- Home

- »

- Advanced Interior Materials

- »

-

Conductive Textiles Market Size, Share, Industry Report, 2033GVR Report cover

![Conductive Textiles Market Size, Share & Trends Report]()

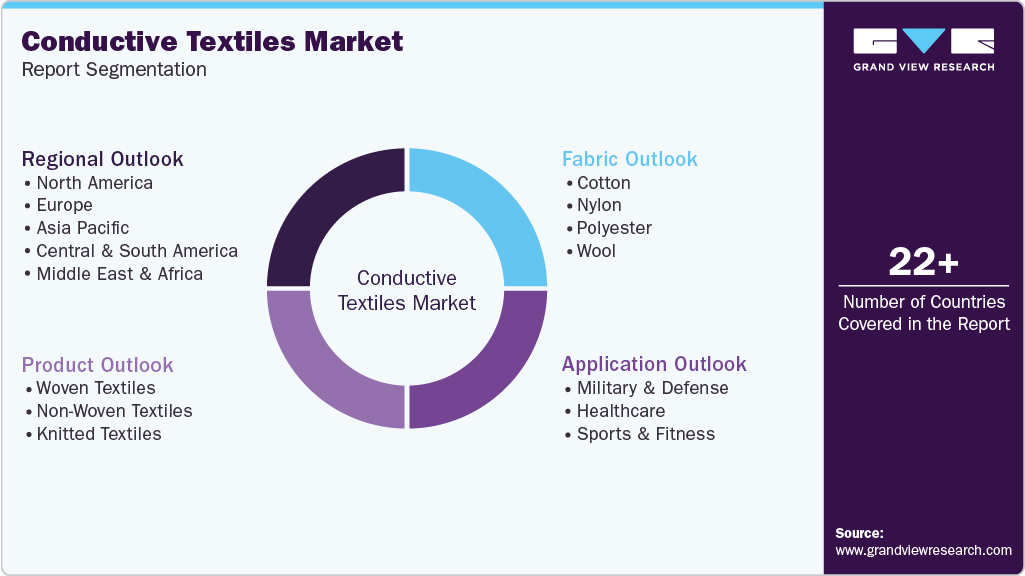

Conductive Textiles Market (2025 - 2033) Size, Share & Trends Analysis Report By Fabric (Cotton, Nylon, Polyester, Wool), By Product (Woven Textiles, Non-Woven Textiles, Knitted Textiles), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-874-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Conductive Textiles Market Summary

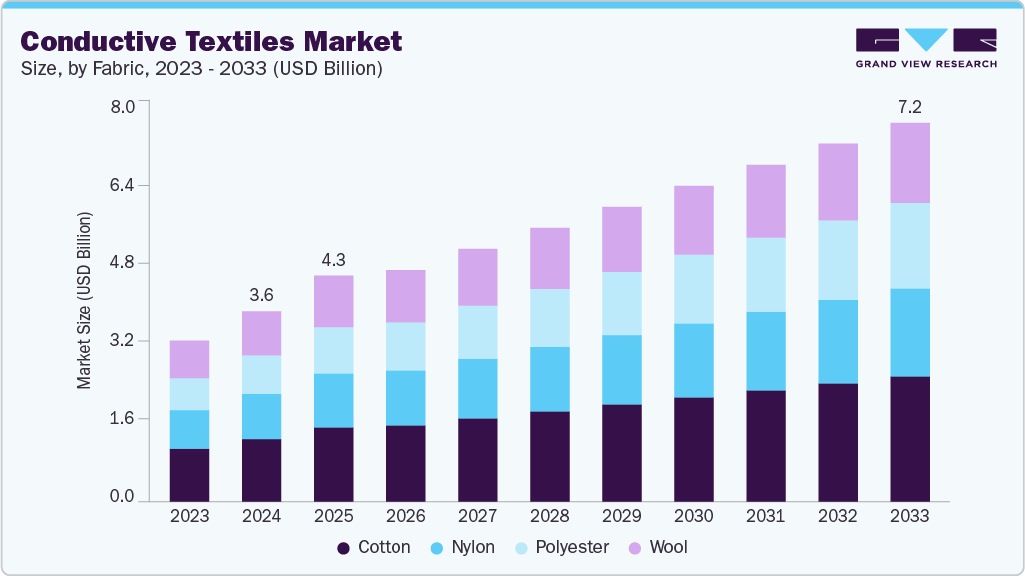

The global conductive textiles market size was estimated at USD 3.61 billion in 2024 and is projected to reach USD 7.20 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The market growth is attributed to the growing adoption of wearable electronics, smart clothing, and textile-based sensors across healthcare, military, and sports industries.

