- Home

- »

- Advanced Interior Materials

- »

-

Copper Clad Laminates Market Size, Industry Report 2030GVR Report cover

![Copper Clad Laminates Market Size, Share & Trends Report]()

Copper Clad Laminates Market (2024 - 2030) Size, Share & Trends Analysis Report By Laminate Type (Rigid, Flexible), By Reinforcement Material (Glass Fiber, Paper Base, Compound Materials), By Resin, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-257-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Clad Laminates Market Summary

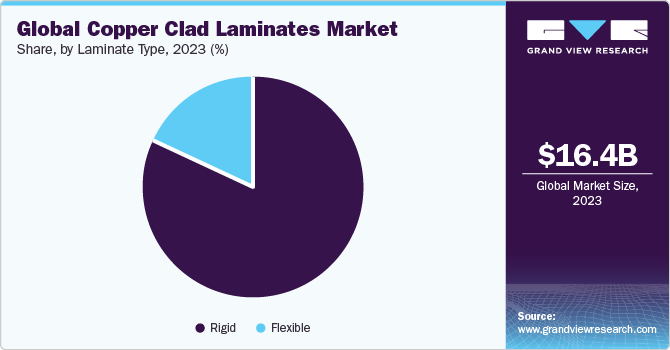

The global copper clad laminates market size was estimated at USD 16.40 billion in 2023 and is projected to reach USD 26.34 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market growth is expected to be driven by the rise of electronics industry, as copper clad laminates (CCL) are used for manufacturing printed circuit boards (PCB). Additionally, advancements in technologies, such as 5G and Internet of Things are contributing to the growth.

Key Market Trends & Insights

- Asia Pacific copper clad laminates market dominated with a revenue share of more than 45% in 2023.

- North America copper clad laminates market is expected to register significant growth during the forecast period.

- By laminate type, rigid segment accounted for the largest revenue share of 82.4% in 2023.

- By reinforcement material, glass fiber segment is expected to grow at the fastest CAGR over the forecast period.

- By resin type, epoxy segment held the fastest CAGR in terms of revenue for the year 2023.

Market Size & Forecast

- 2023 Market Size: USD 16.40 Billion

- 2030 Projected Market Size: USD 26.34 Billion

- CAGR (2024–2030): 6.1%

- Asia Pacific: Largest market in 2023

The increasing use of electronic components in automotive industry such as advanced driver-assistance systems (ADAS) and autonomous driving technology ae leading to the growth of copper clad laminates. Similarly, medical devices like wearable health monitors and implantable devices are installed with copper clad laminates for better reliability and accuracy.

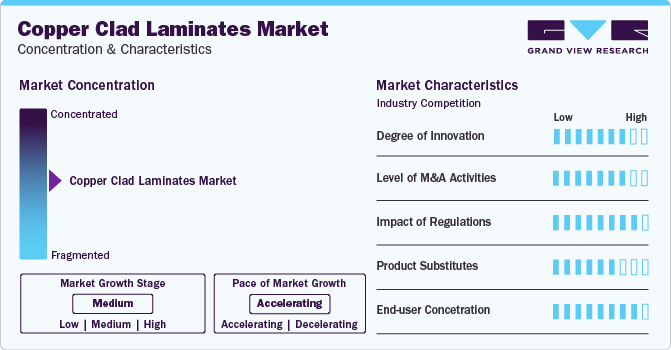

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. The industry is characterized by a high degree of innovation owing to the development of high-frequency materials, the use of new resin materials, and incorporation of nanomaterials. Furthermore, manufacturers are focusing on the development of ultra-thin N-CCL for more compact and smaller electronic devices.

The market exhibited a high level of mergers and acquisitions activities as many manufacturers acquire or merge with smaller companies to increase their market share, expand their geographical presence, and diversify their product portfolio to gain a competitive edge. For instance, in March 2023, MBK Partners announced the acquisition of NexFlex Co., a flexible copper-clad laminates producer for USD 407.2 million.

The industry is subject to high regulatory scrutiny owing to the presence of regulations and standards such as ASTM D1867, IPC-4101C, and IPC-IM 650 that manufacturers need to comply with while manufacturing copper clad laminates. ASTM D1867 specifies the standard requirements for the manufacturing of Printed circuit boards. The manufacturers need to meet the crosswire and length of flexural strength, peel strength at elevated temperatures, volume resistivity, dissipation factor, permittivity, and water absorption tests.

