- Home

- »

- Automotive & Transportation

- »

-

Contract Logistics Market Size & Share, Industry Report 2030GVR Report cover

![Contract Logistics Market Size, Share & Trends Report]()

Contract Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Transportation, Warehousing), By Type, By Transportation Mode, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-554-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Logistics Market Summary

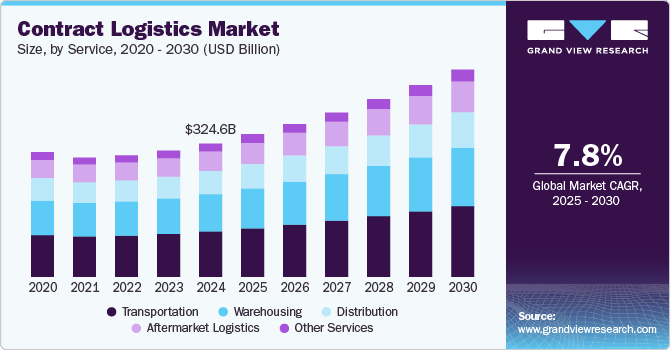

The global contract logistics market size was estimated at USD 324.6 billion in 2024 and is projected to reach USD 503.3 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The market is gaining momentum, driven by rapid e-commerce growth, increasing globalization of supply chains, and rising pressure on businesses to streamline operations and reduce overhead.

Key Market Trends & Insights

- The Asia Pacific contract logistics market accounted for 34.2% of the global share in 2024.

- China held a substantial market share in 2024.

- By service, transportation segment accounted for the largest share of 34.4% in 2024.

- By type, outsourcing segment accounted for the largest share in 2024.

- By transportation mode, roadways segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 324.6 Billion

- 2030 Projected Market Size: USD 503.3 Billion

- CAGR (2025-2030): 7.8%

- Asia Pacific: Largest market in 2024

Companies increasingly outsource to third-party logistics (3PL) providers to focus on core business operations and reduce costs. However, managing end-to-end visibility across complex, multi-modal logistics networks remains a key challenge. Adopting automation, artificial intelligence (AI), and digital logistics platforms presents a major growth opportunity for the market.

The rapid growth of e-commerce is a key market driver. In 2024, U.S. e-commerce sales reached USD 1.19 trillion, up 8.1% year-over-year, accounting for 16.1% of total retail sales. India’s market is also expanding quickly, projected to grow from USD 123 billion in 2024 to USD 292.3 billion by 2028 at a CAGR of 18.7%. This growth is fueling demand for faster, scalable, and tech-enabled logistics. Contract logistics providers are addressing this need with integrated warehousing, efficient last-mile delivery, and real-time visibility to support the evolving digital retail landscape.

Globalization of supply chains drives demand for contract logistics. Businesses sourcing and distributing across borders increasingly depend on third-party providers to manage complex, multi-country operations. This reliance fuels growth in integrated logistics solutions that deliver efficiency, ensure compliance, and strengthen resilience in global trade. These solutions also help companies reduce costs, streamline supply chains, and quickly adapt to evolving regulatory and geopolitical conditions.

Companies increasingly outsource to third-party logistics (3PL) providers to focus on core operations and reduce costs. The U.S. Logistics Costs Report (CSCMP) highlights that outsourced logistics helps companies mitigate rising warehousing and transportation expenses, which reached over 8.7% of GDP in the U.S. alone. In addition, compliance with complex international regulations, including the EU Import Control System 2 (ICS2) and the U.S. FDA's Food Safety Modernization Act (FSMA), makes outsourcing a strategic necessity for many businesses.

High dependency on fuel prices and fluctuating transportation costs remain a major market restraint. Volatility in global oil prices directly impacts freight rates and overall logistics expenses, putting pressure on service provider margins. In addition, infrastructure challenges in emerging markets, such as poor road connectivity, limited warehousing, and port congestion, disrupt supply chain continuity. These factors restrict scalability and reduce service reliability across affected regions.

Service Insights

The transportation segment accounted for the largest share of 34.4% in 2024. Factors such as the increasing demand for fast, last-mile delivery solutions, the rise of same-day delivery models, and the expansion of e-commerce networks across urban and rural areas contribute to segment growth.