Key Market Trends & Insights

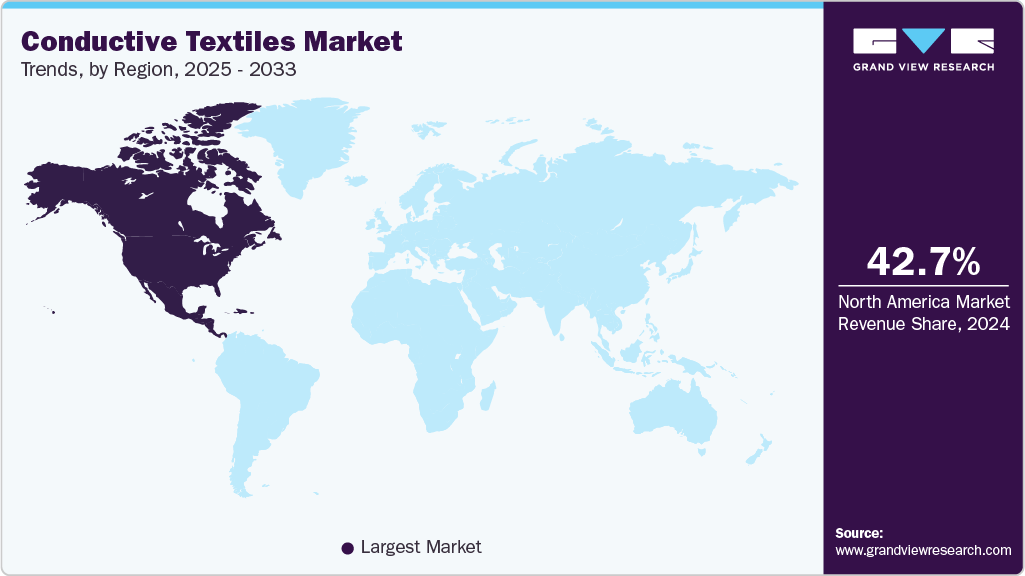

- North America dominated the conductive textiles market with the largest revenue share of 42.7% in 2024.

- By fabric, the nylon segment is expected to grow at the fastest CAGR of 11.3% over the forecast period.

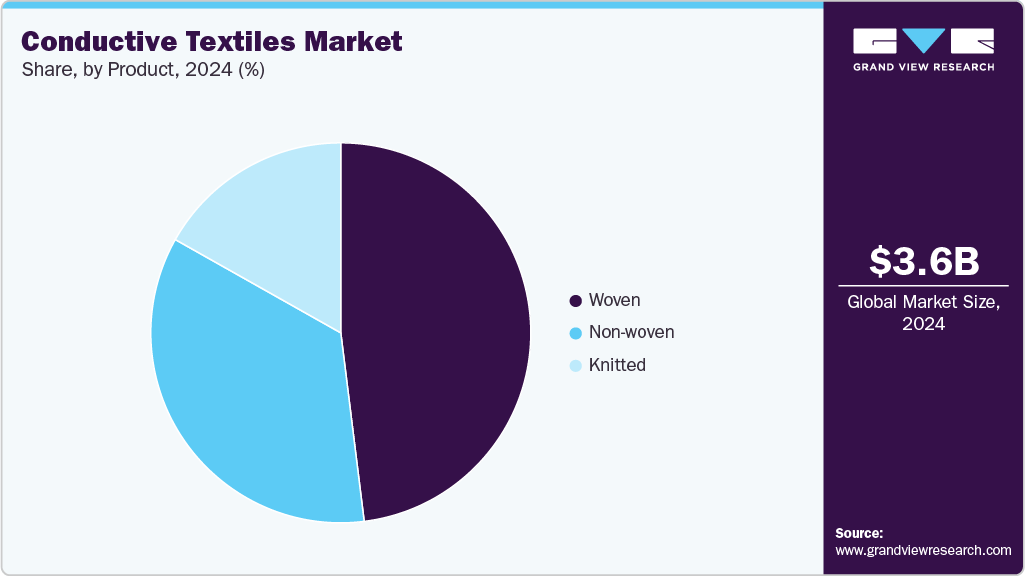

- By product, the woven segment is expected to grow at the fastest CAGR of 7.2% over the forecast period.

