- Home

- »

- Next Generation Technologies

- »

-

Connected Retail Market Size, Share & Growth Report, 2030GVR Report cover

![Connected Retail Market Size, Share & Trends Report]()

Connected Retail Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By Region, And Segment Forecasts

- Report ID: 978-1-68038-765-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Retail Market Size & Trends

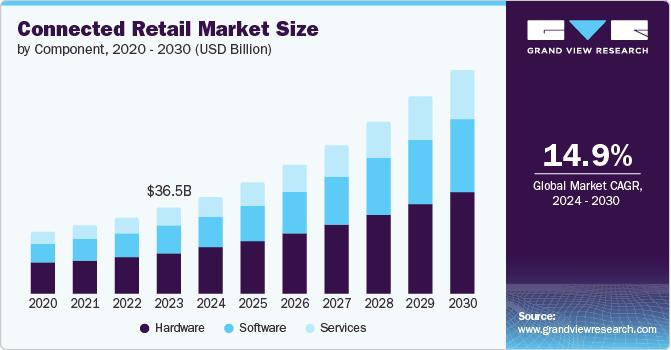

The global connected retail market size was valued at USD 36.53 billion in 2023 and is anticipated to grow at a CAGR of 14.9% from 2024 to 2030. Connected retail refers to integrating digital technologies into physical retail spaces, creating a seamless and interactive shopping experience for consumers. This integration is increasingly in demand as it enhances customer engagement and satisfaction through personalized interactions and streamlined processes.

One of the primary drivers of this trend is the shift towards enhancing customer experience. Connected retail leverages IoT devices, AI-powered analytics, and mobile applications to offer personalized recommendations, real-time promotions, and digital payment options. These features cater to modern consumer preferences who value convenience, customization, and efficiency in their shopping journeys. By providing a more engaging and tailored experience, retailers can foster deeper connections with their customers, ultimately driving loyalty and repeat business.

Moreover, the data-driven insights enabled by connected retail solutions play a pivotal role in shaping decision-making processes for retailers. Retailers are able to gather actionable data on customer behavior, product preferences, and inventory levels through sensors and analytics platforms in real-time. This data-driven approach improves operational efficiency by optimizing inventory management and supply chain logistics and enables retailers to make informed marketing and pricing strategies. By understanding and responding to consumer trends more effectively, retailers can adapt quickly to market demands and gain a competitive edge in a rapidly evolving industry landscape.

The rapid expansion of online shopping has fueled technology integration in brick-and-mortar stores. Customers look for tailored shopping experiences, convenience, and instant access to product details, highlighting the importance of connected retail solutions. Moreover, businesses adopting cutting-edge in-store technologies like interactive mirrors, smart changing rooms, and RFID systems to improve customer interaction. For instance, in October 2022, Checkpoint Systems announced the launch of SFERO, a modular RFID (Radio Frequency Identification) solution for apparel retailers. SFERO combines RFID with Electronic Article Surveillance (EAS) capabilities, offering high inventory management and loss prevention performance. The system aims to enhance operational efficiency by providing real-time inventory visibility, enabling retailers to optimize stock levels and reduce out-of-stocks while minimizing losses from theft. This solution is tailored to meet the evolving needs of apparel retailers looking to improve customer experience and streamline operations. Furthermore, developments such as mobile shopping, intelligent shelf systems, and subscription services are driving the growth of connected retail. The combination of technology, customer demands, and forward-thinking retail strategies are propelling the strong growth of the connected retail sector.

Component Insights

The hardware segment held the largest market revenue share of 48.7% in 2023. The rapid expansion of Internet of Things (IoT) applications in retail drives the demand for hardware components. IoT technology relies heavily on hardware components such as sensors, RFID tags, and smart devices to enable seamless connectivity between physical and digital retail spaces. These components are essential for collecting real-time data on inventory levels, customer behavior, and operational efficiency, which retailers use to enhance service delivery and optimize business processes. Moreover, the increasing adoption of omnichannel retail strategies has spurred demand for hardware that supports interconnected retail ecosystems. Retailers are investing in hardware solutions like digital signage, interactive kiosks, and mobile POS systems to create unified shopping experiences across online and offline channels.

