- Home

- »

- Healthcare IT

- »

-

Connected Health And Wellness Solutions Market Report 2030GVR Report cover

![Connected Health And Wellness Solutions Market Size, Share & Trends Report]()

Connected Health And Wellness Solutions Market Size, Share & Trends Analysis Report By Product (Personal Medical Devices, Wellness Products), By Function (Clinical Monitoring, Telehealth), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-998-2

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global connected health and wellness solutions market size was estimated to be USD 54.15 billion in 2023 and is projected to grow at a CAGR of 20.3% from 2024 to 2030. Several factors are driving the growth of the market. These include the increasing prevalence of chronic diseases, the rise in healthcare costs, and the growing adoption of wearable devices & mobile apps for health monitoring. For instance, in March 2023, Royal Philips unveiled Philips Virtual Care Management, offering a wide range of adaptable solutions & services for health systems, providers, payers, and employer groups to engage & support patients effectively from any location. In addition, the need for remote patient monitoring and the expanding use of telemedicine services during the COVID-19 pandemic has also contributed to the market's expansion.

Technology is reducing medical costs and increasing accessibility to more individuals. High-speed internet and favorable government initiatives have also contributed to the rapid growth of the market. Personalized healthcare can offer solutions to chronic health problems. For instance, in September 2022, CareCloud, Inc. introduced its new Remote Patient Monitoring (RPM) solution as part of the CareCloud Wellness product lineup. This latest offering complements the existing Chronic Care Management (CCM) solutions, providing healthcare providers with the tools to monitor patients' health remotely and enhance the quality of care they receive beyond traditional clinical visits. RPM enables healthcare professionals to track various aspects of their patients' well-being outside of the healthcare facility, enabling proactive interventions and ultimately improving patient outcomes. These innovative solutions leverage the power of connectivity to provide individuals with convenient access to healthcare resources and tools that can help them better manage their health and well-being.

The connected health and wellness solutions market has experienced significant growth as a result of the COVID-19 pandemic. With the increased focus on health and wellbeing, more people are turning to digital solutions to monitor and improve their overall wellness. This has led to a surge in demand for connected health devices such as wearable fitness trackers, remote patient monitoring systems, and virtual health platforms.

In response to government directives to limit movement during the COVID-19 pandemic, telemedicine services have seen a surge in popularity. With hospitals focused on treating COVID-19 patients, individuals are increasingly turning to remote monitoring solutions to track their health and seeking medical attention only for urgent situations. This shift has contributed to a notable increase in sales of smart wearables, particularly smartwatches, in recent months.

Furthermore, the expected increase in demand for mHealth devices, driven by technological advancements and innovative product designs, is likely to drive market growth in the coming years. The industry’s focus on integrating Internet of Things (IoT) devices and wearable medical technologies, such as sensors and mobile communication devices, is also projected to contribute to this growth. In addition, as healthcare costs continue to rise and awareness of connected health devices grows, healthcare systems are under pressure to implement new strategies to accommodate high patient volumes. This emphasis on cost reduction and the adoption of connected health solutions is expected to propel the connected health and wellness solutions market forward.

Industry Dynamics

The market is currently undergoing significant fragmentation. Numerous players in the market offering a variety of products and services, and this fragmentation can be attributed to the diverse range of technologies and solutions available in the market, as well as the increasing number of startups and established companies entering the space.

The market is characterized by a high degree of innovation, driven by technological advancements and a focus on integrating Internet of Things (IoT) devices and wearable medical technologies. The market is continuously evolving to meet the increasing demand for advanced and connected healthcare solutions. With a strong emphasis on reducing healthcare costs and improving patient outcomes, the industry is pushing boundaries to introduce innovative strategies and products.

Regulations play a significant role in shaping the market by ensuring product safety, data privacy protection, and adherence to industry standards. Compliance with regulations is essential for market growth and consumer trust. Regulatory changes can impact product development, market access, and overall industry innovation.

The market is experiencing a notable level of merger and acquisition (M&A) activity as companies seek to strengthen their market positions, expand their product offerings, and increase their technological capabilities. For instance, in April 2024, OMRON Healthcare, Co., Ltd. acquired Luscii Healthtech, a player in the digital health and remote consultation service platforms industry. M&A deals are being pursued to enhance innovation, access new markets, and drive growth in the rapidly evolving healthcare industry.

