- Home

- »

- Next Generation Technologies

- »

-

Container Handling Equipment Market Size Report, 2030GVR Report cover

![Container Handling Equipment Market Size, Share & Trends Report]()

Container Handling Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment Type (Stacking Cranes, Mobile Harbor Cranes), By Propulsion Type, By Lifting Capacity, By Handling Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-602-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Container Handling Equipment Market Summary

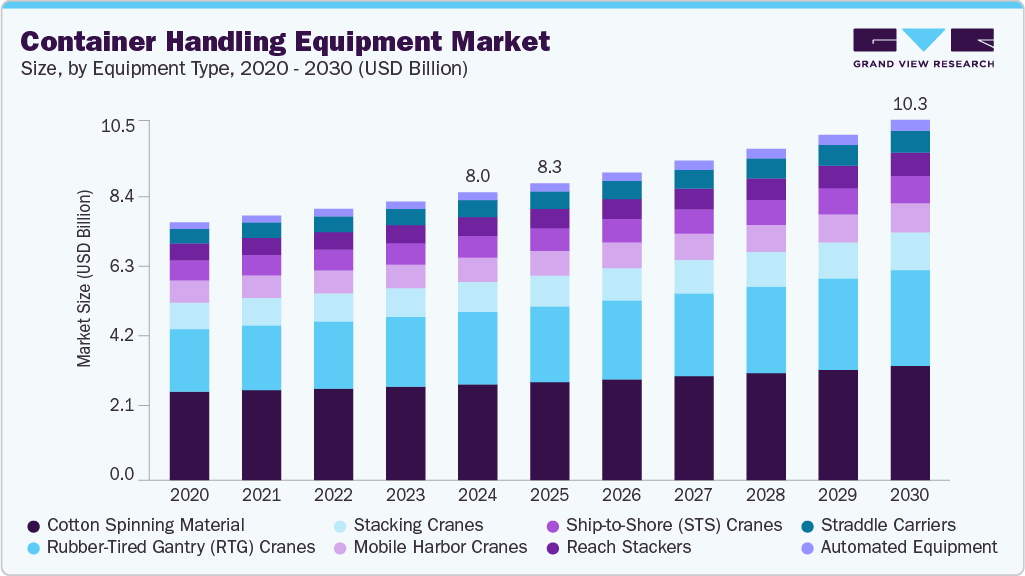

The global container handling equipment market size was estimated at USD 8.03 billion in 2024, and is projected to reach USD 10.31 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. Terminal automation, encompassing the full or partial substitution of manned operations with automated equipment and processes, has emerged as a significant trend in the global container handling equipment market.

Key Market Trends & Insights

- North America container handling equipment market accounted for a 25.3% share of the overall market in 2024.

- The container handling equipment industry in the U.S. held a dominant position in 2024.

- By equipment type, the forklift trucks segment accounted for the largest share of 32.8% in 2024.

- By propulsion type, the diesel segment held the largest market share in 2024.

- By lifting capacity, the > 100 Tons segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.03 Billion

