- Home

- »

- Next Generation Technologies

- »

-

Consumer IoT Market Size & Share, Industry Report, 2033GVR Report cover

![Consumer IoT Market Size, Share & Trends Report]()

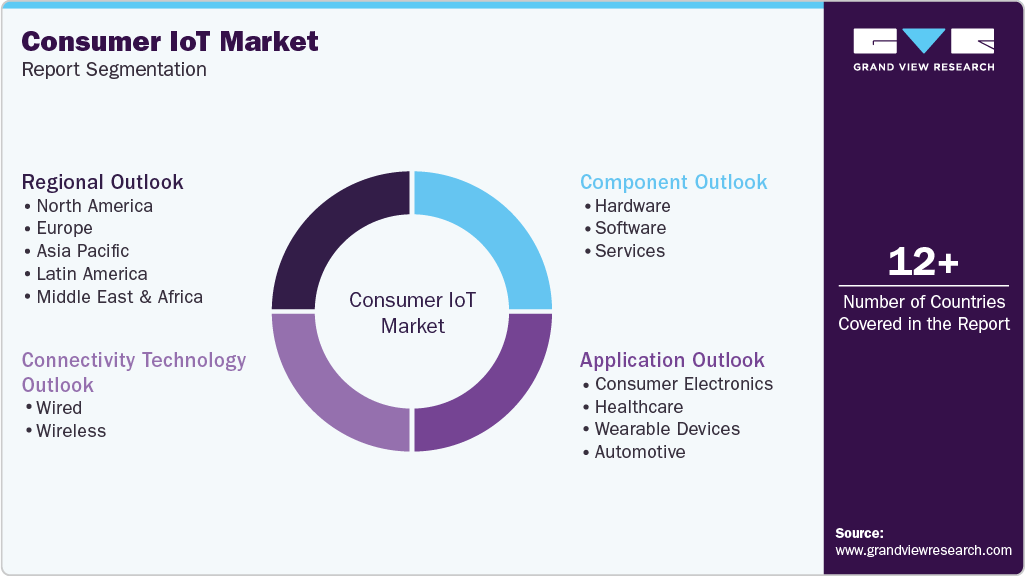

Consumer IoT Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Connectivity Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-020-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Consumer IoT Market Summary

