- Home

- »

- Medical Devices

- »

-

Continuous Passive Motion Devices Market Size Report 2030GVR Report cover

![Continuous Passive Motion Devices Market Size, Share & Trends Report]()

Continuous Passive Motion Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Knee Joint, Shoulder Joint), By Design (Portable Devices, Fixed Devices), By Demographics, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-822-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

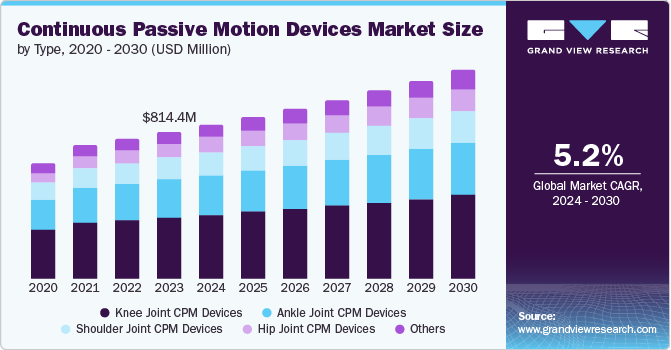

The global continuous passive motion devices market was valued at USD 814.4 million in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. This growth can be attributed to the rising prevalence of orthopedic disorders, such as knee replacement surgeries and ligament reconstruction. Patients have increasingly sought CPM devices as they help prevent joint stiffness and enhance range of motion after orthopedic surgery on joints including the knee, hip, ankle, and shoulder.

CPM therapy is a non-invasive, drug-free method for managing pain and improving joint mobility after surgery. Advanced CPM devices can be effectively operated at home and in outpatient settings for enhanced postoperative rehabilitation while maintaining cost effectiveness. The market has witnessed a considerable rise in demand for CPM devices as patients have become increasingly aware of these benefits, thereby contributing to market growth.

Furthermore, the development of portable and lightweight designs have made CPM devices more practical and user-friendly, leading to widespread adoption. Such characteristics enable users to ensure proper motion of limbs as the first stage of rehabilitation following the traumas and soft tissue medical procedure. Moreover, the U.S. Food and Drug Administration (FDA) and Europe Medicine Agency (EMA) have approved several CPM devices for clinical and home care use. Stringent regulations ensure patient safety and treatment efficacy.

Type Insights

Knee joint CPM devices have secured the dominant market share with 41.3% in 2023 owing to their widespread adoption after knee arthroplasty, ACL reconstruction, and other knee surgeries for outpatient knee rehabilitation. These devices facilitate controlled, repetitive motion, prevent muscle stiffness and promote healing by enhancing blood flow and nutrient diffusion. They also allow elderly patients to maintain joint mobility without active effort, reducing pain and swelling. Furthermore, the increasing penetration of rehabilitation services and government regulations have considerably increased patient adoption of knee joint CPM devices.

Hip joint CPM devices are expected to register the fastest CAGR over the forecast period. The rising number of joint reconstruction surgeries, including hip replacements, have propelled the market growth as these devices are widely used after hip arthroplasty and other hip surgeries. Patients with limited mobility benefit from passive motion as they can control their motion without active effort.

Design Insights

Portable devices have dominated the market in 2023 and is projected to grow lucratively over the forecast period due to their rising adoption for enhanced recovery process for patients. The market has witnessed a major shift towards home-based care driven by patient preference for cost-effectiveness. This has led patients to easily operate these devices at home for continued therapy beyond hospital stays. Such convenience of using these devices promotes consistent rehabilitation, leading to faster recovery times. Moreover, innovations in materials, miniaturization, and wireless connectivity in portable devices including wearable sensors, mobile apps, and cloud-based data storage have enhanced patient monitoring. This has resulted in the huge adoption of smart CPM devices which incorporate real-time monitoring and precise motion control, preventing joint stiffness. These devices adapt to individual needs, optimizing therapy parameters based on patient progress.

Fixed CPM devices are anticipated to emerge at the fastest-growing CAGR of 4.2% over the forecast period. These devices offer consistent, controlled motion without user intervention, ensuring reliable therapy. Their safe implementation encourages adoption among patients and healthcare providers. Additionally, fixed devices are versatile and are applied beyond joint surgeries, including osteoarthritis, fractures, and trauma-related injuries.