- 2030 Projected Market Size: USD 10.31 Billion

- CAGR (2025-2030): 4.4%

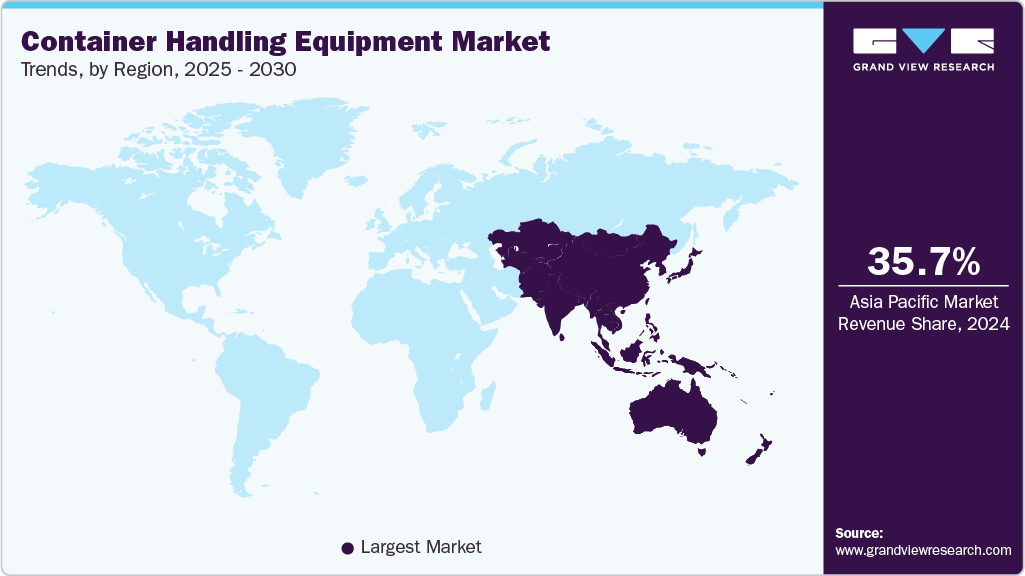

- Asia Pacific: Largest market in 2024

According to recent research published by PubMed Central, only 3% of the world's container terminals were found to be either fully or semi-automated, indicating substantial growth potential in this segment. The real acceleration of container terminal automation has occurred in the last decade, with 47 terminals being automated between 2012 and 2021, compared to a very gradual uptake in the 1990s and 2000s. This trend continues to gain momentum with recent developments such as the announcement in early 2022 of a new semi-automated container terminal in Busan that will eventually handle more than 2 million TEU with three berths. Terminal automation is driven by the need for operations standardization, reduction in manning, increased handling capacity, and productivity improvements, making it an increasingly attractive option for port operators despite the significant capital investment required.Automated Guided Vehicles (AGVs) have become highly valued components of port operations due to their ability to autonomously perform braking, turning, navigation, and handling tasks without human intervention. The evolution of AGV technology represents a critical trend in the container handling equipment market, with continuous improvements in navigation algorithms enhancing operational efficiency. Recent research indicates significant advancements in path planning algorithms specifically designed for port environments, addressing the unique challenges posed by the abundance and arrangement of obstacles in container terminals. Innovations such as improved hybrid algorithms based on key obstacles for JPS and DWA algorithms have demonstrated significant enhancements in navigation time, reduction in the number of turns, and decreased collisions with unknown obstacles.

These technological improvements are particularly important given the complexity of port environments where obstacles vary in shape with complex arrangements and frequently changing positions due to constant cargo movement. As ports continue to invest in automation, the demand for more sophisticated AGVs with enhanced navigation capabilities represents a significant growth driver in the container handling equipment market.

Environmental considerations are increasingly influencing the global container handling equipment market, with ports and terminal operators seeking greener technologies to reduce their carbon footprint. A notable development in this direction is the evolution of AGVs from the first generation, powered by diesel-hydraulic engines, to the latest generation guided by GPS technology and powered by batteries. These newer models offer significant environmental benefits, including zero CO2 emissions and reduced noise pollution, while maintaining operational capabilities with speeds reaching up to 6 meters per second. The Rotterdam APMT terminal exemplifies this trend by employing 'lift AGVs' that combine container lifting capabilities with environmentally friendly operation. As environmental regulations become more stringent worldwide and ports face increasing pressure to reduce their environmental impact, the demand for eco-friendly container handling equipment is expected to grow substantially, driving innovation and market expansion in this segment. This trend aligns with broader sustainability initiatives across the maritime and port sectors, making environmental performance a key differentiator in the equipment market.

Modern container terminals rely on advanced information technologies to optimize their operations, representing another significant trend in the container handling equipment market. Advanced terminal operating systems (TOSs) are now standard in most terminals, controlling and optimizing the movement and storage of containers throughout the facility. These systems are complemented by technologies such as RFID, optical character recognition (OCR), and anti-sway systems in cranes, which enhance operational precision and efficiency. The automation of gate functions through automated truck gates represents another area where information technology is transforming container handling operations.

The integration of these technologies with equipment creates intelligent systems capable of optimizing container movements, reducing waiting times, and improving overall terminal throughput. As data becomes increasingly valuable in port operations, the demand for container handling equipment with enhanced connectivity and information processing capabilities continues to grow. This trend is further reinforced by ongoing research into improved algorithms for equipment coordination, as evidenced by studies on reducing the probability of path conflicts between multiple AGVs in port environments.

A critical trend influencing the global container handling equipment market is the increased focus on return on investment (ROI) and operational efficiency in terminal operations. Research indicates that terminal operators and investors carefully analyze the time required to realize returns on automation investments before committing resources to new equipment. This financial prudence is driving demand for equipment that can demonstrate clear operational benefits and cost savings over its lifecycle. The market is responding with innovations that enhance productivity while reducing labor costs, such as remotely operated ship-to-shore cranes that, while still manned, require operators with different skill sets and potentially lower pay scales compared to traditional crane operators. Additionally, semi-automated solutions that focus on specific high-return aspects of terminal operations, such as automating vertical movement of containers in the yard, provide options for terminals seeking incremental improvements without full automation. Ports globally are pursuing both greenfield and brownfield automation projects, primarily focusing on yard operations, including stacking cranes and horizontal transportation, indicating a strategic approach to modernization that prioritizes areas with the highest potential efficiency gains.