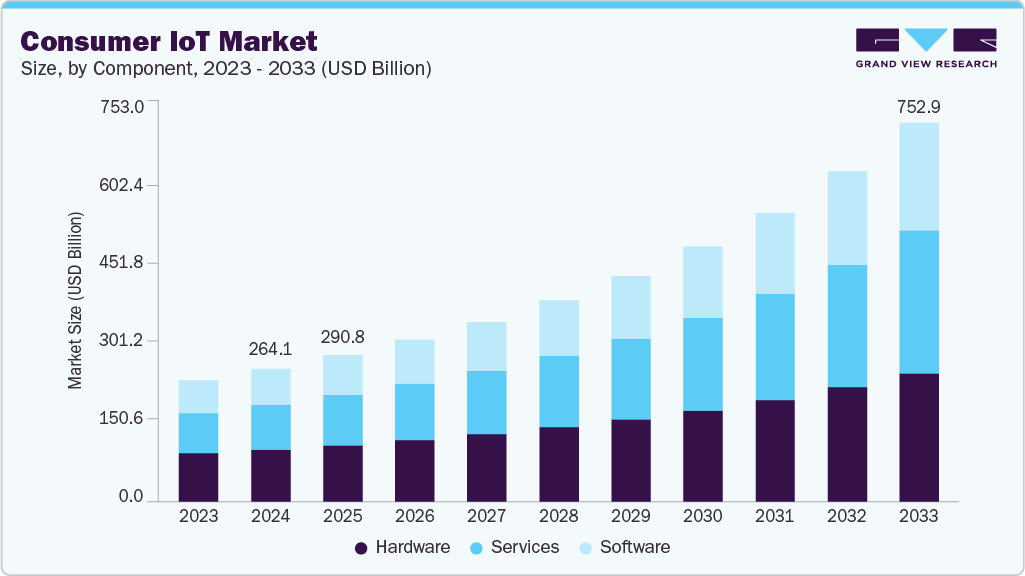

The global consumer IoT market size was estimated at USD 264.14 billion in 2024 and is projected to reach USD 752.96 billion by 2033, growing at a CAGR of 12.6% from 2025 to 2033. This market expansion is driven by the growing proliferation of interconnected devices designed for home, health, mobility, and entertainment applications.

Key Market Trends & Insights

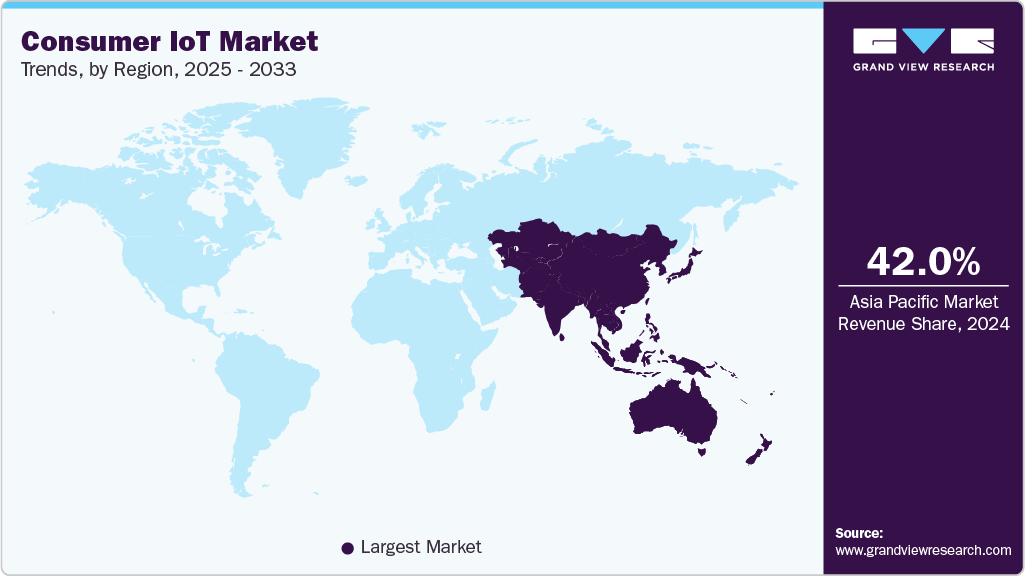

- Asia Pacific dominated the global consumer IoT market with the largest revenue share of 42.0% in 2024.

- The consumer IoT market in China accounted for the largest market revenue share in the Asia Pacific in 2024.

- By component, the hardware segment led the market with the largest revenue share of 37.67% in 2024.

- By connectivity technology, the wireless segment led the market with the largest revenue share of 54.16% in 2024.

- By application, the consumer electronics segment led the market with the largest revenue share of 36.53% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 264.14 Billion

- 2033 Projected Market Size: USD 752.96 Billion

- CAGR (2025-2033): 12.6%

- Asia Pacific: Largest market in 2024

Consumers integrate connected technologies into daily life, and the emphasis is shifting from isolated smart products toward holistic, interoperable ecosystems that enhance convenience, efficiency, and real-time decision-making across multiple contexts. Modern consumer IoT growth is accelerated by the convergence of edge computing, low-power microelectronics, and AI-based analytics that extend device intelligence beyond basic automation. This evolution allows for adaptive learning, predictive maintenance, and hyper-personalized interactions, redefining user expectations around seamless experience and autonomy. The integration of generative AI technologies further amplifies these transformations, turning traditional devices into interactive digital companions capable of understanding and anticipating user behavior. Digital ecosystems are becoming increasingly context-aware, responsive, and embedded across the consumer lifestyle spectrum.The growing demand for seamless, always-on connectivity among consumer devices is significantly fueling the market growth. Connectivity platforms supporting real-time data exchange, such as wearables, smart home appliances, health monitors, and entertainment systems, enable devices to communicate, coordinate, and adapt to user behavior. This ecosystem of interconnected devices helps consumers gain new value through automation, personalized experiences, and unified control, thereby accelerating adoption in the consumer segment.

