- Home

- »

- Medical Devices

- »

-

Compounding Pharmacies Market Size & Share Report, 2030GVR Report cover

![Compounding Pharmacies Market Size, Share & Trends Report]()

Compounding Pharmacies Market (2024 - 2030) Size, Share & Trends Analysis Report By Therapeutic Area (Specialty Drugs, Dermatology), By Age Cohort (Pediatric, Adult), By Compounding Type (PIA, PDA), By Sterility, And Segment Forecasts

- Report ID: GVR-4-68040-107-5

- Number of Report Pages: 168

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2021 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Compounding Pharmacies Market Summary

The global compounding pharmacies market size was estimated at USD 13.1 billion in 2023 and is expected to reach USD 18.6 billion by 2030, growing at a CAGR of 5.11% from 2024 to 2030. The increasing importance of compounding for enhancing medication adherence is one of the major factors driving the market's growth.

Key Market Trends & Insights

- North America accounted for the largest share of 43.56% in 2022.

- By therapeutic areas, the pain management segment dominated the market with the largest revenue share of 33.1% in 2022.

- By age cohort, the adult segment dominated the market with the largest revenue share of 44.1% in 2022.

- By sterility, the sterility segment dominated the market with the largest share of 58.52% in 2022.

- By compounding type, the PIA segment dominated the market with the largest market of 37.38% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 13.1 Billion

- 2030 Projected Market Size: USD 18.6 Billion

- CAGR (2024-2030): 5.11%

- North America: Largest market in 2022

Medication adherence can be challenging for patients due to various factors, such as swallowing issues, taste preferences, or allergies, to certain ingredients in commercially available medications. Compounding pharmacies specialize in creating personalized medications tailored to individual patient needs, addressing barriers to adherence by providing customized dosage forms, flavors, and allergen-free formulations, to enhance patient acceptance and compliance, ultimately driving demand for their services.Moreover, the increasing demand for personalized medicine is contributing to the growth of the market. Personalized medicine aims to increase the safety and effectiveness of medications by tailoring them to each patient's unique needs. Patients with specific needs, such as allergies and intolerance to certain substances, medication for rare/orphan diseases, and others, require compounded medications tailored to their specific conditions. In addition, compounded pharmacies are used to provide access to some discontinued medications, mainly due to commercial reasons. For instance, the U.S. FDA lists around 206 discontinued medications, including budesonide and ursodiol capsules, which compounded medications can easily substitute.

Moreover, the shortage of commercial medications, especially for chronic conditions, has resulted in increased demand for compounded medications, contributing to the growth of the market. According to the Medicine Shortage Survey 2022 conducted by the Pharmaceutical Group of the European Union (PGEU), 29 member countries out of 29 survey countries in Europe reported medication shortages among the community pharmacists in the region. The majority of the shortage of medication was reported for cardiovascular medications. Pharmaceutical compounding is often considered the solution to address the medication shortage and cover the gaps due to shortage.

The COVID-19 pandemic negatively impacted the market initially in 2020. This shortage was due to supply chain disruption, delays & discontinuation in the manufacturing processes, quality issues, and difficulties in purchasing raw materials. However, the market recovered in 2021 and exhibited steady growth. In 2021, the demand for compounded medications increased owing to the increased demand for certain COVID-19 treatments and diminished manufacturing capacity due to the scarcity of commercially accessible drugs. Furthermore, due to the shortage of drugs required for treatments, the FDA issued a policy for state-licensed pharmacies and federal facilities, which are not registered with the FDA as outsourcing facilities for compounding medication for patients for the public health emergency duration.

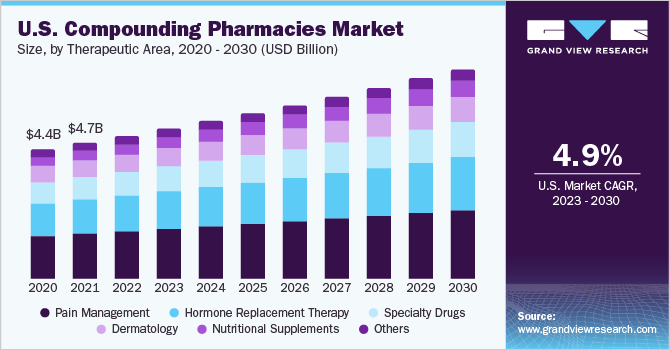

Therapeutic Area Insights

Based on the therapeutic areas, the market is divided into hormone replacement therapy, pain management, specialty drugs, dermatology, and nutritional supplements. The pain management segment dominated the market with the largest revenue share of 33.1% in 2022. The high share of the segment can be attributed to the growing prevalence of chronic pain and side effects associated with commercially available pain management medications. The compounded pain management medications have several benefits, including bypassing the Gastrointestinal (GI) system for patients experiencing GI side effects and combining multiple medications in a single dose.

