- Home

- »

- Medical Devices

- »

-

Consumer Health Contract Manufacturing Market Report 2030GVR Report cover

![Consumer Health Contract Manufacturing Market Size, Share & Trends Report]()

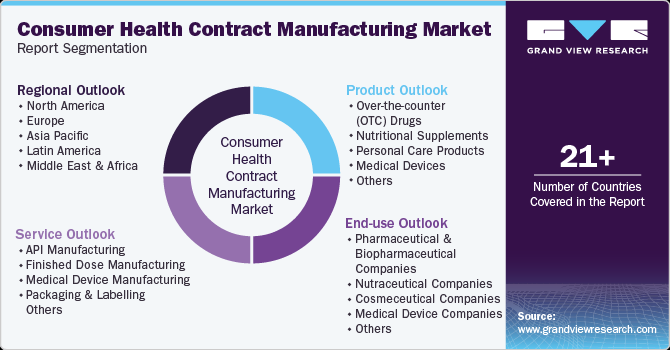

Consumer Health Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Over-the-counter Drugs, Nutritional Supplements, Personal Care Products, Medical Devices), By Service, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

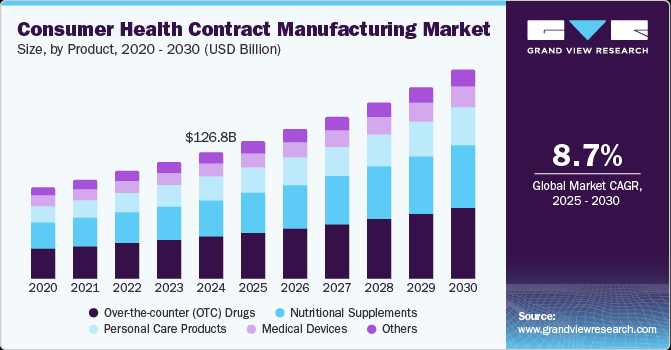

The global consumer health contract manufacturing market size was valued at USD 126.82 billion in 2024 and is expected to grow at a CAGR of 8.72% from 2025 to 2030. The growth is driven by rising demand for cost-efficient production, regulatory compliance, and specialized expertise. Companies increasingly outsource manufacturing to reduce capital investment and enhance scalability. Growing consumer preference for dietary supplements, OTC medications, and personal care products fuels market expansion. Technological advancements, including automation and sustainable practices, improve efficiency and product quality. The rise of e-commerce and direct-to-consumer channels accelerates production flexibility. Additionally, expanding healthcare access in emerging markets and increased focus on self-care and preventive healthcare further drive demand for high-quality contract manufacturing services in the consumer health sector.

Increasing demand for cost-effective and scalable production solutions drives the consumer health contract manufacturing industry. As companies seek to streamline operations and focus on core competencies, outsourcing production to contract manufacturers helps reduce capital investment and enhance efficiency. The rising consumer preference for dietary supplements, over-the-counter (OTC) medications, and personal care products fueled the need for specialized manufacturing capabilities. Additionally, stringent regulatory requirements foster pharmaceutical and consumer health brands to partner with contract manufacturers that offer compliance expertise and advanced quality assurance systems.

Technological advancements and innovation in formulation development also contribute to market growth. Manufacturers are integrating automation, advanced packaging solutions, and sustainable production practices to meet evolving consumer preferences for convenience and eco-friendly products. The increasing penetration of e-commerce and direct-to-consumer (DTC) channels further accelerated demand for flexible and fast production cycles. Moreover, expanding healthcare access in emerging markets and growing awareness of self-care and preventive healthcare continue to drive the need for high-quality contract manufacturing services in the consumer health sector.

Market Opportunities

The industry is expanding due to rising demand for cost-effective, high-quality production solutions. Companies increasingly outsource manufacturing to streamline operations, meet regulatory compliance, and leverage advanced technologies. Key opportunities include the growth of nutraceuticals, sustainable manufacturing, personalized healthcare, and digital transformation. Emerging markets, evolving consumer preferences, and regulatory shifts further accelerate the industry, driving innovation and competitive differentiation.

-

Rising consumer focus on preventive healthcare and wellness fueled demand for vitamins, supplements, and functional foods. Advancements in bioavailability and clean-label formulations enhance market growth. Future impact includes a surge in plant-based and science-backed nutraceutical products.