The software component is expected to grow at the fastest CAGR of 15.9% over the forecast period. The increasing digital transformation within the retail sector fuels the demand for software components. Retailers increasingly adopt connected technologies to enhance efficiency, improve customer experience, and optimize operations. These technologies use software components to integrate various aspects of retail operations, from inventory management and logistics to customer relationship management (CRM) and data analytics. Moreover, omnichannel retailing has increased the demand for sophisticated software solutions. Retailers aim to provide a seamless shopping experience across physical stores, online platforms, mobile apps, and social media channels. It requires robust software systems that can unify data from diverse sources, allowing retailers to track customer behavior, manage inventory in real-time, personalize marketing efforts, and facilitate smooth transactions across different touchpoints.

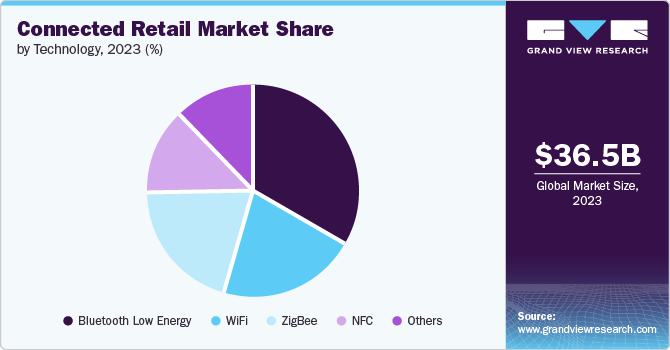

Technology Insights

Bluetooth low energy dominated the segment with largest revenue share in 2023. BLE has gained traction primarily because it enables seamless and efficient communication between various devices and platforms while consuming minimal power. This low energy consumption is crucial in retail settings where devices such as beacons, sensors, and smart tags need to operate continuously without frequent battery replacements, thus ensuring uninterrupted service and lower operational costs. Retailers strategically place BLE beacons throughout stores to send targeted messages, promotions, and personalized offers directly to customers' smartphones. This proximity-based marketing enhances the customer experience by providing relevant information, driving foot traffic, and boosting sales through timely and contextual engagement.

Near Field Communication (NFC) segment is expected to witness the fastest CAGR during the forecast period. Customers are able to make payments swiftly by tapping their NFC-enabled devices (like smartphones or wearables) on payment terminals, eliminating the need for physical cards or cash. This frictionless payment experience speeds up the checkout process and enhances customer satisfaction by reducing waiting times and offering a more secure payment method. Additionally, retailers can use NFC-enabled smart tags or posters to deliver targeted promotions and product information directly to customers' devices as they browse through stores.

Regional Insights

North America dominated the market with a revenue share of 37.4% in 2023 and is projected to grow over the forecast period. The increasing consumer preference for seamless shopping experiences that integrate digital and physical channels drives the growth. Connected retail technologies like IoT (Internet of Things) devices, smart shelves, and mobile apps enable retailers to offer personalized recommendations, streamline checkout processes, and provide real-time inventory updates. This integration enhances convenience for consumers, who can research products online, check availability in nearby stores, and purchase through various channels, fostering a more cohesive shopping journey. Moreover, e-commerce has accelerated the adoption of connected retail solutions. Retailers use technologies such as RFID (Radio-Frequency Identification) tags and AI-powered analytics to optimize inventory management and ensure product availability across online and offline platforms.