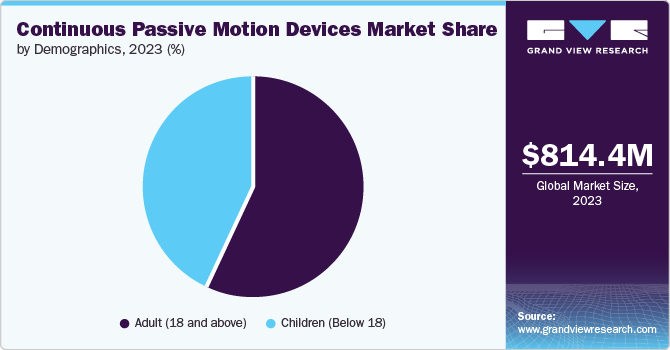

Demographics Insights

Adults have led the market with the dominant share of 57.0% in 2023 owing to the increasing prevalence of joint replacement surgeries, such as knee and hip arthroplasty among the geriatric population. With the growing elderly population, joint-related conditions such as loss of bone mass and density have become more common, necessitating post-surgical rehabilitation and promoting CPM adoption. Additionally, trauma-related injuries and ligament reconstruction surgeries contribute to the need for joint rehabilitation. CPM therapy aids recovery by providing controlled motion without active effort.

Children (below 18) are projected to emerge at the fastest CAGR over the forecast period. Pediatric joint surgeries, such as ACL reconstruction or fracture repair, have considerably driven demand for CRM devices as children with orthopedic disorders or post-surgical needs benefit from CPM therapy. Moreover, the increasing awareness about post-surgical rehabilitation among parents and healthcare providers have resulted in major adoption of pediatric-focused CPM devices These devices ensure gentle, controlled motion without causing harm to young patients.

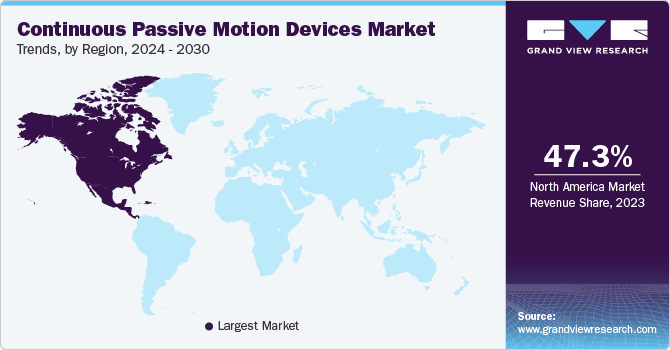

Regional Insights

The North America CPM devices market accounted for the dominant share of 47.3% in 2023 owing to the increasing prevalence of musculoskeletal disorders, such as osteoarthritis and joint-related conditions. Furthermore, technological advancements led to several innovations in CPM device design, portability, and safety that enhanced adoption rates.

U.S. Continuous Passive Motion Devices Market Trends

The CPM devices market in the U.S. was significantly propelled by the rising number of joint reconstruction surgeries, particularly for knee and hip arthroplasty among the growing geriatric population. These devices play a crucial role in post-surgical rehabilitation, preventing muscle stiffness and enhancing joint mobility. CPM devices cater to older adults who benefit from passive motion therapy after joint surgeries. Additionally, adherence to U.S. FDA regulations to ensure device safety and efficacy has fostered market trust and increased adoption.

Europe Continuous Passive Motion Devices Market Trends

The Europe CPM devices market held 24.7% of the global revenue share in 2023 owing to the rising awareness about the benefits of non-invasive post-operative therapy. CPM devices offer drug-free therapy for managing pain and enhancing joint mobility with repetitive motion to prevent joint stiffness in ankle, shoulder, hip and knee.