The copper clad laminates market serves a diverse range of end-users across various industries such as consumer electronics, computers, aerospace, automotive, medical, industrial, and telecommunication infrastructure. Therefore, the end-use concentration is high in this market. Understanding the specific needs of end-users along with providing efficient services to the clients are a few of the major factors for copper clad laminates manufacturers.

Laminate Type Insights

The rigid type was the largest segment accounting for 82.4% share of the global revenue in 2023. Rigid copper clad laminate is a substrate material that is used in printed circuit boards that contain a thin layer of copper laminate on either one or both sides of the PCB (called single CCL or double CCL). Manufacturers use substrate materials such as FR-4, an epoxy resin, Polytetrafluoroethylene (PTFE), and ceramic, along with a copper or aluminum metal core to manufacture multi, double, and single layer of rigid PCBs.

The flexible segment is projected to grow at a significant CAGR from 2024 to 2030, owing to its rising use in cell phones, digital cameras, automotive global positioning systems (GPS), and laptops owing to its light weight, thinness, and flexibility. Moreover, the rising technological advancements by researchers in the development of new types of products such as high-Tg; halogen-free, phosphor-free; high-speed; ultra-thin flexible copper clad laminate is expected to further boost the market growth.

Reinforcement Material Insights

The glass fiber segment is expected to grow at the fastest CAGR over the forecast period, owing to the material’s high strength-to-weight ratio, high electrical insulation, dimensional stability, and cost-effectiveness. The major applications of glass fiber-reinforced CCL are smartphones & laptops, tablets and wearables, computers & servers, telecommunication equipment, and industrial control systems.

Paper-based reinforced copper clad laminates involve a substrate made from paper impregnated with resin and coated with a layer of copper. The use of paper as a substrate is a more environmentally sustainable material compared to other materials, thus making them suitable for applications where reducing the environmental impact is a priority, such as automotive electronics.

Resin Insights

The epoxy resin segment accounted for the highest CAGR in terms of revenue for the year 2023 due to its high mechanical properties, low shrinkage, easy processing, and high corrosion resistance. Moreover, properties such as being relatively inexpensive compared to their resins, easy to dissolve making them easy for impregnating, adherence to copper foil or electroless copper, bonding with epoxy-finished glass fiber, easy to drill, and flame resistance are expected to further propel the market growth.

Phenolic resin based copper clad laminates (FR-1 and FR-2) are a type of CCL that utilizes phenolic resin as the binder for the glass fiber reinforcement. Their low cost, high mechanical strength, and flame retardant properties make them suitable for low cost electronic devices, ad low power circuits. However, phenolic resin CCLs have a lower maximum operating temperature compared to FR-4, which is expected to limit the growth of product over the forecast period.

Polyimide resins are expected to grow at a significant CAGR from 2024 to 2030, owing to its growing demand in Military and defense sectors. End-users prefer polyimide resins because they can withstand the thermal stress of several repair cycles.Moreover, their high operating temperature rating (250 - 260°C), good thermal conductivity, and low corrosion-to-temperature (CTE) are expected to further drive the industry growth.

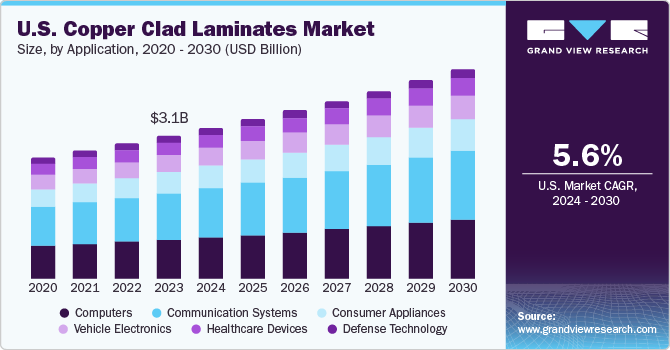

Application Insights

The communication systems led the market with over 32% of the global revenue share in 2023. The increasing demand for faster and more reliable communication like 5G networks and high-bandwidth internet access is one of the primary driving factors in the industry. In addition, the use of copper clad laminates in communication systems allows for a smaller and more compact communication device, leading to its further growth.