The nutritional supplements segment is anticipated to witness the fastest growth rate over the forecast period. This can be attributed to the growing demand for personalized beauty and anti-aging products. Hence, to cater to this demand, many companies are offering a range of compounded nutraceutical products. For instance, Medisca Inc. offers more than 100 high-quality compounded nutraceutical products, which are tested for heavy metals, including prenatal multivitamins, minerals, antioxidants, and many other supplements. The hormone replacement therapy segment held a significant market share in 2022.

Hormone replacement therapy often requires personalized formulations to meet each patient's unique needs. Compounding pharmacies specialize in creating customized hormone medications tailored to specific patient preferences and hormone levels. According to a study published by the National Center for Biotechnology Information, in December 2022, hormone replacement treatment prescriptions increased by 13.64% each year, from 5.01 per 1000 person-years-at-risk (PYAR) in 2010 to 18.16 per 1000 PYAR in 2021.

Age Cohort Insights

Based on the age cohort, the market is divided into adult, pediatric, and geriatric. The adult segment dominated the market with the largest revenue share of 44.1% in 2022. Adult patients may require personalized medication due to the factors, such as sensitivities to certain ingredients and specific dosage strengths. These demands can be met by compounding pharmacies that can address these needs by creating tailored medications in the form of creams, capsules, or gels. The pediatric segment is expected to witness the fastest growth rate over the forecast period. Children often require customized medications due to their smaller size, preferred tastes, limited dosage options, and difficulties swallowing solid dosage forms.

These customized medications improve medication adherence and make it simpler for children to take their prescribed medications. Hence, many companies are launching personalized compounded medications for these age groups. For instance, in March 2021, Children's Hospital Colorado, in partnership with STAQ Pharma, launched a product line of compounded medications designed for pediatric patients. Geriatric patients may require medication formulation with adjusted dosages, specialized delivery forms, or combinations of multiple medications in a single formulation for ease of administration. Compounding pharmacies can prepare personalized medications that are suitable for geriatric patients.

Sterility Insights

Based on sterility, the market is segmented into sterile and non-sterile. The sterility segment dominated the market with the largest share of 58.52% in 2022. It is expected to expand further at the fastest growth rate over the forecast period. The growth of the segment can be attributed to the rising demand for sterile-compounded medications in various healthcare settings. Furthermore, the rising complexity of patient needs and advancements in medical treatments may also contribute to the growth of the segment.

For instance, in October 2019, The National Association of Boards of Pharmacy stated that it had received funding from the FDA to build a data-sharing system for better control of sterile compounding pharmacies. The non-sterility segment can address therapeutic gaps where commercially available medications may not meet specific patient needs. Compounded medications in non-sterile forms can be specially formulated to accommodate allergies, sensitivities, or unique patient requirements not met by mass-produced drugs. The flexibility and versatility of non-sterile compounding also play a major role in driving the market’s growth.

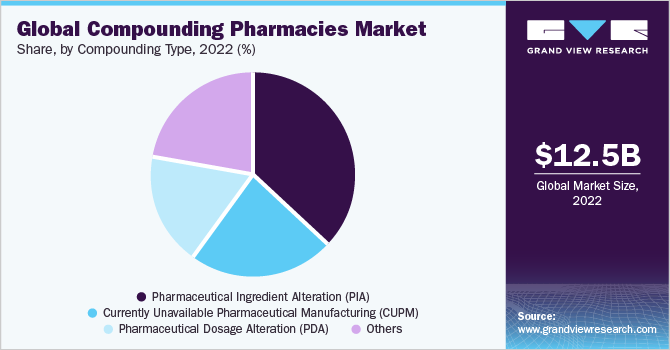

Compounding Type Insights

Based on the compounding types, the market is segmented into pharmaceutical Dosage Alteration (PDA), Pharmaceutical Ingredient Alteration (PIA), Currently Unavailable Pharmaceutical Manufacturing (CUPM), and others. The PIA segment dominated the market with the largest market of 37.38% in 2022 and is expected to witness the fastest growth rate over the forecast period. A significant demand for compounded medications involves modifying or altering pharmaceutical ingredients to meet specific patient needs.