In addition, rising consumer expectations for convenience, automation, and context-aware experiences are becoming key growth drivers. As users demand that devices anticipate needs, whether adjusting lighting and temperature, tailoring media preferences, or managing energy usage, manufacturers are embedding sensors, AI, and connectivity into everyday products. The need for smooth interoperability across devices and platforms pushes companies to invest in robust connectivity infrastructure, software frameworks, and ecosystem partnerships.

Moreover, evolving regulatory mandates and privacy/security standards are pushing for the stronger adoption of the consumer IoT industry. Governments and industry bodies demand that devices support data protection, firmware security, and transparency in data handling. Platforms that enable automated alerts, firmware updates, secure provisioning, and anomaly detection help manufacturers and users comply with regulations, thereby reducing user risk and building trust in connected consumer IoT ecosystems.

Furthermore, the proliferation of smart homes, voice assistants, and ambient intelligence is generating strong demand for the integrated consumer IoT industry. Devices such as smart speakers, locks, home energy systems, and appliances become part of a unified ecosystem, and consumers benefit from cross-device control, predictive automation, and enhanced analytics. These capabilities promote stickiness in the consumer IoT industry, as devices become more valuable in aggregate than alone.

Component Insights

The hardware segment led the market with the largest revenue share of 37.67% in 2024, driven by the surging demand for advanced connected devices such as smart sensors, wearables, home automation systems, and connected appliances. Increasing component miniaturization, advancements in semiconductor technology, and falling sensor and chipset costs enable mass adoption across households and consumer electronics. Consumers increasingly seek reliable, high-performance devices that deliver seamless connectivity and automation. The hardware segment will continue to serve as the backbone of growth in the consumer IoT industry.

The services segment is expected to witness at the fastest CAGR of 14% from 2025 to 2033. This growth is attributed to the rising adoption of cloud-based platforms, AI-driven analytics, and edge computing solutions, which are fueling demand for managed and professional services that ensure device interoperability, real-time insights, and secure data flow. Expanding smart home ecosystems, wearable health monitoring, and connected mobility solutions necessitate ongoing maintenance and leveraging digital twin technology and predictive analytics. As consumer IoT devices become more complex, the services segment will play a pivotal role in sustaining reliability, security, and customer satisfaction across the global market.

Connectivity Technology Insights

The wireless segment accounted for the largest market revenue share in 2024, owing to the greater scalability offered by these networks. They do not require hardware installations and can be extended easily without considering the facility's obstructions. Most wireless sensors comprise nodes that can be extended by adding extra nodes whenever required. They are more cost-effective as their prices have reduced due to the ongoing advancements in wireless technology and an increasing number of manufacturers. This combination of reliability, performance, and cost-effectiveness continues to drive this segment's dominance in the consumer IoT industry.

The wired segment is expected to witness at the fastest CAGR from 2025 to 2033. The steady pace drives this growth, as this connectivity mode is still very popular among consumers. The wired network typically employs Ethernet, making it highly reliable. They are less likely to observe dropped connections. They offer greater data transmission speed as they are not affected by the distance and placement of devices. In addition, wired networks are more secure as they are deployed with a LAN firewall, further propelling the segment’s expansion in the market.

Application Insights

The consumer electronics segment accounted for the largest market revenue share in 2024, owing to the increasing consumer inclination toward incorporating smart consumer electronics devices in residential spaces. The advent of technologies, such as sensors, digital assistants, advanced networking, and cloud computing, has made home automation possible in day-to-day life using electronic equipment, thereby increasing the segmental growth in the consumer IoT industry.