Equipment Type Insights

The forklift trucks segment accounted for the largest share of 32.8% in 2024. Forklift trucks remain the backbone of mid-scale container handling operations, especially in emerging economies where full-scale automation is still cost-prohibitive. Their versatility in loading, unloading, and stacking at smaller ports and inland container depots has kept demand steady. However, the rise of electric forklifts, capable of longer operating cycles with minimal emissions, is reshaping buying preferences. In North America and parts of Europe, regulatory pressure for emission reduction has accelerated this transition, particularly among second-tier ports.

The automated equipment segment is projected to grow at the fastest CAGR over the forecast period, driven by port modernization and the demand for 24/7 operations. Port terminals in developed economies, such as the Port of Rotterdam and the Port of Los Angeles, are shifting toward unmanned guided vehicles and stacker cranes to boost throughput efficiency. While upfront capital investment is high, the long-term gains in operational efficiency, safety, and labor cost reduction are driving its adoption in tier-one ports globally. Asia-Pacific is fast catching up, with China and Singapore leading the way in adopting autonomous port operations.

Propulsion Type Insights

The diesel segment held the largest market share in 2024. Despite the global push for greener port operations, diesel-powered container handling equipment still accounts for the largest share of the market, especially in regions with underdeveloped electrification infrastructure. Diesel’s reliability, long operational range, and ability to handle high-capacity workloads make it a staple in high-volume port activities, particularly in developing countries where energy infrastructure is lagging.

The electric segment is projected to grow at the fastest CAGR over the forecast period, fueled by global decarbonization efforts and incentives for low-emission port technologies. Scandinavian ports, parts of California, and pilot projects in India are experimenting with battery-electric and hybrid container handlers. Recent advancements in lithium-ion battery life and charging infrastructure have significantly improved uptime, making electric models increasingly viable even for high-load scenarios. Manufacturers are now designing modular electric equipment that can be easily integrated into existing port workflows.

Lifting Capacity Insights

The > 100 Tons segment dominated the market in 2024. Equipment in this category is tailored for mega-ports handling ultra-large container vessels (ULCVs). Demand for 100+ ton lifting capacity machines is closely linked to transcontinental shipping and global trade volumes. Growth in this segment is mainly concentrated in gateway ports across China, the UAE, and Western Europe. The surge in e-commerce logistics has also indirectly fueled investments in such high-capacity gear to manage larger and more frequent shipments.

The 50-100 Tons segment is projected to grow at a significant CAGR over the forecast period. This category serves a broader range of users, from regional ports to intermodal terminals. The trend here is toward hybrid designs, capable of both reach stacking and conventional lifting. OEMs are focusing on improving flexibility and automation compatibility in this range to cater to diverse use cases. This segment is becoming the sweet spot for many ports aiming for a balance between capacity and cost.

Handling Mode Insights

The manual segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The affordability of manually operated container handling equipment and the low cost of labor in countries across Africa, Southeast Asia, and Latin America keep this segment relevant. However, operational risks and slower processing times remain limitations that are pushing some governments toward partial automation grants.

The automatic segment is projected to grow at the fastest CAGR over the forecast period. Automatic handling equipment is shaping the future of smart ports. Automated stacking cranes, robotic arms, and AGVs (Automated Guided Vehicles) are being deployed across new-age terminals. The shift is evident in places like the Yangshan Deep-Water Port (China), where automation has significantly boosted container throughput per hour. Integration with AI-based yard management systems is the next frontier, enabling predictive routing and real-time container tracking.