-

Service providers offering data-driven customization and small-batch production will attract manufacturers focusing on personalized wellness solutions and self-care innovation.

-

Regulatory and consumer-driven sustainability initiatives have been increasing rapidly in recent years. Several service providers adopting eco-friendly production, biodegradable packaging, and carbon-neutral operations will gain market preference and meet future global compliance standards.

-

Growing integration of smart factories, AI-powered quality control, and blockchain traceability to optimize efficiency will likely bolster market demand. Market players leveraging automation and digital integration will enhance operational agility, ensuring faster, transparent, and scalable production for clients.

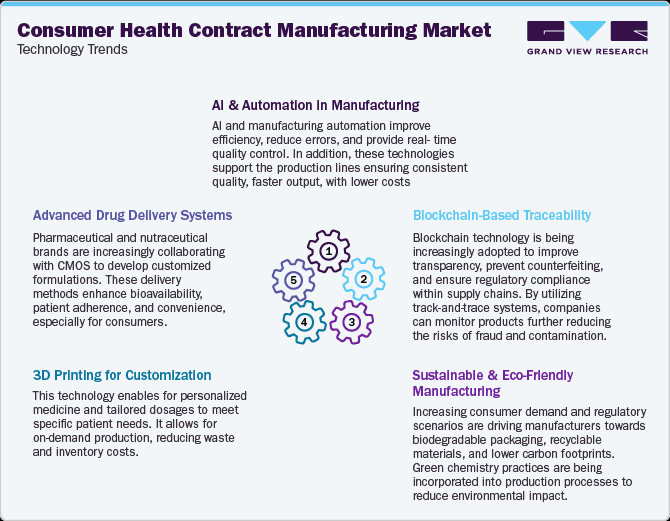

Technology Landscape

The industry is evolving with the integration of advanced technologies and automation. These innovations enhance the efficiency, quality, and scalability of consumer health contract manufacturing throughout production. In addition, Artificial Intelligence (AI) and automation-driven manufacturing, blockchain-based traceability enhance operations, minimize errors, and facilitate real-time quality control. In addition, blockchain-based serialization and track-and-trace solutions enhance supply chain transparency and ensure regulatory compliance. Such factors are anticipated to drive the market. Also, three-dimensional printing is boosting the development of personalized medicine through custom drug formulations while continuous manufacturing processes propel production, further supporting reducing costs. Such technological trends are expected to drive the market.

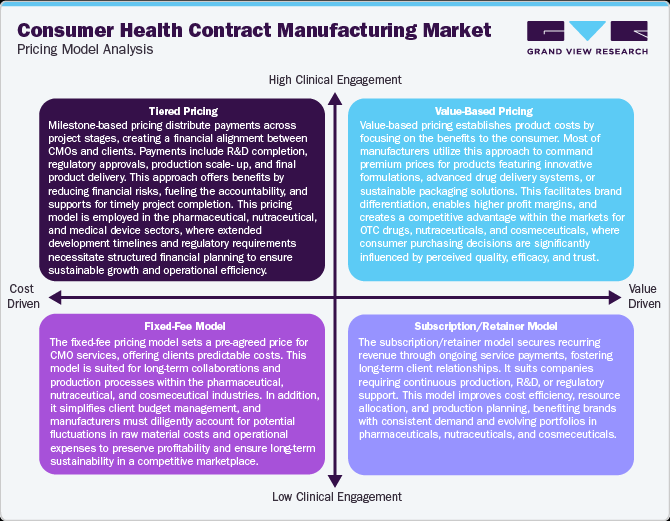

Pricing Model Analysis

The consumer health contract manufacturing market is undertaking numerous pricing models for cost efficiency and profitability. Cost-plus pricing ensures stable margins, while volume-based discounts attract large clients. Fixed contract pricing offers stability; however, it risks cost variability. Moreover, performance-based pricing ties to key metrics like quality and delivery efficiency, promoting high standards. In addition, value-based pricing leverages perceived product value for premium pricing. Raw material costs, regulatory compliance, and market demand influence these models, impacting competitive strategies across the pharmaceutical, nutraceutical, and cosmeceutical sectors.

Market Concentration & Characteristics

The industry growth stage is medium, and growth is accelerating. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansion, and regional expansion.

The industry is experiencing rapid innovation, driven by factors such as AI-powered manufacturing optimization, increased demand for OTC medications, and the development of dosage forms like chewable tablets and dissolvable films. In addition, a strong emphasis on sustainable packaging, personalized medicine, and digital traceability supply chains facilitate innovation.

