbion, NatureWorks, BASF, Evonik Industries AG, Sulzer Ltd, Vizag chemical, Mitsubishi Chemical Corporation, Entec Polymers, Fujian Greenjoy Biomaterial Co., Ltd., and Orinko Advanced Plastics Co., Ltd.

b. Rising non-degradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for compostable plastics to effectively manage plastic pollution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.