Product expansion in the market varies across different companies, with some demonstrating a high degree of innovation by introducing cutting-edge technologies. Other companies may exhibit moderate or low levels of product expansion, focusing on more traditional solutions. For instance, in January 2024, Pylo Health, a company specializing in remote patient monitoring devices and a partner of Prevounce, unveils the release of two advanced patient devices: the Pylo 900-LTE blood pressure monitor and the Pylo 200-LTE weight scale. Overall, the market is characterized by diverse approaches to product development and expansion.

The global expansion in the market is currently at a moderate level. While there is growing demand for connected healthcare devices and services worldwide, the market still faces challenges in terms of adoption and regulatory hurdles. However, with ongoing technological advancements and increasing awareness of the benefits of connected health solutions, the market is expected to reach high levels of expansion in the coming years.

Product Insights

The software & services category in the wellness & health segment held the largest share of 47.1%. This growth can be attributed to the increasing demand for value-based healthcare delivery systems and the rising popularity of online health subscriptions and information downloads. For instance, in October 2023, Ricoh USA, Inc. introduced RICOH Remote Patient Monitoring (RPM) Enablement, a comprehensive managed services solution tailored for health systems. This new offering aims to enhance RPM workflows, promoting greater efficiency and sustainability while positively impacting both patient and care delivery team experiences. In addition, the growing awareness and preference for personalized and convenient medical services are driving the expansion of this segment in the connected health and wellness industry.

Wellness products expected to exhibit the fastest growth over forecast period. Improved health, which is often seen as the most conventional aspect of wellness, extends beyond medication and supplements to encompass consumer medical devices and personal health tracking devices. For instance, Garmin Malaysia unveiled the HRM-Fit in March 2024, a new heart rate monitor specifically designed for women. With a clip-on design, it can be easily attached to medium- and high-support sports bras for optimal comfort, ensuring precise tracking of real-time heart rate and workout information. Due to the increasing emphasis on physical well-being, consumers in emerging economies are willing to invest more in health and wellness products, thereby contributing to the overall market expansion.

End-use Insights

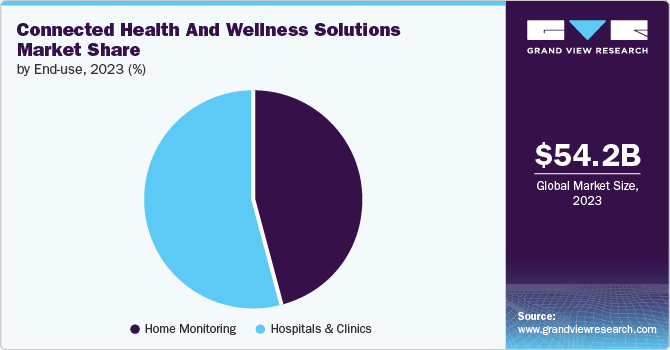

The hospitals & clinics segment accounted for the largest revenue share in 2023. This growth can be attributed to the increasing adoption of digital health technologies in healthcare facilities to improve patient care and outcomes. Hospitals and clinics are increasingly investing in connected health solutions such as remote patient monitoring, telemedicine, and digital health platforms to enhance the delivery of healthcare services. These technologies enable healthcare providers to remotely monitor patients, provide virtual consultations, and access patient health data in real time, leading to improved efficiency and quality of care.

Furthermore, the integration of connected health and wellness solutions in hospitals and clinics is helping to streamline healthcare processes and reduce healthcare costs. By leveraging digital health technologies, healthcare facilities can optimize resource utilization, reduce hospital readmissions, and enhance patient engagement. The shift towards value-based care and the emphasis on preventive healthcare are driving the adoption of connected health solutions in hospitals and clinics, as they enable healthcare providers to deliver personalized and proactive care to patients. The hospitals and clinics segment is expected to continue its growth in the connected health and wellness solutions market as healthcare organizations prioritize digital transformation to meet the evolving needs of patients and improve healthcare delivery.

The home monitoring segment is expected to experience the highest CAGR of 23.8% over the forecast period. The rise of telehealth and remote patient monitoring further drives the growth of the home monitoring segment. With the increasing adoption of telemedicine services, there is a growing need for connected health devices that can capture and transmit health data to healthcare providers for remote monitoring and virtual consultations. For instance, in October 2022, GE Healthcare and AMC Health announced a partnership to offer remote patient monitoring services for individuals requiring chronic and post-acute care at home. This trend has been particularly significant since the COVID-19 pandemic, which has accelerated the shift towards remote healthcare delivery. As a result, the home monitoring segment is expected to see sustained growth as technological advancements continue to enhance the capabilities and accuracy of connected health devices.