Stringent global regulatory frameworks, including GMP compliance and adherence to FDA and EMA guidelines, are significantly contributing to the market. Besides, strict quality control, and requirement for clean label formulations, and the advancements in digitized compliance systems led to increased preference for contract manufacturing services in the overall market. Moreover, integration of advanced technologies by CMOs ensuring product safety, transparency, and facilitating global market access.

Most healthcare companies lack the resources and capital for consumer health product development. This has led to rising mergers & acquisitions among CMOs and pharmaceutical & biopharmaceutical, nutraceutical companies, cosmeceutical, and medical device companies to expand their service offerings. Such a factor further enhances the market positively.

The growing trend of outsourcing to achieve cost-effective production of consumer health products is a major driver of market expansion. Strategic collaborations and acquisitions focused on developing innovative health solutions are further contributing to this dynamic.

Market players are expanding their global presence to meet the increasing demands of clients in new markets. This includes establishing manufacturing facilities in emerging economies to capitalize on growing demand and achieve cost advantages, thereby accelerating market growth.

Product Insights

The over-the-counter (OTC) drugs segment captured the largest market share of 33.25% in 2024. The growth of this segment can be primarily attributed to the expanding pharmaceutical industry and the increasing use of OTC drugs among consumers due to rising awareness for self-care and growing convenient accessibility. Besides, increasing disposable income, urbanization, and initiatives promoting self-medication further drive segment growth. Additionally, OTC drugs are fueled by growing requirements for personalized & specialty OTC Medications for targeted solutions like allergy-specific antihistamines and others. These OTC medicines, deemed safe and effective by regulatory bodies like the U.S. FDA, address common, self-treatable health conditions and symptoms, including colds, minor pain, allergies, and other symptoms. Moreover, the availability of OTC through online and offline platforms has increased accessibility, further creating a rising demand for consumer health contract manufacturing services.

The nutritional supplements segment is expected to grow at a CAGR of 9.35% over the forecast period. This growth is fueled by increasing consumer preference for nutritional supplements to address diverse dietary, physical, and mental health needs. Besides, rising disposable incomes and a growing aging population contribute to the segment growth. Moreover, an increasing consumer focus on mental and emotional well-being is further propelling the requirement for nutritional supplements as individuals increasingly prioritize proactive health management, which has led to a rise in the need for various dietary supplements as these have become integral to daily routines. Such factors are expected to drive the market growth over the estimated period.

Service Insights

The API manufacturing segment dominated the market in 2024, driven by rising demand for high-quality, cost-effective drug components. Contract manufacturers provide specialized expertise, regulatory compliance, and scalable production, enabling pharmaceutical companies to focus on core competencies. Increasing outsourcing trends, stringent quality standards, and expanding generic and OTC drug markets further fuel growth. In addition, adopting outsourcing for development and manufacturing as a cost-effective strategy further drives market expansion. Moreover, the cost-efficiency of these services for various production scales significantly contributes to the segment's growth.

The packaging & labeling segment is expected to grow at a significant CAGR during the forecast period. The increasing integration of advanced technologies in consumer health product manufacturing propels this expansion. Contract manufacturing services also contribute by offering streamlined packaging and labeling processes, resulting in cost efficiencies and enhanced operational effectiveness. Moreover, the trend towards serialization and functional labeling in consumer health further addresses the requirements of the end-use companies, from fulfilling labeling requirements to developing useful packaging enhancements, which drives segment growth.

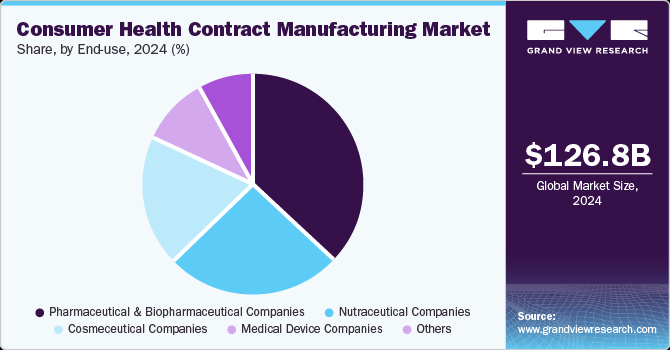

End Use Insights

The pharmaceutical & biopharmaceutical companies segment dominated the market with the largest revenue share in 2024. The segment's growth is majorly due to increasing preference for contract manufacturing organizations (CMOs) due to the presence of advanced manufacturing processes and technology and increased production of customized pharmaceuticals, including specialty OTC drugs and nutraceuticals, to cater to the diverse needs of consumers. Moreover, the growing focus on innovative formulations for consumer health drives market growth. In addition, outsourcing companies such as CMOs support pharmaceutical & biopharmaceutical companies to meet their production needs, further minimizing production costs.