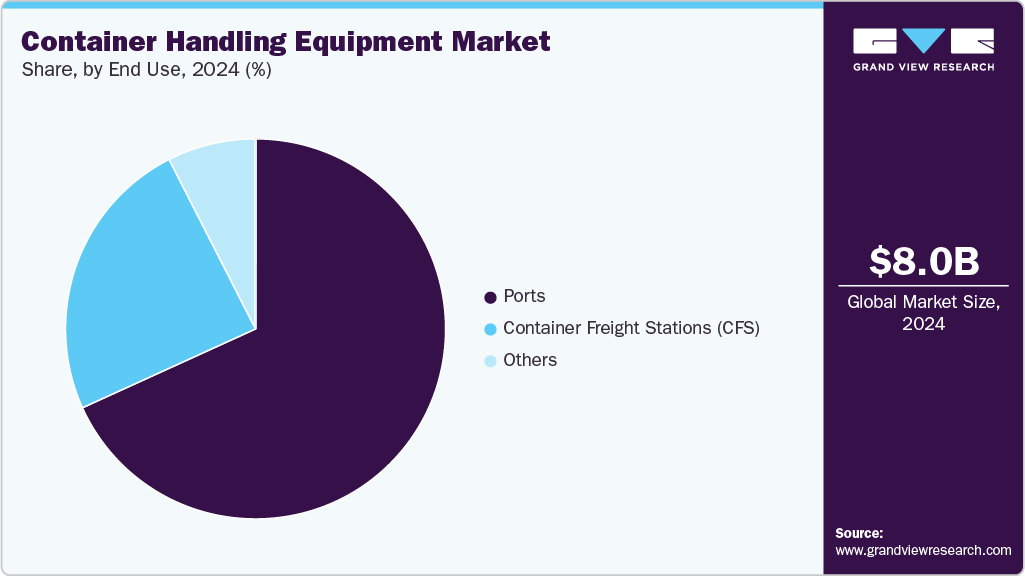

End Use Insights

The ports segment dominated the market in 2024. Ports represent the largest end-user segment, with a clear bifurcation: traditional ports still depend on semi-manual processes, while advanced ports are investing in end-to-end automation. Key drivers include rising container volumes, aging infrastructure replacement, and international green port standards. Equipment that can be integrated with port operating systems (POS) and offer real-time analytics is increasingly in demand.

The Container Freight Stations (CFS) segment is projected to grow at a significant CAGR over the forecast period. The CFS segment is witnessing a quiet transformation. With the increasing integration of intermodal logistics and last-mile delivery services, these stations are evolving from basic transit points to tech-enabled container hubs. The demand here leans toward compact, multi-functional handling equipment, especially electric forklifts and semi-automatic stackers. In India, CFSs along the Dedicated Freight Corridor (DFC) are becoming test beds for digitally coordinated handling operations.

Regional Insights

North America container handling equipment market accounted for a 25.3% share of the overall market in 2024, driven by extensive port infrastructure development and modernization initiatives across the U.S. and Canada. The region's market is characterized by the increasing adoption of automated container handling equipment solutions and a strong focus on environmental sustainability in port operations. The presence of major ports along both the Pacific and Atlantic coasts contributes to steady demand for advanced port cargo handling equipment, while ongoing investments in port expansion projects continue to shape market dynamics.

U.S. Container Handling Equipment Industry Trends

The container handling equipment industry in the U.S. held a dominant position in 2024.The country's leadership position is supported by its extensive network of over 20 container ports, with the Port of Los Angeles being the busiest. The market is driven by significant investments in port automation technologies and the increasing adoption of zero-emission container handling equipment. Major ports across the country are actively transitioning towards more sustainable operations, with several facilities implementing battery-electric and hybrid handling equipment to reduce their environmental impact.

Europe Container Handling Equipment Industry Trends

The container handling equipment industry in Europe was identified as a lucrative region in 2024, characterized by advanced port infrastructure and a strong emphasis on technological innovation. The region's market is driven by significant investments in port automation and sustainable handling solutions across Germany, the United Kingdom, and France. European ports are at the forefront of adopting electric and hybrid container handling equipment, reflecting the region's strong commitment to reducing environmental impact in port operations.

Germany container handling equipment market’s dominance is supported by its extensive network of ports, including Hamburg, Bremerhaven, and Wilhelmshaven, which serve as major transshipment and gateway ports. The German market is characterized by high adoption rates of automated container handling equipment solutions and significant investments in port infrastructure development.

The container handling equipment market in the UK is making significant investments in port development schemes to establish itself as a central marine trade hub in the European region. For instance, the development of Scotland's most crucial port facility has been initiated. This project results in a 7.3-hectare expansion in the port's berthage area, potentially increasing the need for port equipment in the nation.

Asia Pacific Container Handling Equipment Industry Trends

The container handling equipment market in the Asia-Pacific region is driven by rapid industrialization and expanding international trade activities. Countries like China, India, Japan, and South Korea are making significant investments in port infrastructure development and modernization. The region is witnessing increasing adoption of automated container handling equipment solutions and sustainable equipment, particularly in major maritime hubs.

China container handling equipment market is supported by its extensive network of 34 container ports and 2,000 minor ports, with Shanghai being the world's largest port. China's market is characterized by significant investments in port automation technologies and indigenous manufacturing capabilities for container handling equipment.

