- Home

- »

- Pharmaceuticals

- »

-

Connective Tissue Disease Market Size & Share Report 2030GVR Report cover

![Connective Tissue Disease Market Size, Share & Trends Report]()

Connective Tissue Disease Market (2024 - 2030) Size, Share & Trends Analysis Report By Disease (Rheumatoid Arthritis), By Drug (Pharmaceuticals), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connective Tissue Disease Market Trends

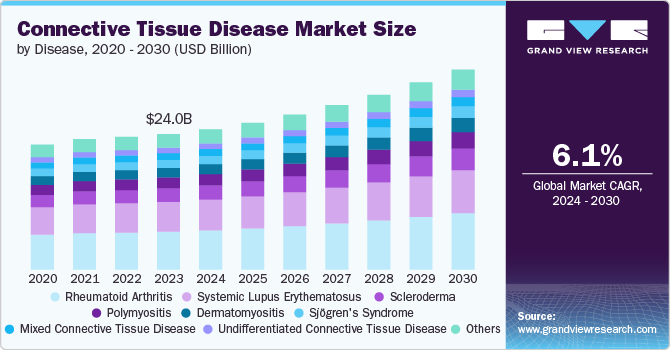

The global connective tissue disease market size was estimated at USD 24.04 billion in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. This growth is attributed to the increasing prevalence of these diseases, advancements in diagnostic techniques & treatment approaches, and growing demand for effective treatments. The rising incidence of autoimmune and rheumatic disorders, such as rheumatoid arthritis, systemic lupus erythematosus, and scleroderma, is a significant driver for the growth of the connective tissue disease (CTD) market. According to the Lupus Foundation of America,about 1.5 million Americans and more than five million people globally are affected by some type of lupus.

Moreover, the aging population worldwide is another significant driver for the growth of the market. As individuals age, they are more prone to developing autoimmune disorders such as rheumatoid arthritis and scleroderma, both of which fall under the category of connective tissue disease. This demographic trend fuels the demand for innovative therapies and personalized medicine approaches tailored to address the specific needs of elderly patients with connective tissue diseases. Pharmaceutical companies invest in research and development activities to introduce novel treatments targeting these conditions.

Furthermore, technological advancements in precision medicine and biomarker discovery are revolutionizing the diagnosis and treatment landscape for connective tissue diseases. The emergence of targeted therapies that aim to modulate specific pathways involved in autoimmune responses is propelling market growth. For instance, biologics such as monoclonal antibodies are being developed to target key molecules implicated in CTD pathogenesis, offering patients more effective and safer treatment options. These innovations are reshaping the market by providing personalized solutions that improve patient outcomes and quality of life.

Disease Insights

The Rheumatoid Arthritis (RA) segment dominated the market and accounted for a share of 28.04% in 2023. The increasing prevalence of RA globally, coupled with the rising awareness about early diagnosis and treatment, has significantly contributed to the growth of this segment. According to the Institute for Health Metrics and Evaluation, in 2020, approximately 17.6 million people globally were affected by rheumatoid arthritis, with a range of uncertainty between 15.8 million and 20.3 million. Furthermore, ongoing research and development efforts focused on novel drug formulations are expected to drive continued growth in the rheumatoid arthritis segment within the market.

The scleroderma segment is projected to grow at a significant rate over the forecast period. Scleroderma is an autoimmune disease characterized by skin thickening, scarring, and inflammation due to an overactive immune system. According to the National Organization for Rare Disorders, about one in 10,000 people is affected by systemic scleroderma. This condition tends to occur more frequently in women and typically manifests between the ages of 30 and 50. The presence of high unmet medical needs and the subsequent introduction of new products catering to these needs are further propelling the growth of the scleroderma treatment market.

Drug Insights

Biopharmaceuticals held the largest share of 88.7% in 2023 and are anticipated to grow rapidly over the forecast period. The segment includes biologics and biosimilars. Monoclonal antibodies and other biologic therapies revolutionized the treatment of chronic and autoimmune conditions that affect connective tissues. These advanced biopharmaceuticals offer more targeted and effective treatments than traditional small-molecule drugs. The rising prevalence of these connective tissue disorders, driven by an aging population and lifestyle factors, has fueled demand for innovative biologic therapies. Additionally, ongoing research and development efforts by major pharmaceutical companies have led to the approval of new biopharmaceutical products for connective tissue diseases. In June 2022, the FDA in the U.S. approved a new biosimilar of rituximab, known as rituximab-Marx (RIABNI). This was authorized for use in treating adult individuals suffering from moderate to severe rheumatoid arthritis (RA) when used alongside methotrexate.