The aftermarket logistics segment is expected to grow at the highest CAGR during the forecast period, driven by the growing demand for reverse logistics, repair, and return services and increased focus on customer experience in product servicing across industries like automotive, electronics, and appliances.

Type Insights

The outsourcing segment accounted for the largest share in 2024. Factors such as the increasing need for cost-efficiency, access to specialized logistics infrastructure, and growing reliance on third-party logistics providers for global operations fuel this trend.

The insourcing segment is expected to grow at a significant CAGR during the forecast period. The growth is mainly attributed to large enterprises bringing logistics functions in-house to gain tighter control over operations, ensure data security, and maintain service consistency in sensitive verticals such as healthcare and aerospace.

Transportation Mode Insights

The roadways segment accounted for the largest share in 2024, driven by increasing demand for flexible, last-mile delivery, rising preference for cost-effective short- to mid-haul transport, and expanding road infrastructure. The national highway network in India grew from 65,569 km in 2004 to 1,46,145 km in 2024, with four-lane or higher stretches expanding 2.6 times in the last decade. Similarly, the U.S. government allocated USD 1.32 billion under the 2025 RAISE grant program to fund 109 infrastructure projects, reflecting strong investment in road modernization and connectivity. These developments continue to strengthen the backbone of contract logistics across key economies.

The airways segment is projected to grow at the fastest CAGR during the forecast period, fueled by increasing cross-border e-commerce, rising need for high-speed transport of time-sensitive goods like pharmaceuticals and electronics, and growing reliance on digital air freight solutions.

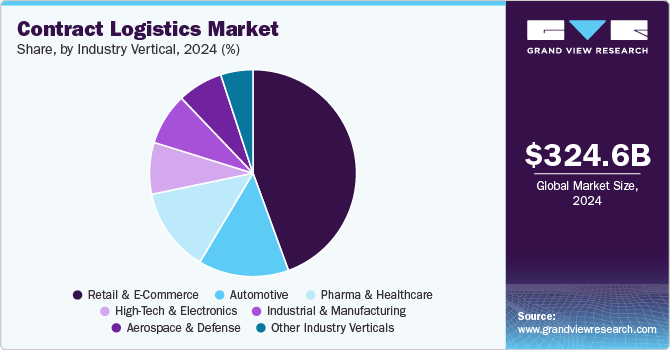

Industry Vertical Insights

The retail & e-commerce segment accounted for the largest share in 2024. Factors such as the increasing penetration of online shopping, omnichannel retailing, and consumer demand for rapid delivery and real-time order tracking fuel growth.In India alone, 125 million new online shoppers have emerged over the past three years, with 80 million more expected by 2025. This underscores the sector's expanding customer base and the increasing need for agile and tech-driven contract logistics solutions.

The pharma & healthcare segment is expected to grow at the highest CAGR during the forecast period, driven by the growing need for temperature-controlled logistics, regulatory-compliant handling of medical goods, and the rising volume of healthcare-related shipments, including vaccines, biologics, and diagnostic kits. For instance, regulations including the U.S. FDA’s Drug Supply Chain Security Act (DSCSA) and the EU’s Good Distribution Practice (GDP) guidelines require end-to-end traceability, controlled storage, and compliant transport of pharmaceutical products, ensuring their safety, integrity, and efficacy throughout the logistics process.

Regional Insights

The Asia Pacific contract logistics market accounted for 34.2% of the global share in 2024, driven by rapid e-commerce growth, mobile commerce adoption, and increasing cross-border trade. In India, efforts to modernize logistics infrastructure are further supported by international funding. For instance, in 2024, the Asian Development Bank (ADB) approved a USD 350 million loan to bolster India's multi-modal logistics reforms to strengthen institutional frameworks and encourage private sector participation. These initiatives are expected to significantly enhance supply chain efficiency and operational capacity, reinforcing demand for integrated regional contract logistics solutions.

Global logistics firms are also expanding their presence to capitalize on the region’s growing demand for efficient, technology-driven logistics solutions. In November 2023, CEVA Logistics completed its acquisition of Stellar Value Chain, significantly expanding its warehousing footprint and contract logistics capabilities across 60+ locations and 35 cities in India. These developments are expected to enhance supply chain efficiency, support the growing demand for 3PL services, and drive greater adoption of integrated contract logistics solutions across the region.