- By application, the sports & fitness segment is expected to grow at the fastest CAGR of 7.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.61 Billion

- 2033 Projected Market Size: USD 7.20 Billion

- CAGR (2025-2033): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are increasingly inclined toward garments that monitor health parameters or enhance connectivity. As industries seek more seamless integration of electronics into everyday objects, textiles embedded with conductive elements offer the ideal lightweight and flexible solution. Moreover, the growing interest in smart fashion and tech-enabled apparel is further fueling this demand. Military applications such as surveillance uniforms and energy-harvesting gear also contribute to market growth. Rising awareness about personal wellness and fitness further encourages adoption.

One of the major drivers is the rapid advancement in materials science and nanotechnology that allows the integration of conductive properties into flexible fabrics without compromising comfort. The healthcare sector is adopting smart garments for continuous monitoring of vital signs, while the military leverages them for communication, camouflage, and health tracking. Sports and fitness industries also drive demand through smart performance gear and activity monitoring wearables. Another key driver is the consumer electronics industry's pursuit of miniaturized, wearable technology. R&D investments also support the demand focused on improving conductivity, washability, and fabric durability. Similarly, corporate interest in smart uniforms and IoT-connected apparel further bolsters growth.

Ongoing innovations include the development of stretchable conductive yarns, graphene infused fibers, and e-textiles embedded with wireless communication modules. Printed electronics using conductive inks are enabling cost-effective production at scale. Companies are introducing washable conductive fabrics, a major advancement for commercial viability. Research is ongoing into biodegradable conductive materials to enhance sustainability. Trends also show a convergence of fashion and tech, with apparel brands collaborating with tech firms for product innovation. Energy-harvesting textiles and garments with embedded sensors for temperature, ECG, and posture tracking are gaining traction. Modular and reconfigurable designs are emerging for easy customization and multiple use cases.

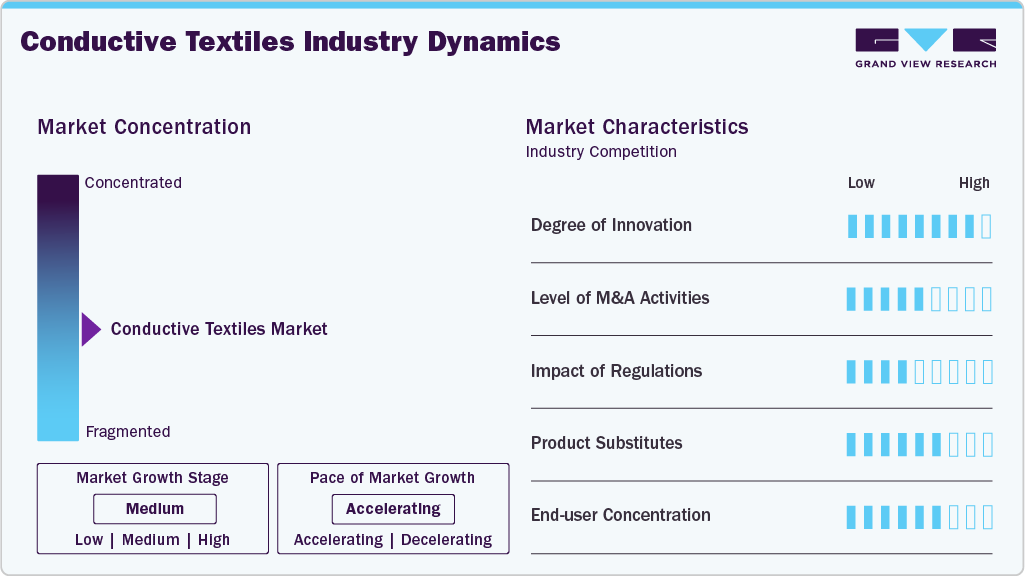

Market Concentration & Characteristics

The conductive textiles market is moderately fragmented, with a mix of established players and startups competing across various segments such as healthcare wearables, defense fabrics, and sportswear. Leading firms control core patents and manufacturing technologies, while smaller firms focus on innovation in materials and coatings. The market is witnessing some consolidation, but innovation-driven entrants continue to keep competition active. Strategic partnerships among textile companies, electronics firms, and research institutions are common to maintain competitiveness. Regional players also cater to localized demand, adding to the market’s fragmented nature.