U.S. Connected Retail Market Trends

The connected retail market in the U.S. dominated the market with a share of 65.8% in 2023. The increasing adoption of mobile devices and smartphones among consumers is attributed to increasing demand for connected retail technology. These devices have become a major way to shop, allowing customers to research products, compare prices, read reviews, and purchase anytime and anywhere. Another significant technological advancement driving the demand for connected retail is artificial intelligence (AI) and machine learning. These technologies enable retailers to analyze vast amounts of consumer data to offer personalized recommendations, promotions, and customer service. AI-powered chatbots and virtual assistants also enhance customer engagement by responding instantly to inquiries and guiding shoppers through their purchasing decisions.

Europe Connected Retail Market Trends

The Europe Connected Retail market was identified as a lucrative region in this industry.High smartphone penetration rates across the continent influence consumer behavior, with a significant portion of shoppers using mobile devices to browse products, make purchases, and engage with retailers through apps and mobile-responsive websites. This trend has prompted retailers to invest heavily in omnichannel strategies that seamlessly blend online and offline experiences, catering to the preferences of tech-savvy consumers. Furthermore, urbanization and dense population centers in major European cities contribute to higher foot traffic in retail spaces, prompting the adoption of connected retail technologies like IoT sensors and smart shelving systems to optimize operations and enhance customer experiences. Furthermore, there is a growing emphasis on sustainability, driving retailers to integrate environmentally friendly practices into their operations through technology-driven solutions that minimize carbon footprints and promote eco-friendly products. These market-specific drivers underscore the evolution of retail in Europe towards a more integrated, personalized, and technologically advanced landscape.

The connected retail market in UK is expected to grow rapidly in the coming years. the shift in consumer behavior towards omnichannel shopping experiences. Consumers increasingly demand seamless integration between online and offline retail channels, where they can browse products digitally, make purchases via mobile apps or websites, and have the option for in-store pickup or delivery. This trend has accelerated due to its convenience, allowing shoppers to research products, compare prices, and complete transactions across various touchpoints. Additionally, the COVID-19 pandemic has further accelerated the adoption of connected retail solutions in the UK. Lockdowns and social distancing measures compelled many consumers to shift towards online shopping, prompting retailers to enhance their digital capabilities rapidly. This period underscored the importance of robust e-commerce platforms, efficient logistics, and personalized customer experiences, driving investment in technologies that support seamless digital interactions and fulfillment options.

The Germany connected retail market held a substantial market share in 2023. Strong infrastructure and widespread internet connectivity provide a solid foundation for adopting digital technologies in retail which fosters market growth. This infrastructure supports the seamless integration of online and offline channels, allowing retailers to offer unified shopping experiences that blend physical store visits with digital interactions. Consumers in Germany increasingly value convenience and efficiency, making connected retail solutions such as mobile apps, IoT-enabled devices, and AI-driven personalized recommendations highly appealing. Additionally, German retailers face intense competition, particularly from e-commerce giants and global brands expanding their presence in the market. To stay competitive, the local retailers are embracing connected retail technologies to differentiate themselves through enhanced customer service and innovative shopping experiences. Technologies such as augmented reality (AR) for virtual product try-ons and smart inventory management systems streamline operations and attract tech-savvy consumers seeking interactive and personalized shopping journeys.

Asia Pacific Connected Retail Market Trends

Asia Pacific market is anticipated to witness the highest growth in the connected retail market at 17.5% CAGR by 2030. One primary driver is the rapid adoption of digital technologies and smartphones across the region. Countries such as China, India, and Southeast Asia have seen a surge in internet penetration and smartphone usage, creating a large base of digitally savvy consumers. These consumers are comfortable with online shopping, mobile payments, and interacting with brands through digital channels. Moreover, the Asia Pacific region is home to some of the world's largest e-commerce markets, such as China and India, where online retail giants like Alibaba, JD.com, and Flipkart have revolutionized consumer shopping behaviors. Integrating digital platforms with physical retail spaces, known as omnichannel retailing, is becoming more prevalent. Retailers are leveraging technologies such as augmented reality (AR), virtual reality (VR), and IoT (Internet of Things) to enhance the shopping experience, improve inventory management, and personalize customer interactions.