Asia Pacific Continuous Passive Motion Devices Market Trends

The CPM devices market in Asia Pacific (APAC) region secured 17.6% of the share in 2023. The region witnessed a surge in joint reconstruction surgeries, including knee and hip arthroplasty owing to the aging population and the growing lifestyle-oriented orthopedic conditions. Moreover, innovations in CPM device design, safety features, and user-friendliness have encouraged remote patient monitoring, thereby driving market adoption rates.

Key Continuous Passive Motion Devices Company Insights

The continuous motion devices market is fairly fragmented featuring key players including The Furniss Corporation, Surgi-Care Inc.; BTL Corporate, and others. These companies strive to dominate the market by undertaking advanced product development, strategic partnerships and increased R&D efforts.

-

The Furniss Corporation is a medical manufacturer specializing in CPM devices. The company guarantees a 3-day turnaround on technical service repairs and offers to rent virtually unlimited Knee CPMs. Their durable, user-friendly devices are built to withstand rigorous hospital and home care environments.

-

Surgi-Care, Inc., based in New England, is a leading supplier of orthopedic surgical products, medical devices, and services. They offer a range of products, including sports medicine implants, surgical instrumentation, orthopedic braces, and CPM equipment. Surgi-Care partners with innovators including DJO Global and provides same-day shipping, access to educated product professionals, and strong product lines.

Key Continuous Passive Motion Devices Companies:

The following are the leading companies in the continuous passive motion devices market. These companies collectively hold the largest market share and dictate industry trends.

- The Furniss Corporation Ltd.

- Surgi-Care, Inc.

- Bio-Med International Pvt Ltd.

- CHINESPORT Spa Cap. (Chinesport Rehabilitation)

- BTL Corporate

- Chattanooga (DJO, LLC)

- Biodex

- Kinetec UK

- Kinex Medical Company, LLC

- HMS Medical Systems

Recent Developments

-

In November 2023, Salona Global, soon to be renamed Evome Medical Technologies, launched Biodex SpaceTek Knee Device -- a novel portable medical device designed to treat patients with knee replacements and injuries. This product was developed in collaboration with the National Aeronautics and Space Administration (NASA) specifically designed for use in outer space. It leverages technology similar to that of the Biodex S4 isokinetic machine with dynamometers.

-

In March 2023, HMS Medical Systems introduced KNEEFLEX Es Continuous Passive Motion (CPM) equipment. This device enhances precision, safety, and efficiency for patients and healthcare professionals. The KNEEFLEX Es facilitates knee mobility recovery by utilizing advanced algorithms to deliver consistent and accurate motion, crucial for optimal rehabilitation outcomes.

Continuous Passive Motion Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 854.2 million

Revenue forecast in 2030

USD 1.2 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, design, demographics, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Kuwait, Saudi Arabia, UAE

Key companies profiled

The Furniss Corporation Ltd.; Surgi-Care, Inc.; Bio-Med International Pvt Ltd.; CHINESPORT Spa Cap. (Chinesport Rehabilitation); BTL Corporate; Chattanooga (DJO, LLC); Biodex; Kinetec UK; Kinex Medical Company, LLC; HMS Medical Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Passive Motion Devices Market Report Segmentation

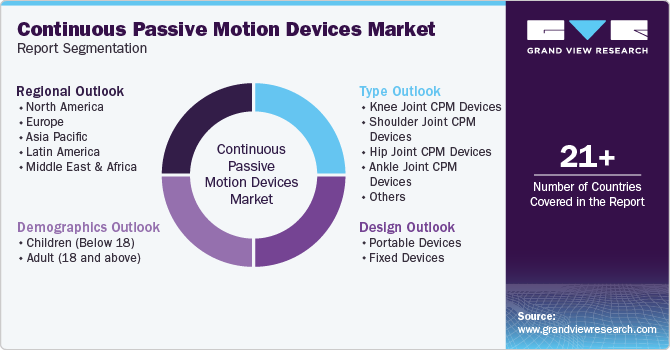

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continuous passive motion devices market report based on type, design, demographics, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Knee Joint CPM Devices

-

Shoulder Joint CPM Devices

-

Hip Joint CPM Devices

-

Ankle Joint CPM Devices

-

Others

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Devices

-

Fixed Devices

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Children (Below 18)

-

Adult (18 and above)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.