Application Insights

The wellness and prevention segment accounted for the largest market share of 42.9% in 2023, driven by several key factors. The category also anticipated to show fastest growth over forecast timeline. Rising awareness regarding health and wellbeing is likely to drive the segment growth. Besides, the growing popularity of digital health trends can also be attributed to overall segment growth. In January 2022, OMRON Healthcare, Inc. introduced remote patient monitoring services with advanced mobile app and connected blood pressure monitors globally. Thus, the company expanded digital health services to assist customers on each step of their heart health journey. Such initiatives are expected to support the market growth. In addition, advancements in technology, such as wearable devices and health trackers, are enabling individuals to monitor and track their health metrics more easily, further fueling the growth of the wellness and prevention segment in the connected health and wellness solutions market.

The diagnosis & treatment segment is expected to experience significant growth in the connected health and wellness solutions market. This growth can be attributed to the increasing adoption of advanced technologies such as telemedicine, wearable devices, and remote monitoring tools. These solutions enable healthcare providers to remotely diagnose and treat patients, improving access to healthcare services and enhancing patient outcomes. The integration of artificial intelligence and machine learning algorithms in these solutions also plays a key role in improving the accuracy and efficiency of diagnoses and treatments, further driving the growth of this segment in the market.

Function Insights

The telehealth segment dominated the market in 2023 and is expected to emerge as the fastest-growing function category with a CAGR of 20.7% forecast period owing to factors such as the growing adoption of telehealth services. The growth of the segment is anticipated to be driven by the development of healthcare infrastructure and the rise in healthcare spending in emerging economies. In addition, the increasing focus on continuous patient monitoring for elderly individuals, along with the introduction of wearable remote monitoring devices, is expected to fuel market growth. It is projected that by 2024, approximately 30 million Americans will be utilizing patient monitoring tools, thereby positively impacting the overall market.

The clinical monitoring segment in the connected health and wellness solutions market is experiencing significant growth. This can be attributed to the increasing focus on proactive healthcare management and the rising adoption of remote patient monitoring technologies. Healthcare providers are increasingly turning to connected solutions to track and monitor the health status of patients in real-time, leading to better management of chronic conditions and improved patient outcomes. The availability of advanced wearable devices and health monitoring systems has also fueled the growth of the clinical monitoring segment, providing healthcare professionals with valuable data insights to deliver personalized and timely interventions.

Regional Insights

North America connected health and wellness solutions market dominated the overall global market and accounted for the 39.9% revenue share in 2023, driven by the increasing adoption of digital health technologies and supportive regulatory frameworks. For instance, in March 2024, Analog Devices, Inc. announced the U.S. Food and Drug Administration's (FDA) clearance of the 510(k) application for its Sensinel Cardiopulmonary Management System, which is now commercially available. The compact wearable device is a non-invasive, remote monitoring system that captures cardiopulmonary measurements, enabling remote management of cardiac chronic diseases.

U.S. Connected Health And Wellness Solutions Market Trends

The connected health and wellness solutions market in the U.S. held a significant share of North American market in 2023 due to strategic initiatives by key market players, such as IBM, Microsoft, and Philips, which are investing in research and development, acquisitions, and partnerships. For instance, in August 2022, Medtronic PLC forged a strategic partnership with BioIntelliSense, a pioneer in continuous health monitoring, to acquire the exclusive U.S. rights to distribute BioIntelliSense's BioButton multi-parameter wearable for continuous, connected monitoring in U.S. hospitals and 30-day post-acute hospital-to-home settings.

Europe Connected Health And Wellness Solutions Market Trends

The European connected health and wellness solutions market is witnessing growth fueled due to advancements in technology. The market is driven by the increasing adoption of wearable devices, mobile apps, and telemedicine platforms that enable patients to monitor their health remotely and receive personalized care. For instance, in November 2023, AstraZeneca announced the launch of Evinova, a cutting-edge health-tech business designed to accelerate innovation in the life sciences sector and improve patient outcomes. Evinova will focus on developing digital solutions, including remote patient monitoring and digital therapeutics, with a robust pipeline of innovative products in these areas. Additionally, the COVID-19 pandemic has accelerated the adoption of digital health solutions, leading to increased demand for connected health and wellness solutions.