Substitutes include traditional non-conductive fabrics paired with wearable devices such as smartwatches or chest straps, which serve similar monitoring purposes without requiring the fabric itself to be functional. However, these alternatives often lack comfort, seamlessness, and aesthetic integration. Rigid electronics still dominate in many use cases but are gradually losing favor in favor of flexible, textile-integrated solutions. The threat from substitutes remains moderate, especially in applications where user comfort, integration, and discretion are priorities.

Fabric Insights

Nylon segment held the largest revenue market share of 47.1% in 2024, due to its exceptional strength, elasticity, and chemical resistance. It offers a favorable surface for metal coatings or conductive polymer treatments, ensuring consistent conductivity and durability. Its flexibility makes it ideal for applications requiring repeated motion and stretching, such as in military wearables, sports gear, and electronic garments. Nylon-based conductive fabrics also exhibit strong washability and abrasion resistance, which are critical for long-term wearable usage. The material’s compatibility with various conductive agents such as silver or carbon further enhances its utility. Moreover, its widespread availability and mature processing infrastructure support cost-effective mass production. These advantages make nylon the preferred base material for high-performance conductive textiles.

Polyester segment is expected to grow at a significant CAGR of 11.2% over the forecast period, due to its cost-efficiency, excellent durability, and adaptability for functional coatings. Its increasing use in consumer electronics, smart fashion, and healthcare garments is fueling demand, particularly in wearable sensors and ECG monitoring fabrics. Polyester blends well with conductive inks and metal coatings, making it suitable for large-scale production of printed circuits and flexible sensors. Advancements in vapor deposition and screen-printing techniques have improved polyester's conductivity while preserving fabric integrity. Furthermore, its recyclability and compatibility with sustainable manufacturing practices are making it attractive amid rising environmental concerns. As a result, polyester is rapidly gaining traction as a viable alternative to traditional conductive substrates.

Product Insights

Woven Textiles segment held the largest revenue market share of 48.0% in 2024. This growth is attributed to the superior structural integrity, dimensional stability, and durability of woven textile. The tightly interlaced fiber structure allows for uniform distribution of conductive elements like metallic yarns or coatings, ensuring consistent electrical performance. These fabrics are widely used in military uniforms, industrial workwear, and EMI shielding applications where strength and repeated wear are essential. Woven textiles offer better abrasion resistance and longevity compared to other forms, making them ideal for harsh environments. Their ability to maintain conductivity even under mechanical stress has made them a reliable choice in high-performance applications. Additionally, woven fabrics support customization in terms of thread orientation and density, which enhances functionality for specific end-uses.

Non-woven segment is expected to grow at the fastest CAGR of 6.5% over the forecast period, primarily due to its lightweight nature, low production cost, and high adaptability to coating techniques. Non-woven fabrics offer a large surface area for the deposition of conductive inks, polymers, or nanomaterials, making them ideal for disposable medical wearables, sensor patches, and flexible circuits. These materials are increasingly used in smart hygiene products and single-use health monitoring devices, where comfort and cost-effectiveness are prioritized. Moreover, advancements in electrospinning and melt-blown techniques are enabling better integration of conductive agents. As demand rises for soft, flexible, and affordable smart textiles in healthcare and consumer electronics, non-woven conductive fabrics are gaining strong momentum in the market.

Application Insights

Military & Defense segment held the largest revenue market share of 32.9% in 2024, primarily due to its critical need for advanced wearable technologies that enhance situational awareness, communication, and soldier health monitoring. Conductive fabrics are integrated into uniforms and gear for real-time data transmission, biometric sensing, and electromagnetic interference (EMI) shielding. Governments across the globe are investing heavily in smart textiles for battlefield applications, such as self-regulating clothing, heated apparel, and fabric-based communication systems. The reliability, durability, and multi-functionality of conductive textiles make them well-suited for rugged military environments. Additionally, collaborations between defense agencies and tech firms are accelerating innovation and deployment in this segment, solidifying its leading position.

Sports & Fitness segment is expected to grow at the fastest CAGR of 7.9% over the forecast period, driven by increasing consumer demand for smart apparel that monitors performance, posture, heart rate, and hydration levels. Athletes and fitness enthusiasts are adopting wearable textiles integrated with sensors for real-time feedback and injury prevention. The rise of health-conscious lifestyles and wearable technology has led to a surge in smart fitness gear, from shirts and leggings to socks and headbands. Innovations in flexible electronics and washable conductive fibers are making these garments more practical and durable. As sports brands collaborate with tech companies to develop advanced, data-driven clothing, this segment is expected to witness exponential growth in the coming years.