The pharmaceutical segment includes Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Disease-Modifying Anti-Rheumatic Drugs (DMARDs), Corticosteroids, and others. This growth is driven by rising autoimmune disease prevalence, advancements in drug therapies including biologics for DMARDs, and increased patient awareness. These drugs effectively manage symptoms and modify disease progression, underscoring their pivotal role in improving patient outcomes and quality of life. As research continues and new treatments emerge, the segment is expected to expand further, meeting the evolving needs of CTD patients worldwide.

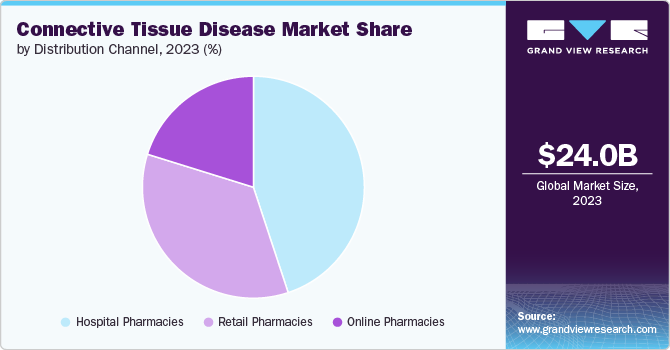

Distribution Channel Insights

Hospital pharmacies held the largest share of 44.97% in 2023. Hospital pharmacies are the primary source of medications for patients with connective tissue diseases, as they often require complex treatment regimens involving biologics, immunosuppressants, and corticosteroids. The rising incidence of conditions such as rheumatoid arthritis, systemic lupus erythematosus, and scleroderma are fueling the demand for these medications, which are typically administered under medical supervision in a hospital setting. As the connective tissue disease market continues to grow, hospital pharmacies remain a crucial distribution channel for providing patients with access to the necessary medications and ensuring proper monitoring and management of these complex conditions.

The online pharmacies segment is anticipated to witness significant growth over the forecast period. This growth is driven by the increasing adoption of digital healthcare solutions, the convenience and accessibility of online ordering, and the rising demand for specialty medications for treating conditions such as rheumatoid arthritis, lupus, and scleroderma. Patients with connective tissue diseases require complex treatment regimens and regular medication refills, making online pharmacies an attractive option. Integrating telemedicine services, mobile apps, and artificial intelligence-powered features by online pharmacies further enhances the patient experience and improves medication adherence.

Regional Insights

North America connective tissue disease market accounted for the largest revenue share of 39.39% share in 2023. This can be attributed to the growing emphasis on the well-established healthcare infrastructure in the region, high prevalence of target disease, and increased focus on personalized medicine and targeted therapies. Patients are increasingly seeking treatments tailored to their specific genetic profile and disease subtype, which has led to the development of companion diagnostics that help match patients with the most effective therapies.

U.S. Connective Tissue Disease Market Trends

The connective tissue disease market in the U.S. is expected to grow substantially over the forecast period. The U.S. market for connective tissue diseases is characterized by a robust regulatory framework influencing treatments' research, development, and commercialization. The FDA oversees the approval process for new therapies targeting connective tissue diseases, ensuring safety and efficacy standards are met before products reach the market. For Instance, in May 2024, The FDA approved using the Benlysta (belimumab) Autoinjector for children with systemic lupus erythematosus (SLE). This approval significantly advances the treatment options available for pediatric patients suffering from this chronic autoimmune disease.

Europe Connective Tissue Disease Market Trends

The connective tissue disease market in Europe is expected to witness lucrative growth over the forecast period. European governments strongly supported the research and development of new treatments for connective tissue diseases, leading to a robust pipeline of innovative therapies, including biologics and targeted small molecules. Many European countries have implemented favorable reimbursement policies for connective tissue disease treatments, improving patient access to the latest therapies. This has been a significant driver of market growth. Improvements in diagnostic technologies, such as antinuclear antibody (ANA) testing, enabled earlier and more accurate detection of connective tissue disorders in Europe which expanded the pool of patients seeking specialized care.