The connected health and wellness solutions market in the UK is one of the major markets in the region, driven by an increasing demand for personalized and preventive healthcare. Key drivers of this growth include the rise of digital health technologies, such as wearables and mobile apps, which are enabling patients to take a more active role in their own health management. For instance, in April 2023, BT Group unveiled a virtual wards program, designed to support healthcare providers across the UK. This initiative is a key component of BT's commitment to collaborate with the National Health Service (NHS) to create innovative, patient-centric services that are more efficient, safer, and better equipped to meet the needs of all users

The connected health and wellness solutions market in Germany is expected to grow significantly over the forecast period. driven by the increasing demand for digital healthcare services and the need for personalized wellness solutions. To capitalize on this trend, a company could partner with leading German healthcare providers. For instance, .in January 2024, Implicity, a remote patient monitoring (RPM) company specializing in cardiac data management solutions, formed a strategic partnership with the German Society of Cardiologists in Private Practice, a professional organization and founding member of the European Society of Cardiology's Council for Cardiology Practice.

Asia Pacific Connected Health And Wellness Solutions Market Trends

The connected health and wellness solutions market in Asia Pacific region is expected to grow at the fastest growth rate during the forecast period, driven by factors such as the increasing adoption of digital health technologies, growing awareness of preventive healthcare, and rising demand for personalized healthcare services. The region's large and aging population, combined with the prevalence of chronic diseases such as diabetes and cardiovascular disease, is also driving demand for connected health and wellness solutions. Additionally, the Asia Pacific region's high smartphone penetration and rapid adoption of mobile health technologies is anticipated to positively influence the market growth. For instance, in March 2023, Fujitsu unveiled a cutting-edge cloud-based platform, designed to facilitate the secure collection and utilization of health-related data, with the aim of accelerating digital transformation in the healthcare industry.

The connected health and wellness solutions market in China is expected to grow at the fastest rate during the forecast period due to the investment of tech giants and healthcare companies. These investments are expected to drive innovation, improve healthcare outcomes, and increase access to healthcare services for the Chinese population.

The connected health and wellness solutions market in Japan is expected to grow over the forecast period. riven by factors such as an aging population, increasing healthcare costs, partnership between companies and the need for remote monitoring and personalized care. For instance, in November 2023, Tochtech Technologies, partnered with Mediva Inc. to launch a groundbreaking project in Japan, aimed at validating the efficacy of Tochtech's Vericare platform in enhancing safety and health outcomes for seniors, with a focus on improving their quality of life.

Latin America Connected Health And Wellness Solutions Market Trends

The connected health and wellness solutions market in Latin America is experiencing significant growth attributed to various factors. Partnering with local healthcare providers or tech companies could provide an invaluable entry point For instance, in April 2023, a landmark collaboration between FAPESP and Hapvida NotreDame Intermédica, a health plan operator in Brazil, was launched at the Federal University of Ceará (UFC) in Fortaleza. The Reference Center on Artificial Intelligence (CEREIA) was established to drive innovation and research in AI. The center will focus on six key areas, including the development of intelligent systems for remote patient monitoring, enabling more effective and efficient healthcare services.

The connected health and wellness solutions market in Mexico is experiencing significant growth fueled by technological advancements. Innovations such as wearable devices, telemedicine platforms, and health-tracking apps are revolutionizing healthcare delivery, promoting proactive wellness management, and enhancing patient engagement.

Middle East & Africa Connected Health And Wellness Solutions Market Trends

The connected health and wellness solutions market in MEA is experiencing significant growth over the forecast period. Technological advancements such as telemedicine, remote patient monitoring, and digital health platforms are enhancing healthcare delivery across the region. These innovations bridge geographical barriers, enable timely interventions, and empower patients with personalized care. With governments and healthcare providers embracing digital transformation, the MEA region is experiencing a paradigm shift towards more efficient and accessible healthcare services.

The connected health and wellness solutions market in Saudi Arabia is anticipated to grow lucratively over the forecast period. The country's healthcare system is undergoing a transformation, driven by innovative technologies such as telehealth services, remote monitoring devices, and AI-driven healthcare platforms. These advancements enable remote consultations, real-time health monitoring, and personalized treatment plans, thereby enhancing accessibility and efficiency in healthcare delivery.