Regional Insights

North America conductive textiles market dominated the global market and accounted for the largest revenue share of 42.7% in 2024. North America demonstrates consistent demand for conductive textiles across healthcare, defense, and sports apparel. The U.S. leads in R&D, with several universities and companies pioneering advanced materials, smart garments, and bio-monitoring textiles. Government contracts from defense agencies like DARPA and the U.S. Army support the development of intelligent uniforms. The growing health-conscious consumer base is driving interest in smart fitness wearables. Tech startups are partnering with fashion and medical brands to produce commercial products. Canada also shows increasing adoption in military and rehabilitation sectors. Overall, innovation and policy support drive strong market performance in the region.

U.S. Conductive Textiles Market Trends

In the U.S., the conductive textiles market is supported by technological advancements and public-sector funding. The military remains a key end user, demanding wearable tech for communication, monitoring, and camouflage. Healthcare providers are adopting smart garments for chronic illness management and elderly care. Consumer brands are increasingly offering smart fitness clothing integrated with biometric sensors. Leading research institutions work closely with private firms to commercialize innovations. Additionally, sustainability and user comfort remain focal points in product design. U.S.-based companies are setting global benchmarks for product functionality and safety.

Europe Conductive Textiles Market Trends

Europe demonstrates consistent demand for conductive textiles due to its robust focus on innovation, quality, and sustainability. Strong R&D capabilities, especially in countries such as Germany, France, and the Netherlands, have enabled early adoption and development of advanced smart fabrics. The region benefits from stringent EU regulations that push companies to create safe, eco-friendly, and durable solutions. Demand from healthcare, automotive interiors, and professional sportswear is particularly high. European firms are actively integrating conductive textiles into medical wearables and vehicle seat fabrics. Universities and public-private partnerships foster innovation and commercial scalability. This solid infrastructure and customer focus position Europe as the market leader.

Germany conductive textiles market plays a vital role in European market, thanks to its deep-rooted industrial and engineering expertise. It focuses on smart applications in automotive interiors, medical monitoring, and technical workwear. German companies emphasize quality, long-term durability, and regulatory compliance in product development. Government funding supports numerous textile-tech innovation centers across the country. Collaborations between universities, automotive OEMs, and fabric producers drive continuous improvement. With a strong emphasis on sustainable materials and precise production techniques, Germany is at the forefront of European smart textile innovation. Its role is pivotal in maintaining Europe’s market leadership.

Asia Pacific Conductive Textiles Market Trends

Asia Pacific region is witnessing fast growth due to increasing demand from South Korea, Japan, and India. South Korea is investing heavily in integrating smart fabrics into healthcare and defense, while Japan focuses on robotics-enabled wearables and elderly care garments. India is exploring smart school uniforms and medical clothing through public-private projects. Textile manufacturing ecosystems in Vietnam, Bangladesh, and Thailand are also beginning to incorporate conductive elements. Regional investments in digital health and flexible electronics are boosting production. Collaborations between startups and traditional fabric manufacturers are increasing. The region is positioning itself as a significant innovation and manufacturing base.

Conductive textiles market in China has emerged as a crucial manufacturing hub for conductive textiles, leveraging its well-established textile industry and cost advantages. Companies are increasingly producing graphene and silver-infused yarns, with support from government-led innovation parks. Domestic applications in military gear, healthcare, and consumer electronics are growing steadily. Smart garment prototypes and industrial wearables are also seeing rising deployment. China’s export-driven model helps spread its products to Europe, North America, and Southeast Asia. Universities and tech companies are partnering to develop washable and flexible e-textiles. Government-backed programs are further fueling innovation in this sector.

Central & South America Conductive Textiles Market Trends

Central & South America is in the early stages of adopting conductive textiles, with Brazil and Mexico showing the highest potential. Healthcare and sportswear are the primary sectors that are experimenting with smart fabrics. Local startups and universities are initiating pilot projects for patient monitoring and athlete performance. However, high production costs and limited technological infrastructure slow adoption. Most products are imported, but regional governments are showing interest in wearable health solutions. Some textile companies are beginning to collaborate with international firms to localize manufacturing. The market is expected to grow gradually as awareness and investment increase.