The connected retail market in China is held a substantial market share in 2023. One significant driver is the country's widespread adoption of mobile technology and digital platforms. With over 1 Million smartphone users, Chinese consumers are transforming their shopping behaviors through mobile apps and e-commerce platforms. Moreover, Chinese consumers place a high value on convenience and efficiency, which connected retail technologies enhance. Features such as mobile payments, personalized recommendations based on big data analytics, and seamless online-to-offline (O2O) shopping experiences cater to these preferences. Company like Alibaba have pioneered these technologies, integrating online shopping with physical retail stores through QR codes and digital payments.

Japan connected retail market is undergoing significant advancements due to the implementation of cutting-edge technologies such as digital signage, smart labels, and intelligent vending machines. These innovative systems have paved the way for various applications, including foot traffic monitoring, efficient inventory management, and the implementation of customer loyalty programs. The remarkable growth of Japan's retail sector can be attributed to the influential factors of tourism and inflation, which have played crucial roles in driving the success of department store sales, surpassing the industry average.

Key Connected Retail Company Insights

Some of the key companies in the connected retail market include Honeywell International Inc.; Rockwell Automation, Inc.; NXP Semiconductors NV; and Cisco Systems, Inc.

-

Honeywell operates as an e-commerce platform that specializes in selling a diverse range of Honeywell products for various settings such as homes, offices, and more. Our extensive product catalog encompasses air purifiers, fans, filters, humidifiers, safes, thermostats, and many other items.

-

Rockwall Automation is a global industrial automation and information intelligence organization. They produce aerospace electronics truck components, printing presses, valves and meters industrial automation.

Key Connected Retail Companies:

The following are the leading companies in the connected retail market. These companies collectively hold the largest market share and dictate industry trends.

- NXP Semiconductors NV

- Honeywell International Inc.

- Cisco Systems, Inc.

- GE Digital

- International Business Machines Corporation (IBM)

- MindTree Ltd.

- PTC Inc.

- Rockwell Automation, Inc.

- UiPath Inc.

Recent Developments

-

In January 2024, SAP announced the launch of new AI-driven retail capabilities aimed at enhancing customer experience. These innovations integrate AI to provide personalized shopping experiences, improve inventory management, and optimize supply chain operations. The goal is to empower retailers to understand better and respond to customer preferences in real time, ultimately driving increased efficiency and customer satisfaction in the retail sector.

-

In October 2022, Facilio, a facility management software provider, announced a partnership with Tutenlabs to digitize and automate a significant number of large-format retail stores across North America. This collaboration intends to leverage Facilio's technology to enhance operational efficiency and sustainability in retail environments by integrating IoT and AI-driven solutions.The goal is to optimize building performance and maintenance processes, ultimately improving the overall customer experience within these retail spaces.

-

In October 2021, Zalando announced the launch of Connected Retail in Italy, a new service enabling retailers to extend their reach to millions of customers through the Zalando platform. This initiative aims to enhance customer choice by integrating local stores into Zalando's online shopping experience. Through Connected Retail, Italian retailers can showcase their inventory on Zalando's website, allowing customers to browse and purchase items directly from nearby stores.

Connected Retail Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.41 billion

Revenue Forecast in 2030

USD 95.19 billion

Growth Rate

CAGR of 14.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; South Africa; Saudi Arabia

Key companies profiled

NXP Semiconductors NV; Honeywell International Inc.; Cisco Systems, Inc; GE Digital; International Business Machines Corporation (IBM); MindTree Ltd.; PTC Inc.; Rockwell Automation, Inc.; UiPath Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Retail Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected retail market report based on component, technology, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Managed Services

-

Professional Services

-

Remote Device Management Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

ZigBee

-

WiFi

-

NFC

-

Bluetooth Low Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.