PIA involves altering the composition or concentration of active ingredients in medications, often to customize them for individual patients. The PDA segment dominated the market with the largest market share. PDA is an essential aspect of compounding pharmacies; the dominance of a specific segment within the market may change depending on factors, such as regional preferences, patient demands, and market dynamics.

Regional Insights

North America accounted for the largest share of 43.56% in 2022. The presence of several compounding pharmacies and the shortage of certain medications are driving the regional market growth. According to the statistics published by the American Pharmacists Association, in October 2021, over 56,000 community pharmacies were operating in the U.S., with 7,500 offering advanced compounding services. The market in the Asia Pacific region is expected to witness the fastest growth rate over the forecast period.

The increasing demand for personalized medications, rising prevalence of chronic diseases, expansion of healthcare infrastructure, and increasing awareness about and demand for alternative therapies are the key factors driving the market growth. Europe held a significant market share in 2022. The aging population and advancements in medical treatments are contributing to the growth of the market in Europe. In addition, regulatory frameworks and guidelines, such as those set by the European Directorate for the Quality of Medicines (EDQM), aid in ensuring the safety, quality, and standardization of compounded medications, further supporting the growth of the industry.

Key Companies & Market Share Insights

The market is highly fragmented due to the presence of many independent pharmacies operating in different regions. The industry participants are focusing on development and innovation while implementing strategic business moves to sustain the competition. For instance, in Feb 2023, Harrow, a prominent eye care pharmaceutical firm in the U.S., announced the availability of its patent-pending, next-generation compounded Atropine formulations through ImprimisRx. Moreover, in July 2022, Fagron acquired a 503B outsourcing facility in Boston from Fresenius Kabi. Fagron has increased its sterile compounding footprint in the U.S. Some of the prominent players in the global compounding pharmacies market include:

-

Walgreen Co.

-

JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy)

-

Fagron

-

Albertsons Companies

-

The London Specialist Pharmacy Ltd (Specialist Pharmacy)

-

Galenic Laboratories Limited (Roseway Labs)

-

Aurora Compounding

-

MEDS Pharmacy

-

Apollo Clinical Pharmacy

-

Formul8

-

Fusion Apothecary

Compounding Pharmacies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.7 billion

Revenue Forecast in 2030

USD 18.6 billion

Growth rate

CAGR of 5.11% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Therapeutic area, age cohort, compounding type, sterility, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Walgreens Co; JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy); Fagron; Albertsons Companies; The London Specialist Pharmacy Ltd. (Specialist Pharmacy); Galenic Laboratories Ltd. (Roseway Labs); Aurora Compounding MEDS Pharmacy; Apollo Clinical Pharmacy; Formul8; Fusion Apothecary

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compounding Pharmacies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the compounding pharmacies market report on the basis of therapeutic area, age cohort, compounding type, sterility, and region:

-

Compounding Pharmacies Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormone Replacement Therapy

-

Pain Management

-

Specialty Drugs

-

Dermatology

-

Nutritional Supplements

-

Others

-

-

Compounding Pharmacies Age Cohort Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Compounding Pharmacies Compounding Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Ingredient Alteration (PIA)

-

Currently Unavailable Pharmaceutical Manufacturing (CUPM)

-

Pharmaceutical Dosage Alteration (PDA)

-

Others

-

-

Compounding Pharmacies Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non-sterile

-

-

Compounding Pharmacies Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global compounding pharmacies market size was estimated at USD 12.5 billion in 2022 and is expected to reach USD 13.1 billion in 2023.

b. The global compounding pharmacies market is expected to grow at a compound annual growth rate of 5.11% from 2023 to 2030 to reach USD 18.6 billion by 2030.

b. The pain management segment dominated the compounding pharmacies market with a share of 33.1% in 2022, owing to the growing prevalence of chronic pain and side effects associated with commercially available pain management medications.

b. Some key players operating in the compounding pharmacies market include Walgreens Co, JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy), Fagron; Albertsons Companies, The London Specialist Pharmacy Ltd (Specialist Pharmacy), Galenic Laboratories Limited (Roseway Labs), Aurora Compounding MEDS Pharmacy, Apollo Clinical Pharmacy, Formul8, Fusion Apothecary

b. Key factors that are driving the compounding pharmacies market growth include increasing supportive government policies, increasing demand for personalized medications, and the growing importance of pharmaceutical compounding in promoting medication adherence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.