The computer application segment is expected to be the fastest growing segment over the forecast period as copper clad laminates are the base material for Printed Circuit Boards (PCBs) used in computers. PCBs are used to connect and support various electronic components such as microprocessors and memory modules, as well as various integrated circuits within the computer system. Thus, the growing demand for computers around the world is estimated to boost product demand.

Copper clad (CCL) laminates have a wide range of uses in medical devices because they are used to support the complex electronics that drive modern medical devices.For instance, devices used for patient monitoring, like electrocardiogram (ECG) machines or wearable health trackers employ CCL to create the PCBs that process and transmit vital signs. The stability and conductivity of CCL contribute to the accuracy of data acquisition, ensuring reliable monitoring of patients, thereby driving the industry.

Copper clad laminates provide a stable and conductive surface for mounting electronic components like sensors, control units, and communication modules in vehicles. The CCL's properties, such as electrical conductivity and thermal stability, make it ideal for supporting essential circuits in various automotive systems, including engine control units, infotainment systems, and safety features.

Regional Insights

The North America copper clad laminates market is expected to witness significant growth over the forecast period owing to rising investments in modernizing automotive systems, enhancing medical devices, and growing emphasis on developing compact computers.

U.S. Copper Clad Laminates Market Trends

The U.S. copper clad laminates market is expected to grow at a CAGR of 5.6% from 2024 to 2030. This growth is attributed to the U.S. government’s focus on the development of technologically advanced medical devices such as imaging equipment, pacemakers, and defibrillators.

The copper clad laminates market in Canada held over 17.3% of the revenue share in 2023, due to various factors such as increasing demand for consumer electronics such as smartphones, laptops, cameras, and home appliances, along with the adoption of technological advancement related to CCL in the country.

Asia Pacific Copper Clad Laminates Market Trends

Asia Pacific led the market and accounted for a revenue share of more than 45% in 2023 owing to surging demand for smartphones, laptops, consumer electronics, and other electronic devices. Furthermore, governments in developing countries such as India, China, Indonesia, and Malaysia provide support and incentives to the electronics manufacturing industry, further boosting the CCL demand. Asia Pacific also exhibits the presence of major copper clad manufacturers like Taiwan Union Technology Corporation (Taiwan), Nan Ya Plastics Industrial Co. Ltd. (Taiwan), and Shengyi Technology Co., Ltd. (China).

The copper clad laminates market in China is expected to grow at a CAGR of 5.2% from 2024 to 2030 due to its growing electronics and automotive industry. Furthermore, the Chinese government is promoting the development of advanced manufacturing industries, including copper clad laminates sector. The implementation of favorable policies related to advanced manufacturing is expected to boost product demand in the country.

Europe Copper Clad Laminates Market Trends

The Europe copper clad laminates market is expected to grow at a significant CAGR from 2024 to 2030 owing to growing 5G technology and adoption of satellite communication systems. Furthermore, rising automotive electronics industry in Germany, France, and Italy provides an opportunity for manufacturers to capitalize on the demand for copper clad laminates.

The Germany copper clad laminates market accounted for a major revenue share in Europe for the year 2023. The growing automotive industry in the country is projected to propel the need for automation, thereby resulting in the rise of the overall product demand.

The copper clad laminates market in UK is projected to grow at the fastest CAGR of 6.5% over the forecast period. This growth is attributed to the growing population and increasing demand for computers, communication systems, and automotive electronics in the country.

Middle East & Africa Copper Clad Laminates Market Trends

The Middle East & Africa copper clad laminates market witnessed high product demand as countries like Saudi Arabia, Qatar, and UAE are investing heavily in developing technologically advanced automotive and communication systems such as 5G mobile telecommunications.

The copper clad laminates market in Saudi Arabia accounted for the largest revenue share in the region. The industry is growing primarily due to increasing adoption of laptops, smartphones, and other electronic devices in the country.

Central & South America Copper Clad Laminates Market Trends

The Central & South America copper clad laminates market exhibits a growing trend over the forecast period owing to the rising consumer electronics industry growth, rise in healthcare infrastructure, and increasing demand for computers.

The copper clad laminates market in Brazil is expected to grow at the fastest CAGR over the forecast period. The rapid growth of electronic and defense sector in the country is projected to drive the growth in Brazil.