The container handling equipment market in India emerges as the fastest-growing market in the Asia-Pacific region. The country's growing economy fuels a thriving port industry, with Mumbai Port serving as India's primary gateway for imports and exports. The Indian government has planned to invest in developing ports around the nation due to the decline in imports and exports. The building of new ports, the creation of Special Economic Zones, and the expansion of manufacturing are all predicted to increase demand for container handling equipment in India.

Key Container Handling Equipment Companies Insights

Key players operating in the container handling equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Container Handling Equipment Companies:

The following are the leading companies in the container handling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Cargotec Corporation

- Liebherr Group

- Sany Group

- Konecranes

- Hyster-Yale, Inc.

- Toyota Industries Corporation

- China Communications Construction Company Limited

- PALFINGER AG

- Mi-Jack

- Daifuku Co., Ltd.

Recent Developments

-

In April 2024, SANY signed a significant contract with APM Terminals (APMT) to supply 28 pieces of all-electric container handling equipment for the upcoming APMT Suape terminal in Brazil. This includes two remotely operated ship-to-shore cranes, seven remote-controlled rubber-tyred gantry cranes, two electric reach stackers, two electric empty container handlers, one electric forklift, and 14 electric terminal tractors. The agreement, signed on April 25 in The Hague, also encompasses a global framework for port crane supply, marking a strategic expansion for SANY in Latin America.

-

In October 2024, Liebherr Group delivered Germany's first LPS 600 portal slewing crane to J. MÜLLER Weser GmbH & Co. KG at the Port of Brake. This state-of-the-art crane features a 61-meter boom, electric drive, motorized grab control, and a large cable drum, enabling it to handle a range of dry bulk and general cargo at impressive speeds—up to 1,000 tonnes per hour under optimal conditions. Designed to adapt to the port’s needs, the crane’s curved chassis and flood-protected wheels ensure it can operate across Brake’s 2.5-kilometer quay, reaching areas of the port that previously faced access challenges. This investment is set to enhance J. MÜLLER’s handling capabilities for materials such as grain, minerals, steel, timber, and wind turbines. With sustainability as a priority, the LPS 600’s electric drive reduces CO₂ emissions and energy costs, supporting J. MÜLLER’s environmental goals. The LPS 600, tailored to meet Brake’s specific cargo demands, incorporates video monitoring and custom J. MÜLLER branding. Its closed grab also reduces emissions when managing dusty cargo like animal feed and grain, enhancing air quality in the port. Liebherr’s technical and operational teams collaborated closely with J. MÜLLER to adapt the crane to Brake’s unique needs, reflecting their joint focus on quality and reliability.

Container Handling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.32 billion

Revenue forecast in 2030

USD 10.31 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, propulsion type, lifting capacity, handling mode, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Cargotec Corporation; Liebherr Group; Sany Group; Konecranes; Hyster-Yale, Inc.; Toyota Industries Corporation; China Communications Construction Company Limited; PALFINGER AG; Mi-Jack; Daifuku Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Container Handling Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global container handling equipment market report based on equipment type, propulsion type, lifting capacity, handling mode, end use, and region.

-

Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Forklift Trucks

-

Rubber-Tired Gantry (RTG) Cranes

-

Stacking Cranes

-

Mobile Harbor Cranes

-

Ship-to-Shore (STS) Cranes

-

Reach Stackers

-

Straddle Carriers

-

Automated Equipment

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diesel

-

Electric

-

Hybrid

-

-

Lifting Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

< 50 Tons

-

50-100 Tons

-

>100 Tons

-

-

Handling Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manual

-

Automatic

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ports

-

Container Freight Stations (CFS)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global container handling equipment market size was estimated at USD 8.03 billion in 2024 and is expected to reach USD 8.32 billion in 2025.

b. The global container handling equipment market size is expected to grow at a significant CAGR of 4.4% to reach USD 10.31 billion in 2030.

b. Asia-Pacific (APAC) held the largest market share of 35.7% in 2024. This is due to the rapid industrialization and expanding international trade activities. Countries like China, India, Japan, and South Korea are making significant investments in port infrastructure development and modernization.

b. Some of the players in the container handling equipment market are Cargotec Corporation, Liebherr Group, Sany Group, Konecranes, Hyster-Yale, Inc., Toyota Industries Corporation, China Communications Construction Company Limited, PALFINGER AG, Mi-Jack, and Daifuku Co., Ltd.

b. The key driving trend in the container handling equipment market is the rising adoption of electric and hybrid equipment, driven by stricter emissions regulations and the industry's shift toward sustainable and energy-efficient port operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.