Middle East & Africa Conductive Textiles Market Trends

The Middle East & Africa region is gradually entering the conductive textiles space, largely driven by growing interest in smart city infrastructure and digital healthcare. Defense and medical sectors are exploring fabric-based wearables for real-time monitoring and communication. Climatic challenges in the region drive demand for lightweight, breathable, and heat-sensitive smart garments. However, the lack of local production capacity limits rapid scaling. Most conductive textile products are imported from Europe and Asia. Some Gulf countries are investing in R&D hubs and innovation programs to reduce dependency. With increased awareness, the market is expected to see steady growth.

Key Conductive Textiles Company Insights

Some of the key players operating in the market include Toray Industries, Inc., Parker Hannifin Corporation

-

Toray is a leading Japanese materials company known for its advanced fibers and functional textiles. In the conductive textiles space, it offers high-performance fabrics used in wearable electronics, medical sensors, and automotive interiors. Toray focuses on combining durability, flexibility, and conductivity through innovations in polymer science and nanomaterials.

-

Based in the U.S., Parker Hannifin specializes in motion and control technologies, including conductive fabrics for EMI shielding and military wearables. Through its Chomerics division, the company produces metallized fabrics that are widely used in aerospace, defense, and industrial applications where durability and signal protection are critical.

Seiren Co., Ltd. and Bekaert are some of the emerging market participants in the conductive textiles market.

-

Seiren is a Japanese textile manufacturer recognized for its smart fabric innovations. It develops conductive textiles for applications in healthcare, automotive seats, and smart clothing. Known for combining design aesthetics with functional coatings, Seiren emphasizes stretchability and comfort alongside electrical performance.

-

Headquartered in Belgium, Bekaert is a global leader in metallic fiber production and a major supplier of conductive yarns and fabrics. Its Bekinox stainless steel fibers are widely used in anti-static clothing, EMI shielding, and smart textiles. The company serves multiple sectors, including defense, medical, and technical apparel.

Key Conductive Textiles Companies:

The following are the leading companies in the conductive textiles market. These companies collectively hold the largest market share and dictate industry trends.

- Toray Industries, Inc.

- 3M Company

- Seiren Co., Ltd.

- Bekaert

- Laird PLC

- Eeonyx Corporation

- Parker Hannifin Corporation

- Swift Textile Metalizing LLC

- Holland Shielding Systems B.V.

- Shieldex

Recent Developments

-

In June 2025, Parker Hannifin Corporation announced the all-cash purchase of Curtis Instruments for $1 billion, boosting its electrification portfolio, including potential enhancements for conductive fabrics in EV and industrial applications.

-

In January 2025, Toray Industries announced plans to commercialize its proprietary multifunctional coating agent - a water-dispersed solution for textiles and nonwovens that eliminates SARS‑CoV‑2 up to 100 times faster than conventional agents. The coating offers broad-spectrum hygiene protection, with full-scale production scheduled for fiscal year 2026.

Conductive Textiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.30 billion

Revenue forecast in 2033

USD 7.20 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fabric, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Brazil

Key companies profiled

Toray Industries, Inc.; 3M Company; Seiren Co., Ltd.; Bekaert; Laird PLC; Eeonyx Corporation; Parker Hannifin Corporation; Swift Textile Metalizing LLC; Holland Shielding Systems B.V.; Shieldex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conductive Textiles Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the conductive textiles market based on fabric, product, application, and region:

-

Fabric Outlook (Revenue, USD Million, 2021 - 2033)

-

Cotton

-

Nylon

-

Polyester

-

Wool

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Woven Textiles

-

Non-Woven Textiles

-

Knitted Textiles

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military & Defense

-

Healthcare

-

Sports & Fitness

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global conductive textiles market size was estimated at USD 3.61 billion in 2024 and is expected to reach USD 4.30 billion in 2025.

b. The global conductive textiles market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 7.20 billion by 2033.

b. Nylon segment held the highest revenue market share of 47.1% in 2024, due to its exceptional strength, elasticity, and chemical resistance. It offers a favorable surface for metal coatings or conductive polymer treatments, ensuring consistent conductivity and durability.

b. Some of the key players operating in the conductive textiles market include Toray Industries, Inc., 3M Company, Seiren Co., Ltd., Bekaert, Laird PLC, Eeonyx Corporation, Parker Hannifin Corporation, Swift Textile Metalizing LLC, Holland Shielding Systems B.V., and Shieldex

b. Key factors driving the conductive textiles market include rising demand for wearable electronics, smart textiles, and advancements in flexible electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.