Key Copper Clad Laminates Company Insights

Some of the key players operating in market are AGC Inc.; ITEQ CORPORATION; Kblaminate; and Panasonic Holdings Corporation:

-

AGC Inc. specializes in architectural glass, automotive, electronics, chemicals, life sciences, and ceramic sectors. The company has numerous manufacturing facilities and research centers with operations in over 30 countries around the world.

-

ITEQ CORPORATION is engaged in the production of high-performance copper-clad laminate materials for printed circuit board (PCB) applications. The company serves, radio frequency and microwave devices (e.g. 5G and mmWaves), computational & communications applications (e.g. servers, storage, switches), high-density interconnect solutions (e.g. smartphones), and automotive applications (e.g. advanced driver assist systems).

NAN YA PLASTICS CORPORATION, Cipel Italia., and Taiwan Union Technology Corporation. are some of the emerging participants in copper clad laminates industry.

-

NAN YA PLASTICS CORPORATION specializes in producing plastic products, chemicals, electronic material, fibers and textiles, machinery, and switchgear. The company caters to household appliances, outdoor sports, transport materials, building materials coatings, 3C appliances, civil farms, industrial equipment, and other applications.

-

Taiwan Union Technology Corporation is a Taiwanese company that is engaged in the production and distribution of high frequency, extreme low loss, super low loss, very low loss, and low loss laminates; mid-loss materials; non-flow/ mid-flow prepreg; high thermal reliability; and standard loss materials.

Key Copper Clad Laminates Companies:

The following are the leading companies in the copper clad laminates market. These companies collectively hold the largest market share and dictate industry trends.

- Kblaminates.

- NAN YA PLASTICS CORPORATION

- Taiwan Union Technology Corporation.

- ITEQ CORPORATION

- AGC Inc.

- Rogers Corporation.

- Doosan Corporation.

- Isola Group

- Shandong JinBao Electric Co., Ltd.

- Dhan Laminates.

- Sytech Technology Co. Ltd.

- Panasonic Holdings Corporation

- Cipel Italia.

Recent Developments

-

In October 2023, Taiflex Scientific Co. Ltd., a Taiwan-based company specializing in the production and supply of flexible copper clad laminate (FCCL), is scheduled to begin production in its new manufacturing factory in Thailand by the 2nd quarter of 2024. The expansion is expected to give the company a competitive edge compared to others.

-

In April 2022, Panasonic Holdings Corporation announced the development of high-thermal conductive film R-2400 for multilayer circuit boards. These circuits are used to improve the energy efficiency of electric vehicle batteries, power supply modules, and drive units.

Copper Clad Laminates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.40 billion

Revenue forecast in 2030

USD 26.34 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Laminate type, reinforcement material, resin, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Kblaminates; NAN YA PLASTICS CORPORATION; Taiwan Union Technology Corporation; ITEQ CORPORATION; AGC Inc.; Rogers Corporation; Doosan Corporation; Isola Group; Shandong JinBao Electric Co.,Ltd.; Dhan Laminates;Sytech Technology Co. Ltd; Panasonic Holdings Corporation; Cipel Italia

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Clad Laminates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the copper clad laminates market report based on laminate type, reinforcement material, resin, application, and region:

-

Laminate Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Reinforcement Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Fiber

-

Paper Base

-

Compound Materials

-

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Phenolic

-

Polyimide

-

Other Resins

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Computers

-

Communication Systems

-

Consumer Appliances

-

Vehicle Electronics

-

Healthcare Devices

-

Defense Technology

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global copper clad laminates market size was estimated at USD 16.40 billion in 2023 and is expected to reach USD 17.40 billion in 2024.

b. The global copper clad laminates market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 26.34 billion by 2030.

b. Rigid copper clad laminates led the market and accounted for over 82% share of the revenue in 2023 owing to its application as a substrate material that is used in single, double, or multi layered printed circuit boards.

b. Some of the key players operating in the copper clad laminates market include Kblaminates., NAN YA PLASTICS CORPORATION, ITEQ CORPORATION, AGC Inc., Rogers Corporation., and Doosan Corporation.

b. The key factors that are driving the global copper clad laminates market include utilizing copper clad laminates in communication systems, computers, vehicle technology, defense technology, and medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.