The wearable segment is expected to witness at the fastest CAGR from 2025 to 2033. The growth is driven by increased internet penetration, rising disposable incomes, and lower average selling prices. Wearable devices provide several benefits for healthcare providers and patients, as they help with glucose monitoring, hand hygiene monitoring, heart rate monitoring, disease monitoring, and depression monitoring. Thus, the rising adoption of wearable consumer IoT devices for health monitoring is expected to create lucrative growth opportunities for the market.

Regional Insights

The consumer IoT market in North America is anticipated to grow at a significant CAGR during the forecast period, primarily driven by the rising health consciousness and increasing adoption of wearable fitness tracking devices. Growing consumer interest in leveraging fitness technology to improve lifestyle and access health-related benefits is fueling market growth. The expanding integration of smart home solutions is accelerating regional demand, supported by the broader trend toward connected lifestyle products and personalized health management.

U.S. Consumer IoT Market Trends

The consumer IoT market in the U.S. accounted for the largest market revenue share of 69% in 2024. Rising concerns over health & wellness, especially following pandemic learnings, are pushing demand for remote health monitoring, fitness trackers, and connected health devices. Expanding 5G rollout across urban and suburban zones lowers latency and boosts device reliability, making real-time applications more viable. Growing regulatory attention to device security builds consumer trust, encouraging purchase. Rising interest in sustainability among U.S. consumers leads to greater demand for energy-efficient IoT devices, home energy monitoring, and products that help reduce power use in the consumer IoT industry.

Europe Consumer IoT Market Trends

The consumer IoT market in Europe is expected to grow at a substantial CAGR of 13% from 2025 to 2033. In Europe, the market is driven by strong public policy support for digital transformation, energy efficiency, and sustainability. Countries across the region are enacting stricter regulations around energy consumption and e-waste, pushing manufacturers to develop greener, more efficient connected devices. Smart home adoption is rising, where consumers demand both comfort and efficiency. Integrating smart city projects and renewable energy initiatives creates cross-sector demand for IoT that synchronizes with infrastructure.

The UK consumer IoT market is expected to grow at a significant CAGR during the forecast period. The country focuses on increasing uptake of smart home security systems, voice assistants, and connected entertainment, partly driven by consumers’ desire for convenience and digital leisure. The UK government’s focus on smart city programs, clean energy, and carbon reduction targets encourages the adoption of consumer IoT industry for monitoring emissions and improving transportation systems. Regulatory emphasis on cybersecurity and consumer safety is updating capabilities and providing reliable after-sales support.

The consumer IoT market in Germany is growing strong, particularly where it intersects with Industry 4.0 and industrial-consumer crossover applications. High domestic manufacturing strength means IoT innovations in connected appliances, smart vehicles, and automation are more easily developed. Consumers highly value durability, data privacy, and security, so devices with strong privacy protections and firmware update support gain a competitive advantage. The push for energy efficiency in homes and industry drives smart thermostats, energy monitoring, and connected lighting uptake. The proliferation of 5G and edge-computing infrastructure in Germany supports lower-latency services that enable more responsive and interconnected consumer experiences for the market.

Asia Pacific Consumer IoT Market Trends

Asia Pacific dominated the consumer IoT market with the largest revenue share of 42.0% in 2024, fueled by large populations, rising incomes, and rapid urbanization. Device costs are falling, making IoT more accessible even in lower and middle-income segments. Increasing mobile & broadband network coverage enables more use of real-time applications, video streaming, and connected media. Environmental concerns and energy costs push consumers and governments to favor energy-efficient devices and systems that strengthen the market’s growth trajectory across the region.