Moreover, nutraceutical companies' segments are anticipated to witness the fastest growth during the forecast period. Nutraceuticals are increasingly in demand among consumers as these products provide health benefits beyond essential nutrition. Most nutraceutical companies offer various vitamins and mineral supplements, dietary supplements, functional foods, and herbal products that promote overall well-being and prevent diseases, further contributing to market growth. Besides, increasing consumer health consciousness, changing lifestyles, and rising demand for various nutritional products are expected to drive the market over the estimated period.

Regional Insights

North America consumer health contract manufacturing market accounted for the largest share of 33.54% in 2024 due to the strong presence of CMOs and growing innovations for consumer health products such as OTC drugs, personal care products, and nutritional products. In addition, many end-use companies have shifted their focus to contract manufacturers to efficiently handle the increasing volume of product categories. Besides, the rising emphasis on personal care practices among populations is the primary factor for market growth. Furthermore, the presence of various distribution platform chains for products is another factor driving the market across the region. This has led to rising demand for the consumer health contract manufacturing market.

U.S. Consumer Health Contract Manufacturing Market Trends

The consumer health contract manufacturing market in the U.S. is driven by the strong presence of pharmaceutical and biopharmaceutical companies, increasing drug approvals, and rising demand for cost-effective sales solutions. The growing outsourcing trend among pharma firms to optimize commercial operations and reduce overhead costs has further fueled market expansion. Increased demand for OTC medicine, emerging R&D activities, and continuous innovation of personal care products and nutritional supplements among companies drive market growth. These factors are expected to provide new growth opportunities for the market.

Europe Consumer Health Contract Manufacturing Market Trends

The consumer health contract manufacturing market in Europeis experiencing growth due to the increasing prevalence of diseases, rising adoption of outsourcing services such as CMOs for consumer health product manufacturing, growing focus on stringent regulatory requirements, and emerging R&D activities. In addition, CMOs allow end-user companies to focus on core activities and further reduce costs and operational efficiency, leading to a greater reliance on CMOs for product commercialization.

The UK consumer health contract manufacturing market is anticipated to grow significantly over the forecast period. The country's market growth is due to its expanding healthcare sectors and rising emphasis on high-technology-oriented manufacturing processes. With a strong focus on outsourcing sales operations, most end-use companies in the UK are leveraging sales to enhance market reach, strengthen engagement with the consumer, and further support their lifestyle improvement.

The consumer health contract manufacturing market in Germany held a significant share in 2024. The country's growth is due to its strong focus on cost efficiency. Regulatory compliance drives companies to collaborate with contract manufacturers for market access, sales optimization, and consumer engagement. Moreover, growing interest in new and innovative natural ingredients-based nutritional products, OTC drugs, and personal care products drives the market growth.

Asia Pacific Consumer Health Contract Manufacturing Market Trends

The consumer health contract manufacturing market in Asia Pacificis projected to grow at the fastest CAGR over the forecast period. The market's growth is due to rising healthcare expenditures and numerous opportunities in countries like Japan, China, and India. Moreover, rapid expansion of the end-use industries, increasing demand for various consumer health products, and rising demand for cost-effective products drive the market growth. In addition, growing healthcare investments, the presence of an established market, and a surge in product demand accelerate the market growth.

China consumer health contract manufacturing market is expected to grow over the forecast period. Rising investments in the consumer healthcare industry and growing demand for various OTC drugs, nutritional supplements, and personal care products drive market growth. Moreover, growing strategic initiatives further contribute to market growth.

The consumer health contract manufacturing market in Japan is witnessing significant growth over the forecast period. The market's growth is due to the increasing availability of new drugs, the presence of developed CMOs in the country, and expanding consumer health product requirements, leading to emerging product launches. Moreover, the rapidly aging population and a growing prevalence of chronic diseases further contribute to market growth.