Asia Pacific Connective Tissue Disease Market Trends

The connective tissue disease market in Asia Pacific is anticipated to witness the fastest growth of 6.7% CAGR over the forecast period. This is due to the increasing awareness about autoimmune disorders, rising healthcare expenditure, and expanding access to advanced medical treatments. Rapid urbanization and rising disposable incomes in emerging economies fuel market growth, driving demand for advanced treatment options and healthcare services. Economic factors such as government investments in healthcare infrastructure and insurance coverage expansions are expanding access to treatment for CTDs, particularly in populous countries including China and India. Socially, increasing health literacy and patient awareness are shaping demand patterns, influencing treatment-seeking behaviors, and fostering collaborations between healthcare providers and pharmaceutical companies to address unmet medical needs effectively in the region.

Key Connective Tissue Disease Company Insights

Some of the key players operating in the market include Amgen, Inc., Novartis AG, Pfizer and others. These companies focus on biologics and biosimilars, expanding product indications, investing in R&D, and driving operational efficiency to support financial growth and shareholder returns. Their scale, expertise, and diversified portfolios position them as connective tissue disease market leaders.

Key Connective Tissue Disease Companies:

The following are the leading companies in the connective tissue disease market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc.

- Amgen, Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- Lilly

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- UCB S.A.

Recent Developments

-

In April 2024, RemeGen Co., Ltd. recently announced that the U.S. FDA granted Telitacicept Fast Track Designation for treating Primary Sjögren's Syndrome. This designation is a significant milestone in the drug development process, as it expedites the review of drugs intended to treat serious conditions and fill an unmet medical need.

-

In May 2024, the FDA approved the use of subcutaneous belimumab for treating pediatric patients aged 5 years and older with systemic lupus erythematosus (SLE).This approval marks a significant advancement in managing SLE, a chronic autoimmune disease that can affect various organs and tissues in the body.

-

In July 2023, Boehringer Ingelheim International GmbH received U.S. FDA approval for its Cyltezo (adalimumab-adbm), interchangeable biosimilar to HUMIRA, for treating various chronic inflammatory diseases, including RA in the U.S.

Connective Tissue Disease Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.90 billion

Revenue forecast in 2030

USD 35.48 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, drug, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Amgen, Inc.; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Johnson & Johnson Services, Inc.; Lilly; Novartis AG; Pfizer Inc.; Regeneron Pharmaceuticals Inc.; UCB S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connective Tissue Disease Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connective tissue disease market report on the basis of disease, drug, distribution channel, region:

-

Connective Tissue Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Rheumatoid Arthritis (RA)

-

Systemic Lupus Erythematosus (SLE)

-

Scleroderma

-

Polymyositis

-

Dermatomyositis

-

Sjögren's Syndrome

-

Mixed Connective Tissue Disease (MCTD)

-

Undifferentiated Connective Tissue Disease (UCTD)

-

Other connective tissue disease

-

-

Connective Tissue Disease Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

-

Disease-Modifying Anti-Rheumatic Drugs (DMARDs)

-

Corticosteroids

-

Other Pharmaceuticals

-

-

Biopharmaceuticals

-

Biologics

-

TNF Inhibitors

-

IL-6 Inhibitors

-

B-cell Inhibitors

-

T-cell Inhibitors

-

Other Biologics

-

-

Biosimilars

-

-

-

Connective Tissue Disease Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global connective tissue disease market size was estimated at USD 24.04 billion in 2023 and is expected to reach USD 24.90 billion in 2024.

b. The global connective tissue disease market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 35.48 billion by 2030.

b. North America dominated the connective tissue disease market with a share of 39.39% in 2023. This can be attributed to the growing emphasis on the well-established healthcare infrastructure in the region, high prevalence of target disease, and increased focus on personalized medicine and targeted therapies.

b. Some key players operating in the connective tissue disease market include AbbVie, Inc.; Amgen, Inc.; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; Johnson & Johnson Services, Inc.; Lilly; Novartis AG; Pfizer Inc.; Regeneron Pharmaceuticals Inc.; UCB S.A.

b. Key factors that are driving the connective tissue disease market growth include increasing prevalence of connective tissue diseases, aging population, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.