The consumer IoT market in Japan is gaining momentum, driven by its advanced manufacturing base, strong robotics tradition, and aging population. Demand for solutions that assist aging in place is rising from consumers and governmental/social welfare programs. Japanese consumers expect high quality, reliability, minimal latency, and strong security; thus, devices that deliver superior performance, seamless integration, and long life are preferred. The supply side also benefits from deep R&D and innovation, enabling rapid deployment of advanced sensors, edge computing, and localized AI features.

The China consumer IoT market is rapidly expanding. The dual influence of government policy and strong local manufacturing & supply chains is driving the consumer IoT industry. Smart manufacturing, logistics, and large smart city pilots create ecosystems where consumer IoT devices can interoperate with larger connected infrastructure. High mobile & internet penetration, plus strong 5G/edge infrastructure, allows services with richer content to flourish. Environmental regulation and consumer awareness also push for devices that are energy efficient and offer recyclability and sustainability for the market.

Key Consumer IoT Company Insights

Some of the key players operating in the market include Amazon.com, Inc. and Apple Inc. among others.

-

Amazon.com, Inc. is leveraging its expansive ecosystem of connected devices, cloud infrastructure, and AI technologies to strengthen its dominance in the consumer IoT industry. Amazon integrates seamless voice control, automation, and personalized experiences across households through its Alexa-enabled smart home devices, Ring security systems, and Fire TV products. The company’s continuous investment in cloud computing (AWS IoT Core), edge AI, interoperability standards, and user convenience. Combining hardware innovation with powerful cloud analytics, Amazon continues to shape the evolution of the global consumer IoT industry.

-

Apple Inc. maintains a leading position in the consumer IoT industry through its tightly integrated ecosystem of hardware, software, and services. The company’s HomeKit platform, Apple Watch, AirTag, and HealthKit services exemplify its focus on privacy-centric, user-friendly connected experiences. Apple’s emphasis on secure device communication, on-device AI processing, and advanced health monitoring features positions it as a benchmark for reliability and innovation in IoT. Strategic investments in augmented reality, spatial computing, and next-generation wearable technologies are further solidifying Apple’s influence in the rapidly expanding consumer IoT industry.

Huawei Technologies Co., Ltd. and Schneider Electric are some of the emerging market participants in the consumer IoT industry.

-

Huawei Technologies Co., Ltd. is an emerging player rapidly expanding its footprint through its HarmonyOS ecosystem and diverse range of connected devices. The company’s focus on interoperability, AI-powered automation, and smart home solutions has positioned it as a strong competitor in the Asia-Pacific consumer IoT space. Huawei’s continuous investment in 5G infrastructure, edge computing, and AI integration enhances user connectivity and cross-platform experiences, driving its growth trajectory in the consumer IoT industry.

-

Schneider Electric is emerging as a key player in the consumer IoT industry, emphasizing energy-efficient and sustainable connected solutions. Through its Wiser smart home ecosystem, Schneider Electric provides real-time energy monitoring, home automation, and control systems designed to optimize energy consumption and improve household safety. The company’s commitment to sustainability, coupled with its expertise in IoT-enabled energy management and smart grid integration, is helping it gain traction among eco-conscious consumers and smart city developers worldwide.

Key Consumer IoT Companies:

The following are the leading companies in the consumer IoT market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Apple Inc.

- AT&T

- Microsoft

- Cisco Systems, Inc.

- Honeywell International Inc.

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Intel Corporation

- Schneider Electric

- Huawei Technologies Co., Ltd.

Recent Developments

-

In October 2025, Apple introduced the M5-powered iPad Pro featuring integrated support for the Thread smart home protocol, marking the first iPad model to include this connectivity standard officially. This advancement enhances the Consumer IoT industry by facilitating seamless integration and communication with smart home devices. This strategic move signals Apple’s renewed focus on expanding smart home roles for its devices, potentially reviving the iPad’s function as a central home hub in future smart environments.