China Contract Logistics Market Trends

The contract logistics industry in China held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by the expanding e-commerce sector, digital retail innovation, advanced infrastructure, and rising demand for last-mile delivery solutions. Furthermore, increasing consumer expectations for faster fulfillment, the widespread use of mobile payments, and the growth of cross-border trade further fuel the need for efficient and scalable logistics services. According to China's National Bureau of Statistics, online retail sales reached USD 2.15 trillion in 2024, with 974 million online shoppers and over 1 billion online payment users. This surge accelerates demand for efficient, tech-driven contract logistics services to support high delivery volumes and evolving consumer expectations.

Japan contract logistics industry held a significant share in 2024. In Japan, the market is influenced by the steady growth in e-commerce, high consumer expectations for reliable and timely delivery, and a strong focus on automation and efficiency. According to Japan’s Ministry of Economy, Trade and Industry (METI), B2C e-commerce sales of goods reached approximately USD 162.4 billion in 2022, growing by 5.37% year-over-year. The country's expanding digital retail landscape continues to boost the need for efficient, tech-driven contract logistics services that can support high service levels and operational scalability.

Europe Contract Logistics Market Trends

The contract logistics industry in Europe was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by rising cross-border trade within the EU and growing demand for value-added services such as reverse logistics and tailored warehousing. Moreover, the growing demand for specialized logistics services in sectors including healthcare is reshaping the European contract logistics landscape. As the pharmaceutical industry continues to face evolving challenges in transportation and compliance, companies are increasingly investing in infrastructure to support temperature-sensitive products. In this context, in February 2024, Bolloré Solutions Logistiques (BSL) acquired STEF Logistique Santé (SLS), expanding its pharmaceutical logistics capabilities with 13,000 m² of temperature-controlled space across Strasbourg. This acquisition reinforces the region’s push toward specialized contract logistics services in high-value sectors such as healthcare.

German contract logistics market is being shaped by increasing automation, skilled labor shortages, and the demand for real-time supply chain visibility. Relevant regulatory frameworks, such as the EU Mobility Package, which governs transport operations across borders, and Germany’s Supply Chain Due Diligence Act (LkSG), which enforces ethical sourcing and traceability, are directly impacting contract logistics providers.

North America Contract Logistics Market Industry Trends

The contract logistics industry in North America was identified as a lucrative region in 2024. The market in North America is being driven by surging e-commerce volumes, increasing demand for last-mile delivery, and growing investments in automation and digital supply chain technologies. In Canada, the rise in online grocery and pharmaceutical delivery further accelerates the need for temperature-controlled and urban micro-fulfillment centers. The government's National Trade Corridors Fund (NTCF) is also boosting infrastructure capacity, thereby enabling more efficient freight movement across provinces and into the U.S.

Mexico contract logistics market benefits from a strong nearshoring push as manufacturers shift operations closer to the U.S. to reduce supply chain risk. The United States-Mexico-Canada Agreement (USMCA) agreement facilitates smoother trade flows, while the development of intermodal corridors and customs modernization programs improves cross-border logistics efficiency.

The contract logistics industry in the U.S. held a dominant position in 2024. The market in the United States is witnessing significant transformation, driven by rising demand for nearshoring and regional warehousing and strong investments in automation and digital freight solutions. Heightened geopolitical tensions and evolving trade dynamics are prompting a shift in supply chain strategies across industries.

In April 2025, reciprocal tariffs, including a 10% baseline on all imports and higher rates of 34% on China, 27% on India, 24% on Japan, and 20% on the EU, disrupted traditional trade flows. Companies are reevaluating sourcing strategies, diversifying supplier bases, and shifting toward more resilient, domestically anchored logistics operations. This shift accelerates demand for agile, tech-enabled contract logistics providers equipped to navigate tariff-driven volatility and optimize supply chain efficiency.

Key Contract Logistics Company Insights

Some key players operating in the market include DHL Supply Chain (a division of Deutsche Post AG), GXO Logistics, Inc., United Parcel Service, Inc., and DB Schenker.

-

Founded in 1969 and headquartered in Bonn, Germany, DHL Supply Chain is a division of Deutsche Post AG. The company specializes in contract logistics and supply chain management services. It offers end-to-end logistics solutions, including warehousing, transportation, packaging, and value-added services across sectors such as automotive, healthcare, retail, and technology. The company operates a global network of logistics facilities and leverages advanced automation, robotics, and data analytics to optimize supply chain performance.