Key Connected Health And Wellness Solutions Company Insights

The competitive scenario in the connected health and wellness solutions market is highly competitive, with key players such as OMRON Healthcare, Inc., Koninklijke Philips N.V., GE Healthcare, Drägerwerk AG & Co. KGaA, Fitbit LLC, Medtronic, and Abbott holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Connected Health And Wellness Solutions Companies:

The following are the leading companies in the connected health and wellness solutions market. These companies collectively hold the largest market share and dictate industry trends.

- OMRON Healthcare, Inc.

- Koninklijke Philips N.V.

- GE Healthcare

- Drägerwerk AG & Co. KGaA

- Fitbit LLC

- Medtronic

- Abbott

- Boston Scientific Corporation

- Garmin International, Inc.

- Apple, Inc.

- Masimo Corporation

- ResMed

- NXGN Management, LLC.

Recent Developments

-

For instance, in April 2024, OMRON Healthcare, Co., Ltd. acquired Luscii Healthtech, a player in the digital health and remote consultation service platforms industry.

-

In April 2024, Tembo Health, a telemedicine provider catering to seniors, entered into a strategic partnership with Springwell Senior Living, a 250-resident senior living community in northwest Baltimore. The community, which offers independent living, assisted living, and memory care services, will integrate Tembo Health's telemedicine services to provide residents with convenient and accessible healthcare solutions.

-

In March 2024 , Garmin Malaysia unveiled the HRM-Fit, a new heart rate monitor specifically designed for women. With a clip-on design, it can be easily attached to medium- and high-support sports bras for optimal comfort, ensuring precise tracking of real-time heart rate and workout information

-

In February 2024, HealthSnap and Chronic Care Management solutions for healthcare providers secured a significant funding round of USD 25 million. The Series B financing was led by Sands Capital, with new investors Comcast Ventures and Florida Opportunity Fund participating in the round.

Connected Health And Wellness Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 64.38 billion

Revenue forecast in 2030

USD 195.26 billion

Growth rate

CAGR of 20.3% from 2024 to 2030

Actual Data

2018 - 2023

Forecast Data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, function, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK, Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

OMRON Healthcare, Inc.; Koninklijke Philips N.V.; GE Healthcare; Drägerwerk AG & Co. KGaA; Fitbit LLC; Medtronic; Abbott; Boston Scientific Corporation.; Garmin International, Inc.; Apple, Inc.; Masimo Corporation; ResMed ; NXGN Management, LLC.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Health And Wellness Solutions Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global connected health and wellness solutions market report on the basis of product, function, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Medical Devices

-

Insulin Pump

-

BP Monitor

-

Glucose Monitor

-

Personal Pulse Oximeter

-

Others

-

-

Wellness Products

-

Digital Pedometer

-

Body Analyzer

-

Heart Rate Monitor

-

Sleep Quality Monitor

-

Others

-

-

Software & Services

-

Online Subscription

-

Fitness & Wellness App

-

Others

-

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Monitoring

-

Telehealth

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis & Treatment

-

Wellness & Prevention

-

Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Monitoring

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global connected health and wellness solutions market size was estimated at USD 54.15 billion in 2023 and is expected to reach USD 64.38 billion in 2024.

b. The global connected health and wellness solutions market is expected to grow at a compound annual growth rate of 20.3% from 2024 to 2030 to reach USD 195.26 billion by 2030.

b. North America dominated the connected health and wellness solutions market with a share of 39.92% in 2023. This is attributable to the presence of well-developed healthcare infrastructure, the widespread coverage of the internet, and the high awareness levels coupled with the supportive regulations formulated for increased patient safety.

b. Some key players operating in the connected health and wellness solutions market include OMRON Healthcare, Inc., Koninklijke Philips N.V., GE Healthcare, Drägerwerk AG & Co. KGaA; Fitbit LLC; Medtronic; Abbott; Boston Scientific Corporation; Garmin International, Inc.; Apple, Inc.; Masimo Corporation; ResMed; NXGN Management, LLC.

b. Key factors that are driving the connected health and wellness solutions market growth include the mass adoption of mHealth devices and the introduction of technologically advanced product designs coupled with the adoption of Internet of Things (IoT) devices and wearable medical devices, which include sensors and mobile communication devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."