India consumer health contract manufacturing market is witnessing considerable growth due to increased focus on health and wellness, growing demand for various OTC drugs, and rising need for nutritional supplements among the aging population and emerging middle-class and consumer needs drive the Indian market growth for consumer health contract manufacturing market. Besides, a growing focus on healthy lifestyles and the increasing availability of consumer products support appropriate self-diagnosis and self-treatment. Such factors are anticipated to drive the market growth.

Key Consumer Health Contract Manufacturing Company Insights

Key market players are undertaking various strategic initiatives, such as partnerships, collaborations, mergers & acquisitions, and service expansions to strengthen their service portfolio and provide a competitive advantage. For instance, in August 2024,Aenova announced the development of a new gummy production line at its Romania facility. With the rising popularity of gummies as a preferred dosage form for food supplements and pharmaceuticals, the company plans to launch the line by the end of 2024. The new line is projected to have an annual production capacity of approximately one billion gummies.

Key Consumer Health Contract Manufacturing Companies:

The following are the leading companies in the consumer health contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Recipharm AB

- Piramal Consumer Products

- Scapa Healthcare

- Catalent, Inc

- SCN BestCo

- Aenova Group

- Ventiz Healthcare

- Bionova

- Aurohealth

- Siegrified AG

- Thermo Fisher Scientific Inc

- Famar

- Sirio Pharma Co., Ltd

- Tishcon Corporation

- Vit-Best Nutrition Inc

Recent Developments

-

In April 2024, Recipharm announced its plans to sell seven European manufacturing and development sites specializing in semi-solid dosages to Blue Wolf Capital. The sell-encompassing facilities in Spain, France, and Sweden further support the company’s strategic shift toward expanding its biological production capabilities. Blue Wolf Capital will likely form a new CDMO company with these sites.In November 2024, Pharmaceutics International, Inc. (PII) announced an investment of USD 3.6 million to expand its prefilled syringe (PFS) services, focusing on advanced labeling, automated visual inspection, and fill-finish technology. Such investments have expanded the company’s operational capabilities in the significant market.

-

In June 2023, Biopharma Group acquired the U.S. Pharma Lab, a contract manufacturer specializing in the custom development, manufacture, & distribution of nutraceutical products, including vitamins, probiotics, and minerals. The acquisition strengthened the company’s service offerings in the market.

Consumer Health Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 137.71 billion

Revenue forecast in 2030

USD 209.22 billion

Growth rate

CAGR of 8.72% from 2025 to 2030

Historical Year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Lonza, Recipharm AB; Piramal Consumer Products; Scapa Healthcare; Catalent, Inc; SCN BestCo; Aenova Group; Ventiz Healthcare; Bionova, Aurohealth; Siegfried AG; Thermo Fisher Scientific Inc; Famar; Sirio Pharma Co., Ltd; Tishcon Corporation; Vit-Best Nutrition Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Consumer Health Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global consumer health contract manufacturing market report based on product, service, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Over-the-counter (OTC) Drugs

-

Nutritional Supplements

-

Personal Care Products

-

Medical Devices

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

API Manufacturing

-

Finished Dose Manufacturing

-

Medical Device Manufacturing

-

Packaging & Labelling

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Nutraceutical Companies

-

Cosmeceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global consumer health contract manufacturing market size was estimated at USD 126.82 billion in 2024 and is expected to reach USD 137.71 billion in 2025.

b. The global consumer health contract manufacturing market is expected to grow at a compound annual growth rate of 8.72% from 2025 to 2030 to reach USD 209.22 billion by 2030.

b. North America dominated the consumer health contract manufacturing market, with a share of 33.54% in 2024. This is attributable to the strong presence of CMOs and increasing demand for outsourcing services in the region, growing innovations in consumer health products, growing emphasis on personal care practices and self-care, rising stringent regulatory framework.

b. Some key consumer health contract manufacturing market players are Lonza, Recipharm AB, Piramal Consumer Products, Scapa Healthcare, Catalent, Inc, SCN BestCo, Aenova Group, Ventiz Healthcare, Bionova, Aurohealth, Siegrified AG, Thermo Fisher Scientific Inc, Famar, Sirio Pharma Co., Ltd, Tishcon Corporation, and Vit-Best Nutrition Inc among others

b. Key factors driving the consumer health contract manufacturing market growth are the rising demand for self-care & preventive healthcare, stringent regulatory requirements & compliance, and growing technological advancements & automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.