-

Founded in 1907 and headquartered in Georgia, U.S., United Parcel Service, Inc. (UPS) is a global logistics and package delivery company offering services including freight forwarding, supply chain management, and last-mile delivery. Through its UPS Supply Chain Solutions division, the company provides contract logistics, customs brokerage, and e-fulfillment solutions. UPS operates a robust global logistics infrastructure supported by advanced digital tools such as real-time tracking, automated sortation, and AI-driven supply chain visibility platforms.

Key Contract Logistics Companies:

The following are the leading companies in the contract logistics market. These companies collectively hold the largest market share and dictate industry trends.

- DHL Supply Chain (a division of Deutsche Post AG)

- GXO Logistics, Inc.

- United Parcel Service, Inc.

- DB Schenker

- Kuehne + Nagel International AG

- DSV A/S

- Nippon Express Co., Ltd.

- CEVA Logistics

- GEODIS SA

- Ryder System, Inc.

Recent Developments

-

In October 2024, DB Schenker announced the launch of an 18,000-square-meter contract logistics warehouse near Amsterdam to support the semiconductor industry.

-

In May 2024, C.H. Robinson launched its contract logistics services in Australia and New Zealand, expanding its presence in Oceania with a focus on tailored warehousing, inventory management, and distribution solutions to support growing regional demand.

-

In October 2023, Ryder System announced its acquisition of Impact Fulfillment Services (IFS), adding 15 U.S. locations and expanding its contract packaging, manufacturing, and warehousing capabilities across key consumer sectors.

-

In March 2023, Kuehne+Nagel opened its third Transport Operation Centre for the Asia Pacific region in Gurugram, India, to centralize pan-India distribution management. The facility supports over 30 sites with route optimization, real-time monitoring, and strategic supply chain planning to enhance logistics efficiency and sustainability.

-

In September 2022, Rhenus Logistics announced the launch of a new business unit, Supply Chain Solutions, in India to enhance integrated logistics services. The expansion includes new offerings across contract logistics, warehousing, and tech-enabled supply chain visibility, with a growing focus on sustainable solutions like electric vehicles and carbon-neutral services.

-

In January 2022, Röhlig Logistics and Penske Logistics established Röhlig Penske Logistics GmbH, a joint venture focused on contract logistics in Germany and the Netherlands. The move added 55,000 sqm of warehousing and expanded transport and e-commerce services to support the growing demand for integrated logistics solutions in Western Europe.

Contract Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 345.9 billion

Revenue forecast in 2030

USD 503.3 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Service, type, transportation mode, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

DHL Supply Chain (a division of Deutsche Post AG); GXO Logistics, Inc.; United Parcel Service, Inc.; DB Schenker; Kuehne + Nagel International AG; DSV A/S; Nippon Express Co., Ltd.; CEVA Logistics; GEODIS SA; Ryder System, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contract logistics market report based on service, type, transportation mode, industry vertical, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Warehousing

-

Distribution

-

Aftermarket Logistics

-

Other Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Outsourcing

-

Insourcing

-

-

Transportation Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Roadways

-

Railways

-

Airways

-

Waterways

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail & E-Commerce

-

Automotive

-

Pharma & Healthcare

-

Industrial & Manufacturing

-

Aerospace & Defense

-

High-Tech & Electronics

-

Other Industry Verticals

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contract logistics market size was estimated at USD 324.6 billion in 2024 and is expected to reach USD 345.9 billion in 2025.

b. The global contract logistics market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 503.3 billion by 2030.

b. North America dominated the contract logistics market in 2024. The contract logistics market in North America is being driven by surging e-commerce volumes, increasing demand for last-mile delivery, and growing investments in automation and digital supply chain technologies.

b. Some key players operating in the contract logistics market include, DHL Supply Chain (a division of Deutsche Post AG), GXO Logistics, Inc., United Parcel Service, Inc., DB Schenker, Kuehne + Nagel International AG, DSV A/S, Nippon Express Co., Ltd., CEVA Logistics, GEODIS SA, Ryder System, Inc.

b. Key factors that are driving the market growth include rapid e-commerce growth, increasing globalization of supply chains, and rising pressure on businesses to streamline operations and reduce overhead.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.