-

In September 2025, Huawei unveiled its latest Consumer IoT products, including the HUAWEI WATCH GT 6 Series, WATCH Ultimate 2, and WATCH D2. These wearables feature advanced health and fitness monitoring capabilities, such as the new TruSense system offering precise outdoor positioning and extensive workout mode enhancements, including cycling, trail running, golf, and skiing. These innovation-driven devices blend cutting-edge technology with stylish design, driving market growth.

-

In September 2025, Cisco Systems, Inc. and Tata Communications announced a collaboration to integrate Tata’s MOVE eSIM orchestration into Cisco’s IoT Control Center, enabling global IoT device connectivity management and seamless network deployment. This collaboration accelerates digital transformation and supports the growing demand for connected devices across diverse industries, strengthening Cisco’s market position in the Consumer IoT industry.

Consumer IoT Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 290.83 billion

Revenue forecast in 2033

USD 752.96 billion

Growth rate

CAGR of 12.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Amazon.com, Inc.; Apple Inc.; AT&T; Microsoft; Cisco Systems, Inc.; Honeywell International Inc.; IBM Corporation; Samsung Electronics Co., Ltd.; Sony Corporation; Intel Corporation; Schneider Electric; Huawei Technologies Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Consumer IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global consumer IoT market report based on component, connectivity technology, application, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Processor

-

Sensors

-

Temperature

-

Pressure

-

ECG

-

Accelerometers

-

Inertial Measurement Unit

-

Humidity

-

Light

-

Camera Modules

-

Others (Magnetic, Motion & Position, etc.)

-

-

Memory Devices

-

Logic Devices

-

-

Software

-

Data Management

-

Security

-

Real-time Streaming Management

-

Remote Monitoring

-

Network Management

-

Others (Application Management, Device Management)

-

-

Services

-

Professional Services

-

Consulting Services

-

Implementation Services

-

Support & Maintenance

-

-

Managed Services

-

-

-

Connectivity Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Wired

-

Wireless

-

Bluetooth

-

Zigbee

-

Wi-Fi

-

NFC

-

ANT+

-

Others (BLE, WLAN, GNSS)

-

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer Electronics

-

Lighting

-

Washing Machine

-

Dishwasher

-

TV

-

Others (Dryer, Oven, Cooktop, Kettle, etc.)

-

-

Healthcare

-

Blood Pressure Monitor

-

Fitness & Heartrate Monitor

-

Pulse Oximeter

-

Blood Glucose Meter

-

Others (Programmable Syringe Pump, Fall Detector, etc.)

-

-

Wearable Devices

-

Smart Watch

-

Smart Glasses

-

Body-worn Cameras

-

Fitness Tracker

-

Others (AI Hearing Aids, VR Headsets, etc.)

-

-

Automotive

-

Connected Cars

-

In-car Infotainment

-

Traffic Management

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer IoT market was estimated at USD 264.14 billion in 2024 and is expected to reach USD 290.83 billion in 2025.

b. The global consumer IoT market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2033 and to reach USD 752.96 billion by 2033.

b. The Asia Pacific dominated the consumer IoT market with a share of over 42% in 2024, fueled by large populations, rising incomes, and rapid urbanization. Device costs are falling, making IoT more accessible even in lower and middle-income segments. Increasing mobile & broadband network coverage enables more use of real-time applications, video streaming, and connected media. Environmental concerns and energy costs push consumers and governments to favor energy-efficient devices and systems that strengthen the market’s growth trajectory across the region.

b. The key players in the consumer IoT market are Amazon.com, Inc., Apple Inc., AT&T, Microsoft, Cisco Systems, Inc., Honeywell International Inc., IBM Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Intel Corporation, Schneider Electric, Huawei Technologies Co., Ltd.

b. Key drivers of the consumer IoT market include the growing proliferation of interconnected devices designed for home, health, mobility, and entertainment applications. Consumers integrate connected technologies into daily life, and the emphasis is shifting from isolated smart products toward holistic, interoperable ecosystems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.